Us Station Service Voltage Transformer Ssvt Market

Market Size in USD Million

CAGR :

%

USD

341.54 Million

USD

600.05 Million

2024

2032

USD

341.54 Million

USD

600.05 Million

2024

2032

| 2025 –2032 | |

| USD 341.54 Million | |

| USD 600.05 Million | |

|

|

|

|

Station Service Voltage Transformer (SSVT) Market Analysis

The U.S. station service voltage transformer (SSVT) market is witnessing steady growth, driven by increasing investments in grid modernization, transmission infrastructure, and renewable energy projects. Rising demand for reliable auxiliary power solutions in substations is boosting adoption across industrial and utility sectors, while stringent regulatory standards and efficiency requirements are fostering product innovation. The shift towards smart grid deployments and cost-efficient power solutions is further accelerating market expansion.

In addition, the presence of key market players, ongoing R&D efforts, and infrastructure upgrades is strengthening the competitive landscape. The replacement of aging power equipment and advancements in energy-efficient technologies continue to create new opportunities, positioning the market for long-term growth and stability

Station Service Voltage Transformer (SSVT) Market Size

U.S. station service voltage transformer (SSVT) market is expected to reach USD 600.05 million by 2032 from USD 341.54 million in 2024, growing with a CAGR of 7.4% in the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Station Service Voltage Transformer (SSVT) Market Trends

“Rising Electricity Demand And Grid Expansion Projects”

Rising electricity demand is driving grid expansion and modernization, prompting utilities to invest in high-voltage transmission for improved reliability and renewable energy integration. This growth is increasing the need for Station Service Voltage Transformers (SSVTs), which provide auxiliary power directly from high-voltage lines, eliminating the need for separate distribution networks. SSVTs enhance grid efficiency, reduce infrastructure costs, and support remote and industrial applications. As transmission infrastructure expands, the demand for SSVTs will continue to grow, driven by their role in ensuring reliable power supply and operational flexibility.

Report Scope and Station Service Voltage Transformer (SSVT) Market Segmentation

|

Attributes |

Station Service Voltage Transformer (SSVT) Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Trench Group (Canada), Mitsubishi Electric Corporation (Japan), ABB (Switzerland), Fuji Electric Co., Ltd. (Japan), Sieyuan Electric Co., Ltd. (China), Arteche (Spain), KONČAR d.d. (Croatia), Hitachi Energy Ltd. (Switzerland), RITZ U.S. (U.S.), Niagara Power Transformer LLC (U.S.), Larson Electronics (U.S.), Power Grid Components Inc. (U.S.), Pfiffner Group (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Station Service Voltage Transformer (SSVT) Market Definition

A station service voltage transformer (SSVT) is a specialized high-voltage transformer that steps down transmission voltages, typically ranging from 69 kV to 765 kV, to lower, U.S.ble voltages for powering station equipment. It provides direct power for auxiliary loads, protection systems, lighting, and control circuits within substations, industrial plants, and remote locations. By eliminating the need for separate distribution transformers, SSVTs simplify infrastructure, reduce costs, and enhance system reliability. These transformers are designed for continuous operation, ensuring a stable power supply even in high-voltage environments. They play a crucial role in transmission and distribution (T&D) networks, particularly where dedicated distribution lines are unavailable. Their use is expanding due to increasing demand for grid stability, smart substations, and renewable energy integration.

Station Service Voltage Transformer (SSVT) Market Dynamics

Drivers

- Government Investments in Smart Grid Modernization

Grid resilience projects, undergrounding power lines, and advanced transmission infrastructure are key drivers for the Station Service Voltage Transformer These initiatives enhance grid efficiency, enable renewable energy integration, and require reliable auxiliary power solutions, increasing demand for SSVTs. With the push for grid reliability and expansion, the market is set for steady growth, driven by the need for cost-effective, space-saving, and maintenance-friendly alternatives to traditional power supply solutions in an evolving energy landscape.

