Global Blue Green Algae Fertilizers Market

Размер рынка в млрд долларов США

CAGR :

%

USD

1.02 Billion

USD

2.66 Billion

2025

2033

USD

1.02 Billion

USD

2.66 Billion

2025

2033

| 2026 –2033 | |

| USD 1.02 Billion | |

| USD 2.66 Billion | |

|

|

|

|

Global Blue Green Algae Fertilizers Market Segmentation, By Technology Type (Carrier Enriched Biofertilizers, Liquid Biofertilizers, and Other Technology Types), Application (Soil Treatment, Seed Treatment, and Others), Type (Nitrogen-Fixing Biofertilizers, Phosphate Solubilizing and Mobilizing Biofertilizers, Potash Solubilizing and Mobilizing Biofertilizers, and Others), Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Other Crops) - Industry Trends and Forecast to 2033

What is the Global Blue Green Algae Fertilizers Market Size and Growth Rate?

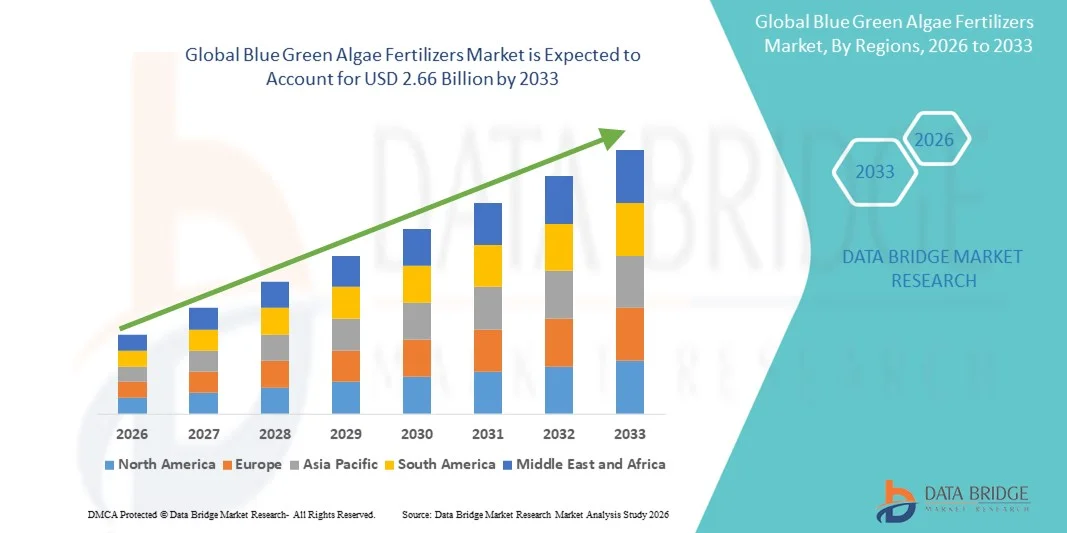

- The global blue green algae fertilizers market size was valued at USD 1.02 billion in 2025 and is expected to reach USD 2.66 billion by 2033, at a CAGR of12.60% during the forecast period

- Major factors that are expected to boost the growth of the blue green algae fertilizers market in the forecast period are the rise in the organic food industry. Furthermore, the increase in the awareness regarding the utilization of chemical fertilizers is further anticipated to propel the growth of the blue green algae fertilizers market

- Moreover, the upsurge in the utilization of biofertilizers in the ranches and private farms is further estimated to supplement in the blue green algae fertilizers market growth

What are the Major Takeaways of Blue Green Algae Fertilizers Market?

- Concerns regarding the environment and technological limitations, and the poor infrastructure and the rise in the initial investment are further projected to impede the growth of the blue green algae fertilizers market in the timeline period

- In addition, the advancing countries will further provide potential opportunities for the growth of the blue green algae fertilizers market in the coming years. However, the absence of alertness and decrease in the acceptance rate of biofertilizers might further challenge the growth of the blue green algae fertilizers market in the near future

- North America dominated the blue green algae fertilizers market with an estimated 43.32% revenue share in 2025, driven by strong adoption of sustainable agricultural practices, rising demand for organic food, and increasing regulatory support for bio-based fertilizers across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of around 10.5% from 2026 to 2033, driven by rapid agricultural expansion, rising population-driven food demand, and increasing adoption of eco-friendly farming practices across China, India, Japan, Southeast Asia, and Australia

- The Carrier Enriched Biofertilizers segment dominated the market with an estimated 46.3% share in 2025, owing to their longer shelf life, ease of handling, cost-effectiveness, and wide acceptance among farmers in developing economies

Report Scope and Blue Green Algae Fertilizers Market Segmentation

|

Attributes |

Blue Green Algae Fertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Blue Green Algae Fertilizers Market?

