Global Free Ad Supported Streaming Tv Market

Размер рынка в млрд долларов США

CAGR :

%

USD

12.96 Billion

USD

46.49 Billion

2025

2033

USD

12.96 Billion

USD

46.49 Billion

2025

2033

| 2026 –2033 | |

| USD 12.96 Billion | |

| USD 46.49 Billion | |

|

|

|

|

Global Free Ad-Supported Streaming TV Market Segmentation, By Content Genre (Movies, News, Sports, and Other), Channel Format (Linear FAST and On-Demand AVOD), Distribution Platform (OEM Smart-TV, OTT Aggregators, and Other), Device Type (Smart TVs, Streaming Devices, and Other), Advertising Inventory (In-Stream Video, Interactive and Shoppable, and Other)- Industry Trends and Forecast to 2033

Free Ad-Supported Streaming TV Market Size

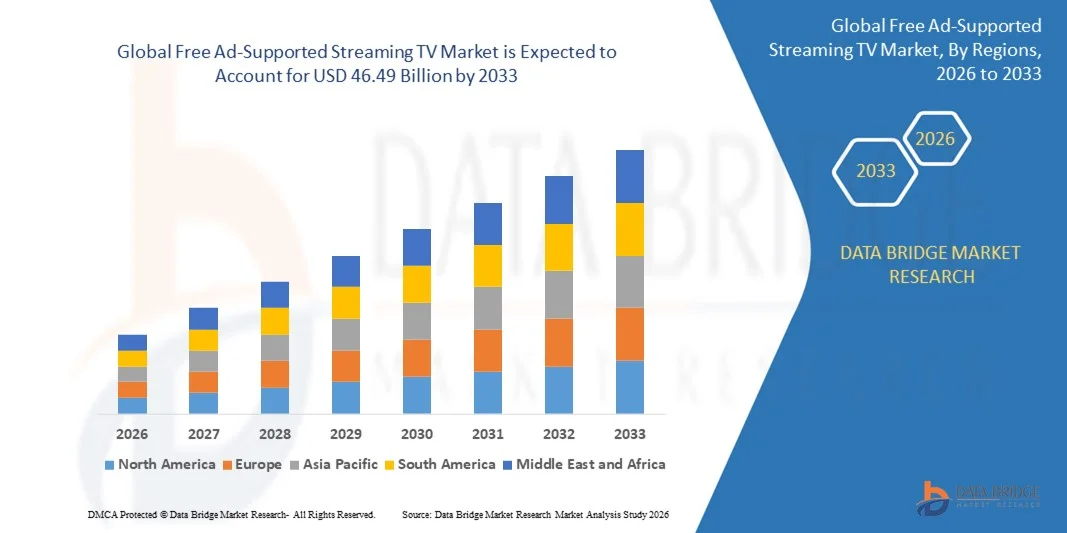

- The global free Ad-supported streaming TV market size was valued at USD 12.96 billion in 2025 and is expected to reach USD 46.49 billion by 2033, at a CAGR of 17.31% during the forecast period

- The market growth is largely fuelled by the rapid shift from traditional cable TV to digital streaming platforms and the rising preference for free content supported by advertisements

- Increasing internet penetration, widespread adoption of smart TVs, and growing acceptance of ad-based video-on-demand models are supporting market expansion

Free Ad-Supported Streaming TV Market Analysis

- The market is driven by advertisers seeking cost-effective alternatives to linear television and improved audience targeting through data-driven advertising

- In addition, the availability of diverse content libraries, such as movies, TV shows, and live channels, combined with partnerships between content owners and streaming platforms, is enhancing user engagement and accelerating market growth

- North America dominated the free ad-supported streaming TV market with the largest revenue share of 31.50% in 2025, driven by widespread internet penetration, high adoption of smart TVs, and a shift in consumer preference toward cost-effective, ad-supported content

- Asia-Pacific region is expected to witness the highest growth rate in the global free Ad-supported streaming TV market, driven by rapid urbanization, growing internet penetration, and increasing adoption of connected TV devices

- The movies segment held the largest market revenue share in 2025, driven by high viewer demand for free access to classic, regional, and genre-focused film libraries. FAST movie channels enable platforms to monetize long-tail content while maintaining high viewer retention

Report Scope and Free Ad-Supported Streaming TV Market Segmentation

|

Attributes |

Free Ad-Supported Streaming TV Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Amazon.com, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Free Ad-Supported Streaming TV Market Trends

