Global Liquid Chromatography Devices Market

Размер рынка в млрд долларов США

CAGR :

%

USD

4.22 Billion

USD

5.73 Billion

2024

2032

USD

4.22 Billion

USD

5.73 Billion

2024

2032

| 2025 –2032 | |

| USD 4.22 Billion | |

| USD 5.73 Billion | |

|

|

|

|

Global Liquid Chromatography Devices Market Segmentation, By Technique (High Performance Liquid Chromatography (HPLC), Ultra High Pressure Liquid Chromatography (UHPLC), Low Pressure Liquid Chromatography (LPLC), Fast Protein Liquid Chromatography (FPLC), and Others), Type (Instruments and Consumables and Services), Accessories (Columns, Auto-Sampler Accessories, and Others), Application (Pharma and Bio, Public, Industry, and Others), End-User (Pharmaceutical Companies, Academics and Research Institutes, Hospitals, Agriculture Industry, and Others)- Industry Trends and Forecast to 2032

Liquid Chromatography Devices Market Size

- The global liquid chromatography devices market size was valued atUSD 4.22 billion in 2024and is expected to reachUSD 5.73 billion by 2032, at aCAGR of 3.90%during the forecast period

- This growth is driven by factors such as the increasing demand for analytical testing across pharmaceuticals, biotechnology, food safety, and environmental monitoring sectors, advancements in chromatography technologies

Liquid Chromatography Devices Market Analysis

- The term "liquid chromatography" basically refers to a chromatographic technique for separating ions or molecules that are dissolved in a solvent.

- It entails the separation of biomolecules based on their size, type, and other characteristics, and it necessitates the use of stationary phase, mobile phase, and elutants to complete the separation technique

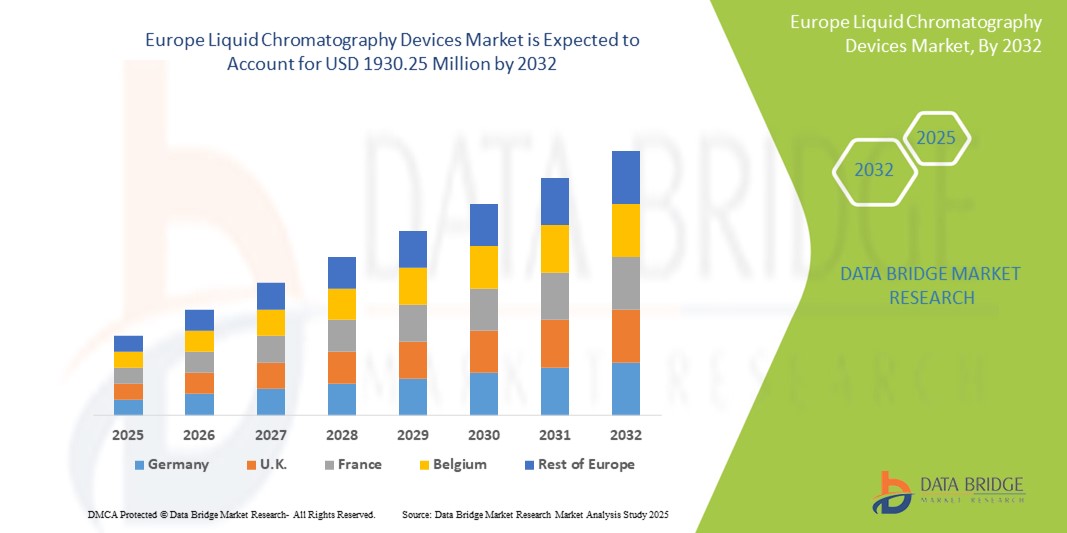

- North America is expected to dominate the liquid chromatography devices market with 32.3% due to rapid expansion of the pharmaceutical industry, substantial investment in research and development, and the rising demand for clinical diagnostic applications

- Asia-pacific is expected to be the fastest growing region in the liquid chromatography devices market during the forecast period due to significant innovations in healthcare infrastructure and technology

