Bangladesh Fright Forwarding Market

市场规模(十亿美元)

CAGR :

%

USD

20.21 Billion

USD

34.65 Billion

2025

2033

USD

20.21 Billion

USD

34.65 Billion

2025

2033

| 2026 –2033 | |

| USD 20.21 Billion | |

| USD 34.65 Billion | |

|

|

|

|

孟加拉國貨運代理市場細分、產品/服務(服務和軟體)、運輸方式(海運(TEU)、公路貨運、空運(噸位)、鐵路貨運和水路貨運)、物流模式(第三方物流 (3PL)、第二方物流 (2PL) 和第一方物流(1PL))、客戶類型(B2B、電子商務及最後一公里配送、B2C)、貨運代理類型(拼箱商/無船承運人、多式聯運/聯運運營商 (MTO)、報關行、港口代理及其他)、最終用戶(工業製造、零售、食品飲料、醫療保健、石油天然氣、飲料、媒體娛樂及其他)

孟加拉國貨運代理市場規模

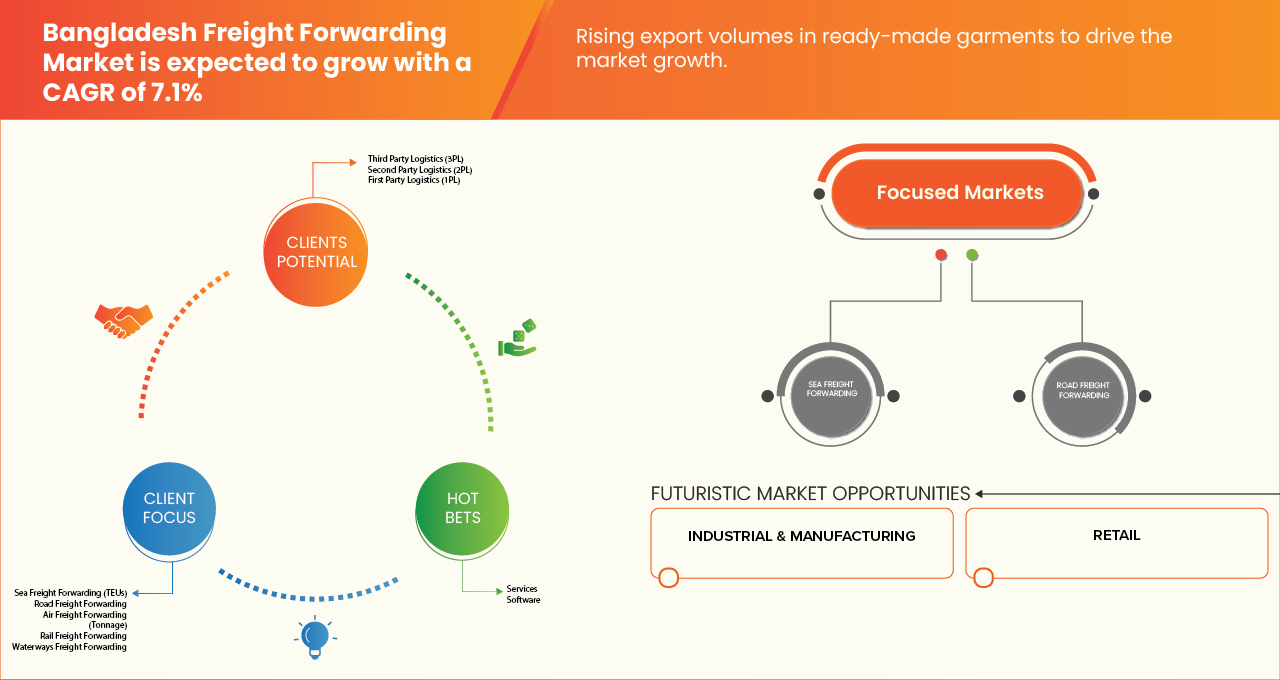

- 預計孟加拉貨運代理市場規模將從2025年的202.1億美元成長至2033年的346.5億美元,在2026年至2033年的預測期內,複合年增長率將達到7.1%。

- 由於全球需求不斷增長,特別是來自新興亞洲市場的需求增長,孟加拉國貨運代理市場正經歷強勁增長,這得益於成本競爭力、熟練勞動力供應和強大的出口基礎設施。

- 製造業自動化、數位紡織解決方案的採用以及環保布料和節能生產流程等永續發展措施進一步推動了產業的擴張。

- 政府激勵措施、優惠的貿易協定和外國直接投資正在加速工廠現代化進程,並推動其向國際品質標準靠攏。這使得孟加拉成為貨運代理業的重要參與者之一。

- 此外,不斷增加的研發投入、向技術和功能性航運的多元化發展以及高價值海上運輸的發展,正在提升該國的出口競爭力和長期市場潛力。

孟加拉國貨運代理市場分析

- 受可靠、節能、高性能溫控物流解決方案需求的不斷增長推動,孟加拉國貨運代理市場正經歷加速成長。與傳統處理方式相比,貨運代理系統具有許多優勢,例如減少產品損耗、提高溫度控制精度以及可擴展的儲存和運輸能力。目前,食品飲料(肉類、海鮮、乳製品、水果和蔬菜)、藥品(疫苗、胰島素、生物製劑)、醫療用品和園藝產品出口等行業的貨運代理系統應用日益廣泛。然而,該市場仍面臨能源成本、農村地區冷庫覆蓋率低、基礎設施不足以及需要改善溫度監控和運作可靠性等挑戰。

- 預計到2026年,服務業將保持強勁成長勢頭,市場佔有率將達到91.60%,這主要得益於全球出口訂單的成長、對價格適中的時尚和快時尚產品需求的增加,以及孟加拉在生產方面的競爭優勢——例如低廉的勞動力成本、充足的勞動力資源和成熟的製造業生態系統。此外,自動化、數位化設計工具和永續紡織實踐的採用,提高了生產效率並使其符合國際標準,進一步鞏固了服裝業在2025年的主導地位。

報告範圍及孟加拉國貨運代理市場細分

|

屬性 |

孟加拉貨運代理關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括監管標準、關稅及其分析、價值鏈分析、技術矩陣、供應鏈分析、市場滲透率與增長前景矩陣、滲透率和增長前景映射、新業務和新興業務的收入機會及未來展望、市場滲透率與增長前景矩陣、滲透率和增長前景映射、新業務和新興業務的收入機會及未來展望、進站數據、未來前景、滲透率和增長前景分析公司比較、新業務和新興業務的收入機會及未來展望、進成本分析公司比較公司分析公司。 |

孟加拉國貨運代理市場趨勢

“數位轉型與一體化物流解決方案”

