Global Beverage Processing Equipment Market

Размер рынка в млрд долларов США

CAGR :

%

USD

8.77 Billion

USD

13.72 Billion

2024

2032

USD

8.77 Billion

USD

13.72 Billion

2024

2032

| 2025 –2032 | |

| USD 8.77 Billion | |

| USD 13.72 Billion | |

|

|

|

|

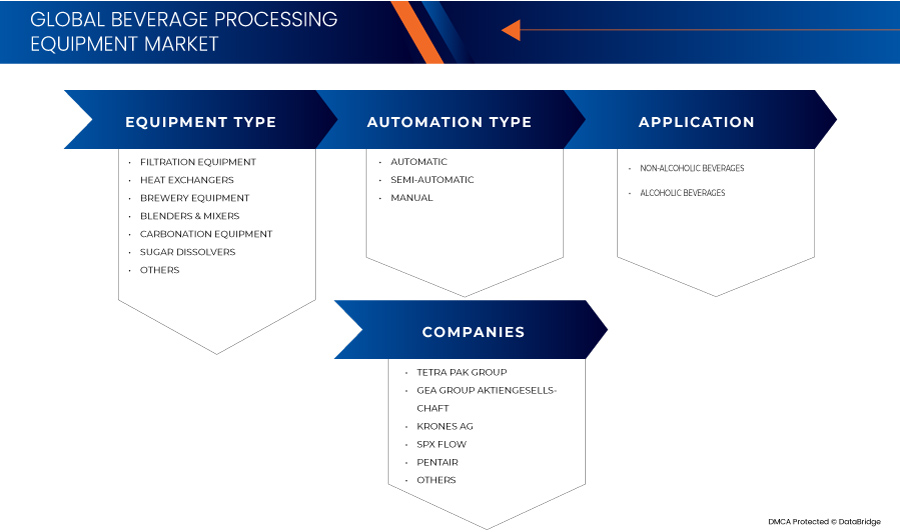

Global Beverages Processing Equipment Market, By Equipment Type (Filtration Equipment, Heat Exchangers, Brewery Equipment, Blenders & Mixers, Carbonation Equipment, Sugar Dissolvers, and Others), Automation Type (Automatic, Semi-Automatic, and Manual), Application (Non-Alcoholic Beverages and Alcoholic Beverages) - Industry Trends and Forecast to 2031.

