Asia Pacific Green Bio Polyols Market

市场规模(十亿美元)

CAGR :

%

USD

342.34 Million

USD

597.66 Million

2024

2032

USD

342.34 Million

USD

597.66 Million

2024

2032

| 2025 –2032 | |

| USD 342.34 Million | |

| USD 597.66 Million | |

|

|

|

亞太綠色和生物多元醇市場細分,按類型(聚醚多元醇和聚酯多元醇)、應用(泡沫、塗料、黏合劑、密封劑、彈性體等)– 產業趨勢及預測(至 2032 年)

綠色和生物多元醇市場分析

亞太綠色和生物多元醇市場對運動和運動鞋等各種應用中的剛性和柔性聚氨酯的需求不斷增加,因為消費者越來越多地尋求環保替代品,以最大限度地減少對環境的影響,同時確保可持續的做法和更少的環境影響,從而推動市場成長。

綠色和生物多元醇市場規模

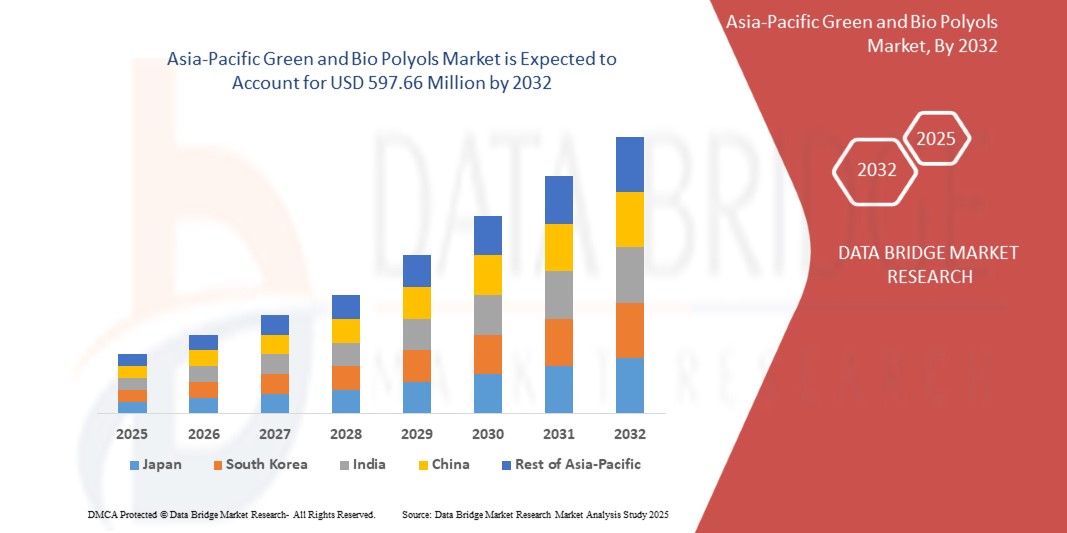

亞太綠色和生物多元醇市場預計將從 2024 年的 3.4234 億美元增至 2032 年的 5.9766 億美元,在 2025 年至 2032 年的預測期內,複合年增長率將大幅增長 7.3%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

綠色和生物多元醇市場趨勢

“可持續材料意識的提高”

亞太地區對永續性的日益重視正在顯著影響對綠色和生物基多元醇的需求,重塑市場格局。隨著人們越來越意識到化石燃料衍生產品對環境的影響,消費者和產業都轉向永續材料。這種範式轉變催化了綠色和生物多元醇的創新和採用,這些多元醇來自植物油和再生材料等可再生資源。

建築、汽車和包裝等關鍵產業正在採用這些環保多元醇,以符合更嚴格的監管框架和不斷變化的消費者偏好。各地區政府都在推出激勵措施和強制措施來減少碳足跡,這進一步推動了對生物替代品的需求。在汽車產業,消費者對環境影響較小的汽車的偏好日益增長,推動了生物聚氨酯泡棉的採用,這種泡棉廣泛應用於座椅、內裝和絕緣材料。同樣,建築業正在利用綠色多元醇來生產節能隔熱材料,以滿足對 LEED 等綠色建築認證日益增長的需求。

