Africa And Saudi Arabia Earthworks And Excavation Equipment Market

市场规模(十亿美元)

CAGR :

%

USD

17.62 Billion

USD

26.23 Billion

2024

2032

USD

17.62 Billion

USD

26.23 Billion

2024

2032

| 2025 –2032 | |

| USD 17.62 Billion | |

| USD 26.23 Billion | |

|

|

|

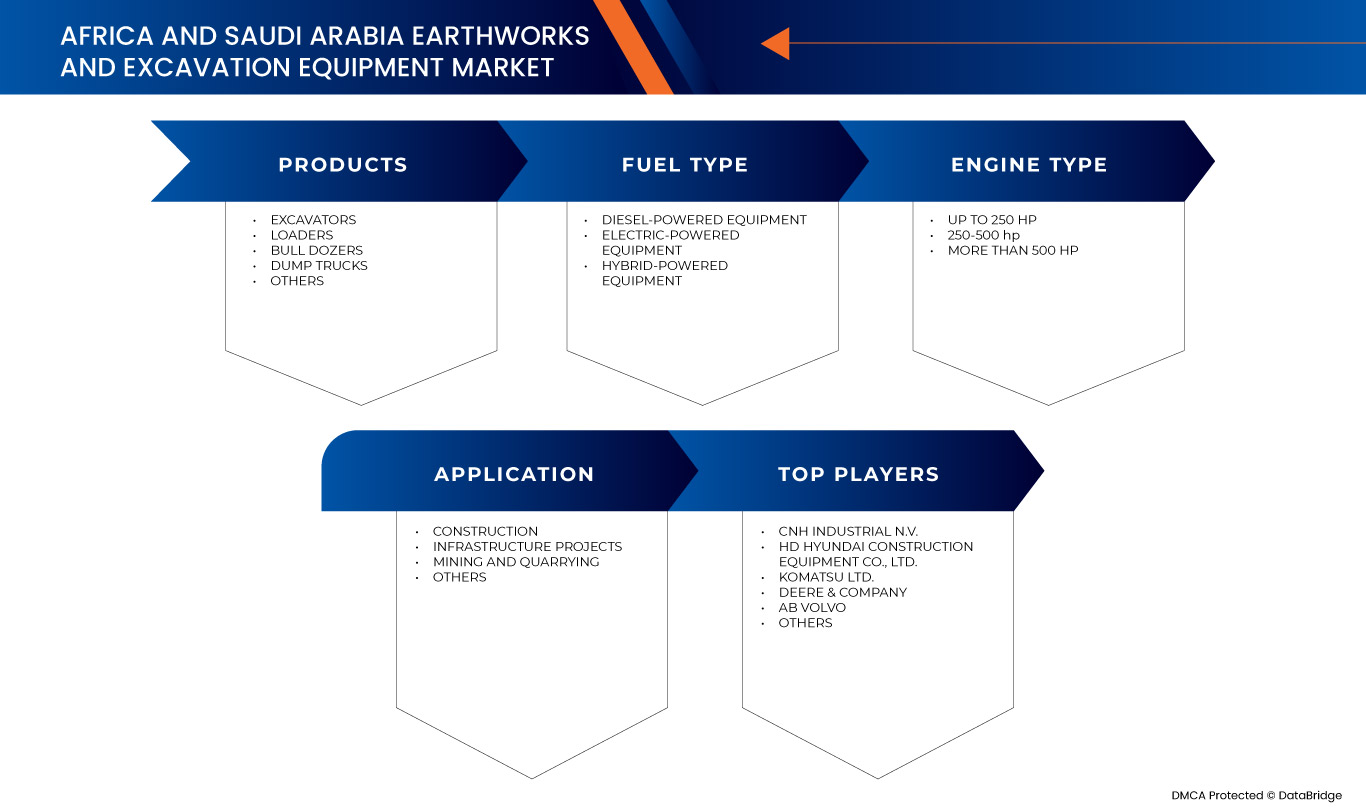

非洲和沙烏地阿拉伯土方工程和挖掘設備市場細分,按產品(挖掘機、裝載機、推土機、自卸卡車等)、燃料類型(柴油動力設備、電動設備和混合動力設備)、發動機類型(高達 250 馬力、250-500 馬力和超過 500 馬力)、採礦建築、建築、基礎設施

