Africa Pharmaceutical Molecules Market

市场规模(十亿美元)

CAGR :

%

USD

13,480.00 Million

USD

26,715.53 Million

2024

2032

USD

13,480.00 Million

USD

26,715.53 Million

2024

2032

| 2025 –2032 | |

| USD 13,480.00 Million | |

| USD 26,715.53 Million | |

|

|

|

|

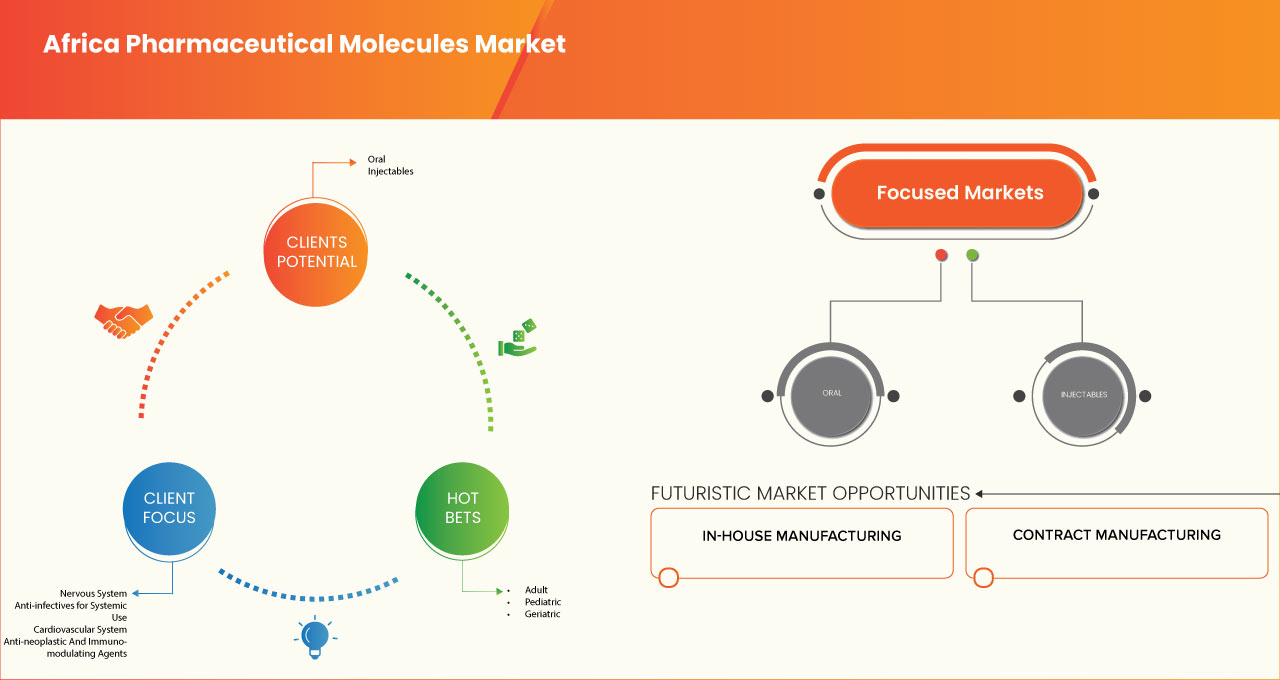

非洲藥物分子市場細分,按類型(神經系統、全身用抗感染藥物、心血管系統、抗腫瘤和免疫調節劑、消化道和代謝、肌肉骨骼系統、泌尿生殖系統和性激素、呼吸系統、血液和造血劑以及疫苗)、劑型(口服和注射劑)、效力(傳統投標和高效力)、製造方法(內部製造和合約製造)、年齡組 20 零售和其他行業(2033) 2070 2070 2070 2070 20720720-2070年 2070970 年齡組(成人和其他企業趨勢)、2003720 2070 207070年 2070707072070720707070707070707060 月和其他年齡組(成人和其他行業)、年齡預測和其他行業)。年

非洲藥物分子市場分析

非洲醫藥分子市場的歷史發生了重大變化,其特點是製造能力和醫療保健需求發生了重大轉變。殖民時期,非洲很大程度上依賴進口藥品,傳統醫藥佔據主導地位。 1960 年代,許多國家獲得獨立後,建立本地製藥製造業的動力日益增強,但政治不穩定和基礎設施有限阻礙了成長。到了 20 世紀 80 年代和 90 年代,隨著愛滋病毒/愛滋病等健康危機的升級,南非、埃及和肯亞等國家開始發展當地的生產能力,特別是仿製藥的生產能力,重點關注可負擔得起的藥物。 21 世紀初,在公私合作夥伴關係和外國投資的推動下,以及在非洲藥品監管協調機制 (AMRH) 等旨在標準化法規的區域舉措的建立下,非洲藥品監管進一步增長。如今,市場持續擴大,南非、埃及、摩洛哥和奈及利亞等主要參與者在當地生產方面處於領先地位,但監管差異和原材料取得等挑戰仍然存在。

非洲藥物分子市場規模

預計到 2032 年,非洲藥物分子市場規模將從 2024 年的 134.8 億美元增至 267.1553 億美元,在 2025 年至 2032 年的預測期內,複合年增長率為 9.03%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 整理的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

非洲藥物分子市場 趨勢

“仿製藥生產和本地製造的成長”

非洲醫藥分子市場的一個重要趨勢是越來越關注仿製藥的生產和擴大當地製造能力。這種轉變是由對可負擔藥物不斷增長的需求所推動的,特別是在許多非洲國家流行的治療愛滋病毒/愛滋病、瘧疾和結核病等慢性疾病的藥物需求。為了滿足這項需求,非洲各國政府一直在推動本土製藥業的發展,以減少對昂貴進口藥品的依賴,並改善基本藥品的取得。南非、埃及和奈及利亞等國家已成為該地區製藥製造業的領導者,越來越多的公司建立了生產專利藥品仿製藥的工廠。這一趨勢不僅有助於提高關鍵藥物的可用性和可負擔性,而且還促進了製藥業的經濟成長和創造就業機會。此外,它還推動了監管框架的建立,以確保本地生產的藥品的品質和安全,進一步加強了該行業。

報告範圍和非洲藥物分子市場 細分

|

屬性 |

非洲藥物分子市場 洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

安哥拉、波札那、史瓦濟蘭(前史瓦濟蘭)、賴索托、馬拉威、剛果(金沙薩)、納米比亞、馬達加斯加、茅利求斯、塞席爾、科摩羅、坦尚尼亞、南非、尚比亞、辛巴威、莫三比克、厄立特、吉布地、索馬利亞、肯亞、布魯迪、南蘇丹、蘇丹、衣索比亞、加彭、剛果(布拉柴維爾)、中非共和國、赤道幾內亞、喀麥隆、查德、布吉納法索、尼日、奈及利亞、多哥、幾內亞比紹、幾內亞共和國、塞內加爾、塞拉利昂、賴比瑞亞、佛迪瓦、加納、馬利科特、幾內亞共和國 |

|

主要市場參與者 |

Adcock Ingram (South Africa), Advacare Pharma (U.S.), AstraZeneca (U.K.), BAYER AG (Germany), Boehringer Ingelheim International GmbH (Germany), Cipla (India), F.Hoffmann-La Roche Ltd (Switzerland), Ferring (Switzerland), GSK plc. ( U.K.), Johson & Johnson Services, Inc. (U.S.), MERCK KGAA (Germany), Novartis AG (Switzerland), Pfizer Inc. (U.S.), Pharma Dekho plc (Nigeria), SANOFI (France), Sun Pharmaceutical Industries Ltd. ( India), and swiss pharma Nigeria limited (Nigeria) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Africa Pharmaceutical Molecules Market Definition

Pharmaceutical molecules are chemical or biological substances that serve as active ingredients in medications, playing a crucial role in diagnosing, treating, preventing, or managing diseases and medical conditions. These molecules can be synthetic, semi-synthetic, or naturally derived compounds designed to interact with specific biological targets such as proteins, enzymes, or receptors within the body to produce a desired therapeutic effect. The development of pharmaceutical molecules involves extensive research, including drug discovery, optimization, and clinical testing, to ensure safety, efficacy, and stability before regulatory approval.

