Us Polyurethane Market

Market Size in USD Billion

CAGR :

%

USD

7.55 Billion

USD

11.01 Billion

2024

2032

USD

7.55 Billion

USD

11.01 Billion

2024

2032

| 2025 –2032 | |

| USD 7.55 Billion | |

| USD 11.01 Billion | |

|

|

|

U.S. Polyurethane Market Analysis

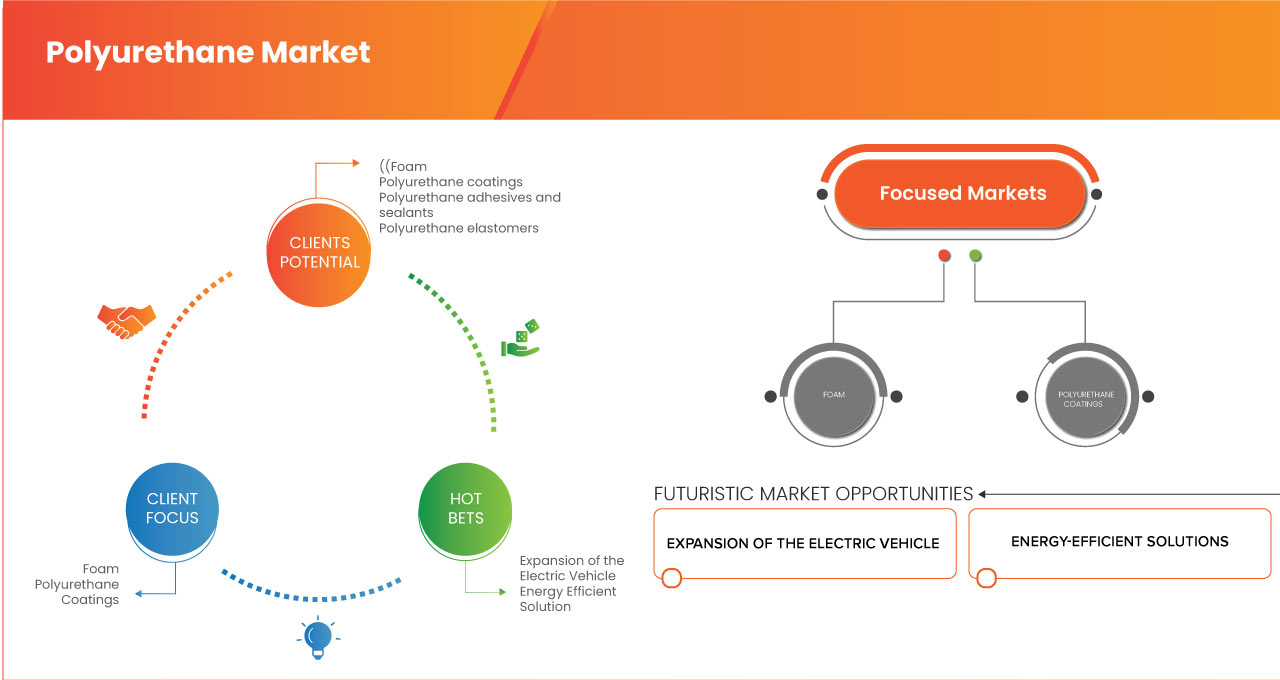

The U.S. polyurethane market is robust and expanding due to growing demand across various sectors including construction, automotive, furniture, and packaging. Polyurethane, known for its versatility and durability, is used in insulation, sealants, coatings, and adhesives. Recent trends show increased adoption of energy-efficient building materials and eco-friendly formulations, driving growth. In addition, advancements in production technology and increased investments in research and development are expanding product applications. However, rising raw material costs and stringent environmental regulations pose challenges to market growth. Manufacturers are focusing on innovative solutions to improve sustainability and performance. Overall, the U.S. polyurethane market is expected to maintain steady growth, driven by technological advancements and demand for high-performance materials across industrial sectors. Strong market fundamentals ensure continued expansion.

