Asia Pacific Medical Device Packaging Market

Размер рынка в млрд долларов США

CAGR :

%

USD

10.95 Billion

USD

20.87 Billion

2024

2032

USD

10.95 Billion

USD

20.87 Billion

2024

2032

| 2025 –2032 | |

| USD 10.95 Billion | |

| USD 20.87 Billion | |

|

|

|

|

Asia-Pacific Medical Device Packaging Market Segmentation, By Material (Polymer, Paper and Paperboard, Nonwoven Material, Others), Container Type (Bags and Pouches, Trays, Boxes, Others), Packaging Type (Primary, Secondary, Tertiary), Applications (Equipment’s and Tools, Devices, IVD, Implants) - Industry Trends and Forecast to 2032

Medical Device Packaging Market Size

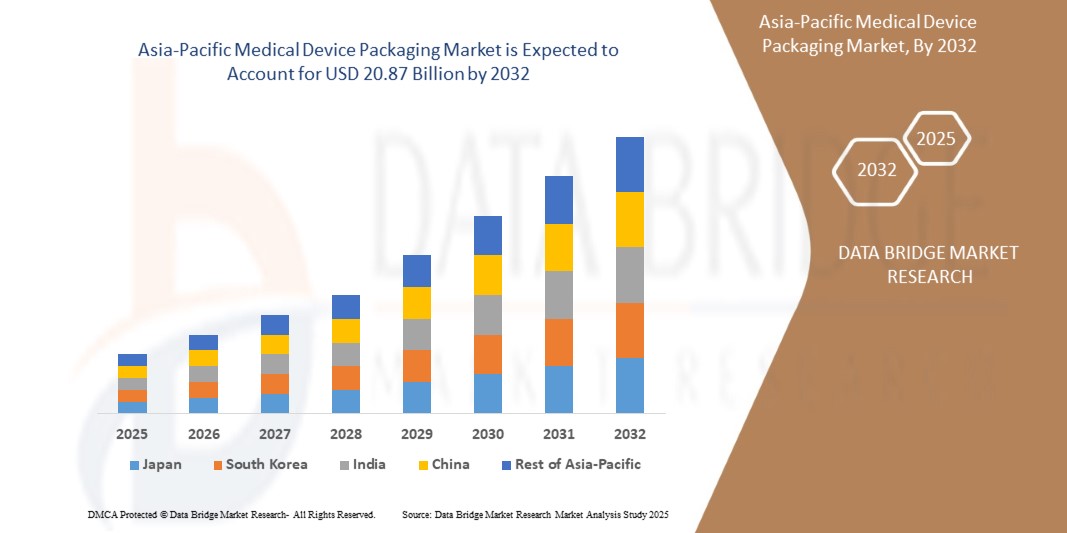

- The Asia-Pacific medical device packaging market was valued atUSD 10.95 billion in 2024and is expected to reachUSD 20.87 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 8.4%,primarily driven by the rising spending towards IoT in the healthcare sector

- The increase in demand for medical devices such as medical supplies, in-vitro diagnostic equipment and reagents, dental goods, surgical implants and instruments, electro-medical equipment and irradiation apparatuses accelerate the market growth.

Medical Device Packaging Market Analysis

- The Asia-Pacific medical device packaging market is experiencing robust growth, propelled by factors such as expanding healthcare infrastructure, rising chronic disease prevalence, and increasing demand for sterile and sustainable packaging solutions.

- Countries like China, India, and Japan are leading this surge due to their strong manufacturing capabilities and supportive government initiatives.

- The shift towards eco-friendly materials and advanced packaging technologies is further improving the market dynamics.

- China is expected to dominate the market with a share of more than 35% of the market share by 2032 as a result of high concentration of medical device manufacturers coupled with positive outlook towards healthcare infrastructure development on a national level

- India is projected to foresee fastest growth movement thanks to the supportive government policies aimed at promoting the industry output in various segments including medical devices

Report Scope and Medical Device Packaging Market Segmentation

|

Attributes |

Medical Device Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Device Packaging Market Trends

“Adoption of Sustainable Packaging Solutions”

- Manufacturers are increasingly using recyclable and biodegradable materials to reduce environmental impact. This is attributed to the fact that stricter environmental regulations are pushing companies to adopt sustainable packaging practices.

- Growing awareness among consumers about environmental issues is driving demand for green packaging. The companies are also coming with sustainable packaging which are providing the competitive edge by appealing to environmentally conscious stakeholders.

- For instance, DKSH is driving new standards of innovation for sustainable packaging and waste management in Asia Pacific's rapidly changing medical markets. Their efforts focus on ensuring the timely and safe delivery of healthcare products while addressing environmental concerns.

Sustainable packaging is reshaping the Asia-Pacific medical device market by aligning industry practices with environmental goals. This shift not only supports regulatory compliance but also strengthens brand reputation among eco-conscious consumers and stakeholders.

Medical Device Packaging Market Dynamics

Driver

“Growing Healthcare Infrastructure in Asia-Pacific”

- Governments are heavily funding hospitals and clinics, boosting demand for medical devices and packaging. This is due to the increased number of hospitals and diagnostic centers in China and India

- Rural and semi-urban outreach drives higher usage of packaged medical supplies. Countries like India and Thailand attract international patients, raising the need for reliable device packaging.