- Instruments segment is expected to dominate the market with a market share of 48.7% due to increasing dominance of integrated HPLC systems and the availability of advanced detectors. Manufacturers in this sector concentrate on developing systems that provide enhanced productivity and application specificity

Report Scope and Liquid Chromatography Devices Market Segmentation

|

Attributes |

Liquid Chromatography Devices KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Liquid Chromatography Devices Market Trends

“Advancements in Chromatography Technologies”

- The development of compact, automated liquid chromatography systems is enhancing throughput and efficiency, making them suitable for point-of-care diagnostics and field applications

- Combining liquid chromatography with mass spectrometry (LC-MS) is providing higher sensitivity and specificity in complex sample analyses, particularly in proteomics and metabolomics

- UHPLC systems offer faster analysis times and improved resolution, catering to the increasing demand for rapid and detailed analytical results in pharmaceutical and clinical research

- The incorporation of AI and ML algorithms in chromatography systems is enabling real-time data analysis and predictive maintenance, thereby enhancing operational efficiency

- Emerging portable chromatography devices are facilitating on-site testing in environmental monitoring and food safety applications, expanding the reach of analytical capabilities

Liquid Chromatography Devices Market Dynamics

Driver

“Increasing Demand in Pharmaceuticals and Biotechnology”

- Significant investments in pharmaceutical and biotechnology research are driving the need for advanced analytical tools such as liquid chromatography to support drug discovery and development

- Stringent regulatory requirements for drug purity and quality control are necessitating the use of reliable and precise analytical techniques such as liquid chromatography

- The rise of personalized medicine approaches is increasing the demand for detailed biomarker analysis, where liquid chromatography plays a crucial role

- The growing biopharmaceutical sector requires robust analytical methods for the characterization and quality assurance of biologics, further propelling the adoption of liquid chromatography

- International health organizations' focus on combating diseases is leading to increased funding for research, thereby boosting the need for advanced analytical instrumentation

Opportunity

“Expansion into Emerging Markets and Applications”

- Rapid industrialization and healthcare infrastructure development in emerging economies are creating new markets for liquid chromatography devices

- Growing concerns over environmental pollution are driving the need for advanced analytical tools to detect contaminants, where liquid chromatography is extensively used

- Increasing consumer awareness and regulatory pressures are pushing the food industry to adopt liquid chromatography for quality assurance and safety testing

- The application of liquid chromatography in forensic investigations is expanding, offering opportunities for market growth in legal and criminal analysis

- The need for pesticide residue analysis and quality control in agriculture is fostering the adoption of liquid chromatography techniques in the agricultural sector

Restraint/Challenge

“High Costs and Operational Complexity”

- The high initial investment and ongoing maintenance expenses associated with liquid chromatography systems can be prohibitive for smaller laboratories and institutions

- Operating and maintaining liquid chromatography systems require specialized training and expertise, which may not be readily available, especially in developing regions

- The intricate nature of chromatographic techniques necessitates meticulous method development and validation, which can be time-consuming and resource-intensive

- Adhering to stringent regulatory standards and ensuring consistent performance across diverse applications can pose significant challenges for manufacturers and users

- The availability and adoption of alternative analytical methods, such as mass spectrometry and gas chromatography, may limit the growth prospects of the liquid chromatography market

Liquid Chromatography Devices Market Scope

The market is segmented on the basis of technique, type, accessories, application, and end-user

|

Segmentation |

Sub-Segmentation |

|

By Technique |

|

|

By Type |

|

|

By Accessories |

|

|

By Application |

|

|

By End-User |

|

In 2025, the instrument is projected to dominate the market with a largest share in type segment

The instruments segment is expected to dominate the liquid chromatography devices market with the largest share of 48.7% in 2025 due to increasing dominance of integrated HPLC systems and the availability of advanced detectors. Manufacturers in this sector concentrate on developing systems that provide enhanced productivity and application specificity

Thepharmaceutical Companiesis expected to account for the largest share during the forecast period in end-user market

In 2025, the pharmaceutical Companies segment is expected to dominate the market with the largest market share of 41.4% due to within these companies, HPLC methods are employed for various applications, including quality control, drug purity determination, characterization of drug candidates, and evaluation of the stability of active ingredients in pharmaceuticals.