- 孟加拉國貨運代理市場的一個顯著且加速發展的趨勢是,越來越多的企業開始採用數位化平台、自動化和數據驅動的物流管理,以提高貨物運輸的可視性、單據準確性和營運效率。貨運代理商正逐步從人工紙本流程轉向整合數位系統,以應對不斷增長的貿易量。

- 例如,孟加拉領先的貨運代理公司正在實施基於雲端的貨運管理系統、電子單證和即時貨物追蹤解決方案,以簡化進出口業務,尤其是在成衣行業。這些數位化工具能夠加快空運、海運和陸運的訂艙、清關協調和貨物監控速度。

- 數位化整合使貨運代理商能夠優化路線規劃、減少運輸延誤並改善與船公司、航空公司、港口和海關當局的協調。例如,自動化數據分析平台可以幫助貨運代理商預測貨運量、管理貨櫃可用性並最大限度地降低滯期費和滯箱費。

- 集中式物流控制面板的日益普及,使貨運代理商能夠透過單一介面管理包括倉儲、清關、多式聯運和最後一公里配送在內的多種服務。這建構了一個更透明、更有效率且以客戶為中心的物流生態系統。

- 這種以技術為驅動的端到端物流解決方案趨勢正在重塑孟加拉國貨運代理市場的服務預期。因此,無論是本地企業還是國際物流公司,都在投資數位貨運平台和整合供應鏈能力,以獲得競爭優勢。

- 隨著托運人越來越重視速度、成本效益、合規性和即時可視性,出口導向產業,尤其是紡織品、製藥和消費品行業,對數位貨運代理服務的需求正在迅速增長。

孟加拉國貨運代理市場動態

司機

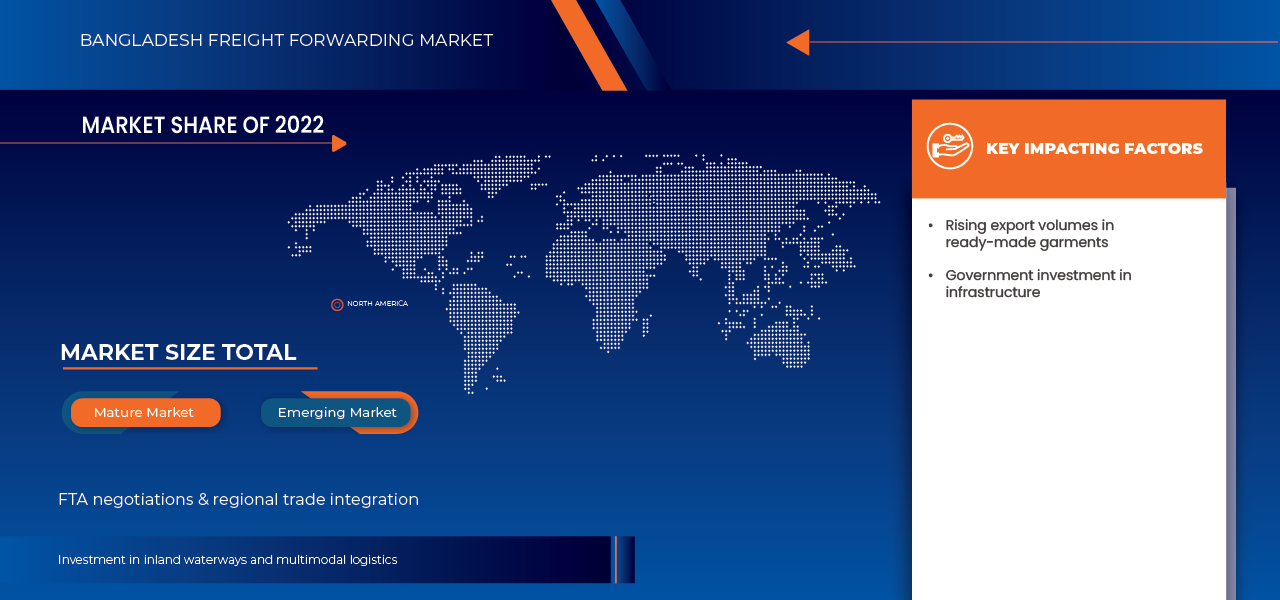

“出口貿易擴張和基礎設施建設推動成長”

- 孟加拉出口導向經濟的快速成長,尤其是在成衣產業的帶動下,是推動貨運代理服務需求的主要動力。對北美、歐洲和亞洲出口量的成長,持續提升了對高效率國際物流和貨物裝卸解決方案的需求。

- 例如,對港口現代化計畫的持續投資,如吉大港擴建以及帕亞拉和馬塔巴里深水港的開發,預計將顯著提高貨物處理能力並緩解擁塞。這些基礎設施建設有望促進海運和多式聯運的貨運活動。

- 隨著國際貿易量的成長,貨運代理商在管理複雜的海關程序、法規遵循和跨境單證方面發揮著至關重要的作用。他們的專業知識有助於出口商最大限度地減少延誤、降低成本,並確保將貨物及時交付到全球市場。

- 此外,政府為改善公路、鐵路和內河航運連接性而採取的舉措,正在加強國內和跨境物流網絡,為貨運代理公司提供多式聯運和綜合運輸解決方案創造了新的機會。

- 越來越多的跨國品牌和買家選擇從孟加拉採購,這推高了對可靠、可擴展且及時性強的貨運代理服務的需求。對於需要嚴格遵守交貨期限的快時尚供應鏈而言,這一點尤其重要。

- 出口成長、基礎設施投資和全球貿易一體化程度提高的綜合影響預計仍將是推動孟加拉國貨運代理市場在預測期內持續擴張的關鍵因素。

克制/挑戰

“港口擁堵和運營延誤”

- 孟加拉主要海港的擁擠和營運延誤是限制該國貨運代理市場發展的關鍵結構性因素。擁塞會降低港口吞吐量,延誤船舶靠泊和貨櫃裝卸,所有這些都會延長運輸時間,增加滯期費和倉儲成本,並降低運輸可靠性。

- 對於貨運代理而言,不可預測的延誤和貨櫃堆積增加了內陸運輸、清關和後續交付的調度複雜性,削弱了其服務承諾,並增加了佔用在港口堆場和內陸貨櫃堆場(ICD)的營運資金。隨著時間的推移,持續存在的瓶頸削弱了孟加拉國物流和貨運代理行業的整體競爭力,使依賴時效性貿易的客戶(例如服裝出口商或易腐貨物進口商)望而卻步。

