Asia Pacific Replaceable Filter Dust Masks Market

市场规模(十亿美元)

CAGR :

%

USD

656.79 Million

USD

1,142.76 Million

2025

2033

USD

656.79 Million

USD

1,142.76 Million

2025

2033

| 2026 –2033 | |

| USD 656.79 Million | |

| USD 1,142.76 Million | |

|

|

|

|

亞太地區可更換濾芯防塵口罩市場,依產品類型(彈性體半面罩呼吸器 (EHMR)、專業城市/運動防污染口罩、動力送風式空氣淨化呼吸器 (PAPR)、全面罩呼吸器(輕度粉塵應用)、其他)、濾芯類型/等級(高效顆粒物濾芯、HEPA 級濾芯、組合濾芯(高效濾芯、組合濾芯(高效能物濾芯、組合濾芯、組合濾芯(高效率)。有害氣體/蒸氣)、其他)、應用領域(工業、醫療/保健、其他)、最終用戶(大型企業、政府及公共安全部門、中小企業 (SME)、個人/專業消費用戶)、分銷管道(直接、間接)劃分——行業趨勢及至 2033 年的預測

亞太地區可更換濾芯防塵口罩市場規模

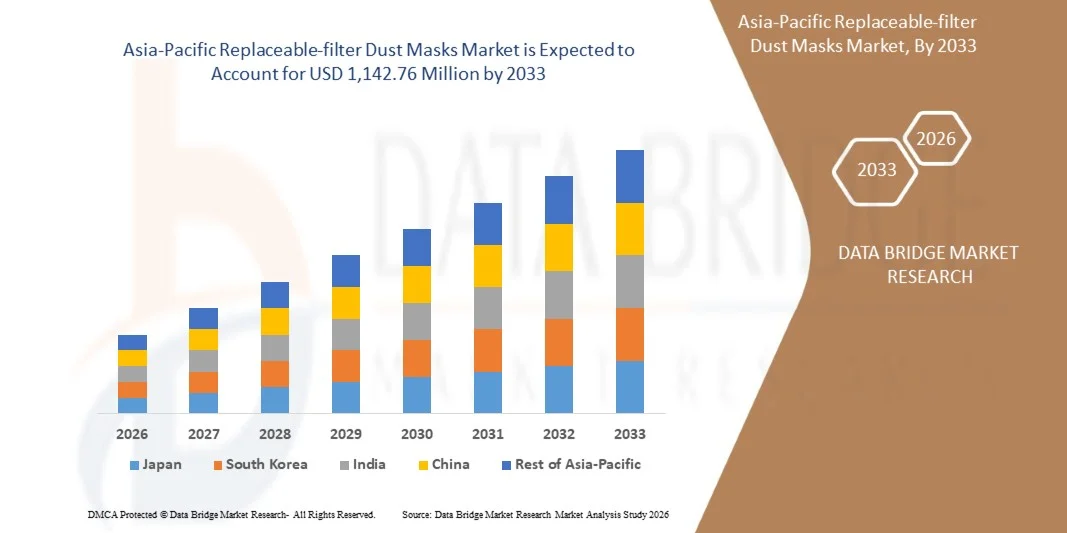

- 2025年亞太地區可更換濾芯防塵口罩市場規模為6.5679億美元,預計2033年將達到11.4276億美元。

- 在2026年至2033年的預測期內,市場預計將以7.3%的複合年增長率成長,主要驅動力是消費者對輕型瓦楞紙箱日益增長的需求。

- 這一增長是由多種因素推動的,例如持續的工業化需要獨特的紙箱和材料,對永續和美觀包裝的需求不斷增長等等。

亞太地區可更換濾芯防塵口罩市場分析

- 亞太地區可更換濾芯防塵口罩市場正穩步擴張,這得益於職業健康意識的提高、工作場所安全法規的日益嚴格以及工業和城市環境中空氣顆粒物暴露量的增加。與一次性口罩相比,可更換濾芯防塵口罩具有成本效益高、使用壽命長、過濾性能穩定、減少浪費等優勢。其應用範圍已擴展至建築、製造、採礦、化學、製藥、農業和基礎建設等行業。然而,發展中國家監管執行力度不足、小型企業意識有限、價格敏感度以及濾芯更換和維護方面的培訓需求等挑戰依然存在。

- 建築業和工業仍然是主要的成長動力,因為這些行業的工人長期暴露於粉塵、煙霧和細顆粒物中,因此需要可靠且可重複使用的呼吸防護設備。亞太主要經濟體的快速工業化、基礎設施擴張和城市發展進一步強化了這項需求。同時,製造業、採礦業和化學企業也越來越重視經認證的呼吸防護設備,以符合不斷變化的職業安全規範。人們對空氣污染和工作場所健康風險日益增長的擔憂,也進一步推動了可更換濾芯式防塵口罩的普及。