Rising Shift Toward Sustainable, Bio-Based, and Soil-Enriching Agricultural Inputs

- The blue green algae fertilizers market is witnessing increasing adoption of eco-friendly, nitrogen-fixing biofertilizers that enhance soil fertility while reducing dependence on synthetic chemical fertilizers

- Manufacturers are focusing on high-efficiency cyanobacteria strains, improved formulation stability, and longer shelf life to support large-scale agricultural deployment

- Growing emphasis on organic farming, regenerative agriculture, and sustainable crop productivity is accelerating adoption across cereals, pulses, oilseeds, and horticulture crops

- For instance, companies such as Novozymes, Agrinos, Symborg, and Kan Biosys are expanding biofertilizer portfolios with algae-based solutions targeting soil health and yield enhancement

- Increasing awareness of soil carbon restoration, microbial balance, and reduced environmental impact is reinforcing demand among farmers and agri-input distributors

- As sustainable agriculture gains priority globally, Blue Green Algae Fertilizers are expected to play a critical role in improving crop productivity while preserving long-term soil health

What are the Key Drivers of Blue Green Algae Fertilizers Market?

- Rising demand for sustainable and cost-effective nutrient solutions that reduce chemical fertilizer usage and improve soil structure

- For instance, in 2024–2025, several agricultural companies expanded investments in microbial and algae-based fertilizers to meet organic and residue-free food production standards

- Increasing adoption of organic farming, precision agriculture, and government-supported bio-input programs across Asia-Pacific, Europe, and Latin America is driving market growth

- Advancements in algae cultivation techniques, strain optimization, and formulation technology have improved product efficacy and farmer acceptance

- Growing pressure to reduce greenhouse gas emissions, nitrate leaching, and soil degradation is accelerating the shift toward biological fertilizers

- Supported by favorable regulatory policies, rising farmer awareness, and sustainable agriculture initiatives, the Blue Green Algae Fertilizers market is poised for steady long-term growth

Which Factor is Challenging the Growth of the Blue Green Algae Fertilizers Market?

- Limited farmer awareness and lack of technical knowledge regarding correct application methods restrict adoption in some regions

- For instance, during 2023–2024, inconsistent field performance due to improper storage and handling affected acceptance in price-sensitive markets

- Variability in product effectiveness across different soil types, climatic conditions, and crop varieties creates adoption challenges

- Shorter shelf life and sensitivity to temperature and moisture compared to chemical fertilizers add logistical complexities

- Competition from subsidized chemical fertilizers and fast-acting synthetic nutrients continues to impact penetration rates

- To overcome these challenges, companies are investing in farmer training programs, improved formulations, and strong distribution networks to expand global adoption of Blue Green Algae Fertilizers

How is the Blue Green Algae Fertilizers Market Segmented?

The market is segmented on the basis of technology type, application, type, and crop type.

- By Technology Type

On the basis of technology type, the blue green algae fertilizers market is segmented into Carrier Enriched Biofertilizers, Liquid Biofertilizers, and Other Technology Types. The Carrier Enriched Biofertilizers segment dominated the market with an estimated 46.3% share in 2025, owing to their longer shelf life, ease of handling, cost-effectiveness, and wide acceptance among farmers in developing economies. These products support stable microbial activity and are extensively used in large-scale soil application programs.

The Liquid Biofertilizers segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by higher nutrient efficiency, faster microbial action, uniform application, and increasing adoption in precision and organic farming. Rising awareness about sustainable inputs and advancements in liquid formulation technologies are accelerating growth.

- By Application

On the basis of application, the market is segmented into Soil Treatment, Seed Treatment, and Others. The Soil Treatment segment dominated the market with a 51.8% share in 2025, supported by widespread use of blue green algae fertilizers to improve soil fertility, enhance nitrogen availability, and restore microbial balance. Soil application remains the most common practice across cereals, pulses, and oilseed cultivation.

The Seed Treatment segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of pre-sowing biological treatments that enhance germination rates, early root development, and crop vigor. Increasing focus on precision agriculture and cost-efficient nutrient management further supports segment growth.

- By Type

On the basis of type, the blue green algae fertilizers market is segmented into Nitrogen-Fixing Biofertilizers, Phosphate Solubilizing and Mobilizing Biofertilizers, Potash Solubilizing and Mobilizing Biofertilizers, and Others. The Nitrogen-Fixing Biofertilizers segment dominated the market with a 48.6% share in 2025, as blue green algae play a crucial role in atmospheric nitrogen fixation, reducing dependence on synthetic nitrogen fertilizers.

The Phosphate Solubilizing and Mobilizing Biofertilizers segment is expected to register the fastest CAGR from 2026 to 2033, driven by increasing phosphorus deficiency in soils and growing demand for improved nutrient uptake efficiency. Sustainable nutrient management practices are accelerating adoption.

- By Crop Type

On the basis of crop type, the market is segmented into Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Other Crops. The Cereals and Grains segment dominated the market with a 44.9% share in 2025, supported by extensive cultivation of rice, wheat, and maize, where blue green algae fertilizers are widely used to improve yield and soil health.