此外,跨國公司也越來越多地將永續性融入其品牌策略,選擇環保原料來提升其市場聲譽。這種轉變不僅解決了企業社會責任 (CSR) 目標,而且還將這些公司定位為環保市場的創新者。此外,在教育活動和媒體報導的推動下,消費者意識的提高已將永續性從小眾關注轉變為主流市場驅動力。這種日益增強的意識正在重塑各行業的購買模式,對綠色和生物多元醇等永續解決方案產生強勁需求。

報告範圍和市場細分

|

屬性 |

綠色和生物多元醇市場關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

中國、日本、韓國、印度、澳洲和紐西蘭、新加坡、馬來西亞、泰國、印尼、菲律賓、亞太其他地區 |

|

主要市場參與者 |

嘉吉公司(美國)、巴斯夫公司(德國)、Emery Oleochemicals(美國)、Stepan Company(美國)、萬華化學(中國)、ALBERDINGK BOLEY GmbH(德國)和 Aurorium(美國) |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

綠色和生物多元醇市場定義

Green and bio polyols are environmentally friendly alternatives to conventional polyols used in the production of polyurethane foams, coatings, adhesives, and elastomers. These polyols are derived from renewable resources such as vegetable oils (e.g., soy, castor, or palm oil), natural sugars, or another biomass. They help reduce reliance on petroleum-based feedstock and contribute to lower greenhouse gas emissions during production. Green polyols emphasize sustainable production methods with minimal environmental impact, whereas bio polyols specifically highlight their biological or renewable origin. Both types retain comparable chemical and physical properties to traditional polyols, making them suitable for diverse industrial applications. Additionally, they support circular economy principles, with some being recyclable or biodegradable. The use of green and bio polyols aligns with growing Asia-Pacific demands for sustainable materials in sectors like automotive, construction, and packaging, as industries transition toward eco-friendly manufacturing solutions.

Green and Bio Polyols Market Dynamics

Drivers

- Increasing Demand for Rigid and Flexible Polyurethane in Various Applications Like Sports and Athletic Footwear

The growing demand for rigid and flexible polyurethane in diverse applications, particularly in sports and athletic footwear, is a key driver accelerating the growth of the Asia-Pacific green and bio polyols market. As industries increasingly prioritize sustainability, the adoption of bio-based polyols for polyurethane production is gaining momentum, especially in high-demand sectors such as footwear. In the sports and athletic footwear industry, polyurethane plays a crucial role due to its lightweight, durable, and versatile properties. Rigid polyurethanes are widely used for structural components, while flexible variants are integral in cushioning and midsole applications. With rising consumer preference for eco-friendly products, footwear manufacturers are shifting toward bio-based polyurethanes to meet market demands and align with sustainability goals. Leading sportswear brands like Adidas, Nike, and Puma are at the forefront of this transformation. For instance, Adidas’ Futurecraft. Footprint sneakers incorporate bio-based polyurethane derived from renewable materials, reflecting the brand's commitment to reducing its environmental impact. Similarly, Nike is integrating bio-polyols in its product lines to create performance footwear that balances sustainability and functionality. The market for bio-polyols is further propelled by increasing awareness among consumers regarding the environmental impact of conventional polyurethane. As customers demand greener alternatives, companies are leveraging bio-based polyols to differentiate their products and strengthen their market positioning. Additionally, the rise of athleisure as a lifestyle trend is expanding the application scope of polyurethane, driving higher production volumes of bio-based variants. The ability of green and bio polyols to reduce greenhouse gas emissions and reliance on fossil fuels aligns seamlessly with Asia-Pacific environmental targets, attracting investments from industry players. For Instance, Allbirds utilizes bio-based polyurethane derived from sugarcane in its footwear. The company’s SweetFoam innovation has become a benchmark in the industry for sustainable midsole production, further driving demand for green polyols

- Circular Economy Focuses on Maximizing Resource Efficiency by Minimizing Waste and Promoting the Reuse

