Vascular Closure Device Market

Market Size in USD Billion

CAGR :

%

USD

1.94 Billion

USD

3.16 Billion

2024

2032

USD

1.94 Billion

USD

3.16 Billion

2024

2032

| 2025 –2032 | |

| USD 1.94 Billion | |

| USD 3.16 Billion | |

|

|

|

Vascular Closure Device Market Analysis

The Vascular Closure Device (VCD) market has seen significant growth, driven by technological advancements and increased demand for minimally invasive procedures. Key innovations include automated, self-activating closure mechanisms that reduce manual intervention and improve safety by minimizing complications such as bleeding and hematomas. In addition, VCDs now incorporate real-time imaging guidance, allowing clinicians to monitor the closure process with high precision, enhancing procedural accuracy and reducing errors. AI-driven analytics are also improving device placement and post-procedural care, helping to optimize recovery time and reduce risks.

The growing preference for minimally invasive procedures, especially in catheterization and angioplasty, is fuelling VCD market expansion. With an aging global population and rising cardiovascular diseases, there is an increasing demand for vascular closure devices across hospitals and outpatient clinics. Furthermore, advancements in materials science have led to more comfortable VCD options, making them suitable for outpatient settings. These innovations, combined with a focus on patient safety and efficient recovery, are propelling the VCD market's growth, and demand is expected to rise as healthcare continues to prioritize minimally invasive solutions.

Vascular Closure Device Market Size

The global Vascular Closure Device market size was valued at USD 1.94 billion in 2024 and is projected to reach USD 3.16 billion by 2032, with a CAGR of 6.33% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Vascular Closure Device Market Trends

“Increasing Integration of Digital Imaging and AI in VCD Market”

The growth of the Vascular Closure Device (VCD) market is the integration of advanced digital imaging technologies. Innovations such as high-definition and 3D imaging are enhancing diagnostic accuracy and efficiency in clinical settings. Automated image analysis, combined with AI, accelerates the interpretation of microscopic samples, offering more precise results. Companies such as Olympus and Leica Microsystems are incorporating AI-powered software to detect cellular structures and abnormalities, which streamlines diagnostic workflows for pathologists. This technological shift is not only improving clinical procedures but also expanding VCD applications in research and personalized medicine, driving further growth and adoption of these devices across healthcare settings.

Report Scope and Vascular Closure Device Market Segmentation

|

Attributes |

Vascular Closure Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Abbott Laboratories (U.S.), Medtronic PLC (Ireland), Terumo Corporation (Japan), Cardinal Health (U.S.), Vascular Solutions, Inc. (U.S.), Boston Scientific Corporation (U.S.), Teleflex Incorporated (U.S.), Gore Medical (U.S.), Johnson & Johnson (U.S.), Braun Melsungen AG (Germany), AngioDynamics, Inc. (U.S.), Fujifilm Holdings Corporation (Japan), Sapheon, Inc. (U.S.), Merit Medical Systems, Inc. (U.S.), Cook Medical (U.S.), Maquet/Getinge Group (Germany), St. Jude Medical, Inc. (U.S.), Aptus Endosystems, Inc. (U.S.), Medi-Globe GmbH (Germany), and EndoTools Therapeutics (Belgium) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Vascular Closure Device Market Definition

A Vascular Closure Device (VCD) is a medical device used to achieve hemostasis (the stopping of bleeding) after a catheterization procedure, such as angiography or percutaneous coronary intervention (PCI). These devices are designed to close the puncture site in the artery, typically in the femoral or radial artery, after a catheter is removed. VCDs help reduce bleeding complications, shorten recovery time, and improve patient comfort compared to traditional manual compression methods. They can be categorized into different types, including suture-based, collagen plug-based, and clip-based closure systems. These devices are widely used in cardiovascular procedures to enhance patient outcomes and facilitate faster ambulation.

