Bangladesh Ready Made Garments Market

市场规模(十亿美元)

CAGR :

%

USD

3.08 Billion

USD

4.71 Billion

2025

2033

USD

3.08 Billion

USD

4.71 Billion

2025

2033

| 2026 –2033 | |

| USD 3.08 Billion | |

| USD 4.71 Billion | |

|

|

|

|

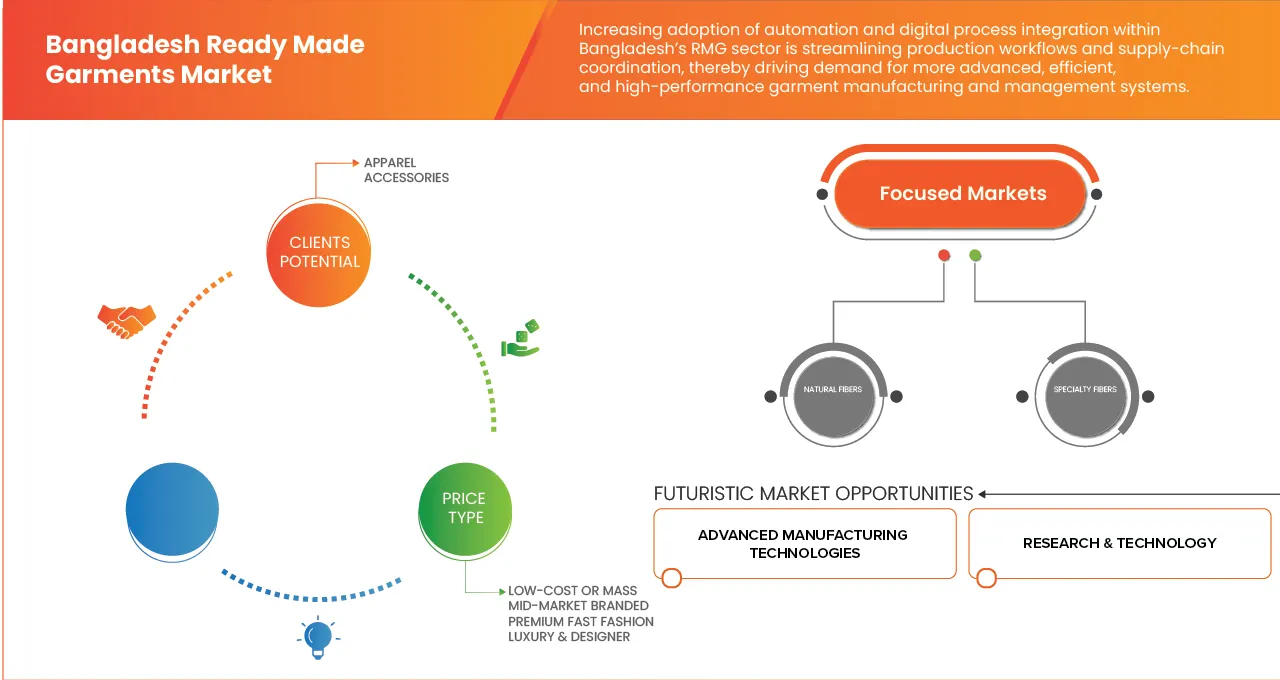

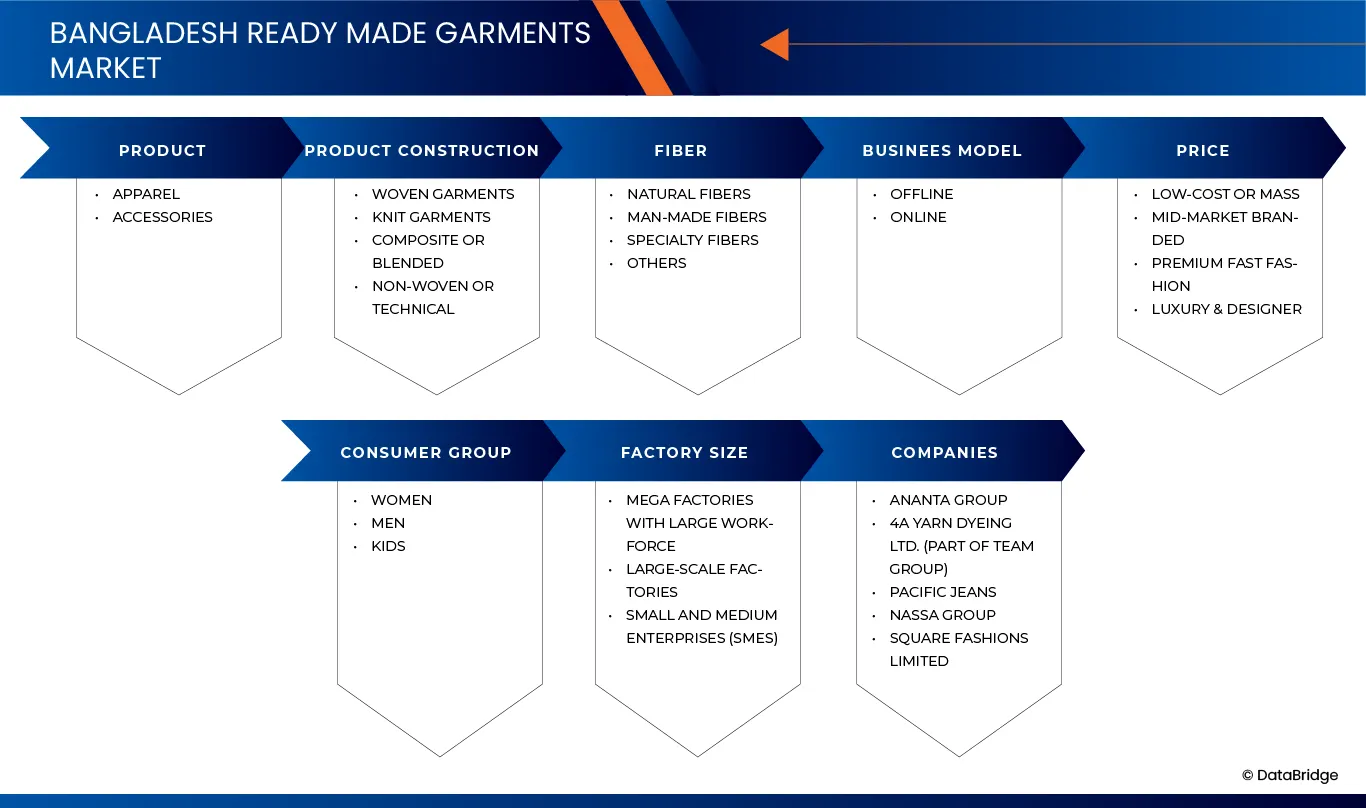

孟加拉國成衣市場細分,包括產品(服裝、配件)、產品結構(梭織服裝、針織服裝、複合或混紡、非織造或技術面料)、纖維類型(天然纖維、人造纖維、特殊纖維及其他)、商業模式(線下、線上)、價格(低成本或大眾市場、中階品牌、高端快時尚、奢侈品及設計師品牌)、消費群體(女性、男性、兒童)、工廠規模(龐大員工隊伍的大型工廠、大型工廠以及中小企業)-產業趨勢及至2033年的預測

孟加拉國成衣市場規模

- 預計孟加拉成衣市場規模將從2025年的30.8億美元成長至2033年的47.1億美元,在2026年至2033年的預測期內,複合年增長率將達到5.5%。

- 由於全球需求不斷增長,特別是來自北美、歐洲和新興亞洲市場的需求增長,孟加拉國成衣市場正經歷強勁增長,這得益於成本競爭力、熟練勞動力供應和強大的出口基礎設施。

- 製造業自動化、數位紡織解決方案的採用以及環保布料和節能生產流程等永續發展措施進一步推動了產業的擴張。

- 政府激勵措施、優惠的貿易協定和外國直接投資正在加速工廠現代化進程,並推動其向國際品質標準接軌。這使得孟加拉成為世界領先的成衣製造中心之一。

- 此外,不斷增加的研發投入、向技術性和功能性紡織品的多元化發展以及高價值服裝領域(運動服、醫用紡織品、智慧服裝)的發展,正在提升該國的出口競爭力和長期市場潛力。