U.S. Polyurethane Market Size

U.S. polyurethane market is expected to reach USD 11.01 billion by 2032 from USD 7.55 billion in 2024, growing with a substantial CAGR of 4.9% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

U.S. Polyurethane Market Trends

“Increasing Demand from the Construction and Automotive Sectors”

Polyurethane’s unique properties, such as durability, versatility, and insulation capabilities, make it an essential material in the construction and automotive industries, leading to expanding applications and market potential. In the construction sector, polyurethane is widely used for insulation, coatings, adhesives, and sealants. As the demand for energy-efficient buildings rises, polyurethane’s superior thermal insulation properties have made it a key material in energy-efficient construction. Rigid polyurethane foam is a popular choice for wall insulation, roof insulation, and foundation insulation due to its high thermal resistance and ability to reduce energy consumption. With the increasing focus on sustainable construction practices and the need to meet energy efficiency standards, polyurethane’s role in enhancing building performance has gained significant traction. In addition, polyurethane coatings provide long-lasting protection for surfaces, further contributing to the durability and lifespan of buildings

In the automotive industry, polyurethane plays a vital role in reducing vehicle weight, improving fuel efficiency, and enhancing comfort. Polyurethane foam is used extensively in automotive seating, offering superior cushioning and comfort while maintaining lightweight properties that help reduce vehicle weight. The demand for lightweight materials in vehicles has surged due to the need for improved fuel efficiency and lower emissions, especially in the context of tightening environmental regulations.

For Instance,

- In March 2023, according to an article published by PSI Urethanes, Inc., PSI Urethanes specializes in custom polyurethane products for the automotive industry, offering solutions like gaskets, bushings, washers, rollers, and engine mounts. Their urethane parts provide superior durability, impact resistance, and longevity, outperforming traditional materials like rubber and metal, making them ideal for automotive applications.

Moreover, as consumer preferences evolve toward more sustainable and energy-efficient products, polyurethane’s role in both the construction and automotive sectors becomes even more critical. With innovations in production techniques and growing awareness about environmental sustainability, the polyurethane market is poised to continue benefiting from increasing demand in these key industries, making it a central player in both construction and automotive advancements.

Report Scope and Market Segmentation

|

Attributes |

U.S. Polyurethane Market Insights |

|

Segments Covered |

|

|

Key Market Players |

BASF (Germany), Dow (U.S.), Saint-Gobain (France), PPG Industries, Inc. (U.S.), Huntsman International LLC (U.S.), General Plastics Manufacturing Company, Inc. (U.S.), Foamcraft, Inc. (U.S.), UFP Technologies, Inc. (U.S.), INOAC CORPORATION (Japan), SEKISUI CHEMICAL CO., LTD. (Japan), SABIC (Saudi Arabia), Chemline (U.S.), Wisconsin Foam Products (U.S.), Polymer Laboratories & Solutions (U.S.), and Capital Resin Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

U.S. Polyurethane Market Definition

Polyurethane is a synthetic polymer made by reacting diisocyanates with polyols. It is a highly versatile material available in various forms, including flexible and rigid foams, coatings, adhesives, sealants, and elastomers. Polyurethane's unique properties, such as excellent durability, flexibility, insulation, and resistance to wear, make it suitable for a wide range of applications. In the construction industry, it's used for thermal insulation and sealants, while in the automotive sector, it’s utilized for lightweight components, seat cushioning, and interior materials. Polyurethane also plays a crucial role in furniture and bedding products, providing comfort through foam-based materials. Its ability to be tailored for different applications, along with its high-performance characteristics, has made polyurethane a critical material across various industries.

U.S. Polyurethane Market Dynamics

Drivers

- Emphasis on Sustainability and Energy Efficiency

As industries and consumers become more aware of environmental impacts, there is increasing demand for materials that support energy conservation and reduce carbon footprints. Polyurethane, known for its superior insulation properties, plays a crucial role in meeting these demands.

In the construction industry, polyurethane’s thermal insulation capabilities are highly valued for improving energy efficiency in buildings. Rigid polyurethane foam, commonly used for insulation in walls, roofs, and floors, helps minimize heat loss or gain, significantly reducing heating and cooling costs. As building codes become stricter and governments push for more energy-efficient construction practices, the demand for polyurethane insulation is expected to grow. In addition, polyurethane-based coatings and sealants help enhance the durability and weather resistance of structures, further contributing to energy efficiency by preventing air leaks and moisture infiltration.

In the automotive sector, the drive for sustainability is pushing manufacturers to adopt lightweight materials that enhance fuel efficiency and reduce emissions. Polyurethane plays a vital role in this transition, as its lightweight yet durable properties make it ideal for automotive components. Polyurethane foams are used extensively in seating, interior components, and lightweight body parts, which help reduce the overall weight of vehicles. This not only improves fuel efficiency but also supports the development of electric vehicles (EVs), which require lightweight materials for better battery performance and range.