Vascular Closure Device Market Dynamics

Drivers

- Increasing Prevalence of Cardiovascular Diseases

The rising global prevalence of cardiovascular diseases (CVDs) is a significant driver for the Vascular Closure Device (VCD) market. CVDs, including coronary artery disease, stroke, and peripheral artery disease, are leading causes of morbidity and mortality worldwide. As these conditions increase, the demand for procedures such as angioplasty, catheterization, and coronary interventions grows, which directly boosts the need for VCDs to safely close arterial access points post-procedure. According to the World Health Organization (WHO), cardiovascular diseases are responsible for nearly 31% of global deaths, underscoring the importance of effective interventional procedures.

VCDs help minimize complications such as bleeding, hematoma formation, and infection, making them essential in the post-procedural recovery phase. Companies such as Medtronic PLC and Boston Scientific have been actively addressing the growing cardiovascular health concerns by developing advanced VCDs to improve patient outcomes. These devices help expedite patient recovery by reducing the time needed for manual compression and lowering the risks associated with vascular puncture sites. As the global population ages and cardiovascular conditions continue to rise, the demand for VCDs is expected to grow, propelling market expansion.

- Growing Preference for Minimally Invasive Surgeries

The increasing shift toward minimally invasive surgeries is another key driver for the growth of the VCD market. Minimally invasive procedures, such as catheter-based interventions, are gaining popularity due to their numerous advantages, including smaller incisions, reduced blood loss, shorter hospital stays, and quicker recovery times. This trend has led to a surge in demand for vascular closure devices that provide safe and efficient closure of arterial access sites with minimal patient discomfort and complications.

Devices such as Teleflex's SafeSeal and Abbott’s ProGlide offer easy-to-use, automated mechanisms that close puncture sites without the need for manual compression, making them ideal for use in outpatient settings. In addition, these devices enable faster patient turnaround times, aligning with the growing trend in healthcare to minimize hospital admissions and reduce the overall cost of treatment. As healthcare systems focus on reducing patient recovery times and procedure costs, the demand for minimally invasive procedures and the VCDs that support them is projected to rise. This shift is being driven by both advancements in technology and an increasing awareness of the benefits of minimally invasive techniques in reducing healthcare burdens.

Opportunities

- Expansion of VCD Applications in Outpatient and Ambulatory Settings

As healthcare systems worldwide aim to reduce hospitalization times and costs, there is an increasing demand for vascular closure devices (VCDs) in outpatient and ambulatory settings. These settings prioritize minimally invasive procedures that enable faster patient recovery and reduce complications associated with prolonged hospital stays. VCDs play a crucial role in achieving rapid hemostasis after catheterization procedures, allowing patients to be discharged more quickly. Companies like Teleflex Incorporated have been developing advanced VCDs tailored for outpatient use, ensuring safety, efficacy, and convenience. This shift not only benefits healthcare providers by optimizing resource utilization but also enhances patient comfort and experience.

- Integration of Artificial Intelligence (AI) and Automation

The integration of artificial intelligence (AI) and automation in vascular closure devices presents a transformative opportunity for the market. AI-driven technologies enhance precision by optimizing image analysis, guiding device placement, and monitoring post-procedural recovery. These advancements help reduce human error and improve procedural efficiency. Companies like Medtronic PLC are leading the way in incorporating AI into VCDs, allowing for real-time data analysis and improved clinical decision-making. AI-enhanced VCDs contribute to better patient outcomes by ensuring proper closure, minimizing complications, and reducing procedure times. This innovation aligns with the growing demand for smarter, technology-driven solutions in vascular interventions.

Restraints/Challenges

- High Cost of Vascular Closure Devices

One of the major restraints in the growth of the Vascular Closure Device (VCD) market is the high cost associated with these devices. VCDs, especially advanced systems incorporating technologies such as automated closure mechanisms, digital imaging, and artificial intelligence, tend to be expensive. This high cost can be a barrier to widespread adoption, particularly in cost-sensitive regions or smaller healthcare facilities that may not have the financial resources to invest in such technologies.