For instance,

- The government of China has been investing in county-level hospitals to enhance medical capacity, which is crucial for improving healthcare services across the country.

Governments of key countries including China and India have been increasing spending on improving healthcare infrastructure. This trend is expected to promote the scope of packaging in medical devices in the near future.

Opportunity

“High Demand for Sustainable Packaging Solutions”

- Governments are encouraging eco-friendly packaging through sustainability mandates, fostering innovation and market entry. Companies adopting sustainable packaging gain competitive advantage by aligning with growing environmental awareness among consumers and healthcare providers.

- Advances in recyclable and biodegradable materials are reducing long-term costs and enhancing operational efficiency. Furthermore, the adoption of sustainability goals and

For instance,

- DuPont's Tyvek material, known for its durability and recyclability, is being increasingly adopted in medical device packaging across Asia-Pacific, aligning with sustainability goals.

Eco-friendly packaging increases global marketability, meeting environmental standards in key export destinations, making it a key growth opportunity in the Medical Device Packaging market.

Restraint/Challenges

“The Need to Comply with Stringent Regulatory Standards”

- Medical device packaging industry participants are adhere to stringent regulatory standards to ensure the safety, sterility, and efficacy of the devices. These standards are crucial for maintaining the integrity of medical devices throughout their lifecycle, from manufacturing to end-use delivery

- The industry participants require documentation and rigorous testing to ensure compliance with global standards. As a result, the packaging validation is considered as one of the critical components in order to maintaining the sterility, safety, and integrity of medical devices throughout their lifecycle.

For instance,

- Regulations such as FDA 21 CFR Part 820, EU MDR, and ISO 116072 ensure that packaging materials and systems maintain sterility during transport and storage.

The compliance with stringent regulations in medical device industry regarding the packaging of the product forms is expected to increase operating costs at various levels, which will in turn have credible threat to the industry in the near future.

Medical Device Packaging Market Scope

The market is segmented on the basis of material, container type, packaging type, and applications.

|

Segmentation |

Sub-Segmentation |

|

By Material |

|

|

By Container Type |

|

|

By Packaging Type |

|

|

By Applications |

|

In 2025, the polymer segment is projected to dominate the market with a largest share in application segment

Polymer dominated the market and accounted for a revenue share of 64.7% in 2024. These materials are considered as safe, hygienic, versatile, and durable, offering aesthetic flexibility from opaque to clear. Their lightweight, cost-effective nature makes them an ideal choice for medical device packaging. Polymer packaging maintains the sterility and integrity of medical devices and diagnostic equipment.

The Pouches and bags is expected to account for the largest share during the forecast period in Container Type market

In 2025, Pouches and bags led the medical device packaging market and accounted for a revenue share of 35.9% in 2024. These products and capable enough to efficiently pack the medical devices of all sizes, offering easy storage and handling. Furthermore, pouches and bags are manufactured from materials such as LLDPE and PET which protect devices from light, moisture, and gases.

Medical Device Packaging Market Regional Analysis

“China is the Dominant Region in the Medical Device Packaging Market”

- TheChinaholds a significant share due to its robust manufacturing capabilities, significant investments in research and development, and a rapidly aging population

- In addition, Government initiatives like "Made in China" have further bolstered domestic production of high-value medical devices, increasing demand for advanced packaging solutions.

“India is Projected to Register the Highest Growth Rate”

- India is expected to witness the highest growth rate in theMedical Device Packaging market, driven by expanding healthcare infrastructure, increasing demand for medical devices, and supportive government initiatives promoting manufacturing and innovation in packaging solutions

- India's large and growing population, coupled with rising healthcare awareness, further contributes to the demand for advanced and sustainable medical device packaging.

Medical Device Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- DuPont (U.S.),

- Mitsubishi Electric Corporation (Japan),

- Texchem Polymer Engineering Division (Malaysia),

- Klockner Pentaplast (U.S.),

- 3M (U.S.),

- Nelipak (U.S.)

- Plastic Ingenuity (U.S.),

- Technipaq Inc. (U.S.),

- Amcor plc (Switzerland),

- DOW (U.S.),

- Berry Global (U.S.),

- Wihuri Group (Finland),

- Oliver (U.S.),

- Beacon Converters (U.S.)

- CONSTANTIA (Austria)

Latest Developments in Asia-Pacific Medical Device Packaging Market

- In February 2024, China's National Medical Products Administration (NMPA) released the 2024 edition of the Medical Device Standards Catalogue, which now includes a total of 1,974 standards. The catalogue is structured into two main sections. The first section focuses on aspects such as quality management systems, unique device identification (UDI), and medical device packaging. The second section covers a wide range of device types, including standards for biological evaluations, electrical equipment, disinfection and sterilization processes, surgical instruments, and implantable surgical devices.

- In May 2024, DuPont announced plans to restructure its business by splitting into three separate companies. With operations across the Asia-Pacific—particularly in Australia, China, and India—the company will form two new independent businesses, one concentrating on electronics and the other on water technologies. The remaining business, to be known as New DuPont, will position itself as a diversified industrial leader. New DuPont aims to strengthen its presence in the fast-growing healthcare sector, with a focus on biopharmaceutical consumables, medical devices, and packaging solutions for medical applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.