Rising Demand For Cost-Free And Ad-Supported Content

- The increasing consumer preference for free, on-demand entertainment is significantly shaping the global free ad-supported streaming TV market, as viewers seek alternatives to paid subscription services. FAST platforms are gaining traction by offering a wide range of movies, TV shows, and live channels supported by advertisements, enabling access to content without monthly fees. This trend is strengthening adoption across diverse age groups and income segments, encouraging platforms to expand content libraries and improve user experience

- Growing awareness of subscription fatigue and rising costs of multiple OTT services have accelerated the shift toward ad-supported streaming models. Consumers are increasingly favoring FAST services for casual viewing, background entertainment, and niche content, prompting media companies and broadcasters to launch dedicated FAST channels. This shift is also driving partnerships between content owners and streaming platforms to monetize archived and long-tail content effectively

- Advertisers are increasingly viewing FAST platforms as attractive channels to reach cord-cutters and digital-first audiences through targeted and data-driven advertising. The availability of addressable ads, audience segmentation, and real-time performance tracking is enhancing advertiser confidence and spend on FAST platforms. These factors are helping platforms differentiate themselves and scale advertising revenues in a competitive digital media landscape

- For instance, in 2024, major media companies expanded their FAST channel offerings across platforms such as Pluto TV, Tubi, and Roku Channel to capitalize on growing viewer engagement. These launches focused on genre-specific and language-based channels, improving content discoverability and increasing average watch time. The expansion also supported higher ad inventory and improved monetization opportunities for platform operators

- While demand for FAST services continues to rise, sustained market growth depends on content quality, seamless ad integration, and maintaining viewer engagement. Platforms are focusing on enhancing recommendation algorithms, improving ad relevance, and expanding original and exclusive programming to compete with subscription-based streaming services

Free Ad-Supported Streaming TV Market Dynamics

Driver

Growing Shift Toward Ad-Supported Streaming Models

- Rising consumer resistance to increasing subscription fees is a major driver for the free ad-supported streaming TV market. Viewers are actively seeking no-cost entertainment options, prompting platforms to scale FAST offerings as a viable alternative to SVOD services. This shift is also encouraging traditional broadcasters and studios to repurpose existing content libraries for FAST distribution

- Expanding availability of smart TVs, connected devices, and high-speed internet is supporting the rapid adoption of FAST platforms globally. Built-in FAST apps and pre-installed channels on smart TVs are improving accessibility and visibility, enabling seamless content consumption. This widespread device penetration is reinforcing market growth across both developed and emerging regions

- Media companies and advertisers are increasingly investing in FAST ecosystems through content licensing, channel launches, and advanced advertising technologies. These initiatives are supported by growing demand for measurable, targeted, and cost-effective advertising solutions, encouraging collaborations between ad-tech providers, content owners, and platform operators

- For instance, in 2023, leading streaming platforms and broadcasters reported increased ad revenues from FAST services due to higher viewer engagement and improved ad targeting capabilities. The growth was driven by increased demand from brands seeking alternatives to traditional TV advertising, along with improved return on ad spend and audience reach

- Although ad-supported streaming models are gaining momentum, long-term growth depends on balancing ad load, content freshness, and user experience. Continuous investment in ad-tech infrastructure, data analytics, and content curation will be critical to sustaining viewer retention and advertiser confidence

Restraint/Challenge

Content Monetization And Ad Revenue Volatility

- Fluctuations in advertising demand and CPM rates pose a key challenge for the free ad-supported streaming TV market, impacting revenue stability for platform operators. Economic uncertainties and shifts in advertising budgets can directly affect ad fill rates and profitability, limiting consistent revenue growth

- Content acquisition and licensing costs remain a concern, particularly as competition intensifies among FAST platforms for premium and exclusive content. Rising content costs can pressure margins, especially for smaller platforms with limited advertising scale and bargaining power

- Viewer tolerance for advertisements varies across regions and demographics, and excessive or repetitive ads can negatively impact user experience and retention. Platforms must carefully manage ad frequency and relevance to avoid viewer fatigue and churn

- For instance, in 2024, several FAST platforms operating in North America and Europe reported challenges related to uneven ad demand and viewer drop-off during high ad loads. These issues prompted platforms to optimize ad placement strategies and invest in improved targeting technologies to maintain engagement

- Addressing these challenges will require diversified revenue strategies, stronger advertiser relationships, and continuous optimization of ad delivery models. Enhancing content quality, improving audience insights, and leveraging programmatic advertising will be essential for unlocking the long-term growth potential of the global free ad-supported streaming TV market

Free Ad-Supported Streaming TV Market Scope

The market is segmented on the basis of content genre, channel format, distribution platform, device type, and advertising inventory

- By Content Genre

On the basis of content genre, the free ad-supported streaming TV market is segmented into movies, news, sports, and other genres. The movies segment held the largest market revenue share in 2025, driven by high viewer demand for free access to classic, regional, and genre-focused film libraries. FAST movie channels enable platforms to monetize long-tail content while maintaining high viewer retention.