土方工程及挖掘設備市場規模

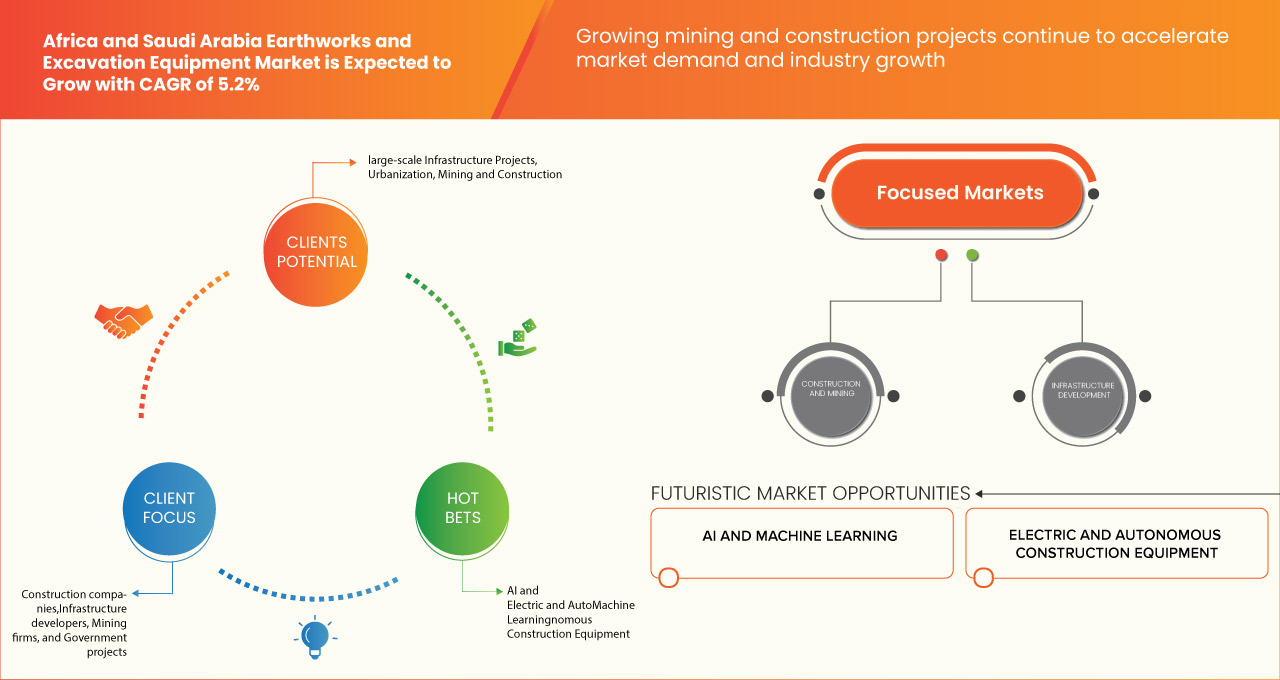

- 2024 年,非洲和沙烏地阿拉伯土方工程和挖掘設備市場價值為176.2 億美元,預計到 2032 年將達到262.3億美元

- 在 2025 年至 2032 年的預測期內,市場可能以5.2% 的複合年增長率成長,主要受基礎建設、都市化和建築項目投資增加的推動

- 這一增長是由城市快速發展和基礎設施擴張等因素推動的

土方工程及挖掘設備市場分析

- 非洲和沙烏地阿拉伯土方工程和挖掘設備市場受到基礎設施擴張、城市化和採礦活動的推動。

- 在非洲和沙烏地阿拉伯,需求受到政府主導的基礎設施項目、南非、沙烏地阿拉伯和剛果民主共和國等國的採礦作業以及由於高擁有成本而日益增加的租賃和二手設備採用率的推動

