Asia Pacific Submarine Cable System Market

市场规模(十亿美元)

CAGR :

%

USD

6.90 Million

USD

13.55 Million

2024

2032

USD

6.90 Million

USD

13.55 Million

2024

2032

| 2025 –2032 | |

| USD 6.90 Million | |

| USD 13.55 Million | |

|

|

|

|

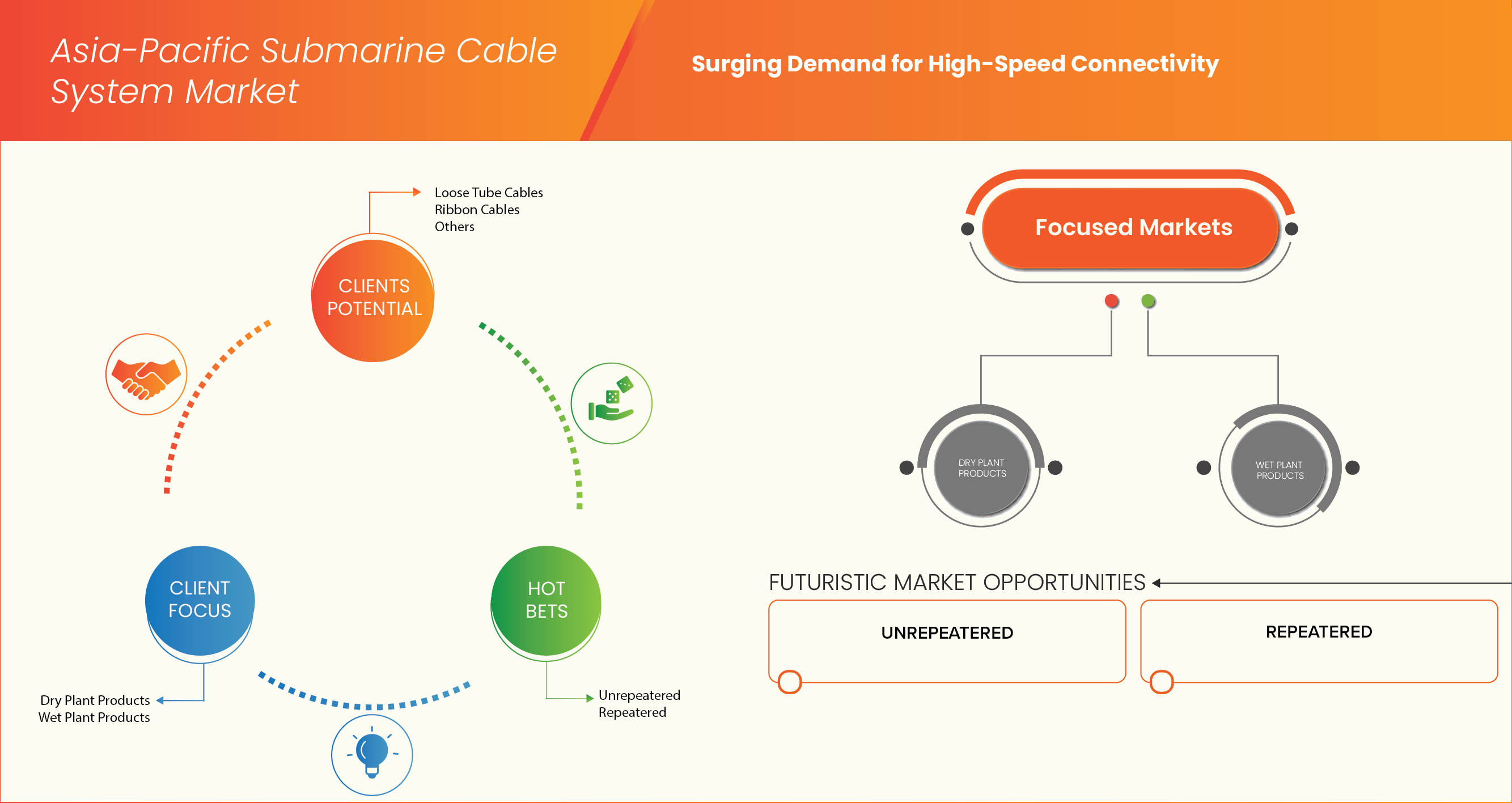

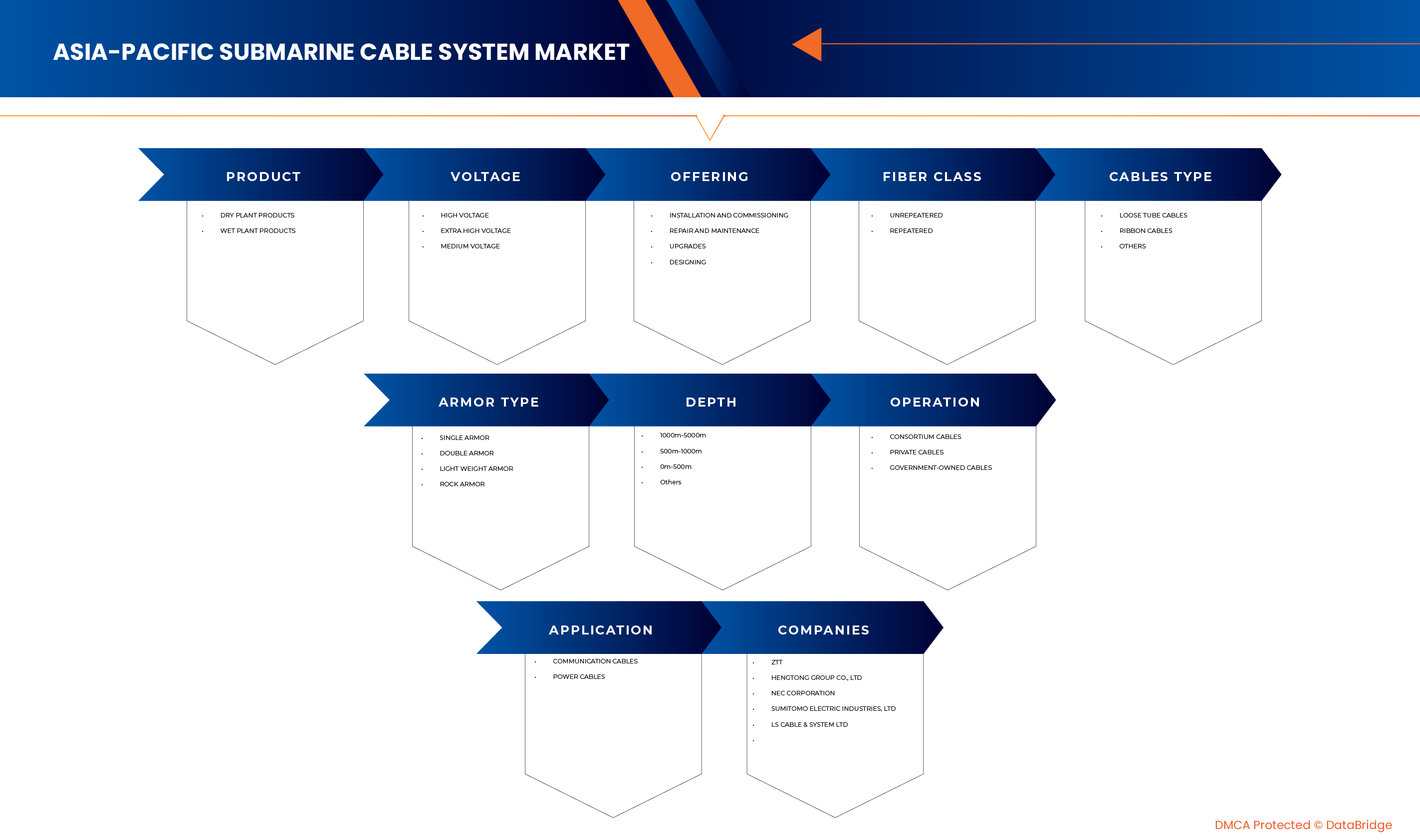

亞太海底電纜系統市場細分,按產品(陸上設備產品和濕式設備產品)、電壓(高壓、超高壓和中壓)、服務內容(安裝調試、維修維護、升級和設計)、光纖等級(非中繼式和中繼式)、電纜類型(鬆套管電纜、帶狀電纜和其他)、鎧式和中繼式)、電纜類型(鬆套管電纜、帶狀電纜和其他)、鎧式和單層鎧式裝、雙層鎧裝、輕型鎧裝和岩石鎧裝)、深度(1000米-5000米、500米-1000米、0米-500米及其他)、運營模式(聯盟電纜、私有電纜和政府所有電纜)、應用領域(通信電纜和電力)-電纜和電力)

亞太地區海底電纜系統市場規模

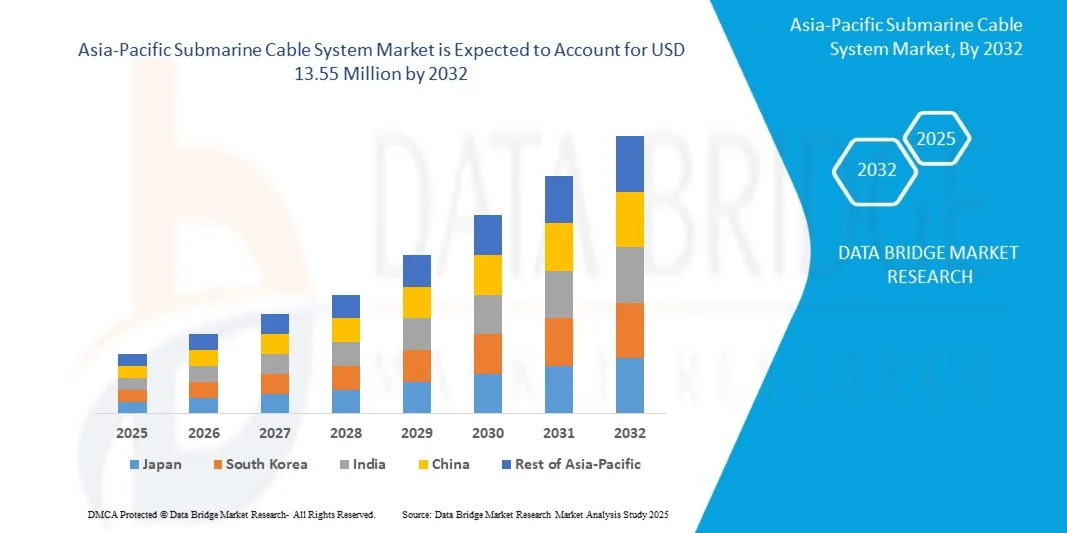

- 亞太海底電纜系統市場預計將從2024年的690萬美元成長至2032年的1,355萬美元,在2025年至2032年的預測期內,複合年增長率將達到8.9%。