Beverages Processing Equipment Market Analysis and Size

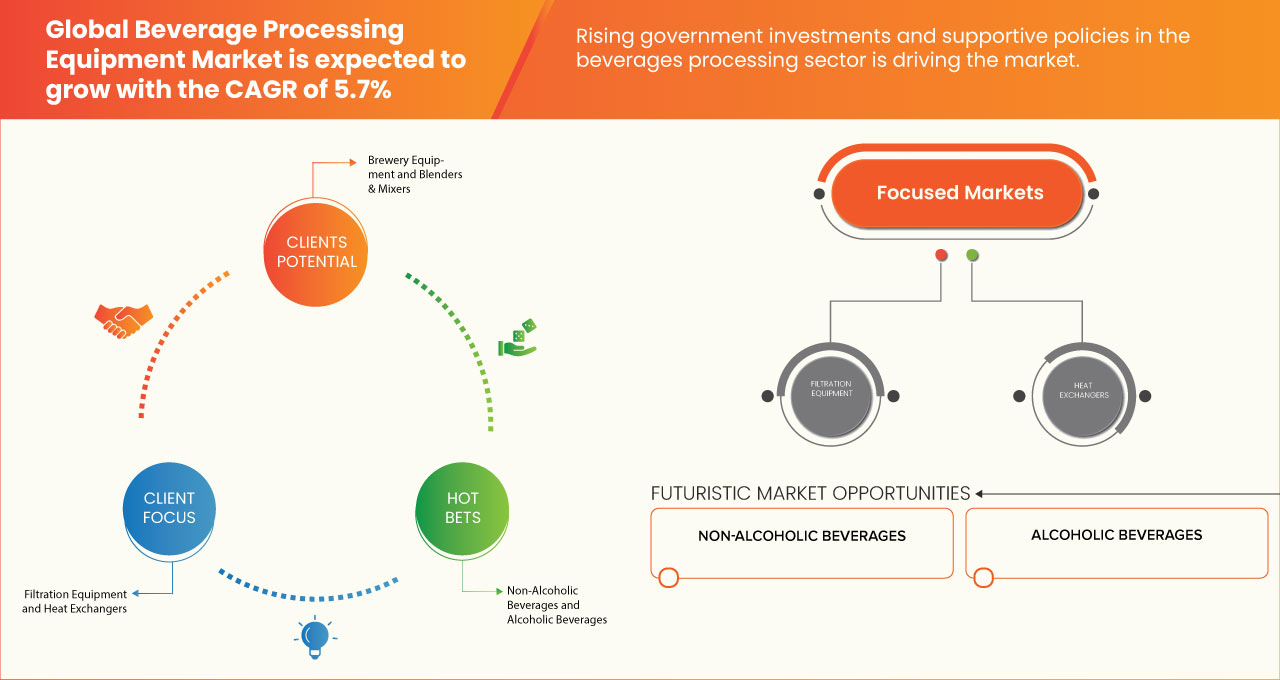

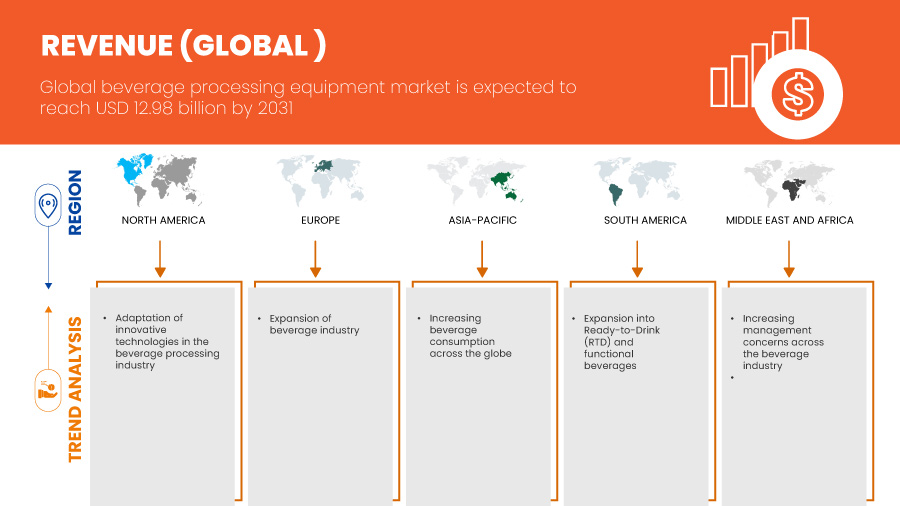

Data Bridge Market Research analyzes that the global beverages processing equipment market is expected to reach USD 12.98 billion by 2031 from USD 8.31 billion in 2023, growing with a CAGR of 5.7% from 2024 to 2031.

Expansion of beverage industry are expected to drive the market growth. High initial investment and maintenance costs is expected to hinder the market. Adaptation of innovative technologies in the beverage processing industry is expected to provide opportunity for the market growth. Changing consumer preference toward fresh and non-processed food and beverages is expected to challenge the market.