The Fruits and Vegetables segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for organic produce, high-value crops, and residue-free farming practices. Increasing adoption of biofertilizers in horticulture is further fueling market expansion.

Which Region Holds the Largest Share of the Blue Green Algae Fertilizers Market?

- North America dominated the blue green algae fertilizers market with an estimated 43.32% revenue share in 2025, driven by strong adoption of sustainable agricultural practices, rising demand for organic food, and increasing regulatory support for bio-based fertilizers across the U.S. and Canada. High awareness among farmers regarding soil health improvement, nitrogen fixation, and reduction of chemical fertilizer usage continues to fuel market demand across large-scale commercial farms and organic cultivation systems

- Leading companies in North America are focusing on advanced biofertilizer formulations, improved microbial stability, and large-scale distribution partnerships, strengthening the region’s leadership position. Continuous investment in sustainable agriculture, regenerative farming, and eco-friendly crop inputs supports long-term market growth

- Strong R&D infrastructure, well-developed agri-input distribution networks, and favorable government policies promoting biological alternatives further reinforce North America’s market dominance

U.S. Blue Green Algae Fertilizers Market Insight

The U.S. is the largest contributor in North America, supported by increasing organic acreage, strong demand for residue-free crops, and widespread adoption of biofertilizers in cereals, oilseeds, fruits, and vegetables. Federal and state-level initiatives promoting soil carbon management and sustainable nutrient solutions further accelerate market growth. Presence of leading biofertilizer producers and agri-tech startups strengthens domestic adoption.

Canada Blue Green Algae Fertilizers Market Insight

Canada contributes significantly to regional growth, driven by rising focus on sustainable farming, improving soil fertility in grain-producing regions, and increasing adoption of biological inputs in pulse and oilseed cultivation. Government-backed sustainability programs and growing organic food demand support market expansion.

Asia-Pacific Blue Green Algae Fertilizers Market

Asia-Pacific is projected to register the fastest CAGR of around 10.5% from 2026 to 2033, driven by rapid agricultural expansion, rising population-driven food demand, and increasing adoption of eco-friendly farming practices across China, India, Japan, Southeast Asia, and Australia. Strong government initiatives promoting biofertilizers and reduced chemical dependency are key growth drivers.

China Blue Green Algae Fertilizers Market Insight

China is the largest contributor in Asia-Pacific due to extensive crop cultivation, strong government support for green agriculture, and increasing use of biofertilizers to restore soil fertility and improve yields. Large-scale farming operations and domestic production capabilities support market growth.

India Blue Green Algae Fertilizers Market Insight

India is emerging as a major growth hub, driven by government-led biofertilizer promotion programs, expanding organic farming, and rising awareness among farmers about cost-effective nutrient management. Increasing use in rice, cereals, and pulses accelerates adoption.

Japan and South Korea Blue Green Algae Fertilizers Market Insight

Japan and South Korea show steady growth supported by precision agriculture practices, strong focus on sustainable inputs, and increasing adoption in high-value crops and horticulture. Technological innovation and environmentally conscious farming practices support long-term market expansion.

Which are the Top Companies in Blue Green Algae Fertilizers Market?

The blue green algae fertilizers industry is primarily led by well-established companies, including:

- Novozymes (Denmark)

- GSFC Ltd (India)

- Rashtriya Chemicals & Fertilizers Limited (India)

- T. STANES & COMPANY LIMITED (India)

- National Fertilizers Limited (India)

- MADRAS FERTILIZERS LIMITED (India)

- International Panaacea Limited (India)

- Lallemand, Inc. (Canada)

- Kan biosys (India)

- Kiwa Bio-Tech (China)

- Symborg (Spain)

- Som Phytopharma India Ltd. (India)

- Mapleton Agri Biotec Pty Ltd. (Australia)

- ASB Grünland Helmut Aurenz GmbH (Germany)

- Ficosterra, SL. (Spain)

- Agrinos (Netherlands)

- Australian Bio Fert Pty Ltd. (Australia)

- BioAg Pty Ltd. (Australia)

- Algae Systems LLC (U.S.)

What are the Recent Developments in Global Blue Green Algae Fertilizers Market?

- In October 2025, SIG partnered with Nutrition from Water (NXW) to introduce algae-based protein beverages supported by advanced aseptic packaging solutions, with a strong focus on improving access to nutritious drinks in underserved economies, marking a significant step toward sustainable nutrition innovation

- In September 2025, GNT introduced algae-based Exberry Carotenes derived from Dunaliella salina, offering natural yellow food colorants in liquid, powder, and oil-soluble formats for diverse food applications, reinforcing the shift toward clean-label and plant-based food ingredients

- In July 2025, Corbion obtained regulatory approvals from China’s GACC for its algae-derived omega-3 DHA products, AlgaPrim DHA and AlgaVi DHA, for both human and animal nutrition markets, strengthening its footprint in the fast-growing Asia-Pacific nutrition sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.