For instance,

- According to a blog published by Synthesia Technology, Polyurethane is a sustainable material with low CO2 emissions during production and exceptional insulating properties that contribute to energy efficiency. It is highly recyclable, with up to 30% of its polyols derived from waste. Recycled polyurethane is used in various sectors, including furniture, construction, and automotive, without performance loss.

The focus on sustainability also aligns with polyurethane’s growing role in the development of eco-friendly alternatives. Many manufacturers are exploring bio-based polyurethanes and sustainable production methods to reduce reliance on petroleum-based feedstocks, contributing to a more circular economy. As a result, the emphasis on sustainability and energy efficiency is driving both innovation and adoption of polyurethane in various sectors, further expanding its market presence.

- Growing Consumer Preference for Comfort and Durability in Furniture And Bedding

As consumers increasingly prioritize quality and long-lasting products in their homes, polyurethane has become the material of choice for producing comfortable, durable, and high-performance furniture and bedding items.

In the furniture industry, polyurethane foam is widely used for cushions, upholstery, and mattresses due to its ability to offer exceptional comfort, support, and durability. Flexible polyurethane foam provides the softness and resilience necessary for seating and cushioning applications. It can be engineered to have varying degrees of firmness or softness, making it adaptable to different consumer preferences. As people spend more time at home, particularly with trends like remote work and home-based leisure activities, the demand for comfortable furniture has surged. Polyurethane foam allows manufacturers to produce furniture that meets the growing demand for ergonomic design, long-lasting comfort, and functional aesthetics.

In the bedding industry, polyurethane foam, particularly memory foam, has transformed the mattress market. Memory foam mattresses, which mold to the shape of the body, offer improved sleep quality by providing support and alleviating pressure points. This has made polyurethane foam a preferred material for mattresses, pillow cushions, and other sleep products. As consumers become more aware of the importance of sleep quality, they are increasingly investing in premium bedding products, driving up the demand for polyurethane-based materials. The foam’s durability and ability to retain its shape over time further enhance its appeal, as consumers seek products that provide long-term value.

For instance,

- In 2021, according to an article published by Elsevier, Polyurethane (PU) foams, known for their comfort and insulation properties, can be enhanced by reinforcing alumina particles. This increases the foam's tensile strength and modulus by up to 35% with alumina weight fractions of 1–35%. X-ray diffraction and SEM analysis confirm the improvement, offering better furniture comfort and durability

- According to an article published by Polyurethane Foam Association, Flexible Polyurethane Foam (FPF) is essential in residential furniture, offering customizable shapes for comfort and support. It provides deep-down support, softness, durability, and value, while being versatile for various designs. FPF is also hygienic, recyclable, and meets stringent flammability standards, ensuring long-lasting, comfortable furniture solutions

As consumer preferences continue to shift toward high-quality, durable, and comfortable furniture and bedding, the demand for polyurethane will continue to rise. Polyurethane’s combination of comfort, durability, and versatility makes it an essential material in meeting the expectations of today’s consumers, further driving growth in the market for these products. With increasing trends toward personalization and luxury, polyurethane’s role in shaping the furniture and bedding industries will remain central to satisfying evolving consumer demands.

Opportunities

- Expansion of the Electric Vehicle (EV)

As the U.S. automotive sector shifts toward sustainability and energy efficiency, EVs are becoming the cornerstone of this transformation. Polyurethane, with its versatile properties such as lightweight, durability, thermal insulation, and vibration dampening, is poised to play a critical role in this evolving landscape.

One of the primary factor of this opportunity is the need for lightweight materials in EV manufacturing. Polyurethane-based components, such as seats, interior panels, and insulation foams, help reduce the overall weight of vehicles, thereby enhancing battery efficiency and extending driving range. This aligns perfectly with the EV industry's focus on maximizing energy efficiency. In addition, polyurethane's excellent thermal insulation properties make it ideal for battery packaging, ensuring optimal performance and safety of lithium-ion batteries, which are sensitive to temperature fluctuations.

Furthermore, the growing demand for comfort and noise reduction in EVs creates another avenue for polyurethane applications. Acoustic foams and vibration-dampening materials made from polyurethane are increasingly used to improve cabin quietness, a key selling point for EV manufacturers targeting premium markets. As consumer expectations for comfort and performance rise, the demand for high-quality polyurethane solutions will continue to grow. The U.S.. polyurethane market is well-positioned to capitalize on this trend, given its strong manufacturing base, technological expertise, and established supply chains. By collaborating with EV manufacturers and investing in innovative polyurethane formulations, U.S. companies can secure a competitive edge in this burgeoning sector. Moreover, government incentives for EV adoption and sustainability initiatives further amplify this opportunity, creating a favorable environment for polyurethane market growth.

