Us Periodontal Treatment For Adults Market

Market Size in USD Million

CAGR :

%

USD

816.11 Million

USD

1,620.76 Million

2024

2032

USD

816.11 Million

USD

1,620.76 Million

2024

2032

| 2025 –2032 | |

| USD 816.11 Million | |

| USD 1,620.76 Million | |

|

|

|

U.S. Periodontal Treatment for Adults Market Analysis

The U.S. periodontal treatment for adults market is experiencing steady growth, driven by advancements in dental technologies and an increasing focus on effective treatments for periodontal diseases. Periodontal diseases, which can lead to the loss of teeth if untreated, have spurred the demand for innovative solutions that focus on tissue regeneration. Regenerative biomaterials, including bone grafts, barrier membranes, and growth factors, are now widely used to enhance the healing process, promote bone regeneration, and restore gum tissues. These materials help in re-establishing the support structures around teeth, reducing the need for tooth extraction and improving the long-term health of oral tissues.

The market is characterized by the presence of a variety of materials—both synthetic and biologically derived—that offer customized treatment options for patients. The increasing prevalence of periodontal disease, the rise in adult patients seeking periodontal care, and the shift towards minimally invasive and cost-effective procedures are all key factors driving this market. In addition, the growing awareness about the importance of oral health, supported by a robust pipeline of research and development, has created an environment ripe for innovation in regenerative biomaterials. As these biomaterials continue to evolve, they offer promising solutions for more predictable, long-lasting results in the treatment of periodontal diseases.

U.S. Periodontal Treatment for Adults Market Size

U.S. periodontal treatment for adults market size was valued at USD 816.11 million in 2024 and is projected to reach USD 1,620.76 million by 2032, with a CAGR of 9.0% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

U.S. Periodontal Treatment for Adults Market Trends

“Increasing adoption of minimally invasive procedures.”

One notable market trend in the U.S. periodontal treatment for adults market is the increasing adoption of minimally invasive procedures. These procedures, such as laser-assisted periodontal treatments and advanced scaling techniques, are gaining popularity due to their ability to reduce patient discomfort, shorten recovery times, and improve treatment outcomes. Traditional periodontal treatments often involve more invasive procedures, such as gum surgery, which can result in longer recovery periods and increased patient anxiety. In contrast, minimally invasive techniques utilize cutting-edge technology to target and treat periodontal issues with precision and minimal disruption to the surrounding tissues. This trend is supported by advancements in laser technology, as well as improvements in the development of innovative tools and materials. As a result, more patients are opting for these less invasive alternatives to avoid the pain and longer healing associated with conventional treatments. In addition, the growing awareness among patients about the benefits of these procedures, combined with increasing access to dental care, is contributing to the widespread adoption of minimally invasive periodontal treatments in the U.S. This trend is likely to continue as the demand for patient-friendly, effective treatments rises, and as more practitioners incorporate these advanced techniques into their practices.

Report Scope and U.S. Periodontal Treatment for Adults Market Segmentation

|

Attributes |

U.S. Periodontal Treatment for Adults Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Dentsply Siroma (U.S.), Straumann AG (Switzerland), Medtronic (Ireland), Orapharm (Japan), GSK. (U.K), Life Net Health (U.S.), Pfizer (U.S.), Hioseen (South Korea), Osteogenics Biomedical (U.S.), Epien (U.S.), BioHorizons (U.S.), Biolase (U.S.), Biocomposites (U.K.), Nobel Biocare Services (Switzerland), ZimVie (U.S.), Forward science (U.S.), and PerioProtect (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

U.S. Periodontal Treatment for Adults Market Definition

Periodontal treatment for adults refers to a comprehensive set of dental procedures aimed at preventing, diagnosing, and treating periodontal diseases that affect the gums and supporting structures of the teeth in adults. Periodontal disease, which includes conditions like gingivitis and periodontitis, can cause inflammation, infection, gum recession, and even tooth loss if left untreated. Periodontal treatments typically begin with non-surgical approaches such as scaling and root planing, which involve cleaning below the gum line to remove plaque, tartar, and bacteria. In more advanced cases, surgical procedures such as gum grafts, flap surgery, and bone regeneration may be necessary to restore the health and function of the gums and underlying bone structures. Additionally, treatments may include the use of antibiotics or antimicrobial agents to manage infection and promote healing. Regular periodontal maintenance, including professional cleanings and ongoing monitoring, is crucial for long-term gum health.