- 印尼在塑造區域市場格局方面發揮關鍵作用,其大型製造業中心和不斷擴張的建築活動加速了產品的普及。同時,受出口導向產業和跨國公司的影響,印尼在產品規格和品質基準方面也更加重視與國際安全標準的接軌。東南亞和南亞新興經濟體也正憑藉著不斷增長的工業就業和工人安全意識的逐步提高,成為新興市場。

- 主要製造商正致力於產品創新,包括採用先進的過濾材料、符合人體工學的口罩設計、輕巧可重複使用的外殼以及改進的密封機制,以提升舒適度和防護性能。多層可更換濾芯、相容於多種顆粒物標準以及提高透氣性等創新技術正日益受到重視。在各類產品中,可更換濾芯的可重複使用口罩因其在高暴露行業中的廣泛應用而佔據了相當大的市場份額。與工業分銷商、安全設備供應商和監管機構的策略合作正在影響市場滲透率。隨著該地區工作場所安全法規的不斷收緊,對品質、認證和用戶教育的持續投入對於保持長期競爭力至關重要。

- 預計到2026年,彈性體半面罩呼吸器(EHMR)將佔據最大的市場份額,約為37.36%,這主要得益於該地區不斷增長的工業活動以及對長期、經濟高效的呼吸防護設備的日益普及。中國、印度和東南亞等國家不斷擴大的建築、製造和採礦作業,使得對配備可更換濾芯的耐用型呼吸器的需求不斷增長。這些面罩之所以備受青睞,是因為它們防護性能強,降低了長期採購成本,並且可以透過定期更換濾芯輕鬆維護。其模組化設計——可以根據顆粒物濃度或化學物質暴露情況快速更換濾芯——使其成為既需要防護又需要操作便捷的工作場所的首選。

報告範圍及亞太地區可更換濾芯防塵口罩市場細分

|

屬性 |

瓦楞紙板包裝關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括進出口分析、產能概覽、生產消費分析、價格趨勢分析、氣候變遷情境、供應鏈分析、價值鏈分析、原材料/消耗標準概覽、供應商選擇、PESTLE 分析、五力分析和監管框架。 |

亞太地區可更換濾芯防塵口罩市場趨勢

“主要市場參與者之間策略性收購與合作的增加”

- 亞太地區可更換濾芯防塵口罩產業正經歷併購和合作關係顯著增加的趨勢,主要廠商之間紛紛建立合作關係。大型企業正透過收購區域性企業、成立合資公司以及在新興高需求國家擴大生產能力來鞏固其市場地位。這些策略性舉措的主要驅動力在於,企業需要豐富產品組合、拓展分銷網絡並提高對不斷變化的安全和監管要求的反應速度。

此類合作也促進了業界先進過濾技術、改進的人體工學設計以及永續材料創新技術的更快應用。透過匯集技術專長和製造資源,企業正在加快產品開發週期,並提高其供應鏈的整體效率。