- 亞太地區海底電纜系統市場的成長受到多重抗藥性細菌(MDR)感染日益普遍的影響,這使得使用美羅培南等廣譜碳青黴烯類抗生素成為必要。

- 亞太地區醫療基礎設施投資的不斷增加,包括醫院容量的提升和診斷技術的改進,進一步推動了對強效注射抗生素的需求,從而促進了這一市場擴張。此外,通用型海底電纜系統製劑的日益普及和應用,也為市場提供了更具成本效益的治療選擇,從而提高了市場可近性,並促進了市場的持續成長。

亞太地區海底電纜系統市場分析

- 數位化、雲端運算和新興技術的推動,使得對高頻寬、低延遲連接的需求日益增長,這是亞太地區海底光纜系統需求的主要驅動力。隨著資料流量的持續激增,現有的地面和衛星網路在容量和速度方面都面臨瓶頸。

- 海底電纜系統作為全球互聯網和數據傳輸的關鍵骨幹,仍然是連接各大洲、支援超大規模資料中心以及在廣闊的亞太地區實現無縫數位通訊的重要基礎設施解決方案。

- 資料交換的複雜性和規模日益增長,包括串流媒體服務、人工智慧/機器學習應用和物聯網,使得人們需要像海底電纜系統這樣高度穩健且高容量的基礎設施來支援經濟成長和數位轉型。這鞏固了海底電纜在區域數位生態系統中的關鍵作用。

- 亞太地區海底電纜系統市場的主要驅動力是應對耐多藥細菌的迫切需求,以及醫院和其他臨床機構在治療嚴重感染(通常是院內感染)時對注射用抗生素的高使用率。傳染病的流行程度以及抗生素使用和分發的監管環境(包括憑處方或無需處方銷售抗菌藥物的做法)都會影響市場,進而影響整體消費量。

