Us Sports Flooring Market

Market Size in USD Billion

CAGR :

%

USD

3.93 Billion

USD

5.66 Billion

2024

2032

USD

3.93 Billion

USD

5.66 Billion

2024

2032

| 2025 –2032 | |

| USD 3.93 Billion | |

| USD 5.66 Billion | |

|

|

|

|

Sports Flooring Market Size

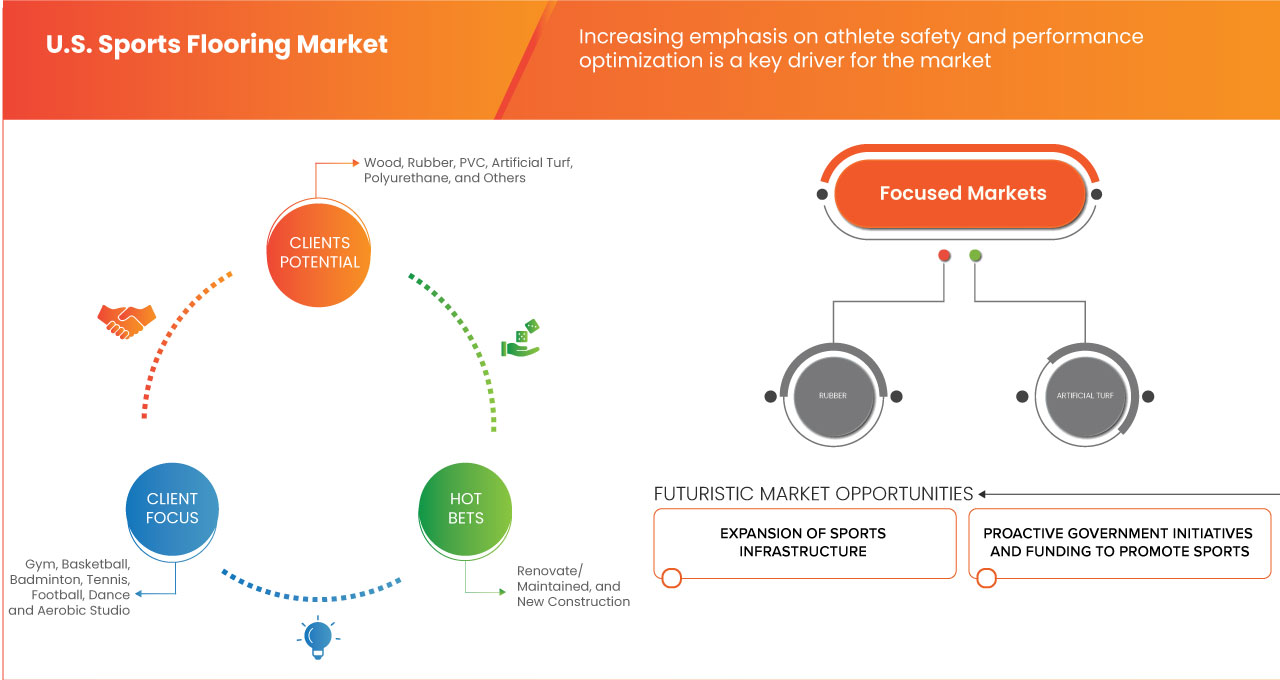

- The U.S. Sports Flooring market size was valued at USD 3.93 billion in 2024 and is expected to reach USD 5.66 billion by 2032, at a CAGR of 4.8% during the forecast period

- The market growth is largely fueled by the increasing emphasis on athlete safety and performance optimization

- Furthermore, growing public awareness regarding health, fitness, and active lifestyles. These converging factors are accelerating the uptake of Sports Flooring solutions, thereby significantly boosting the industry's growth

Sports Flooring Market Analysis

- The U.S. sports flooring market is driven by increased investments in sports infrastructure and a growing emphasis on health and fitness activities

- The rising demand for specialized sports flooring solutions, coupled with technological advancements and a focus on sustainability, is propelling the market's growth in the U.S.