For instance

- According to an article published American Chemistry Council, Inc By replacing steel with polyurethane composites, EVs achieve greater energy efficiency and extended range. Polyurethane foams and coatings enhance soundproofing and passenger comfort by reducing road noise. In battery systems, polyurethane provides thermal insulation and shock absorption, increasing safety and durability. As EV production grows, polyurethane manufacturers have a major opportunity to supply advanced, sustainable solutions to automakers

- In January 2025, according to an article published on Canary Media the U.S. Electric Vehicle (EV) market has experienced notable growth, with EVs and hybrids comprising approximately 20% of new car sales in 2024. Battery Electric Vehicles (BEVs) alone accounted for about 8% of these sales, reflecting a 7% year-over-year increase. In total, Americans purchased around 1.3 million new EVs in 2024, surpassing the previous year's record of 1.19 million. The growing EV market ensures sustained demand for advanced polyurethane solutions, creating the opportunity for innovation and expansion in the industry

The expansion of the EV market offers a transformative opportunity for the U.S. polyurethane industry. By leveraging its unique properties and aligning with the needs of EV manufacturers, the polyurethane market can drive innovation, sustainability, and economic growth in the years to come.

- Rising Adoption of Green Building and Energy-Efficient Solutions

The increasing emphasis on green building practices and energy-efficient solutions presents a significant growth opportunity for the U.S. polyurethane market. With stringent building codes, government incentives, and rising consumer demand for sustainable construction materials, polyurethane-based products are playing a pivotal role in shaping the future of the energy-efficient building sector.

A key factor fueling the demand for polyurethane is its superior insulation efficiency. Polyurethane spray foam insulation offers superior thermal resistance (high R-value per inch) compared to traditional insulation materials. This helps in reducing energy consumption in residential and commercial buildings, aligning with LEED certifications and net-zero energy goals. As states implement stricter energy codes, the demand for high-performance polyurethane insulation is expected to surge. In addition to above polyurethane sealants, coatings, and adhesives contribute to the durability and energy efficiency of modern structures. These materials provide air and moisture barriers, preventing energy losses and improving indoor air quality. With the growing adoption of cool roofing systems, polyurethane-based reflective coatings are gaining traction, further driving market expansion.

The increasing focus on sustainable construction materials is also fostering innovation in bio-based and recycled polyurethane solutions. Developers and builders are actively seeking low-emission, environmentally friendly materials, making eco-friendly polyurethane products a lucrative market segment.

For instance

- In November 2023 according to an article published on American Chemistry Council, Inc the adoption of polyurethane in green building and energy-efficient solutions is transforming the construction industry by enhancing insulation, reducing energy loss, and cutting carbon emissions. Spray polyurethane foam (SPF) insulation can cut energy bills by up to 30% while sealing air leaks that account for 40% of a building’s energy loss. As cities push for sustainability and net-zero energy goals, polyurethane materials are becoming essential for energy-efficient and resilient infrastructure

- In February 2025, according to an article published by ARKA California’s Title 24 Energy Efficiency Standards set strict regulations for building energy performance. These codes require high-performance insulation to minimize energy loss and improve efficiency. Polyurethane-based spray foam and rigid insulation panels are widely used to meet these standards. They help reduce heat transfer, air leakage, and overall energy consumption. Compliance with Title 24 drives the adoption of polyurethane in sustainable construction

With federal and state initiatives promoting energy efficiency and sustainability, polyurethane manufacturers are well-positioned to capitalize on the expanding green building sector. Companies that invest in advanced insulation technologies, sustainable formulations, and high-performance polyurethane solutions will gain a competitive advantage in this rapidly evolving market. As the green building movement accelerates, the polyurethane industry will continue to play a crucial role in driving energy efficiency and sustainability in the construction sector.

Restraints/Challenges

- Volatility in Raw Material Prices

Polyurethane is derived from key raw materials such as isocyanates (MDI and TDI) and polyols, which are petrochemical-based and highly sensitive to fluctuations in crude oil prices. This volatility creates a challenging environment for manufacturers, distributors, and end-users alike.

The primary issues are the unpredictability of crude oil prices, which are influenced by geopolitical tensions, supply chain disruptions, and U.S. economic conditions. For instance, the Russia-Ukraine conflict and OPEC production decisions have led to sharp increases in crude oil prices, driving up the cost of polyurethane raw materials. This unpredictability makes it difficult for manufacturers to forecast costs and set stable pricing for their products, leading to margin compression and reduced competitiveness. In addition, the shutdown of key production facilities in Asia and Europe during the pandemic created a supply-demand imbalance, causing prices of MDI and TDI to spike. This has forced U.S. polyurethane manufacturers to either absorb higher costs or pass them on to customers, risking a decline in demand.