亞太地區可更換濾芯防塵口罩市場動態

司機

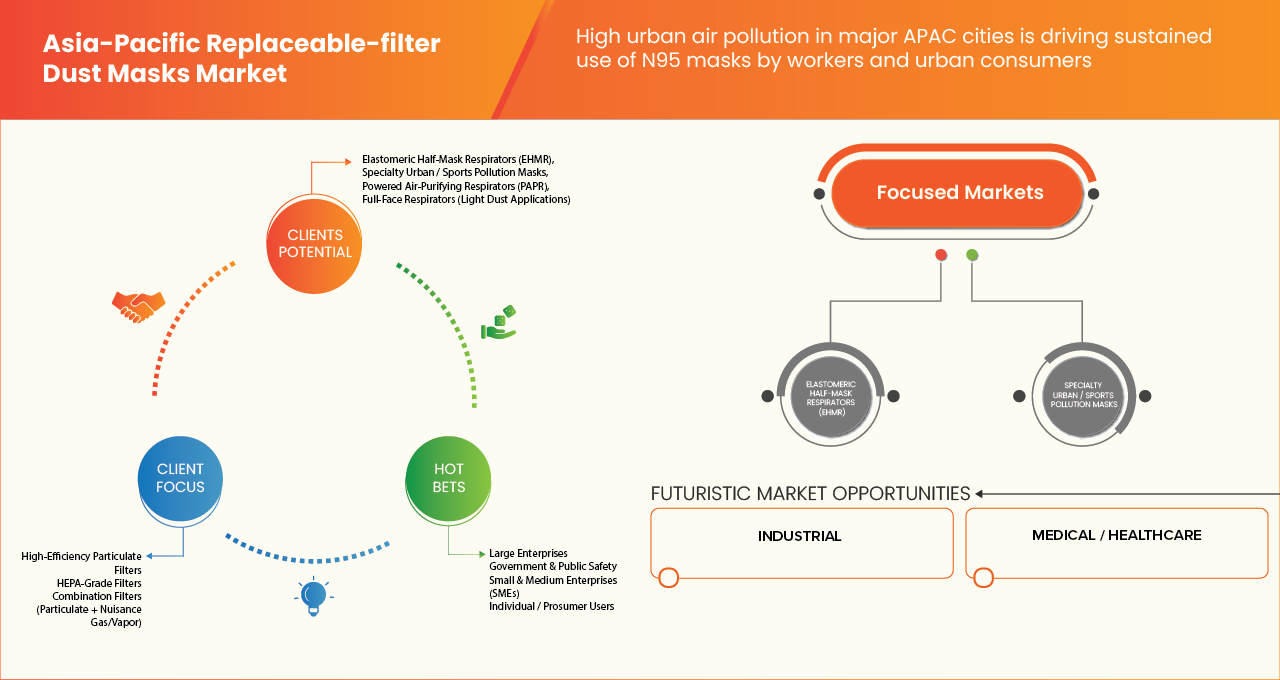

“亞太地區主要城市持續的高污染水平加劇了人們對可更換濾芯防塵口罩的長期依賴。”

- 亞太地區主要大都市日益嚴重的城市空氣污染,凸顯了高效呼吸防護用品的持續需求,其中可更換濾芯的防塵口罩的需求日益增長。反覆出現的霧霾事件、快速的工業發展、密集的交通、建築擴張以及季節性霧霾,造成了長期空氣品質惡劣的狀況,導致公共衛生部門頻繁發布健康警示。隨著各國政府和醫學專家持續建議在空氣品質「差」到「嚴重」時佩戴顆粒物過濾式呼吸器,無論是工人還是城市居民,都在尋求更耐用、可重複使用的防護用品,這些用品不僅能提供持續的過濾效果,還能降低長期廢棄物產生和更換成本。

- 這種轉變正在增強對可更換濾芯式呼吸器的結構性需求,此類呼吸器使用壽命更長,並在反覆發生的污染事件中提供有效的顆粒物防護。隨著時間的推移,使用這類口罩正逐漸成為一種持續的健康管理行為,而不再只是對突發性污染高峰的短期應對措施。

- 2025年11月,《今日印度》報道稱,德里衛生專家建議市民在霧霾嚴重的情況下佩戴N95或N99級口罩。此類反覆發布的建議凸顯了高性能顆粒物過濾的持續必要性,並鼓勵人們使用可更換濾芯的防塵口罩,以便在長時間的污染期間提供持久的防護。

- 2024年7月,根據國家清潔空氣計劃,印度環境、森林和氣候變遷部(MoEF&CC)確定了131個需要採取針對性污染控制措施的印度城市,承認這些城市長期面臨空氣品質問題。人們對長期污染風險的認識不斷提高,促使可更換濾芯的呼吸器在日常生活中得到更廣泛的應用,尤其是在尋求可持續和可重複使用防護措施的城市居民中。

- 2023 年 11 月,世界資源研究所的一篇新聞文章重點介紹了一項針對東南亞主要城市的區域環境分析,明確指出,在高污染日(由車輛排放和工業活動引起),雅加達和曼谷等城市的衛生機構經常發佈公共建議,敦促居民盡可能待在室內或在戶外佩戴口罩,強調使用呼吸器已成為一種反復出現的防護行為。

克制/挑戰

「假冒產品的存在破壞了消費者的信任,並擠壓了合規製造商的利潤空間。”

- 在亞太多個經濟體中,假冒偽劣和不合規的呼吸防護口罩持續存在,已成為可更換濾芯防塵口罩市場發展的一大限制因素。低價的非法替代品經常湧入非正規和灰色市場管道,削弱了那些投資於經認證的濾芯、獲得監管許可並實施嚴格品質控制流程的認證製造商的競爭力。這些不受監管的替代品不僅壓縮了合法生產商的利潤空間,也降低了消費者對優質可更換濾芯呼吸防護系統的信心。持續進行的執法行動,包括查扣產品、打擊假冒偽劣產品以及地方當局發布的合規通知,表明假冒產品的滲透仍然是阻礙市場正規化的結構性障礙,限制了高品質可更換濾芯設計的應用,並加重了現有行業參與者的合規和監管負擔。

- 2025年2月,美國國家職業安全與健康研究所(NIOSH)發布了一份題為“虛假宣傳的口罩和其他面部佩戴產品”的警告,強調假冒偽劣口罩可能無法為工人和消費者提供足夠的呼吸防護。這份官方建議凸顯了劣質低價口罩對口罩生產商獲利構成的持續挑戰。

- 2022年2月,香港海關進行專案行動,在何文田購物中心的臨時攤位上查獲約15,000個疑似假冒醫用口罩,其中許多標有N95或醫用級字樣;一名41歲女子因涉案被捕。

