Global International Maritime Organization Imo 2020 Compliant Marine Oil Market

Размер рынка в млрд долларов США

CAGR :

%

USD

32.51 Billion

USD

62.08 Billion

2025

2033

USD

32.51 Billion

USD

62.08 Billion

2025

2033

| 2026 –2033 | |

| USD 32.51 Billion | |

| USD 62.08 Billion | |

|

|

|

|

Global International Maritime Organization (IMO) 2020 Compliant Marine Oil Market Segmentation, By Types (Hydrogenation, Mix and Match, and Others), Applications (Oil Tankers, Bulk Carriers, General Cargo, Container Ships, and Others) - Industry Trends and Forecast to 2033

What is the Global International Maritime Organization (IMO) 2020 Compliant Marine Oil Market Size and Growth Rate?

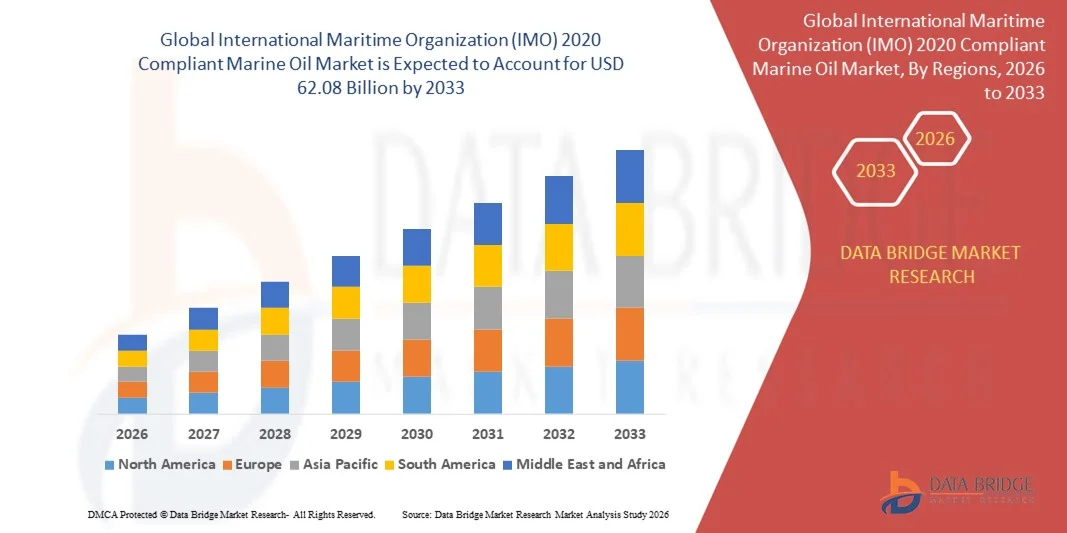

- The global international maritime organization (IMO) 2020 compliant marine oil market size was valued at USD 32.51 billion in 2025 and is expected to reach USD 62.08 billion by 2033, at a CAGR of8.42% during the forecast period

- Increasing awareness about protecting the marine environment coupled with increased focus on the reduction of sulphur oxide produced by ships is the root cause fuelling up the international maritime organization (IMO) 2020 compliant marine oil market growth rate

What are the Major Takeaways of International Maritime Organization (IMO) 2020 Compliant Marine Oil Market?

- Increased focus on decarbonisation is another factor responsible for propelling growth in the international maritime organization (IMO) 2020 compliant marine oil market value. The global aim to reduce the level of carbon dioxide levels is another international maritime organization (IMO) 2020 compliant marine oil market growth determinant

- However, high operating and maintenance costs associated with international maritime organization (IMO) 2020 compliant marine oil will pose a major challenge to the growth of this market. Substitutes or alternatives available in the market will further derail the international maritime organization (IMO) 2020

- North America dominated the Metallocene market with a 43% revenue share in 2025, driven by strong growth in advanced polymer production, packaging innovation, and rising demand for high-performance polyethylene and polypropylene across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.2% from 2026 to 2033, driven by rapid industrialization, expanding packaging consumption, rising automotive production, and large-scale polymer manufacturing across China, India, Japan, South Korea, and Southeast Asia

- The Mix and Match segment dominated the market with an estimated 48–50% share in 2025, as it allows refiners and bunker suppliers to blend low-sulfur fuel components efficiently to meet the 0.50% sulfur cap while optimizing cost and availability

Report Scope and International Maritime Organization (IMO) 2020 Compliant Marine Oil Market Segmentation

|

Attributes |

International Maritime Organization (IMO) 2020 Compliant Marine Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the International Maritime Organization (IMO) 2020 Compliant Marine Oil Market?