The volatility also poses challenges for end-users, particularly in industries like construction, automotive, and furniture, where polyurethane is a critical material. Rising input costs can lead to increased prices for finished products, making it harder for businesses to remain competitive in price-sensitive markets. For instance, higher polyurethane prices can escalate the cost of insulation materials, impacting the affordability of energy-efficient building solutions.

For instance

- In September 2023, according to an article published by BBC in 2022, crude oil prices surged to over USD 120 per barrel due to the Russia-Ukraine conflict and OPEC+ production cuts. This directly increased the cost of petrochemical-derived raw materials like MDI (methylene diphenyl diisocyanate) and polyols, which are essential for polyurethane production

- In January 2025, according to an article published by LexisNexis Risk Solutions winter Storm Enzo caused widespread shutdowns of chemical plants and refineries along the U.S.. Gulf Coast, disrupting the supply of key petrochemicals. At least eight ethylene crackers and five Ethylene Glycol (EG) units were forced to shut down, leading to production halts in essential raw materials for polyurethane manufacturing. Major companies like BASF, Dow, and LyondellBasell experienced unplanned outages, straining the availability of ethylene oxide, ethanolamines, and other feedstocks. These disruptions intensified supply chain shortages, leading to delays in polyurethane production and rising costs for construction, automotive, and insulation industries

The volatility of raw material prices remains a significant challenge for the U.S.. polyurethane market, affecting cost predictability, profitability, and overall market stability. As crude oil prices fluctuate due to geopolitical and economic factors, manufacturers must navigate rising production costs, supply chain disruptions, and competitive pressures. The impact extends to end-users in key industries, where higher polyurethane costs can hinder affordability and market growth.

- Intricated Manufacturing Processes

Unlike conventional materials, polyurethane production requires precise chemical formulations, specialized equipment, and strict environmental controls, adding layers of difficulty to the manufacturing process.

One of the key challenges is the precision in raw material mixing and reaction control. Polyurethane is formed through the reaction of isocyanates (MDI, TDI) and polyols, which must be carefully balanced to achieve the desired density, flexibility, and durability. Any variation in temperature, pressure, or mixing ratios can lead to inconsistent product quality, increasing waste and production downtime. In addition, polyurethane processing involves specialized machinery, such as high-pressure injection molding, spray foam applicators, and reaction injection molding (RIM) systems. These require skilled labor and continuous maintenance, raising operational costs for manufacturers. The lack of experienced technicians further compounds production bottlenecks.

Another challenge is compliance with environmental and safety regulations. The production of polyurethane involves Volatile Organic Compounds (VOCs) and hazardous chemicals, subjecting manufacturers to strict EPA guidelines and OSHA workplace safety standards. Implementing sustainable practices, such as low-emission formulations and waste management systems, requires additional investment, further straining profit margins. Moreover, customization demands from end-users—such as high-performance foams for automotive seating or rigid insulation panels for energy-efficient buildings—add complexity. Meeting these diverse specifications necessitates flexible production lines and advanced R&D capabilities, making it difficult for smaller manufacturers to compete.

For instance

- According to an article published by Thunder Said Energy polyurethane manufacturing is a highly intricate process, involving over 20 intermediate stages to transform raw materials such as oil, gas, air, and mined minerals into various polyurethane products. With hundreds of different formulations catering to diverse applications, the complexity of production increases significantly. This level of intricacy in processing and formulation makes cost modeling and efficiency optimization challenging in the 25MTpa U.S. polyurethane market, which accounts for approximately 5% of all plastics

- In May 2024, according to an article on EPA website the U.S.. Environmental Protection Agency (EPA) enforces strict air quality regulations, such as the National Emission Standards for Hazardous Air Pollutants (NESHAP), which require polyurethane manufacturers to reduce VOC emissions. Companies producing spray polyurethane foam (SPF) must implement costly emission control systems to meet air quality standards, might increasing production costs which can possess a significant challenge to the local small-scale manufacturer.