- 中國已成為海底電纜系統市場的重要區域,其成長潛力巨大,這主要得益於醫療保健支出的增加和傳染病發病率的上升。該地區市場的主要特點是對有效抗生素的迫切需求,以應對嚴重的感染,這在許多醫療設施不斷完善的新興經濟體中都是普遍現象。

- 亞太地區海底電纜系統市場預計將以8.9%的複合年增長率快速成長,這主要得益於醫療保健產業的持續改革和投資。該地區高度重視改善醫院護理和控制人口密集環境下的嚴重感染,這進一步推動了對強效廣譜抗生素(如海底電纜系統)的需求,因為海底電纜系統是感染控制和患者管理策略的關鍵組成部分。

- 乾式設備產品部門是亞太地區海底電纜系統市場的主要終端用戶,市佔率為 63.20%,這反映出彈性網路基礎設施需要持續策略性地部署海底電纜系統以實現國際和區域間連接,使該系統成為亞太地區數位化未來的重要組成部分。

報告範圍及亞太海底電纜系統市場細分

|

屬性 |

亞太地區海底電纜系統關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

中國、日本、韓國、印度、新加坡、澳洲、印尼、泰國、馬來西亞、菲律賓、台灣、越南、紐西蘭以及亞太其他地區 |

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、按地域劃分的公司生產和產能、分銷商和合作夥伴的網絡佈局、詳細和最新的價格趨勢分析以及供應鏈和需求的缺口分析。 |

亞太地區海底電纜系統市場趨勢

“對高頻寬和低延遲連接的需求日益增長”

- 數位化、雲端運算和新興技術的推動,使得對高頻寬、低延遲連接的需求日益增長,這是亞太地區海底光纜系統需求的主要驅動力。隨著資料流量的持續激增,現有的地面和衛星網路在容量和速度方面都面臨瓶頸。

- 海底電纜系統作為全球互聯網和數據傳輸的關鍵骨幹,仍然是連接各大洲、支援超大規模資料中心以及在廣闊的亞太地區實現無縫數位通訊的重要基礎設施解決方案。

- 資料交換的複雜性和規模日益增長,包括串流媒體服務、人工智慧/機器學習應用和物聯網等,使得支援經濟成長和數位轉型對海底電纜系統等高度穩健且高容量的基礎設施提出了更高的要求。這鞏固了海底電纜在區域數位生態系統中的關鍵作用。

- 例如,最近的一份報告指出,亞太地區的數據流量預計將以每年超過30%的速度成長,到2028年將達到前所未有的水平,這需要對新的海底電纜系統進行大量投資,並對現有系統進行升級改造。這凸顯了建造先進的海底電纜系統以滿足這些日益增長的需求的緊迫性。

- 資料密集活動的日益增多以及對彈性網路基礎設施的需求,使得持續策略性地部署海底電纜系統以實現國際和區域間互聯互通成為必要,使該系統成為亞太地區數位化未來的重要組成部分。

亞太海底電纜系統市場動態

司機

“對高速連接的需求激增”

- 在亞太地區,高速網路連線正逐漸成為一項基本需求,這主要得益於數位服務、雲端運算、遠距辦公和資料密集應用的快速普及。

- 隨著消費者對流暢串流媒體、即時通訊和即時存取的期望不斷提高,對更快、更可靠的全球資料傳輸的需求也日益增長。海底光纜系統承載著超過95%的國際網路流量,如今已成為實現這一數位轉型的核心,尤其是在新興經濟體中,隨著網路人口的不斷增長,這一轉型顯得尤為重要。

- 為了滿足日益增長的頻寬需求,各國政府、電信業者和科技公司正大力投資建造和升級海底光纜基礎設施。這些系統不僅能提高網路速度、降低延遲,還能支援智慧城市、數位商務和跨境資料交換的發展。隨著數位連接成為該地區經濟和戰略的重中之重,高速網路的需求正使海底光纜成為市場擴張的關鍵驅動力。

例如

- 2024年11月,Digital Realty強調了亞太地區超大規模資料中心對高速連線日益增長的需求。該公司指出,該地區65%的企業正在積極為其IT場所製定正式的數據策略。此外,72%的企業正在將資料位置策略整合到其人工智慧計畫中,以提升效能和可擴展性。 Digital Realty的PlatformDIGITAL®旨在透過在包括東京、大阪、新加坡、香港和雪梨在內的亞太主要市場提供可擴展且安全的互連解決方案來滿足這些需求。

- 2024年8月,《Swarajya》雜誌重點報導了印度計劃透過三大海底光纜計畫——「2Africa Pearls」、「India-Asia-Express (IAX)」和「India-Europe-Express (IEX)」——在2025年前將其網路容量提升四倍。這些舉措反映了亞太地區對高速網路連線的迫切需求,而這種需求是由快速的數位成長和數據消費所驅動的。透過顯著提升頻寬並增強與關鍵區域的連接,這些海底光纜將在支援頻寬密集型應用以及滿足該地區企業、雲端服務供應商和消費者日益增長的資料需求方面發揮至關重要的作用。

- 2024年12月,NEC公司宣布亞洲直達海底光纜(ADC)竣工。這條高性能海底光纜系統全長約1萬公里,連接中國(香港特別行政區和廣東省)、日本、菲律賓、新加坡、泰國和越南。 ADC的設計資料傳輸速率超過160太比特/秒(Tbps),旨在滿足東亞和東南亞日益增長的高速連接需求。該光纜由ADC聯盟擁有,該聯盟成員包括中國電信、中國聯通、PLDT公司、新加坡電信、軟銀集團、塔塔通訊和越南電信等主要電信和科技公司。 NEC擁有超過60年的海底光纜系統經驗,擔任該專案的系統整合商,提供包括光纜製造、安裝和測試在內的端到端解決方案。

- 亞太地區對高速、可靠網路的快速成長的需求是推動海底光纜系統擴張的主要催化劑。在數位消費、雲端服務和新興技術的推動下,這種需求促使電信營運商和科技巨頭大力投資建造新的海底光纜基礎設施。這些投資不僅提升了數據容量、降低了延遲,還有助於促進區域經濟成長和數位包容。隨著網路連結對日常生活和商業活動的重要性日益凸顯,海底光纜仍然是數位轉型的核心,鞏固了其作為市場關鍵成長驅動力的地位。

