Us Roofing Market

Market Size in USD Billion

CAGR :

%

USD

49.50 Billion

USD

67.65 Billion

2024

2032

USD

49.50 Billion

USD

67.65 Billion

2024

2032

| 2025 –2032 | |

| USD 49.50 Billion | |

| USD 67.65 Billion | |

|

|

|

|

U.S. Roofing Market Size

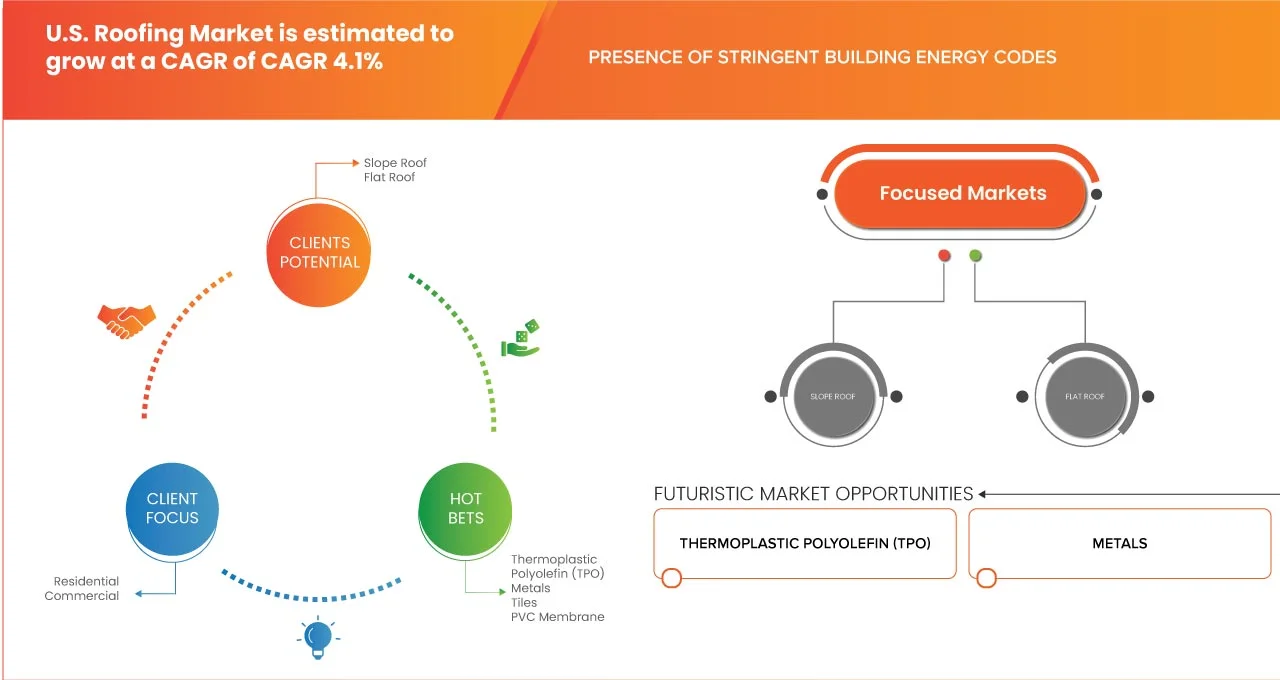

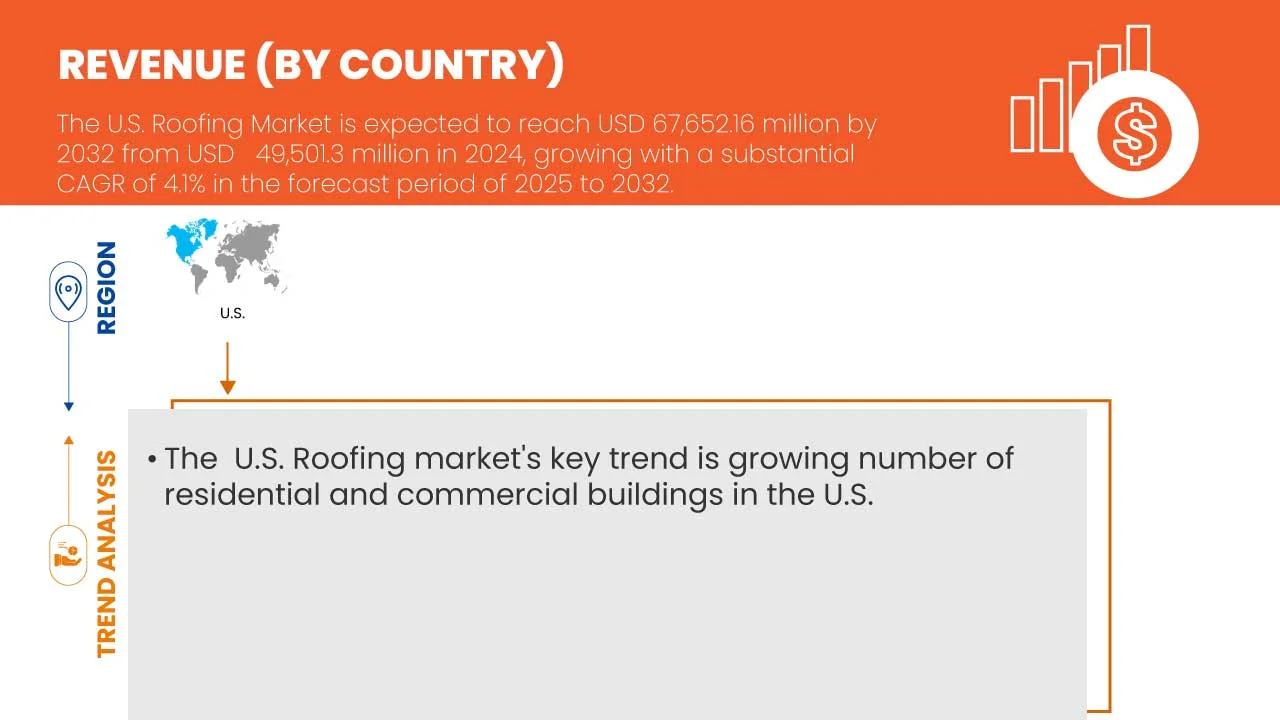

- The U.S. Roofing market was valued at USD 49.50 billion in 2024 and is expected to reach USD 67.65 billion by 2032, at a CAGR of 4.1% during the forecast period

- The market is likely to grow primarily driven by increased construction activity, growing demand for energy-efficient roofing systems, and rising investments in residential and commercial real estate

- This growth is supported by key factors such as advancements in sustainable roofing materials, rising awareness about climate resilience and building codes, and increasing adoption of solar-integrated and green roofing technologies. Government incentives for energy-efficient buildings, the need for roof replacements due to aging infrastructure, and the growth of urban development projects are further accelerating the U.S. roofing market expansion

U.S. Roofing Market Analysis

- The U.S. roofing market is witnessing consistent growth, driven by increasing demand for energy-efficient building solutions, rising residential renovation activities, and infrastructure development. Aging housing stock and frequent climate-related events such as hurricanes, wildfires, and hailstorms are prompting homeowners and commercial property owners to invest in durable and sustainable roofing systems

- In addition, the growing emphasis on green building standards and certifications is accelerating the adoption of environmentally friendly roofing materials, including cool roofs, green roofs, and recycled-content products. However, challenges persist in managing material cost volatility, labor shortages, and navigating complex building codes across regions

- The construction industry's shift toward sustainable and resilient materials is a primary driver, especially as federal and state regulations push for net-zero energy buildings and carbon reduction initiatives. Modern roofing solutions align with this trend by offering better insulation, solar reflectivity, and compatibility with photovoltaic systems. Increasing demand for roofing systems that reduce energy consumption and carbon footprints is influencing product innovation and lifecycle performance. The rise in insurance claims and policyholder awareness around storm-resilient roofing materials is also contributing to market momentum

- Major manufacturers are investing in next-generation roofing technologies such as reflective membranes, synthetic underlayments, and integrated solar roofing to meet evolving performance standards. Product differentiation is occurring through aesthetic customization, improved installation efficiency, and enhanced warranty offerings