- 上述案例表明,孟加拉國主要門戶港口(尤其是吉大港)的擁擠和營運延誤問題仍然持續且根深蒂固。堆場產能反覆超負荷、內陸貨櫃清關不足、駁船或鐵路/公路運輸能力短缺,以及海關和裝卸作業人員間歇性中斷等問題,共同造成了脆弱且難以預測的供應鏈環境。

- 對於貨運代理產業而言,這種不穩定性會削弱服務可靠性,推高滯期費和倉儲成本,延長週轉時間,佔用營運資金,並降低競爭力,尤其對於那些供應鏈依賴於及時交付的客戶而言。除非基礎設施和體制改革能夠顯著改善港口運營,否則擁塞和由此造成的延誤將繼續限制孟加拉國貨運代理市場的成長和效率。

例如,

- 2025 年 8 月,《金融快報》指出,吉大港港口堆場積壓了約 45,000 個標準箱(總容量約為 53,000 個標準箱),約有十幾艘貨櫃船在外面拋錨等待三到六天——這表明港口堆場超負荷運轉和泊位延誤仍然是一個反覆出現的問題。

- 2025 年 5 月,bdnews24.com 報道稱,吉大港海關官員的罷工抗議加劇了貨櫃堆積,儘管該港口的堆場可容納 53,518 個標準箱,但船舶仍需等待長達六天才能靠岸。

- 2025 年 7 月,《商業標準報》報道稱,約有 20 艘貨櫃船在外錨地等待了 9 天,指出船舶積壓是由於基礎設施限制(例如龍門起重機不足、堆場空間不足)而不是船舶數量過多造成的。

孟加拉國貨運代理市場範圍

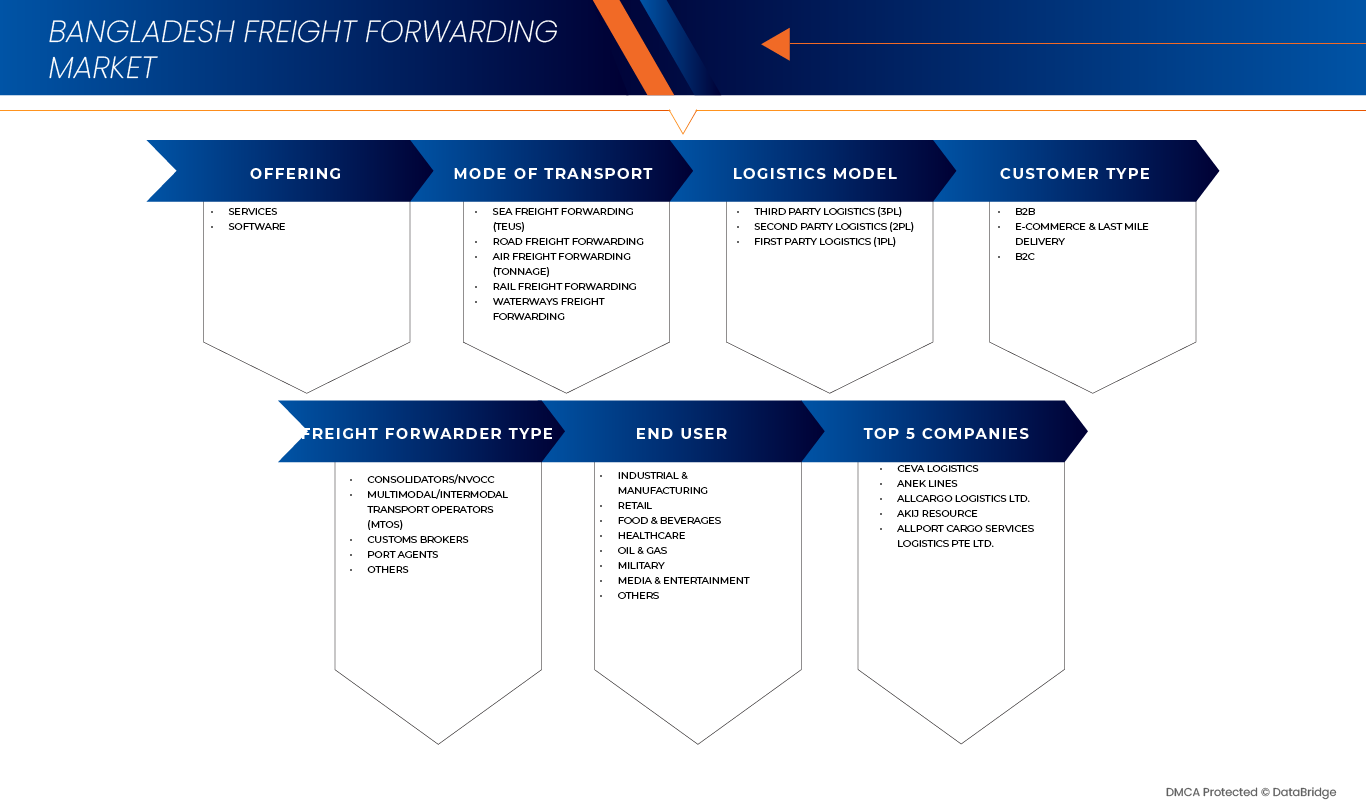

孟加拉國貨運代理市場根據產品、運輸方式、物流模式、客戶類型、貨運代理類型和最終用戶進行細分,形成若干重要細分市場。

- 透過提供

依產品/服務類型,市場可分為服務和軟體兩大類。

由於該國高度依賴出口,尤其是成衣(貨運代理)產業,預計服務業將主導市場。成衣產業需要大規模的海運和空運業務來提供廣泛的物流支援。貨運代理產業是國家財政收入的重要貢獻者,因此對高效率的運輸服務有著龐大的需求,以確保貨物及時運抵國際市場。這種對貨運的依賴凸顯了航運和航空貨運基礎設施在維持出口成長和滿足全球供應鏈需求方面發揮的關鍵作用。

- 按物流模型

依據物流模式,市場分為第三方物流(3PL)、第二方物流(2PL)及第一方物流(1PL)。

第三方物流 (3PL) 領域預計將佔據市場主導地位,這主要得益於貨運代理出口商、快速消費品公司、零售商和電子商務企業強勁的外包趨勢。這些企業日益尋求端到端的物流解決方案,以優化成本、提高供應鏈效率並專注於核心業務,從而推動了對涵蓋倉儲、運輸和最後一公里配送的綜合性 3PL 服務的需求。