The intricate nature of polyurethane manufacturing presents ongoing challenges for producers, from maintaining precise chemical formulations to managing high operational costs and regulatory compliance. Variability in production conditions, specialized equipment requirements, and the demand for customized formulations further add to the complexity.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

U.S. Polyurethane Market Scope

The market is segmented on the basis of type, processing techniques, chemistry, nature, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Foam

- Foam, By Type

- Flexible Polyurethane Foam

- Rigid Polyurethane Foam

- Foam, By Category

- Standard

- Self-Skinning Polyurethane Foam

- Microcellular Polyurethane Foam

- Others

- Foam, By Cell Type

- Open Cell

- Closed Cell

- Foam, By Composition

- Low-Density Composition

- Medium Density Composition

- High Density Composition

- Foam, By Type

Processing Techniques

- Injection Molding

- Reaction Injection Molding (RIM)

- Pour-In-Place

- Extrusion

- Lamination

- Spray Foam

- Casting

Chemistry

- Aliphatic

- Aromatic

Nature

- Chemical-Based

- Bio-Based

- Bio-Based, By Type

- Non-Biodegradable

- Biodegradable

- Bio-Based, By Type

Application

- Furniture and Bedding

- Furniture and Bedding, By Type

- Cushions

- Upholstery

- Others

- Furniture and Bedding, By Type

- Construction Industry

- Construction Industry, By Application

- Foam Insulation

- Sealants and Adhesives

- Elastomeric Coatings

- Flooring

- Construction Industry, By Application

- Automotive Industry

- Automotive Industry, By Type

- Seating

- Interior Components

- Interior Components, By Type

- Dashboards

- Door Panels

- Headliners

- Others

- Interior Components, By Type

- Bumpers and Body Panels

- Automotive Industry, By Type

- Electronics

- Packaging

- Packaging, By Type

- Protective Packaging

- Thermal Insulated Packaging

- Packaging, By Type

- Footwear

- Footwear, By Type

- Soles

- Sports Shoes

- Others

- Footwear, By Type

- Medical Applications

- Medical Applications, By Type

- Medical Tubing and Catheters

- Prosthetics and Implants

- Wound Dressings

- Others

- Medical Applications, By Type

- Textile Industry

- Textile Industry, By Type

- Laminated Fabrics

- Stretch Fabrics

- Textile Industry, By Type

- Marine

- Marine, By Type

- Ships

- FPSO

- Yachts

- Docks

- Others

- Marine, By Type

- Energy Sector

- Energy Sector, By Type

- Wind Turbines

- Oil and Gas Pipelines

- Energy Sector, By Type

- Aerospace and Defense

- Consumer Goods

- Consumer Goods, By Type

- Appliances

- Sports and Recreation

- Sports and Recreation, By Type

- Helmets

- Panels

- Others

- Sports and Recreation, By Type

- Consumer Goods, By Type

- Surfboards

- Others

U.S. Polyurethane Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, U.S. presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

U.S. Polyurethane Market Leaders Operating in the Market Are:

- BASF (Germany)

- Dow (U.S.)

- Saint-Gobain (France)

- PPG Industries, Inc. (U.S.)

- Huntsman International LLC (U.S.)

- General Plastics Manufacturing Company, Inc. (U.S.)

- Foamcraft, Inc. (U.S.)

- UFP Technologies, Inc. (U.S.)

- INOAC CORPORATION (Japan)

- SEKISUI CHEMICAL CO., LTD. (Japan)

- SABIC (Saudi Arabia), Chemline (U.S.)

- Wisconsin Foam Products (U.S.)

- Polymer Laboratories & Solutions (U.S.)

- Capital Resin Corporation (U.S.)

Latest Developments in U.S. Polyurethane Market

- In February 2022, BASF acquires a new site in Canada for the production of battery materials and recycling expansion. The company states that this expansion will help them to power their North America transition to e-mobility. They plan to start with the cathode active materials and follow-up by precursor cathode materials, recycling and metals refining capabilities

- In May 2024, Dow has completed a new VORATRON Polyurethane Systems production line in Ahlen, Germany, increasing capacity tenfold to meet rising e-mobility battery assembly demands. These high-strength adhesives and thermally conductive composites enhance thermal management, weight reduction, and efficiency in EV batteries. Powered by 100% renewable energy, the site supports sustainability goals, ensuring a reliable supply for evolving electric vehicle technologies

- In September 2022, Saint-Gobain has received all the required approvals from relevant authorities for the acquisition of GCP Applied Technologies Inc.,(a major U.S. player in construction chemicals). This acquisition helps company to gain more recognition in the field of construction chemicals