- The wood segment is expected to command with 22.35% share of the U.S. sports flooring market in 2025, driven by its superior durability, aesthetic appeal, and performance characteristics that meet the rigorous demands of athletic activities

Report Scope and Sports Flooring Market Segmentation

|

Attributes |

Sports Flooring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sports Flooring Market Trends

“Increasing Emphasis On Athlete Safety And Performance Optimization”

- A major driving force behind the U.S. sports flooring market is the heightened focus on athlete safety and performance across educational institutions, fitness centers, and professional sports venues, prompting substantial investment in advanced shock-absorbing and high-traction surfaces that mitigate injury risks and boost athletic output

- For instance, in December 2024, Kiefer USA introduced advanced modular sports flooring systems featuring quick installation, low-maintenance materials, and enhanced shock absorption—demonstrating the industry’s commitment to safeguarding athletes while optimizing performance.

- Traditional flooring surfaces—often hard or overly slick—pose significant hazards such as slips, falls, and joint injuries, encouraging facility managers to replace outdated materials with modern systems engineered for superior impact attenuation, traction, and sport-specific performance.

- Emerging flooring technologies now deliver surface adaptability for multi-sport use, enhancing overall functionality and return on investment by supporting dynamic athlete movement and providing sport-tailored performance characteristics.

- The growing involvement of sports medicine professionals, athletic trainers, and regulatory bodies in facility planning is accelerating demand for flooring that meets stringent safety and performance standards, further stimulating market expansion.

- As safety standards rise and flooring technology advances, schools, universities, and sports organizations nationwide are prioritizing the upgrade of existing facilities with state-of-the-art flooring systems that both protect athletes and enhance performance, driving sustained growth in the U.S. sports flooring market

Sports Flooring Market Dynamics

Driver

“Growing Public Awareness Regarding Health, Fitness, And Active Lifestyles”

- The surge in consumer participation at gyms, fitness centers, sports clubs, and home workout spaces is a major driver propelling the U.S. sports flooring market, as facility owners seek high-quality, durable, and safe surfaces that can withstand diverse training styles while minimizing injury risk.

- For instance, in October 2024 the Sports & Fitness Industry Association (SFIA) reported an 11 % year-over-year rise in U.S. team-sports participation—adding 8 million new participants, the strongest growth since 2014—illustrating renewed demand for upgraded athletic facilities.

- Emerging fitness trends such as yoga, CrossFit, and functional training require specialized flooring that offers superior traction, shock absorption, and versatility, prompting both commercial and residential buyers to invest in adaptable, performance-oriented systems.

- Social media, fitness apps, and health-influencer content are amplifying awareness of proper training surfaces, encouraging gyms, schools, and homeowners to modernize spaces with premium sports flooring that enhances user experience and fosters consistent engagement.

- As Americans place greater emphasis on wellness and active living, the need for safety-focused, high-performance sports flooring is expected to grow steadily, establishing adaptable, technologically advanced surfaces as essential components of modern fitness environments nationwide

Restraint/Challenge

“High Initial Capital Expenditure For Installation And Procurement”

- The substantial upfront capital required for premium sports flooring—covering specialized materials, skilled labor, and removal of existing surfaces—poses a major financial barrier for budget-constrained schools, community centers, and small athletic organizations, slowing broader market adoption

- For instance, Calculator Group LLC. estimates that gym-floor installations in the United States range from USD 46,200 to USD 198,000, depending on material type and facility size, making it difficult for many institutions to justify or fund necessary upgrades

- Competition from lower-cost, short-term flooring options further challenges the adoption of high-performance systems, as decision-makers faced with tight budgets often choose less durable surfaces despite their reduced safety and performance benefits

- Although innovations such as Velcro IP Holdings LLC.’s July 2024 fastener technology aim to simplify installation and lower labor expenses, high initial costs remain a key hurdle—highlighting the need for improved financing models, cost-efficient installation techniques, and supportive grant programs to accelerate market growth

