Global Internet Of Things Iot Security Market

Размер рынка в млрд долларов США

CAGR :

%

USD

43.44 Billion

USD

275.47 Billion

2024

2032

USD

43.44 Billion

USD

275.47 Billion

2024

2032

| 2025 –2032 | |

| USD 43.44 Billion | |

| USD 275.47 Billion | |

|

|

|

|

Сегментация мирового рынка безопасности Интернета вещей (IoT) по компонентам (решения, услуги), типу безопасности (сетевая безопасность, безопасность конечных точек, безопасность приложений, безопасность облаков и другие), отраслям конечного использования (производство, здравоохранение, энергетика и коммунальное хозяйство, автомобилестроение, бытовая электроника, розничная торговля, BFSI и другие) — тенденции развития отрасли и прогноз до 2032 года

Размер рынка безопасности Интернета вещей (IoT)

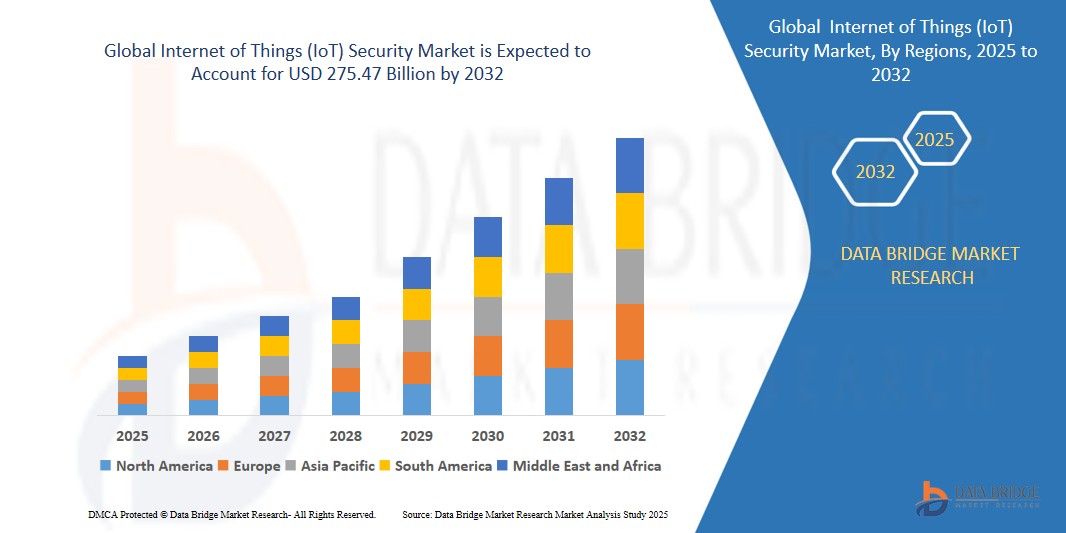

- Объем мирового рынка безопасности Интернета вещей (IoT) в 2024 году оценивался в 43,44 млрд долларов США и, как ожидается, достигнет 275,47 млрд долларов США к 2032 году при среднегодовом темпе роста 30,2% в прогнозируемый период.

- Этот рост обусловлен быстрым распространением устройств Интернета вещей, увеличением киберугроз и строгими нормативными требованиями к защите данных в различных отраслях.

Анализ рынка безопасности Интернета вещей (IoT)

- Рынок безопасности Интернета вещей (IoT) охватывает решения и услуги, предназначенные для защиты устройств и сетей IoT от киберугроз, обеспечивая целостность данных, конфиденциальность и надежность системы с помощью технологий шифрования, аутентификации и обнаружения угроз.

- Спрос на решения по безопасности Интернета вещей в значительной степени обусловлен резким ростом числа подключений устройств Интернета вещей (по прогнозам, к концу 2024 года число подключенных устройств составит 18,8 млрд), а также ростом числа кибератак (в 2024 году 60% организаций сообщили о нарушениях, связанных с Интернетом вещей).

- Ожидается, что Северная Америка будет доминировать на рынке безопасности Интернета вещей благодаря своей передовой технологической инфраструктуре и присутствию таких ключевых поставщиков, как Cisco и IBM, доля рынка которых в 2024 году составит 35,0%.

- Ожидается, что Азиатско-Тихоокеанский регион станет самым быстрорастущим регионом в прогнозируемый период благодаря быстрому внедрению Интернета вещей, правительственным инициативам по развитию умных городов и увеличению инвестиций в кибербезопасность в таких странах, как Китай и Индия.

- Ожидается, что сегмент решений будет доминировать на рынке с долей рынка в 67,0% в 2025 году благодаря важнейшей роли комплексного программного обеспечения безопасности, включая шифрование и обнаружение угроз, в защите экосистем Интернета вещей.