- The Slope Roof segment is expected to dominate the market with a share of 56.69% in 2025 due to its widespread use in residential construction, superior water drainage capabilities, aesthetic appeal, long-term durability, and strong consumer preference for sloped designs that withstand diverse weather conditions effectively

Report Scope and U.S. Roofing Market Segmentation

|

Attributes |

U.S. Roofing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

U.S. Roofing Market Trends

“Technological Advancements, Personalization, and Clean Aesthetic Solutions”

- One prominent trend in the U.S. Roofing market is the growing demand for personalized aesthetic treatments, driven by consumer preference for natural-looking results, age-specific skin concerns, and facial anatomy variations. Clinics and practitioners are increasingly adopting patient-specific injection protocols, advanced imaging, and facial mapping tools to deliver precision-based outcomes that match individual aesthetic goals

- The market is witnessing increased adoption of next-generation dermal filler technologies, including hybrid fillers, HA-based biostimulators, and dual-action formulations that combine volumization with skin rejuvenation. These innovations improve clinical outcomes by offering longer-lasting effects, reduced downtime, and enhanced safety profiles. For instance, RHA (Resilient Hyaluronic Acid) fillers and HA fillers infused with lidocaine or antioxidants are gaining popularity for their smooth integration and reduced post-treatment discomfort

- In 2024, companies such as Revance and Teoxane launched targeted filler products designed for high-mobility facial areas such as the perioral zone and under-eye region, addressing concerns of dynamic wrinkling and volume loss without compromising facial expressiveness. These formulations often incorporate cross-linked HA technologies for controlled diffusion and minimal swelling, appealing to both first-time users and experienced patients seeking subtle, refined enhancements

- Major players are integrating AI-driven consultation platforms and AR-based preview tools into clinical practices, enabling practitioners to model expected outcomes and guide patients through their aesthetic journey. Simultaneously, manufacturers are using 3D printing and microfluidic technologies to develop consistent, high-purity filler products, improving batch quality and reducing injection variability

- With growing awareness of product ingredients and long-term safety, there is increasing demand for ‘clean beauty’ injectables—fillers free from animal-derived components, artificial additives, and preservatives. Manufacturers are responding by investing in vegan-certified, non-GMO, and fully biodegradable formulations