Sports Flooring Market Scope

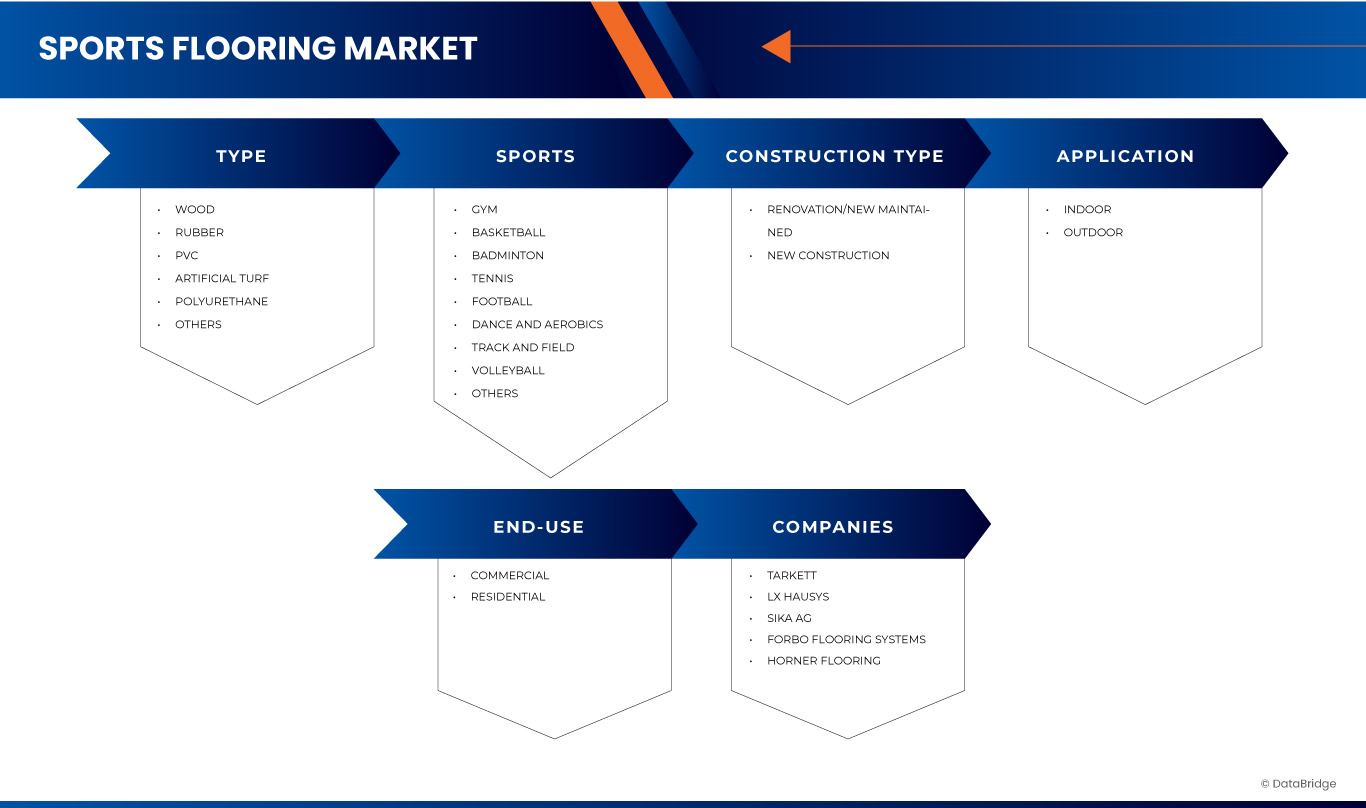

The market is segmented on the basis of type, sports, construction type, application, and end-use.

- By Type

On the basis of type, the market is segmented into wood, rubber, PVC artificial turf, polyurethane, and others. In 2025, the wood segment will dominate the market with a market share of 22.35%, driven by its durability, shock absorption, aesthetic appeal, and suitability for indoor sports like basketball and volleyball in schools.

The wood segment is anticipated to witness the fastest growth rate of 5.9% from 2025 to 2032, fueled by rising investments in school and collegiate sports infrastructure and increasing preference for sustainable, high-performance indoor flooring solutions.

- By Sports

On the basis of sports, the market is segmented into gym, basketball, badminton, tennis, football, dance and aerobic studio, track and field, volleyball, and others. The gym segment held the largest market revenue share in 2025, driven by growing fitness trends, increased gym memberships, and demand for durable, shock-absorbing flooring that enhances workout safety.

The gym segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its need for versatile, low-maintenance flooring that supports diverse activities like CrossFit, yoga, and functional training.

- By Construction Type

On the basis of construction type, the market is segmented into renovate/maintained and new construction. The renovate/maintained segment held the largest market revenue share in 2025, driven by the aging infrastructure in schools and sports facilities requiring upgrades to meet modern safety, performance, and regulatory standards.

The renovate/maintained segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its cost-effective facility upgrades, minimizing downtime, and extending lifespan of existing sports flooring with improved safety features.