克制/挑戰

“高昂的安裝和維護成本”

- 海底電纜系統是數位基礎設施中資本密集度最高的組成部分之一,前期投入龐大,涉及海底勘測、電纜製造、海上作業以及專用安裝設備等諸多方面。根據長度和線路的不同,鋪設一條海底電纜的成本可能在1億美元到5億美元以上不等。

- 由於需要應對複雜的海洋地理環境、獲得跨境許可並遵守環境和安全法規,這些成本進一步增加。對於發展中經濟體和小型業者而言,如此龐大的資本需求可能構成重大進入障礙,限制其更廣泛地參與海底基礎設施開發。

- 除了安裝之外,海底電纜的長期維護和維修也增加了經濟負擔。自然災害、捕魚活動和船舶錨泊造成的損壞較為常見,尤其是在淺水區,需要專業的電纜維修船進行成本高昂且時間緊迫的維修。由於維護作業可能涉及長時間的停機,並且受到船舶和許可證可用性的地域限制,因此在電纜的整個生命週期內,營運成本始終居高不下。這些財務和後勤方面的挑戰將延緩新部署的進程,並使國際互聯互通的擴展變得更加複雜,使得成本成為限制亞太海底電纜系統市場成長的持續因素。

例如,

- 2021年8月發表於《海洋科學與工程雜誌》的一項研究表明,在深海海底光纜系統中安裝中繼器會顯著增加電纜故障的風險。研究建議,減少中繼器的數量可以降低故障風險以及相關的高昂安裝和維護成本。這凸顯了中繼器數量等技術設計選擇如何影響海底光纜系統的整體成本效益和可靠性。

- 高昂的安裝和維護成本仍然是亞太地區海底電纜市場面臨的主要限制因素。海底電纜的部署和維護屬於資本密集工程,這構成了巨大的財務障礙,尤其對於規模較小的企業和新興經濟體而言。頻繁的中斷和複雜的海上物流進一步加劇了這些成本。因此,高昂的成本可能導致基礎設施項目延期,限制區域互聯互通的擴展,並對新部署項目的經濟可行性構成挑戰。

亞太海底電纜系統市場範圍

亞太地區海底電纜系統市場按產品、電壓、供應、光纖等級、電纜類型、鎧裝類型、深度、運作和應用進行細分。

• 副產品

根據產品類型,亞太地區海底電纜系統市場可分為陸上設備產品和濕式設備產品。陸上設備產品預計將佔據市場主導地位,因為其作為陸上基礎設施發揮著至關重要的作用,包括電纜登陸站、網路營運中心和供電設備等,這些設備對於海底電纜的有效運作和管理至關重要。陸上組件的成熟度和與陸地網路無縫整合相關的巨額資本投入,顯著提升了其市場地位,確保了可靠的電力供應和數據處理。

由於水下組件(例如中繼器、分支單元和海底光放大器)技術的不斷進步,乾式設備產品領域預計將成為成長最快的領域。這些進步顯著提高了電纜容量,降低了訊號損耗,並延長了使用壽命。此外,新電纜線路的深度和長度不斷增加,也推動了這一成長,因為需要更精密、更可靠的水下設備組件來確保長期性能。同時,水下設備產品深海部署和維護技術的創新也可能加速該領域的普及。

• 按電壓

依電壓等級,亞太地區海底電纜系統市場可分為高壓、超高壓和中壓三大類。由於長距離通訊電纜中中繼器和其他主動組件的驅動功率通常較高,高壓電纜預計將佔據市場主導地位。這些電纜通常採用更高的電壓以最大限度地減少長距離傳輸過程中的功率損耗。跨洋通訊電纜的廣泛部署(佔新安裝電纜的大多數)也促使市場傾向於選擇高壓系統。此外,不斷增長的數據容量需求通常需要功率更大的中繼器,這進一步鞏固了高壓電纜的領先地位。

由於短距離島際或沿海通訊電纜的特殊電力需求,以及海底輸電專案對較低電壓可能更有效率或更適合併網,高壓電力市場預計將成為成長最快的領域。此外,專用短距離資料中心互連的日益普及也推動了這一成長,因為中壓電力在這些應用中更具成本效益。適用於各種電壓等級的先進電力轉換技術的日益普及,提高了亞太地區各種海底應用的經濟性和可近性,進一步加速了這個市場的擴張。

• 透過提供

根據服務內容,亞太地區海底電纜系統市場可細分為安裝調試、維修維護、升級和設計。由於部署新的海底電纜需要高額的資本支出和專業技術,包括路徑勘測、電纜敷設和最終系統激活,因此安裝調試部分預計將佔據市場主導地位。數據流量的持續成長以及連接新興經濟體和繞過擁塞區域的新路徑需求,直接推動了這一關鍵初始階段更大的市場份額。

由於確保現有電纜系統持續運作並最大限度延長其使用壽命至關重要,安裝調試領域預計將成為成長最快的領域。隨著電纜老化和新技術的湧現,對主動維護、故障偵測和容量提升的需求日益增長。人們對最佳操作實踐的認識和遵循程度不斷提高,加上水下機器人和維修船能力的提升,正在推動這些服務的利用,從而防止代價高昂的停機並延長系統壽命。

• 按光纖等級

根據光纖等級,亞太地區海底光纜系統市場可分為非中繼型和中繼型。由於亞太地區大多數國際海底光纜覆蓋距離遙遠,需要中繼器來放大光訊號並維持數千公里的資料完整性,因此中繼型光纜預計將佔據市場主導地位。跨太平洋和亞洲內部線路的高容量需求要求系統能夠持續進行長距離高速資料傳輸,這使得中繼型光纜成為不可或缺的解決方案,並鞏固了其主要應用。

由於短途島際或沿海光纖電纜的部署日益增多,尤其是在亞太群島國家,預計中繼器部分將成為成長最快的領域。這些系統通常無需有源中繼器即可在數百公里範圍內運行,從而提供了更經濟高效且更簡便的部署方案。此外,光纖技術的進步,例如光纖衰減的降低和相干傳輸技術的進步,正在擴大無中繼器系統的有效覆蓋範圍,進一步推動了對該應用的需求和成長。