U.S. Periodontal Treatment for Adults Market Dynamics

Drivers

- Expansion of Dental Insurance Coverage for Periodontal Care

With increasing awareness about oral health and the rising cost of dental care, there has been a growing demand for comprehensive dental insurance plans. These plans not only cover preventive services such as routine check-ups and cleanings but also extend to more complex procedures such as fillings, crowns, and even orthodontics. This shift is largely driven by the need for more affordable dental care options, as out-of-pocket costs for dental treatments can be high. As insurance companies expand their coverage to include a broader range of services, they aim to attract a larger customer base, particularly those who may have previously delayed or avoided dental care due to financial constraints.

The expansion of coverage also reflects a growing recognition of the connection between oral health and overall health. For example, untreated dental issues can lead to or exacerbate other health problems such as heart disease, diabetes, or respiratory issues. This has spurred a push for insurance plans that offer not only preventative care but also treatment for more serious conditions. Furthermore, the ongoing expansion of dental insurance coverage is influenced by policy reforms and regulatory changes, such as the implementation of the Affordable Care Act (ACA) in the U.S., which includes provisions for oral health coverage under certain health plans. These changes are gradually reshaping the landscape of dental insurance and encouraging more people to seek out coverage.

For instances,

- In November 2020, according to the article published by NCBI, the ACA expanded dental coverage for low-income adults, increasing access to dental benefits in Medicaid expansion states by 18.9%. Despite increased coverage, overall dental visit rates showed limited improvement. A significant rise in dental visits was observed among white adults, but a slight increase in complete tooth loss was noted.

- In September 2021, according to the article published by NCBI, among 7,637 low-income adults, the mean age was 37.8 years, with 54.5% women. In Medicaid expansion states, dental visit rates increased by 12.4 percentage points (P = .003). Expansion states with dental benefits saw an 8.2 percentage point increase in Medicaid coverage, 11.4 percentage point rise in dental visits, and 12.6 percentage point decrease in the uninsured rate. In non-dental benefit states, expansion led to a 1.3-teeth increase in missing teeth and an 8.7 percentage point decrease in functional dentition.

- In November 2024, according to the article published by Dental Tribune International,CMS (Centers for Medicare and Medicaid Services )expanded Medicare to include certain medically necessary dental services under specific conditions, sparking the push for broader dental benefits. CMS introduced an annual review process to assess additional scenarios for coverage, paving the way for more comprehensive integration of oral healthcare into Medicare.

In conclusion, the growing demand for comprehensive dental insurance reflects both the rising costs of dental care and the increasing awareness of its importance to overall health. As insurance providers expand coverage to include a wider range of services, they are addressing the need for more affordable and accessible dental care options. This shift not only helps reduce financial barriers for individuals but also promotes better oral health, which is closely linked to overall well-being. With ongoing policy reforms and regulatory changes, the landscape of dental insurance continues to evolve, encouraging more people to seek the coverage they need for optimal health.

- Improved Patient Education on the Importance of Periodontal Health and Care

Increased patient education also plays a significant role in promoting early detection and intervention for periodontal diseases, which often have subtle symptoms that can go unnoticed. As people become more educated about the signs of gum disease—such as bleeding gums, bad breath, or receding gums—they are more likely to seek treatment sooner, preventing more severe complications down the line. Dental professionals are now using a variety of platforms, including social media, websites, and educational workshops, to reach a broader audience and explain the importance of maintaining healthy gums.

Moreover, as patient education focuses on the connection between oral health and systemic health, more adults are recognizing how gum disease can affect conditions such as stroke, respiratory issues, and even pregnancy complications. This awareness leads to a higher demand for periodontal care, as individuals are more motivated to prevent these potentially serious health issues. The growing recognition of these health risks has made patients more proactive in seeking periodontal treatments and maintaining consistent oral hygiene practices.

For instances,

- In October 2020, according to the article published by NCBI, as it empowers individuals to understand the impact on oral health and overall wellbeing. Educational efforts should focus on prevention strategies, self-care practices, and the importance of regular dental check-ups, helping individuals take proactive steps in managing their oral health.

- In December 2023 according to the article published by International Dental Journal, Improved patient education in periodontal treatment helps individuals understand how gum disease impacts oral function, overall health, and self-esteem. Educating patients about the risks of untreated periodontal disease, its connection to systemic health, and the importance of early intervention empowers them to take proactive steps, improving long-term outcomes and quality of life.

In conclusion, improved patient education has been crucial in increasing awareness about periodontal disease and its impact on overall health. As people recognize early signs such as bleeding gums and bad breath, they are more likely to seek timely treatment, preventing severe complications. Dental professionals are using various platforms, such as social media and workshops, to educate the public. Moreover, the growing understanding of the link between oral health and systemic conditions, such as heart disease and stroke, is motivating more adults to prioritize periodontal care. This increased awareness has led to greater demand for treatments and a more proactive approach to maintaining oral health.