Africa Pharmaceutical Molecules Market Dynamics

Drivers

- Regulatory Improvements Create Favorable Market Environments

監管改善已成為非洲醫藥分子市場成長的重要推手。過去十年來,非洲大陸各國加強了監管框架,建立了更清晰、更有效率的藥品審批、分銷和安全監測流程。這種轉變增強了投資者信心,鼓勵國內外製藥公司以創新分子和療法進入市場。隨著各國政府不斷使其法規與國際標準接軌,新藥預計進入市場的速度正在提高,從而減少了延誤並確保基本藥物更快地送達消費者。此外,更強有力的監管體系提高了藥品的品質和安全,建立了公眾信任並進一步刺激了市場需求。這些變化也促進了地方當局與全球製藥公司之間的合作,從而提高了當地的生產能力和獲得先進藥物的機會。

此外,許多非洲國家透過非洲藥品管理局(AMA)等區域機構實施了協調的監管流程,促進了國家之間的合作並確保了藥品標準跨境一致。這個簡化流程使製藥公司更容易擴大在該地區市場的範圍,促進了藥品分子的跨國貿易。隨著監管機構變得更加透明和高效,國際利害關係人越來越多地將非洲視為一個可行且不斷成長的投資市場。這些改進不僅促進了當地的製造業,也為非洲國家在全球製藥業中確立競爭力創造了機會。

例如,

- 2021年9月,根據普渡大學發表的文章,改善非洲的監管環境需要加強許可製度、加強產品註冊並實施強而有力的市場控制機制。建立藥物警戒計畫、改善臨床試驗監督以及確保更好的溝通和透明度至關重要。此外,投資於訓練有素的員工、可持續的資金和現代化的基礎設施將顯著提高國家藥品監管機構的效率

- 2021年8月,根據NCBI發表的文章,東非共同體藥品監管協調(MRH)倡議於2012年啟動,旨在透過簡化監管流程同時保持嚴謹性,改善人們獲得安全、優質藥品的機會。未來的主要行動包括藥品安全監測、區域技術官員、合作框架協議、永續資金以及擴大醫療產品範圍

2023年2月,根據matrix4prevention發表的文章,世衛組織認可尼日利亞國家監管機構在全球基準工具中處於3級,其監管體系穩定、運作良好、綜合。坦尚尼亞、加納、奈及利亞和埃及已達到 ML3 級別,標誌著監管體係有效。全球監管機構中,只有不到 30% 能夠充分運作

非洲監管的改善簡化了藥品審批和安全流程,增強了投資者信心和市場准入。透過非洲藥品管理局等機構制定的協調法規促進了跨境貿易和更快的藥物引進。這些改革提高了產品質量,促進了當地製造業的發展,並使非洲成為一個具有競爭力的醫藥市場。

- 科技進步增強醫療服務

科技和數位健康解決方案正在透過改善醫療保健的獲取和效率來推動非洲製藥分子市場的成長。行動醫療 (mHealth) 應用程式和遠距醫療使醫療保健變得更加容易獲得,特別是在偏遠地區,患者可以諮詢醫生、追蹤病情並堅持治療。此外,藥物研發中的人工智慧(AI)加速了標靶療法的開發,而區塊鏈等數位工具則增強了供應鏈管理,減少了假藥並改善了分銷。這些技術進步使醫療保健更加高效,刺激了對藥品的需求,並促進了非洲藥品市場的整體成長。

技術和數位健康解決方案的採用也有助於克服醫療保健系統中的重大障礙,例如醫療保健專業人員短缺和基礎設施挑戰。遠距醫療使城市地區的醫生能夠遠距諮詢農村地區的患者,擴大獲得專科護理的機會。行動技術實現了健康監測以及患者和醫療保健提供者之間的即時溝通,減少了治療延誤。此外,數位平台正在改善數據收集和分析,從而可以在藥物開發、監管流程和公共衛生策略方面做出更明智的決策。這些進步正在促進更敏捷和永續的醫療保健體系,進一步支持整個非洲大陸醫藥市場的成長。

例如,

- 2023年12月,根據Newtown partners發表的文章,隨著科技和數位健康解決方案佔據中心地位,醫藥市場正經歷轉型。隨著醫療科技新創公司、電子商務模式和送貨上門服務的興起,偏遠地區的患者現在可以獲得基本藥物,為製藥業的創新和成長創造了新的機會

- 2024年2月,根據IQVIA發表的文章,數位健康解決方案和本地疫苗生產的興起。遠距醫療、人工智慧診斷和行動醫療平台等技術正在擴大醫療保健的覆蓋面,解決基礎設施限制等挑戰,並提高整個非洲大陸的醫療質量

行動醫療應用、遠距醫療和藥物研發中的人工智慧等技術和數位健康解決方案正在推動非洲製藥市場的成長。這些創新改善了醫療保健的取得、效率和供應鏈管理。它們克服了基礎設施挑戰,增強了患者護理,並支持更快的藥物開發,從而促進了更具響應能力、更可持續的醫療保健體系

機會

- 政府和外國投資推動製藥業成長

政府和外國投資的增加為非洲醫藥分子市場的成長提供了重大機會。非洲各國政府都認識到建立自給自足的製藥業的戰略重要性,並正在實施鼓勵本地和外國投資的政策。這些措施包括提供稅收優惠、降低原材料進口關稅以及改善監管框架以創造良好的商業環境。因此,許多跨國製藥公司正在非洲國家建立生產設施和合作夥伴關係,因為這些國家擁有不斷成長的消費群體、經濟多樣化以及進入新興市場的機會。外國資本的湧入也促進了當地製藥生產能力的發展,特別是活性藥物成分(API)和仿製藥的生產,這對於降低醫療成本和改善治療機會至關重要。

此外,政府支持的措施和公私合作夥伴關係正在促進創新並擴大研發能力。這種本地和國際投資的結合不僅加強了非洲的製藥製造業,也改善了非洲大陸的醫療保健基礎設施。隨著這些投資的不斷增加,它們為滿足非洲日益增長的醫療保健需求、減少對進口的依賴以及創造更具彈性和競爭力的醫藥市場提供了一個充滿希望的機會。

例如,

- 2023年11月,根據Prosper-Africa發表的文章,增加政府和外國對非洲製藥業的投資對於建立當地生產能力、加強供應鏈和提高醫療保健的復原力至關重要。對診斷和醫療技術的投資將加強疾病管理,而技術驅動的醫療保健改進將提高資產生產率,確保整個非洲大陸的醫療保健系統可持續、高效

Increasing government and foreign investments are driving Africa's pharmaceutical market growth. Policies supporting local and foreign investments, along with tax incentives and improved regulations, are fostering manufacturing capabilities, particularly in APIs and generic medicines. These investments are boosting R&D, strengthening healthcare infrastructure, and reducing dependency on imports, creating a competitive pharmaceutical sector.