孟加拉成衣市場分析

- 預計到2025年,服裝業將保持強勁成長勢頭,市佔率將達到93.28%。這主要得益於全球出口訂單的成長、消費者對價格適中的時尚和快時尚產品需求的增加,以及孟加拉在生產方面的競爭優勢——例如低廉的勞動力成本、充足的勞動力資源和成熟的製造業生態系統。此外,自動化、數位化設計工具和永續紡織實踐的採用,提高了生產效率並使其符合國際標準,進一步鞏固了服裝業在2025年的主導地位。

報告範圍及孟加拉國成衣市場細分

|

屬性 |

孟加拉成衣市場關鍵洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括監管標準、關稅及其分析、價值鏈分析、技術矩陣、供應鏈分析、市場滲透率與增長前景矩陣、滲透率和增長前景映射、新業務和新興業務的收入機會及未來展望、市場滲透率與增長前景矩陣、滲透率和增長前景映射、新業務和新興業務的收入機會及未來展望、進站數據、未來前景、滲透率和增長前景分析公司比較、新業務和新興業務的收入機會及未來展望、進成本分析公司比較公司分析公司。 |

孟加拉國成衣市場動態

司機

“具有競爭力的勞動力成本和龐大的勞動力隊伍支撐著大批量服裝生產”

- 孟加拉國成衣製造業持續鞏固其作為世界領先服裝製造中心之一的地位,這主要得益於其具有競爭力的勞動力成本和龐大的熟練勞動力。該行業擁有超過400萬名從業人員,其中大部分是女性。穩定的勞動力供應為大規模生產、快速訂單交付以及滿足全球買家所需的規模化生產提供了有力支撐。這一勞動力優勢使孟加拉能夠持續維持低於越南、印度和中國等競爭市場的生產成本,使其成為尋求成本效益高且不犧牲品質的品牌的首選目的地。

- 年輕的人口結構和持續的就業機會進一步增強了該行業的成長潛力。過去十年,孟加拉致力於改善工人培訓體系、升級工業園區並提高勞動法規標準,打造了一支生產效率更高、更可靠的勞動力團隊。由於孟加拉的勞動力習慣於大規模生產和標準化流程,國際零售商越來越傾向於從孟加拉國批量訂購針織和梭織服裝。

- 此外,國家推行的以勞動力發展和產業擴張為重點的政策提升了國家的競爭力。政府主導的培訓計畫、技能提升中心以及與全球組織的合作,有效增強了勞工的能力,使其能夠更有效率地完成複雜的製造任務。這些措施有助於提高產量、提升產品品質並縮短交貨週期——這些都是全球買家在選擇供應商時重點考慮的因素。

例如

- 2023年12月,世界銀行的出版品指出,孟加拉的人口結構——其中很大一部分人口年齡在35歲以下——為服裝業的勞動力持續增長提供了保障,確保了該行業勞動力的長期可持續性。

- 2025 年 1 月,國際勞工組織 (ILO) 的調查結果強調,孟加拉服裝廠正在進行的技能發展計畫提高了縫紉效率,減少了生產錯誤,直接提高了生產力和出口準備度。

- 2024 年 11 月,孟加拉服裝製造商和出口商協會 (BGMEA) 的一份報告強調,成衣製造業僱用了超過 400 萬名工人,並且仍然是世界上最具成本競爭力的服裝製造基地之一,顯著增強了出口競爭力。

機會

“全球消費者對可持續和符合道德規範生產的服裝的需求日益增長,從而開拓了高端市場領域”

- 全球服裝產業正經歷一場重大變革,其驅動力在於消費者對環境永續性、道德採購和負責任的生產實踐的意識日益增強。歐盟、美國和日本等主要市場的買家正積極優先選擇那些展現透明度、減少碳足跡、保障工人福利並採用環保生產技術的品牌。這項轉變正在重塑全球採購格局,並為能夠達到這些更高標準的國家創造了巨大的機會。對於孟加拉——全球最大的成衣出口國之一——而言,這一趨勢為其提供了一個絕佳的機會,使其能夠重新定位自身,進軍更高價值、更注重永續發展的市場領域。