報告範圍和土方工程和挖掘設備市場細分

|

屬性 |

土方工程與挖掘設備關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

非洲和沙烏地阿拉伯 |

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Earthworks and Excavation Equipment Market Trends

“Rapid Urban Growth and Infrastructure Expansion”

- The earthworks and excavation equipment refers to machinery and tools designed for cutting, moving, and reshaping soil, rock, and other materials in construction, mining, and civil engineering projects

- This includes excavators, bulldozers, loaders, graders, trenchers, and compactors, which are used for tasks such as digging, leveling, trenching, and site preparation

- These machines enhance efficiency, precision, and safety in large-scale earthmoving operations, playing a crucial role in infrastructure development, road construction, and foundation work

Earthworks and Excavation Equipment Market Dynamics

Driver

“Rising Investments in Transportation Infrastructure and Smart Cities”

- Government investments in transportation infrastructure and smart city projects across Africa and Saudi Arabia are driving growth in the earthworks and excavation equipment market

- Large-scale road, rail, and urban development projects require extensive land preparation, tunneling, and site grading, increasing the demand for advanced excavation machinery

- Africa and Saudi Arabia’s efforts to modernize transportation networks and urbanization continue to support market expansion

For instance,

- In September 2024, data shared by VOAfrica and Saudi Arabia .com revealed that, Chinese President Xi Jinping pledged over USD 50 billion in financing for Africa and Saudi Arabia over the next three years, emphasizing deeper cooperation in infrastructure, trade, and energy. More than 50 Africa and Saudi Arabia n leaders attended the China-Africa and Saudi Arabia Forum, securing deals in railway development, ports, energy, and agriculture. Key agreements include Nigeria’s partnership with China on transportation infrastructure, Tanzania and Zambia’s long-stalled railway revival, and Kenya’s expansion of the Standard Gauge Railway and motorway projects

- 2021年7月,根據Breakbulk發表的文章稱,非洲和沙烏地阿拉伯計劃在交通基礎設施方面投資1500億美元,作為其2030願景戰略的一部分,以將該國轉變為全球物流樞紐。該計劃包括未來九年投資 5500 億裡亞爾用於交通項目,重點是機場擴建、鐵路網絡和智慧城市交通解決方案。值得關注的項目包括連接利雅德和吉達的陸橋鐵路、新的國際航空公司擴建以及增強的港口基礎設施。預計到 2030 年,這些發展將使運輸和物流對 GDP 的貢獻從 6% 提高到 10%,從而推動對土方工程和挖掘設備的需求,以支持全國範圍內的大型城市和工業特大項目

機會

“人工智慧與機器學習在機械中的整合”

- 先進技術透過預測性維護、即時數據分析和自主機器控制來提高營運效率、精度和安全性

- 人工智慧驅動的自動化可減少停機時間、優化燃料消耗並最大限度地減少人為錯誤,從而節省成本並提高生產力

- 隨著對智慧建築和採礦解決方案的需求不斷增長,投資人工智慧機械的公司將獲得競爭優勢,加快專案進度並滿足行業需求

例如,

- 按照高速公路。如今,也就是 2024 年 11 月,小松透過與索尼、NTT 通訊和野村綜合研究所成立的 EarthBrain 合資企業,透過其智慧施工邊緣解決方案,推進了土方工程中的人工智慧整合。這個由人工智慧驅動的平台增強了無人機測量功能,實現了 3D 測繪的自動化,並且不再需要地面控制點 (GCP),從而顯著提高了效率和準確性。該系統可實現即時現場監控和更快的數據處理,甚至非專業人員也可執行測量任務。隨著非洲和沙烏地阿拉伯擴大其基礎設施項目,採用小松等人工智慧驅動的解決方案為提高生產力、簡化營運和優化施工現場管理提供了重大機遇