- As regulatory bodies and end-users become more sophisticated, aesthetic injectable brands are prioritizing transparency, clinical validation, and ESG-aligned product development. This includes publishing peer-reviewed safety and efficacy data, implementing carbon-neutral production initiatives, and aligning brand messaging with sustainability and ethical treatment philosophies—helping build stronger consumer trust and brand loyalty across Asia-Pacific markets

U.S. Roofing Market Dynamics

Driver

“Rising Housing Starts and Consistent Re-Roofing Cycles”

- Rising housing starts and predictable re-roofing activity are central to the expansion of the U.S. roofing market. Growth in single-family and multi-family construction is steadily increasing the demand for new roof installations, while the natural life cycle of existing roofs ensures a recurring flow of replacement projects

- This dual dynamic—new construction paired with cyclical replacement—creates a balanced and resilient demand structure. Recent U.S. Census Bureau data highlights sustained increases in residential construction activity, reinforcing the sector’s underlying strength

- The roofing industry is benefitting not only from structural growth in housing but also from demographic and urbanization trends that drive continuous development. Aging housing stock across many regions is further amplifying the volume of re-roofing projects, ensuring contractors and suppliers maintain a steady pipeline

- Together, these factors establish rising housing starts and consistent re-roofing cycles as a core driver of long-term growth, providing stability to manufacturers, distributors, and service providers in the U.S. roofing market

Restraint/Challenge

“Insurance Market Instability In High-Risk States”

- Insurance market instability in high-risk states poses a profound challenge to the U.S. roofing market. As increasing climate-driven disasters—wildfires, hurricanes, convective storms—intensify, insurers have withdrawn from vulnerable regions, cancelled policies based on roof age or location, and raised premiums sharply

- This instability increases homeowner exposure to uninsured losses, discourages investment in roof upgrades, and hampers the viability of roofing businesses dependent on retrofit demand. In many high-risk states, insurers of last resort face fiscal strain, while legislation and mitigation programs scramble to fill policy gaps. The roofing industry must adapt to a shifting landscape where insurance availability is shrinking even as the need for resilient roofs grows

- Roofing professionals face both reduced demand (as homeowners forgo insurance-dependent projects) and heightened urgency to deliver resilient solutions that can restore insurability. The roofing market must therefore pivot toward durable, risk-reducing retrofit strategies that can support both property resilience and insurance access in this uncertain environment

