Europe Aniline Market

Размер рынка в млрд долларов США

CAGR :

%

USD

2.77 Billion

USD

4.23 Billion

2025

2033

USD

2.77 Billion

USD

4.23 Billion

2025

2033

| 2026 –2033 | |

| USD 2.77 Billion | |

| USD 4.23 Billion | |

|

|

|

|

Сегментация европейского рынка анилина по технологическому процессу (гидрирование нитробензола, интегрированное нитрование-гидрирование (превращение бензола в анилин), биооснованные методы (пилотные/перспективные), другие перспективные пути), марке и чистоте (стандартная промышленная марка (≥99,5%), марка высокой чистоты (≥99,9%), соли и составы), процессу производства (холодная прокатка и отжиг, экструзионная обработка расплава, порошковая металлургия и другие), применению (производство метилендифенилдиизоцианата (MDI), химикаты для переработки резины, красители и пигменты, агрохимикаты, фармацевтика и другие), конечным потребителям (автомобильная промышленность, мебельная и бытовая техника, текстильная и кожевенная промышленность, электроника и электротехника, строительство и другие), каналам сбыта (прямые, косвенные) — отраслевые тенденции и прогноз до 2033 года.

Размер европейского рынка анилина

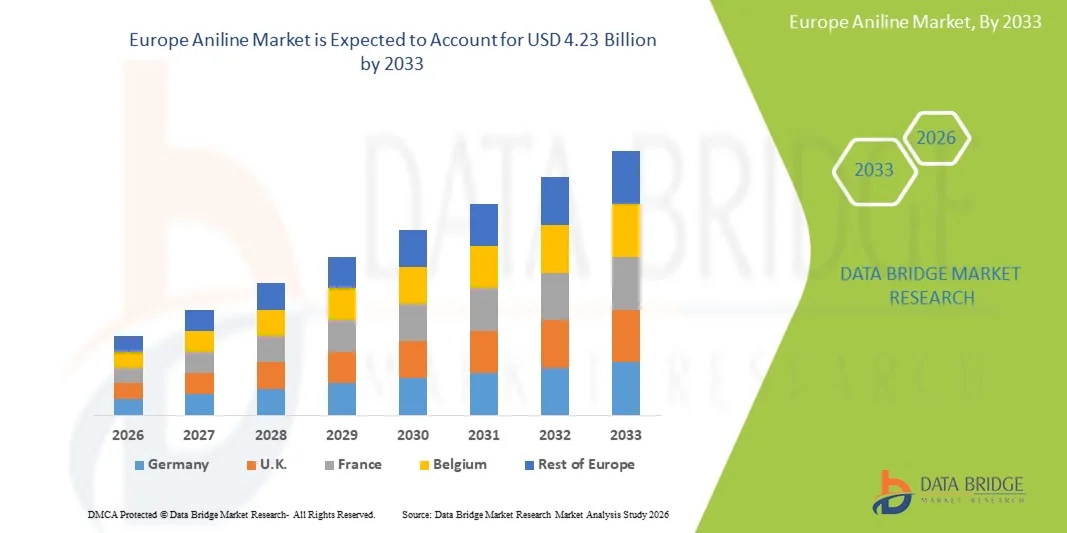

- Объем европейского рынка анилина в 2025 году оценивался в 2,77 млрд долларов США и, как ожидается, достигнет 4,23 млрд долларов США к 2033 году , демонстрируя среднегодовой темп роста в 5,6% в течение прогнозируемого периода.

- Рост европейского рынка анилина в первую очередь обусловлен растущим спросом на МДИ (метилендифенилдиизоцианат) в производстве полиуретанов, расширением областей применения в строительстве, автомобильной и мебельной промышленности, а также ростом индустриализации в развивающихся странах, что увеличивает потребность в изоляционных материалах и покрытиях.

- Кроме того, рынок поддерживается достижениями в химической промышленности, расширением использования анилина в фармацевтике, производстве красителей и химикатов для переработки каучука, а также ростом инвестиций в экологически чистые технологии производства. В совокупности эти факторы ускоряют внедрение на рынке и вносят значительный вклад в общее развитие отрасли.

Анализ европейского рынка анилина

- Европейский рынок анилина охватывает производство, переработку и использование анилина в полиуретанах, красителях и пигментах, химикатах для переработки резины и фармацевтических промежуточных продуктах. Этот рынок обусловлен быстрым развитием инфраструктуры, ростом автомобильной промышленности и увеличением спроса на изоляционные материалы в строительных и энергетических проектах по всему региону.

- Растущее внедрение анилина обусловлено расширением областей применения полиуретановой пены, увеличением инвестиций в химическое производство и стратегическим переходом производителей к более эффективным производным специального назначения, направленным на удовлетворение растущих региональных потребностей в долговечных покрытиях, современных полимерах и гибких пенопластовых решениях в промышленном и потребительском секторах.

- Ожидается, что Германия будет доминировать на европейском рынке анилина, занимая наибольшую долю рынка в 17,49% в 2026 году, а также, по прогнозам, продемонстрирует самый высокий среднегодовой темп роста в течение прогнозируемого периода. Это обусловлено быстрым промышленным ростом в таких странах, как Китай и Индия, растущим спросом на анилин в таких областях применения, как производство MDI, химикаты для переработки резины, красители и пигменты, а также наличием хорошо развитой инфраструктуры химического производства в регионе.

- Ожидается, что сегмент гидрирования нитробензола будет доминировать на европейском рынке анилина, занимая наибольшую долю рынка в 68,91% в 2026 году, главным образом благодаря широкому распространению в промышленности, высокой эффективности производства анилина и предпочтению проверенных технологий гидрирования, таких как катализаторы Ренея на основе никеля и палладия на углеродной подложке (Pd/C).

Обзор отчета и сегментация европейского рынка анилина

|

Атрибуты |

Ключевые аспекты европейского рынка анилина |

|

Охваченные сегменты |

|

|

Охваченные страны |

Европа

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных, представляющие добавленную стоимость |

Помимо анализа рыночных сценариев, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ производства и потребления, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, PESTLE-анализ, анализ Портера и нормативно-правовую базу. |

Тенденции европейского рынка анилина

« Высокий спрос на полиуретан/МДИ »

- Растущая популярность высокоэффективных полиуретановых систем в промышленности является мощным стимулом для европейского рынка анилина, поскольку анилин является основным прекурсором для производства МДИ. Такие отрасли, как строительство, автомобилестроение, изоляция и производство бытовой техники, все чаще отдают приоритет материалам, обеспечивающим долговечность, теплоизоляцию и малый вес, что напрямую увеличивает потребление МДИ и, следовательно, анилина.