The sports segment is expected to witness the fastest growth rate from 2026 to 2033, supported by rising interest in free live sports highlights, niche leagues, and on-demand replays. Increasing content partnerships and advertiser interest in sports-driven audiences are further strengthening segment growth

- By Channel Format

On the basis of channel format, the market is segmented into linear FAST and on-demand AVOD. The linear FAST segment dominated the market in 2025 due to its traditional TV-style programming, scheduled content flow, and ease of passive viewing. This format appeals strongly to audiences transitioning from cable television to free streaming options.

The on-demand AVOD segment is expected to witness the fastest growth rate from 2026 to 2033, driven by consumer preference for content flexibility, personalized viewing, and pause-and-play convenience. Improved recommendation engines and targeted advertising are also supporting adoption

- By Distribution Platform

On the basis of distribution platform, the market is segmented into OEM smart-TV platforms, OTT aggregators, and other platforms. OEM smart-TV platforms accounted for the largest share in 2025, supported by pre-installed FAST apps, prominent home-screen visibility, and direct integration with smart TV operating systems. These advantages enhance user engagement and ad impressions.

OTT aggregators is expected to witness the fastest growth rate from 2026 to 2033, driven by their ability to bundle multiple FAST channels, expand content discovery, and offer unified advertising inventory for brands seeking wider reach. These platforms simplify user navigation by providing centralized access to diverse content libraries across genres and languages.

- By Device Type

On the basis of device type, the market is segmented into smart TVs, streaming devices, and other devices. Smart TVs dominated the market in 2025 due to rising global penetration, larger screen preferences, and seamless access to FAST services without additional hardware. Advertisers also favor smart TVs for premium ad placement and higher viewability.

Streaming devices is expected to witness the fastest growth rate from 2026 to 2033, supported by affordability, portability, and their role in enabling FAST access on older television models and secondary household screens. These devices allow consumers to convert non-smart TVs into connected viewing systems without significant investment. Growing demand for flexible, multi-room entertainment and ease of plug-and-play installation is strengthening adoption.

- By Advertising Inventory

On the basis of advertising inventory, the market is segmented into in-stream video, interactive and shoppable ads, and other formats. The in-stream video segment held the largest market share in 2025, driven by standardized ad formats, high completion rates, and strong advertiser confidence. These ads closely mirror traditional TV advertising effectiveness.

Interactive and shoppable advertising is expected to witness the fastest growth rate from 2026 to 2033, supported by advancements in ad technology, increased viewer engagement, and rising demand for performance-driven and commerce-enabled advertising experience.

Free Ad-Supported Streaming TV Market Regional Analysis

- North America dominated the free ad-supported streaming TV market with the largest revenue share of 31.50% in 2025, driven by widespread internet penetration, high adoption of smart TVs, and a shift in consumer preference toward cost-effective, ad-supported content

- Viewers in the region highly value on-demand access, diversified content offerings, and the convenience of watching free streaming platforms across multiple devices

- This strong adoption is further supported by robust advertising spend, a mature OTT ecosystem, and growing investments in FAST channels, establishing free ad-supported streaming as a preferred choice for both viewers and advertisers

U.S. Free Ad-Supported Streaming TV Market Insight

The U.S. free ad-supported streaming TV market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of OTT platforms and the increasing availability of linear FAST channels. Consumers are increasingly gravitating toward free, ad-supported services as an alternative to subscription-based platforms, driven by flexibility, content variety, and smart device integration. The growing preference for mobile and connected TV viewing, along with the rise in interactive advertising formats, is significantly boosting market growth.

Europe Free Ad-Supported Streaming TV Market Insight

The Europe free ad-supported streaming TV market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing internet penetration, adoption of connected TVs, and the rise of local and international FAST channels. European consumers are attracted to free, ad-supported content for its affordability and variety, while advertisers increasingly use these platforms to target specific demographics. Growth across linear and on-demand AVOD segments is also supported by ongoing investments in content localization and multi-platform distribution.

U.K. Free Ad-Supported Streaming TV Market Insight

The U.K. free ad-supported streaming TV market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing adoption of smart TVs and OTT devices, along with rising demand for on-demand and linear ad-supported content. The U.K. market is experiencing high engagement in news, sports, and entertainment genres, and advertisers are leveraging interactive and shoppable ad formats to enhance viewer engagement. Robust broadband infrastructure and consumer familiarity with digital advertising are expected to further drive market expansion.