U.S. Roofing Market Scope

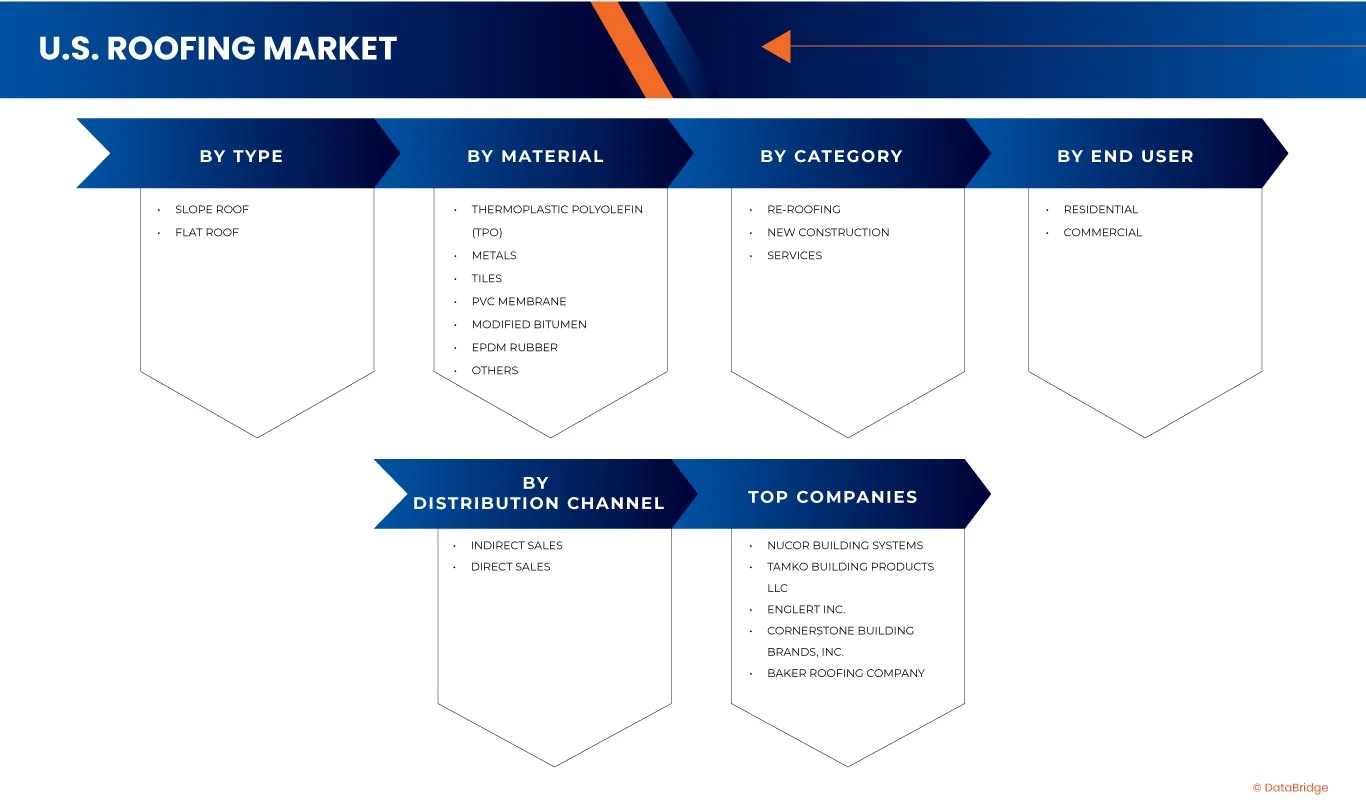

The U.S. Roofing market is segmented on the basis of type, material, category, end user and distribution channel

• By Type

On the basis of type, the U.S. roofing market is segmented into slope roof and flat roof. In 2025, the slope roof segment is anticipated to dominate the U.S. roofing market with a 56.69% market share. This strong position is primarily due to its extensive application in residential housing, especially in suburban and rural regions where sloped designs are traditionally preferred. The superior water and snow drainage properties of slope roofs make them highly effective in preventing leaks and structural damage. In addition, their aesthetic appeal, architectural versatility, and long-standing consumer preference further strengthen their adoption, ensuring their continued dominance in the roofing industry.

The slope roof segment is projected to record the fastest CAGR of 4.5% from 2025 to 2032, reflecting its growing demand across the U.S. construction sector. This growth is fueled by rising residential construction activities, supported by urban expansion and increasing housing demand. In addition, the ongoing renovation and replacement of aging housing stock are creating significant opportunities for slope roof installations. Consumers are also showing strong preference for aesthetically appealing designs that enhance curb appeal, while the superior performance of slope roofs in water and snow drainage further boosts their adoption.

• By Material

On the basis of material, the U.S. Roofing market is segmented into thermoplastic polyolefin (TPO), metals, tiles, PVC membrane, modified bitumen, EPDM rubber and others. In 2025, thermoplastic polyolefin (TPO) is projected to lead the U.S. roofing materials market with a 23.09% market share. Its dominance is attributed to multiple advantages, including cost-effectiveness and superior energy efficiency, making it a preferred choice for modern roofing needs. TPO membranes are lightweight and easy to install, reducing labor time and expenses. Their reflective properties help minimize heat absorption, significantly lowering cooling costs for buildings. With increasing demand in commercial and industrial sectors, TPO’s durability and sustainability are driving its widespread adoption across the country.

The thermoplastic polyolefin (TPO) segment is anticipated to record the fastest CAGR of 5.7% from 2025 to 2032, reflecting its growing popularity in the U.S. roofing market. This growth is driven by rising residential construction activities and the increasing need to renovate and replace aging housing stock. TPO’s ability to offer cost efficiency, modern aesthetics, and sustainable performance makes it highly attractive to consumers. Moreover, its excellent energy efficiency, durability, and low-maintenance features, along with superior resistance to water leakage and weather conditions, further accelerate its widespread adoption.

• By Category

On the basis of category, the U.S. Roofing market is segmented into re-roofing, new construction and services. In 2025, the re-roofing segment is projected to dominate the U.S. roofing market with a 68.00% market share. This leadership is largely driven by the significant proportion of aging residential and commercial buildings that require roof replacement to maintain safety and functionality. In addition, frequent weather-related damages such as storms, heavy rainfall, and snow further accelerate the demand for re-roofing solutions. Consumers are also increasingly investing in energy-efficient and durable roofing upgrades that not only enhance structural performance but also contribute to long-term cost savings and improved sustainability.

The proteinate segment is expected to witness the fastest CAGR of 4.7% from 2025 to 2032, for roof replacements after weather-related damages, and increasing consumer investments in energy-efficient and durable roofing upgrades.

• By End User

On the basis of end user, the U.S. Roofing market is segmented into residential and commercial, In 2025, the residential segment is expected to dominate with 57.54% market share, due to strong housing demand, ongoing home renovation projects, rising consumer preference for aesthetic and energy-efficient roofing solutions, and government incentives supporting sustainable residential construction practices across suburban and urban communities.

The residential segment is anticipated to grow at the fastest CAGR of 4.4% from 2025 to 2032, reflecting the robust momentum in the U.S. housing sector. Strong demand for new homes, coupled with ongoing renovation and remodeling projects, is driving the need for modern roofing solutions. Homeowners are increasingly prioritizing aesthetic appeal, durability, and energy efficiency when selecting roofing materials. In addition, government incentives and policies that promote sustainable and eco-friendly residential construction practices are further boosting adoption, particularly across both suburban and urban communities, strengthening the segment’s long-term growth outlook.

• By Distribution Channel

On the basis of distribution channel, the U.S. Roofing market is segmented into indirect sales and direct sales. In 2025, the indirect sales segment is expected to dominate with 77.78% market share, supported by the strong presence of distributors and retailers, wider product availability through established dealer networks, and contractor reliance on supply chains that offer competitive pricing, bulk procurement, and faster delivery across diverse project sites.