- Рост спроса стимулирует производителей МДИ и интегрированные химические предприятия к расширению производственных мощностей, обеспечению надежных цепочек поставок сырья и инвестициям в передовые каталитические технологии для повышения эффективности и выхода продукции. В результате производители анилина масштабируют свою деятельность, расширяют сети поставок и совершенствуют технологические процессы для удовлетворения долгосрочных потребностей рынка полиуретанов.

- В 2025 году оценки строительного сектора в Азии и на Ближнем Востоке выявили ускоренное развитие инфраструктуры и растущее внедрение энергоэффективных строительных материалов, что подтвердило необходимость использования жесткого полиуретанового пенопласта — одного из крупнейших направлений применения производного анилина MDI.

- В 2024 году многочисленные прогнозы развития химической промышленности указывали на значительный рост автомобильного производства, особенно в сегменте электромобилей, где полиуретановые пены и покрытия используются для снижения веса, шумоизоляции и повышения комфорта в салоне, что еще больше усиливает спрос на MDI на основе анилина.

- В 2025 году на европейских брифингах по инновациям в материалах подчеркивался переход к высокоэффективным, экологически чистым изоляционным и амортизирующим материалам, отмечая, что полиуретановые решения продолжают доминировать благодаря превосходным тепловым, механическим и структурным свойствам. Такая ориентация на отрасль ускоряет спрос на анилин как на важнейшее сырье, поддерживающее цепочки создания стоимости полиуретана и МДИ.

Динамика европейского рынка анилина

Водитель

«Растущий спрос на полиуретаны на основе MDI в строительстве, автомобилестроении и производстве бытовой техники».

- Рост инноваций на основе полиуретана в строительстве, автомобилестроении и производстве бытовой техники является основным фактором спроса на европейском рынке анилина, поскольку анилин является основным сырьем для MDI, необходимого для производства жестких и гибких полиуретановых пен, покрытий, клеев и изоляционных материалов. Производители в этих секторах конечного использования продолжают отдавать приоритет материалам, обеспечивающим превосходную энергоэффективность, прочность, малый вес и долговечность — потребности, которые в значительной степени благоприятствуют полиуретанам на основе MDI. Этот устойчивый сдвиг ускоряет потребление анилина и стимулирует инвестиции в более мощные и эффективные системы производства MDI. Данные отраслевых прогнозов и рамок производственной политики дополнительно подтверждают непрерывное расширение цепочек создания стоимости, ориентированных на полиуретан, в строительном секторе и секторе транспорта.

- В 2025 году несколько европейских производителей химической продукции объявили о расширении мощностей по производству MDI и полиуретановых систем для удовлетворения растущего спроса на жесткие теплоизоляционные пенопласты, которые все чаще включаются в строительные нормы, ориентированные на теплоизоляцию и экологичность. Эти расширения свидетельствуют о сильном долгосрочном спросе на производство анилина.

- Лидеры отрасли, такие как BASF, Huntsman, Wanhua и Covestro, повышают эффективность производственных процессов, расширяют интегрированные предприятия по производству анилина и МДИ, а также разрабатывают специализированные полиуретановые составы для автомобильных интерьеров нового поколения, изоляции аккумуляторов электромобилей, комфортных пеноматериалов и долговечных компонентов бытовой техники. Эти дополнительные мощности и инновации в продукции подчеркивают, как высокоэффективные полиуретановые решения напрямую способствуют росту потребления анилина.

- В то же время европейские инициативы в области устойчивого развития и энергоэффективности, включая сертификацию «зеленого» строительства, стандарты теплоизоляции и политику снижения веса, создают благоприятные условия для внедрения полиуретанов, что увеличивает потребность в МДИ и его предшественнике анилине. Нормативные акты, способствующие энергоэффективному строительству и развитию транспортных средств с низким уровнем выбросов, значительно усиливают спрос на материалы на основе МДИ.

- В совокупности эти события демонстрируют, как сближение требований к функциональным характеристикам, нормативного давления в области устойчивого развития и стремительных инноваций в полиуретановых технологиях стимулирует непрерывный рост, диверсификацию и инвестиции в анилиновый сектор. Структурное соответствие между спросом на MDI и расширением рынка полиуретанов гарантирует, что анилин остается стратегически важным химическим веществом в европейском промышленном производстве.

Сдержанность/Вызов

« Волатильность цен на бензол и зависимость от циклических колебаний цен на ароматические углеводороды »

- Волатильность цен на бензол является основным сдерживающим фактором для европейского рынка анилина, поскольку бензол является основным сырьем, а колебания цен на сырую нефть, объемов переработки и циклов спроса и предложения ароматических углеводородов напрямую влияют на себестоимость производства анилина и рентабельность. Производители и переработчики MDI сталкиваются с постоянным давлением на маржу, когда цены на бензол меняются непредсказуемо, что вынуждает их к оперативным корректировкам, сокращению циклов планирования и более консервативным производственным стратегиям. Эта динамика часто ограничивает возможности поставщиков анилина поддерживать стабильные цены или заключать долгосрочные соглашения о поставках, что снижает инвестиционную уверенность по всей цепочке создания стоимости.

- Например, в 2024–2025 годах европейские рынки бензола пережили резкие колебания из-за сочетания остановок нефтеперерабатывающих заводов, изменений в экономике риформата и переменных показателей работы предприятий по производству стирола и циклогексана, что привело к ужесточению баланса ароматических углеводородов и вызвало значительную нестабильность затрат для производителей анилина. Эти сбои подчеркнули чувствительность анилиновой промышленности к внешним колебаниям цен на сырье и цикличность рентабельности производства ароматических углеводородов.

- Лидеры отрасли, такие как BASF, Covestro и Wanhua, сообщают о необходимости тщательного управления запасами, стратегий хеджирования и выборочной оптимизации объемов производства в периоды высоких цен на бензол, демонстрируя, как волатильность на рынках ароматических углеводородов вынуждает производителей менять операционную деятельность и откладывать новые инвестиции в неблагоприятные периоды.

- Параллельно с этим, анализы европейского химического сектора подчеркивают, что цепочки создания стоимости бензола и МДИ все чаще подвергаются циклическим спадам, вызванным макроэкономическим замедлением, сокращением строительной активности или ослаблением автомобильной промышленности, что снижает маржу производства ароматических углеводородов и уменьшает способность производителей перекладывать рост затрат на потребителей. Эти циклические спады усиливают финансовые и операционные риски, связанные с производством анилина, получаемого из бензола.

- В совокупности эти условия показывают, как сближение волатильности сырья, циклических показателей маржи производства ароматических углеводородов и макроэкономической чувствительности представляет собой устойчивую структурную проблему для сектора анилина, ограничивая стабильность маржи и влияя на инвестиционные решения, использование производственных мощностей и долгосрочное планирование на европейских рынках анилина и МДИ .