- 國際買家對這些改進給予了正面評價。全球主要零售商和時尚品牌如今已將永續性指標納入供應商選擇流程,許多人將孟加拉視為負責任生產的新興領導者。這種轉變使孟加拉製造商能夠進入高端和細分市場,例如有機棉服裝、再生聚酯服裝、低影響牛仔布和循環時尚系列。這些產品類別通常價格更高,採購期限也更長,從而增強了該行業的出口韌性。

- 此外,西方市場監管框架的不斷改善也加速了這一機會的到來。歐盟關於盡職調查、碳足跡報告和可追溯性的新法規要求品牌與秉持高環境和社會標準的工廠合作。孟加拉工廠已採用更清潔的技術、數位化合規系統和透明的供應鏈機制,因此能夠很好地從這項監管轉變中獲益。

例如,

- 2024年2月,LightCastle Partners發表的一篇文章報道稱,H&M、Zara和Nike等全球知名品牌擴大了從孟加拉國工廠的採購,這些工廠採用了無水染色技術和減少浪費的系統,這反映出買家對可持續生產能力的信心增強。

- 2025年8月,SAGE出版社的一篇文章重點指出,受歐盟和美國消費者對低影響服裝需求的轉變推動,孟加拉對再生聚酯混紡面料和環保牛仔布的出口訂單不斷增長。

克制/挑戰

“對棉花和特殊面料等進口原材料的依賴會增加生產成本和交貨時間”

- 儘管孟加拉是全球最大的服裝出口國之一,但其成衣產業仍嚴重依賴進口原料,尤其是原棉、人造纖維以及高價值服裝領域使用的特種布料。這種結構性依賴在生產計劃、成本管理和交貨週期優化方面造成了顯著的脆弱性。雖然孟加拉擁有強大的針織布料生產基地,但其大部分梭織布料以及幾乎所有用於產品多元化的高性能、合成和技術性紡織品仍依賴進口。

- 全球棉花市場波動劇烈,受供應波動、天氣幹擾、貿易限制及價格不穩定等因素影響。孟加拉是全球第二大棉花進口國,國際棉花價格或運費的任何變化都會直接影響其服裝生產成本。同樣,運動服、外套、內衣和混紡面料生產商依賴主要來自中國、印度和印尼的特種紡織品。對這些原材料的依賴增加了其受地緣政治緊張局勢、運輸延誤和匯率波動的影響——所有這些都會擾亂供應鏈的連續性。

- 原物料採購週期延長也會導致交貨期延長,這對於全球買家要求快速週轉和準時交貨的行業來說至關重要。當紡織廠和工廠的布料收貨出現延誤時,它們難以維持生產計劃,往往被迫以更高的成本空運原材料或協商延長交貨期限——這兩種情況都會影響盈利能力和買家滿意度。在旺季或全球性突發事件(例如港口擁擠、貨櫃短缺或出口國政策突然變化)期間,交貨期方面的挑戰會更加嚴峻。

- 此外,對進口的依賴限制了孟加拉全面轉型至高價值服飾領域的能力。由於國內缺乏足夠的合成纖維、氨綸、功能性布料和高級後整理劑的生產能力,當地製造商無法在運動服和功能性服裝等快速增長的領域擴大生產規模。因此,工廠往往必須以更高的單位成本進口小批量特種布料,與中國、越南和印度等擁有一體化紡織供應鏈的國家相比,降低了價格競爭力。

例如,

- 2025年11月,《金融快報》的一項調查結果顯示,孟加拉幾乎100%的棉花原料依賴進口,使得該產業極易受到全球價格波動和運輸限制的影響。

- 2025年10月,孟加拉服裝製造商和出口商協會(BGMEA)的報告指出,當地服裝廠使用的梭織布料超過70%來自國外供應商,這顯著增加了交貨時間和投入成本。

- 2025 年 7 月,《印度紡織雜誌》報道稱,全球運費和匯率的波動提高了布料和原料的進口成本,並收緊了服裝出口商的利潤空間。

孟加拉國成衣市場範圍

孟加拉國成衣市場根據產品類型、產品結構、纖維類型、商業模式、價格、消費群體和工廠規模分為七個主要細分市場。

- 副產品

按產品劃分,市場分為服裝和配件。

由於孟加拉擁有強大的出口導向產業結構、大規模的生產能力、具有競爭力的勞動力成本以及成熟的全球買家網絡,服裝業預計將主導該國的成衣市場。此外,對技術、合規標準和產品多元化的持續投入,也鞏固了孟加拉作為領先服裝採購中心的地位。