The indirect sales segment is forecasted to register the fastest CAGR of 4.3% from 2025 to 2032, highlighting its growing importance in the U.S. roofing market. This growth is supported by the extensive availability of products through well-established dealer and distributor networks that ensure wider market reach. Contractors and builders increasingly rely on these channels for competitive pricing, bulk procurement advantages, and consistent product availability. Moreover, indirect sales channels enable faster delivery across diverse project sites, ensuring efficiency and timely project completion, thereby strengthening their role in the industry.

U.S. Roofing Market – Regional Analysis

- The U.S. roofing market is witnessing steady growth driven by rising residential renovations, expansion of commercial infrastructure, and demand for energy-efficient, weather-resistant materials

- Technological innovations such as solar-integrated and reflective roofing are gaining momentum, supported by stricter building codes and sustainability goals. Distribution networks remain critical, with re-roofing dominating due to aging infrastructure and frequent weather-related replacements shaping market dynamics

U.S. Roofing Market Share

The U.S. Roofing industry is primarily led by well-established companies, including:

- Nucor Building Systems (U.S.)

- TAMKO Building Products LLC (U.S.)

- ENGLERT INC. (U.S.)

- Cornerstone Building Brands, Inc. (U.S.)

- Baker Roofing Company (U.S.)

- Carlisle SynTec Systems (U.S.)

- CertainTeed, LLC (U.S.)

- GAF, Inc. (U.S.)

- Kingspan Group (Ireland)

Latest Developments in U.S. Roofing Market

- In May 2025, The U.S. roofing shingles market report highlighted rapid adoption of smart roofing technologies, including solar-integrated shingles and sensor-based monitoring systems. Manufacturers are focusing on durability, eco-friendly production, and energy efficiency to meet evolving consumer expectations and regulatory pressures, driving innovation in roofing materials and installation practices

- In July 2025, U.S. asphalt shingle shipments recorded a four-percent decline in the second quarter, while Canadian shipments experienced strong growth. This shift highlights evolving regional demand patterns, potentially influenced by raw material costs, consumer preferences, and weather-driven replacement cycles, signaling a need for U.S. manufacturers to adapt production strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. ROOFING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES ANALYSIS

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.2 PATENT ANALYSIS

4.2.1 PATENT FILING TRENDS AND GROWTH

4.2.2 MATERIAL INNOVATIONS IN PATENTS

4.2.3 TECHNOLOGY INTEGRATION AND SMART ROOFING PATENTS

4.2.4 KEY PATENT HOLDERS AND COMPETITIVE LANDSCAPE

4.2.5 STRATEGIC IMPLICATIONS OF PATENT ACTIVITY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.6.1 QUALITY AND CONSISTENCY

4.6.2 TECHNICAL EXPERTISE

4.6.3 SUPPLY CHAIN RELIABILITY

4.6.4 COMPLIANCE AND SUSTAINABILITY

4.6.5 COST AND PRICING STRUCTURE

4.6.6 FINANCIAL STABILITY

4.6.7 FLEXIBILITY AND CUSTOMIZATION

4.6.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.7 BRAND OUTLOOK

4.7.1 BRAND COMPARATIVE ANALYSIS OF GLOBAL URO-GYNECOLOGY MARKET

4.7.2 PRODUCT VS BRAND OVERVIEW

4.7.3 PRODUCT OVERVIEW

4.7.4 BRAND OVERVIEW

4.8 CONSUMERS' BUYING BEHAVIOUR

4.8.1 PRICE SENSITIVITY AND VALUE CONSIDERATION

4.8.2 ROLE OF CONTRACTORS AND INSTALLERS

4.8.3 IMPACT OF CLIMATE AND REGIONAL CONDITIONS

4.8.4 BRAND TRUST AND WARRANTY INFLUENCE

4.8.5 SHIFT TOWARD SUSTAINABILITY AND AESTHETICS

4.9 COST ANALYSIS BREAKDOWN

4.9.1 RAW MATERIAL COSTS

4.9.2 LABOR AND INSTALLATION COSTS

4.9.3 EQUIPMENT AND LOGISTICS COSTS

4.9.4 OVERHEADS AND REGULATORY COMPLIANCE

4.9.5 MAINTENANCE, REPLACEMENT, AND LIFECYCLE COSTS

4.1 INDUSTRY ECO-SYSTEM ANALYSIS

4.10.1 PROMINENT COMPANIES

4.10.2 SMALL & MEDIUM SIZE COMPANIES

4.10.3 END USERS

4.11 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.11.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.11.1.1 JOINT VENTURES

4.11.1.2 MERGERS AND ACQUISITIONS

4.11.1.3 LICENSING AND PARTNERSHIP

4.11.1.4 TECHNOLOGY COLLABORATIONS

4.11.1.5 STRATEGIC DIVESTMENTS

4.11.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.11.3 STAGE OF DEVELOPMENT

4.11.4 TIMELINES AND MILESTONES

4.11.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.11.6 RISK ASSESSMENT AND MITIGATION