For instance,

- In October 2024, according to an article published by Strategic Partnerships, Inc., the U.S. government allocated significant funding for smart grid modernization, strengthening the nation’s power infrastructure. Key investments included USD 1.5 billion for transmission upgrades in California, USD 888 million for grid modernization in Massachusetts, USD 218.7 million for new transmission lines in Indiana, and USD 176 million for microgrid development in Northern California. In addition, USD 150 million was dedicated to a natural gas plant in Texas, while USD 23.7 million supported smart grid technologies in North Carolina. These initiatives are driving demand for Station Service Voltage Transformers (SSVTs) as they provide reliable auxiliary power for grid modernization, ensuring efficient power supply, improved stability, and enhanced renewable energy integration

Expansion of Industrial and Commercial Power Infrastructure

As residential, industrial, and commercial energy demands continue to rise, the need for reliable and efficient power distribution is becoming more critical. Upgrading substations, expanding transmission networks, and integrating advanced grid technologies are essential to support high-load applications and decentralized power systems. This surge in grid modernization is driving demand for Station Service Voltage Transformers (SSVTs), which play a crucial role in enhancing grid stability, ensuring efficient power distribution, and providing accurate voltage measurement across industrial and commercial sectors. SSVTs offer a compact, cost-effective solution for supplying auxiliary power, making them indispensable in modern substation designs and remote power applications.

For instance,

In March 2023, the U.S. Energy Information Administration (EIA) reported that total U.S. electricity consumption in 2022 reached a record 4.07 trillion kWh, reflecting a 3.2% increase from the previous year. The commercial and industrial sectors were key drivers of this growth, with commercial electricity sales rising by 4.7% and industrial sales by 2.0%. The industrial sector accounted for 26% of total retail electricity sales, while the commercial sector represented 35.4%. This rising power demand emphasized the need for expanding power infrastructure, boosting the demand for Station Service Voltage Transformers (SSVTs). These transformers are critical for ensuring stable voltage supply, efficient energy distribution, and reliable auxiliary power solutions in industrial and commercial applications

Opportunities

- Integration of IoT And AI in Power Monitoring

The integration of IoT and AI in power monitoring presents a significant opportunity for the Station Service Voltage Transformer (SSVT). These advanced technologies enable real-time monitoring, predictive maintenance, and improved grid efficiency, reducing operational costs while enhancing reliability. AI-driven analytics help detect faults early, preventing outages and optimizing power distribution. As smart grids and digital substations become more prevalent, the demand for IoT-enabled SSVTs is expected to grow, driving market expansion and fostering innovation in the power transmission sector.

For instance,

- In November 2024, As per the data published by the U.S. Department of Energy (DOE) allocated USD 11 million to four HVDC transmission projects aimed at reducing costs and improving grid efficiency. Funding was awarded to GE Vernova Advanced Research, Sandia National Laboratories, the University of Pittsburgh, and Virginia Polytechnic Institute to develop cost-effective HVDC converter technologies. This initiative presents a significant opportunity for the U.S. Station Service Voltage Transformer (SSVT) market, as HVDC expansion drives demand for advanced transformers. Leading companies such as ABB, Siemens Energy, and General Electric stand to benefit from the increasing need for HVDC-compatible SSVTs, fostering market growth and technological advancements

Public-Private Partnerships in Grid Modernization Projects

Public-private partnerships in grid modernization projects offer significant growth opportunities for the Station Service Voltage Transformer. By combining government support with private sector innovation, these collaborations accelerate investments in advanced power infrastructure, smart grids, and renewable energy integration. As utilities upgrade aging systems and implement real-time monitoring solutions, the demand for reliable SSVTs will increase. These projects enhance grid stability, efficiency, and sustainability, positioning manufacturers to benefit from the rising need for accurate and resilient power solutions.

For instance,

- In June 2024, Deloitte partnered with Utilidata to modernize the U.S. power grid using AI-driven solutions, integrating NVIDIA’s computing platform with Utilidata’s Karman platform to enhance grid efficiency, reliability, and sustainability. This collaboration underscores the potential of public-private partnerships in advancing grid modernization, creating demand for Station Service Voltage Transformers (SSVTs) that support real-time voltage monitoring and precision measurement. As utilities adopt AI-powered solutions, investment in next-generation power infrastructure will rise, strengthening the market for advanced SSVTs

Restraints/Challenges

- Environmental Concerns Over Transformer Oil Disposal

Many traditional transformer oils contain hazardous substances like PCBs, requiring strict disposal and recycling measures to prevent environmental contamination. Increasing regulatory pressure and sustainability initiatives are driving the shift toward biodegradable and non-toxic alternatives, but high costs and logistical hurdles complicate the transition. Advancing recycling technologies, ensuring regulatory compliance, and investing in eco-friendly transformer oils are essential to reducing environmental risks while maintaining grid reliability.