- 按產品構造

根據產品結構,市場可細分為梭織服裝、針織服裝、複合或混紡服裝、非織造或技術服裝以及維生素服裝。由於孟加拉擁有龐大的產能、全球對襯衫、褲子和正裝的強勁需求,以及該國在梭織服裝製造領域的成熟優勢,梭織服裝預計將主導孟加拉國成衣市場。具有競爭力的勞動力成本、合規性的提升以及與國際品牌的長期合作關係進一步鞏固了其市場主導地位。

- 透過纖維

根據纖維類型,孟加拉國成衣市場分為天然纖維、人造纖維、特殊纖維和其他纖維。

由於孟加拉高度依賴棉質服裝,全球對透氣性和永續紡織品的需求旺盛,以及消費者對環保服裝的偏好日益增強,天然纖維服裝預計將主導孟加拉國成衣市場。孟加拉成熟的棉質服裝製造生態系統也進一步推動了這一領域的成長。

- 按商業模式

根據商業模式,孟加拉國成衣市場分為線下市場和線上市場。

由於傳統零售店的強大影響力、消費者對實體購物體驗的偏好以及品牌和非品牌服裝店的廣泛分佈,預計線下通路將繼續主導孟加拉國成衣市場。此外,農村地區數位普及率較低也進一步鞏固了線下零售的主導地位。

- 按價格

根據價格,孟加拉國成衣市場分為低成本或大眾市場、中端品牌市場、高端快時尚市場以及奢侈品和設計師市場。

由於孟加拉具有價格競爭力的製造業結構、龐大的消費群體對價格適中的服裝的高需求以及強大的生產效率,預計低成本或大眾市場將主導該國成衣市場。孟加拉以低價提供優質服裝的能力持續推動其在大眾市場的主導地位。

- 消費者團體

根據消費群體,市場分為女性、男性和兒童。

由於女性勞動參與率不斷提高、消費者對多樣化時尚品類的需求日益增長,以及民族服飾、休閒服飾和正裝的強勁增長,預計女性服飾將主導孟加拉國成衣市場。此外,都市化進程的加速、女性可支配收入的增加以及潮流驅動型消費的興起,也進一步鞏固了這個市場地位。

- 按工廠尺寸

根據工廠規模,市場分為擁有大量員工的巨型工廠、大型工廠和中小企業。

預計擁有龐大員工隊伍的大型工廠將憑藉其高產能、處理大宗出口訂單的能力以及對國際標準的嚴格遵守,主導孟加拉國成衣市場。這些大型工廠提供具有競爭力的價格、高效的交貨週期和先進的基礎設施,使其成為全球服裝品牌的首選合作夥伴。

孟加拉成衣市場洞察

孟加拉國成衣市場憑藉低廉的生產成本、熟練的勞動力和強有力的政府支持,仍然是全球最具競爭力和出口導向的服裝行業之一。該行業對國民生產總值貢獻顯著,並佔出口收入的大部分。大型全球時尚零售商從孟加拉採購針織服裝、梭織服裝和增值服裝,因為孟加拉的產品品質穩定且價格具有競爭力,從而推動了市場需求。為了滿足不斷發展的國際標準,孟加拉市場正在加大對技術、永續性和合規性的投資。擁有龐大勞動力的巨型工廠憑藉其規模、效率和處理大宗訂單的能力,在生產中佔據主導地位。在國內,由於價格實惠和生活方式的轉變,女裝、天然纖維和低成本大眾服裝的需求強勁。儘管面臨原材料價格波動和合規壓力等挑戰,孟加拉仍在不斷鞏固其作為全球服裝製造中心的地位,並不斷擴大多元化和出口機會。

孟加拉成衣 市佔率

成衣產業主要由一些老牌企業主導,其中包括:

- 阿南塔集團(孟加拉)

- 亞洲服裝有限公司(孟加拉)

- Pacific Jeans(孟加拉)

- 比托皮集團(孟加拉)

- Fakir服裝有限公司(孟加拉)

- NASSA集團(孟加拉)