亞太地區可更換濾芯防塵口罩市場範圍

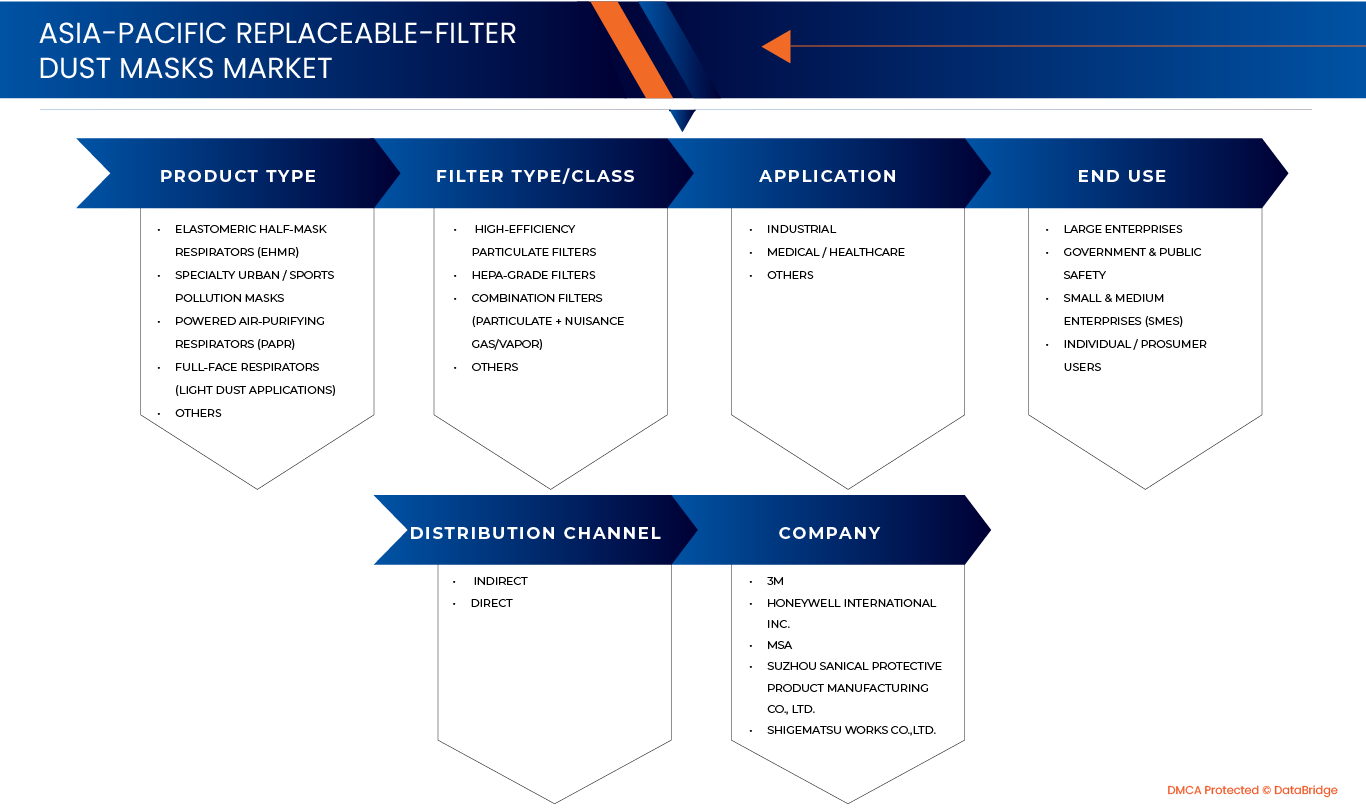

亞太地區可更換濾芯防塵口罩市場根據產品類型、濾芯類型/等級、應用、最終用途和分銷管道分為五個主要部分。

- 依產品類型

根據產品類型,市場可細分為彈性體半面罩呼吸器 (EHMR)、專業城市/運動防污染口罩、動力送風式呼吸器 (PAPR)、全面罩呼吸器(輕度粉塵應用)和其他產品。預計到 2026 年,彈性體半面罩呼吸器 (EHMR) 將佔據最大市場份額。亞太地區對 EHMR 的需求主要受以下因素驅動:工業安全合規性的提高、對耐用性需求的增強以及長期使用的成本效益。製造業、採礦業和建築業對 EHMR 的日益普及,以及呼吸防護強制令的出台,顯著提升了 EHMR 在區域工作場所的滲透率。

- 按篩選類型/類別

根據過濾器類型/等級,市場可細分為高效能顆粒過濾器、HEPA等級過濾器、組合過濾器(顆粒物+有害氣體/蒸氣)和其他過濾器。預計到2026年,高效能顆粒過濾器市場將佔據主導地位。高效能顆粒過濾器的成長得益於更嚴格的空氣品質標準、日益增強的職業危害意識以及化學、製藥和電子產業的擴張。對高效過濾細粉塵、煙霧和有害顆粒物的需求不斷增長,加速了工業和醫療保健領域的應用。