4.11.7 FUTURE OUTLOOK

4.12 PROFIT MARGINS SCENARIO ON U.S. ROOFING MARKET

4.12.1 MANUFACTURER PROFIT MARGINS

4.12.2 CONTRACTOR AND INSTALLER MARGINS

4.12.3 DISTRIBUTOR AND RETAILER MARGINS

4.12.4 RESIDENTIAL ROOFING PROFITABILITY

4.12.5 COMMERCIAL ROOFING PROFITABILITY

4.13 RAW MATERIAL COVERAGE

4.13.1 ASPHALT & BITUMEN

4.13.2 METALS (STEEL, ALUMINUM, COPPER, ZINC)

4.13.3 POLYMERS & SYNTHETICS (PVC, TPO, EPDM)

4.13.4 CLAY & CONCRETE TILES

4.13.5 WOOD (CEDAR SHAKES/SHINGLES)

4.13.6 SLATE

4.13.7 INSULATION & UNDERLAYMENT MATERIALS

4.13.8 ADHESIVES, SEALANTS & FASTENERS

4.14 TECHNOLOGICAL ADVANCEMENTS

4.14.1 SMART ROOFING AND INTEGRATED SOLAR SOLUTIONS

4.14.2 ADVANCED ROOFING MATERIALS AND NANOTECHNOLOGY

4.14.3 PREFABRICATION AND MODULAR ROOFING SYSTEMS

4.14.4 DIGITALIZATION AND DRONE-BASED INSPECTIONS

4.14.5 SUSTAINABILITY AND ENERGY-EFFICIENT ROOFING INNOVATIONS

4.15 SUPPLY CHAIN ANALYSIS

4.15.1 OVERVIEW

4.15.2 LOGISTIC COST SCENARIO

4.15.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.15.4 CONCLUSION

4.16 VALUE CHAIN ANALYSIS

4.16.1 OVERVIEW

4.16.2 RAW MATERIAL SUPPLY

4.16.3 EQUIPMENT & TECHNOLOGY PROVIDERS

4.16.4 DISTRIBUTION AND LOGISTICS

4.16.5 END-USERS (BRANDS & INDUSTRY SECTORS)

4.16.6 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.2 OUTLOOK: LOCAL PRODUCTION VS. IMPORT RELIANCE

5.3 SECTION 232 TARIFFS RESHAPE MARKET ECONOMICS

5.4 DOMESTIC CAPACITY EXPANSION AS A STRATEGIC PRIORITY

5.5 REGIONAL DEPENDENCE ON IMPORTS PERSISTS

5.6 VENDOR SELECTION CRITERIA DYNAMICS

5.7 IMPACT ON SUPPLY CHAIN

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.4 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING HOUSING STARTS AND CONSISTENT RE-ROOFING CYCLES

7.1.2 INCREASING FREQUENCY OF EXTREME WEATHER EVENTS

7.1.3 FEDERAL AND STATE INCENTIVES FOR ENERGY-EFFICIENT ROOFING

7.2 RESTRAINTS

7.2.1 VOLATILE RAW MATERIAL AND SHINGLE PRICES

7.2.2 PERSISTENT SHORTAGE OF SKILLED ROOFING LABOR

7.3 OPPORTUNITY

7.3.1 GROWING DEMAND FOR ROOFTOP SOLAR-INTEGRATED ROOFING

7.3.2 EXPANSION OF COOL AND ENERGY-EFFICIENT ROOFING RETROFITS

7.4 CHALLENGES

7.4.1 INSURANCE MARKET INSTABILITY IN HIGH-RISK STATES

7.4.2 DELAYS FROM FRAGMENTED LOCAL PERMITTING AND CODES

8 U.S. ROOFING MARKET, BY TYPE

8.1 OVERVIEW

8.2 SLOPE ROOF

8.2.1 ASPHALT SHINGLES

8.2.2 METAL ROOFING

8.2.3 TILE ROOFING

8.2.4 LOW-SLOPE ROOFING

8.2.5 STEEP-SLOPE ROOFING

8.2.6 OTHERS

8.3 FLAT ROOF

9 U.S. ROOFING MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 THERMOPLASTIC POLYOLEFIN (TPO)

9.3 METALS

9.4 TILES

9.5 PVC MEMBRANE

9.6 MODIFIED BITUMEN

9.7 EPDM RUBBER

9.8 OTHERS

10 U.S. ROOFING MARKET, BY END USER

10.1 OVERVIEW

10.2 RESIDENTIAL

10.3 COMMERCIAL

10.3.1 OFFICE BUILDINGS

10.3.2 HOSPITALITY

10.3.3 RETAIL & SHOPPING CENTERS

10.3.4 HEALTHCARE FACILITIES

10.3.5 INSTITUTIONAL

10.3.6 RESTAURANTS

10.3.7 OTHERS

11 U.S. ROOFING MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 RE-ROOFING

11.3 NEW CONSTRUCTION

11.4 SERVICES

12 U.S ROOFING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 INDIRECT SALES

12.3 DIRECT SALES

13 U.S. ROOFING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S. MANUFACTURERS

13.2 COMPANY SHARE ANALYSIS: U.S. DISTRIBUTORS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 NUCOR BUILDING SYSTEMS

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 TAMKO BUILDING PRODUCTS LLC

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 ENGLERT INC.