- Square Fashions Limited(孟加拉)

- 斯特林集團(孟加拉)

- 4A 紗線染色有限公司(Team 集團旗下公司)(孟加拉)

- Envoy Group(孟加拉)

- EPYLLION集團(孟加拉)

- 藍色夢想集團(孟加拉)

- PRIDE GROUP(孟加拉)

- Poshgarments(孟加拉國)

- Partex集團(孟加拉)

孟加拉國成衣市場最新發展動態

- 2023年10月,安納塔集團與NTX達成策略聯盟,在孟加拉啟動「未來工廠」計畫。該工廠是一座新一代紡織廠,旨在將尖端面料染色和印花技術與可持續的水資源和能源管理以及全面數位化相結合。該工廠將支持安納塔集團豐富的服裝產品組合,涵蓋牛仔服、運動服、外套、內衣和針織衫等,並輔以合成纖維和人造纖維產品的垂直整合生產。

- 10月,太平洋牛仔集團在吉大港出口加工區七家工廠因工人騷亂和安全隱患而停產一周後重新開業。停產期間發生了抗議活動,造成人員受傷,並導致421名工人被解僱。為維護秩序,確保牛仔布生產和運作全面恢復,安保力量已部署到位。

- Anlima Yarn Dyeing 重申了其核心業務模式——以「AN Thread」品牌向針織和梭織紡織業以及出口型服裝廠供應染色紗線和高強度縫紉線,凸顯了其作為孟加拉國紡織價值鏈上游關鍵供應商的地位。

- Bitopi與BYETS計畫簽署了一份諒解備忘錄,將在其兩家成衣工廠(包括其自身旗下的一家工廠)實施基於工作場所的技能再培訓和提升計劃,旨在提高員工技能和生產力。

- 由於孟加拉的外部抗議活動導致暫時停產,Bitopi 集團確認其工廠(包括其出口加工區工廠)已全面恢復生產,員工出勤率也已恢復正常。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF BANGLADESH READY-MADE GARMENTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 GEOGRAPHIC SCOPE

