Global Nylon 6 And Nylon 66 Market

Размер рынка в млрд долларов США

CAGR :

%

USD

12.56 Billion

USD

20.48 Billion

2025

2033

USD

12.56 Billion

USD

20.48 Billion

2025

2033

| 2026 –2033 | |

| USD 12.56 Billion | |

| USD 20.48 Billion | |

|

|

|

|

Global Nylon 6 and Nylon 66 Market Segmentation, By Product Type (Nylon 6 (PA6) (Fiber Grade & Resin Grade) and Nylon 66 (PA66) (Fiber Grade & Resin Grade)), Application (Automotive, Engineering Plastics, Electronics & Electrical, Textiles, Consumer Goods, and Others) - Industry Trends and Forecast to 2033

What is the Global Nylon 6 and Nylon 66 Market Size and Growth Rate?

- The global Nylon 6 and Nylon 66 market size was valued at USD 12.56 billion in 2025 and is expected to reach USD 20.48 billion by 2033, at a CAGR of 6.30% during the forecast period

- Increasing demand for Nylon 6 and Nylon 66 from manufacturers across automotive, textile, and electrical & electronics sectors is driving market growth. Rising industrialization, urbanization, and adoption of high-performance polymers in lightweight and durable applications further support market expansion

- Growing preference for advanced engineering plastics with high mechanical strength, thermal resistance, and chemical stability is boosting Nylon 6 and Nylon 66 adoption in high-performance applications such as automotive components, industrial machinery, and consumer electronics

What are the Major Takeaways of Nylon 6 and Nylon 66 Market?

- Rising awareness of product performance advantages, increasing demand for lightweight and durable components, and technological advancements in polymer processing are positively influencing market growth. Innovations in reinforced and blended Nylon 6 and Nylon 66 grades offer new opportunities for manufacturers

- High production costs, volatility in raw material prices, and competition from alternative polymers such as polypropylene, polyethylene, and bioplastics may limit market adoption. Limited awareness of specialized high-performance grades among smaller manufacturers also presents a challenge

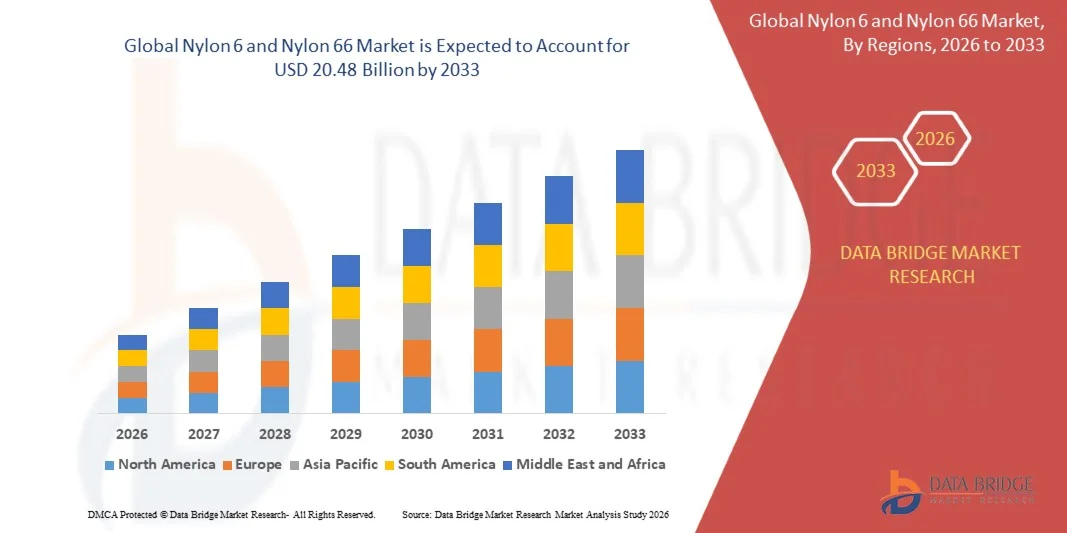

- North America dominated the Nylon 6 and Nylon 66 market with a 38.2% revenue share in 2025, supported by strong demand for high-performance polymers across automotive, electronics, and industrial applications in the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.87% from 2026 to 2033, driven by rapid industrialization, growing automotive and electronics production, and rising demand for engineering plastics in China, Japan, India, and South Korea

- The Nylon 6 (PA6) segment dominated the market with a revenue share of 55.8% in 2025, driven by its versatile properties such as high tensile strength, excellent abrasion resistance, and cost-effective production

Report Scope and Nylon 6 and Nylon 66 Market Segmentation

|

Attributes |

Nylon 6 and Nylon 66 Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Nylon 6 and Nylon 66 Market?