- 按交通方式

根據運輸方式,市場可細分為海運貨運代理(TEU)、公路貨運代理、空運貨運代理(噸位)、鐵路貨運代理和水路貨運代理。

由於該國服裝出口量龐大,且日益依賴貨櫃運輸,預計海運貨運代理(TEU)業務將主導市場。吉大港和蒙格拉港業務的擴張以及貨櫃裝卸效率的提升進一步推動了這一增長,提高了周轉速度,減少了擁堵,並為國際貿易提供了更可靠的物流保障。出口需求的成長和港口基礎設施的完善共同作用,使海運貨運代理成為該國貨運領域的主要組成部分。

- 依消費者類型

根據客戶類型,市場分為 B2B、電子商務和最後一公里配送以及 B2C。

預計 B2B 領域將主導市場,這得益於強大的工業基礎、高產量的出口製造業以及貨運代理、紡織、製藥、化工和電子等關鍵行業的穩定需求,這些行業共同需要大規模、可靠的物流和供應鏈解決方案。

- 依貨運代理類型

依貨運代理類型,市場可細分為集運商/無船承運人、多式聯運/聯運業者、報關行、港口代理及其他。

預計貨運代理商/無船承運人 (NVOCC) 細分市場將佔據主導地位,這主要得益於貨櫃吞吐量的成長以及中小出口商對拼箱 (LCL) 服務日益增長的需求,他們尋求的是經濟高效的運輸解決方案。

- 最終用戶

根據最終用戶劃分,市場分為工業和製造業、零售業、食品和飲料業、醫療保健業、石油和天然氣業、軍事業、媒體和娛樂業以及其他行業。

由於孟加拉擁有強大的出口導向生產基地,其中成衣業(佔孟加拉貿易額的大部分)尤為突出,工業和製造業領域將主導孟加拉國貨運代理市場。孟加拉對國際市場的高度依賴、原材料(布料、機械、化學品)的持續流入以及成品的大規模出口,都對海運、空運、公路、鐵路和水路貨運服務產生了巨大的需求。

孟加拉貨運代理市場洞察

孟加拉的貨運代理市場正經歷強勁成長,這主要得益於該國不斷擴大的成衣出口和國際貿易量的持續成長。對高效、經濟的物流解決方案的需求不斷增長,以及對更快運輸速度的追求,推動了第三方物流 (3PL)、拼箱/無船承運人 (NVOCC) 服務和先進供應鏈管理系統的應用。對港口基礎設施的投資、吉大港和蒙格拉港貨櫃裝卸效率的提升以及更完善的數位化追蹤解決方案,正在加速營運效率和可靠性的提高。此外,貨運代理商、出口商、船公司和倉儲服務商之間日益密切的合作,正在建構端到端的物流解決方案,從而提升服務品質和在全球市場的競爭力。這些因素共同使孟加拉成為區域貨運代理和全球服裝供應鏈中的關鍵參與者。

孟加拉國貨運代理市場份額

孟加拉國貨運代理行業主要由一些實力雄厚的公司主導,其中包括:

- CEVA物流(瑞士)

- AKIJ資源(孟加拉)

- Allport Cargo Services Logistics Pte Ltd.(新加坡)

- ANEK Lines-被阿提卡集團(希臘)收購

- Allcargo Logistics Ltd.(印度)

- 美國聯合包裹服務公司(UPS)

- AEx集團(孟加拉)

- ASF Express (BD) Ltd(孟加拉)

- Alif國際代理公司(孟加拉國)

- 聯合海空物流有限公司(孟加拉)

- 貨物配送網(BD)有限公司(孟加拉)

- AMRA 物流有限公司(孟加拉)

- 遠東物流 BD 有限公司(孟加拉)

- RK Freight Ltd(孟加拉)

- 聯合海事服務公司(孟加拉國)

- Ambition Inc.(孟加拉)

- APS物流(孟加拉)

- 2C航運(孟加拉)

- Mars Freight Bangladesh Ltd.(孟加拉)

- Shams集團公司(孟加拉)

- AEx Cargo Intl.(孟加拉)

- DSV(丹麥)

- MOL物流株式會社(日本)

- 聯邦快遞(美國)

孟加拉國貨運代理市場最新動態

- 2025年6月,DHL與戴姆勒卡車和hylane公司合作,以「運輸即服務」模式在德國引入30輛梅賽德斯-奔馳eActros 600全電動卡車,旨在提升包裹中心的運輸效率。此次合作透過減少排放、提高能源效率以及將先進的電動卡車技術融入日常物流運營,協助DHL實現永續發展目標。此舉也進一步強化了DHL轉型為更環保、更有效率的長途公路運輸解決方案的策略。

- 2025 年 5 月,德迅集團與贏創集團在亞太地區(中國、印度、東南亞等)簽訂了主要物流供應商協議,在一體化運輸管理框架下,每年管理約 7 萬件空運、海運和公路貨運。

- 2022 年 9 月,3i Logistics 在 2022 年南亞商業卓越獎中被評為“南亞頂級可持續物流和供應鏈解決方案提供商之一”,以表彰其在充滿挑戰的條件下(包括在 COVID-19 期間的交付)在項目物流、貨運代理、運輸和供應鏈服務方面的表現。

- 2023年3月,AH Khan & Company Ltd.榮獲ISO 9001:2015和ISO 28000:2007認證,標誌著其發展歷程中的一個重要里程碑,正式認可了其對品質管理和安全供應鏈營運的承諾。認證儀式在達卡俱樂部舉行,體現了公司對卓越營運和全球標準的日益重視。

- 2024 年,Crown Logistics 發佈公司資料,重點介紹了公司在倉儲、整合和專案貨物處理方面為優化營運、採用技術和加強服務品質所做的努力——強調了公司在孟加拉國業務中持續致力於提高營運效率和永續性。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUN INSIGHT