- Strengthening Collaboration Between Public-Private Sector Partnerships

Public-private partnerships (PPPs) present a powerful opportunity for the growth of Africa’s pharmaceutical molecules market, fostering collaboration between governments, private companies, and international organizations to address the continent’s healthcare challenges. By pooling resources, expertise, and infrastructure, PPPs can significantly accelerate the development of local pharmaceutical manufacturing, reducing reliance on imported medicines and improving access to essential treatments. Governments benefit from the expertise and efficiency of the private sector, while private companies gain from favorable policies, financial incentives, and access to large markets. These partnerships can lead to the establishment of state-of-the-art manufacturing facilities, the production of affordable generic medicines, and the development of essential drugs tailored to meet local health needs.

Moreover, PPPs facilitate the expansion of research and development (R&D) initiatives, enabling the creation of region-specific treatments for diseases prevalent in Africa, such as malaria, tuberculosis, and HIV. They also improve regulatory frameworks and create training programs to build local expertise in the pharmaceutical sector. As African governments increasingly prioritize healthcare and economic diversification, the growing number of public-private collaborations offers a promising pathway to strengthen the continent’s pharmaceutical market, ensuring a more sustainable, competitive, and self-reliant healthcare ecosystem.

For instance,

- In February 2021, according to the article published by Public-private partnerships (PPPs) in Africa's pharmaceutical sector are driving scientific advancement and addressing public health challenges. Collaborations between governments, academic institutions, and pharmaceutical companies foster drug discovery, data integration, and machine learning models. These partnerships are crucial for advancing treatments in neglected diseases, cancer, and neurological disorders across the continent

- In September 2024, according to the article published by Africa's pharmaceutical market leverage private sector innovation and funding with public sector incentives to overcome challenges such as high development costs. By aligning efforts and resources, PPPs improve operational efficiency, accelerate research, and enhance infrastructure, boosting drug discovery and delivery in an economically diverse, sustainable manner

- In October 2022, according to the article published by African development bank group, pivotal in expanding Africa's $1.3Bn vaccine market, which accounts for 25% of global public volumes. Through collaborations with organizations such as Gavi and UNICEF, PPPs drive increased access, demographic shifts, and innovative vaccine technologies, ensuring long-term contracts and sustainable growth in the sector

Public-private partnerships (PPPs) are driving Africa's pharmaceutical market growth by combining resources, expertise, and infrastructure. These collaborations promote local manufacturing, reduce import reliance, and improve access to treatments. PPPs also boost R&D, create region-specific medicines, and enhance regulatory frameworks, fostering a more sustainable, competitive, and self-reliant healthcare system.

Restraints/Challenges

- High Costs of Pharmaceutical Molecules Production

The high cost of pharmaceuticals remains a significant challenge for the African pharmaceutical molecules market, hindering access to essential medicines and placing a heavy burden on both patients and healthcare systems. Many African countries rely heavily on imported medicines, which are often expensive due to tariffs, transportation costs, and currency fluctuations. This reliance on imports also limits competition, keeping prices high and making it difficult for lower-income populations to afford necessary treatments. The high cost of branded drugs, particularly for chronic disease management and specialized treatments, exacerbates this issue. Furthermore, while there is a growing market for generic medicines, many local manufacturers struggle with limited production capacities, regulatory barriers, and insufficient infrastructure to meet demand at affordable prices. In addition, the cost of raw materials for drug production, especially active pharmaceutical ingredients (APIs), can be high, further driving up production costs.

These challenges create a significant gap in healthcare access, particularly in rural areas where healthcare infrastructure is already limited. Addressing the high cost of pharmaceuticals requires strengthening local manufacturing capabilities, improving supply chain efficiency, and encouraging government policies that promote the production of affordable, high-quality medicines. Overcoming these challenges is crucial to improving healthcare outcomes and ensuring equitable access to medicines across Africa.

For instance,

- In November 2022, according to the article published by Institute For Economic Justice ,the high costs of pharmaceutical molecule production in Ghana stem from various factors, including a lack of qualified personnel, higher raw material and transport costs, expensive machinery, elevated interest rates on loans, high utility charges, and insufficient collaboration between local research institutions and manufacturers for R&D-driven production

- In July 2021, according to the article published by NCBI, Rising pharmaceutical costs are a significant driver of increasing healthcare expenses in Africa, where access to affordable drugs remains a challenge. The global trend of escalating pharmaceutical expenditures, projected to reach $1.5 trillion in 2023, directly impacts African nations, placing further strain on healthcare systems and affordability for local populations

High pharmaceutical costs in Africa, driven by import reliance, tariffs, and limited local manufacturing, hinder access to essential medicines. This issue is exacerbated by expensive branded drugs and inadequate infrastructure. Strengthening local production, improving supply chains, and supportive government policies are key to reducing costs and improving healthcare access across the continent.

- Limited Skilled Workforce in Pharmaceutical Industry

The lack of a skilled workforce remains a significant challenge for the growth of Africa's pharmaceutical molecules market, impeding the development of a robust and self-sustaining pharmaceutical industry. While demand for medicines continues to rise across the continent, there is a shortage of qualified professionals in key areas such as pharmaceutical manufacturing, research and development (R&D), quality control, and regulatory affairs. This skills gap limits the ability of local pharmaceutical companies to meet international standards, hindering their ability to produce high-quality, competitive medicines. In addition, the absence of a strong scientific and technical workforce slows the progress of drug discovery and innovation, particularly for diseases that are endemic to the region. The shortage of skilled labor also impacts the efficient operation of manufacturing facilities, leading to delays, increased costs, and reliance on imported expertise.

To address this challenge, there is a need for increased investment in education, vocational training programs, and partnerships with international organizations to build local capacity. Expanding training opportunities for scientists, engineers, and technicians will not only strengthen the pharmaceutical sector but also drive economic growth by fostering a skilled workforce capable of supporting the production and innovation of medicines tailored to Africa's specific healthcare needs.

For instance,

- In July 2024, according to the article published by WHO, the African pharmaceutical market faces a critical shortage of skilled professionals, including pharmacists, biomedical engineers, and chemists, with insufficient industrial and regulatory training available. This lack of a skilled workforce hinders the growth of local manufacturing, distribution, and regulatory systems, emphasizing the need for government investment in workforce development

- In January 2024, according to the article published by The lack of skilled workers across African markets undermines growth prospects for healthcare firms. This shortage of technical expertise, particularly in manufacturing and regulatory processes, creates significant challenges for investment in the pharmaceutical sector, limiting capacity building and hindering the region's ability to develop a robust local healthcare industry

The shortage of skilled professionals in Africa’s pharmaceutical sector, particularly in manufacturing, R&D, and regulatory affairs, hampers industry growth. This skills gap limits local production capacity and innovation. Addressing this challenge requires investment in education, vocational training, and international partnerships to develop a capable workforce and improve pharmaceutical self-sufficiency.