Increasing Shift Toward Low-Sulfur, High-Performance, and Fuel-Efficient Marine Oils

- The international maritime organization (IMO) 2020 compliant marine oil market is witnessing a strong transition toward very low sulfur fuel oil (VLSFO) and ultra-low sulfur marine gasoil (ULSMGO) to meet the global 0.50% sulfur cap

- Ship operators are increasingly adopting high-performance marine oils with improved combustion stability, thermal efficiency, and compatibility across engine types

- Refiners and fuel suppliers are introducing customized fuel blends to ensure engine protection, deposit control, and compliance with emission regulations

- For instance, companies such as ExxonMobil, Shell, TotalEnergies, BP, and Saudi Aramco have expanded IMO-compliant marine fuel portfolios across major global bunkering hubs

- Rising focus on fuel efficiency, reduced maintenance costs, and operational reliability is accelerating the shift from traditional high-sulfur fuel oils

- As global maritime regulations tighten, IMO 2020 compliant marine oils are becoming essential for sustainable shipping operations and long-term regulatory compliance

What are the Key Drivers of International Maritime Organization (IMO) 2020 Compliant Marine Oil Market?

- Enforcement of IMO 2020 sulfur regulations mandating a maximum sulfur content of 0.50% in marine fuels is the primary growth driver

- For instance, between 2024 and 2025, leading bunker fuel suppliers upgraded refining and blending capabilities to ensure consistent supply of compliant fuels

- Growth in global seaborne trade, container shipping, and bulk cargo transportation is increasing demand for compliant marine oils

- Rising adoption of scrubber-free vessels is driving direct consumption of low-sulfur marine fuels

- Technological advancements in refining processes have improved fuel stability, storage safety, and engine compatibility

- Supported by investments in port infrastructure, bunkering facilities, and maritime decarbonization, the IMO 2020 Compliant Marine Oil market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the International Maritime Organization (IMO) 2020 Compliant Marine Oil Market?

- Price volatility of low-sulfur marine fuels compared to conventional heavy fuel oil increases operational costs for ship operators

- For instance, during 2024–2025, fluctuations in crude oil prices and refining margins impacted the affordability of VLSFO across major ports

- Compatibility issues related to fuel stability, sediment formation, and engine deposits pose operational challenges

- Limited availability of compliant fuels in smaller or remote ports restricts adoption in certain regions

- High capital costs associated with fuel switching, storage segregation, and engine adjustments create barriers for older fleets

- To overcome these challenges, market players are focusing on fuel standardization, supply chain optimization, and engine-friendly formulations to enhance adoption of IMO 2020 compliant marine oils

How is the International Maritime Organization (IMO) 2020 Compliant Marine Oil Market Segmented?

The market is segmented on the basis of type and application.

- By Types

On the basis of type, the international maritime organization (IMO) 2020 compliant marine oil market is segmented into Hydrogenation, Mix and Match, and Others. The Mix and Match segment dominated the market with an estimated 48–50% share in 2025, as it allows refiners and bunker suppliers to blend low-sulfur fuel components efficiently to meet the 0.50% sulfur cap while optimizing cost and availability. This approach offers flexibility in sourcing, ensures fuel compatibility with diverse marine engines, and supports large-scale supply across global bunkering hubs. Mix-and-match solutions are widely preferred by ship operators seeking stable combustion performance and regulatory compliance without major engine modifications.

The Hydrogenation segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising investments in advanced refining technologies to produce cleaner, more stable low-sulfur marine fuels. Hydrogenated fuels offer improved fuel consistency, reduced sediment formation, and enhanced engine protection, making them increasingly attractive as fuel quality standards tighten.