4.1 PESTEL ANALYSIS

4.2 PRICING ANALYSIS

4.2.1 KEY PRICING DRIVERS

4.2.2 CUSTOMER SEGMENTATION AND PRICE SENSITIVITY

4.2.3 VALUE-ADDED SERVICES AND PREMIUM PRICING

4.2.4 MARKET IMPLICATIONS

4.2.5 CONCLUSION

4.3 CONSUMER BUYING BEHAVIOUR

4.3.1 OVERVIEW OF BUYER PRIORITIES

4.3.2 PRICE SENSITIVITY AND SERVICE EXPECTATIONS

4.3.3 TECHNOLOGY ADOPTION AND DIGITAL PREFERENCES

4.3.4 BRAND LOYALTY AND TRUST FACTORS

4.3.5 DEMAND FOR VALUE-ADDED LOGISTICS SERVICES

4.3.6 CHANGING ENGAGEMENT AND COMMUNICATION CHANNELS

4.4 ECONOMIC ANALYSIS

4.4.1 KEY COMPONENTS OF ECONOMIC ANALYSIS

4.5 ECONOMIC ANALYSIS

4.6 REGIONAL GROWTH OPPORTUNITIES

4.6.1 STRATEGIC GEOGRAPHIC POSITION AS A REGIONAL GATEWAY

4.6.2 DEEP-SEA AND SEAPORT DEVELOPMENTS AS CATALYSTS FOR REGIONAL FLOWS

4.6.2.1 MATARBARI DEEP SEA PORT AND BAY OF BENGAL HUB POTENTIAL

4.6.2.2 CAPACITY EXPANSION AT CHATTOGRAM, MONGLA, AND PAYRA PORTS

4.6.3 INLAND CONNECTIVITY AND MULTIMODAL CORRIDOR DEVELOPMENT

4.6.3.1 DHAKA–CHATTOGRAM–MATARBARI LOGISTICS SPINE

4.6.3.2 DHIRASRAM INLAND CONTAINER DEPOT AND RAIL-BASED FREIGHT EXPANSION

4.6.3.3 INLAND WATERWAYS AND PROTOCOL TRANSIT ROUTES

4.6.4 CROSS-BORDER AND TRANSIT TRADE OPPORTUNITIES

4.6.4.1 BBIN AND SUB-REGIONAL CONNECTIVITY ADVANCEMENTS

4.6.4.2 GATEWAY POTENTIAL FOR NEPAL AND BHUTAN

4.6.5 EMERGING REGIONAL CLUSTER OPPORTUNITIES WITHIN BANGLADESH

4.6.5.1 DHAKA–GAZIPUR–NARAYANGANJ MANUFACTURING BELT

4.6.5.2 CHATTOGRAM–COX’S BAZAR–MATARBARI COASTAL CORRIDOR

4.6.5.3 SOUTHWEST EXPORT CORRIDOR VIA MONGLA AND PADMA BRIDGE

4.7 TECHNOLOGICAL ANALYSIS

4.7.1 OVERVIEW OF TECHNOLOGICAL MATURITY IN FREIGHT FORWARDING

4.7.2 CORE TRADE FACILITATION AND CUSTOMS TECHNOLOGIES

4.7.2.1 BANGLADESH SINGLE WINDOW AND PAPERLESS TRADE SYSTEMS

4.7.2.2 AUTOMATED CUSTOMS RISK MANAGEMENT

4.7.3 PORT AND TERMINAL DIGITALIZATION

4.7.3.1 PORT COMMUNITY SYSTEMS AND TERMINAL OPERATING SYSTEMS

4.7.3.2 TRANSITION TOWARD SMART PORT TECHNOLOGIES

4.7.4 DIGITALIZATION OF FREIGHT FORWARDING OPERATIONS

4.7.4.1 TRANSPORT AND WAREHOUSE MANAGEMENT SYSTEMS

4.7.4.2 ELECTRONIC DATA INTERCHANGE AND CLIENT SYSTEM INTEGRATION

4.8 EMERGING TECHNOLOGIES AND INNOVATION TRENDS

4.8.1.1 DATA ANALYTICS AND PREDICTIVE OPERATIONS

4.8.1.2 INTERNET OF THINGS (IOT) FOR TRACKING AND CONDITION MONITORING

4.8.1.3 AUTOMATION AND ROBOTICS IN PORT-CENTRIC LOGISTICS

4.8.2 TECHNOLOGY IN E-COMMERCE AND LAST-MILE LOGISTICS

4.9 KEY STRATEGIC INITIATIVES

4.9.1 INTEGRATION OF MARITIME, PORT, AND INLAND LOGISTICS SERVICES

4.9.1.1 DEVELOPMENT OF END-TO-END LOGISTICS CAPABILITIES

4.9.1.2 EXPANSION OF PORT-CENTRIC AND DRY-PORT INFRASTRUCTURE

4.9.1.3 COORDINATION OF MULTIMODAL TRANSPORT NETWORKS

4.9.2 EMPHASIS ON MODERNISATION, INNOVATION AND TECHNOLOGY ADOPTION

4.9.2.1 DEPLOYMENT OF DIGITAL LOGISTICS SYSTEMS

4.9.2.2 INTRODUCTION OF INTELLIGENT TRANSPORT AND TRACKING SOLUTIONS

4.9.3 REGIONAL POSITIONING AND HINTERLAND/TRANSSHIPMENT STRATEGY

4.9.3.1 STRATEGIC POSITIONING AS A REGIONAL GATEWAY

4.9.3.2 INVESTMENT IN MULTIMODAL AND PORT-LINKED INFRASTRUCTURE

4.9.3.3 EXPANSION INTO CROSS-BORDER AND TRANSSHIPMENT LOGISTICS

4.9.4 DIVERSIFICATION OF SERVICE PORTFOLIO — FROM BASIC FORWARDING TO VALUE-ADDED LOGISTICS

4.9.4.1 EXPANSION BEYOND TRADITIONAL FORWARDING

4.9.4.2 DEVELOPMENT OF INTEGRATED 3PL AND 4PL SOLUTIONS

4.9.5 ALIGNMENT WITH SUSTAINABILITY AND GLOBAL COMPLIANCE TRENDS

4.9.5.1 EVOLVING TOWARD GREENER LOGISTICS

4.9.5.2 PREPARING FOR INTERNATIONAL COMPLIANCE REQUIREMENTS

4.9.6 CONCLUSION

4.1 CASE STUDY ANALYSIS

4.10.1 CASE STUDY: PORT DIGITALISATION AND ITS IMPACT ON FREIGHT FORWARDING EFFICIENCY

4.10.1.1 BACKGROUND AND STRATEGIC CONTEXT

4.10.1.2 OPERATIONAL CHALLENGES BEFORE CROSS-BORDER INTEGRATION

4.10.1.2.1 LACK OF REAL-TIME OPERATIONAL VISIBILITY

4.10.1.2.2 MANUAL DOCUMENTATION AND PHYSICAL PROCESSING

4.10.1.2.3 INEFFICIENT COORDINATION AMONG STAKEHOLDERS

4.10.1.3 DIGITALIZATION MEASURES INTRODUCED

4.10.1.3.1 DEPLOYMENT OF TERMINAL OPERATING SYSTEMS (TOS)

4.10.1.3.2 INTRODUCTION OF PORT COMMUNITY SYSTEMS (PCS)

4.10.1.3.3 ELECTRONIC GATE PASSES AND DIGITAL CARGO DOCUMENTATIONS

4.10.1.3.4 PARTIAL INTEGRATION WITH CUSTOMS AND SINGLE WINDOW PLATFORMS

4.10.1.4 IMPACT ON FREIGHT FORWARDING EFFICIENCY

4.10.1.4.1 IMPROVED PLANNING AND RESOURCE ALLOCATION

4.10.1.4.2 REDUCTION IN CONTAINER DWELL TIME

4.10.1.4.3 ENHANCED RELIABILITY FOR EXPORT SECTORS

4.10.1.4.4 LOWER OPERATING COSTS AND FEWER ADMINISTRATIVE BURDENS

4.10.1.4.5 STRONGER ALIGNMENT WITH GLOBAL SUPPLY CHAIN STANDARDS

4.10.2 CASE STUDY: CROSS-BORDER LOGISTICS AND REGIONAL MARKET INTEGRATION

4.10.2.1 BACKGROUND & STRATEGIC CONTEXT

4.10.2.2 OPERATIONAL CHALLENGES PRIOR TO CROSS-BORDER INTEGRATION

4.10.2.2.1 REGULATORY COMPLEXITY AND FRAGMENTED DOCUMENTATION

4.10.2.2.2 WEAK BORDER INFRASTRUCTURE AND LIMITED MULTIMODAL CONNECTIVITY

4.10.2.2.3 LIMITED COORDINATION AMONG AGENCIES ACROSS BORDERS

4.10.2.3 STRATEGIC INTERVENTIONS BY LOGISTICS OPERATORS

4.10.2.3.1 FORMATION OF CROSS-BORDER PARTNERSHIPS

4.10.2.3.2 DEPLOYMENT OF DEDICATED DOCUMENTATION SUPPORT TEAMS