Africa Pharmaceutical Molecules Market Scope

The market is segmented seven notable segments based on type, dosage form, potency, manufacturing method, age group, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Nervous System

- Paracetamol Solution For Infusion

- Escitalopram Film-Coated Tablets

- 20 Mg

- 5 Mg

- 10 Mg

- Pregabalin Capsules

- Gabapentin Tablet And Capsules

- Gabapentin Film-Coated Tablets

- 800 Mg

- 600 Mg

- Gabapentin Capsules

- 400 Mg

- 300 Mg

- 100 Mg

- Gabapentin Film-Coated Tablets

- Sertraline Film-Coated Tablets

- 100 Mg

- 50 Mg

- Aripiprazole Tablets

- Aripiprazole Tablets (Various Strengths)

- Aripiprazole Orodispersible Tablets (Various Strengths)

- Olanzapine Film-Coated Tablets

- Risperidone Tablets 1mg

- Donepezil Film-Coated Tablets

- 10 Mg

- 5 Mg

- Lorazepam Film-Coated Tablets

- Atomoxetine Tablet And Solution

- Atomoxetine Tablets (Various Strengths)

- Atomoxetine Oral Solution

- Mirtazapine Film-Coated Tablets

- Levetiracetam

- Levetiracetam Film-Coated Tablets

- Levetiracetam Oral Syrup (Various Strengths)

- Topiramate Film-Coated Tablets

- Memantine Film-Coated Tablets

- 20 Mg

- 5 Mg

- 10 Mg

- Cinnarizine + Dimenhydrinate Film-Coated Tablets

- Oxcarbazepine Tablets

- 600 Mg

- 300 Mg

- Vortioxetine Film-Coated Tablets

- Lacosamide Tablets

- 200 Mg

- 150 Mg

- 100 Mg

- 50 Mg

- Lacosamide Syrup

- Anti-Infectives For Systemic Use

- Azithromycin Powder For Solution For Infusion: 500mg

- Levofloxacin Film-Coated Tablets

- 500mg

- 250mg

- Fluconazole Capsule

- 150 Mg

- 50 Mg

- 200 Mg

- Others

- Valaciclovir Film-Coated Tablets

- 500 Mg

- 1000 Mg

- Tigecycline Powder For Solution For Infusion: 5mg/5ml

- 心血管系統

- 氨氯地平片

- 5毫克

- 10毫克

- 阿托伐他汀薄膜衣片

- 10毫克

- 20毫克

- 40毫克

- 氯沙坦

- 氯沙坦膜衣片

- 氯沙坦+氫氯噻嗪薄膜衣片

- 瑞舒伐他汀薄膜衣片

- 10毫克

- 20毫克

- 5毫克

- 纈沙坦薄膜衣片

- 80毫克

- 160毫克

- 40毫克

- 120毫克

- 卡維地洛片

- 6.25 毫克

- 25毫克

- 厄貝沙坦

- 厄貝沙坦薄膜衣片

- 150毫克

- 75毫克

- 300毫克

- 厄貝沙坦+Hctz薄膜衣片

- 300毫克+12.5毫克

- 150毫克+12.5毫克

- 300毫克+25毫克

- 厄貝沙坦薄膜衣片

- 氯噻酮片

- 12.5毫克

- 25毫克

- 50毫克

- 依折麥布

- 依折麥布+辛伐他汀薄膜衣

- 10 毫克 + 10 毫克

- 10 毫克 + 20 毫克

- 10毫克+40毫克

- 依折麥布+瑞舒伐他汀膠囊

- 10 毫克 + 10 毫克

- 10 毫克 + 20 毫克

- 10 毫克 + 5 毫克

- 依折麥布薄膜衣片

- 25毫克

- 50毫克

- 依折麥布+辛伐他汀薄膜衣

- 培哚普利+吲達帕胺片

- 4 毫克 + 1.25 毫克

- 8 毫克 + 2.5 毫克

- 2 毫克 + 0.625 毫克

- 替米沙坦片

- 20毫克

- 40毫克

- 80毫克

- 匹伐他汀薄膜衣片

- 4毫克

- 2毫克

- 1毫克

- 西地那非薄膜衣片(20毫克)

- 纈沙坦+氫氯噻嗪(Hctz)片

- 360 毫克 + 25 毫克

- 80 毫克 + 12.5 毫克

- 160 毫克 + 25 毫克

- 160 毫克 + 12.5 毫克

- 320 毫克 + 12.5 毫克

- 依普利酮薄膜衣片

- 25毫克

- 50毫克

- 馬西替坦薄膜衣片(10毫克)

- 氨氯地平片

- 抗腫瘤和免疫調節劑

- 阿比特龍

- 250毫克

- 500毫克

- 他莫昔芬

- 10毫克

- 20毫克

- 比卡魯胺

- 50毫克

- 150毫克

- 來那度胺

- 硼替佐米

- 黴酚酸酯

- 舒尼替尼

- 來曲唑

- 帕博西利

- 特立氟胺

- 7毫克

- 14毫克

- 富馬酸二甲酯

- 來氟米特

- 10毫克

- 20毫克

- 吡非尼酮

- 泊馬度胺

- 芬戈莫德

- 阿比特龍

- 消化道和代謝

- 西他列汀片

- 西他列汀薄膜衣片(不同規格)

- 西他列汀+二甲雙胍薄膜衣片(多種組合)

- 恩格列淨片

- 恩格列淨薄膜衣片

- 10毫克

- 25毫克

- 恩格列淨 + 二甲雙胍薄膜衣片(多種組合)

- 恩格列淨薄膜衣片

- 恩格列淨 + 利拉利汀錠(多種組合)

- 達格列淨片

- 10毫克

- 5毫克

- 昂丹司瓊注射 – 4毫克/8毫克

- 維格列汀錠 – 50毫克

- 泮托拉唑注射液 – 40毫克

- 吡格列酮片

- 不同強度的吡格列酮片

- 吡格列酮+二甲雙胍包衣錠(多種組合)

- 埃索美拉唑注射劑 – 40毫克

- 卡格列淨片

- 卡格列淨薄膜衣片

- 300毫克

- 100毫克

- 卡格列淨+二甲雙胍薄膜衣片(多種組合)

- 卡格列淨薄膜衣片

- 阿卡波糖片

- 50毫克

- 100毫克

- 西他列汀片

- 肌肉骨骼系統

- 依托昔布薄膜衣片

- 塞來昔布膠囊

- 100毫克

- 200毫克

- 阿崙膦酸薄膜衣片 70 毫克

- 非布索坦膜衣片

- 80毫克

- 120毫克

- 伊班膦酸薄膜衣片 150 毫克

- 50毫克

- 150毫克

- 泌尿生殖系統和性荷爾蒙

- 西地那非薄膜衣片

- 他達拉非薄膜衣片

- 非那雄胺薄膜衣片

- 西洛多辛薄膜衣片

- 8毫克

- 4毫克

- 索利那新薄膜衣片

- 5毫克

- 10毫克

- 米拉貝隆緩釋片

- 呼吸系統

- 孟魯司特薄膜衣片:10毫克

- 其他的

- 血液和造血劑

- 氯吡格雷薄膜衣片 75 毫克

- 75毫克+75毫克

- 75毫克+100毫克

- 氯吡格雷+阿斯匹靈硬包衣片

- 阿哌沙班薄膜衣片

- 5毫克

- 2.5毫克

- 利伐沙班薄膜衣片

- 20毫克

- 10毫克

- 15毫克

- 2.5毫克

- 替格瑞洛薄膜衣片

- 60毫克

- 90毫克

- 普拉格雷薄膜衣片

- 5毫克

- 10毫克

- 氯吡格雷薄膜衣片 75 毫克

- 疫苗

- MMR(麻疹、腮腺炎、德國麻疹)