For instance,

- Many traditional transformer oils contain hazardous substances like PCBs, requiring strict disposal and recycling measures to prevent environmental contamination. Increasing regulatory pressure and sustainability initiatives are driving the shift toward biodegradable and non-toxic alternatives, but high costs and logistical hurdles complicate the transition. Advancing recycling technologies, ensuring regulatory compliance, and investing in eco-friendly transformer oils are essential to reducing environmental risks while maintaining grid reliability

Supply Chain Disruptions Affecting High Volatge Instrument Availability

Supply chain disruptions pose a major restraint for the U.S. Station Service Voltage Transformer (SSVT) market, causing delays in equipment availability and project execution. Raw material shortages, logistical constraints, and rising transportation costs have impacted the production and delivery of essential transformer components. These challenges slow grid expansion, modernization, and infrastructure upgrades. To mitigate risks, manufacturers and utilities must adopt strategies such as supplier diversification, improved inventory management, and increased domestic production to strengthen supply chain resilience.

For instance,

- In February 2025, Data shared by Utility Dive reveals that, supply chain disruptions have significantly impacted transformer availability, creating a major restraint for the U.S. Station Service Voltage Transformer (SSVT) market. Rising demand, aging infrastructure, and extreme weather events have increased the need for transformers, yet manufacturing slowdowns and material shortages particularly in specialized electrical steel have led to delivery delays of up to six years. With over 80,000 transformer variants in use and demand expected to surge by 260% by 2050, these supply chain bottlenecks threaten grid reliability and renewable energy expansion. Addressing these challenges requires policy coordination, supplier diversification, and investment in domestic manufacturing to enhance long-term supply stability