For instance, premium VCDs such as Medtronic's Angio-Seal or Abbott’s Perclose ProGlide are priced significantly higher than traditional manual compression methods, making it difficult for some healthcare institutions, especially in emerging markets, to justify their purchase. This can lead to resistance in adopting newer devices in favor of more affordable, manual alternatives, limiting market penetration. In addition, insurance coverage and reimbursement policies for these devices may vary by region, further complicating their accessibility for healthcare providers and patients. As a result, the high cost of advanced VCDs remains a key challenge that could limit the growth of the market, particularly in regions with lower healthcare budgets.

- Lack of Standardization and Regulatory Hurdles

The lack of standardization and regulatory challenges in the VCD market can also hinder growth. Different VCDs come with varying specifications, technologies, and designs, creating a fragmented market that can be difficult for healthcare providers to navigate. In addition, the regulatory approval process for medical devices can be time-consuming and complex, which may delay the introduction of new VCD products.

For example, in some regions, VCDs must undergo rigorous clinical trials to prove their safety and efficacy before they can be approved for use. This process can take several years and involve significant investments in research and development, making it difficult for smaller companies to enter the market or for new technologies to be rapidly adopted. Furthermore, inconsistent regulatory frameworks across countries can complicate global marketing and distribution efforts for manufacturers. As a result, the lack of standardization and regulatory hurdles can slow innovation, limit market expansion, and increase costs for both manufacturers and end-users.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Vascular Closure Device Market Scope

The market is segmented on the basis of type, access, procedure, distribution channel, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Passive Approximators