- 黃熱病

- B型肝炎

- Hpv(人類乳突病毒)

- 瘧疾

- 流感

劑型

- 口服

- 注射劑

效力

- Traditional Potency

- High-Potency

Manufacturing Method

- In-House Manufacturing

- Contract Manufacturing

Age Group

- Adult

- Pediatric

- Geriatric

Distribution Channel

- Direct Tenders

- Retail Sales

- Hospital Pharmacies

- Drug Stores

- E-Pharmacy

- Others

- Others

Africa Pharmaceutical Molecules Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Africa Pharmaceutical Molecules Market Leaders Operating in the Market Are:

- Adcock Ingram (South Africa)

- Advacare Pharma (U.S.)

- AstraZeneca (U.K.)

- BAYER AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Cipla (India)

- F.Hoffmann-La Roche Ltd (Switzerland)

- Ferring (Switzerland)

- GSK plc. (U.K.)

- Johson & Johnson Services, Inc. ( U.S.)

- MERCK KGAA (Germany)

- Novartis AG (Switzerland)

- Pfizer Inc. ( U.S.)

- Pharma Dekho plc (Nigeria)

- SANOFI (France)

- Sun Pharmaceutical Industries Ltd. ( India)

- swiss pharma Nigeria limited (Nigeria)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE AFRICA PHARMACEUTICAL MOLECULES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 DBMR TRIPOD DATA VALIDATION MODEL

2.3 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.4 DBMR MARKET POSITION GRID

2.5 VENDOR SHARE ANALYSIS

2.6 SECONDARY SOURCES

2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

5 AFRICA PHARMACEUTICAL MOLECULES MARKET: REGULATIONS

5.1 REGULATORY FRAMEWORK FOR AFRICA PHARMACEUTICAL MOLECULES MARKET

5.2 NATIONAL MEDICINES REGULATORY AUTHORITIES (NMRAS)

5.3 EAST AFRICAN COMMUNITY (EAC) MEDICINES REGULATORY HARMONIZATION

5.4 ECONOMIC COMMUNITY OF WEST AFRICAN STATES (ECOWAS) MEDICINES REGULATORY HARMONIZATION

5.5 SOUTHERN AFRICAN DEVELOPMENT COMMUNITY (SADC) MEDICINES REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 REGULATORY IMPROVEMENTS CREATE FAVORABLE MARKET ENVIRONMENTS