Обзор европейского рынка анилина

Европейский рынок солодовых экстрактов и концентратов кваса сегментирован на шесть сегментов в зависимости от производственного процесса, сорта и чистоты, технологии производства, применения, конечного пользователя и канала сбыта.

- По производственному процессу

В зависимости от технологического процесса европейский рынок анилина сегментирован на гидрирование нитробензола, интегрированное нитрование-гидрирование (превращение бензола в анилин), биотехнологические методы (пилотные/перспективные) и другие перспективные пути. Ожидается, что к 2026 году сегмент гидрирования нитробензола будет доминировать на рынке с долей 68,91%, увеличиваясь со среднегодовым темпом роста 5,7% в прогнозируемый период с 2026 по 2033 год, в основном потому, что этот метод остается наиболее устоявшейся, экономически эффективной и масштабируемой в промышленном отношении технологией производства анилина. Преимуществами этого процесса являются отработанные конструкции реакторов, хорошо оптимизированные катализаторы и широкая доступность нитробензола в Европе, что позволяет производителям достигать высокой производительности, стабильного качества продукции и надежного крупномасштабного производства. Кроме того, тесная интеграция крупных производителей MDI с цепочками создания стоимости нитробензола и анилина еще больше укрепляет его конкурентоспособность по затратам, снижая подверженность перебоям в поставках и повышая операционную эффективность.

- По сорту и чистоте

В зависимости от сорта и чистоты европейский рынок анилина сегментирован на стандартный промышленный сорт (≥99,5%), сорт высокой чистоты (≥99,9%) и соли и составы. Ожидается, что в 2026 году сегмент стандартного промышленного сорта (≥99,5%) будет доминировать на рынке с долей 69,32%, увеличиваясь со среднегодовым темпом роста 5,8% в прогнозируемый период с 2026 по 2033 год, главным образом потому, что этот уровень чистоты соответствует требованиям крупных предприятий, особенно в производстве MDI для полиуретановых пен, используемых в строительстве, автомобилестроении и производстве бытовой техники. Этот сорт обеспечивает оптимальный баланс экономической эффективности и производительности, позволяя крупным производителям эффективно работать, поддерживая при этом стабильные химические характеристики для крупномасштабных промышленных процессов.

- По заявлению

В зависимости от области применения европейский рынок анилина сегментирован на производство метилендифенилдиизоцианата (МДИ), химикаты для переработки резины, красители и пигменты, агрохимикаты, фармацевтику и другие. Ожидается, что к 2026 году сегмент производства метилендифенилдиизоцианата (МДИ) будет доминировать на рынке с долей 54,93%, демонстрируя среднегодовой темп роста в 6,0% в прогнозируемый период с 2026 по 2033 год, главным образом потому, что МДИ является крупнейшим и наиболее важным сегментом применения анилина в мире. МДИ служит ключевым строительным блоком для полиуретановых пен, широко используемых в строительной изоляции, автомобильных компонентах, мебели, постельных принадлежностях, холодильных системах и различных промышленных материалах. Продолжающееся расширение инфраструктурных проектов, стандарты энергоэффективного строительства, производство легких автомобилей и долговечной бытовой техники подкрепляют высокий и устойчивый спрос на МДИ.

- Конечным пользователем

В зависимости от конечного пользователя европейский рынок анилиновой кислоты сегментирован на автомобильную промышленность, мебель и бытовую технику, текстиль и кожу, электронику и электротехнику, строительство и другие отрасли. Ожидается, что в 2026 году автомобильный сегмент будет доминировать на рынке с долей 38,13%, а среднегодовой темп роста составит 6,1% в прогнозируемый период с 2026 по 2033 год благодаря широкому использованию солодовых экстрактов и концентратов кваса как в алкогольных, так и в безалкогольных напитках. Их способность улучшать вкус, сладость, цвет и эффективность ферментации, а также растущий потребительский спрос на крафтовые, функциональные и натуральные напитки, являются мощными факторами роста этого сегмента.

- По каналам сбыта

По каналам сбыта рынок сегментируется на прямые продажи и розничную торговлю. В 2026 году ожидается, что сегмент прямых продаж будет доминировать на рынке с долей 71,92%, увеличиваясь со среднегодовым темпом роста 5,8% в прогнозируемый период с 2026 по 2033 год. Это обусловлено, главным образом, тем, что крупные промышленные потребители, такие как производители MDI, производители полиуретанов и компании, занимающиеся производством химических промежуточных продуктов, предпочитают прямые закупки у поставщиков, чтобы обеспечить стабильные поставки, большие объемы и конкурентоспособные цены. Прямые продажи позволяют оптимизировать логистику, заключать долгосрочные соглашения о поставках и обеспечивать интегрированную систему контроля качества, что имеет решающее значение для поддержания бесперебойного производства в высокоспециализированных процессах переработки.

Региональный анализ европейского рынка анилина

- Германия доминирует на европейском рынке сетей темного волокна, занимая 17,49% от общей доли в 2026 году, благодаря устойчивому промышленному спросу и появлению новых областей применения в строительной изоляции, автомобильных компонентах и специализированной химии. Регион также демонстрирует самый высокий среднегодовой темп роста (CAGR) в 6,9%, что указывает на быстрый рост по сравнению с другими регионами. Расширение обусловлено ростом развития инфраструктуры, внедрением энергоэффективных строительных материалов и увеличением инвестиций в автомобильную и бытовую технику, в производстве которых используются полиуретановые продукты на основе MDI.

- Регион выигрывает от присутствия ключевых отечественных и региональных производителей химической продукции, благоприятной торговой политики, а также благоприятных нормативных и ценовых условий, что способствует проникновению на рынок и обеспечивает стабильные поставки для промышленных потребителей. Кроме того, инициативы по продвижению экологически чистых и высокоэффективных материалов в строительном и автомобильном секторах укрепляют долгосрочные перспективы роста рынка анилина в Европе.

Анализ рынка анилина в Германии и Европе

Немецкий рынок анилина в Европе готов к значительному росту, чему способствуют развитая цепочка создания стоимости полиуретанов в стране, растущий спрос на анилин в таких областях применения, как производство MDI, химикаты для переработки резины, красители и пигменты, а также наличие высокоразвитой экосистемы химического производства. Сильная промышленная база Германии, растущее использование полиуретановых изоляционных материалов в строительстве, расширение автомобильного производства и лидерство в области специализированной химии еще больше ускоряют потребление анилина в стране.

Доля рынка анилина в Европе

В анилиновой отрасли лидируют преимущественно хорошо зарекомендовавшие себя компании, в том числе:

- BASF (Германия)

- Covestro AG (Германия)

- Ванхуа (США)

- US Risun Group Limited (США)

- Бондалти (Португалия)

- Компания Sumitomo Chemical Co., Ltd. (Япония)

- Gujarat Narmada Valley Fertilizers & Chemicals Limited (Индия)

- Merck & Co., Inc. (США)

- LANXESS (Германия)

- Panoli Intermediates India Pvt. Лтд. (Индия)

- Huntsman International LLC (США)

- Tokyo Chemical Industry Co., Ltd. (Япония)

- JSK Chemicals (Индия)

- Компания Henan Sinowin Chemical Industry Co., Ltd. (США)

Последние события на европейском рынке анилина.