The global beverages processing equipment market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

Equipment Type (Filtration Equipment, Heat Exchangers, Brewery Equipment, Blenders & Mixers, Carbonation Equipment, Sugar Dissolvers, and Others), Automation Type (Automatic, Semi-Automatic, and Manual), Application (Non-Alcoholic Beverages and Alcoholic Beverages) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, China, India, Japan, Australia & New Zealand, South Korea, Singapore, Malaysia, Indonesia, Philippines, Thailand, Rest of Asia-Pacific, Germany, France, Italy, U.K., Russia, Spain, Belgium, Netherlands, Switzerland, Turkey, and Rest of Europe, South Africa, Egypt, U.A.E., Saudi Arabia, Israel, and Rest of Middle East and Africa |

|

Market Players Covered |

Tetra Pak Group, GEA Group Aktiengesellschaft, Krones AG, SPX Flow, Pentair, KHS Group, ALFA LAVAL, JBT., Bühler AG, Paul Mueller Company, Bucher Unipektin AG, Praj Industries, HRS Process Systems Ltd., TechniBlend, Inc., Fristam, Omnia Della Toffola SpA, PROXES GMBH, Caloris Engineering, LLC., FME Food Machinery Europe Sp. z o.o, and Bigtem Makine A.S among others |

Market Definition

Beverage processing involves the transformation of raw ingredients into drinks through various techniques. It encompasses steps like mixing, heating, cooling, and filtration to achieve desired flavors and textures. Processing ensures beverages meet quality standards and safety regulations before packaging. It plays a crucial role in maintaining consistency and shelf life, optimizing production efficiency throughout the manufacturing process.

Global Beverages Processing Equipment Market Dynamics:

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing Beverage Sector

The growing beverage sector is a significant driver for the global beverage processing equipment market. This growth is fueled by rising consumer demand for a variety of beverages, including carbonated soft drinks, juices, alcoholic beverages, and functional drinks like sports and energy beverages. The increasing global population, urbanization, and changing consumer lifestyles have led to higher consumption of ready-to-drink products, thus necessitating advanced beverage processing equipment to meet production demands efficiently and maintain product quality.

As the beverage sector expands, manufacturers are increasingly investing in advanced processing technologies to enhance production efficiency and product consistency. This includes equipment for filtration, homogenization, pasteurization, and packaging. The need to adhere to stringent food safety regulations and quality standards drives the adoption of sophisticated processing machinery. This trend is further propelled by the requirement to produce beverages with extended shelf lives and improved safety profiles, ensuring consumer trust and satisfaction.

The globalization of the beverage industry has opened new markets and increased competition among producers. To remain competitive and meet international standards, beverage manufacturers are investing in state-of-the-art processing equipment that ensures product uniformity and compliance with global quality norms. This need to meet diverse regulatory requirements and consumer preferences worldwide is a key driver for the continuous growth and evolution of the beverage processing equipment market.

Rising consumer demand, the push for advanced technology, the trend towards healthier options, globalization, and supportive government policies collectively contribute to the increasing need for sophisticated beverage processing equipment. This continuous investment and innovation in processing technologies foster the market's growth and development, ensuring that manufacturers can meet evolving consumer preferences and regulatory standards. Thus, the growing beverage sector significantly is driving the global beverage processing equipment market.

- Increasing Beverage Consumption Across the Globe

The surge in the beverage consumption stems from various factors, including changing consumer lifestyles, urbanization, and rising disposable incomes. As more people seek convenience and ready-to-drink options, the demand for processed beverages like juices, soft drinks, and alcoholic beverages has skyrocketed. This trend necessitates the expansion and modernization of beverage processing facilities to keep up with consumer preferences.

One major factor contributing to the rise in beverage consumption is the shift in dietary habits, with consumers opting for healthier and functional drinks. Beverages enriched with vitamins, minerals, and other nutrients are gaining popularity, prompting beverage manufacturers to invest in advanced processing equipment to maintain the nutritional value and quality of these products. This shift towards health-conscious consumption directly boosts the demand for sophisticated beverage processing technologies. Moreover, the increasing popularity of premium and craft beverages, such as artisanal sodas, specialty coffees, and craft beers, is fueling the growth of the beverage processing equipment market. These high-quality, often small-batch products require precise and reliable processing equipment to ensure consistency and meet the high standards expected by discerning consumers. As a result, beverage producers are compelled to adopt advanced equipment that can handle the complexities of producing such specialized drinks.