6.1.2 ADVANCEMENTS IN TECHNOLOGY ENHANCE HEALTHCARE SERVICE DELIVERY

6.1.3 PHARMACEUTICAL MANUFACTURING GROWTH FOSTERS LOCAL PRODUCTION CAPABILITIES

6.1.4 RISING MIDDLE CLASS SPARKS RAPID URBANIZATION ACROSS AFRICA

6.2 RESTRAINTS

6.2.1 HEAVY RELIANCE ON IMPORTS INCREASES MARKET VULNERABILITY

6.2.2 LIMITED RESEARCH AND DEVELOPMENT INFRASTRUCTURE HAMPERS INNOVATION

6.3 OPPORTUNITIES

6.3.1 GOVERNMENT AND FOREIGN INVESTMENTS PROMOTING PHARMACEUTICAL INDUSTRY GROWTH

6.3.2 STRENGTHENING COLLABORATION BETWEEN PUBLIC-PRIVATE SECTOR PARTNERSHIPS

6.3.3 RISING DEMAND FOR CHRONIC DISEASE TREATMENT SOLUTIONS

6.4 CHALLENGES

6.4.1 HIGH COSTS OF PHARMACEUTICAL MOLECULES PRODUCTION

6.4.2 LIMITED SKILLED WORKFORCE IN PHARMACEUTICAL INDUSTRY

7 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY TYPE

7.1 OVERVIEW

7.2 NERVOUS SYSTEM

7.2.1 PARACETAMOL SOLUTION FOR INFUSION

7.2.2 ESCITALOPRAM FILM-COATED TABLETS

7.2.3 PREGABALIN CAPSULES

7.2.4 GABAPENTIN TABLET AND CAPSULES

7.2.5 SERTRALINE FILM-COATED TABLETS

7.2.6 ARIPIPRAZOLE TABLETS

7.2.7 OLANZAPINE FILM-COATED TABLETS

7.2.8 RISPERIDONE TABLETS 1MG

7.2.9 DONEPEZIL FILM-COATED TABLETS

7.2.10 LORAZEPAM FILM-COATED TABLETS

7.2.11 ATOMOXETINE TABLET AND SOLUTION

7.2.12 MIRTAZAPINE FILM-COATED TABLETS

7.2.13 LEVETIRACETAM

7.2.14 TOPIRAMATE FILM-COATED TABLETS

7.2.15 MEMANTINE FILM-COATED TABLETS

7.2.16 CINNARIZINE + DIMENHYDRINATE FILM-COATED TABLETS

7.2.17 OXCARBAZEPINE TABLETS

7.2.18 VORTIOXETINE FILM-COATED TABLETS

7.2.19 LACOSAMIDE TABLETS

7.2.20 LACOSAMIDE SYRUP

7.2.20.1 20 MG

7.2.20.2 5 MG

7.2.20.3 10 MG

7.2.21 GABAPENTIN FILM-COATED TABLETS

7.2.22 GABAPENTIN CAPSULES

7.2.22.1 800 MG

7.2.22.2 600 MG

7.2.23 400 MG

7.2.24 300 MG

7.2.25 100 MG

7.2.26 100 MG

7.2.27 50 MG

7.2.27.1 ARIPIPRAZOLE TABLETS (VARIOUS STRENGTHS)

7.2.27.2 ARIPIPRAZOLE ORODISPERSIBLE TABLETS (VARIOUS STRENGTHS)

7.2.28 10 MG

7.2.29 5 MG

7.2.29.1 ATOMOXETINE TABLETS (VARIOUS STRENGTHS)

7.2.29.2 ATOMOXETINE ORAL SOLUTION

7.2.29.2.1 LEVETIRACETAM FILM-COATED TABLETS

7.2.29.2.2 LEVETIRACETAM ORAL SYRUP (VARIOUS STRENGTHS)

7.2.30 20 MG

7.2.31 5 MG

7.2.32 10 MG

7.2.32.1 600 MG

7.2.32.2 300 MG

7.2.32.2.1 200 MG

7.2.32.2.2 150 MG

7.2.32.2.3 100 MG

7.2.32.2.4 50 MG

7.3 ANTI-INFECTIVES FOR SYSTEMIC USE

7.3.1 AZITHROMYCIN POWDER FOR SOLUTION FOR INFUSION: 500MG

7.3.2 LEVOFLOXACIN FILM-COATED TABLETS

7.3.3 FLUCONAZOLE CAPSULE

7.3.4 VALACICLOVIR FILM-COATED TABLETS

7.3.5 TIGECYCLINE POWDER FOR SOLUTION FOR INFUSION: 5MG/5ML

7.3.5.1 500MG

7.3.5.2 250MG

7.3.5.2.1 150 MG

7.3.5.2.2 50 MG

7.3.5.2.3 200 MG

7.3.5.2.4 OTHERS

7.3.5.2.4.1 500 MG

7.3.5.2.4.2 1000 MG

7.4 CARDIOVASCULAR SYSTEM

7.4.1 AMLODIPINE TABLETS

7.4.2 ATORVASTATIN FILM-COATED TABLETS

7.4.3 LOSARTAN

7.4.4 ROSUVASTATIN FILM-COATED TABLETS

7.4.5 VALSARTAN FILM-COATED TABLETS

7.4.6 CARVEDILOL TABLETS

7.4.7 IRBESARTAN

7.4.8 CHLORTALIDONE TABLETS

7.4.9 EZETIMIBE

7.4.10 PERINDOPRIL + INDAPAMIDE TABLETS

7.4.11 TELMISARTAN TABLETS

7.4.12 PITAVASTATIN FILM-COATED TABLETS

7.4.13 SILDENAFIL FILM-COATED TABLETS (20MG)

7.4.14 VALSARTAN + HYDROCHLOROTHIAZIDE (HCTZ) TABLETS

7.4.15 EPLERENONE FILM-COATED TABLETS

7.4.16 MACITENTAN FILM-COATED TABLETS (10MG)

7.4.16.1 5 MG

7.4.16.2 10 MG

7.4.16.2.1 10 MG

7.4.16.2.2 20 MG

7.4.16.2.3 40 MG

7.4.16.2.4 LOSARTAN FILM-COATED TABLETS

7.4.16.2.5 LOSARTAN + HCTZ FILM-COATED TABLETS

7.4.16.2.5.1 10 MG

7.4.16.2.5.2 20 MG

7.4.16.2.5.3 5 MG

7.4.16.2.6 80 MG

7.4.16.2.7 160 MG

7.4.16.2.8 40 MG

7.4.16.2.9 120 MG

7.4.16.2.9.1 6.25 MG

7.4.16.2.9.2 25 MG

7.4.16.3 IRBESARTAN FILM-COATED TABLETS

7.4.16.4 IRBESARTAN + HCTZ FILM-COATED TABLETS

7.4.16.5 150 MG

7.4.16.6 75 MG

7.4.16.7 300 MG

7.4.16.7.1 300 MG+12.5 MG

7.4.16.7.2 150 MG+12.5 MG

7.4.16.7.3 300 MG+25 MG

7.4.16.7.3.1 12.5 MG

7.4.16.7.3.2 25 MG

7.4.16.7.3.3 50 MG

7.4.17 EZETIMIBE + SIMVASTATIN FILM-COATED

7.4.18 EZETIMIBE + ROSUVASTATIN CAPSULE

7.4.19 EZETIMIBE FILM-COATED TABLETS

7.4.19.1 10 MG + 10 MG

7.4.19.2 10 MG + 20 MG

7.4.19.3 10 MG + 40 MG

7.4.19.3.1 10 MG + 10 MG

7.4.19.3.2 10 MG + 20 MG

7.4.19.3.3 10 MG + 5 MG

7.4.19.3.3.1 25 MG

7.4.19.3.3.2 50 MG

7.4.19.3.4 4 MG + 1.25 MG

7.4.19.3.5 8 MG + 2.5 MG

7.4.19.3.6 2 MG + 0.625 MG

7.4.19.3.6.1 20 MG

7.4.19.3.6.2 40 MG

7.4.19.3.6.3 80 MG

7.4.19.4 4 MG

7.4.19.5 2 MG

7.4.19.6 1 MG

7.4.19.6.1 360 MG + 25 MG

7.4.19.6.2 80 MG + 12.5 MG

7.4.19.6.3 160 MG + 25 MG

7.4.19.6.4 160 MG + 12.5 MG

7.4.19.6.5 320 MG + 12.5 MG

7.4.19.6.5.1 25 MG

7.4.19.6.5.2 50 MG

7.5 ANTI-NEOPLASTIC AND IMMUNOMODULATING AGENTS

7.5.1 ABIRATERONE

7.5.2 TAMOXIFEN

7.5.3 BICALUTAMIDE

7.5.4 LENALIDOMIDE

7.5.5 BORTEZOMIB

7.5.6 MYCOPHENOLATE MOFETIL

7.5.7 SUNITINIB

7.5.8 LETROZOLE

7.5.9 PALBOCICLIB

7.5.10 TERIFLUNOMIDE

7.5.11 DIMETHYL FUMARATE

7.5.12 LEFLUNOMIDE

7.5.13 PIRFENIDONE

7.5.14 POMALIDOMIDE

7.5.15 FINGOLIMOD

7.5.15.1 250MG

7.5.15.2 500MG

7.5.15.2.1 10MG

7.5.15.2.2 20MG

7.5.15.2.3 50MG

7.5.15.2.4 50MG

7.5.15.2.4.1 7MG

7.5.15.2.4.2 14MG

7.5.15.2.5 10MG

7.5.15.2.6 20MG

7.6 ALIMENTARY TRACT & METABOLISM

7.6.1 SITAGLIPTIN TABLETS

7.6.2 EMPAGLIFLOZIN TABLETS

7.6.3 DAPAGLIFLOZIN TABLETS

7.6.4 ONDANSETRON INJECTION – 4MG/8MG

7.6.5 VILDAGLIPTIN TABLETS – 50MG

7.6.6 PANTOPRAZOLE INJECTION – 40MG

7.6.7 PIOGLITAZONE TABLETS

7.6.8 ESOMEPRAZOLE INJECTION – 40MG

7.6.9 CANAGLIFLOZIN TABLETS

7.6.10 ACARBOSE TABLETS

7.6.10.1 SITAGLIPTIN FILM-COATED TABLETS (VARIOUS STRENGTHS)

7.6.10.2 SITAGLIPTIN + METFORMIN FILM-COATED TABLETS (VARIOUS COMBINATIONS)

7.6.10.2.1 EMPAGLIFLOZIN FILM-COATED TABLETS

7.6.10.2.2 EMPAGLIFLOZIN + METFORMIN FILM-COATED TABLETS (VARIOUS COMBINATIONS)

7.6.10.2.3 EMPAGLIFLOZIN + LINAGLIPTIN TABLETS (VARIOUS COMBINATIONS)

7.6.10.2.3.1 10 MG

7.6.10.2.3.2 25 MG

7.6.10.3 10 MG

7.6.10.4 5 MG

7.6.10.4.1 PIOGLITAZONE TABLETS VARIOUS STRENGTHS

7.6.10.4.2 PIOGLITAZONE + METFORMIN COATED TABLETS (VARIOUS COMBINATIONS)

7.6.10.4.2.1 CANAGLIFLOZIN FILM-COATED TABLETS

7.6.10.4.2.2 CANAGLIFLOZIN + METFORMIN FILM-COATED TABLETS (VARIOUS COMBINATIONS)

7.6.10.5 300 MG

7.6.10.6 100 MG

7.6.10.6.1 50MG

7.6.10.6.2 100MG

7.7 MUSCULO-SKELETAL SYSTEM

7.7.1 ETORICOXIB FILM-COATED TABLETS

7.7.2 CELECOXIB CAPSULES

7.7.3 ALENDRONIC ACID FILM-COATED TABLETS 70 MG

7.7.4 FEBUXOSTAT FILM-COATED TABLETS

7.7.5 IBANDRONIC ACID FILM-COATED TABLETS 150 MG

7.7.5.1 100 MG

7.7.5.2 200 MG

7.7.5.2.1 80 MG

7.7.5.2.2 120 MG

7.7.5.2.2.1 50 MG

7.7.5.2.2.2 150 MG

7.8 GENITO-URINARY SYSTEM AND SEX HORMONES

7.8.1 SILDENAFIL FILM-COATED TABLETS

7.8.2 TADALAFIL FILM-COATED TABLETS

7.8.3 FINASTERIDE FILM-COATED TABLETS

7.8.4 SILODOSIN FILM-COATED TABLETS

7.8.5 SOLIFENACIN FILM-COATED TABLETS

7.8.6 MIRABEGRON PROLONGED-RELEASE TABLETS

7.8.6.1 8 MG

7.8.6.2 4 MG

7.8.6.2.1 5MG

7.8.6.2.2 10MG

7.8.6.2.2.1 50MG

7.8.6.2.2.2 25MG

7.9 RESPIRATORY

7.9.1 MONTELUKAST FILM-COATED TABLETS: 10MG

7.9.2 OTHERS

7.1 BLOOD AND BLOOD FORMING AGENTS

7.10.1 CLOPIDOGREL FILM-COATED TABLETS 75MG

7.10.2 CLOPIDOGREL + ASA HARD-COATED TABLETS

7.10.3 APIXABAN FILM-COATED TABLETS

7.10.4 RIVAROXABAN FILM-COATED TABLETS

7.10.5 TICAGRELOR FILM-COATED TABLETS

7.10.6 PRASUGREL FILM-COATED TABLETS

7.10.6.1 75MG+75MG

7.10.6.2 75MG+100MG

7.10.6.2.1 5 MG

7.10.6.2.2 2.5 MG

7.10.6.2.2.1 20MG

7.10.6.2.2.2 10MG

7.10.6.2.2.3 15MG

7.10.6.2.2.4 2.5MG

7.10.6.2.3 60MG

7.10.6.2.4 90MG

7.10.6.2.5 5MG