- By Application

On the basis of application, the market is segmented into indoor and outdoor. The indoor segment accounted for the largest market revenue share in 2025, driven by the increasing indoor sports activities, demand for controlled environments, and the need for durable, safe, multipurpose flooring solutions.

The indoor segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing popularity of indoor sports leagues and fitness centers requiring specialized flooring that supports diverse athletic activities safely.

- By End-Use

On the basis of end-use, the market is segmented into commercial and residential. The commercial segment accounted for the largest market revenue share in 2025, driven by rising investments in commercial fitness centers, sports complexes, and recreational facilities demanding durable, high-performance, and safety-compliant flooring solutions.

The commercial segment is also expected to witness the fastest CAGR from 2025 to 2032, propelled by expanding corporate wellness programs and increased demand for multipurpose, adaptable flooring in commercial sports and fitness venues.

Sports Flooring Market Regional Analysis

U.S. Sports Flooring Market Insight

The U.S. held the largest revenue share within North America in 2025, fueled by increasing investments in sports infrastructure, rising health and fitness awareness, and strong demand from educational institutions and commercial fitness centers. Advanced sports flooring solutions are gaining traction due to their safety features, durability, and performance benefits, particularly in indoor sports facilities and gyms.

Sports Flooring Market Share

The Sports Flooring industry is primarily led by well-established companies, including:

- Tarkett (France)

- LX HAUSYS. (Korea)

- Sika AG (Switzerland)

- Forbo Flooring System (Netherlands)

- Horner Flooring (U.S.)

- Aacer Flooring (U.S.)

- Abacus Sports (U.S.)

- CONICA (Switzerland)

- Continental Flooring Company (U.S.)

- Ecore International (U.S.)

- Fab Floorings India (India)

- Flexcourt (U.s.)

- Gerflor (U.S.)

- Hamberger Industriewerke Gmbh (Germany)

- Junckers Industrier A/S (Denmark)

- Kiefer USA (U.S.)

- Mateflex (U.S.)

- Rephouse Ltd (Hong Kong)

- Shreeji Woodcraft Pvt. Ltd. (India)

- Snapsports (U.S.)

Latest Developments in U.S. Sports Flooring Market

- In May 2025, Kiefer USA joined the Diverzify Network of Brands, enhancing its capabilities through shared resources and expanded reach. This collaboration has positioned Kiefer USA to better serve clients nationwide, delivering customized flooring solutions that prioritize athlete safety, performance, and sustainability

- In July 2023, Tarkett launched PureGrain, a breakthrough that is slated to completely alter the landscape of sporting fields. This ground-breaking product, made from maize cobs, not only represents a big step towards a greener future, but it also offers great performance for athletes of all skill levels. This kind of product launch has helped the company to broaden its product portfolio and gain a new consumer base

- In September 2021, building and interior design materials manufacturer LX Hausys joined a bid to acquire stake in furniture company Hanssem. LX Hausys reported that it plans to invest 300 billion won (USD 259 million) in a special purpose company formed by IMM Private Equity (PE). Hanssem manufactures flooring, doors and windows. With this acquisition, LX Hausys is expected to strengthen its presence in the local interior design market using the synergy between two companies

- In 2021, The international governing body of basketball, FIBA, and Junckers Industier A/s entered a long-term agreement under which Junckers will provide wood flooring globally by the year 2024. This agreement is helping the company to generate a stable turnover and gain a new consumer base by promoting its brand image

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INDUSTRY RIVALRY

4.2 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.3 RAW MATERIAL SOURCING ANALYSIS

4.3.1 KEY MATERIALS AND AVAILABILITY

4.3.2 SUPPLY CHAIN AND GEOPOLITICAL RISKS

4.3.3 ENVIRONMENTAL REGULATIONS AND COMPLIANCE

4.3.4 SUSTAINABILITY AND INNOVATION TRENDS

4.3.5 LOCALIZATION AND TECHNOLOGY USE

4.3.6 CONCLUSION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING EMPHASIS ON ATHLETE SAFETY AND PERFORMANCE OPTIMIZATION

5.1.2 GROWING PUBLIC AWARENESS REGARDING HEALTH, FITNESS, AND ACTIVE LIFESTYLES

5.1.3 RISING INVESTMENTS IN SCHOOL AND COMMUNITY-LEVEL SPORTS INFRASTRUCTURE

5.2 RESTRAINTS

5.2.1 HIGH INITIAL CAPITAL EXPENDITURE FOR INSTALLATION AND PROCUREMENT

5.2.2 INCONSISTENT CONSUMER PERFORMANCE EXPECTATIONS ACROSS APPLICATIONS

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF SPORTS INFRASTRUCTURE ACROSS THE U.S.