- By Application

On the basis of application, the international maritime organization (IMO) 2020 compliant marine oil market is segmented into Oil Tankers, Bulk Carriers, General Cargo, Container Ships, and Others. The Container Ships segment dominated the market with a 42–45% share in 2025, supported by high fuel consumption, dense global trade routes, and strict compliance requirements across international ports. Container vessels operate on fixed schedules and frequent port calls, making the consistent availability of IMO-compliant marine oils critical for uninterrupted operations. The segment benefits from strong adoption of very low sulfur fuel oil (VLSFO) and marine gasoil due to scrubber-free fleet expansion.

The Oil Tankers segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing crude oil and refined product transportation, expanding offshore production, and stringent emission norms for tanker fleets. Rising fleet modernization and compliance-focused fuel procurement strategies are accelerating demand for IMO 2020 compliant marine oils in this segment.

Which Region Holds the Largest Share of the International Maritime Organization (IMO) 2020 Compliant Marine Oil Market?

- North America dominated the Metallocene market with a 43% revenue share in 2025, driven by strong growth in advanced polymer production, packaging innovation, and rising demand for high-performance polyethylene and polypropylene across the U.S. and Canada. Widespread adoption of metallocene catalysts in flexible packaging, consumer goods, and automotive lightweighting applications continues to support market expansion

- Leading producers in North America are investing in next-generation metallocene catalyst technologies to improve polymer uniformity, strength, and recyclability, reinforcing the region’s technological leadership

- Strong presence of global petrochemical majors, advanced R&D infrastructure, and high penetration of sustainable packaging solutions further strengthen regional dominance

U.S. Metallocene Market Insight

The U.S. is the largest contributor in North America, supported by extensive polyethylene and polypropylene production capacity, strong demand from food packaging, healthcare packaging, and industrial films, and continuous innovation in catalyst design. Growing focus on downgauging, recyclability, and performance-driven plastics accelerates adoption of metallocene-based polymers. Presence of major chemical companies, integrated refining–petrochemical complexes, and strong downstream demand supports steady market growth.

Canada Metallocene Market Insight

Canada contributes significantly due to growing demand for high-strength films, industrial packaging, and agricultural applications. Access to cost-competitive feedstock, expanding polymer processing capacity, and rising emphasis on sustainable plastic solutions support adoption of metallocene-based materials. Collaboration between polymer producers and packaging converters further drives market penetration.

Asia-Pacific Metallocene Market

Asia-Pacific is projected to register the fastest CAGR of 10.2% from 2026 to 2033, driven by rapid industrialization, expanding packaging consumption, rising automotive production, and large-scale polymer manufacturing across China, India, Japan, South Korea, and Southeast Asia. High demand for flexible packaging, consumer goods, and infrastructure materials is accelerating adoption of metallocene catalysts for enhanced polymer performance and processing efficiency

China Metallocene Market Insight

China is the largest contributor in Asia-Pacific due to massive polyethylene capacity expansions, strong domestic packaging demand, and government support for advanced materials. Increasing use of metallocene-based polymers in food packaging, hygiene products, and industrial films drives sustained growth.

Japan Metallocene Market Insight

Japan shows steady growth supported by high-quality polymer manufacturing, advanced automotive materials, and strong focus on precision packaging. Demand for consistent polymer properties and lightweight materials supports metallocene adoption.

India Metallocene Market Insight

India is emerging as a high-growth market, driven by expanding packaging, infrastructure development, and rising consumption of consumer plastics. Investments in petrochemical complexes and growing preference for high-performance polymers accelerate demand.

South Korea Metallocene Market Insight

South Korea contributes through strong demand from automotive, electronics packaging, and specialty polymer applications. Advanced manufacturing capabilities and focus on material innovation support long-term market growth.

Which are the Top Companies in International Maritime Organization (IMO) 2020 Compliant Marine Oil Market?

The international maritime organization (IMO) 2020 compliant marine oil industry is primarily led by well-established companies, including:

- Exxon Mobil Corporation (U.S.)

- Reliance Industries Limited (India)

- Shell Group of Companies (U.K.)

- China Petrochemical Corporation (China)

- bp p.l.c. (U.K.)

- LUKOIL (Russia)

- Chevron Corporation (U.S.)

- Total (France)

- Saudi Arabian Oil Co. (Saudi Arabia)

- Gazprom (Russia)

- Petróleo Brasileiro S.A. (Brazil)

- PetroChina Company Limited (China)

- Indian Oil Corporation Ltd (India)

- Gazprom Neft PJSC (Russia)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.