“Rising Demand for High-Performance, Sustainable, and Multi-Functional Nylon 6 and Nylon 66”

- The Nylon 6 and Nylon 66 market is witnessing strong growth driven by high-performance, lightweight, and multifunctional polymers used across automotive, electrical, electronics, and industrial applications. Increasing demand for durable, heat-resistant, and chemical-resistant materials is accelerating adoption

- Manufacturers are introducing advanced polymer blends, reinforced fibers, and engineered compounds to enhance mechanical strength, thermal stability, and corrosion resistance in automotive components, electrical housings, and industrial machinery

- Consumers and industries are increasingly prioritizing eco-friendly, recyclable, and bio-based Nylon 6 and Nylon 66 solutions to meet sustainability goals and regulatory compliance

- For instance, companies such as Toray Industries, BASF, SABIC, Huntsman, and Lanxess are expanding their product portfolios with high-performance and lightweight nylon solutions tailored for automotive, electronics, and industrial applications

- Rising awareness of sustainability, energy efficiency, and lightweight material adoption in automotive and industrial sectors is accelerating global market growth

- As industries continue seeking high-strength, versatile, and environmentally friendly nylon solutions, Nylon 6 and Nylon 66 are expected to remain central to innovation across global industrial and engineering applications

What are the Key Drivers of Nylon 6 and Nylon 66 Market?

- Rising demand for high-performance, lightweight, and durable polymers in automotive, electrical, electronics, and industrial applications is driving strong adoption globally

- For instance, in 2025, BASF, Toray Industries, SABIC, Mitsubishi Chemical, and Huntsman expanded their high-performance nylon product lines for automotive under-the-hood components, electrical connectors, and industrial machinery

- Growth in automotive lightweighting initiatives, increasing electric vehicle production, and rising industrial automation are boosting demand across North America, Europe, and Asia-Pacific

- Advancements in polymer synthesis, reinforced fibers, and engineering compounds have improved thermal resistance, mechanical strength, and chemical durability

- Rising interest in bio-based, recyclable, and sustainable nylons supports adoption, aligned with regulatory standards and consumer preference for eco-friendly industrial materials

- With ongoing R&D investments, strategic partnerships, and product innovations, the Nylon 6 and Nylon 66 market is expected to maintain strong growth over the coming years

Which Factor is Challenging the Growth of the Nylon 6 and Nylon 66 Market?

- High raw material and production costs of high-performance nylon polymers restrict affordability in price-sensitive regions

- For instance, during 2024–2025, fluctuations in caprolactam and hexamethylene diamine supply and energy costs impacted production volumes for multiple manufacturers

- Strict environmental, safety, and chemical compliance regulations increase operational and production complexities

- Limited awareness of bio-based or sustainable nylon alternatives in emerging markets restricts widespread adoption

- Intense competition from alternative polymers such as polypropylene, PET, and PBT creates pressure on pricing and product differentiation

- To overcome these challenges, companies are focusing on cost-efficient production, scalable bio-based solutions, regulatory compliance, and market education to expand global adoption of high-quality Nylon 6 and Nylon 66 products

How is the Nylon 6 and Nylon 66 Market Segmented?

The market is segmented on the basis of product type and application.

• By Product Type

On the basis of product type, the Nylon 6 and Nylon 66 market is segmented into Nylon 6 (PA6) and Nylon 66 (PA66), each further categorized into Fiber Grade and Resin Grade. The Nylon 6 (PA6) segment dominated the market with a revenue share of 55.8% in 2025, driven by its versatile properties such as high tensile strength, excellent abrasion resistance, and cost-effective production. PA6 fiber and resin grades are widely used in automotive components, industrial machinery, and consumer goods due to easy processing, durability, and thermal stability. The Resin Grade PA6 is preferred for molded components and engineering plastics, while Fiber Grade supports textiles and high-strength applications.

The Nylon 66 (PA66) segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for high-performance materials in automotive under-the-hood parts, electrical connectors, and industrial machinery where higher temperature resistance, stiffness, and chemical durability are critical.

• By Application

On the basis of application, the Nylon 6 and Nylon 66 market is segmented into Automotive, Engineering Plastics, Electronics & Electrical, Textiles, Consumer Goods, and Others. The Automotive segment dominated the market with a revenue share of 48.9% in 2025, driven by the growing adoption of lightweight, high-strength polymers for under-the-hood components, fuel systems, and structural parts.

The Engineering Plastics segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for durable, heat-resistant, and chemically stable materials in industrial machinery, electrical housings, and precision engineering components. Rising automotive production, expanding electronics manufacturing, and growing industrial automation globally are boosting adoption across these applications. Nylon 6 and Nylon 66 are favored for their mechanical strength, thermal stability, chemical resistance, and versatility, ensuring sustained growth across automotive, engineering, and high-performance industrial sectors.

Which Region Holds the Largest Share of the Nylon 6 and Nylon 66 Market?