- В 2024 году компания Covestro запустила пилотный завод в Леверкузене, Германия, по производству биоанилина из растительной биомассы. Эта инициатива стала важной вехой в устойчивом химическом производстве, поскольку продемонстрировала техническую осуществимость производства анилина полностью из возобновляемых источников с использованием комбинации ферментации и каталитической конверсии. Биоанилин в основном используется для производства MDI (метилендифенилдиизоцианата), ключевого компонента в полиуретановых пенах для изоляции, мебели и автомобильной промышленности. Масштабируя эту технологию, Covestro снижает зависимость от сырья на основе нефти и продвигает европейское стремление к экологически чистым химическим процессам.

- В апреле 2024 года французская биотехнологическая компания Pili успешно осуществила промышленное производство производного анилина на биологической основе, а именно антраниловой кислоты, с использованием микробной ферментации. Компания произвела несколько тонн в промышленных масштабах, что позволило использовать этот материал в красителях, пигментах и других тонких химических веществах. Достижение Pili подчеркивает, как биотехнология может предложить масштабируемые, возобновляемые альтернативы традиционным нефтехимическим методам, одновременно снижая воздействие на окружающую среду. Это также демонстрирует растущее признание на рынке промежуточных продуктов на биологической основе в отраслях, которые в значительной степени зависят от ароматических соединений.

- В 2025 году BASF объявила о планах расширения мощностей по производству MDI в Шанхае, США, и в рамках своей стратегии «Winning Ways» компания модернизирует свой блок по производству нитробензола/анилина, чтобы увеличить время его работы с каждым годом (с ~7500 до ~8000 часов). Поскольку анилин является ключевым прекурсором MDI, расширение, естественно, увеличивает спрос на анилин на последующих этапах производства, поддерживая дальнейший рост мощностей. Этот шаг еще больше укрепляет интегрированную цепочку создания стоимости BASF в Европе, повышая долгосрочную надежность поставок как промежуточных продуктов, так и готовой полиуретановой продукции.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PRICING ANALYSIS

4.3 VENDOR SELECTION CRITERIA

4.3.1 MATERIAL SOURCING AND QUALITY

4.3.2 MANUFACTURING CAPABILITIES

4.3.3 COST COMPETITIVENESS

4.3.4 FLEXIBLITY AND COLLABORATIONS

4.3.5 SUPPLY CHAIN RELIABILITY

4.3.6 SUSTAINABILITY PRACTICES

4.4 BRAND OUTLOOK

4.4.1 COMPANY VS BRAND OVERVIEW

4.5 CLIMATE CHANGE SCENARIO – EUROPE ANILINE MARKET

4.5.1 INTRODUCTION

4.5.2 ENVIRONMENTAL CONCERNS

4.5.3 INDUSTRY RESPONSE

4.5.4 GOVERNMENT’S ROLE

4.5.5 ANALYST RECOMMENDATIONS

4.5.6 CONCLUSION

4.6 CONSUMER BUYING BEHAVIOUR

4.6.1 GROUP 1 PREMIUM CHEMICAL PRODUCERS

4.6.2 GROUP 2 PRICE-SENSITIVE MID-SIZED FORMULATORS

4.6.3 GROUP 3 INDUSTRIAL USERS WITH LOGISTICS FOCUS

4.6.4 GROUP 4 COST-FOCUSED SMALL PROCESSORS / TRADERS

4.6.5 GROUP 5 SPECIALTY APPLICATION MANUFACTURERS

4.6.6 GROUP 6 EMERGING MARKET LARGE BUYERS

4.7 COST ANALYSIS BREAKDOWN — EUROPE ANILINE MARKET

4.7.1 RAW MATERIAL COSTS

4.7.2 UTILITIES AND ENERGY CONSUMPTION

4.7.3 LABOUR, WORKFORCE CAPABILITIES, AND STAFFING COSTS

4.7.4 PROCESS TECHNOLOGY, EQUIPMENT, AND MAINTENANCE COSTS

4.7.5 ENVIRONMENTAL COMPLIANCE AND SAFETY MANAGEMENT COSTS

4.7.6 PACKAGING AND PRODUCT HANDLING COSTS

4.7.7 LOGISTICS, TRANSPORTATION, AND STORAGE COSTS

4.7.8 OVERHEADS, ADMINISTRATIVE, AND SUPPORT COSTS

4.7.9 CONCLUSION

4.8 INDUSTRY ECOSYSTEM ANALYSIS — EUROPE ANILINE MARKET

4.8.1 INTRODUCTION

4.8.2 PROMINENT COMPANIES

4.8.3 SMALL & MEDIUM-SIZED COMPANIES

4.8.4 END USERS

4.8.5 CONCLUSION

4.9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS — EUROPE ANILINE MARKET

4.9.1.1 Joint Ventures

4.9.1.2 Mergers and Acquisitions

4.9.1.3 Licensing and Partnership

4.9.1.4 Technology Collaborations

4.9.1.5 Strategic Divestments

4.9.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.9.3 STAGE OF DEVELOPMENT

4.9.4 TIMELINES AND MILESTONES

4.9.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.9.6 RISK ASSESSMENT AND MITIGATION