Opportunities

- Emerging Treatments for Complex Periodontal Disease

Emerging treatments for complex periodontal disease represent a significant advancement in the management of conditions that are often resistant to traditional therapies. One of the notable innovations is the development of regenerative techniques and biologics aimed at promoting tissue healing and regeneration. Methods such as platelet-rich plasma (PRP) and platelet-rich fibrin (PRF) are being integrated into periodontal procedures to enhance healing and tissue regeneration. In addition, tissue engineering approaches employing scaffold materials infused with growth factors can support the regeneration of periodontal tissues, such as the bone and gum structures lost due to severe periodontal disease. These therapies aim to restore lost tissues and regenerate the supportive structures of the teeth, potentially improving long-term dental outcomes for patients.

For instance,

- In April 2024, according to an article published by the Journal of Biological Engineering, there has been a growing utilization of nanoparticle (NP)-based detection strategies to create quick and efficient detection assays. Every single one of these platforms leverages the distinct characteristics of NPs to identify periodontitis. Plasmonic NPs include metal NPs, quantum dots (QDs), carbon base NPs, and nanozymes, exceptionally potent light absorbers and scatterers.

- In June 2024, according to an article published by the Royal Society of Chemistry, periodontal biosensors and biomarkers are critical in improving oral health diagnostic skills. Clinicians may accomplish early identification, tailored therapy, and efficient tracking of periodontal diseases by using these technologies, ushering in a new age of accurate oral healthcare. These innovations improve our capacity to diagnose, monitor, and adapt periodontal therapies, bringing in the next phase of customized and effective dental healthcare.

Moreover, advancements in laser therapy are transforming the treatment landscape for complex periodontal conditions. Laser-assisted periodontal procedures, including the use of diode lasers and Er: YAG lasers, enable less invasive intervention options that reduce healing times and improve patient comfort by minimizing damage to surrounding tissues. Lasers can facilitate the precise removal of infected tissue and promote bacterial reduction, addressing the underlying causes of periodontal disease more effectively. The combination of these emerging therapies enhances the clinical efficacy of periodontal treatments and aligns with the current trend towards minimally invasive and patient-centered care, ultimately aiding practitioners in providing comprehensive and innovative treatment options for individuals suffering from complex periodontal disease.

- Increasing Importance of Periodontal Care

The increasing importance of periodontal care in relation to overall systemic health has created significant opportunities for the U.S. periodontal treatment for adults market. Research has increasingly demonstrated links between periodontal disease and several systemic health conditions, including cardiovascular disease, diabetes, and respiratory diseases. This growing body of evidence emphasizes the necessity of effective periodontal care as a component of preventive health. As healthcare professionals and patients become more aware of these correlations, there is likely to be a rise in referrals to periodontists and a greater emphasis on early intervention and preventive strategies. Consequently, this awareness can lead to increased patient demand for periodontal services and a more integrated approach to oral health within broader healthcare initiatives.

For instance,

- In July 2024, according to an article published by the Glendale Heights Family Dental, maintaining healthy gums through periodontal maintenance offers numerous benefits, such as reduced risk of tooth loss, and improved overall health. By investing in periodontal maintenance, individuals can enjoy these benefits and boost in self-confidence and quality of life, enabling them to pursue their passions and interests without the burdens of tooth loss and related oral health issues.

- In September 2022, according to an article published by the Coeur d’ Alene Dental Center, periodontal disease is a major cause of tooth loss among adults in the U.S. This makes periodontal care crucial to protect oral health as well as maintaining a smile. Moreover, the importance of periodontal care is further underlined by the Centers for Disease Control and Prevention (CDC), which reports that half the U.S. adult population have gum disease, with the risk of destruction of gum and bone tissue and periodontal ligaments, and subsequent loss of teeth. Moreover, research suggests that the spread of infection from periodontal disease can trigger inflammation in other areas of the body, increasing the risk of illnesses such as stroke, heart disease, and diabetes.

In response to the heightened recognition of the systemic implications of periodontal health, dental practitioners are focusing on comprehensive treatment modalities that include routine periodontal assessments and interdisciplinary collaboration with other healthcare providers. This shift enhances patient outcomes and supports value-based care paradigms in the healthcare landscape, which prioritize preventive and holistic approaches. As periodontal treatment gains traction as a critical component of overall health management, periodontal practices have the opportunity to expand their service offerings, engage in public awareness campaigns, and implement innovative treatment protocols. By capitalizing on this trend, periodontal providers can grow their patient base but contribute to better health outcomes through proactive disease management and education

Restraints/Challenges

- High Treatment Costs Limiting Access to Periodontal Care for Adults

Periodontal treatments, which include procedures such as scaling and root planing, gum surgery, and dental implants, often come with hefty price tags due to the complexity and specialized care required. These high costs can limit accessibility for many patients, impacting market demand and growth. In addition, the high cost of advanced periodontal therapies, along with the need for multiple sessions, can make it a financial burden for individuals without adequate insurance coverage. As a result, patients may delay treatment or seek alternative options, potentially affecting the overall market size. However, for those who can afford it or have access to insurance, the demand for high-quality periodontal care remains robust, particularly in regions with a higher concentration of dental professionals and advanced treatment technologies. Consequently, treatment costs both act as a barrier for some and as a driver for specialized providers within the market.