- In January 2021, PPG announced its agreement to acquire VersaFlex, a manufacturer of polyurea, epoxy, and polyurethane coatings. The acquisition strengthens PPG's portfolio with a focus on water/wastewater infrastructure, flooring, and transportation. VersaFlex's expertise in polyurea and coatings technology complements PPG's growth strategy in protective and industrial coatings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VALUE CHAIN ANALYSIS: U.S. POLYURETHANE MARKET

4.7 VENDOR SELECTION CRITERIA

4.7.1 QUALITY AND CONSISTENCY

4.7.2 TECHNICAL EXPERTISE

4.7.3 SUPPLY CHAIN RELIABILITY

4.7.4 COMPLIANCE AND SUSTAINABILITY

4.7.5 COST AND PRICING STRUCTURE

4.7.6 FINANCIAL STABILITY

4.7.7 FLEXIBILITY AND CUSTOMIZATION

4.7.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.8 CLIMATE CHANGE SCENARIO

4.8.1 ENVIRONMENTAL CONCERNS

4.8.2 INDUSTRY RESPONSE

4.8.3 GOVERNMENT’S ROLE

4.8.4 ANALYST RECOMMENDATIONS

4.9 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.1 RAW MATERIAL COVERAGE OF THE U.S. POLYURETHANE MARKET

4.10.1 POLYOLS

4.10.2 DIISOCYANATES

4.10.3 ADDITIVES AND CATALYSTS

4.10.4 BLOWING AGENTS

4.10.5 CHAIN EXTENDERS AND CROSSLINKERS

4.10.6 SUPPLY CHAIN AND MARKET TRENDS

4.10.7 CONCLUSION

4.11 SUPPLY CHAIN ANALYSIS

4.11.1 OVERVIEW

4.11.2 LOGISTIC COST SCENARIO

4.11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS IN THE U.S. POLYURETHANE MARKET

5 REGULATION COVERAGE

5.1 CERTIFIED STANDARDS

5.2 SAFETY STANDARDS

5.2.1 MATERIAL HANDLING & STORAGE

5.2.2 TRANSPORT & PRECAUTIONS

5.2.3 HAZARD IDENTIFICATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FROM THE CONSTRUCTION AND AUTOMOTIVE SECTORS

6.1.2 EMPHASIS ON SUSTAINABILITY AND ENERGY EFFICIENCY

6.1.3 GROWING CONSUMER PREFERENCE FOR COMFORT AND DURABILITY IN FURNITURE AND BEDDING

6.2 RESTRAINTS

6.2.1 ENVIRONMENTAL CONCERNS ASSOCIATED WITH PRODUCTION OF POLYURETHANE

6.2.2 RESTRICTED RECYCLING CAPABILITIES

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF THE ELECTRIC VEHICLE (EV)

6.3.2 RISING ADOPTION OF GREEN BUILDING AND ENERGY-EFFICIENT SOLUTIONS

6.4 CHALLENGES

6.4.1 VOLATILITY IN RAW MATERIAL PRICES

6.4.2 INTRICATED MANUFACTURING PROCESSES

7 U.S. POLYURETHANE MARKET, BY TYPE

7.1 OVERVIEW

7.2 FOAM

7.3 POLYURETHANE COATINGS

7.4 POLYURETHANE ADHESIVES AND SEALANTS

7.5 POLYURETHANE ELASTOMERS

7.6 WATER-BASED POLYURETHANE

8 U.S. POLYURETHANE MARKET, BY PROCESSING TECHNIQUES

8.1 OVERVIEW

8.2 INJECTION MOLDING

8.3 REACTION INJECTION MOLDING (RIM)

8.4 POUR-IN-PLACE

8.5 EXTRUSION

8.6 LAMINATION

8.7 SPRAY FOAM

8.8 CASTING

9 U.S. POLYURETHANE MARKET, BY CHEMISTRY

9.1 OVERVIEW

9.2 ALIPHATIC

9.3 AROMATIC

10 U.S. POLYURETHANE MARKET, BY NATURE

10.1 OVERVIEW

10.2 CHEMICAL-BASED

10.3 BIO-BASED

11 U.S. POLYURETHANE MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FURNITURE AND BEDDING

11.3 CONSTRUCTION INDUSTRY

11.4 AUTOMOTIVE INDUSTRY

11.5 ELECTRONICS

11.6 PACKAGING

11.7 FOOTWEAR

11.8 MEDICAL APPLICATIONS

11.9 TEXTILE INDUSTRY

11.1 MARINE

11.11 ENERGY SECTOR

11.12 AEROSPACE AND DEFENSE

11.13 CONSUMER GOODS

11.14 SURFBOARDS

11.15 OTHERS

12 U.S. POLYURETHANE MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.S.

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BASF

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 SWOT ANALYSIS

14.1.5 RECENT DEVELOPMENT

14.2 DOW

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 SWOT ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 SAINT-GOBAIN