- 透過申請

根據應用領域,市場可分為工業、醫療/保健和其他領域。預計到2026年,工業領域將受益於更嚴格的安全法規、大規模製造業擴張以及粉塵和化學顆粒物暴露風險的增加。亞太地區各行業對工人保護計畫的投資不斷增長,工廠、煉油廠和建築項目的審核力度也隨之加大,進一步提升了對可更換濾芯呼吸器的需求。

- 最終用戶

根據最終用途,市場可細分為大型企業、政府及公共安全部門、中小企業 (SME) 和個人/專業消費者用戶。預計到 2026 年,大型企業市場將佔據主導地位,其主要驅動力是透過標準化的安全規程、大量採購以及更加重視遵守全球職業健康規範來推動產品普及。大型企業完善的 EHS(環境、健康與安全)體系、穩定的預算以及對高品質呼吸器的偏好,推動了亞太地區製造中心呼吸器消費量的成長。

- 按分銷管道

根據分銷管道,市場可分為直接分銷和間接分銷。間接分銷通路可細分為電商平台、工業分銷商及零售商。預計到2026年,間接分銷管道將佔據主導地位,這主要得益於強大的分銷商網絡、更廣泛的市場覆蓋以及透過安全產品供應商提供的多元化品牌。工業買家更傾向於選擇分銷商,因為分銷商能夠提供可靠的庫存、快速的交貨和具有競爭力的價格,這些因素共同推動了亞太地區可更換濾芯防塵口罩的間接銷售。

亞太地區可更換濾芯防塵口罩市場份額

亞太地區可更換濾芯防塵口罩市場的競爭格局分析全面展現了主要製造商在產業中的定位。本部分概述了每個競爭對手的關鍵訊息,包括其公司背景、財務表現、整體收入狀況和市場潛力。此外,還重點介紹了他們在研發方面的投入、近期策略舉措、區域佈局以及生產規模。

市場上的主要市場領導者包括:

- 重松製作所(日本)

- KOKEN LTD.(日本)

- 劍橋面具公司(英國)

- 蘇州三佳防護用品製造有限公司(中國)

- 上海大勝保健品製造有限公司(中國)

- 3M公司(美國)

- 霍尼韋爾國際公司(美國)

- MSA Safety Incorporated(美國)

- Drägerwerk AG & Co. KGaA(德國)

- Moldex-Metric公司(美國)

- GVS SpA(義大利)

- 馬克瑞特(中國)

亞太地區可更換濾芯防塵口罩市場最新發展動態

- 2024年4月,亞太地區主要生產中心的製造商報告稱,市場對可更換濾芯防塵口罩的輕巧且經濟高效的包裝解決方案的需求顯著增長。這項轉變主要由電子商務和快速消費品(FMCG)公司推動,這些公司致力於降低物流和最後一公里配送成本,尤其是在高銷售量市場。

- 2023年12月,該地區幾家領先的口罩生產商加強了與位於主要工業園區的包裝供應商的合作。這些合作關係促成了專為可重複使用呼吸器和可更換濾芯大宗運輸而設計的高強度定制防護包裝的開發,從而提高了產品在長途運輸過程中的安全性。

- 2024年3月,農業和出口產業的防塵口罩生產商與包裝供應商接洽,尋求防潮耐用的紙箱解決方案。這些升級的包裝材料對於確保口罩在亞太地區農業市場常見的潮濕氣候和儲存環境中運輸時的品質和保質期至關重要。

- 2023年9月,服務化工、製藥和工業安全領域的公司擴展了其包裝產品線,新增了高強度、抗衝擊解決方案。此次擴展有助於安全分銷用於危險作業環境的高級呼吸器和濾芯,反映出各行業對員工安全和合規性的日益增長的需求。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 CONSUMER BUYING BEHAVIOUR IN THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.2.1 HEALTH AND SAFETY CONSCIOUSNESS

4.2.2 BRAND TRUST AND REPUTATION

4.2.3 PRODUCT FEATURES AND INNOVATION

4.2.4 PRICE SENSITIVITY AND VALUE PERCEPTION

4.2.5 AWARENESS OF CERTIFICATIONS AND COMPLIANCE

4.2.6 ACCESSIBILITY AND DISTRIBUTION CHANNELS

4.2.7 SOCIAL INFLUENCE AND RECOMMENDATIONS

4.2.8 ENVIRONMENTAL AND SUSTAINABILITY CONSIDERATIONS

4.2.9 PURCHASE FREQUENCY AND USAGE PATTERNS

4.2.10 CONCLUSION

4.3 VENDOR SELECTION CRITERIA – ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.3.1 PRODUCT QUALITY & TECHNICAL COMPETENCE