The concept of a circular economy is rapidly gaining traction across industries, and its focus on maximizing resource efficiency by minimizing waste and promoting the reuse of materials is becoming a key driver of the Asia-Pacific green and bio polyols market. This economic model encourages manufacturers to adopt sustainable practices, such as using renewable resources, reducing energy consumption, and recycling materials, which aligns seamlessly with the growing demand for environmentally friendly solutions in the production of polyurethane products. In a circular economy, the emphasis is on reducing the reliance on virgin, petroleum-based resources and instead utilizing bio-based alternatives, such as green and bio polyols. These renewable polyols are derived from plant-based feedstocks or waste materials, contributing to a reduction in greenhouse gas emissions and supporting sustainable production processes. This shift is particularly important in industries such as automotive, construction, and consumer goods, where the use of traditional, non-renewable materials is being increasingly scrutinized. Leading companies are embracing circular economy principles by incorporating bio-based polyols into their product offerings. For example, BASF’s PolyTHF products, used in various applications, are now produced with a focus on sustainability and renewable feedstocks, contributing to a circular economy. Likewise, Covestro’s commitment to circularity is evident in its development of polyurethanes based on recycled CO2 and bio-based polyols, reducing reliance on fossil fuels and promoting a more sustainable supply chain

Opportunities

- Increased Construction Activities, Particularly in Emerging Economies

監管部門對環保產品的推動為亞太綠色和生物多元醇市場創造了重大機會。隨著世界各國政府實施更嚴格的環境法規和永續發展目標,對由可再生和可生物降解材料製成的產品的需求日益增長。生物基多元醇用於生產永續泡沫、塗料和黏合劑,符合這些監管要求,為石油基產品提供了替代品。綠建築認證和節能標準進一步支持了這一轉變,鼓勵製造商在其產品中採用環保材料。因此,這些監管趨勢推動了綠色和生物多元醇市場的發展,促進了建築、汽車和包裝等各行業的創新和擴張。對環保產品的監管推動將為亞太綠色和生物多元醇市場創造巨大機遇,鼓勵向更永續、可再生的替代品轉型。隨著政府實施更嚴格的環境法規並設定雄心勃勃的永續發展目標,企業將被迫採用生物基和循環解決方案來滿足這些要求。這種監管轉變將促進創新,提高永續多元醇的可用性,並滿足消費者對環保產品日益增長的偏好。

- 監理推動環保產品

監管部門對環保產品的推動為全球綠色和生物多元醇市場創造了重大機會。隨著世界各國政府實施更嚴格的環境法規和永續發展目標,對由可再生和可生物降解材料製成的產品的需求日益增長。生物基多元醇用於生產永續泡沫、塗料和黏合劑,符合這些監管要求,為石油基產品提供了替代品。綠建築認證和節能標準進一步支持了這一轉變,鼓勵製造商在其產品中採用環保材料。因此,這些監管趨勢推動了綠色和生物多元醇市場的發展,促進了建築、汽車和包裝等各行業的創新和擴張。總之,監管部門對環保產品的推動將為全球綠色和生物多元醇市場創造巨大的機會,鼓勵向更永續、可再生的替代方案轉變。隨著政府實施更嚴格的環境法規並設定雄心勃勃的永續發展目標,企業將被迫採用生物基和循環解決方案來滿足這些要求。這種監管轉變將促進創新,提高永續多元醇的可用性,並滿足消費者對環保產品日益增長的偏好。

限制/挑戰

- 關於使用綠色和生物多元醇的嚴格規定

生物基多元醇的高生產成本仍是其在亞太市場廣泛應用的關鍵限制因素。與受益於成熟、經濟高效的製造流程和完善的供應鏈的傳統多元醇不同,生物基多元醇依賴可再生原料,如植物油、農業廢棄物或其他生物質。這些原料通常涉及複雜的萃取、精煉和加工步驟,從而大大增加生產成本。成本上升的主要驅動因素之一是依賴先進技術和基礎設施將生物基原料轉化為高品質的多元醇。這些技術,包括酵素處理或發酵,需要大量的資本投資和營運支出。此外,生物基多元醇領域尚未實現規模經濟,進一步加劇了與石油基替代品之間的成本差距。原料的多變性和有限性也是造成高昂成本的原因之一。農業產量波動、季節限制以及其他使用相同生物質資源的產業的競爭等因素可能會推高原料價格。例如,常用於生物多元醇生產的大豆油或蓖麻油經常因食品和生物燃料行業的需求而面臨價格壓力。這些成本因素使得生物基多元醇對於包裝、汽車和消費品等價格敏感的產業缺乏吸引力。公司可能會猶豫是否要從傳統多元醇轉型,特別是在永續性認證無法提供顯著競爭優勢或消費者支付溢價意願有限的市場中。