Germany Free Ad-Supported Streaming TV Market Insight

The Germany free ad-supported streaming TV market is expected to witness the fastest growth rate from 2026 to 2033, driven by government initiatives promoting digital content access, growing interest in linear FAST channels, and the rising penetration of connected devices. German consumers are increasingly opting for ad-supported platforms due to cost-effectiveness and flexible content consumption. The integration of targeted advertising and interactive inventory is further boosting revenue opportunities for broadcasters and OTT providers.

Asia-Pacific Free Ad-Supported Streaming TV Market Insight

The Asia-Pacific free ad-supported streaming TV market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising smartphone penetration, growing internet accessibility, and increasing consumer adoption of smart TVs and streaming devices in countries such as China, Japan, and India. The region's expanding OTT ecosystem, coupled with a young, tech-savvy population, is fueling the demand for FAST and AVOD platforms. Increasing investments by advertisers and aggregators are further accelerating market growth.

Japan Free Ad-Supported Streaming TV Market Insight

The Japan free ad-supported streaming TV market is expected to witness the fastest growth rate from 2026 to 2033 due to high broadband penetration, a culture of early adoption of digital entertainment, and growing consumer preference for on-demand, ad-supported content. The market is seeing strong uptake in sports, movies, and news segments, while OTT aggregators and streaming device usage enhance accessibility across households. Advertisers are increasingly leveraging interactive and shoppable formats to improve engagement and monetization.

China Free Ad-Supported Streaming TV Market Insight

The China free ad-supported streaming TV market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s massive internet user base, rapid urbanization, and technological adoption. Chinese consumers are embracing free streaming services on smart TVs, mobile devices, and OTT aggregators, with strong engagement across movies, sports, and news genres. The growth of FAST channels and localized ad-supported content, alongside partnerships between platforms and advertisers, is significantly propelling market expansion in the region.

Free Ad-Supported Streaming TV Market Share

The Free Ad-Supported Streaming TV industry is primarily led by well-established companies, including:

• Amazon.com, Inc. (U.S.)

• Crackle (U.S.)

• Peacock TV LLC (U.S.)

• Plex (U.S.)

• Pluto TV (U.S.)

• Roku, Inc. (U.S.)

• Sling TV (U.S.)

• Tubi TV (U.S.)

• Vudu (U.S.)

• Xumo, Inc. (U.S.)

Latest Developments in Global Free Ad-Supported Streaming TV Market

- In August 2025, Hisense launched Hisense Channels, a FAST service featuring over 200 premium channels powered by Xumo Enterprise. Available on Hisense Google TVs, the platform delivers content from leading publishers such as Scripps, Radial Entertainment, and Stingray. This launch enhances viewer engagement, expands monetization opportunities, and strengthens Hisense’s position in the growing FAST market

- In July 2025, Zee5 partnered with Amagi Media Labs to launch a FAST service in India, providing free advertisement-supported content across genres such as comedy, drama, and horror. The service aims to replicate a traditional TV-like experience, diversify revenue streams, and strengthen Zee5’s competitiveness in the rapidly expanding Indian connected TV market

- In February 2025, Fox Corporation announced that Tubi reached 97 million monthly active users and 10 billion streaming hours in 2024. In addition, Super Bowl LIX broadcasts on FOX and Tubi generated USD 800 million in combined advertising revenue. This milestone demonstrates the growing adoption of FAST platforms, highlighting significant monetization potential and market influence for ad-supported streaming services

- In February 2025, Walmart completed a USD 2.3 billion acquisition of Vizio, gaining access to a smart-TV brand and a foothold in FAST streaming. The acquisition enables Walmart to leverage Vizio’s user base for content distribution and advertising, strengthening its position in the free streaming sector and supporting growth in connected TV commerce

- In February 2025, Outbrain acquired Teads for USD 900 million to integrate content recommendation technology with connected-TV video inventory. The merger aims to enhance ad targeting and monetization for FAST platforms, increasing advertiser ROI and expanding scalable revenue opportunities in the global streaming market

- In February 2025, Samsung TV Plus India expanded its FAST offerings by launching five exclusive channels in collaboration with Warner Bros. Television. The channels, including House of Crime, Foodie Hub, Wild Flix, Wheel World, and XXtreme Jobs, focus on Hindi-language programming for regional and urban audiences. This initiative enhances viewer choice, strengthens engagement, and creates additional advertising value, reinforcing Samsung’s presence in India’s growing FAST ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.