7.10.6.2.6 10MG

7.11 VACCINES

7.11.1 MMR (MEASLES, MUMPS, RUBELLA)

7.11.2 YELLOW FEVER

7.11.3 HEPATITIS B

7.11.4 HPV (HUMAN PAPILLOMAVIRUS)

7.11.5 MALARIA

7.11.6 FLU (INFLUENZA)

8 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY POTENCY

8.1 OVERVIEW

8.2 TRADITIONAL POTENCY

8.3 HIGH-POTENCY

9 AFRICA PHARMACEUTICAL MOLECULES MARKET, MANUFACTURING METHOD

9.1 OVERVIEW

9.2 IN-HOUSE MANUFACTURING

9.3 CONTRACT MANUFACTURING

10 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY DOSAGE FORM

10.1 OVERVIEW

10.2 ORAL

10.2.1 TABLET

10.2.2 CAPSULES

10.2.3 SOLUTION/SYRUPS

10.3 INJECTABLES

10.3.1 SOLUTION

10.3.2 POWDER

11 AFRICA PHARMACEUTICAL MOLECULES MARKET, AGE GROUP

11.1 OVERVIEW

11.2 ADULT

11.3 PEDIATRIC

11.4 GERIATRIC

12 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDERS

12.3 RETAIL SALES

12.3.1 HOSPITAL PHARMACIES

12.3.2 DRUG STORES

12.3.3 E-PHARMACY

12.3.4 OTHERS

12.4 OTHERS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ADCOCK INGRAM

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 ADVACARE PHARMA

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 ASTRAZENECA

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 BAYER AG

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 CIPLA

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 F. HOFFMANN-LA ROCHE LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 FERRING

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 GSK PLC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 JOHNSON & JOHNSON SERVICES, INC.

14.10.1 COMPANY PROFILES

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

14.11 MERCK KGAA

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 NOVARTIS AG

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 PFIZER INC.

14.13.1 COMPANY PROFILES

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 PHARMA DEKHO PLC.

14.14.1 COMPANY SNAPSOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 PHARMA DEKHO PLC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SANOFI

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 SUN PHARMACEUTICAL INDUSTRIES LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 SWISS PHARMA NIGERIA LIMITED

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 2 AFRICA NERVOUS SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 3 AFRICA NERVOUS SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 4 TABLE 3: AFRICA NERVOUS SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 5 AFRICA ESCITALOPRAM FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 6 AFRICA GABAPENTIN TABLET AND CAPSULES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 7 AFRICA GABAPENTIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 8 AFRICA GABAPENTIN CAPSULES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 9 AFRICA SERTRALINE FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 10 AFRICA ARIPIPRAZOLE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 11 AFRICA DONEPEZIL FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 12 ATOMOXETINE TABLET AND SOLUTIONS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 13 AFRICA LEVETIRACETAM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 14 MEMANTINE FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 15 AFRICA OXCARBAZEPINE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 16 AFRICA LACOSAMIDE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 17 AFRICA ANTI-INFECTIVES FOR SYSTEMIC USE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 18 AFRICA ANTI-INFECTIVES FOR SYSTEMIC USE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 19 AFRICA ANTI-INFECTIVES FOR SYSTEMIC USE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 20 AFRICA LACOSAMIDE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 21 AFRICA FLUCONAZOLE CAPSULE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 22 AFRICA VALACICLOVIR FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 23 AFRICA CARDIOVASCULAR SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 24 AFRICA CARDIOVASCULAR SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 25 AFRICA CARDIOVASCULAR SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 26 AMLODIPINE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 27 AFRICA ATORVASTATIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 28 AFRICA LOSARTAN IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 29 AFRICA ROSUVASTATIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 30 AFRICA VALSARTAN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 31 AFRICA CARVEDILOL TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 32 AFRICA IRBESARTAN IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 33 AFRICA IRBESARTAN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 34 AFRICA IRBESARTAN + HCTZ FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 35 AFRICA CHLORTALIDONE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 36 AFRICA EZETIMIBE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 37 AFRICA EZETIMIBE + SIMVASTATIN FILM-COATED IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 38 AFRICA EZETIMIBE + ROSUVASTATIN CAPSULE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 39 AFRICA EZETIMIBE FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 40 AFRICA PERINDOPRIL + INDAPAMIDE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 41 AFRICA TELMISARTAN TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 42 AFRICA PITAVASTATIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 43 AFRICA VALSARTAN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 44 AFRICA EPLERENONE FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 45 AFRICA ANTI-NEOPLASTIC AND IMMUNOMODULATING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 46 AFRICA ANTI-NEOPLASTIC AND IMMUNOMODULATING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 47 AFRICA ANTI-NEOPLASTIC AND IMMUNOMODULATING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 48 AFRICA ABIRATERONE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 49 AFRICA TAMOXIFEN IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 50 AFRICA BICALUTAMIDE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 AFRICA TERIFLUNOMIDE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 52 AFRICA LEFLUNOMIDE IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 53 AFRICA ALIMENTARY TRACT & METABOLISM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 54 AFRICA ALIMENTARY TRACT & METABOLISM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 55 AFRICA ALIMENTARY TRACT & METABOLISM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 56 AFRICA SITAGLIPTIN TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 AFRICA EMPAGLIFLOZIN TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 58 AFRICA EMPAGLIFLOZIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 AFRICA DAPAGLIFLOZIN TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 60 AFRICA PIOGLITAZONE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 61 AFRICA CANAGLIFLOZIN TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 62 AFRICA CANAGLIFLOZIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 63 AFRICA ACARBOSE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 64 AFRICA MUSCULO-SKELETAL SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 65 AFRICA MUSCULO-SKELETAL SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032(MILLION UNITS)