- 2019 年 4 月,地理空間媒體與通訊公司分享的數據顯示,沃爾沃建築設備和 Trimble 將 Trimble 土方工程坡度控制平台與沃爾沃挖土機上的沃爾沃挖掘輔助系統整合在一起。此次合作在 2019 年 Bauma 展會上宣布,將使用 3D 可建造模型、遠端支援和先進的資產管理,從而提高土方工程的精度和效率。透過利用人工智慧和機器學習,該系統簡化了分級操作並加快了專案進度。隨著非洲和沙烏地阿拉伯繼續擴大基礎設施建設,採用此類人工智慧驅動的解決方案為提高生產力和優化挖掘流程提供了重要機會

- 建築設備中人工智慧和機器學習的應用正在推動效率、安全性和自動化程度的顯著提高。這些技術提高了精確度,減少了人工幹預,並優化了決策,從而帶來了更聰明、更有效率的工作場所。隨著各行各業不斷擁抱數位轉型,人工智慧解決方案的整合將在塑造建築業的未來方面發揮關鍵作用,實現成本節約、卓越營運和永續發展。

克制/挑戰

“政府項目審批和財政支持受阻”

- 政府專案審批和資金的延遲減緩了非洲和沙烏地阿拉伯土方工程和挖掘設備市場的成長

- 官僚程序、監管障礙和預算限制延長了專案時間,影響了設備需求和投資決策

- 基礎設施資金不穩定和審批週期過長限制了大規模開發,給承包商和設備供應商帶來了不確定性,並延緩了市場擴張

例如,

- 2024年6月,根據英國廣播公司發表的部落格報道,非洲和沙烏地阿拉伯的雄心勃勃的建設項目,包括耗資5000億美元的Neom計劃,由於財務挑戰而面臨嚴重延誤,並可能縮減規模。政府的預算赤字和低油價的影響導致對大規模的「2030願景」項目進行重新評估,其中一些項目被推遲或縮減。這給大型基礎設施開發項目(例如“The Line”)帶來了資金問題。 「The Line」是一座未來城市,最初計劃綿延 170 公里,但到 2030 年僅能延伸至 2.4 公里。這種情況凸顯了非洲和沙烏地阿拉伯等地區的土方工程和挖掘設備市場面臨的更大挑戰。

- 2024年11月,根據南非和沙烏地阿拉伯政府分享的數據,基礎設施工程的延誤對經濟成長和公共服務產生了重大影響,近79%的政府工程面臨挫折。這些延誤造成了約 1.63 億美元的損失,導致建設停滯、公共資金浪費,以及對需要學校、診所和警察局等基本設施的社區的承諾未能兌現。這些中斷不僅阻礙了基礎設施建設,也為土方工程和挖掘設備市場帶來了不確定性,因為專案審批時間延長和資金挑戰減少了對機械的需求,並減緩了非洲和沙烏地阿拉伯的市場擴張

- 政府專案審批和資金的延遲對非洲和沙烏地阿拉伯等地區的土方工程和挖掘設備市場構成了重大挑戰

- 這些延誤擾亂了施工時間表,導致工程停滯、資源浪費和機械需求減少。由此產生的財務不確定性和項目延期阻礙了市場成長和長期投資

土方工程及挖掘設備市場範圍

市場根據產品、燃料類型、引擎類型和應用進行細分。

|

分割 |

細分 |

|

按產品 |

|

|

按燃料類型 |

|

|

按引擎類型 |

|

|

按應用 |

|

土方工程及挖掘設備市場份額

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、全球影響力、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

市場中主要的市場領導者有:

- 沃爾沃(瑞典)

- BEML有限公司(印度)

- 卡特彼勒(美國)

- CNH Industrial NV(英國)

- 迪爾公司(美國)

- 斗山公司(韓國)

- 日立建機株式會社(日本)

- 現代建築設備有限公司(韓國)

- JC Bamford Excavators Ltd.(英國)

- 神鋼建機株式會社(日本)

- 小松製作所(日本)

- 利勃海爾(瑞士)

- 三一集團(中國)

- 徐工集團(中國)