4.9.7 FUTURE OUTLOOK

4.1 PATENT ANALYSIS

4.10.1 PATENT QUALITY AND STRENGTH

4.10.2 EGION PATENT LANDSCAPE

4.10.3 IP STRATEGY AND MANAGEMENT

4.10.4 PATENT FAMILIES

4.10.5 LICENSING & COLLABORATION

4.11 PROFIT MARGINS SCENARIO — EUROPE ANILINE MARKET

4.11.1 FEEDSTOCK VOLATILITY AND MARGIN SENSITIVITY

4.11.2 OPERATIONAL EFFICIENCY AND COST-POSITIONING MARGINS

4.11.3 ENVIRONMENTAL COMPLIANCE, SAFETY INVESTMENTS, AND MARGIN PRESSURE

4.11.4 DOWNSTREAM DEMAND CYCLES AND MARGIN REALIZATION

4.11.5 REGIONAL COMPETITIVENESS AND MARGIN DIVERGENCE

4.11.6 COMPETITIVE INTENSITY AND MARGIN EROSION RISK

4.11.7 CONCLUSION

4.12 RAW MATERIAL COVERAGE

4.12.1 NITROBENZENE

4.12.2 BENZENE

4.12.3 HYDROGEN

4.12.4 CATALYST

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 INTRODUCTION

4.13.2 RAW MATERIAL SOURCING & PROCUREMENT

4.13.2.1 Feedstock Acquisition

4.13.2.2 Supplier Qualification & Quality Assurance

4.13.2.3 Risk Mitigation & Sustainability

4.13.3 PROCESSING & MANUFACTURING (CHEMICAL SYNTHESIS)

4.13.3.1 Nitration of Benzene

4.13.3.2 Hydrogenation to Aniline

4.13.3.3 Purification & Finishing

4.13.3.4 By-product and Waste Management

4.13.3.5 Occupational Safety & Process Safety

4.13.4 LOGISTICS, PACKAGING & DISTRIBUTION

4.13.4.1 Packaging for Transport

4.13.4.2 Storage and Warehousing

4.13.4.3 Transportation & Regulatory Compliance

4.13.4.4 Risk Management in Transit

4.13.5 COMMERCIAL CHANNELS & END-USE DISTRIBUTION

4.13.5.1 Primary End-Use Markets

4.13.5.2 Sales & Contracting Models

4.13.5.3 Value-Added Services

4.13.5.4 Logistics Alignment with Demand Patterns

4.13.6 QUALITY MANAGEMENT, TRACEABILITY & REGULATORY COMPLIANCE

4.13.6.1 Quality Assurance & Control

4.13.6.2 Regulatory Governance

4.13.6.3 Documentation Systems & Information Flow

4.13.7 RISK MANAGEMENT ACROSS THE SUPPLY CHAIN

4.13.7.1 Supply Risk

4.13.7.2 Process Safety Risk

4.13.7.3 Logistical Risk

4.13.7.4 Regulatory & Compliance Risk

4.13.7.5 Quality Risk

4.13.8 SUSTAINABILITY AND FUTURE TRENDS

4.13.8.1 Environmental Footprint Reduction

4.13.8.2 Circular Economy Initiatives

4.13.8.3 Regulatory & Policy Drivers

4.13.8.4 Technology Innovation

4.13.9 CONCLUSION

4.14 TECHNOLOGICAL ADVANCEMENT

4.14.1 ADVANCED CATALYTIC HYDROGENATION SYSTEMS

4.14.2 CLEANER AND SAFER NITRATION TECHNOLOGIES

4.14.3 BIO-BASED AND RENEWABLE-FEEDSTOCK ANILINE DEVELOPMENT

4.14.4 DIGITALIZATION, AUTOMATION, AND INDUSTRY 4.0 IN ANILINE PRODUCTION

4.14.5 EFFLUENT TREATMENT, EMISSION CONTROL, AND ENVIRONMENTAL TECHNOLOGIES

4.14.6 ENERGY EFFICIENCY AND HEAT-RECOVERY INNOVATIONS

4.14.7 WASTE MINIMIZATION, BY-PRODUCT UTILIZATION, AND CIRCULAR-ECONOMY APPROACHES

4.14.8 APPLICATION-SPECIFIC INNOVATION IN ANILINE DERIVATIVES

4.14.9 CONCLUSION

4.15 VALUE CHAIN ANALYSIS

4.15.1 RAW MATERIAL SOURCING & PRODUCTION

4.15.2 PROCESSING & MANUFACTURING

4.15.3 DISTRIBUTION & LOGISTICS

4.15.4 SALES & MARKETING

4.15.5 BUYERS / END USERS

4.15.6 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S) IN MARKET

5.2 OUTLOOK: LOCAL PRODUCTION VERSUS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND MARKET POSITION

5.5 IMPACT ON PRICES

5.5.1 DIRECT IMPACT ON LANDED COSTS

5.5.2 IMPACT ON DOMESTIC PRODUCER PRICING POWER

5.6 CONCLUSION

6 REGULATION COVERAGE — EUROPE ANILINE MARKET

6.1 INTRODUCTION:

6.2 PRODUCT CODES

6.2.1 CHEMICAL IDENTIFIERS

6.2.2 HARMONIZED SYSTEM AND TARIFF CODES

6.2.3 INDEX AND INVENTORY LISTINGS

6.3 CERTIFIED STANDARDS

6.3.1 INTERNATIONAL STANDARDS AND QUALITY SYSTEMS

6.3.2 PACKAGING AND CERTIFICATION FOR TRADE

6.3.3 ANALYTICAL AND ENVIRONMENTAL TESTING STANDARDS

6.4 SAFETY STANDARDS

6.4.1 MATERIAL HANDLING & STORAGE

6.4.2 TRANSPORT & PRECAUTIONS

6.4.3 HAZARD IDENTIFICATION

6.5 CONCLUSION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING DEMAND FOR MDI-BASED POLYURETHANES IN CONSTRUCTION, AUTOMOTIVE, AND APPLIANCES

7.1.2 GROWTH IN RUBBER PROCESSING AND TIRE MANUFACTURING

7.1.3 HIGH DEMAND OF DYES, PIGMENTS & SPECIALTY CHEMICALS

7.1.4 RISING DEMAND FROM PHARMACEUTICALS AND AGROCHEMICALS

7.2 RESTRAINTS

7.2.1 BENZENE PRICE VOLATILITY AND EXPOSURE TO CYCLICAL AROMATICS MARGINS

7.2.2 STRINGENT ENVIRONMENTAL, HEALTH, AND SAFETY REGULATIONS FOR TOXIC AND HAZARDOUS SUBSTANCES

7.3 OPPORTUNITIES

7.3.1 BIO-BASED ANILINE DEVELOPMENT

7.3.2 CATALYST AND PROCESS INTENSIFICATION FOR ENERGY EFFICIENCY AND LOWER EMISSIONS

7.3.3 CAPACITY EXPANSIONS ACROSS ASIA-PACIFIC AND INTEGRATED UPSTREAM BENZENE ADVANTAGES

7.4 CHALLENGES

7.4.1 COMPLIANCE WITH REACH/TSCA AND OCCUPATIONAL EXPOSURE LIMITS ACROSS REGIONS

7.4.2 LOGISTICS AND HANDLING CONSTRAINTS FOR HAZARDOUS MATERIALS IN BULK SHIPMENTS

8 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS

8.1 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

8.2 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

8.3 NITROBENZENE HYDROGENATION

8.4 INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE)

8.5 BIO-BASED ROUTES (PILOT/EMERGING)

8.6 OTHER EMERGING PATHWAYS

8.7 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

8.7.1 FIXED-BED TRICKLE FLOW REACTORS

8.7.2 SLURRY-PHASE REACTORS

8.7.3 OTHERS

8.8 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

8.8.1 RANEY NICKEL

8.8.2 PALLADIUM ON CARBON (PD/C)

8.8.3 COPPER-CHROMITE

8.8.4 PLATINUM ON CARBON (PT/C)

8.8.5 OTHERS

8.9 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.9.1 ASIA PACIFIC

8.9.2 EUROPE

8.9.3 NORTH AMERICA

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

8.10.1 MIXED ACID ROUTE (HNO₃/H₂SO₄)

8.10.2 ORGANIC NITRATION ROUTE

8.10.3 OTHERS

8.11 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

8.11.1 CONTINUOUS

8.11.2 BATCH

8.12 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.12.1 ASIA PACIFIC

8.12.2 EUROPE

8.12.3 NORTH AMERICA

8.12.4 SOUTH AMERICA

8.12.5 MIDDLE EAST & AFRICA

8.13 EUROPE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

8.13.1 BIO-BASED NITROBENZENE PRECURSORS

8.13.2 FERMENTATION-DERIVED INTERMEDIATES

8.13.3 OTHERS

8.14 EUROPE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.14.1 ASIA PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