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 SWOT ANALYSIS

14.3.5 RECENT DEVELOPMENT

14.4 PPG INDUSTRIES, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 SWOT ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 HUNTSMAN INTERNATIONAL LLC

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 SWOT ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 CAPITAL RESIN CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 SWOT ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 CHEMLINE

14.7.1 COMPANY SNAPSHOT

14.7.2 SWOT ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 FOAMCRAFT, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 SWOT ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 GENERAL PLASTICS MANUFACTURING COMPANY, INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 SWOT ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 INOAC CORPORATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 SWOT ANALYSIS

14.10.4 RECENT DEVELOPMENT

14.11 POLYMER LABORATORIES & SOLUTION

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 SABIC

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SWOT ANALYSIS

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT NEWS

14.13 SEKISUI CHEMICAL CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 SWOT ANALYSIS

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENT

14.14 UFP TECHNOLOGIES, INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 SWOT ANALYSIS

14.14.5 RECENT DEVELOPMENT

14.15 WISCONSIN FOAM PRODUCTS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 SWOT ANALYSIS

14.15.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 ESTIMATED PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 U.S. POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 U.S. POLYURETHANE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 4 U.S. FOAM IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 U.S. FOAM IN POLYURETHANE MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 6 U.S. FOAM IN POLYURETHANE MARKET, BY CELL TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 U.S. FOAM IN POLYURETHANE MARKET, BY COMPOSITION, 2018-2032 (USD THOUSAND)

TABLE 8 U.S. POLYURETHANE MARKET, BY PROCESSING TECHNIQUES, 2018-2032 (USD THOUSAND)

TABLE 9 U.S. POLYURETHANE MARKET, BY CHEMISTRY, 2018-2032 (USD THOUSAND)

TABLE 10 U.S. POLYURETHANE MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 11 U.S. BIO-BASED IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 U.S. POLYURETHANE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 13 U.S. FURNITURE AND BEDDING IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 U.S. CONSTRUCTION INDUSTRY IN POLYURETHANE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 U.S. AUTOMOTIVE INDUSTRY IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 U.S. INTERIOR COMPONENTS IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. PACKAGING IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 U.S. FOOTWEAR IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. MEDICAL APPLICATIONS IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. TEXTILE INDUSTRY IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 U.S. MARINE IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 U.S. ENERGY SECTOR IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 U.S. CONSUMER GOODS IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 U.S. SPORTS AND RECREATION IN POLYURETHANE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 U.S POLYURETHANE MARKET

FIGURE 2 U.S POLYURETHANE MARKET: DATA TRIANGULATION

FIGURE 3 U.S POLYURETHANE MARKET: DROC ANALYSIS

FIGURE 4 U.S POLYURETHANE MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 U.S POLYURETHANE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S POLYURETHANE MARKET: MULTIVARIATE MODELLING

FIGURE 7 U.S POLYURETHANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 U.S POLYURETHANE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S POLYURETHANE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET APPLICATION COVERAGE GRID

FIGURE 11 U.S POLYURETHANE MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY: OVERVIEW

FIGURE 13 FIVE SEGMENTS COMPRISE THE U.S. POLYURETHANE MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 INCREASING DEMAND FROM THE CONSTRUCTION AND AUTOMOTIVE SECTORS IS EXPECTED TO DRIVE THE U.S POLYURETHANE MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE FOAM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE POLYURETHANE MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 U.S. POLYURETHANE MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS OF THE U.S. POLYURETHANE MARKET

FIGURE 23 VENDOR SELECTION CRITERIA

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR U.S. POLYURETHANE MARKET

FIGURE 25 U.S. POLYURETHANE MARKET: BY TYPE, 2024

FIGURE 26 U.S. POLYURETHANE MARKET, BY PROCESSING TECHNIQUES, 2024

FIGURE 27 U.S. POLYURETHANE MARKET, BY CHEMISTRY, 2024

FIGURE 28 U.S. POLYURETHANE MARKET: BY NATURE, 2024

FIGURE 29 U.S. POLYURETHANE MARKET, BY APPLICATION, 2024

FIGURE 30 U.S. POLYURETHANE MARKET: COMPANY SHARE 2024 (%)

Us Polyurethane Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Polyurethane Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Polyurethane Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.