Область применения отчета и сегментация рынка безопасности Интернета вещей (IoT)

|

Атрибуты |

Ключевые аспекты рынка безопасности Интернета вещей (IoT) |

|

Охваченные сегменты |

|

|

Охваченные страны |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья/расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка безопасности Интернета вещей (IoT)

«Внедрение обнаружения угроз на основе ИИ в сфере безопасности Интернета вещей»

- Важной тенденцией на рынке безопасности Интернета вещей является интеграция искусственного интеллекта (ИИ) и машинного обучения (МО) в решения по безопасности, что позволяет заблаговременно обнаруживать угрозы и реагировать в режиме реального времени. К 2024 году 55% решений по безопасности Интернета вещей будут использовать ИИ.

- Облачные решения по безопасности набирают популярность благодаря своей масштабируемости и гибкости, при этом прогнозируется, что сегмент облачной безопасности будет расти среднегодовыми темпами на 27,5% в течение прогнозируемого периода.

Например, в июне 2024 года компания Cisco Systems представила интеллектуальную промышленную сеть Интернета вещей для поддержки приложений искусственного интеллекта и машинного обучения, повысив безопасность развертываний промышленного Интернета вещей.

- Эта тенденция обуславливает спрос на передовые масштабируемые решения по безопасности Интернета вещей, учитывающие меняющийся ландшафт угроз.

Динамика рынка безопасности Интернета вещей (IoT)

Водитель

«Быстрое распространение устройств Интернета вещей и рост киберугроз»

- Экспоненциальный рост числа устройств Интернета вещей (по прогнозам, к 2025 году их число превысит 30 миллиардов), а также растущая сложность кибератак (при этом количество инцидентов с программами-вымогателями на устройствах Интернета вещей в 2024 году увеличится на 35%) вносят значительный вклад в рост рынка безопасности Интернета вещей.

- Решения по безопасности Интернета вещей обеспечивают надежную защиту с помощью шифрования, аутентификации и обнаружения угроз, снижая риски утечки данных на 30% на предприятиях, внедряющих эти технологии.

- Например, в 2024 году крупный поставщик медицинских услуг внедрил решения по безопасности Интернета вещей для защиты подключенных медицинских устройств, повысив безопасность данных пациентов на 25%.

- Поскольку организации уделяют первостепенное внимание кибербезопасности, спрос на решения по безопасности Интернета вещей продолжает расти, обеспечивая безопасные и надежные экосистемы Интернета вещей.

Возможность

«Расширение безопасности Интернета вещей в инициативах умного города»

- Растущее внедрение Интернета вещей в проекты умных городов (а к 2025 году 65% городов мира будут инвестировать в инфраструктуру на базе Интернета вещей) открывает значительные возможности для роста рынка за счет повышения безопасности подключенных городских систем.

- Эти решения защищают интеллектуальные сети, системы управления дорожным движением и сети общественной безопасности, а их развертывание, как ожидается, позволит сократить количество киберинцидентов в интеллектуальных городах на 20% к 2025 году.

Например, в 2024 году Сингапур расширил свою систему безопасности Интернета вещей для умного города, сотрудничая с такими поставщиками, как Fortinet, для защиты подключенной инфраструктуры.

- Эта возможность стимулирует расширение рынка, обеспечивая безопасное и масштабируемое развертывание интеллектуальных городских систем.

Сдержанность/Вызов

«Сложность интеграции и отсутствие стандартизации»

- Сложность интеграции (40% предприятий сообщают о проблемах с развертыванием решений безопасности Интернета вещей с существующей ИТ-инфраструктурой в 2024 году) и отсутствие стандартизированных протоколов для всех устройств Интернета вещей (затрагивающее 50% развертываний) создают значительные препятствия для рынка безопасности Интернета вещей.

- Эти проблемы требуют значительных инвестиций в обеспечение взаимодействия и квалифицированный персонал, что увеличивает затраты организаций на развертывание.

- Например, в 2024 году 35% малых и средних предприятий назвали высокие затраты на интеграцию препятствием для внедрения решений по безопасности Интернета вещей.

- Эти проблемы могут препятствовать росту рынка, что требует разработки совместимых и экономически эффективных решений.

Сфера охвата рынка безопасности Интернета вещей (IoT)

Рынок сегментирован по принципу применения, типа продукта, технологии, типа увеличения, конечного пользователя и канала сбыта.

|

Сегментация |

Подсегментация |

|

По компонентам |

|

|

По типу безопасности |

|

|

По отраслям конечного использования |

|

Ожидается, что к 2025 году сегмент решений будет доминировать на рынке, занимая наибольшую долю в сегменте компонентов.

Ожидается, что сегмент решений будет доминировать на рынке безопасности Интернета вещей с наибольшей долей в 59,48% в 2025 году благодаря росту киберугроз, соблюдению нормативных требований и спросу на обнаружение угроз в режиме реального времени. Резкий рост числа подключенных устройств в различных отраслях увеличил количество возможных направлений атак, побуждая организации инвестировать в надежные решения безопасности. Достижения в области анализа угроз на основе ИИ и защиты конечных точек дополнительно стимулируют внедрение решений на предприятиях и в проектах интеллектуальной инфраструктуры .