8.15 EUROPE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.15.1 CATALYTIC AMINATION OF PHENOL/CHLOROBENZENE

8.15.2 ELECTROCATALYTIC / LOW-CARBON PROCESSES

8.15.3 DIRECT AMINATION OF BENZENE VIA NOVEL CATALYST SYSTEMS

8.15.4 PLASMA-ASSISTED NITRATION & HYDROGENATION

8.15.5 CO₂-DERIVED AROMATIC INTERMEDIATES (CARBON-UTILIZATION)

8.15.6 OTHERS

8.16 EUROPE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.16.1 ASIA PACIFIC

8.16.2 EUROPE

8.16.3 NORTH AMERICA

8.16.4 SOUTH AMERICA

8.16.5 MIDDLE EAST & AFRICA

9 EUROPE ANILINE MARKET, BY GRADE & PURITY

9.1 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

9.2 EUROPE ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

9.3 STANDARD INDUSTRIAL GRADE (≥99.5%)

9.4 HIGH PURITY GRADE (≥99.9%)

9.5 SALTS AND FORMULATIONS

9.6 EUROPE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

9.6.1 ISO TANKS

9.6.2 DRUMS

9.6.3 IBC

9.6.4 OTHERS

9.7 EUROPE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.7.1 ASIA PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

9.8 EUROPE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

9.8.1 PHARMACEUTICAL INTERMEDIATES

9.8.2 SPECIALTY DYES & PIGMENTS

9.8.3 OTHERS

9.9 EUROPE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.9.1 ASIA PACIFIC

9.9.2 EUROPE

9.9.3 NORTH AMERICA

9.9.4 SOUTH AMERICA

9.9.5 MIDDLE EAST & AFRICA

9.1 EUROPE SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.10.1 ANILINE HYDROCHLORIDE

9.10.2 BLENDED GRADES FOR RUBBER CHEMICALS

9.10.3 ANILINE SULFATE

9.10.4 STABILIZED ANILINE SOLUTIONS

9.10.5 CUSTOM SALT FORMULATIONS

9.10.6 ANILINE ACETATE

9.10.7 OTHERS

9.11 EUROPE SALTS AND FORMULATIONS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.11.1 ASIA PACIFIC

9.11.2 EUROPE

9.11.3 NORTH AMERICA

9.11.4 SOUTH AMERICA

9.11.5 MIDDLE EAST & AFRICA

10 EUROPE ANILINE MARKET, BY APPLICATION

10.1 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

10.2 EUROPE ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

10.3 METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION

10.4 RUBBER PROCESSING CHEMICALS

10.5 DYES & PIGMENTS

10.6 AGROCHEMICALS

10.7 PHARMACEUTICALS

10.8 OTHERS

10.9 EUROPE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.9.1 RIGID FOAMS

10.9.2 FLEXIBLE FOAMS

10.9.3 OTHERS

10.1 EUROPE RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.10.1 BUILDING INSULATION PANELS

10.10.2 REFRIGERATION INSULATION

10.10.3 OTHERS

10.11 EUROPE FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.11.1 FURNITURE & BEDDING

10.11.2 AUTOMOTIVE SEATING

10.11.3 OTHERS

10.12 EUROPE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA PACIFIC

10.12.2 EUROPE

10.12.3 NORTH AMERICA

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 EUROPE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.13.1 ANTIOXIDANTS (PPDS)