The rapid expansion of the global beverage industry also highlights the need for efficient and scalable processing solutions. With emerging markets in Asia, Latin America, and Africa showing robust growth in beverage consumption, manufacturers are under pressure to enhance their production capabilities. Investments in modern beverage processing equipment enable these companies to scale operations, improve production efficiency, and meet the rising demand in these burgeoning markets.

Opportunity

- Adoption of Innovative Technologies in the Beverage Processing Industry

Technological advancements have revolutionized various aspects of beverage processing, enhancing efficiency, productivity, and product quality. Automation and robotics, for instance, have enabled streamlined manufacturing processes, decreasing labor costs and improving overall operational efficiency. This integration of advanced technologies allows beverage processing equipment manufacturers to develop and offer sophisticated machinery that meets the evolving needs of beverage processors.

The adoption of digitalization and Internet of Things (IoT) in beverage processing equipment has facilitated real-time monitoring and data analytics. Sensors embedded in equipment can track parameters such as temperature, humidity, and processing times, ensuring precise control over production processes. This data-driven approach not only enhances product consistency and quality but also enables predictive maintenance, minimizing equipment downtime and optimizing operational uptime.

Innovative technologies also contribute to enhancing beverage safety and hygiene standards. Advancements in sanitation techniques, such as automated cleaning systems and antimicrobial coatings, help mitigate contamination risks during processing. These technologies are crucial for compliance with stringent beverage safety regulations, thereby bolstering consumer confidence and market competitiveness for beverage processors. In addition, the advent of smart manufacturing concepts, including artificial intelligence (AI) and machine learning, enables equipment to self-optimize and adapt to changing production demands in real-time.

Predictive analytics algorithms can forecast demand patterns and production requirements, allowing manufacturers to adjust production schedules and optimize resource utilization proactively. This agility is particularly valued in a dynamic market environment where consumer preferences and regulatory requirements evolve rapidly.

Restraint/Challenge

- Operational Complexity Associated with Beverage Processing Equipment

Operational complexity is a significant factor acting as a restraint for the global beverage processing equipment market. The intricate nature of modern beverage production, which involves multiple stages and specialized processes, presents numerous challenges for manufacturers. These complexities can deter companies from investing in advanced processing equipment, thus limiting market growth. Understanding the specific factors contributing to operational complexity helps in identifying why this is a substantial barrier.

One key aspect of operational complexity is the integration of advanced technologies into existing production lines. Modern beverage processing equipment often includes sophisticated automation and control systems that require specialized knowledge and training to operate efficiently. The need for skilled personnel to manage and maintain these systems can be a significant hurdle, especially for smaller manufacturers with limited resources. This necessity for specialized skills can lead to increased operational costs and potential disruptions during the transition period, making companies hesitant to adopt new technologies.

Another contributing factor is the maintenance and downtime associated with advanced processing equipment. High-tech machinery often comes with stringent maintenance requirements to ensure optimal performance and longevity. Frequent maintenance and the need for regular updates or replacements of parts can lead to increased operational expenses. Additionally, unplanned downtimes due to equipment failure can disrupt production schedules, leading to financial losses and delayed product deliveries. The potential for such disruptions makes some manufacturers wary of investing heavily in new processing technologies.

Regulatory compliance adds another layer of complexity to beverage processing operations. Manufacturers must adhere to strict food safety and quality standards, which can vary significantly across different regions. Ensuring that advanced processing equipment meets these diverse regulatory requirements can be challenging and costly. The process of obtaining necessary certifications and approvals can be time-consuming, further delaying the implementation of new equipment. This regulatory burden can discourage companies from upgrading their processing capabilities, thus restraining market growth.