Liquid Chromatography Devices Market Regional Analysis

“North America Holds the Largest Share in the Liquid Chromatography Devices Market”

- North America holds a substantial market share of approximately 32.3% in the global liquid chromatography devices market

- This dominance is attributed to the region's advanced healthcare infrastructure, leading pharmaceutical and biotechnology sectors, and significant R&D investments

- The presence of major market players in the U.S., such as Thermo Fisher Scientific and Waters Corporation, contributes to continuous innovations in chromatography technologies, enhancing the region's leadership position

- Stringent regulatory requirements and a strong focus on analytical testing, particularly in the pharmaceutical and environmental sectors, drive the demand for liquid chromatography devices in North America

- The U.S. boasts an extensive network of research institutions and high adoption rates of advanced LC technologies in drug development, clinical research, and quality control, further reinforcing its dominance

“Asia-Pacific is Projected to Register the HighestCAGR in the Liquid Chromatography Devices Market”

- Asia Pacific is the fastest-growing region in the liquid chromatography devices market,

- Countries such as China, India, Japan, and South Korea have witnessed significant development in their pharmaceutical, biologics, and chemicals sectors, driving the demand for chromatography instruments, consumables, and services

- Governments in Asian countries have prioritized the development of domestic healthcare industries through incentives and initiatives aimed at boosting manufacturing and R&D capabilities

- The rise of contract research and manufacturing organizations (CRMO) in the region has attracted business from global pharmaceutical companies, further boosting regional chromatography usage

- The Asia Pacific region is projected to maintain rapid growth during the forecast period, with significant demand from drug discovery, clinical research, and environmental testing

Liquid Chromatography Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Gilson Incorporated(U.S)

- Phenomenex Inc.,(U.S)

- Waters Corporation(U.S)

- Shimadzu Corporation(Japan)

- Tosoh Bioscience(Japan)

- Thermo Fisher Scientific. (U.S)

- Hitachi Ltd., (Japan)

- PerkinElmer, Inc. (U.S)

- General Electric Company (U.S)

- Merck KGaA (Germany)

- Bio-Rad Laboratories, Inc. (U.S)

- B.D. (U.S)

- Bio-Rad Laboratories, Inc. (U.S)

- Showa Denko K.K (Japan)

- JASCO (U.S)

- SIELC Technologies (U.S)

- Orochem Technologies Inc. (U.S.)

- YMC Co. Ltd. (Japan)

- Restek Corporation (U.S.)

- Trajan Scientific (Australia)

- Hamilton Company (U.S)

Latest Developments in Liquid Chromatography Devices Market

- In April 2024,Waters Corporationhas introduced the Alliance iS Bio HPLC System, designed to tackle the operational and analytical challenges faced by biopharma quality control (QC) laboratories. This innovative HPLC system integrates advanced bio-separation technology with built-in instrument intelligence features, aimed at enhancing efficiency for biopharma QC analysts

- In April 2022,Shimadzu unveiledLabSolutions MD software, which aids in the creation of analytical methods for high-performance liquid chromatography (HPLC). The program allows automated column and solvent screening and provides capabilities for established technique scouting

- In August 2021, anultra-highperformance liquid chromatography (UHPLC) and automated high performance liquid chromatography (HPLC) method development system was introduced by Thermo Fisher Scientific and ChromSword as a result of their collaboration. This system allows chromatographers to deliver robust and validated methods with greater assurance and in less time

- In February 2021,Shimadzu Corporation'slaunch of the new i-Series LC-2050/LC-2060 integrated HPLC systems. These systems feature high-speed sampling capabilities and minimal carryover, making them suitable for quality control applications

- In November 2020, PerkinElmer Inc.introduced a novel HPLC, UHPLC, and software solution, LC 300TM platform and Simplicity ChromTM software

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.