- 多元醇(聚氨酯)生產的嚴格監管

對多元醇(聚氨酯)生產的嚴格規定增加了合規成本和營運複雜性,為亞太綠色和生物多元醇市場帶來了重大挑戰。美國NESHAP、歐洲REACH等法規以及世界各國的法律都要求企業投資先進技術,以減少排放、確保化學品安全並滿足環境標準。這些法規通常要求對製造流程進行大量測試、記錄和調整,這可能會減慢生產速度、增加營運成本並設定市場進入障礙,特別是對於向永續和生物基生產方法過渡的公司而言。例如

美國

國家有害空氣污染物排放標準 (NESHAP) 規定新建和現有工廠設施的有害空氣污染物排放量減少約 70%,從而導致更高的合規成本和潛在的營運延遲。

歐洲

REACH(化學品註冊、評估、授權和限制)綜合法規要求對化學品進行安全測試和記錄,影響生產過程並增加合規研發成本。

印度

1986 年環境保護法 控制污染和確保安全生產規範的規定,要求遵守環境安全協議,但這可能會增加生產成本。

原材料短缺和運輸延誤的影響和當前市場情勢

Data Bridge Market Research 提供高水準的市場分析,並透過考慮原材料短缺和運輸延遲的影響和當前市場環境來提供資訊。這意味著評估策略可能性、制定有效的行動計劃並協助企業做出重要決策。

除了標準報告外,我們還提供對採購層面的深入分析,包括預測運輸延遲、按地區劃分的經銷商映射、商品分析、生產分析、價格映射趨勢、採購、類別績效分析、供應鏈風險管理解決方案、高級基準測試以及其他採購和戰略支援服務。

經濟放緩對產品定價和供應的預期影響

當經濟活動放緩時,各行各業就開始受到影響。 DBMR 提供的市場洞察報告和情報服務考慮了經濟衰退對產品定價和可及性的預測影響。透過這種方式,我們的客戶通常可以領先競爭對手一步,預測他們的銷售額和收入,並估算他們的盈虧支出。

亞太綠色和生物多元醇市場範圍

市場根據類型和應用進行細分。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

類型

- 聚醚多元醇

- 聚酯多元醇

應用

- 泡棉

- 塗料

- 黏合劑

- 密封劑

- 彈性體

- 其他的

亞太綠色和生物多元醇市場區域分析

對市場進行分析,並按上述國家、類型和應用提供市場規模洞察和趨勢。

市場涵蓋的國家有中國、日本、韓國、印度、澳洲和紐西蘭、新加坡、馬來西亞、泰國、印尼、菲律賓和亞太其他地區。

中國憑藉其大規模的生產能力和政府對永續和環保措施的大力支持,在亞太綠色和生物多元醇市場佔據主導地位。該國是生物基原料的主要生產國,為綠色和生物多元醇的生產提供了堅實的基礎。

由於汽車、建築和家具等產業對環保產品的需求增加,中國也有望成為亞太綠色和生物多元醇市場成長最快的國家。

報告的國家部分還提供了影響個別市場因素以及影響市場當前和未來趨勢的國內市場監管變化。下游和上游價值鏈分析、技術趨勢和波特五力分析、案例研究等數據點是用於預測各國市場情景的一些指標。此外,在對國家數據進行預測分析時,還考慮了亞太品牌的存在和可用性,以及由於來自本地和國內品牌的大量或稀缺的競爭而面臨的挑戰、國內關稅和貿易路線的影響。

亞太綠色和生物多元醇市場份額

市場競爭格局提供了競爭對手的詳細資訊。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投資、新市場計劃、亞太地區業務、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度、應用優勢。以上提供的數據點僅與公司對市場的關注有關。