Station Service Voltage Transformer (SSVT) Market Scope

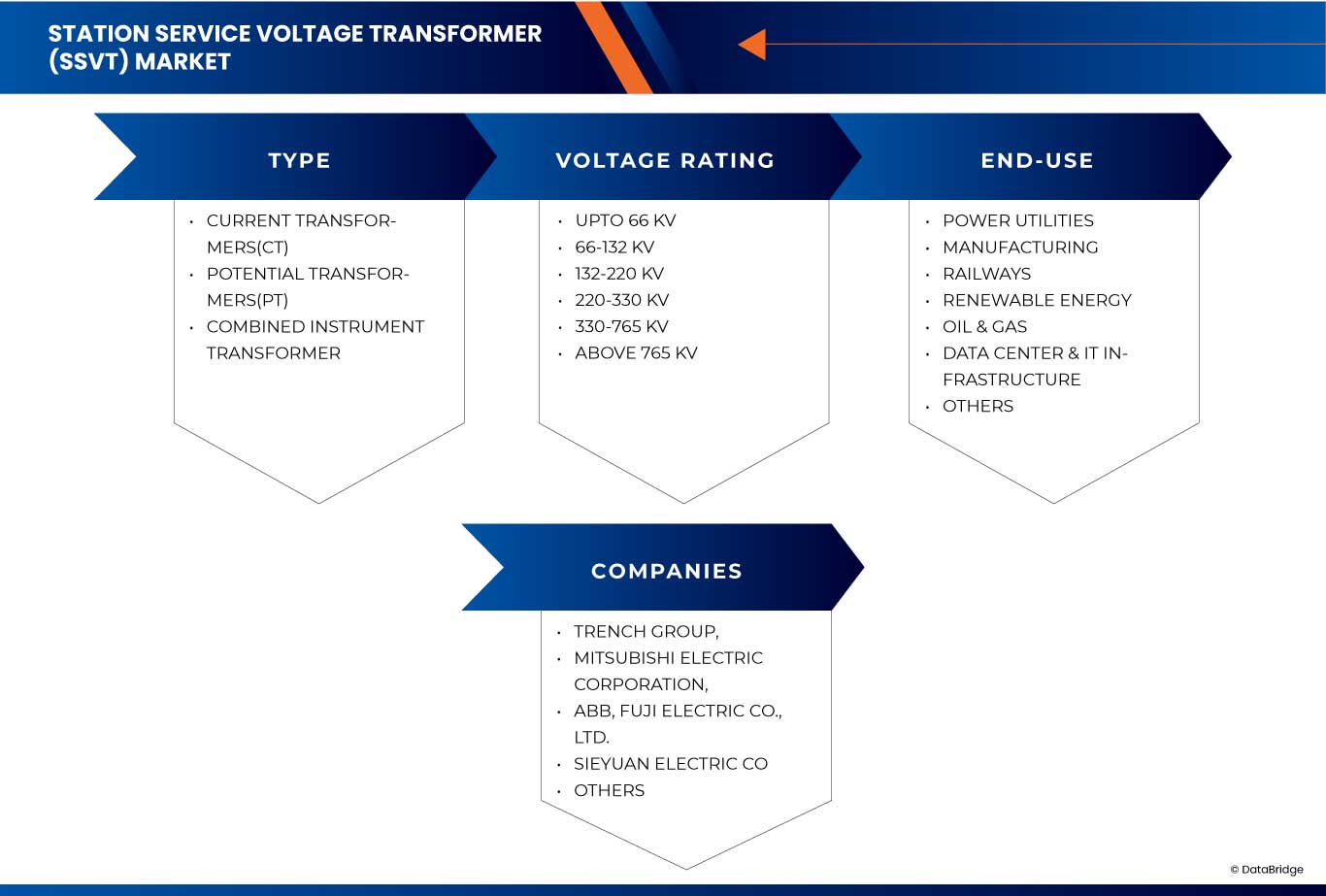

The market is segmented into eight notable segments based on the type, voltage rating, and end-use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Step-Up Transformers

- Step Down

- Oil-Immersed Transformers

- Dry-Type Transformers

- Others

Voltage Rating

- Upto 66 KV

- 66-132 KV

- 132-220 KV

- 220-330 KV

- 330-765 KV

- Above 765 KV

End Use

- Power Utilities

- Step-Up Transformers

- Step Down

- Oil-Immersed Transformers

- Dry-Type Transformers

- Others

- Manufacturing

- Step-Up Transformers

- Step Down

- Oil-Immersed Transformers

- Dry-Type Transformers

- Others

- Railways

- Step-Up Transformers

- Step Down

- Oil-Immersed Transformers

- Dry-Type Transformers

- Others

- Renewable Energy

- Step-Up Transformers

- Step Down

- Oil-Immersed Transformers

- Dry-Type Transformers

- Others

- Oil & Gas

- Step-Up Transformers

- Step Down

- Oil-Immersed Transformers

- Dry-Type Transformers

- Others

- Data Center & It Infrastructure

- Step-Up Transformers

- Step Down

- Oil-Immersed Transformers

- Dry-Type Transformers

- Others

Station Service Voltage Transformer (SSVT) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Station Service Voltage Transformer (SSVT) Market Leaders Operating in the Market Are:

- Trench Group (Canada)

- Mitsubishi Electric Corporation (Japan)

- ABB (Switzerland)

- Fuji Electric Co., Ltd. (Japan)

- Sieyuan Electric Co., Ltd. (China)

- Arteche (Spain)

- KONČAR d.d. (Croatia)

- Hitachi Energy Ltd. (Switzerland)

- RITZ U.S. (U.S.)

- Niagara Power Transformer LLC (U.S.)

- Larson Electronics (U.S.)

- Power Grid Components Inc. (U.S.)

- Pfiffner Group (Switzerland)

Latest Developments in Station Service Voltage Transformer (SSVT) Market

- In February 2025, Arteche has launched the URNR-TR-36, a dry-type outdoor voltage transformer designed to withstand VFTO, ferroresonance, and harmonics, ensuring high durability. This strengthens Arteche’s position in the SSVT market by offering a reliable, VFTO-resistant solution with advanced insulation and international compliance, enhancing its credibility among utilities and industrial operators

- In April 2024, Hitachi Energy is investing over USD 1.5 billion to expand global transformer manufacturing by 2027, including a USD 180 million facility in Finland. This enhances production capacity, strengthens market leadership, and meets growing demand for high power voltage instrument transformers while advancing digitalization, sustainability, and innovation

- In November 2021, Sieyuan Electric has supplied its first power transformer to Celsia Energía for the 115 kV Zarzal Substation project in Colombia, paving the way for additional deliveries. This milestone reinforces Sieyuan Electric’s presence in the Latin American market and boosts its reputation in high-voltage equipment supply, potentially driving demand for its Station Service Voltage Transformers (SSVTs) in future substation projects