4.10.2.3.3 ADOPTION OF MULTIMODAL ROUTING THROUGH RIVER PORTS AND ROAD CORRIDORS

4.10.2.3.4 ALIGNMENT WITH NEW TRANSIT AGREEMENTS

4.10.2.4 KEY OUTCOMES FOR FREIGHT FORWARDING OPERATIONS

4.10.2.4.1 REDUCED TRANSIT TIME AND GREATER PREDICTABILITY

4.10.2.4.2 EXPANSION OF SERVICE PORTFOLIOS

4.10.2.4.3 NEW REVENUE STREAMS AND MARKET PENETRATION

4.10.2.4.4 STRENGTHENING BANGLADESH’S ROLE AS A REGIONAL GATEWAY

4.11 SUPPLY CHAIN ANALYSIS – BANGLADESH FREIGHT FORWARDING MARKET

4.11.1 CUSTOMER BOOKING & CONTRACTING

4.11.2 DOCUMENTATION, COMPLIANCE & CUSTOMS CLEARANCE

4.11.3 INLAND TRANSPORTATION & FIRST-MILE MOVEMENT

4.11.4 PORT OPERATIONS & TERMINAL HANDLING

4.11.5 INTERNATIONAL CARRIAGE (OCEAN & AIR FREIGHT)

4.11.6 WAREHOUSING, DISTRIBUTION & VALUE-ADDED SERVICES

4.11.7 LAST-MILE DELIVERY & IMPORT DISTRIBUTION

4.11.8 DIGITALISATION & TRADE FACILITATION

4.11.9 BOTTLENECKS, RISKS & MITIGATION

5 REGULATORY

5.1 NATIONAL REGULATORY FRAMEWORK

5.2 OPERATIONAL & DOCUMENTATION REQUIREMENTS

5.3 DANGEROUS GOODS, SECURITY & SPECIAL CARGO

5.4 TRADE FACILITATION, RISK MANAGEMENT & DIGITALISATION

5.5 INSTITUTIONAL & INDUSTRY COMPLIANCE PROGRAMMES

5.6 LABOUR, PROFESSIONAL STANDARDS & FINANCIAL COMPLIANCE

5.7 REGULATORY GAPS & MARKET IMPLICATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING EXPORT VOLUMES IN READY-MADE GARMENTS

6.1.2 GOVERNMENT INVESTMENT IN INFRASTRUCTURE

6.1.3 E-COMMERCE & RETAIL GROWTH

6.2 RESTRAINTS

6.2.1 PORT CONGESTION AND OPERATIONAL DELAYS

6.2.2 HIGH LOGISTICS COSTS

6.3 OPPORTUNITIES

6.3.1 FTA NEGOTIATIONS & REGIONAL TRADE INTEGRATION

6.3.2 INVESTMENT IN INLAND WATERWAYS AND MULTIMODAL LOGISTICS

6.4 CHALLENGES

6.4.1 FRAGMENTED FREIGHT FORWARDING MARKET

6.4.2 SKILLED WORKFORCE SHORTAGE

7 BANGLADESH FREIGHT FORWARDING MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SERVICES

7.3 SOFTWARE

8 BANGLADESH FREIGHT FORWARDING MARKET, BY CUSTOMER TYPE

8.1 OVERVIEW

8.2 B2B

8.3 E-COMMERCE & LAST MILE DELIVERY

8.4 B2C

9 BANGLADESH FREIGHT FORWARDING MARKET, BY FREIGHT FORWARD TYPE

9.1 OVERVIEW

9.2 CONSOLIDATORS/NVOCC

9.3 MULTIMODAL/INTERMODAL TRANSPORT OPERATORS (MTOS)

9.4 CUSTOMS BROKERS

9.5 PORT AGENTS

9.6 OTHERS

10 BANGLADESH FREIGHT FORWARDING MARKET, BY LOGISTICS MODEL

10.1 OVERVIEW

10.2 THIRD PARTY LOGISTICS (3PL)

10.3 SECOND PARTY LOGISTICS (2PL)

10.4 FIRST PARTY LOGISTICS (1PL)

11 BANGLADESH FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT

11.1 OVERVIEW

11.2 SEA FREIGHT FORWARDING

11.3 ROAD FREIGHT FORWARDING

11.4 AIR FREIGHT FORWARDING

11.5 RAIL FREIGHT FORWARDING

11.6 WATERWAYS FREIGHT FORWARDING

12 BANGLADESH FREIGHT FORWARDING MARKET, BY END USER

12.1 OVERVIEW

12.2 INDUSTRIAL & MANUFACTURING

12.3 RETAIL

12.4 FOOD & BEVERAGES

12.5 HEALTHCARE

12.6 OIL & GAS

12.7 MILITARY

12.8 MEDIA & ENTERTAINMENT

12.9 OTHERS

13 BANGLADESH FREIGHT FORWARDING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: BANGLADESH

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CEVA LOGISTICS

15.1.1 COMPANY SNAPSHOT

15.1.2 SERVICE PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 ANEK LINES

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 ALLCARGO LOGISTICS LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 AKIJ RESOURCE

15.4.1 COMPANY SNAPSHOT

15.4.2 SERVICE PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 ALLPORT CARGO SERVICES LOGISTICS PTE LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 AEX CARGO INTL.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 AEX GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 SERVICE PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ALIF INTERNATIONAL AGENCY

15.8.1 COMPANY SNAPSHOT

15.8.2 SERVICE PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ALLIED MARITIME SERVICES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 ALLIED SEA-AIR LOGISTICS LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 SERVICE PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 AMBITION INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 AMRA LOGISTICS LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 APS LOGISTICS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 ASF EXPRESS (BD) LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 CARGO DISTRIBUTION NETWORK (BD) LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 DSV

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 FAREAST LOGISTICS BD LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 FEDEX

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MARS FREIGHT BANGLADESH LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 MARVEL FREIGHT LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 MOL LOGISTICS CO., LTD.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 RK FREIGHT LTD

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 SHAMS GROUP OF COMPANIES

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 UNITED PARCEL SERVICE OF AMERICA, INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 SERVICE PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 2C SHIPPING

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 A.H. KHAN & CO.