市場上的綠色和生物多元醇市場領導者有:

- 嘉吉公司(美國)

- 巴斯夫公司(德國)

- Emery Oleochemicals(美國)

- Stepan公司(美國)

- Wanhua (China)

- ALBERDINGK BOLEY GmbH(德國)

- Aurorium(美國)

綠色和生物多元醇市場的最新發展

- 2024 年 11 月,Krishna Enterprise 和 Alberdingk Boley 宣佈在印度市場進行水性丙烯酸分散體的合作。自 1985 年以來,Krishna Enterprise 一直致力於提供塗料領域的創新解決方案,Gaurang Goradia 於 10 月訪問了 Alberdingk,簽署了合作協議

- 2024 年 10 月,嘉吉因在其位於 Gresik 的可可加工廠成功實施工業 4.0 技術而被印尼工業部授予 INDI 4.0 2024 智慧工廠獎。這項認可凸顯了嘉吉對先進製造實踐的承諾,包括自動化、即時數據監控和能源管理,旨在提高效率和永續性

- 2023 年 7 月,Stepan 榮獲 2023 年世界金融永續發展獎,以表彰其對永續發展和環保實踐的承諾。該獎項凸顯了 Stepan 在跨產業創造創新、環保解決方案方面的努力,鞏固了其在永續商業實踐方面的領導地位

- 2024 年 6 月,特種原料製造商 Aurorium 宣布推出 Haelium Pharmaceutical Solutions,體現了對醫療保健的長期承諾。經過數十年的創新,Haelium 產品線使 Aurorium 成為亞太地區醫藥成分領域的領導者,體現了獨特的卓越方法

- 2024 年 6 月,巴斯夫擴大了其產品組合,推出了生物質平衡 (BMB) ecoflex,這是一種經認證的可堆肥生物聚合物,適用於包裝行業。這款 ecoflexF Blend C1200 BMB 使用來自有機廢棄物的可再生原料,減少了化石資源的消耗,並降低了 60% 的碳足跡

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.1.7 CONCLUSION

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 BARGAINING POWER OF BUYERS

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICE INDEX

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.6.1 QUALITY AND CONSISTENCY

4.6.2 TECHNICAL EXPERTISE

4.6.3 SUPPLY CHAIN RELIABILITY

4.6.4 COMPLIANCE AND SUSTAINABILITY

4.6.5 COST AND PRICING STRUCTURE

4.6.6 FINANCIAL STABILITY

4.6.7 FLEXIBILITY AND CUSTOMIZATION

4.6.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT'S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 PRODUCTION CAPACITY OVERVIEW

4.8.1 CURRENT PRODUCTION CAPACITY

4.8.2 REGIONAL DISTRIBUTION OF PRODUCTION CAPACITY

4.8.3 TECHNOLOGICAL ADVANCEMENTS AND INNOVATION

4.8.4 CAPACITY EXPANSION AND FUTURE PROJECTIONS

4.9 RAW MATERIAL COVERAGE

4.9.1 PLANT OILS

4.9.1.1 Castor Oil

4.9.1.2 Soybean Oil

4.9.1.3 Palm Oil

4.9.2 AGRICULTURAL RESIDUES AND WASTE BIOMASS

4.9.2.1 Corn Stover

4.9.2.2 Wheat Straw and Rice Husk

4.9.3 SUGAR-BASED FEEDSTOCKS

4.9.3.1 Sugar Alcohols

4.9.4 ALGAE AND OTHER NOVEL SOURCES

4.9.4.1 Algae

4.9.5 WASTE OILS AND BY-PRODUCTS

4.9.5.1 Used Cooking Oils

4.9.6 CONCLUSION

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.2.1 Transportation Costs

4.10.2.2 Storage and Inventory Management

4.10.2.3 Asia-Pacific Supply Chain Disruptions

4.10.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.10.3.1 Raw Material Sourcing and Transportation