4.3.1.1 MATERIAL INTEGRITY AND FILTRATION EFFICIENCY

4.3.1.2 DESIGN ADAPTABILITY AND USER COMFORT

4.3.1.3 BATCH CONSISTENCY AND QUALITY TESTING MECHANISMS

4.3.2 REGULATORY COMPLIANCE AND CERTIFICATION STANDARDS

4.3.2.1 ADHERENCE TO REGIONAL STANDARDS

4.3.2.2 PARTICIPATION IN VOLUNTARY CERTIFICATIONS

4.3.2.3 REGULATORY TRANSPARENCY

4.3.3 COST EFFICIENCY AND COMMERCIAL VIABILITY

4.3.3.1 PRICING STRUCTURE AND LONG-TERM AFFORDABILITY

4.3.3.2 COST-TO-PERFORMANCE RATIO

4.3.3.3 FLEXIBILITY IN CONTRACT TERMS

4.3.4 PRODUCTION CAPACITY AND SUPPLY RELIABILITY

4.3.4.1 MANUFACTURING FOOTPRINT AND AUTOMATION LEVEL

4.3.4.2 LEAD TIME AND ON-TIME DELIVERY PERFORMANCE

4.3.4.3 INVENTORY PLANNING AND EMERGENCY ALLOCATION

4.3.5 INNOVATION CAPABILITY AND PRODUCT DEVELOPMENT STRENGTH

4.3.5.1 R&D INVESTMENTS AND PATENT OWNERSHIP

4.3.5.2 SPEED OF PRODUCT CUSTOMIZATION

4.3.5.3 TREND ALIGNMENT

4.3.6 SUPPLY CHAIN TRANSPARENCY AND ETHICAL PRACTICES

4.3.6.1 TRACEABILITY OF RAW MATERIALS

4.3.6.2 ENVIRONMENTAL AND SOCIAL COMPLIANCE

4.3.6.3 VENDOR GOVERNANCE AND POLICY DOCUMENTATION

4.3.7 MARKET REPUTATION AND CLIENT FEEDBACK

4.3.7.1 INDUSTRY FEEDBACK AND PEER ENDORSEMENTS

4.3.7.2 AFTER-SALES RESPONSIVENESS

4.3.7.3 LONGEVITY IN THE MARKET

4.3.8 TECHNOLOGICAL INTEGRATION AND DIGITAL CAPABILITY

4.3.8.1 INTEGRATION OF DIGITAL QUALITY MONITORING SYSTEMS

4.3.8.2 USE OF ERP AND LOGISTICS PLATFORMS

4.3.8.3 DATA-SHARING WILLINGNESS

4.3.9 CONCLUSION

4.4 RAW MATERIAL COVERAGE – ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.4.1 FILTRATION MEDIA (MELT-BLOWN & ELECTROSTATIC LAYERS)

4.4.1.1 TECHNICAL RELEVANCE

4.4.1.2 ELECTROSTATIC ENHANCEMENT

4.4.1.3 SUPPLY RELIABILITY

4.4.2 NONWOVEN OUTER AND INNER LAYERS (SPUN-BOND FABRICS)

4.4.2.1 FUNCTIONAL CHARACTERISTICS

4.4.2.2 REAL-WORLD APPLICABILITY

4.4.2.3 REGIONAL PRODUCTION STRENGTH

4.4.3 ELASTOMERS AND HEAD STRAPS

4.4.3.1 USER-CENTRIC IMPORTANCE

4.4.3.2 MATERIAL ADAPTABILITY

4.4.3.3 SUSTAINABILITY SHIFTS

4.4.4 NOSE CLIPS AND STRUCTURAL SUPPORT COMPONENTS

4.4.4.1 PERFORMANCE SIGNIFICANCE

4.4.4.2 COMFORT ENHANCEMENTS

4.4.4.3 EMERGENCE OF POLYMER-BASED ALTERNATIVES

4.4.5 EXHALATION VALVES AND FILTER CARTRIDGES

4.4.5.1 OPERATIONAL ROLE

4.4.5.2 MATERIAL INNOVATIONS

4.4.5.3 CARTRIDGE HOUSING

4.4.6 ACTIVATED CARBON LAYERS

4.4.6.1 PRACTICAL USE CASES

4.4.6.2 MATERIAL ADVANTAGES

4.4.7 PACKAGING MATERIALS

4.4.7.1 INDUSTRY PRACTICE

4.4.7.2 LOGISTICAL IMPORTANCE

4.4.8 CONCLUSION

4.5 BRAND OUTLOOK – ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.5.1 TRUST AND SAFETY ASSURANCE

4.5.2 DESIGN AND COMFORT AS DIFFERENTIATORS

4.5.3 INNOVATION AND VALUE-ADDED FUNCTIONALITY

4.5.4 LOCALIZATION AND REGIONAL RELEVANCE

4.5.5 DIGITAL ENGAGEMENT AND BRAND VISIBILITY

4.5.6 INDUSTRIAL AND INSTITUTIONAL ENDORSEMENT

4.5.7 PRICING STRATEGY AND PERCEIVED VALUE

4.5.8 CONCLUSION

4.6 SUPPLY CHAIN EXPLANATION FOR THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.6.1 RAW MATERIAL SOURCING AND PREPARATION