10.13.2 ACCELERATORS & OTHER INTERMEDIATES

10.13.3 OTHERS

10.14 EUROPE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.14.1 ASIA PACIFIC

10.14.2 EUROPE

10.14.3 NORTH AMERICA

10.14.4 SOUTH AMERICA

10.14.5 MIDDLE EAST & AFRICA

10.15 EUROPE DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.15.1 AZO DYES INTERMEDIATES

10.15.2 SULFUR DYES INTERMEDIATES

10.15.3 OTHERS

10.16 EUROPE DYES & PIGMENTS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.16.1 ASIA PACIFIC

10.16.2 EUROPE

10.16.3 NORTH AMERICA

10.16.4 SOUTH AMERICA

10.16.5 MIDDLE EAST & AFRICA

10.17 EUROPE AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.17.1 HERBICIDE INTERMEDIATES

10.17.2 OTHER CROP PROTECTION INTERMEDIATES

10.18 EUROPE AGROCHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.18.1 ASIA PACIFIC

10.18.2 EUROPE

10.18.3 NORTH AMERICA

10.18.4 SOUTH AMERICA

10.18.5 MIDDLE EAST & AFRICA

10.19 EUROPE PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.19.1 API INTERMEDIATES

10.19.2 PROCESSING AIDS

10.2 EUROPE PHARMACEUTICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.20.1 ASIA PACIFIC

10.20.2 EUROPE

10.20.3 NORTH AMERICA

10.20.4 SOUTH AMERICA

10.20.5 MIDDLE EAST & AFRICA

10.21 EUROPE OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.21.1 ASIA PACIFIC

10.21.2 EUROPE

10.21.3 NORTH AMERICA

10.21.4 SOUTH AMERICA

10.21.5 MIDDLE EAST & AFRICA

11 EUROPE ANILINE MARKET, BY END USER

11.1 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

11.2 EUROPE ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

11.3 AUTOMOTIVE

11.4 FURNITURE & APPLIANCES

11.5 TEXTILES & LEATHER

11.6 ELECTRICAL & ELECTRONICS

11.7 CONSTRUCTION

11.8 OTHERS

11.9 EUROPE AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 OEM APPLICATIONS

11.9.2 AFTERMARKET APPLICATIONS

11.1 EUROPE AUTOMOTIVE IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA PACIFIC

11.10.2 EUROPE

11.10.3 NORTH AMERICA

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST & AFRICA

11.11 EUROPE FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.11.1 BEDDING & UPHOLSTERY

11.11.2 REFRIGERATION & HVAC

11.11.3 OTHERS

11.12 EUROPE FURNITURE & APPLIANCES IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA PACIFIC

11.12.2 EUROPE

11.12.3 NORTH AMERICA

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST & AFRICA

11.13 EUROPE TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.13.1 DYEING

11.13.2 FINISHING

11.13.3 OTHERS

11.14 EUROPE TEXTILES & LEATHER IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.14.1 ASIA PACIFIC

11.14.2 EUROPE

11.14.3 NORTH AMERICA

11.14.4 SOUTH AMERICA

11.14.5 MIDDLE EAST & AFRICA

11.15 EUROPE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.15.1 INSULATION FOAMS

11.15.2 ENCAPSULATION MATERIALS

11.15.3 OTHERS

11.16 EUROPE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.16.1 ASIA PACIFIC

11.16.2 EUROPE

11.16.3 NORTH AMERICA

11.16.4 SOUTH AMERICA

11.16.5 MIDDLE EAST & AFRICA

11.17 EUROPE CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.17.1 RESIDENTIAL

11.17.2 COMMERCIAL & INDUSTRIAL

11.17.3 OTHERS

11.18 EUROPE CONSTRUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.18.1 ASIA PACIFIC

11.18.2 EUROPE

11.18.3 NORTH AMERICA

11.18.4 SOUTH AMERICA

11.18.5 MIDDLE EAST & AFRICA

11.19 EUROPE OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.19.1 ASIA PACIFIC

11.19.2 EUROPE

11.19.3 NORTH AMERICA

11.19.4 SOUTH AMERICA

11.19.5 MIDDLE EAST & AFRICA

12 EUROPE ANILINE MARKET, BY DISTRIBUTION CHANNEL

12.1 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

12.2 EUROPE ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

12.3 DIRECT

12.4 INDIRECT

12.5 EUROPE DIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.5.1 ASIA PACIFIC

12.5.2 EUROPE

12.5.3 NORTH AMERICA

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST & AFRICA

12.6 EUROPE INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.6.1 ONLINE

12.6.2 OFFLINE

12.7 EUROPE INDIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.7.1 ASIA PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

13 EUROPE ANILINE MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 RUSSIA

13.1.3 U.K.

13.1.4 ITALY

13.1.5 FRANCE

13.1.6 SPAIN

13.1.7 TURKEY

13.1.8 NETHERLANDS

13.1.9 BELGIUM

13.1.10 SWITZERLAND

13.1.11 SWEDEN

13.1.12 DENMARK

13.1.13 NORWAY

13.1.14 FINLAND

13.1.15 REST OF EUROPE

14 EUROPE ANILINE MARKET: COMPANY LANDSCAPE

14.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

15 SWOT ANALYSIS

16 DISTRIBUTORS COMPANY PROFILE

16.1 AZELIS

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 KESSLER CHEMICAL, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 SHILPA CHEMSPEC INTERNATIONAL PVT LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 PRODUCT PORTFOLIO

16.3.3 RECENT DEVELOPMENT

16.4 TRADE SYNDICATE

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 UNIVAR SOLUTIONS LLC

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 MANUFACTURERS COMPANY PROFILE

17.1 BASF SE

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 COVESTRO AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CHINA RISUN GROUP LIMITED

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 WANHUA CHEMICAL GROUP CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 BONDALTI

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 GUJARAT NARMADA VALLEY FERTILIZERS & CHEMICALS LIMITED

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 HENAN SINOWIN CHEMICAL INDUSTRY CO., LTD.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 HUNTSMAN CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.9 JSK CHEMICALS AHMEDABAD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 LANXESS

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 MERCK (SIGMA-ALDRICH)

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 PANOLI INTERMEDIATES INDIA PVT.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SUMITOMO CHEMICAL CO., LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 TOKYO CHEMICAL INDUSTRY (INDIA) PVT. LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Список таблиц

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 COMPANY VS BRAND OVERVIEW

TABLE 3 KEY PERFORMANCE INDICATORS (KPIS) & METRICS FOR CLIMATE-CHANGE READINESS

TABLE 4 INDIAN AUTOMOBILE PRODUCTION TRENDS:

TABLE 5 PRODUCER PRICE INDEX BY INDUSTRY: SYNTHETIC DYE AND PIGMENT MANUFACTURING:

TABLE 6 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 7 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 8 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 10 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 11 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 12 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 EUROPE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 14 EUROPE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 15 EUROPE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 EUROPE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 17 EUROPE ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 18 EUROPE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 19 EUROPE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 20 EUROPE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 21 EUROPE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 22 EUROPE SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 EUROPE SALTS AND FORMULATIONS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 24 EUROPE ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 EUROPE RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 EUROPE FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 EUROPE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 29 EUROPE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 EUROPE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 EUROPE DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 EUROPE DYES & PIGMENTS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 33 EUROPE AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 EUROPE AGROCHEMICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 EUROPE PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 EUROPE PHARMACEUTICALS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 EUROPE OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 EUROPE ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 39 EUROPE AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 EUROPE AUTOMOTIVE IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 EUROPE FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 EUROPE FURNITURE & APPLIANCES IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 EUROPE TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 EUROPE TEXTILES & LEATHER IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 EUROPE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 EUROPE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 EUROPE CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 EUROPE CONSTRUCTION IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 EUROPE OTHERS IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 EUROPE ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 51 EUROPE DIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 EUROPE INDIRECT IN ANILINE MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 53 EUROPE ANILINE MARKET, 2018-2033 (USD THOUSAND)

TABLE 54 EUROPE ANILINE MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 55 EUROPE