4.10.3.2 Sustainability in Logistics

4.10.3.3 Asia-Pacific Distribution and Supply Chain Coordination

4.10.3.4 Technological Integration

4.10.4 CONCLUSION

4.11 TECHNOLOGY ADVANCEMENTS BY MANUFACTURERS

4.11.1 FEEDSTOCK INNOVATION AND RAW MATERIAL OPTIMIZATION

4.11.1.1 Advanced Catalysis and Green Chemistry

4.11.1.2 Feedstock Diversification

4.11.2 ADVANCED PRODUCTION TECHNIQUES

4.11.2.1 Biocatalysis and Enzymatic Processes

4.11.2.2 Green Solvents and Solvent-free Processes

4.11.2.3 Continuous and Flow Chemistry

4.11.3 PROCESS INTEGRATION AND ENERGY EFFICIENCY

4.11.3.1 Heat Integration and Energy Recovery

4.11.3.2 Process Intensification

4.11.4 PERFORMANCE AND PRODUCT INNOVATION

4.11.4.1 Tailored Bio Polyols for Specific Applications

4.11.4.2 Enhanced Durability and Stability

4.11.5 CIRCULAR ECONOMY AND WASTE REDUCTION

4.11.5.1 Recycling of Bio-Based Polyols

4.11.5.2 Zero-Waste Manufacturing

4.11.6 CONCLUSION

5 REGULATION COVERAGE

5.1 ENVIRONMENTAL REGULATIONS AND STANDARDS

5.1.1 CARBON FOOTPRINT AND GREENHOUSE GAS EMISSIONS

5.1.2 SUSTAINABILITY AND BIODEGRADABILITY

5.1.3 REACH AND CHEMICAL SAFETY REGULATIONS

5.2 FEEDSTOCK SOURCING AND AGRICULTURAL REGULATIONS

5.2.1 SUSTAINABLE SOURCING OF RAW MATERIALS

5.2.2 AGRI-ENVIRONMENTAL REGULATIONS

5.2.3 TRACEABILITY AND CERTIFICATION

5.3 PRODUCT SAFETY AND REGULATORY COMPLIANCE

5.3.1 SAFETY AND TOXICITY REGULATIONS

5.3.2 FLAMMABILITY STANDARDS

5.4 CIRCULAR ECONOMY AND WASTE MANAGEMENT REGULATIONS

5.4.1 EXTENDED PRODUCER RESPONSIBILITY (EPR)

5.4.2 PLASTIC WASTE AND PACKAGING REGULATIONS

5.5 REGIONAL REGULATIONS AND STANDARDS

5.6 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING AWARENESS OF SUSTAINABLE MATERIALS

6.1.2 INCREASING DEMAND FOR RIGID AND FLEXIBLE POLYURETHANE IN VARIOUS APPLICATIONS LIKE SPORTS AND ATHLETIC FOOTWEAR

6.1.3 CIRCULAR ECONOMY FOCUSES ON MAXIMIZING RESOURCE EFFICIENCY BY MINIMIZING WASTE AND PROMOTING THE REUSE

6.2 RESTRAINTS

6.2.1 PERFORMANCE LIMITATIONS COMPARED TO CONVENTIONAL POLYOLS

6.2.2 HIGH PRODUCTION COST FOR BIO BASED POLYOLS

6.3 OPPORTUNITIES

6.3.1 INCREASED CONSTRUCTION ACTIVITIES, PARTICULARLY IN EMERGING ECONOMIES

6.3.2 REGULATORY PUSH FOR ECO-FRIENDLY PRODUCTS

6.3.3 TECHNOLOGICAL ADVANCEMENTS IN PRODUCTION

6.4 CHALLENGE

6.4.1 STRINGENT REGULATION FOR POLYOLS (POLYURETHANE) PRODUCTION

7 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY TYPE

7.1 OVERVIEW

7.2 POLYETHER POLYOLS

7.3 POLYESTER POLYOLS

8 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 FOAM

8.3 COATINGS

8.4 ADHESIVES

8.5 SEALANTS

8.6 ELASTOMERS

8.7 OTHERS

9 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY REGION

9.1 ASIA-PACIFIC

9.1.1 CHINA

9.1.2 JAPAN

9.1.3 SOUTH KOREA

9.1.4 INDIA

9.1.5 AUSTRALIA AND NEW ZEALAND

9.1.6 SINGAPORE

9.1.7 MALAYSIA

9.1.8 THAILAND

9.1.9 INDONESIA

9.1.10 PHILIPPINES

9.1.11 REST OF ASIA-PACIFIC

10 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 CARGILL, INCORPORATED

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 BASF

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 EMERY OLEOCHEMICALS

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 STEPAN COMPANY

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 POLYLABS TM.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 ALBERDINGK BOLEY GMBH