• 依電纜類型

根據電纜類型,亞太地區海底電纜系統市場可分為鬆套管電纜、帶狀電纜和其他類型。鬆套管電纜預計將佔據市場主導地位,因為它是一種應用廣泛且堅固耐用的海底電纜設計,以其靈活性、易於部署和有效保護單根光纖免受應力和環境因素影響而聞名。其在惡劣海底環境中久經考驗的可靠性,以及能夠適應不同數量的光纖,使其在各種海底電纜項目中廣泛應用。

由於對更高光纖密度光纜的需求不斷增長,尤其是在新部署和升級項目中,預計鬆套管光纜細分市場將成為成長最快的領域。這種需求的成長主要源自於對更高容量和麵向未來發展的需求。帶狀光纜能夠在更小的線纜直徑內實現極高的光纖密度,從而在製造效率、開槽難度和單芯成本方面都具有顯著優勢。這種轉變旨在最大限度地提高日益擁擠的線纜走廊中的資料吞吐量。此外,高容量新線路的不斷建設也促進了帶狀光纜的部署,進一步加速了該細分市場的成長。

• 依護甲類型

根據鎧裝類型,亞太海底電纜系統市場可分為單層鎧裝、雙層鎧裝、輕型鎧裝和岩石鎧裝。由於單層鎧裝電纜常用於深海區域,而這些區域受到的外部幹擾(例如捕魚、錨泊)風險顯著降低,因此預計單層鎧裝電纜將佔據市場主導地位。單層鎧裝電纜在部署過程中能夠提供足夠的抗拉強度和輕微磨損保護,在絕大多數深水電纜線路中實現了防護性和成本效益之間的平衡。

由於淺水沿海地區和繁忙航道的電纜部署日益增多,單層鎧裝電纜預計將成為成長最快的細分市場。在這些區域,來自漁船、船錨和海底磨損等外部威脅顯著增加。雙層鎧裝電纜提供更強的機械保護,這對於防止損壞和確保這些脆弱區域的系統韌性至關重要。此外,國家關鍵基礎設施項目對電纜保護和韌性的日益重視也推動了高強度鎧裝電纜的更高成長率。

• 依深度

根據深度,亞太海底電纜系統市場可分為0-500公尺、500-1000公尺、1000-5000公尺及其他深度段。由於亞太地區主要國際通訊電纜穿越的深海區域廣闊,預計1000-5000公尺深度段將佔據市場主導地位。此深度範圍涵蓋了電纜鋪設的大部分海底區域,因此需要專門的深水安裝技術和組件。連接各大洲和大型陸地的主要目的必然涉及在這些深度段鋪設相當長的電纜段。

由於國內和區域海底電纜系統數量不斷增加,尤其是在群島國家,這些系統主要在靠近海岸線、島嶼和大陸架的淺水區運行,預計1000米至5000米深度段將成為增長最快的細分市場。該細分市場還包括離岸風電場和油氣平台等關鍵基礎設施。雖然目前市場份額較小,但沿海經濟的快速發展和專業海底應用正在推動部署在這些較淺水域的海底電纜系統實現更高的成長率。

• 透過操作

根據營運模式,亞太地區海底光纜系統市場可分為聯盟光纜、私有光纜和政府所有光纖纜線。由於跨洲和大型洲際光纜系統建設涉及高昂的資本成本和風險共擔,因此聯盟光纜預計將佔據市場主導地位。由多家電信業者和內容供應商組成的聯盟匯集資源,共同建造和營運這些大規模、高容量的網絡,這些網絡構成了全球互聯網連接的骨幹,並佔據了光纜部署的絕大部分。

由於超大規模內容供應商(例如Google、Meta、亞馬遜和微軟)不斷增加對專用海底光纜基礎設施的投資,以支援其龐大的資料中心網路和雲端服務,預計聯盟光纜細分市場將成為成長最快的領域。這些專用光纜能夠更好地控製網路架構、容量和安全性。科技巨頭為優化其全球數據流量而進行的戰略轉變,正在推動私有和營運的光纜系統實現更高的成長率。

• 透過申請

根據應用領域,亞太地區海底電纜系統市場可分為通訊電纜和電力電纜。由於全球對海底電纜在跨洲傳輸網路數據、語音和視訊流量方面的巨大依賴,通訊電纜預計將佔據市場主導地位。數位內容、雲端運算和國際商業營運的持續爆炸性成長,推動了對高頻寬、低延遲通訊鏈路的迫切需求,使其成為海底電纜系統最主要、最大的應用領域。

由於全球對再生能源(尤其是離岸風電場)的日益重視,通訊電纜領域預計將成為成長最快的細分市場。海底電力電纜對於將這些海上設施產生的電力輸送到陸上電網至關重要。此外,跨越水域互聯國家電網以增強能源安全和優化電力分配的趨勢也日益增長。雖然海底電力傳輸的市場份額小於通訊電纜,但綠色能源基礎設施的快速發展正推動其以更高的速度成長。

亞太地區海底電纜系統市場區域分析

- 亞太地區被公認為海底電纜系統的重要市場,這主要得益於數位轉型的高度普及和不斷增長的數據流量以及雲端服務的擴展,使得海底電纜基礎設施成為該地區全球互聯互通和數位經濟戰略的重要組成部分。

- 數據消費和互聯網普及率的不斷攀升,以及亞太地區各經濟體對增強網路彈性和改善數位基礎設施的需求,是推動該地區海底電纜系統日益普及的主要催化劑。

- 電信基礎設施的穩定擴張和現代化,尤其是在主要經濟中心和新興市場,以及確保無縫國際通訊和資料中心互聯互通的沉重負擔,進一步加速了亞太地區對功能強大、高容量海底電纜系統產品的需求。

中國亞太地區海底電纜系統市場洞察

中國亞太海底光纜系統市場的主要驅動力在於滿足日益增長的數位數據流量的迫切需求,這主要源自於其龐大的網路使用者群體、蓬勃發展的雲端運算產業以及廣泛的數位經濟。這要求不斷部署和升級海底光纜系統,以實現國際互聯互通和資料中心互聯。同時,市場也日益重視國內製造和創新,以減少對國外技術的依賴,並迫切需要擴大網路容量以滿足不斷增長的需求。

印度亞太地區海底電纜系統市場洞察

印度亞太海底光纜系統市場的主要驅動力在於滿足日益增長的數位數據流量的迫切需求,這尤其源於其快速增長的互聯網普及率、蓬勃發展的數位服務業以及雄心勃勃的「數位印度」計劃。這要求持續部署和升級海底光纜系統,以實現國際連接和區域資料中心建設。同時,市場也日益重視外國投資和合作在提升網路基礎設施以及迫切需要擴大寬頻存取以連接其龐大人口方面所發揮的作用。