5.3.2 PROACTIVE GOVERNMENT INITIATIVES AND FUNDING TO PROMOTE SPORTS PARTICIPATION AND FACILITY DEVELOPMENT

5.4 CHALLENGES

5.4.1 INTENSIFYING COMPETITION AMONG MANUFACTURERS LEADING TO PRESSURE ON PROFIT MARGINS

5.4.2 STRICT REGULATORY STANDARDS GOVERNING FLOORING INSTALLATION AND COMPLIANCE

6 U.S. SPORTS FLOORING MARKET, BY TYPE

6.1 OVERVIEW

6.2 WOOD

6.3 RUBBER

6.4 PVC

6.5 ARTIFICIAL TURF

6.6 POLYURETHANE

6.7 OTHERS

7 U.S. SPORTS FLOORING MARKET, BY SPORTS

7.1 OVERVIEW

7.2 GYM

7.3 BASKETBALL

7.4 BADMINTON

7.5 TENNIS

7.6 FOOTBALL

7.7 DANCE AND AEROBICS

7.8 TRACK AND FIELD

7.9 VOLLEYBALL

7.1 OTHERS

8 U.S. SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE

8.1 OVERVIEW

8.2 RENOVATION/NEW MAINTAINED

8.3 NEW CONSTRUCTION

9 U.S. SPORTS FLOORING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 INDOOR

9.3 OUTDOOR

10 U.S. SPORTS FLOORING MARKET, BY END-USE

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 RESIDENTIAL

11 U.S. SPORTS FLOORING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: U.S.

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 TARKETT

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 LX HAUSYS.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 SIKA AG

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT DEVELOPMENTS

13.4 FORBO FLOORING SYSTEM

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 HORNER FLOORING

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.6 AACER FLOORING

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 ABACUS SPORTS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 CONICA

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 CONTINENTAL FLOORING COMPANY

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 ECORE INTERNATIONAL

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 FAB FLOORINGS INDIA

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 FLEXCOURT

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 GERFLOR

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 HAMBERGER INDUSTRIEWERKE GMBH

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENTS

13.15 JUNCKERS INDUSTRIER A/S

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 KIEFER USA

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 MATEFLEX

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 REPHOUSE LTD

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 SHREEJI WOODCRAFT PVT. LTD.

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENTS

13.2 SNAPSPORTS

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Figure

FIGURE 1 U.S. SPORTS FLOORING MARKET

FIGURE 2 U.S. SPORTS FLOORING MARKET: DATA TRIANGULATION

FIGURE 3 U.S. SPORTS FLOORING MARKET: DROC ANALYSIS

FIGURE 4 U.S. SPORTS FLOORING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. SPORTS FLOORING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. SPORTS FLOORING MARKET: MULTIVARIATE MODELLING

FIGURE 7 U.S. SPORTS FLOORING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 U.S. SPORTS FLOORING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EXECUTIVE SUMMARY

FIGURE 10 U.S. SPORTS FLOORING MARKET: SEGMENTATION

FIGURE 11 SIX SEGMENTS COMPRISE THE U.S. SPORTS FLOORING MARKET, BY TYPE (2024)

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 INCREASING EMPHASIS ON ATHLETE SAFETY AND PERFORMANCE OPTIMIZATION IS EXPECTED TO DRIVE THE U.S. SPORTS FLOORING MARKET IN THE FORECAST PERIOD

FIGURE 14 THE WOOD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. SPORTS FLOORING MARKET IN 2025 AND 2032

FIGURE 15 PORTER’S FIVE FORCES

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. SPORTS FLOORING MARKET

FIGURE 17 U.S. SPORTS FLOORING MARKET: BY TYPE, 2024

FIGURE 18 U.S. SPORTS FLOORING MARKET, BY SPORTS, 2024

FIGURE 19 U.S. SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2024

FIGURE 20 U.S. SPORTS FLOORING MARKET, BY APPLICATION, 2024

FIGURE 21 U.S. SPORTS FLOORING MARKET, BY END-USE, 2024

FIGURE 22 U.S. SPORTS FLOORING MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.