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 AURORIUM

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BIOBASED TECHNOLOGIES

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 WANHUA

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

表格列表

TABLE 1 COUNTRY WISE REGULATION FOR PRODUCTION OF POLYOLS (POLYURETHANE)

TABLE 2 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 4 ASIA-PACIFIC POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC FOAM IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 12 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 14 ASIA-PACIFIC POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 20 CHINA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 CHINA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 22 CHINA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 23 CHINA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 24 CHINA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 25 CHINA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 26 CHINA GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 27 CHINA FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 28 JAPAN GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 JAPAN GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 30 JAPAN POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 31 JAPAN POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 32 JAPAN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 33 JAPAN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 34 JAPAN GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 JAPAN FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 36 SOUTH KOREA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 SOUTH KOREA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 38 SOUTH KOREA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 39 SOUTH KOREA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 40 SOUTH KOREA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 41 SOUTH KOREA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 42 SOUTH KOREA GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 SOUTH KOREA FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 44 INDIA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 INDIA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 46 INDIA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 47 INDIA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 48 INDIA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 49 INDIA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 50 INDIA GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 INDIA FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 52 AUSTRALIA AND NEW ZEALAND GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 AUSTRALIA AND NEW ZEALAND GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 54 AUSTRALIA AND NEW ZEALAND POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 55 AUSTRALIA AND NEW ZEALAND POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 56 AUSTRALIA AND NEW ZEALAND POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 57 AUSTRALIA AND NEW ZEALAND POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 58 AUSTRALIA AND NEW ZEALAND GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 AUSTRALIA AND NEW ZEALAND FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 60 SINGAPORE GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SINGAPORE GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 62 SINGAPORE POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 63 SINGAPORE POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 64 SINGAPORE POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 65 SINGAPORE POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 66 SINGAPORE GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 SINGAPORE FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 68 MALAYSIA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 MALAYSIA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 70 MALAYSIA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 71 MALAYSIA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 72 MALAYSIA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 73 MALAYSIA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 74 MALAYSIA GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 MALAYSIA FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 76 THAILAND GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 THAILAND GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 78 THAILAND POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 79 THAILAND POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 80 THAILAND POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 81 THAILAND POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 82 THAILAND GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 THAILAND FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 84 INDONESIA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 INDONESIA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 86 INDONESIA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 87 INDONESIA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 88 INDONESIA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 89 INDONESIA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 INDONESIA GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 91 INDONESIA FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 92 PHILIPPINES GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 PHILIPPINES GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 94 PHILIPPINES POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 95 PHILIPPINES POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 96 PHILIPPINES POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 97 PHILIPPINES POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 98 PHILIPPINES GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 PHILIPPINES FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 100 REST OF ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 REST OF ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

图片列表

FIGURE 1 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET

FIGURE 2 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: SEGMENTATION

FIGURE 12 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, BY TYP, 2024

FIGURE 13 EXECUTIVE SUMMARY OF ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING AWARENESS OF SUSTAINABLE MATERIALS IS EXPECTED TO DRIVE THE ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE POLYETHER POLYOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET, 2023-2032, AVERAGE SELLING PRICE (USD/TON)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET

FIGURE 24 TOTAL LENGTH OF NATIONAL HIGHWAY IN (KM) (2014-2023) OF INDIA

FIGURE 25 NUMBER OF AIRPORTS (2014-2024) IN INDIA

FIGURE 26 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: BY TYPE, 2024

FIGURE 27 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: BY APPLICATION, 2024

FIGURE 28 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: SNAPSHOT (2024)

FIGURE 29 ASIA-PACIFIC GREEN AND BIO POLYOLS MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。