Recent Developments

- In 2024, Tetra Pak Group unveiled its ‘Factory Sustainable Solutions’ offering, a new comprehensive approach to optimizing energy, water, and Cleaning-in-Place (CIP) processes across factories. This initiative, part of Tetra Pak’s broader sustainability portfolio, will provide Food and Beverage (F&B) producers with a customized blend of advanced technologies and superior plant integration capabilities. The goal is to help F&B producers enhance their energy and resource efficiency, aiding them in achieving their sustainability targets while reducing operational costs

- In 2024, GEA Group Aktiengesellschaft at Anuga FoodTec launched Insight Partner, a new cloud-based application for food processing and packaging. The solution provided real-time monitoring and analytics, optimizing machine performance and extending equipment lifespan. It aimed to enhance efficiency, reduce downtime, and lower Total Cost of Ownership for food plants. Insight Partner featured user-friendly interfaces, live data access, and proactive maintenance alerts, supporting operational productivity and maintenance planning

- In May, SPX FLOW's APV Aseptic Rapid Recovery System (ARRS) won the Sustainable Product Award at the 2024 SEAL Business Sustainability Awards for cutting product waste by 87%. The technology reduced dairy product loss from 4% to 0.5% by recapturing leftovers in process piping. It also minimized water usage and cleaning time, enhancing sustainability in dairy and beverage production. The innovation aims to set a new standard in aseptic processing for improved environmental impact and consumer safety

- In May 2024, Alfa Laval introduced a new heat exchanger, the Hygienic WideGap, aiming to revolutionize sustainable practices in food processing. It cuts emissions by half in the production of liquid foods like juices and plant-based beverages. The new technology enhances energy efficiency by 50 percent and reduces steam and power consumption significantly. This innovation supports the food industry's shift away from fossil fuels, addressing both energy use and greenhouse gas emissions. It offers a sustainable solution for food production at a time when global food demand is rising sharply

- In April 2024, Alfa Laval introduced the Alfa Laval Foodec Hygiene Plus, a highly hygienic decanter designed specifically for the food industry. It features advanced cleaning features and smooth surfaces to prevent residue build-up and enhance cleanliness. Optional extras like TrueStainlessTM and SaniRibs further improve hygiene by using stainless steel for key parts and reducing pathogen hotspots. This innovation aims to meet evolving hygiene standards in food production, ensuring improved productivity and product quality

Global Beverages Processing Equipment Market Scope

The global beverages processing equipment market is segmented into three notable segments based on equipment type, automation type, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Equipment Type

- Filtration Equipment

- Heat Exchangers

- Brewery Equipment

- Blenders & Mixers

- Carbonation Equipment

- Sugar Dissolvers

- Others

On the basis of equipment type, the market is segmented into filtration equipment, heat exchangers, brewery equipment, blenders & mixers, carbonation equipment, sugar dissolvers, and others.

Automation Type

- Automatic

- Semi-Automatic

- Manual

On the basis of automation type, the market is segmented into automatic, semi-automatic, and manual.

Application

- Non-Alcoholic Beverages

- Alcoholic Beverages

On the basis of application, the market is segmented into non-alcoholic beverages and alcoholic beverages.