4.6.2 MANUFACTURING AND ASSEMBLY

4.6.3 PACKAGING AND LABELLING

4.6.4 DISTRIBUTION AND LOGISTICS

4.6.5 RETAIL ACCESS AND END-USER ENGAGEMENT

4.6.6 POST-PURCHASE SUPPORT AND DISPOSAL MECHANISMS

4.6.7 CONCLUSION

4.7 COST ANALYSIS BREAKDOWN

4.7.1 KEY COST COMPONENTS

4.7.1.1 RAW MATERIALS

4.7.1.2 COMPONENTS & REPLACEABLE FILTERS

4.7.1.3 LABOR COSTS

4.7.1.4 MANUFACTURING & EQUIPMENT (DEPRECIATION/OVERHEADS)

4.7.1.5 TESTING, CERTIFICATION & QUALITY ASSURANCE

4.7.1.6 PACKAGING & ACCESSORIES

4.7.1.7 DISTRIBUTION, LOGISTICS & SUPPLY CHAIN

4.7.1.8 OVERHEADS, SG&A, R&D, AND COMPLIANCE

4.8 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.8.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.8.2 ACTIVE DEVELOPMENT

4.8.3 STAGE OF DEVELOPMENT

4.8.4 TIMELINES AND MILESTONES

4.8.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.8.6 RISK ASSESSMENT AND MITIGATION

4.8.6.1 RISKS

4.8.6.2 MITIGATION STRATEGIES

4.8.7 FUTURE OUTLOOK

4.9 VALUE CHAIN ANALYSIS

4.9.1 RAW MATERIALS & PRIMARY COMPONENTS

4.9.2 COMPONENT MANUFACTURING & MASK/FILTER CONVERSION

4.9.3 EQUIPMENT & TECHNOLOGY PROVIDERS

4.9.4 QUALITY, STANDARDS & REGULATORY INTERFACE

4.9.5 DISTRIBUTION & INDUSTRIAL SUPPLY LOGISTICS

4.9.6 OEMS, CDMOS, TESTING LABS & SERVICE LAYER

4.9.7 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S)

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVER

7.1.1 PERSISTENT HIGH POLLUTION LEVELS ACROSS MAJOR APAC CITIES ARE STRENGTHENING LONG-TERM RELIANCE ON REPLACEABLE-FILTER DUST MASKS

7.1.2 STRENGTHENING OCCUPATIONAL SAFETY REGULATIONS IN CONSTRUCTION AND MINING, MANDATING CERTIFIED RESPIRATORY PROTECTION

7.1.3 GROWING CONSUMER HEALTH CONSCIOUSNESS FAVORING HIGHER-GRADE RESPIRATORS

7.2 RESTRAINT

7.2.1 PRESENCE OF COUNTERFEIT PRODUCTS UNDERMINING TRUST AND SQUEEZING MARGINS OF COMPLIANT MANUFACTURERS

7.2.2 COMFORT AND FIT ISSUES REDUCING CONSISTENT MASK USAGE

7.3 OPPORTUNITES

7.3.1 SMART RESPIRATORS CREATING PREMIUM TECHNOLOGY-DRIVEN MARKET NICHES

7.3.2 EXPANDING HEALTHCARE INFRASTRUCTURE IN CHINA, INDIA, AND SOUTHEAST ASIA DRIVING HIGHER INSTITUTIONAL DEMAND FOR ADVANCED REPLACEABLE-FILTER RESPIRATORS

7.3.3 RISING ADOPTION OF INDUSTRIAL-GRADE AND SECTOR-SPECIFIC REPLACEABLE-FILTER MASK VARIANTS

7.4 CHALLENGES

7.4.1 NAVIGATING HETEROGENEOUS REGULATORY AND CERTIFICATION FRAMEWORKS

7.4.2 MANAGING INVENTORY PLANNING AND DEMAND VOLATILITY, WITH SUDDEN SPIKES DURING OUTBREAKS, POLLUTION EPISODES, OR DISASTERS