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 DBMR MARKET SWOT MODEL

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES ANALYSIS

4.2 COMPANY EVALUATION QUADRANT

4.3 PRICING ANALYSIS

4.4 COMPANY COMPARATIVE ANALYSIS

4.5 IMPORT & EXPORT DATA

4.5.1 TYPE OF PRODUCTS EXPORTED / EXPORT COMPOSITION

4.5.2 IMPORTS (RAW MATERIALS & INPUTS FOR READY MADE GARMENTS)

4.5.3 NET EXPORT EARNINGS

4.5.4 SOURCES

4.5.5 LOGISTIC PROCESS & KEY PORTS / OTHERS

4.5.6 RECENT TRENDS AND HIGHLIGHTS

4.6 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES & FUTURE OUTLOOK

4.7 PENETRATION AND GROWTH PROSPECT MAPPING

4.7.1 MARKET PENETRATION STATUS (CURRENT POSITIONING)

4.7.1.1 GLOBAL MARKET POSITION

4.7.2 BUYER SEGMENT PENETRATION

4.7.3 PRODUCT CATEGORY PENETRATION

4.7.4 GROWTH PROSPECT MAPPING (OPPORTUNITY HOTSPOTS)

4.7.5 GROWTH BY PRODUCT CATEGORY

4.7.5.1 STRONGEST GROWTH AREAS (SHORT–MEDIUM TERM)

4.7.5.2 HIGH-POTENTIAL (MEDIUM–LONG TERM)

4.7.5.3 TRANSFORMATIONAL GROWTH (LONG TERM)

4.7.6 GROWTH BY VALUE-CHAIN SEGMENT

4.7.6.1 UPSTREAM: TEXTILE & RAW MATERIALS

4.7.6.2 MIDSTREAM: GARMENT MANUFACTURING

4.7.6.3 DOWNSTREAM: BRANDING, PACKAGING, LOGISTICS

4.8 MARKET PENETRATION VS. GROWTH PROSPECT MATRIX

4.8.1 QUADRANT A — HIGH PENETRATION | HIGH GROWTH

4.8.2 QUADRANT B — LOW PENETRATION | HIGH GROWTH

4.8.3 QUADRANT C — HIGH PENETRATION | LOW GROWTH

4.8.4 QUADRANT D — LOW PENETRATION | LOW GROWTH

4.8.5 STRATEGIC IMPLICATIONS FOR BANGLADESH RMG

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 RAW MATERIAL SOURCING

4.9.3 MANUFACTURING & PROCESSING

4.9.4 LOGISTICS & DISTRIBUTION

4.9.5 END-USE & MARKET DEMAND

4.9.6 CHALLENGES & FUTURE OUTLOOK

4.1 TECHNOLOGY MATRIX

4.11 VALUE CHAIN ANALYSIS

4.11.1 RAW MATERIALS AND INPUTS

4.11.2 PROCESSING / TEXTILE MILLS

4.11.3 GARMENT MANUFACTURING

4.11.4 SUPPORT SERVICES / BACKWARD LINKAGES

4.11.5 EXPORT LOGISTICS

4.11.6 MARKETS & BUYERS

4.11.7 REGULATORY / INSTITUTIONAL ENVIRONMENT

4.11.8 CONCLUSION

5 TARIFF AND ITS ANALYSIS – BANGLADESH READY-MADE GARMENTS (RMG) MARKET

5.1 OVERVIEW OF RELEVANT TARIFFS

5.2 TRADE POLICIES INFLUENCING THE MARKET

5.3 COST IMPACT ON STAKEHOLDERS

5.3.1 IMPACT ON EXPORT-ORIENTED MANUFACTURERS

5.3.2 IMPACT ON INTERNATIONAL BUYERS AND GLOBAL BRANDS

5.3.3 IMPACT ON DOMESTIC TEXTILE AND UPSTREAM SUPPLIERS

5.3.4 IMPACT ON LOGISTICS PROVIDERS AND FREIGHT OPERATORS

5.4 SUPPLY CHAIN DISRUPTIONS

5.5 STRATEGIC RESPONSE BY OEM

6 REGULATORY STANDARDS – BANGLADESH READY MADE GARMENTS MARKET

6.1 NATIONAL REGULATORY FRAMEWORK

6.1.1 LABOUR LAWS & WORKER RIGHTS

6.1.2 FACTORY SAFETY & BUILDING COMPLIANCE

6.1.3 ENVIRONMENTAL & CHEMICAL STANDARDS

6.1.4 SOCIAL COMPLIANCE MANDATES

6.2 INDUSTRY & INSTITUTIONAL COMPLIANCE PROGRAMS

6.2.1 BGMEA & BKMEA COMPLIANCE STANDARDS

6.2.2 RMG SUSTAINABILITY COUNCIL (RSC)

6.3 INTERNATIONAL BUYER-DRIVEN STANDARDS

6.3.1 SOCIAL & ETHICAL STANDARDS (CSR)

6.3.2 FACTORY AUDIT STANDARDS

6.4 ENVIRONMENTAL & SUSTAINABILITY STANDARDS

6.4.1 INTERNATIONAL CERTIFICATIONS

6.4.2 CHEMICAL MANAGEMENT

6.5 TRADE, EXPORT & CUSTOMS REGULATIONS

6.5.1 EXPORT RULES

6.5.2 CUSTOMS & TRADE FACILITATION

6.5.3 INTERNATIONAL TRADE REQUIREMENTS

6.6 INTERNATIONAL LABOR & HUMAN RIGHTS COMPLIANCE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 COMPETITIVE LABOR COSTS AND A LARGE WORKFORCE SUPPORT HIGH-VOLUME APPAREL PRODUCTION