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 BADAL & COMPANY

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 BLUE OCEAN FREIGHT SYSTEM LTD.

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 CDZ GLOBAL LOGISTICS LTD.

15.29.1 COMPANY SNAPSHOT

15.29.2 PRODUCT PORTFOLIO

15.29.3 RECENT DEVELOPMENT

15.3 CMX (PVT.) LTD.

15.30.1 COMPANY SNAPSHOT

15.30.2 PRODUCT PORTFOLIO

15.30.3 RECENT DEVELOPMENT

15.31 COMPASS GLOBAL LOGISTICS, LLC

15.31.1 COMPANY SNAPSHOT

15.31.2 PRODUCT PORTFOLIO

15.31.3 RECENT DEVELOPMENT

15.32 CROWN LOGISTICS LTD

15.32.1 COMPANY SNAPSHOT

15.32.2 PRODUCT PORTFOLIO

15.32.3 RECENT DEVELOPMENT

15.33 DB SCHENKER

15.33.1 COMPANY SNAPSHOT

15.33.2 PRODUCT PORTFOLIO

15.33.3 RECENT DEVELOPMENT

15.34 DHAKA LOGISTICS NETWORK

15.34.1 COMPANY SNAPSHOT

15.34.2 PRODUCT PORTFOLIO

15.34.3 RECENT DEVELOPMENT

15.35 DHL GROUP

15.35.1 COMPANY SNAPSHOT

15.35.2 REVENUE ANALYSIS

15.35.3 PRODUCT PORTFOLIO

15.35.4 RECENT DEVELOPMENT

15.36 EAST WEST HOLDINGS LTD. (EWHL)

15.36.1 COMPANY SNAPSHOT

15.36.2 PRODUCT PORTFOLIO

15.36.3 RECENT DEVELOPMENT

15.37 FARAJI LOGISTICS

15.37.1 COMPANY SNAPSHOT

15.37.2 PRODUCT PORTFOLIO

15.37.3 RECENT DEVELOPMENT

15.38 FEEDERLOGISTICS.

15.38.1 COMPANY SNAPSHOT

15.38.2 PRODUCT PORTFOLIO

15.38.3 RECENT DEVELOPMENT

15.39 FLEET FREIGHT

15.39.1 COMPANY SNAPSHOT

15.39.2 PRODUCT PORTFOLIO

15.39.3 RECENT DEVELOPMENT

15.4 FREIGHT CONNECTION INDIA PVT. LTD.

15.40.1 COMPANY SNAPSHOT

15.40.2 PRODUCT PORTFOLIO

15.40.3 RECENT DEVELOPMENT

15.41 FREIGHTWALLA

15.41.1 COMPANY SNAPSHOT

15.41.2 PRODUCT PORTFOLIO

15.41.3 RECENT DEVELOPMENT

15.42 GAC.

15.42.1 COMPANY SNAPSHOT

15.42.2 PRODUCT PORTFOLIO

15.42.3 RECENT DEVELOPMENT

15.43 GEODIS.

15.43.1 COMPANY SNAPSHOT

15.43.2 PRODUCT PORTFOLIO

15.43.3 RECENT DEVELOPMENT

15.44 GLOBAL LOGISTICS SOLUTIONS PVT LTD.

15.44.1 COMPANY SNAPSHOT

15.44.2 PRODUCT PORTFOLIO

15.44.3 RECENT DEVELOPMENT

15.45 GREENLINE LOGISTICS.

15.45.1 COMPANY SNAPSHOT

15.45.2 PRODUCT PORTFOLIO

15.45.3 RECENT DEVELOPMENT

15.46 HUB FREIGHT BANGLADESH

15.46.1 COMPANY SNAPSHOT

15.46.2 PRODUCT PORTFOLIO

15.46.3 RECENT DEVELOPMENT

15.47 INTERTRANS GROUP

15.47.1 COMPANY SNAPSHOT

15.47.2 PRODUCT PORTFOLIO

15.47.3 RECENT DEVELOPMENT

15.48 JB LOGISTICS.

15.48.1 COMPANY SNAPSHOT

15.48.2 PRODUCT PORTFOLIO

15.48.3 RECENT DEVELOPMENT

15.49 JEBSEN & JESSEN PTE LTD.

15.49.1 COMPANY SNAPSHOT

15.49.2 PRODUCT PORTFOLIO

15.49.3 RECENT DEVELOPMENT

15.5 K & S FREIGHT SYSTEMS INC.

15.50.1 COMPANY SNAPSHOT

15.50.2 PRODUCT PORTFOLIO

15.50.3 RECENT DEVELOPMENT

15.51 KHAN BROTHER'S GROUPS.

15.51.1 COMPANY SNAPSHOT

15.51.2 PRODUCT PORTFOLIO

15.51.3 RECENT DEVELOPMENT

15.52 KHIMJI POONJA FREIGHT FORWARDERS PVT. LTD.

15.52.1 COMPANY SNAPSHOT

15.52.2 PRODUCT PORTFOLIO

15.52.3 RECENT DEVELOPMENT

15.53 KUEHNE + NAGEL

15.53.1 COMPANY SNAPSHOT

15.53.2 REVENUE ANALYSIS

15.53.3 PRODUCT PORTFOLIO

15.53.4 RECENT DEVELOPMENT

15.54 MAXPEED

15.54.1 COMPANY SNAPSHOT

15.54.2 PRODUCT PORTFOLIO

15.54.3 RECENT DEVELOPMENT

15.55 MGH

15.55.1 COMPANY SNAPSHOT

15.55.2 PRODUCT PORTFOLIO

15.55.3 RECENT DEVELOPMENT

15.56 MIR LOGISTIC.

15.56.1 COMPANY SNAPSHOT

15.56.2 PRODUCT PORTFOLIO

15.56.3 RECENT DEVELOPMENT

15.57 MULTI FREIGHT LIMITED

15.57.1 COMPANY SNAPSHOT

15.57.2 PRODUCT PORTFOLIO

15.57.3 RECENT DEVELOPMENT

15.58 NABIL GROUP OF INDUSTRIES

15.58.1 COMPANY SNAPSHOT

15.58.2 PRODUCT PORTFOLIO

15.58.3 RECENT DEVELOPMENT

15.59 NAVANA LOGISTICS LTD.

15.59.1 COMPANY SNAPSHOT

15.59.2 PRODUCT PORTFOLIO

15.59.3 RECENT DEVELOPMENT

15.6 NIPPON EXPRESS BANGLADESH LTD.

15.60.1 COMPANY SNAPSHOT

15.60.2 PRODUCT PORTFOLIO

15.60.3 RECENT DEVELOPMENT

15.61 ORIGIN SOLUTIONS LTD.

15.61.1 COMPANY SNAPSHOT

15.61.2 PRODUCT PORTFOLIO

15.61.3 RECENT DEVELOPMENT

15.62 PIONEER LOGISTICS HOLDINGS PTE LTD. .

15.62.1 COMPANY SNAPSHOT

15.62.2 PRODUCT PORTFOLIO

15.62.3 RECENT DEVELOPMENT

15.63 PRIME LOGISTICS LIMITED.

15.63.1 COMPANY SNAPSHOT

15.63.2 PRODUCT PORTFOLIO

15.63.3 RECENT DEVELOPMENT

15.64 QNS GLOBAL GROUP.

15.64.1 COMPANY SNAPSHOT

15.64.2 PRODUCT PORTFOLIO

15.64.3 RECENT DEVELOPMENT