For instances,

- In January 2021, according to the article published by ellicottcitydentistry, Periodontal disease treatment costs range from USD 1,700 to USD 8,000, with teeth extractions averaging USD 200 to USD 300 per tooth. Initial treatment often involves root scaling and planing, but if ineffective, more expensive surgery, including pocket reduction and bone grafting, may be required. These high costs present significant financial barriers for many patients.

- In April 2023, according to the article published by The Journal of the American Dental Association , In 2018, Periodontal Disease (PD) resulted in USD 3.5 billion in direct costs in the U.S. In addition, PD-related edentulism contributed to USD 150.7 billion in indirect costs. These significant financial burdens highlight the high treatment costs associated with managing periodontal disease and its impact on overall healthcare expenditures.

In conclusion, high treatment costs significantly influence the U.S. Periodontal Treatment for Adults market by limiting access for certain segments of the population. These elevated expenses can lead to delays in seeking treatment or push individuals to explore alternative options, thereby affecting overall market demand. However, for those with the financial means or proper insurance, the demand for advanced periodontal care remains strong. Ultimately, while cost presents a challenge for some, it also fuels the growth of specialized providers who cater to those able to afford such treatments.

- Complexity of Treatment Protocols Increasing Challenges in Periodontal Care

Periodontal treatments often require a multi-step approach, including initial diagnosis, ongoing maintenance, and various surgical or non-surgical interventions. The complexity of these treatment regimens can make the process time-consuming, requiring patients to commit to long-term care and multiple appointments, which can be a deterrent for some individuals. Furthermore, the need for specialized expertise and advanced technology to effectively manage periodontal disease drives up the costs, influencing both the accessibility and affordability of treatment options. On the other hand, as awareness of the importance of oral health grows, more patients are willing to invest in complex treatments, which boosts demand within the market. In addition, the increasing prevalence of periodontal disease in adults due to factors such as aging and poor oral hygiene further fuels the need for sophisticated treatment protocols, driving the growth of the market overall.

For instances,

- In February 2021, according to the article published by NCBI, Periodontitis affects over 40% of U.S. adults and requires a multifactorial approach for effective treatment. Successful management involves understanding its pathogenesis, risk factors, and treatment protocols. Non-surgical therapy, such as scaling and root planing, may be followed by surgical options. Regular maintenance and long-term follow-up are essential for treatment success.

In January 2024, according to the article published by NCBI, Periodontal surgery is required for deep pockets after non-surgical therapy, with procedures tailored to pocket type. Options include gingivectomy, wedge procedure, gingival flap, osseous surgery, and regenerative therapies such as bone grafting and guided tissue regeneration. Each procedure addresses specific tissue and bone conditions, making treatment protocols complex and individualized.