15.3.1 COMP.ANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 CORNERSTONE BUILDING BRANDS, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 BAKER ROOFING COMPANY

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 ABC SUPPLY CO INC

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ATAS INTERNATIONAL INC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CARLISE SYNTECH SYSTEM

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 CERTAINTEED

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 COATED METAL GROUP (CMG)

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 COLONIAL ROOFING, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 DECRA ROOFING SYSTEM INC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 DIVERSIFIED ROOFING

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 DREXEL METALS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 ENDUREED

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 GAF MATERIALS LLC

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 IB ROOF SYSTEM

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 INNOVATIVE CHEMICAL PRODUCTS GROUP (APOC)

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 ISAIAH INDUSTRIES INC

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 KINGSPAN GROUP

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 MALARKEY ROOFING

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 MID-STATES ASPHALT

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 PEACH STATE ROOFING, INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 SERVICES PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 REMEDY ROOFING

15.24.1 COMPANY SNAPSHOT

15.24.2 SERVICES PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 SERVICE WORKS

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

15.26 SHEFFIELD METALS, INC.

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 STA DRY ROOFING

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 STAR ROOFING

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 SUTTER ROOFING

15.29.1 COMPANY SNAPSHOT

15.29.2 PRODUCT PORTFOLIO

15.29.3 RECENT DEVELOPMENT

15.3 QXO INC (BEACON)

15.30.1 COMPANY SNAPSHOT

15.30.2 PRODUCT PORTFOLIO

15.30.3 RECENT DEVELOPMENT

15.31 ABC SUPPLY CO INC

15.31.1 COMPANY SNAPSHOT

15.31.2 PRODUCT PORTFOLIO

15.31.3 RECENT DEVELOPMENT

15.32 SRS DISTRIBUTION INC

15.32.1 COMPANY SNAPSHOT

15.32.2 PRODUCT PORTFOLIO

15.32.3 RECENT DEVELOPMENT

15.33 BUILDERS FIRST SOURCE INC

15.33.1 COMPANY SNAPSHOT

15.33.2 REVENUE ANALYSIS

15.33.3 PRODUCT PORTFOLIO

15.33.4 RECENT DEVELOPMENT

15.34 GULFSIDE SUPPLY (GULFEAGLE)

15.34.1 COMPANY SNAPSHOT

15.34.2 PRODUCT PORTFOLIO

15.34.3 RECENT DEVELOPMENT

15.35 IVEY ROOFING

15.35.1 COMPANY SNAPSHOT

15.35.2 PRODUCT PORTFOLIO

15.35.3 RECENT DEVELOPMENT

15.36 ADAMS ROOFING AND CONSTRUCTION PLLC

15.36.1 COMPANY SNAPSHOT

15.36.2 PRODUCT PORTFOLIO

15.36.3 RECENT DEVELOPMENT

15.37 ADVANCED ROOFING INC.

15.37.1 COMPANY SNAPSHOT

15.37.2 PRODUCT PORTFOLIO

15.37.3 RECENT DEVELOPMENT

15.38 ALL AROUND ROOFING

15.38.1 COMPANY SNAPSHOT

15.38.2 PRODUCT PORTFOLIO

15.38.3 RECENT DEVELOPMENT

15.39 AMSTILL ROOFING COMPANY

15.39.1 COMPANY SNAPSHOT

15.39.2 PRODUCT PORTFOLIO

15.39.3 RECENT DEVELOPMENT

15.4 BLUE HAMMER ROOFING

15.40.1 COMPANY SNAPSHOT

15.40.2 PRODUCT PORTFOLIO

15.40.3 RECENT DEVELOPMENT

15.41 CHAMPION ROOFING INC.

15.41.1 COMPANY SNAPSHOT

15.41.2 SERVICES PORTFOLIO

15.41.3 RECENT DEVELOPMENTS

15.42 CORE ROOFING SYSTEMS

15.42.1 COMPANY SNAPSHOT

15.42.2 PRODUCT PORTFOLIO

15.42.3 RECENT DEVELOPMENT

15.43 COREY CONSTRUCTION LLC

15.43.1 COMPANY SNAPSHOT

15.43.2 PRODUCT PORTFOLIO

15.43.3 RECENT DEVELOPMENT

15.44 CROWTHER ROOFING AND SHEET METAL OF FLORIDA, INC.

15.44.1 COMPANY SNAPSHOT

15.44.2 PRODUCT PORTFOLIO

15.44.3 RECENT DEVELOPMENTS

15.45 FSR SERVICES

15.45.1 COMPANY SNAPSHOT

15.45.2 PRODUCT PORTFOLIO

15.45.3 RECENT DEVELOPMENT

15.46 KELLY ROOFING

15.46.1 COMPANY SNAPSHOT

15.46.2 PRODUCT PORTFOLIO

15.46.3 RECENT DEVELOPMENT

15.47 LEGACY ROOFING

15.47.1 COMPANY SNAPSHOT

15.47.2 PRODUCT PORTFOLIO

15.47.3 RECENT DEVELOPMENT

15.48 LINEAR ROOFING GENERAL CONTRACTORS LLC

15.48.1 COMPANY SNAPSHOT

15.48.2 PRODUCT PORTFOLIO

15.48.3 RECENT DEVELOPMENT

15.49 MIDAMERICA ROOFING, INC.

15.49.1 COMPANY SNAPSHOT

15.49.2 PRODUCT PORTFOLIO

15.49.3 RECENT DEVELOPMENT

15.5 O'HARA'S SON ROOFING (OSR)

15.50.1 COMPANY SNAPSHOT

15.50.2 SERVICES PORTFOLIO

15.50.3 RECENT DEVELOPMENT

15.51 SELA ROOFING AND REMODELLING

15.51.1 COMPANY SNAPSHOT

15.51.2 PRODUCT PORTFOLIO