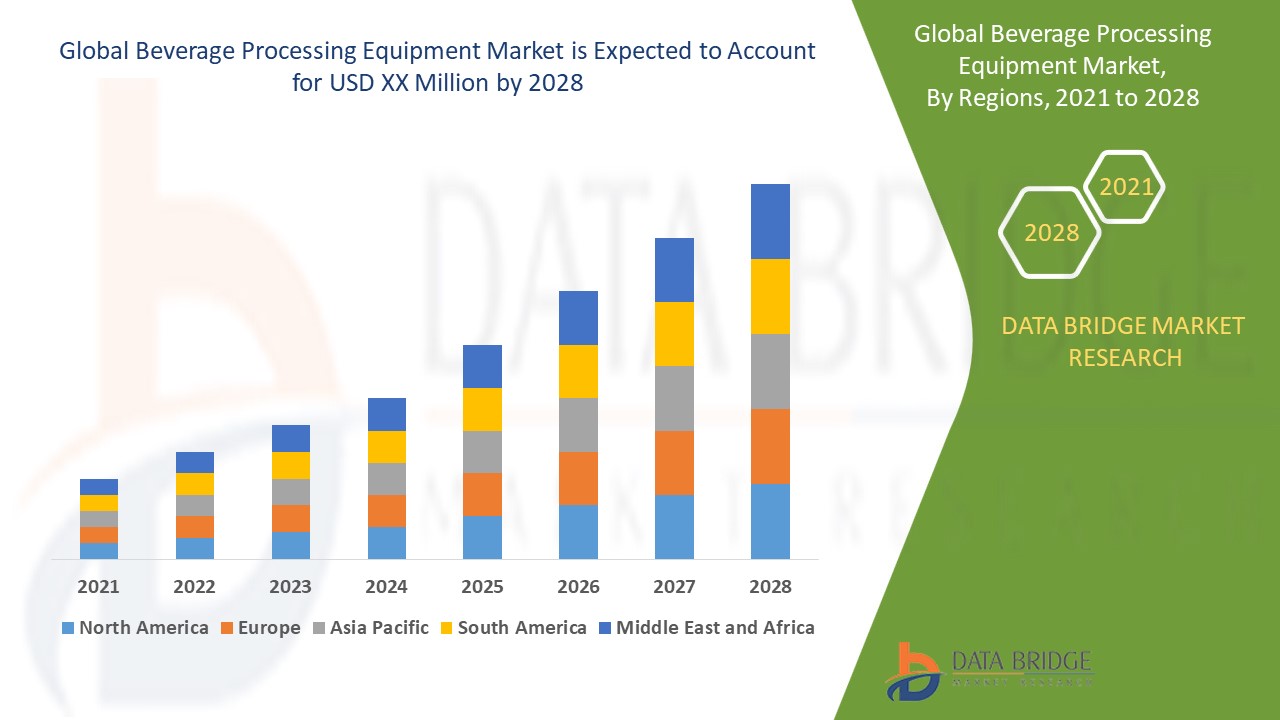

Global Beverages Processing Equipment Market Regional Analysis/Insights

The global beverages processing equipment market is segmented into three notable segments based on equipment type, automation type, and application.

The countries covered in the global beverages processing equipment market are U.S., Canada, Mexico, Brazil, Argentina, rest of South America, China, India, Japan, Australia & New Zealand, South Korea, Singapore, Malaysia, Indonesia, Philippines, Thailand, rest of Asia-Pacific, Germany, France, Italy, U.K., Russia, Spain, Belgium, Netherlands, Switzerland, Turkey, and rest of Europe, South Africa, Egypt, U.A.E., Saudi Arabia, Israel, and rest of Middle East and Africa.

Asia-Pacific region is expected to dominate the global beverages processing equipment market due to rising government investments and supportive policies in the beverages processing sector. China is expected to dominate the Asia-Pacific region due to increasing beverage consumption across the country. Germany is expected to dominate the Europe region due to its vast manufacturing capabilities, low production costs, and extensive export network. The U.S. is expected to dominate the North America region due to adaptation of innovative technologies in the beverage processing industry.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Beverages Processing Equipment Market Share Analysis

The global beverages processing equipment market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the global beverages processing equipment market.

Some of the prominent participants operating in the global beverages processing equipment market are Tetra Pak Group, GEA Group Aktiengesellschaft, Krones AG, SPX Flow, Pentair, KHS Group, ALFA LAVAL, JBT., Bühler AG, Paul Mueller Company, Bucher Unipektin AG, Praj Industries, HRS Process Systems Ltd., TechniBlend, Inc., Fristam, Omnia Della Toffola SpA, PROXES GMBH, Caloris Engineering, LLC., FME Food Machinery Europe Sp. z o.o, and Bigtem Makine A.S. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.