Ожидается, что сегмент «Умный дом» займет наибольшую долю на рынке конечных пользователей в течение прогнозируемого периода.

Ожидается, что в 2025 году сегмент «Умный дом» будет доминировать на рынке, занимая наибольшую долю в 48,67% благодаря росту внедрения подключенных устройств, таких как умные колонки, камеры и термостаты. Растущая обеспокоенность по поводу конфиденциальности, утечек данных и уязвимостей домашних сетей привела к увеличению спроса на комплексные системы безопасности Интернета вещей. Повышение осведомленности потребителей в сочетании с интеграцией автоматизированных протоколов безопасности дополнительно стимулирует рост этого сегмента .

Региональный анализ рынка безопасности Интернета вещей (IoT)

«Северная Америка занимает самую большую долю на рынке безопасности Интернета вещей (IoT)»

- Северная Америка доминирует на рынке безопасности Интернета вещей (IoT), чему способствует раннее внедрение технологий IoT в таких отраслях, как производство, здравоохранение и умные города.

- США лидируют в регионе по таким показателям, как сильный Закон об улучшении кибербезопасности Интернета вещей, росту числа кибератак и значительным инвестициям в инфраструктуру кибербезопасности.

- В регионе размещены штаб-квартиры таких крупных игроков рынка, как Cisco, IBM и Palo Alto Networks, что ускоряет внедрение инноваций в области обнаружения и предотвращения угроз.

- Наличие передовых цифровых экосистем и растущее использование интеллектуальных устройств в потребительских и промышленных средах продолжают подпитывать спрос на надежные решения по безопасности Интернета вещей.

«Прогнозируется, что в Азиатско-Тихоокеанском регионе будет зафиксирован самый высокий среднегодовой темп роста рынка безопасности Интернета вещей (IoT)»

- Ожидается, что Азиатско-Тихоокеанский регион станет свидетелем самых высоких темпов роста рынка безопасности Интернета вещей, чему будут способствовать правительственные инициативы по цифровой трансформации и быстрое расширение экосистем Интернета вещей в таких секторах, как энергетика, производство и транспорт.

- Такие страны, как Китай, Индия и Южная Корея, вносят ключевой вклад благодаря масштабному развертыванию Интернета вещей, развитию умных городов и повышению осведомленности о киберуязвимости.

- Япония, с ее технически подкованным населением и регулирующим акцентом на стандарты безопасности Интернета вещей, стимулирует спрос на передовые фреймворки безопасности и защищенные системы аутентификации устройств.

- Растущее внедрение сетей 5G и увеличение проникновения подключенных устройств стимулируют как государственные, так и частные инвестиции в инфраструктуру безопасности Интернета вещей по всему региону.

Доля рынка безопасности Интернета вещей (IoT)

В разделе «Конкурентная среда рынка» представлена подробная информация по конкурентам. В неё включены сведения о компании, её финансовые показатели, полученная выручка, рыночный потенциал, инвестиции в исследования и разработки, новые рыночные инициативы, глобальное присутствие, производственные площадки и объекты, производственные мощности, сильные и слабые стороны компании, запуск продукта, широта и разнообразие продуктов, доминирующие области применения. Представленные выше данные относятся только к рыночным интересам компаний.

Основными лидерами рынка, работающими на рынке, являются:

- Cisco Systems, Inc. (США)

- Корпорация IBM (США)

- Корпорация Microsoft (США)

- Amazon Web Services, Inc. (США)

- Корпорация Intel (США)

- Check Point Software Technologies Ltd. (Израиль)

- Fortinet, Inc. (США)

- Palo Alto Networks, Inc. (США)

- Broadcom Inc. (Symantec Corporation) (США)

- Trend Micro Inc. (Япония)

Последние разработки на мировом рынке безопасности Интернета вещей (IoT)

- В октябре 2024 года BlackBerry объявила о намерении изучить возможности развития своего бизнеса Cylance, стремясь перенаправить инвестиции в прибыльные секторы безопасных коммуникаций и Интернета вещей. Этот стратегический шаг подчёркивает стремление компании использовать возможности роста в сфере безопасности Интернета вещей.

- В январе 2025 года правительство США запустило программу маркировки Cyber Trust Mark, призванную помочь потребителям определить устройства для умного дома, соответствующие установленным стандартам кибербезопасности. Эта инициатива направлена на повышение доверия потребителей и поощрение производителей уделять первостепенное внимание безопасности при разработке устройств Интернета вещей.

- В январе 2023 года компания PTC приобрела ServiceMax, усилив свой портфель решений по безопасности Интернета вещей за счет интеграции управления выездным обслуживанием с передовой аналитикой Интернета вещей и дополненной реальностью.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.