- In September 2019, Končar – Instrument Transformers has supplied 24 high-voltage instrument transformers (525 kV) for Malaysia’s largest gas combined thermal power plant, commissioned by GE Grid Solutions. Developed by Tenaga Nasional Berhad (TNB), the plant will begin operations in 2021, meeting 10% of the country’s electricity demand. This milestone enhances KONČAR’s expertise in High Power Voltage Instrument Transformers, expanding its global presence, strengthening industry partnerships, and solidifying its role as a trusted supplier for large-scale energy projects in Southeast Asia

- Data collection and base year analysis is done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. Also market share analysis and key trend analysis are the major success factors in the market report. To know more please request an analyst call or can drop down your inquiry.

- The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America versus Country and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 DBMR MARKET POSITION GRID

2.6 VENDOR SHARE ANALYSIS

2.7 MULTIVARIATE MODELING

2.8 TYPE TIMELINE CURVE

2.9 MARKET END-USE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PATENT ANALYSIS

4.3 VALUE CHAIN ANALYSIS – STATION SERVICE VOLTAGE TRANSFORMER (SSVT)

4.3.1 RAW MATERIAL SOURCING

4.3.2 COMPONENT MANUFACTURING

4.3.3 ASSEMBLY AND TESTING

4.3.4 DISTRIBUTION AND LOGISTICS

4.3.5 INSTALLATION AND COMMISSIONING

4.3.6 OPERATION AND MAINTENANCE

4.3.7 END-OF-LIFE MANAGEMENT

4.3.8 CONCLUSION

4.4 PENETRATION AND GROWTH PROSPECT MAPPING

4.4.1 MARKET PENETRATION

4.4.2 GROWTH PROSPECTS

4.5 TECHNOLOGY MATRIX

4.6 COMPANY COMPARATIVE ANALYSIS

4.7 COMPARISON OF STATION SERVICE VOLTAGE TRANSFORMER (SSVT) WITH TRADITIONAL VOLTAGE TRANSFORMERS

5 REGULATORY STANDARDS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING ELECTRICITY DEMAND AND GRID EXPANSION PROJECTS

6.1.2 GOVERNMENT INVESTMENTS IN SMART GRID MODERNIZATION

6.1.3 EXPANSION OF INDUSTRIAL AND COMMERCIAL POWER INFRASTRUCTURE

6.1.4 INCREASING ELECTRICITY DEMAND DUE TO URBANIZATION

6.2 RESTRAINTS

6.2.1 NEEDED HIGH CAPITAL INVESTMENT FOR INSTALLATION AND MAINTENANCE

6.2.2 STRICT REGULATORY REQUIREMENTS DELAYING PROJECT APPROVALS

6.3 OPPORTUNITIES

6.3.1 GROWTH IN HIGH-VOLTAGE DIRECT CURRENT (HVDC) PROJECTS

6.3.2 INTEGRATION OF IOT AND AI IN POWER MONITORING

6.3.3 PUBLIC-PRIVATE PARTNERSHIPS IN GRID MODERNIZATION PROJECTS

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL CONCERNS OVER TRANSFORMER OIL DISPOSAL

6.4.2 SUPPLY CHAIN DISRUPTIONS AFFECTING HIGH VOLTAGE INSTRUMENT AVAILABILITY

7 U.S STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY TYPE

7.1 OVERVIEW

7.2 STEP DOWN

7.3 STEP-UP TRANSFORMERS

7.4 OIL-IMMERSED TRANSFORMERS

7.5 DRY-TYPE TRANSFORMERS

7.6 OTHERS

8 U.S STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY VOLTAGE RATING

8.1 OVERVIEW

8.2 UPTO 66 KV

8.3 66-132 KV

8.4 132-220 KV

8.5 220-330 KV

8.6 330-765 KV

8.7 ABOVE 765 KV

9 U.S STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY END-USE

9.1 OVERVIEW

9.2 POWER UTILITIES

9.2.1 POWER UTILITIES, BY TYPE

9.3 MANUFACTURING

9.3.1 MANUFACTURING, BY TYPE

9.4 RAILWAYS

9.4.1 RAILWAYS, BY TYPE

9.5 RENEWABLE ENERGY

9.6 OIL & GAS

9.6.1 OIL & GAS, BY TYPE

9.7 DATA CENTER & IT INFRASTRUCTURE

9.7.1 DATA CENTER & IT INFRASTRUCTURE, BY TYPE

9.8 OTHERS

10 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: U.S.