15.65 RAJPAT SHIPPING & LOGISTICS.

15.65.1 COMPANY SNAPSHOT

15.65.2 PRODUCT PORTFOLIO

15.65.3 RECENT DEVELOPMENT

15.66 SEAWAYS FREIGHT LINKS

15.66.1 COMPANY SNAPSHOT

15.66.2 PRODUCT PORTFOLIO

15.66.3 RECENT DEVELOPMENT

15.67 SWIFT FREIGHT INTERNATIONAL LTD.

15.67.1 COMPANY SNAPSHOT

15.67.2 PRODUCT PORTFOLIO

15.67.3 RECENT DEVELOPMENT

15.68 TOWER FREIGHT LOGISTICS LIMITED (TFL)

15.68.1 COMPANY SNAPSHOT

15.68.2 PRODUCT PORTFOLIO

15.68.3 RECENT DEVELOPMENT

15.69 YOUNGONE LOGISTICS

15.69.1 COMPANY SNAPSHOT

15.69.2 PRODUCT PORTFOLIO

15.69.3 RECENT DEVELOPMENT

15.7 3I LOGISTICS GROUP

15.70.1 COMPANY SNAPSHOT

15.70.2 PRODUCT PORTFOLIO

15.70.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 MACROECONOMIC FACTORS

TABLE 2 COMPREHENSIVE ECONOMIC ANALYSIS FOR BANGLADESH FREIGHT FORWARDING MARKET

TABLE 3 BANGLADESH FREIGHT FORWARDING MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 4 BANGLADESH FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 BANGLADESH WAREHOUSING IN FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 BANGLADESH VALUE-ADDED SERVICES IN FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 BANGLADESH FREIGHT FORWARDING MARKET, BY CUSTOMER TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 BANGLADESH FREIGHT FORWARDING MARKET, BY FREIGHT FORWARD TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 BANGLADESH FREIGHT FORWARDING MARKET, BY LOGISTICS MODEL, 2018-2033 (USD THOUSAND)

TABLE 10 BANGLADESH FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 11 BANGLADESH FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 BANGLADESH FREIGHT FORWARDING MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 13 BANGLADESH INDUSTRIAL & MANUFACTURING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 BANGLADESH READY-MADE GARMENTS (RMGS) IN FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 BANGLADESH READY-MADE GARMENTS (RMGS) IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 16 BANGLADESH RETAIL IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 17 BANGLADESH FOOD & BEVERAGES IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 18 BANGLADESH HEALTHCARE IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 19 BANGLADESH OIL & GAS IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 20 BANGLADESH MILITARY IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 21 BANGLADESH MEDIA & TRANSPORT IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 22 BANGLADESH OTHERS IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

图片列表

FIGURE 1 BANGLADESH FREIGHT FORWARDING MARKET

FIGURE 2 BANGLADESH FREIGHT FORWARDING MARKET: DATA TRIANGULATION

FIGURE 3 BANGLADESH FREIGHT FORWARDING MARKET: DROC ANALYSIS

FIGURE 4 BANGLADESH FREIGHT FORWARDING MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 BANGLADESH FREIGHT FORWARDING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BANGLADESH FREIGHT FORWARDING MARKET: MULTIVARIATE MODELLING

FIGURE 7 BANGLADESH FREIGHT FORWARDING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 BANGLADESH FREIGHT FORWARDING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 BANGLADESH FREIGHT FORWARDING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 TWO SEGMENTS COMPRISE THE BANGLADESH FREIGHT FORWARDING MARKET, BY OFFERING (2025)

FIGURE 13 BANGLADESH FREIGHT FORWARDING MARKET: SEGMENTATION

FIGURE 14 GOVERNMENT INVESTMENT IN INFRASTRUCTURE, E-COMMERCE & RETAIL IS EXPECTED TO DRIVE THE BANGLADESH FREIGHT FORWARDING MARKET IN THE FORECAST PERIOD

FIGURE 15 THE SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BANGLADESH FREIGHT FORWARDING MARKET IN 2026 AND 2033

FIGURE 16 DROC ANALYSIS

FIGURE 17 BANGLADESH FREIGHT FORWARDING MARKET: BY OFFERING, 2025

FIGURE 18 BANGLADESH FREIGHT FORWARDING MARKET: BY CUSTOMER TYPE, 2025

FIGURE 19 BANGLADESH FREIGHT FORWARDING MARKET: BY FREIGHT FORWARD TYPE, 2025

FIGURE 20 BANGLADESH FREIGHT FORWARDING MARKET: BY LOGISTICS MODEL, 2025

FIGURE 21 BANGLADESH FREIGHT FORWARDING MARKET: BY MODE OF TRANSPORT, 2025

FIGURE 22 BANGLADESH FREIGHT FORWARDING MARKET: BY END USER, 2025

FIGURE 23 BANGLADESH FREIGHT FORWARDING MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。