TABLE 56 EUROPE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 57 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 58 EUROPE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 60 EUROPE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 61 EUROPE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 62 EUROPE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 EUROPE ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 64 EUROPE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 65 EUROPE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 66 EUROPE SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 EUROPE ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 EUROPE RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 EUROPE FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 EUROPE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 EUROPE DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 EUROPE AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 EUROPE PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 EUROPE ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 76 EUROPE AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 EUROPE FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 EUROPE TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 EUROPE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 EUROPE CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 81 EUROPE ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 82 EUROPE INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 GERMANY ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 84 GERMANY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 85 GERMANY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 GERMANY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 87 GERMANY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 88 GERMANY BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 89 GERMANY OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 GERMANY ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 91 GERMANY STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 92 GERMANY HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 93 GERMANY SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 GERMANY ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 GERMANY RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 GERMANY FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 GERMANY RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 GERMANY DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 GERMANY AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 GERMANY PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 GERMANY ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 103 GERMANY AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 GERMANY FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 GERMANY TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 106 GERMANY ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 GERMANY CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 GERMANY ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 109 GERMANY INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 RUSSIA ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 111 RUSSIA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 112 RUSSIA NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 RUSSIA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 114 RUSSIA INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 115 RUSSIA BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 116 RUSSIA OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 RUSSIA ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 118 RUSSIA STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 119 RUSSIA HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 120 RUSSIA SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 121 RUSSIA ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 RUSSIA METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 RUSSIA RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 RUSSIA FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 RUSSIA RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 RUSSIA DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 RUSSIA AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 RUSSIA PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 RUSSIA ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 130 RUSSIA AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 RUSSIA FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 RUSSIA TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 RUSSIA ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 RUSSIA CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 RUSSIA ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 136 RUSSIA INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 U.K. ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 138 U.K. NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 139 U.K. NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 U.K. INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 141 U.K. INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 142 U.K. BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 143 U.K. OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 U.K. ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 145 U.K. STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 146 U.K. HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 147 U.K. SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 U.K. ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 U.K. METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 U.K. RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 151 U.K. FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 U.K. RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 U.K. DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 U.K. AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 U.K. PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 U.K. ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 157 U.K. AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 U.K. FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 U.K. TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 U.K. ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 U.K. CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 U.K. ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 163 U.K. INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 ITALY ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 165 ITALY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 166 ITALY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 ITALY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 168 ITALY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 169 ITALY BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 170 ITALY OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 171 ITALY ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 172 ITALY STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 173 ITALY HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 174 ITALY SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 ITALY ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 ITALY METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 ITALY RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 ITALY FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 ITALY RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 ITALY DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 ITALY AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 ITALY PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 ITALY ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 184 ITALY AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 ITALY FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 ITALY TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 ITALY ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 188 ITALY CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 ITALY ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 190 ITALY INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 191 FRANCE ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 192 FRANCE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 193 FRANCE NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 FRANCE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 195 FRANCE INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 196 FRANCE BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 197 FRANCE OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 FRANCE ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 199 FRANCE STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 200 FRANCE HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 201 FRANCE SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 FRANCE ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 203 FRANCE METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 FRANCE RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 FRANCE FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 FRANCE RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 207 FRANCE DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 FRANCE AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 FRANCE PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 FRANCE ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 211 FRANCE AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 FRANCE FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 FRANCE TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 FRANCE ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 FRANCE CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 FRANCE ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 217 FRANCE INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 SPAIN ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 219 SPAIN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 220 SPAIN NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 SPAIN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 222 SPAIN INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 223 SPAIN BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 224 SPAIN OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 SPAIN ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 226 SPAIN STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 227 SPAIN HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 228 SPAIN SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 SPAIN ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 230 SPAIN METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 231 SPAIN RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 SPAIN FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 SPAIN RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 SPAIN DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 SPAIN AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 SPAIN PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 SPAIN ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 238 SPAIN AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 SPAIN FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 SPAIN TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 SPAIN ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 SPAIN CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 SPAIN ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 244 SPAIN INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 TURKEY ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 246 TURKEY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 247 TURKEY NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 TURKEY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 249 TURKEY INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 250 TURKEY BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 251 TURKEY OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 TURKEY ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 253 TURKEY STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 254 TURKEY HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 255 TURKEY SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 TURKEY ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 257 TURKEY METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 TURKEY RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 TURKEY FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 TURKEY RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 TURKEY DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 262 TURKEY AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 TURKEY PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 TURKEY ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 265 TURKEY AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 266 TURKEY FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 267 TURKEY TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 268 TURKEY ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 TURKEY CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 TURKEY ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 271 TURKEY INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 NETHERLANDS ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 273 NETHERLANDS NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 274 NETHERLANDS NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 NETHERLANDS INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 276 NETHERLANDS INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 277 NETHERLANDS BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 278 NETHERLANDS OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 NETHERLANDS ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 280 NETHERLANDS STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 281 NETHERLANDS HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 282 NETHERLANDS SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 NETHERLANDS ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 284 NETHERLANDS METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 285 NETHERLANDS RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 286 NETHERLANDS FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 287 NETHERLANDS RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 288 NETHERLANDS DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 289 NETHERLANDS AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 290 NETHERLANDS PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 291 NETHERLANDS ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 292 NETHERLANDS AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 293 NETHERLANDS FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 294 NETHERLANDS TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 295 NETHERLANDS ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 296 NETHERLANDS CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 297 NETHERLANDS ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 298 NETHERLANDS INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 299 BELGIUM ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 300 BELGIUM NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 301 BELGIUM NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 302 BELGIUM INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 303 BELGIUM INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 304 BELGIUM BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 305 BELGIUM OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 306 BELGIUM ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 307 BELGIUM STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)

TABLE 308 BELGIUM HIGH PURITY GRADE (≥99.9%) IN ANILINE MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 309 BELGIUM SALTS AND FORMULATIONS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 310 BELGIUM ANILINE MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 311 BELGIUM METHYLENE DIPHENYL DIISOCYANATE (MDI) PRODUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 312 BELGIUM RIGID FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 313 BELGIUM FLEXIBLE FOAMS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 314 BELGIUM RUBBER PROCESSING CHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 315 BELGIUM DYES & PIGMENTS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 316 BELGIUM AGROCHEMICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 317 BELGIUM PHARMACEUTICALS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 318 BELGIUM ANILINE MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 319 BELGIUM AUTOMOTIVE IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 320 BELGIUM FURNITURE & APPLIANCES IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 321 BELGIUM TEXTILES & LEATHER IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 322 BELGIUM ELECTRICAL & ELECTRONICS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 323 BELGIUM CONSTRUCTION IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 324 BELGIUM ANILINE MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 325 BELGIUM INDIRECT IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 326 SWITZERLAND ANILINE MARKET, BY PRODUCTION PROCESS, 2018-2033 (USD THOUSAND)

TABLE 327 SWITZERLAND NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY REACTOR CONFIGURATION, 2018-2033 (USD THOUSAND)

TABLE 328 SWITZERLAND NITROBENZENE HYDROGENATION IN ANILINE MARKET, BY CATALYST TYPE, 2018-2033 (USD THOUSAND)

TABLE 329 SWITZERLAND INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY NITRATION TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 330 SWITZERLAND INTEGRATED NITRATION–HYDROGENATION (BENZENE-TO-ANILINE) IN ANILINE MARKET, BY HYDROGENATION MODE, 2018-2033 (USD THOUSAND)

TABLE 331 SWITZERLAND BIO-BASED ROUTES (PILOT/EMERGING) IN ANILINE MARKET, BY FEEDSTOCK, 2018-2033 (USD THOUSAND)

TABLE 332 SWITZERLAND OTHER EMERGING PATHWAYS IN ANILINE MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 333 SWITZERLAND ANILINE MARKET, BY GRADE & PURITY, 2018-2033 (USD THOUSAND)

TABLE 334 SWITZERLAND STANDARD INDUSTRIAL GRADE (≥99.5%) IN ANILINE MARKET, BY PACKAGING, 2018-2033 (USD THOUSAND)