亞太地區海底電纜系統市場份額

海底電纜系統產業主要由一些老牌企業主導,其中包括:

- 中天科技(中國)

- 恆通集團有限公司(中國)

- NEC公司(日本)

- 住友電工株式會社(日本)

- LS Cable & System Ltd.(韓國)

- SSGCABLE(中國)

- APAR 實業有限公司(印度)

- 古河電氣工業株式會社(日本)

- 努桑塔拉海洋(印尼)

- PT Ketrosden Triasmitra Tbk(印尼)

- PT INFRASTRUKTUR TELEKOMUNIKASI I(印尼)

- 泰韓電纜解決方案有限公司(韓國)

- 寧波東電線電纜有限公司(中國)

- SubCom, LLC(美國)

- 普瑞普科技有限公司(中國)

- PT NICA Globalmarin 印尼(印尼)

- Prima Navalink(印尼)

- PT TWINK 印尼(印尼)

- 光學海事集團(新加坡)

- Xtera公司(美國)

- PT. Nautic Maritime Salvage(印尼)

- 青島漢河電纜有限公司(中國)

- OCC株式會社(日本)

- PT Communication Cable Systems Indo(印尼)

- 普睿司曼集團(義大利)

- PT Voksel Electric Tbk(印尼)

亞太海底電纜系統市場最新發展動態

- 2024年12月,NEC公司完成了亞洲直連海底光纜(ADC)的興建。這條高性能海底光纜連接中國(香港特別行政區和廣東省)、日本、菲律賓、新加坡、泰國和越南。 ADC海底光纜由ADC聯盟所有,包含多對高容量光纖。其設計承載能力超過160Tbps,可實現東亞和東南亞地區的高速資料傳輸。

- 2024年6月,住友電工收購了德國領先的高壓電纜製造商Südkabel的多數股權。此次收購增強了住友電工為德國輸電系統營運商Amprion交付兩項大型高壓直流(HVDC)電纜專案的能力。這兩個項目分別是Korridor B V49和萊茵-美因輸電線路的一部分,對德國的能源轉型至關重要,總價值超過30億歐元。此次收購也有助於住友電工擴大在德國的生產能力,從而響應德國的淨零排放目標。

- 2024年5月,住友電工被SSEN Transmission指定為海底電纜安裝專案的首選得標方,該專案名為“設得蘭2號高壓直流輸電線路”,連接設得蘭群島和蘇格蘭大陸。該計畫將把設得蘭群島附近的三個離岸風電場連接到國家電網,新增1.8吉瓦的風力發電裝置容量,相當於英國已投產離岸風電裝置容量的13%。作為該計畫的一部分,住友電工正在蘇格蘭尼格建設一座價值3.5億英鎊的電纜製造廠,預計將創造數百個就業崗位,並協助英國實現2050年淨零碳排放的目標。

- 2025年4月,APAR實業有限公司將擴建其位於古吉拉特邦卡塔瓦達(Khatalwada)的電纜生產基地。該基地是APAR的關鍵生產基地之一,目前已生產多種電纜,包括海底電纜、特殊海洋電纜和彈性體電纜。此次擴建旨在提升APAR滿足國內外對高性能電纜系統日益增長的需求的能力,這些需求涵蓋電力、再生能源、國防和海洋基礎設施等領域。值得注意的是,此次擴建屬於公司內部自主研發,並非透過任何合作、合資或收購實現。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPANY COMPETITIVE ANALYSIS

4.1.1 STRATEGIC DEVELOPMENT

4.1.2 TECHNOLOGY IMPLEMENTATION PROCESS

4.1.2.1 CHALLENGES

4.1.2.2 IN-HOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

4.1.2.3 TECHNOLOGY SPEND OF THE COMPANY

4.1.2.4 CUSTOMER BASE

4.1.2.5 SERVICE POSITIONING

4.1.2.6 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

4.1.2.7 APPLICATION REACH

4.1.2.8 SERVICE PLATFORM MATRIX

4.2 TECHNOLOGY ANALYSIS

4.2.1 KEY TECHNOLOGIES

4.2.1.1 OPTICAL FIBER TECHNOLOGY

4.2.1.2 REPEATERS/OPTICAL AMPLIFIERS

4.2.1.3 POWER FEED EQUIPMENT (PFE)

4.2.1.4 SPATIAL DIVISION MULTIPLEXING (SDM)

4.2.2 COMPLEMENTARY TECHNOLOGIES

4.2.2.1 INSTALLATION AND COMMISSIONING

4.2.3 ADJACENT TECHNOLOGIES

4.3 USED CASES & ITS ANALYSIS

4.4 OVERVIEW

4.4.1 PRIMARY PRICING MODELS

4.4.2 PRICING INFLUENCERS

4.4.3 COMPETITOR PRICING TACTICS

4.4.4 MARKET CHALLENGES INFLUENCING PRICE STRATEGY

4.4.5 STRATEGIC PRICING APPROACHES ADOPTED BY LEADING PLAYERS

4.4.6 CONCLUSION

4.5 FUNDING DETAILS – INVESTOR OVERVIEW: ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET

4.5.1 TECHNOLOGY GIANTS

4.5.2 TELECOM AND INFRASTRUCTURE COMPANIES

4.5.3 GOVERNMENT AND PUBLIC SECTOR INVOLVEMENT

4.5.4 PRIVATE EQUITY AND INVESTMENT FUNDS

4.5.5 COLLABORATIVE AND CROSS-BORDER FUNDING

4.5.6 STRATEGIC FOCUS OF FUNDING

4.5.7 TRENDS IN INVESTOR PARTICIPATION

4.5.8 CONCLUSION

4.6 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO: ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET