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 TRENCH GROUP

12.1.1 COMPANY SNAPSHOT

12.1.2 PRODUCT PORTFOLIO

12.1.3 RECENT DEVELOPMENT

12.2 MITSUBISHI ELECTRIC CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 ABB

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 FUJI ELECTRIC CO., LTD.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 SIEYUAN ELECTRIC CO., LTD

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENTS

12.6 ARTECHE

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT/NEWS

12.7 HITACHI, LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 KONČAR D.D.

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENTS

12.9 LARSON ELECTRONICS LLC

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 NIAGARA POWER TRANSFORMER LLC

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 PFIFFNER GROUP

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 POWER GRID COMPONENTS INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 RITZ USA

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS/NEWS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 TECHNOLOGY MATRIX FOR KEY MARKET PLAYERS

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 FUNCTIONAL COMPARISON

TABLE 4 DESIGN & CONSTRUCTION COMPARISON

TABLE 5 PERFORMANCE & OPERATIONAL COMPARISON

TABLE 6 KEY ADVANTAGES & DISADVANTAGES

TABLE 7 REGULATORY STANDARDS RELATED TO U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET

TABLE 8 INSTALLATION AND MAINTENANCE COST ESTIMATE FOR STATION SERVICE VOLTAGE TRANSFORMERS (SSVTS)

TABLE 9 STORAGE REQUIREMENTS FOR PCB TRANSFORMER OIL

TABLE 10 REGULATORY REQUIREMENTS FOR PCB TRANSFORMER OIL DISPOSAL

TABLE 11 PENALTIES FOR NON-COMPLIANCE WITH PCB TRANSFORMER OIL DISPOSAL REGULATIONS

TABLE 12 U.S STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 U.S STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY VOLTAGE RATING, 2018-2032 (USD THOUSAND)

TABLE 14 U.S STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 15 U.S POWER UTILITIES IN STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 U.S. MANUFACTURING IN STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. RAILWAYS IN STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 U.S. RENEWABLE ENERGY IN STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. OIL & GAS IN STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. DATA CENTER & IT INFRASTRUCTURE IN STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: SEGMENTATION

FIGURE 2 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: DATA TRIANGULATION

FIGURE 3 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: DROC ANALYSIS

FIGURE 4 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: MULTIVARIATE MODELING

FIGURE 10 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: TYPE TIMELINE CURVE

FIGURE 11 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: END-USE COVERAGE GRID

FIGURE 12 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: SEGMENTATION

FIGURE 13 FIVE SEGMENTS COMPRISE THE U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET, BY TYPE (2024)

FIGURE 14 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 RISING ELECTRICITY DEMAND AND GRID EXPANSION PROJECTS IS EXPECTED TO DRIVE THE U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 STEP DOWN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET IN 2025 & 2032

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF U.S. HIGH POWER VOLTAGE INSTRUMENT TRANSFORMERS MARKET

FIGURE 19 U.S. PRIMARY ENERGY CONSUMPTION AND PRODUCTION (1950-2023)

FIGURE 20 U.S. GOVERNMENT INVESTMENT IN SMART POWER GRID

FIGURE 21 U.S. ELECTRICITY TO MAJOR END-USE SECTORS AND ELECTRICITY DIRECT USE BY ALL SECTORS, 1950-2022

FIGURE 22 U.S. POWER CONSUMPTION AND EXPANSION BY INDUSTRIAL AND COMMERCIAL SECTOR(2023)

FIGURE 23 TOP 10 CITIES WITH THE HIGHEST ELECTRICITY CONSUMPTION IN THE U.S.

FIGURE 24 U.S STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: BY TYPE, 2024

FIGURE 25 U.S STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: BY VOLTAGE RATING, 2024

FIGURE 26 U.S STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: BY END-USE, 2024

FIGURE 27 U.S. STATION SERVICE VOLTAGE TRANSFORMER (SSVT) MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.