TABLE 66 AFRICA MUSCULO-SKELETAL SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032(USD/UNITS)

TABLE 67 AFRICA CELECOXIB CAPSULES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 68 SOUTH AFRICA FEBUXOSTAT FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE. 2018-2032 (USD MILLION)

TABLE 69 AFRICA IBANDRONIC ACID FILM-COATED TABLETS 150 MG IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 70 AFRICA GENITO-URINARY SYSTEM AND SEX HORMONES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 71 AFRICA GENITO-URINARY SYSTEM AND SEX HORMONES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 72 SOUTH AFRICA GENITO-URINARY SYSTEM AND SEX HORMONES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE. 2018-2032(USD/UNITS)

TABLE 73 AFRICA SILODOSIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 74 AFRICA SOLIFENACIN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 75 AFRICA MIRABEGRON PROLONGED-RELEASE TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 76 AFRICA RESPIRATORY SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 77 AFRICA RESPIRATORY SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 78 AFRICA RESPIRATORY SYSTEM IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032(USD/UNITS)

TABLE 79 AFRICA BLOOD AND BLOOD FORMING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 80 AFRICA BLOOD AND BLOOD FORMING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, (MILLION UNITS)

TABLE 81 AFRICA BLOOD AND BLOOD FORMING AGENTS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE,(USD/UNITS)

TABLE 82 AFRICA CLOPIDOGREL FILM-COATED TABLETS 75 MG IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 83 AFRICA APIXABAN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 84 AFRICA RIVAROXABAN FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 85 AFRICA TICAGRELOR FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 86 AFRICA PRASUGREL FILM-COATED TABLETS IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 87 AFRICA VACCINES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 88 AFRICA VACCINES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (MILLION UNITS)

TABLE 89 AFRICA VACCINES IN PHARMACEUTICAL MOLECULES MARKET, BY TYPE, 2018-2032 (USD/UNITS)

TABLE 90 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY POTENCY, 2018-2032 (USD MILLION)

TABLE 91 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY MANUFACTURING METHOD, 2018-2032 (USD MILLION)

TABLE 92 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY DOSAGE FORM, 2018-2032 (USD MILLION)

TABLE 93 AFRICA ORAL IN PHARMACEUTICAL MOLECULES MARKET, BY DOSAGE FORM, 2018-2032 (USD MILLION)

TABLE 94 AFRICA INJECTABLES IN PHARMACEUTICAL MOLECULES MARKET, BY DOSAGE FORM, 2018-2032 (USD MILLION)

TABLE 95 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

TABLE 96 AFRICA PHARMACEUTICAL MOLECULES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 97 AFRICA RETAIL SALES IN PHARMACEUTICAL MOLECULES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

图片列表

FIGURE 1 AFRICA PHARMACEUTICAL MOLECULES MARKET: SEGMENTATION

FIGURE 2 AFRICA PHARMACEUTICAL MOLECULES MARKET: GEOGRAPHICAL SCOPE

FIGURE 3 AFRICA PHARMACEUTICAL MOLECULES MARKET: YEARS CONSIDERED FOR THE STUDY

FIGURE 4 AFRICA PHARMACEUTICAL MOLECULES MARKET: DATA TRIANGULATION

FIGURE 5 AFRICA PHARMACEUTICAL MOLECULES MARKET: DROC ANALYSIS

FIGURE 6 AFRICA PHARMACEUTICAL MOLECULES MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 7 AFRICA PHARMACEUTICAL MOLECULES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 AFRICA PHARMACEUTICAL MOLECULES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 AFRICA PHARMACEUTICAL MOLECULES MARKET: MULTIVARIATE MODELLING

FIGURE 10 AFRICA PHARMACEUTICAL MOLECULES MARKET: DBMR MARKET POSITION GRID

FIGURE 11 AFRICA PHARMACEUTICAL MOLECULES MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 AFRICA PHARMACEUTICAL MOLECULES MARKET: SEGMENTATION

FIGURE 13 AFRICA PHARMACEUTICAL MOLECULES MARKET EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 EXPANSION OF DENTAL INSURANCE COVERAGE FOR PERIODONTAL CARE IS DRIVING THE GROWTH OF THE AFRICA PHARMACEUTICAL MOLECULES MARKET FROM 2025 TO 2032

FIGURE 16 THE NERVOUS SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE AFRICA PHARMACEUTICAL MOLECULES MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 MARKET OVERVIEW

FIGURE 19 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY TYPE, 2024

FIGURE 20 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY TYPE, 2025-2032 (USD MILLION)

FIGURE 21 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY TYPE, CAGR (2025-2032)

FIGURE 22 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY POTENCY, 2024

FIGURE 24 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY POTENCY, 2025-2032 (USD MILLION)

FIGURE 25 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY POTENCY, CAGR (2025-2032)

FIGURE 26 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY POTENCY, LIFELINE CURVE

FIGURE 27 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY MANUFACTURING METHOD, 2024

FIGURE 28 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY MANUFACTURING METHOD, 2025-2032 (USD MILLION)

FIGURE 29 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY MANUFACTURING METHOD, CAGR (2025-2032)

FIGURE 30 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY MANUFACTURING METHOD, LIFELINE CURVE

FIGURE 31 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DOSAGE FORM, 2024

FIGURE 32 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DOSAGE FORM, 2025-2032 (USD MILLION)

FIGURE 33 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DOSAGE FORM, CAGR (2025-2032)

FIGURE 34 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DOSAGE FORM, LIFELINE CURVE

FIGURE 35 AFRICA PHARMACEUTICAL MOLECULES MARKET: AGE GROUP, 2024

FIGURE 36 AFRICA PHARMACEUTICAL MOLECULES MARKET: AGE GROUP, 2025-2032 (USD MILLION)

FIGURE 37 AFRICA PHARMACEUTICAL MOLECULES MARKET: AGE GROUP, CAGR (2025-2032)

FIGURE 38 AFRICA PHARMACEUTICAL MOLECULES MARKET: AGE GROUP, LIFELINE CURVE

FIGURE 39 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 40 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 41 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 42 AFRICA PHARMACEUTICAL MOLECULES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。