4.6.1 CURRENT INDUSTRY LANDSCAPE

4.6.2 TECHNOLOGICAL ADVANCEMENTS TRANSFORMING THE INDUSTRY

4.6.3 REGIONAL AND GEOPOLITICAL DIMENSIONS

4.6.4 INDUSTRY CHALLENGES

4.6.5 MARKET DRIVERS AND STRATEGIC SHIFTS

4.6.6 INTEGRATION WITH RENEWABLE ENERGY AND SUSTAINABILITY GOALS

4.6.7 FUTURE OUTLOOK AND EMERGING OPPORTUNITIES

4.6.8 CONCLUSION: THE ROAD AHEAD

4.7 PENETRATION AND GROWTH PROSPECT MAPPING: ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET

4.7.1 MARKET PENETRATION OVERVIEW

4.7.1.1 MATURE ECONOMIES WITH HIGH INFRASTRUCTURE DENSITY

4.7.1.2 EMERGING ECONOMIES WITH RAPID ADOPTION

4.7.1.3 ISLAND AND DEVELOPING NATIONS WITH LOW PENETRATION

4.7.2 KEY DRIVERS OF MARKET PENETRATION

4.7.2.1 EXPLOSIVE GROWTH IN DATA DEMAND

4.7.2.2 DIGITAL TRANSFORMATION AND CLOUD INFRASTRUCTURE

4.7.2.3 REGIONAL CONNECTIVITY AND TRADE INTEGRATION

4.7.2.4 PUBLIC-PRIVATE PARTNERSHIPS

4.7.3 GROWTH PROSPECT MAPPING

4.7.3.1 TECHNOLOGICAL ADVANCEMENTS

4.7.3.2 GEOGRAPHIC EXPANSION

4.7.3.3 SERVICE LAYER DIVERSIFICATION

4.7.4 GROWTH HOTSPOTS AND STRATEGIC MARKETS

4.7.4.1 SOUTHEAST ASIA

4.7.4.2 SOUTH ASIA

4.7.4.3 OCEANIA AND PACIFIC ISLANDS

4.7.5 FUTURE GROWTH PROSPECTS

4.7.5.1 INTEGRATION WITH EMERGING TECHNOLOGIES

4.7.5.2 SUSTAINABILITY AND GREEN INFRASTRUCTURE

4.7.5.3 STRATEGIC RESILIENCE AND SECURITY

4.7.5.4 INCREASING ROLE OF HYPERSCALERS

4.7.5.5 GOVERNMENT-LED REGIONAL INITIATIVES

4.7.6 LONG-TERM OUTLOOK

4.7.7 CONCLUSION

4.8 REASONS FOR INVESTMENT FROM INVESTORS IN THE ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET

4.8.1 RISING DEMAND FOR DATA CONNECTIVITY

4.8.2 STRATEGIC CONTROL OVER DIGITAL INFRASTRUCTURE

4.8.3 REGIONAL ECONOMIC INTEGRATION AND DIGITAL TRANSFORMATION

4.8.4 LONG-TERM INFRASTRUCTURE INVESTMENT APPEAL

4.8.5 SUPPORT FOR CLOUD EXPANSION AND DATA CENTER ECOSYSTEMS

4.8.6 GEOPOLITICAL AND SECURITY CONSIDERATIONS

4.8.7 EMERGENCE OF RENEWABLE ENERGY AND POWER TRANSMISSION PROJECTS

4.8.8 TECHNOLOGICAL ADVANCEMENT AND INNOVATION OPPORTUNITIES

4.8.9 COLLABORATIVE INVESTMENT ECOSYSTEM

4.8.10 SUSTAINABILITY AND ENVIRONMENTAL GOALS

4.8.11 CONCLUSION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGING DEMAND FOR HIGH-SPEED CONNECTIVITY.

5.1.2 RAPID GROWTH OF DATA CENTER ECOSYSTEMS

5.1.3 GOVERNMENT SUPPORT FOR DIGITAL INFRASTRUCTURE

5.1.4 RISING INVESTMENTS FROM HYPERSCALE CLOUD PROVIDERS

5.2 RESTRAINTS

5.2.1 HIGH INSTALLATION AND MAINTENANCE COSTS

5.2.2 GEOPOLITICAL TENSIONS IMPACTING CABLE ROUTES

5.3 OPPORTUNITY

5.3.1 EMERGENCE OF AI AND 6G TECHNOLOGIES

5.3.2 LACK OF RELIABLE CONNECTIVITY IN ISOLATED ISLANDS

5.3.3 INCREASE IN FUNDING BY PRIVATE CONSORTIUMS

5.4 CHALLENGES

5.4.1 DELAYS DUE TO COMPLEX REGULATORY APPROVALS

5.4.2 REGULAR SERVICE DISRUPTIONS DUE TO NATURAL HAZARDS

6 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 DRY PLANT PRODUCTS

6.3 WET PLANT PRODUCTS

7 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE

7.1 OVERVIEW

7.2 HIGH VOLTAGE

7.3 EXTRA HIGH VOLTAGE

7.4 MEDIUM VOLTAGE

8 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY OFFERING

8.1 OVERVIEW

8.2 INSTALLATION AND COMMISSIONING

8.3 REPAIR AND MAINTENANCE

8.4 UPGRADES

8.5 DESIGNING

9 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS

9.1 OVERVIEW

9.2 UNREPEATED

9.3 REPEATED

10 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY CABLE TYPE

10.1 OVERVIEW

10.2 LOOSE TUBE CABLES

10.3 RIBBON CABLES

10.4 OTHERS

11 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE

11.1 OVERVIEW

11.2 SINGLE ARMOR

11.3 DOUBLE ARMOR

11.4 LIGHTWEIGHT ARMOR

11.5 ROCK ARMOR

12 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY DEPTH

12.1 OVERVIEW

12.2 1000M-5000M

12.3 500M-1000M

12.4 0M-500M

12.5 OTHERS

13 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY OPERATION

13.1 OVERVIEW

13.2 CONSORTIUM CABLES

13.3 PRIVATE CABLES

13.4 GOVERNMENT-OWNED CABLES

14 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 COMMUNICATION CABLES

14.3 POWER CABLES

15 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY COUNTRY

15.1 ASIA- PACIFIC

15.1.1 CHINA

15.1.2 JAPAN

15.1.3 SOUTH KOREA

15.1.4 INDIA

15.1.5 SINGAPORE

15.1.6 AUSTRALIA

15.1.7 INDONESIA

15.1.8 THAILAND

15.1.9 MALAYSIA

15.1.10 PHILIPPINES

15.1.11 TAIWAN

15.1.12 VIETNAM

15.1.13 NEW ZEALAND

15.1.14 REST OF ASIA-PACIFIC

16 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 ZTT

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.2 HENGTONG GROUP CO., LTD

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 RECENT DEVELOPMENT

18.3 NEC CORPORATION

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.4 SUMITOMO ELECTRIC INDUSTRIES, LTD.