U.S. Periodontal Treatment for Adults Market Scope

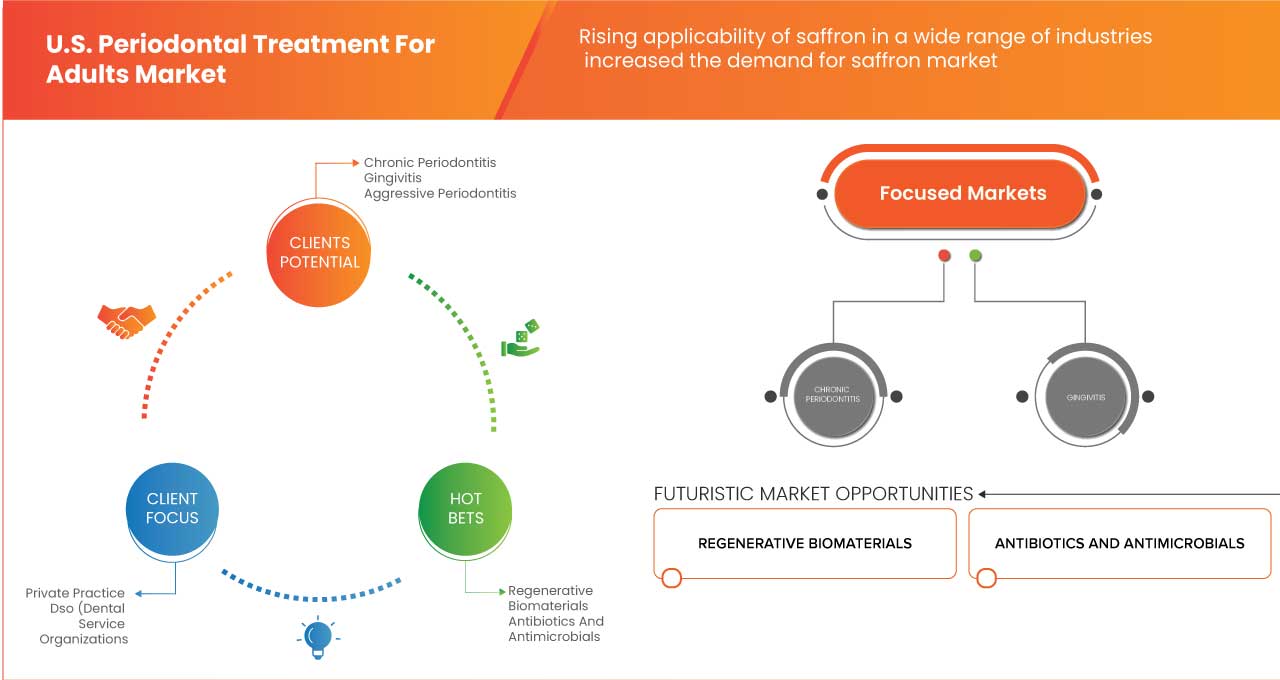

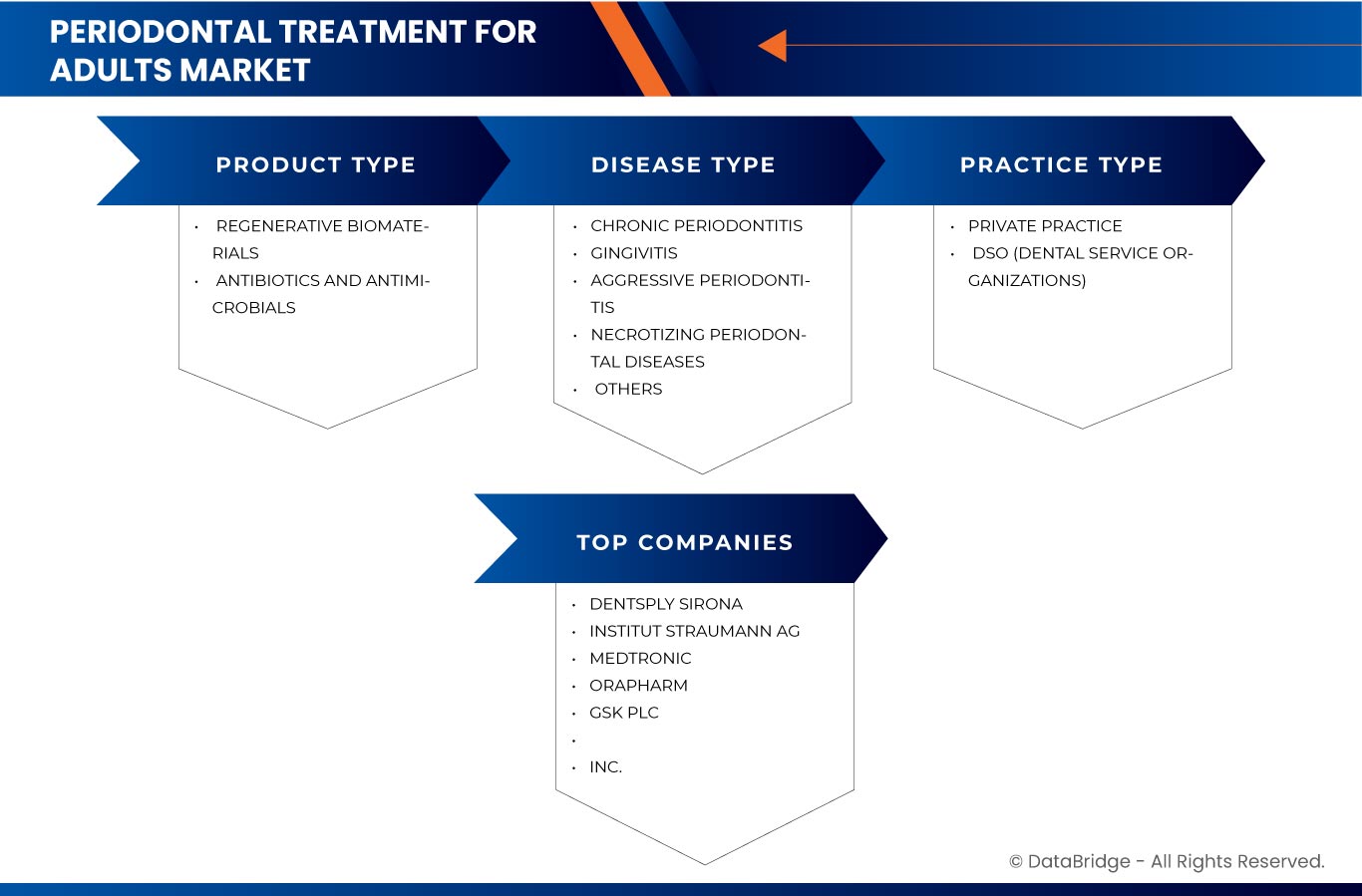

The market is segmented on the basis of product type, disease type, and practice type. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Product Type