15.51.3 RECENT DEVELOPMENT

15.52 SPARTAN

15.52.1 COMPANY SNAPSHOT

15.52.2 PRODUCT PORTFOLIO

15.52.3 RECENT DEVELOPMENT

15.53 SPRINGER PETERSON ROOFING AND SHEET METAL INC

15.53.1 COMPANY SNAPSHOT

15.53.2 PRODUCT PORTFOLIO

15.53.3 RECENT DEVELOPMENT

15.54 STRATA ROOFING

15.54.1 COMPANY SNAPSHOT

15.54.2 PRODUCT PORTFOLIO

15.54.3 RECENT DEVELOPMENT

15.55 TARRANT ROOFING LLC

15.55.1 COMPANY SNAPSHOT

15.55.2 PRODUCT PORTFOLIO

15.55.3 RECENT DEVELOPMENT

15.56 TELGE ROOFING

15.56.1 COMPANY SNAPSHOT

15.56.2 PRODUCT PORTFOLIO

15.56.3 RECENT DEVELOPMENT

15.57 ZURIX ROOFING SYSTEMS.

15.57.1 COMPANY SNAPSHOT

15.57.2 PRODUCT PORTFOLIO

15.57.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 U.S. ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 U.S. ROOFING MARKET, BY TYPE, 2018-2032 (THOUSAND SQUARE FEET)

TABLE 3 U.S. SLOPE ROOF IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 U.S. FLAT ROOF IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 U.S. ROOFING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 6 U.S. ROOFING MARKET, BY MATERIAL, 2018-2032 (THOUSAND SQUARE FEET)

TABLE 7 U.S. THERMOPLASTIC POLYOLEFIN (TPO) IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 U.S. METALS IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 U.S. TILES IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 U.S. PVC MEMBRANE IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 U.S. MODIFIED BITUMEN IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 U.S. EPDM RUBBER IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 U.S. ROOFING MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 14 U.S. ROOFING MARKET, BY END USER, 2018-2032 (THOUSAND SQUARE FEET)

TABLE 15 U.S. RESIDENTIAL IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 U.S. COMMERCIAL IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. OFFICE BUILDINGS IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 U.S. HOSPITALITY IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. RETAIL & SHOPPING CENTERS IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. HEALTHCARE FACILITIES IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 U.S. INSTITUTIONAL IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 U.S. RESTAURANTS IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 U.S. OTHERS IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 U.S. ROOFING MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

TABLE 25 U.S. ROOFING MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 26 U.S. INDIRECT SALES IN ROOFING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 THE U.S. ROOFING MARKET: SEGMENTATION

FIGURE 2 THE U.S. ROOFING MARKET: DATA TRIANGULATION

FIGURE 3 THE U.S. ROOFING MARKET: DROC ANALYSIS

FIGURE 4 THE U.S. ROOFING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 THE U.S. ROOFING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 THE U.S. ROOFING MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 THE U.S. ROOFING MARKET: MULTIVARIATE MODELLING

FIGURE 8 THE U.S. ROOFING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 THE U.S. ROOFING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 THE U.S. ROOFING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 THE U.S. ROOFING MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 SEVEN SEGMENTS COMPRISE THE U.S. ROOFING MARKET, BY MATERIAL (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWING NUMBER OF RESIDENTIAL AND COMMERCIAL BUILDINGS IN THE U.S. IS DRIVING THE U.S. ROOFING MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 SLOPE ROOF SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. ROOFING MARKET IN 2025 & 2032

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 TOTAL PATENTS IN THE U.S. ROOFING MARKET

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 U.S. ROOFING MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/SQUARE FEET)

FIGURE 21 PRODUCTION ANALYSIS

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 COMPANY EQUIVALENT QUADRANT

FIGURE 24 DROC ANALYSIS

FIGURE 25 U.S. ROOFING MARKET: BY TYPE, 2024

FIGURE 26 U.S. ROOFING MARKET: BY MATERIAL, 2024

FIGURE 27 U.S. ROOFING MARKET: BY END USER, 2024

FIGURE 28 U.S. ROOFING MARKET, BY CATEGORY, 2024

FIGURE 29 U.S. ROOFING MARKET, BY DISTRIBUTION CHANNEL, 2024

FIGURE 30 U.S. ROOFING MARKET: COMPANY SHARE 2024 (%)

FIGURE 31 U.S. ROOFING MARKET: COMPANY SHARE 2024 (%)

Us Roofing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Roofing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Roofing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.