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 LS CABLE & SYSTEM LTD

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.6 APAR INDUSTRIES LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 FURUKAWA ELECTRIC CO., LTD.

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 NINGBO ORIENT WIRES &CABLES CO., LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENT

18.9 NUSANTARA MARINE

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 OCC CORPORATION

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 OMS GROUP SDN BHD.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 PT COMMUNICATION CABLE SYSTEMS INDONESIA TBK.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENT

18.13 PT KETROSDEN TRIASMITRA TBK

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 PT. NAUTIC MARITIME SALVAGE

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 PT NICA EUMARIN INDONESIA

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 PT TWINK INDONESIA

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 PT VOKSEL ELECTRIC TBK

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 PRIMA NAVALINK

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 PRYSMIAN

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 PURE PRO TECHNOBLOGY CO., LTD

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 SSGCABLE

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 SUBCOM, LLC

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 TAIHAN CABLE & SOLUTION CO., LTD.

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 TELKOM INFRA

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 QINGDAO HANHE CABLE CO., LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 REVENUE ANALYSIS

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENT

18.26 XTERA

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

表格列表

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 TECHNOLOGY MATRIX

TABLE 3 USED CASE ANALYSIS

TABLE 4 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 9 TABLE 7 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 TABLE 16 ASIA-PACIFIC POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 23 CHINA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 24 CHINA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 CHINA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 CHINA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 27 CHINA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 28 CHINA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 29 CHINA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 CHINA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 CHINA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 32 CHINA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 33 CHINA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 CHINA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 CHINA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 CHINA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 CHINA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 CHINA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 CHINA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 41 JAPAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 JAPAN WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 44 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 45 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 46 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 49 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 50 JAPAN SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 JAPAN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 JAPAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 JAPAN WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 JAPAN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 JAPAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 JAPAN WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 58 SOUTH KOREA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SOUTH KOREA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 61 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 62 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 63 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 66 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 67 SOUTH KOREA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 SOUTH KOREA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 SOUTH KOREA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 SOUTH KOREA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 SOUTH KOREA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 SOUTH KOREA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 SOUTH KOREA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 INDIA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 75 INDIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 INDIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 INDIA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 78 INDIA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 79 INDIA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 80 INDIA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 INDIA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 INDIA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 83 INDIA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 84 INDIA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 INDIA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 INDIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 INDIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 INDIA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 INDIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 INDIA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 92 SINGAPORE DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 SINGAPORE WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 95 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 96 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 97 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 100 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 101 SINGAPORE SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 SINGAPORE COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SINGAPORE DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SINGAPORE WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SINGAPORE POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SINGAPORE DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SINGAPORE WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 AUSTRALIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 AUSTRALIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 112 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 113 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 114 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 117 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 118 AUSTRALIA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 AUSTRALIA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 AUSTRALIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 AUSTRALIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 AUSTRALIA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 AUSTRALIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 AUSTRALIA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 126 INDONESIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 INDONESIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 129 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 130 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 131 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 134 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 135 INDONESIA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 136 INDONESIA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 INDONESIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 INDONESIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 INDONESIA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 INDONESIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 INDONESIA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 143 THAILAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 THAILAND WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 146 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 147 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 148 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 151 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 152 THAILAND SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 153 THAILAND COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 THAILAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 THAILAND WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 THAILAND POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 THAILAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 THAILAND WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 160 MALAYSIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 MALAYSIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 163 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 164 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 165 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 168 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 169 MALAYSIA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 MALAYSIA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 MALAYSIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 MALAYSIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 MALAYSIA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 MALAYSIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 MALAYSIA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 177 PHILIPPINES DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 PHILIPPINES WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 180 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 181 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 182 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 185 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 186 PHILIPPINES SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 PHILIPPINES COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 PHILIPPINES DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 PHILIPPINES WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 PHILIPPINES POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 PHILIPPINES DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 PHILIPPINES WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 194 TAIWAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 TAIWAN WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 197 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 198 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 199 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 202 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 203 TAIWAN SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 204 TAIWAN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 TAIWAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 TAIWAN WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 TAIWAN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 TAIWAN DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 TAIWAN WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 211 VIETNAM DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 VIETNAM WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 214 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 215 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 216 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 219 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 220 VIETNAM SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 221 VIETNAM COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 VIETNAM DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 VIETNAM WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 VIETNAM POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 VIETNAM DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 VIETNAM WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 228 NEW ZEALAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 NEW ZEALAND WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2018-2032 (USD THOUSAND)

TABLE 231 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 232 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2018-2032 (USD THOUSAND)

TABLE 233 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2018-2032 (USD THOUSAND)

TABLE 236 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY OPERATION, 2018-2032 (USD THOUSAND)

TABLE 237 NEW ZEALAND SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 238 NEW ZEALAND COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 NEW ZEALAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 NEW ZEALAND WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 NEW ZEALAND POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 NEW ZEALAND DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 NEW ZEALAND WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 REST OF ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET

FIGURE 2 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 THREE SEGMENTS COMPRISE THE ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET, BY ULTRASOUND SENSOR TYPE (2024)

FIGURE 14 RISING CHRONIC DISEASE BURDEN & AGING POPULATION DRIVING NEED FOR DIAGNOSTIC IMAGING IS EXPECTED TO DRIVE THE ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 15 THE BULK PIEZOELECTRIC TRANSDUCERS (CONVENTIONAL) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET IN 2025 AND 2032

FIGURE 16 DROC ANALYSIS

FIGURE 17 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY PRODUCT, 2024

FIGURE 18 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY VOLTAGE, 2024

FIGURE 19 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY OFFERINGS, 2024

FIGURE 20 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY FIBRE CLASS, 2024

FIGURE 21 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY CABLES TYPE, 2024

FIGURE 22 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY CABLES TYPE, 2024

FIGURE 23 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY CABLES TYPE, 2024

FIGURE 24 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY OPERATION, 2024

FIGURE 25 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: BY APPLICATION, 2024

FIGURE 26 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: SNAPSHOT (2024)

FIGURE 27 ASIA-PACIFIC SUBMARINE CABLE SYSTEM MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。