- Regenerative Biomaterials

- Bone Grafts

- Allograft

- Xenograft

- Synthetic Bone Grafts

- Membranes For Guided Bone/Tissue Regeneration (Gbr/Gtr)

- Resorbable Membranes

- Non-Resorbable Membranes

- Bone Grafts

- Antibiotics And Antimicrobials

- Local Antibiotic

- Systemic Antibiotic Therapy

- Route

- Oral Antibiotics

- Doxycycline

- Amoxicillin

- Metronidazole

- Clindamycin

- Azithromycin

- Vibramycin

- Others

- Topical Antibiotics

- Minocycline Hydrochloride (Arestin)

- Chlorhexidine

- Doxycycline

- Metronidazole Gel

- Others

- Oral Antibiotics

- Regenerative Biomaterials

Disease Type

- Disease Type

- Chronic Periodontitis

- Gingivitis

- Aggressive Periodontitis

- Necrotizing Periodontal Diseases

- Others

Practice Type

- Private Practice

- Regenerative Biomaterials

- Bone Grafts

- Allograft

- Xenograft

- Synthetic Bone Grafts

- Membranes For Guided Bone/Tissue Regeneration (Gbr/Gtr)

- Resorbable Membranes

- Non-Resorbable Membranes

- Bone Grafts

- Antibiotics And Antimicrobials

- Local Antibiotic

- Systemic Antibiotic Therapy

- Route

- Oral Antibiotics

- Doxycycline

- Amoxicillin

- Metronidazole

- Clindamycin

- Azithromycin

- Vibramycin

- Others

- Topical Antibiotics

- Minocycline Hydrochloride (Arestin)

- Chlorhexidine

- Doxycycline

- Metronidazole Gel

- Others

- Oral Antibiotics

- Regenerative Biomaterials

- DSO (Dental Service Organizations)

- Regenerative Biomaterials

- Bone Grafts

- Allograft

- Xenograft

- Synthetic Bone Grafts

- Membranes For Guided Bone/Tissue Regeneration (Gbr/Gtr)

- Resorbable Membranes

- Non-Resorbable Membranes

- Bone Grafts

- Antibiotics And Antimicrobials

- Local Antibiotic

- Systemic Antibiotic Therapy

- Route

- Oral Antibiotics

- Doxycycline

- Amoxicillin

- Metronidazole

- Clindamycin

- Azithromycin

- Vibramycin

- Others

- Topical Antibiotics

- Minocycline Hydrochloride (Arestin)

- Chlorhexidine

- Doxycycline

- Metronidazole Gel

- Others

- Oral Antibiotics

- Regenerative Biomaterials

U.S. Periodontal Treatment for Adults Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

U.S. Periodontal Treatment for Adults Market Leaders Operating in the Market Are:

- Dentsply Siroma (U.S.)

- Straumann AG (Switzerland)

- Medtronic (Ireland)

- Orapharm (Japan)

- GSK. (U.K.)

- Life Net Health (U.S.)

- Pfizer (U.S.)

- Hioseen (South Korea)

- Osteogenics Biomedical (U.S.)

- Epien (U.S.)

- BioHorizons (U.S.)

- Biolase (U.S.)

- Biocomposites (U.K.)

- Nobel Biocare Services (Switzerland)

- ZimVie (U.S.)

- Forward science (U.S.)

- PerioProtect (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 DBMR TRIPOD DATA VALIDATION MODEL

2.3 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.4 DBMR MARKET POSITION GRID