8 TABLE

9 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

9.2.1 ELASTOMERIC HALF-MASK RESPIRATORS (EHMR)

9.2.2 SPECIALTY URBAN / SPORTS POLLUTION MASKS

9.2.3 POWERED AIR-PURIFYING RESPIRATORS (PAPR)

9.2.4 FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS)

9.2.5 OTHERS

9.3 ASIA-PACIFIC ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 DUAL-FILTER PORT

9.3.2 SINGLE-FILTER PORT

9.4 ASIA-PACIFIC FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 STANDARD FULL-FACE

9.4.2 LOW-PROFILE / PANORAMIC

9.4.3 CHEMICAL-RESISTANT FULL FACE

10 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS

10.1 OVERVIEW

10.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

10.2.1 HIGH-EFFICIENCY PARTICULATE FILTERS

10.2.2 HEPA-GRADE FILTERS

10.2.3 COMBINATION FILTERS (PARTICULATE + NUISANCE GAS/VAPOR)

10.2.4 OTHERS

11 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.2.1 INDUSTRIAL

11.2.2 MEDICAL / HEALTHCARE

11.2.3 OTHERS

11.3 ASIA-PACIFIC INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 CONSTRUCTION

11.3.2 MINING

11.3.3 AUTOMOTIVE

11.3.4 SMELTING / METALLURGY

11.3.5 SHIPBUILDING

11.3.6 AGRICULTURE & FORESTRY

11.3.7 OTHERS

12 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, END USE

12.1 OVERVIEW

12.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

12.2.1 LARGE ENTERPRISES

12.2.2 GOVERNMENT & PUBLIC SAFETY

12.2.3 SMALL & MEDIUM ENTERPRISES (SMES)

12.2.4 INDIVIDUAL / PROSUMER USERS

13 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

13.2.1 INDIRECT

13.2.2 DIRECT

13.3 ASIA-PACIFIC INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.3.1 E‑COMMERCE MARKETPLACES

13.3.2 INDUSTRIAL DISTRIBUTORS

13.3.3 RETAIL

14 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY COUNTRY

14.1 ASIA PACIFIC

14.1.1 INDONESIA

14.1.2 VIETNAM

14.1.3 THAILAND

15 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

15.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 3M

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 HONEYWELL INTERNATIONAL INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 MSA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 SUZHOU SANICAL PROTECTIVE PRODUCT MANUFACTURING CO., LTD

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 SHIGEMATSU WORKS CO., LTD.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 CAMBRIDGE MASK CO.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 DRÄGERWERK AG & CO. KGAA

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 GVS S.P.A.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 KOKEN LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 MARKRITE

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 MOLDEX-METRIC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 SHANGHAI DASHENG HEALTH PRODUCTS MANUFACTURING CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 CONSUMER PROFILES AND PURCHASING BEHAVIOR FOR RESPIRATORY PROTECTION PRODUCTS

TABLE 2 SUMMARY OF KEY RAW MATERIALS AND THEIR FUNCTIONAL IMPACT

TABLE 3 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET – BRAND OUTLOOK

TABLE 4 KEY PRODUCTS AND COMPETITIVE LANDSCAPE OF TOP GLOBAL RESPIRATOR AND DUST MASK BRANDS

TABLE 5 TYPICAL COST SHARES OF ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET:

TABLE 6 DETAILS ON MOST COMMON MASKED, BY COUNTRY, 2024

TABLE 7 PRICING/MARGIN ANALYSIS, AT MANUFACTURER’S & DISTRIBUTION LEVEL, BY COUNTRY, 2024

TABLE 8 DETAILS ON MOST COMMON MASKED, BY COUNTRY, 2024

TABLE 9 PRICING/MARGIN ANALYSIS, AT MANUFACTURER’S & DISTRIBUTION LEVEL, BY COUNTRY, 2024

TABLE 10 DETAILS ON MOST COMMON MASKED, BY COUNTRY, 2024

TABLE 11 PRICING/MARGIN ANALYSIS, AT MANUFACTURER’S & DISTRIBUTION LEVEL, BY COUNTRY, 2024

TABLE 12 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC

TABLE 24 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 INDONESIA ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 INDONESIA FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 37 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 38 INDONESIA INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 40 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 41 INDONESIA INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 VIETNAM ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 VIETNAM FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 46 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 47 VIETNAM INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 49 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 50 VIETNAM INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 THAILAND ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 THAILAND FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 55 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 56 THAILAND INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 58 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 59 THAILAND INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

图片列表

FIGURE 1 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 FIVE SEGMENTS COMPRISE THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MARKET, BY PRODUCT TYPE (2025)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING CONSUMER HEALTH CONSCIOUSNESS FAVORING HIGHER-GRADE RESPIRATORS IS A MAJOR FACTOR BOOSTING THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET IN 2026 & 2033

FIGURE 16 DROC

FIGURE 17 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2025

FIGURE 18 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2025

FIGURE 19 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2025

FIGURE 20 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2025

FIGURE 21 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2025

FIGURE 22 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, SNAPSHOT (2025)

FIGURE 23 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: COMPANY SHARE 2025 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。