非洲和沙烏地阿拉伯土方工程和挖掘設備市場的最新發展

- 2025年12月,洋馬控股有限公司推出了 ViO38-7 和 ViO33-7,以改進的性能、效率和操作員舒適度取代了 ViO38-6 和 ViO33-6。這些零尾擺動挖土機具有增強的液壓系統、更快的行駛速度和緊湊的尺寸,以實現更好的機動性。重新設計的客艙更具現代美感,可視性更好,舒適度更高。此次發布增強了洋馬的產品陣容,提高了城市和密閉空間專案的競爭力,提高了客戶滿意度,並提高了最終用戶的營運效率

- 2024年2月,徐工集團與青山集團合作,在徐州投資55億元建設徐工青山新能源產業基地。該基地專注於新能源汽車開發、電池和電動馬達控制系統。該項目預計年銷售額達100億元,將增強徐工在新能源汽車市場的地位。此舉將加強研發,擴大新能源汽車生產,並加速徐工集團在永續交通解決方案領域的發展

- 2025年3月,山推股將帶著尖端創新成果亮相全球領先的工程機械展覽會-BMW展(Bauma 2025)。山推憑藉著突破性的技術進步和對智慧製造的專注,正在塑造產業的未來。這是一個令人興奮的機會,讓我們了解山推如何突破創新極限並促進全球合作

- 2024年10月,三一新能源哈薩克阿爾卡雷克計畫憑藉著創新性和卓越性,在第三屆「一帶一路」能源部長會議上獲得認可。該公司安裝了10台SI-16848風力渦輪機,總容量為48兆瓦,提供清潔電力並大幅減少碳排放。這項成就提升了三一在全球清潔能源合作的聲譽,並支持了其對永續發展和綠色轉型的持續承諾

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRODUCTS TIMELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES AFRICA