2.5 VENDOR SHARE ANALYSIS

2.6 SECONDARY SOURCES

2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: REGULATIONS

5.1 REGULATORY AUTHORITIES IN THE U.S.

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 EXPANSION OF DENTAL INSURANCE COVERAGE FOR PERIODONTAL CARE

6.1.2 IMPROVED PATIENT EDUCATION ON THE IMPORTANCE OF PERIODONTAL HEALTH AND CARE

6.1.3 CONNECTION BETWEEN ORAL HEALTH AND SYSTEMIC DISEASES IMPACTING OVERALL HEALTH

6.2 RESTRAINTS

6.2.1 HIGH TREATMENT COSTS LIMITING ACCESS TO PERIODONTAL CARE FOR ADULTS

6.2.2 COMPLEXITY OF TREATMENT PROTOCOLS INCREASING CHALLENGES IN PERIODONTAL CARE

6.3 OPPORTUNITIES

6.3.1 EMERGING TREATMENTS FOR COMPLEX PERIODONTAL DISEASE

6.3.2 INCREASING IMPORTANCE OF PERIODONTAL CARE

6.3.3 GROWING ADOPTION OF AI AND MACHINE LEARNING IN PERIODONTAL DIAGNOSTICS

6.4 CHALLENGES

6.4.1 LIMITED AWARENESS OF THE PERIODONTAL TREATMENTS

6.4.2 SHORTAGE OF QUALIFIED PERIODONTAL SPECIALISTS

7 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 REGENERATIVE BIOMATERIALS

7.2.1 BONE GRAFTS

7.2.2 MEMBRANES FOR GUIDED BONE/TISSUE REGENERATION (GBR/GTR)

7.3 ANTIBIOTICS AND ANTIMICROBIALS

8 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRACTICE TYPE

8.1 OVERVIEW

8.2 PRIVATE PRACTICE

8.2.1 REGENERATIVE BIOMATERIALS

8.2.1.1 BONE GRAFTS

8.2.1.1.1 ALLOGRAFT

8.2.1.1.2 XENOGRAFT

8.2.1.1.3 SYNTHETIC BONE GRAFTS

8.2.1.2 MEMBRANES FOR GUIDED BONE/TISSUE REGENERATION (GBR/GTR)

8.2.1.2.1 RESORBABLE MEMBRANES

8.2.1.2.2 NON-RESORBABLE MEMBRANES

8.3 ANTIBIOTICS AND ANTIMICROBIALS

8.3.1 LOCAL ANTIBIOTIC

8.3.2 SYSTEMIC ANTIBIOTIC THERAPY

8.3.2.1 ORAL ANTIBIOTICS

8.3.2.1.1 DOXYCYCLINE

8.3.2.1.2 AMOXICILLIN

8.3.2.1.3 METRONIDAZOLE

8.3.2.1.4 CLINDAMYCIN

8.3.2.1.5 AZITHROMYCIN

8.3.2.1.6 VIBRAMYCIN

8.3.2.1.7 OTHERS

8.3.2.2 TOPICAL ANTIBIOTICS

8.3.2.2.1 MINOCYCLINE HYDROCHLORIDE (ARESTIN)

8.3.2.2.2 CHLORHEXIDINE

8.3.2.2.3 DOXYCYCLINE

8.3.2.2.4 METRONIDAZOLE GEL

8.3.2.2.5 OTHERS

8.4 DSO (DENTAL SERVICE ORGANIZATIONS)

8.4.1 REGENERATIVE BIOMATERIALS

8.4.1.1 BONE GRAFTS

8.4.1.1.1 ALLOGRAFT

8.4.1.1.2 XENOGRAFT

8.4.1.1.3 SYNTHETIC BONE GRAFTS

8.4.1.2 MEMBRANES FOR GUIDED BONE/TISSUE REGENERATION (GBR/GTR)

8.4.1.2.1 RESORBABLE MEMBRANES

8.4.1.2.2 NON-RESORBABLE MEMBRANES

8.4.2 ANTIBIOTICS AND ANTIMICROBIALS

8.4.2.1 LOCAL ANTIBIOTIC

8.4.2.2 SYSTEMIC ANTIBIOTIC THERAPY

8.4.2.2.1 ORAL ANTIBIOTICS

8.4.2.2.1.1 DOXYCYCLINE

8.4.2.2.1.2 AMOXICILLIN

8.4.2.2.1.3 METRONIDAZOLE

8.4.2.2.1.4 CLINDAMYCIN

8.4.2.2.1.5 AZITHROMYCIN

8.4.2.2.1.6 VIBRAMYCIN

8.4.2.2.1.7 OTHERS

8.4.2.2.2 TOPICAL ANTIBIOTICS

8.4.2.2.2.1 MINOCYCLINE HYDROCHLORIDE (ARESTIN)

8.4.2.2.2.2 CHLORHEXIDINE

8.4.2.2.2.3 DOXYCYCLINE

8.4.2.2.2.4 METRONIDAZOLE GEL

8.4.2.2.2.5 OTHERS

9 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET, BY DISEASE TYPE

9.1 OVERVIEW

9.2 CHRONIC PERIODONTITIS

9.3 GINGIVITIS

9.4 AGGRESSIVE PERIODONTITIS

9.5 NECROTIZING PERIODONTAL DISEASES

9.6 OTHERS

10 COMPANY SHARE ANALYSIS: U.S.

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 DENTSPLY SIRONA

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENTS

12.2 INSTITUT STRAUMANN AG

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 MEDTRONIC

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 ORAPHARMA

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT DEVELOPMENT

12.5 GSK PLC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 BIOHORIZONS

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 BIOLASE INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 BIOCOMPOSITES