- North America dominated the Nylon 6 and Nylon 66 market with a 38.2% revenue share in 2025, supported by strong demand for high-performance polymers across automotive, electronics, and industrial applications in the U.S. and Canada. Rising industrialization, adoption of lightweight engineering plastics, and increasing focus on sustainable and recyclable materials drive widespread market penetration

- Leading manufacturers are expanding their PA6 and PA66 portfolios through innovations in high-strength fibers, high-temperature resins, and reinforced composites to meet automotive and electronics sector requirements. Regulatory incentives for sustainable materials and stringent quality standards further strengthen market leadership

- High industrial output, advanced manufacturing infrastructure, and strong adoption of engineering plastics in North America fuel continued regional growth

U.S. Nylon 6 and Nylon 66 Market Insight

The U.S. is the largest contributor in North America, driven by robust automotive and electronics manufacturing. Manufacturers are investing in PA6 and PA66 resins and fiber grades with enhanced thermal, mechanical, and chemical resistance to support automotive under-the-hood components, electrical housings, and high-performance industrial parts. Strong R&D capabilities, established supply chains, and advanced production technologies continue to support market expansion.

Canada Nylon 6 and Nylon 66 Market Insight

Canada contributes significantly to regional growth, supported by the rising demand for high-performance engineering plastics in automotive, aerospace, and electronics sectors. Manufacturers are adopting innovative PA6 and PA66 grades to improve durability, chemical resistance, and heat tolerance. Expansion of sustainable production processes and government support for industrial polymer adoption further strengthens the market.

Asia-Pacific Nylon 6 and Nylon 66 Market Insight

Asia-Pacific is projected to register the fastest CAGR of 8.87% from 2026 to 2033, driven by rapid industrialization, growing automotive and electronics production, and rising demand for engineering plastics in China, Japan, India, and South Korea. Rising disposable incomes, urbanization, and increased adoption of lightweight, high-strength polymers accelerate consumption across automotive, electronics, and industrial applications.

China Nylon 6 and Nylon 66 Market Insight

China is the largest contributor to Asia-Pacific, supported by substantial polymer production infrastructure and strong adoption in automotive, electronics, and textiles. Manufacturers are investing heavily in high-performance PA6 and PA66 grades with reinforced, flame-retardant, and temperature-resistant properties, strengthening both domestic consumption and export capacity.

Japan Nylon 6 and Nylon 66 Market Insight

Japan shows steady growth, driven by high demand for PA66 and PA6 in automotive, electronics, and precision engineering applications. Innovations in fiber and resin grades for heat resistance, mechanical strength, and chemical stability continue to attract industrial manufacturers. Strong regulatory frameworks and advanced manufacturing infrastructure support market adoption.

India Nylon 6 and Nylon 66 Market Insight

India is emerging as a key growth market, fueled by rising industrialization, expanding automotive and electronics production, and increasing preference for engineering plastics over metals. Demand for high-performance PA6 and PA66 in industrial machinery, consumer goods, and infrastructure is growing. Expansion of polymer manufacturing facilities and government incentives for industrial polymer adoption support rapid market penetration.

South Korea Nylon 6 and Nylon 66 Market Insight

South Korea contributes significantly due to increasing automotive production, electronics manufacturing, and industrial automation. Rising adoption of PA6 and PA66 for high-strength, temperature-resistant, and lightweight components supports growth. Innovation in reinforced, specialty polymer grades and focus on sustainable production enhance market expansion across automotive, electronics, and industrial sectors.

Which are the Top Companies in Nylon 6 and Nylon 66 Market?

The Nylon 6 and Nylon 66 industry is primarily led by well-established companies, including:

- Toray Industries Inc. (Japan)

- BASF SE (Germany)

- SABIC (Saudi Arabia)

- Mitsubishi Chemical Holdings Corporation (Japan)

- Huntsman Corporation (U.S.)

- LG Chem (South Korea)

- Lanxess AG (Germany)

- Evonik Industries AG (Germany)

- Royal DSM N.V. (Netherlands)

- Mitsui Chemicals Inc. (Japan)

- Cordura (U.S.)

- Ascend Performance Materials (U.S.)

- RadiciGroup (Italy)

- Dow, Inc. (U.S.)

- Solvay S.A. (Belgium)

- EMS-Chemie Holding AG (Switzerland)

- Asahi Kasei Corporation (Japan)

- Formosa Plastics Corporation (Taiwan)

What are the Recent Developments in Global Nylon 6 and Nylon 66 Market?

- In March 2025, BASF announced the launch of the world’s first commercial loopamid® plant, with the production facility at the Caojing site in Shanghai, China, having an annual capacity of 500 metric tons, marking a significant step toward supplying sustainable products for the textile industry, and strengthening the company’s commitment to eco-friendly polymer solutions

- In February 2025, Toray Industries, Inc., revealed a breakthrough in recycling Nylon 66, deploying a proprietary depolymerization technology using subcritical water to uniformly and efficiently depolymerize the resin within minutes and recover it as raw monomer material, highlighting the company’s focus on sustainable production and circular economy initiatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.