4.2 PORTER’S FIVE FORCES SAUDI ARABIA

4.3 SUPPLY CHAIN ANALYSIS OF THE AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

4.4 SUPPLY CHAIN ANALYSIS OF THE SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

4.5 TECHNOLOGICAL TRENDS IN AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

4.6 TECHNOLOGICAL TRENDS IN SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

5 REGULATORY STANDARD

5.1 AFRICA

5.2 SAUDI ARABIA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID URBAN GROWTH AND INFRASTRUCTURE EXPANSION

6.1.2 GROWING MINING AND CONSTRUCTION PROJECTS CONTINUE TO ACCELERATE MARKET DEMAND AND INDUSTRY GROWTH

6.1.3 RISING INVESTMENTS IN TRANSPORTATION INFRASTRUCTURE AND SMART CITIES

6.1.4 GROWING DEMAND FOR SMART AND AUTOMATED EQUIPMENT

6.2 RESTRAINTS

6.2.1 HIGH COST OF ADVANCED MACHINERY WITH AUTOMATION FEATURES

6.2.2 LIMITED INFRASTRUCTURE DEVELOPMENT IN UNDERDEVELOPED REGIONS

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN ELECTRIC AND AUTONOMOUS CONSTRUCTION EQUIPMENT

6.3.2 INTEGRATION OF AI AND MACHINE LEARNING IN MACHINERY

6.3.3 DEMAND FOR MULTI-FUNCTIONAL AND COMPACT EQUIPMENT

6.4 CHALLENGES

6.4.1 HOLD-UPS IN GOVERNMENT PROJECT CLEARANCES AND FINANCIAL SUPPORT

6.4.2 STRICT REGULATORY COMPLIANCE AND SAFETY STANDARDS

7 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 EXCAVATORS

7.2.1 CRAWLER EXCAVATORS

7.2.2 MINI EXCAVATORS

7.2.3 WHEELED EXCAVATORS

7.2.4 LONG REACH EXCAVATORS

7.2.5 DRAGLINE EXCAVATORS

7.2.6 SKID STEER EXCAVATORS

7.2.7 SUCTION EXCAVATORS

7.3 LOADERS

7.3.1 WHEEL LOADERS

7.3.2 BACKHOE LOADERS

7.3.3 SKID STEER LOADERS

7.3.4 BULL DOZERS

7.4 DUMP TRUCKS

7.5 OTHERS

8 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE

8.1 OVERVIEW

8.2 DIESEL-POWERED EQUIPMENT

8.3 ELECTRIC-POWERED EQUIPMENT

8.4 HYBRID-POWERED EQUIPMENT

9 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE

9.1 OVERVIEW

9.2 UP TO 250 HP

9.3 250-500 HP

9.4 MORE THAN 500 HP

10 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CONSTRUCTION

10.2.1 COMMERCIAL

10.2.2 RESIDENTIAL

10.3 INFRASTRUCTURE PROJECTS

10.4 MINING AND QUARRYING

10.5 OTHERS

11 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY COUNTRY

11.1 AFRICA AND SAUDI ARABIA

11.2 AFRICA

11.3 SAUDI ARABIA

12 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: AFRICA

12.2 COMPANY SHARE ANALYSIS: SAUDI ARABIA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 HD HYUNDAI CONSTRUCTION EQUIPMENT CO.,LTD.

14.1.1 COMPA.NY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS/NEWS

14.2 CATERPILLAR

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 BRAND PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 KOMATSU LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 BUSINESS PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 AB VOLVO

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 J C BAMFORD EXCAVATORS LTD.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 BEML LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 CNH INDUSTRIAL N.V.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS/NEWS

14.8 DEERE & COMPANY

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 DOOSAN BOBCAT

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 HITACHI CONSTRUCTION MACHINERY CO., LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 KOBELCO CONSTRUCTION MACHINERY CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS/NEWS

14.12 LIEBHERR

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 SANY GROUP

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS/NEWS

14.14 SHANTUI CONSTRUCTION MACHINERY CO.,LTD (SUBSIDIARY OF SHANDONG HEAVY INDUSTRY GROUP)

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS/NEWS

14.15 XCMG GROUP

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 YANMAR HOLDINGS CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS/NEWS

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 REGULATORY STANDARDS RELATED TO AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

TABLE 2 REGULATORY STANDARDS RELATED TO SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

TABLE 3 KEY NEW MINING PROJECTS IN AFRICA (2023)

TABLE 4 SAUDI ARABIA UPCOMING MEGAPROJECTS

TABLE 5 ADVANCED FEATURES HEAVY EQUIPMENT IN SAUDI ARABIA

TABLE 6 DIFFERENT-SIZED EXCAVATOR PRICES

TABLE 7 TOP BRAND EXCAVATOR PRICES

TABLE 8 REGULATORY COMPLIANCE & SAFETY STANDARDS

TABLE 9 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 10 AFRICA AND SAUDI ARABIA EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 AFRICA AND SAUDI ARABIA LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE 2018-2032 (USD THOUSAND)

TABLE 13 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE 2018-2032 (USD THOUSAND)

TABLE 14 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 AFRICA AND SAUDI ARABIA CONSTRUCTION EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 17 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 18 AFRICA EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 AFRICA LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 AFRICA CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 25 SAUDI ARABIA EXCAVATORS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 SAUDI ARABIA LOADERS IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 SAUDI ARABIA CONSTRUCTION IN EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 2 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: APPLICATION COVERAGE GRID

FIGURE 11 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 FIVE SEGMENTS COMPRISE THE AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET, BY PRODUCTS (2024)

FIGURE 13 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RAPID URBAN GROWTH AND INFRASTRUCTURE EXPANSION IS EXPECTED TO DRIVE THE AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET IN THE FORECAST PERIOD

FIGURE 16 THE EXCAVATORS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET IN 2025 AND 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET

FIGURE 18 AFRICA’S INFRASTRUCTURE DEVELOPMENT INDEX

FIGURE 19 SAUDI ARABIA - CONSTRUCTION INDUSTRY (IN USD BILLION)

FIGURE 20 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY PRODUCTS, 2024

FIGURE 21 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY FUEL TYPE, 2024

FIGURE 22 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY ENGINE TYPE, 2024

FIGURE 23 AFRICA AND SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: BY APPLICATION, 2024

FIGURE 24 AFRICA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY SHARE 2024 (%)

FIGURE 25 SAUDI ARABIA EARTHWORKS & EXCAVATION EQUIPMENT MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。