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 EPIEN MEDICAL, INC.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 FORWARD SCIENCE

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 HIOSSEN

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 LIFENET HEALTH

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 NOBEL BIOCARE USA

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 OSTEOGENICS BIOMEDICAL

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 PERIO PROTECT

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 PFIZER

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENT

12.17 ZIMVIE INC.

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 2 U.S. REGENERATIVE BIOMATERIALS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE 2018-2032 (USD MILLION)

TABLE 3 U.S. BONE GRAFTS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 4 U.S. MEMBRANES FOR GUIDED BONE/TISSUE REGENERATION (GBR/GTR) IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE 2018-2032 (USD MILLION)

TABLE 5 U.S. ANTIBIOTICS AND ANTIMICROBIALS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 U.S. ANTIBIOTICS AND ANTIMICROBIALS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY ROUTE, 2018-2032 (USD MILLION)

TABLE 7 U.S. ORAL ANTIBIOTICS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 U.S. TOPICAL ANTIBIOTICS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 TABLE 1 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRACTICE TYPE, 2018-2032 (USD MILLION)

TABLE 10 U.S. PRIVATE PRACTICE IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 11 U.S. REGENERATIVE BIOMATERIALS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 12 U.S. BONE GRAFTS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 13 U.S. MEMBRANES FOR GUIDED BONE/TISSUE REGENERATION (GBR/GTR) IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 14 U.S. ANTIBIOTICS AND ANTIMICROBIALS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 15 U.S. ANTIBIOTICS AND ANTIMICROBIALS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY ROUTE, 2018-2032 (USD MILLION)

TABLE 16 U.S. ORAL ANTIBIOTICS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 17 U.S. TOPICAL ANTIBIOTICS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 18 U.S. DSO (DENTAL SERVICE ORGANIZATIONS) IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 19 U.S. REGENERATIVE BIOMATERIALS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 20 U.S. BONE GRAFTS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 21 U.S. MEMBRANES FOR GUIDED BONE/TISSUE REGENERATION (GBR/GTR) IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

TABLE 22 U.S. ANTIBIOTICS AND ANTIMICROBIALS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 23 U.S. ANTIBIOTICS AND ANTIMICROBIALS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY ROUTE,2018-2032 (USD MILLION)

TABLE 24 U.S. ORAL ANTIBIOTICS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 25 U.S. TOPICAL ANTIBIOTICS IN PERIODONTAL TREATMENT FOR ADULTS MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 26 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET, BY DISEASE TYPE, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: SEGMENTATION

FIGURE 2 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: GEOGRAPHICAL SCOPE

FIGURE 3 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: YEARS CONSIDERED FOR THE STUDY

FIGURE 4 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: DATA TRIANGULATION

FIGURE 5 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: DROC ANALYSIS

FIGURE 6 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 7 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: MULTIVARIATE MODELLING

FIGURE 10 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: DBMR MARKET POSITION GRID

FIGURE 11 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: SEGMENTATION

FIGURE 13 TWO SEGMENTS COMPRISE THE US PERIODONTAL TREATMENT FOR ADULTS MARKET, BY PRODUCT TYPE

FIGURE 14 US PERIODONTAL TREATMENT FOR ADULTS MARKET EXECUTIVE SUMMARY

FIGURE 15 RISING PREVALENCE OF CHRONIC DISEASES IS DRIVING THE GROWTH OF THE U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET FROM 2025 TO 2032

FIGURE 16 THE CATARACT SURGERY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET IN 2025 AND 2032

FIGURE 17 MARKET OVERVIEW

FIGURE 18 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY PRODUCT TYPE,2024

FIGURE 19 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY PRODUCT TYPE, 2025-2032 (USD MILLION)

FIGURE 20 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 21 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 22 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY PRACTICE TYPE,2024

FIGURE 23 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY PRACTICE TYPE, 2025-2032 (USD MILLION)

FIGURE 24 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY PRACTICE TYPE, CAGR (2025-2032)

FIGURE 25 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY PRACTICE TYPE, LIFELINE CURVE

FIGURE 26 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY DISEASE TYPE, 2024

FIGURE 27 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY DISEASE TYPE, 2025-2032 (USD MILLION)

FIGURE 28 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY DISEASE TYPE, CAGR (2025-2032)

FIGURE 29 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 30 U.S. PERIODONTAL TREATMENT FOR ADULTS MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.