- Collagen Plugs

- Sealant or Gel-based Devices

- Compression Assist Devices

- Active Approximators

- Suture-based Devices

- Clip-based Devices

- External Haemostatic Devices

Access

- Femoral Access

- Radial Access

Procedure

- Interventional Cardiology

- Interventional Radiology/ Vascular Surgery

Distribution Channel

- Direct Tenders

- Retail

Application

- Cardiac Interventions

- Cerebrovascular Interventions

- Peripheral Vascular Interventions

- Others

End User

- Hospitals and Clinics

- Specialty Centres

- Ambulatory Surgery Centres

- Others

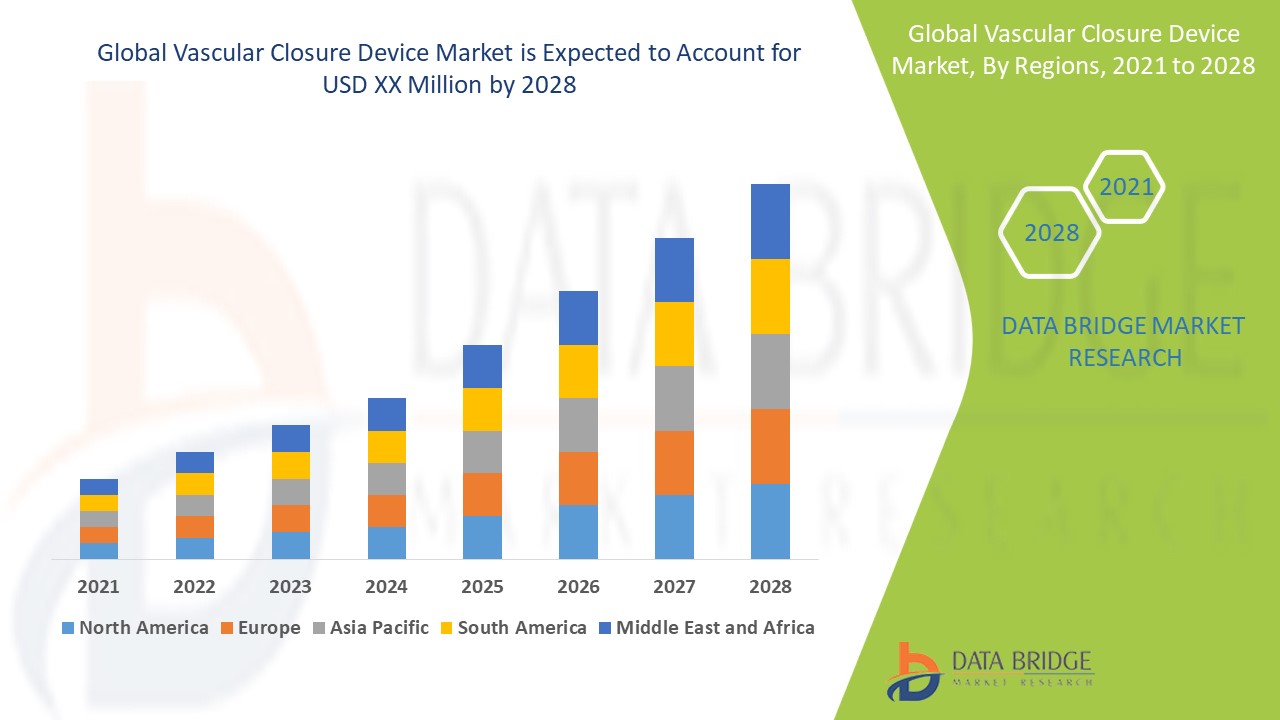

Vascular Closure Device Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, access, procedure, distribution channel, application, and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the vascular closure device (VCD) market due to significant investments in research and development and the growing number of government initiatives to enhance healthcare. The region benefits from advanced healthcare infrastructure and high adoption rates of cutting-edge medical technologies, driving demand for sophisticated diagnostic tools such as VCDs. The presence of leading manufacturers such as Medtronic PLC and Boston Scientific Corporation, along with continuous technological advancements, further support North America's leadership in the market. In addition, increasing healthcare awareness and the rising number of cardiovascular diseases contribute to the growing demand for VCDs in the region.

Asia-Pacific is expected to exhibit the highest growth rate in the VCD market during the forecast period, driven by increasing government expenditure on healthcare and technological advancements. Countries such as China, India, and Japan are investing heavily in healthcare infrastructure, which has led to a surge in demand for modern medical devices, including VCDs. The region is witnessing rapid urbanization, improving healthcare access, and growing medical research investments, all of which contribute to the expanding use of VCDs. Moreover, government initiatives to enhance medical facilities and promote advanced healthcare technologies are expected to fuel market growth in Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Vascular Closure Device Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Vascular Closure Device Market Leaders Operating in the Market Are:

- Abbott Laboratories (U.S.)

- Medtronic PLC (Ireland)

- Terumo Corporation (Japan)

- Cardinal Health (U.S.)

- Vascular Solutions, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- Teleflex Incorporated (U.S.)

- Gore Medical (U.S.)

- Johnson & Johnson (U.S.)

- Braun Melsungen AG (Germany)

- AngioDynamics, Inc. (U.S.)

- Fujifilm Holdings Corporation (Japan)

- Sapheon, Inc. (U.S.)

- The Merit Medical Systems, Inc. (U.S.)

- Cook Medical (U.S.)

- Maquet/Getinge Group (Germany)

- St. Jude Medical, Inc. (U.S.)

- Aptus Endosystems, Inc. (U.S.)

- Medi-Globe GmbH (Germany)

- EndoTools Therapeutics (Belgium)

Latest Developments in Vascular Closure Device Market

- In January 2025, Abbott Laboratories announced the launch of ProGlide 2.0, an enhanced version of their popular Vascular Closure Device (VCD). It incorporates novel hemostatic seal technology, offering more precise control and faster sealing of arterial puncture sites. This innovation helps reduce recovery time and improves overall patient outcomes

- In October 2023, Terumo Corporation announced that its Angio-Seal VIP and Femoseal Vascular Closure Devices received certification under the new European Medical Device Regulation (EU MDR). The first CE-marked units of Femoseal reached the market in June 2023, and Angio-Seal VIP is expected in November 2023. This certification marks a significant milestone in improving femoral arterial hemostasis after percutaneous catheterization

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.