7.1.2 STRONG EXPORT DEMAND FROM MAJOR MARKETS SUCH AS THE EU AND US DRIVES CONTINUOUS EXPANSION

7.1.3 GOVERNMENT INCENTIVES, POLICY SUPPORT, AND IMPROVED INFRASTRUCTURE ENHANCE MANUFACTURING EFFICIENCY

7.2 RESTRAINTS

7.2.1 DEPENDENCE ON IMPORTED RAW MATERIALS LIKE COTTON AND SPECIALTY FABRICS INCREASES PRODUCTION COSTS AND LEAD TIMES

7.2.2 LIMITED PRODUCT AND TECHNOLOGICAL DIVERSIFICATION RESTRICT MOVEMENT INTO HIGHER-VALUE SEGMENTS

7.3 OPPORTUNITIES

7.3.1 RISING GLOBAL PREFERENCE FOR SUSTAINABLE AND ETHICALLY PRODUCED GARMENTS OPENS PREMIUM MARKET SEGMENTS

7.3.2 EXPANSION INTO HIGH-VALUE CATEGORIES SUCH AS ACTIVEWEAR, OUTERWEAR, AND TECHNICAL TEXTILES BOOSTS VALUE-ADDITION

7.3.3 ADOPTION OF AUTOMATION, DIGITAL MANUFACTURING, AND ADVANCED SKILLS TRAINING IMPROVES PRODUCTIVITY

7.4 CHALLENGES

7.4.1 INCREASING COMPLIANCE REQUIREMENTS RELATED TO LABOR RIGHTS, ENVIRONMENTAL STANDARDS, AND SUPPLY CHAIN TRANSPARENCY

7.4.2 CLIMATE-RELATED RISKS SUCH AS FLOODS, CYCLONES, AND RISING TEMPERATURES THREATEN PRODUCTION CONTINUITY

8 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2018-2033 (USD THOUSAND)

8.2.1 APPAREL

8.2.2 ACCESSORIES

8.3 BANGLADESH APPAREL IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.3.1 T-SHIRTS AND SHIRTS

8.3.2 BOTTOMS

8.3.3 UNIFORMS & WORKWEAR

8.3.4 TOPS AND BLOUSES

8.3.5 DRESSES

8.3.6 SLEEPWEAR / LOUNGEWEAR

8.3.7 SUITS

8.3.8 OUTERWEAR

8.3.9 INTIMATES & LINGERIE

8.4 BANGLADESH T-SHIRTS AND SHIRTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.4.1 ROUND NECK T-SHIRTS

8.4.2 POLO SHIRTS

8.4.3 V-NEC T-SHIRTS

8.4.4 DRESS SHIRTS

8.4.5 HENLEY SHIRTS

8.4.6 OTHERS

8.5 BANGLADESH BOTTOMS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.5.1 JEANS

8.5.2 CHINOS

8.5.3 TROUSERS

8.5.4 SHORTS

8.5.5 TRACK PANTS

8.5.6 LEGGINGS

8.5.7 SKIRTS

8.5.8 OTHERS

8.6 BANGLADESH UNIFORMS & WORKWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 CORPORATE UNIFORMS

8.6.2 HOSPITAL SCRUBS

8.6.3 INDUSTRIAL WORKWEAR

8.6.4 SCHOOL UNIFORM

8.6.5 SAFETY JACKETS (HI-VIS)

8.6.6 SECURITY UNIFORMS

8.6.7 CHEF COATS / APRONS

8.6.8 COVERALLS / OVERALLS

8.6.9 OTHERS

8.7 BANGLADESH SLEEPWEAR/LOUNGEWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.7.1 PAJAMAS (MEN/WOMEN/KIDS)

8.7.2 LOUNGE SETS

8.7.3 NIGHTGOWNS

8.7.4 SLEEP SHIRTS

8.7.5 ROBES

8.7.6 OTHERS

8.8 BANGLADESH SUITS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 BUSINESS CASUALS

8.8.2 TWO-PIECE

8.9 BANGLADESH OUTERWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.9.1 JACKETS

8.9.2 COATS

8.9.3 PULLOVERS

8.1 BANGLADESH ACCESSORIES IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.10.1 CAPS

8.10.2 SCARVES

8.10.3 SOCKS

8.10.4 GLOVES

8.10.5 OTHERS

9 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION

9.1 OVERVIEW

9.2 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2018-2033 (USD THOUSAND)

9.2.1 WOVEN GARMENTS

9.2.2 KNIT GARMENTS

9.2.3 COMPOSITE OR BLENDED

9.2.4 NON-WOVEN OR TECHNICAL

9.3 BANGLADESH WOVEN GARMENTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 DENIM

9.3.2 TWILL

9.3.3 POPLIN

9.3.4 OTHERS

9.4 BANGLADESH KNIT GARMENTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 JERSEY

9.4.2 INTERLOCK

9.4.3 RIB

9.4.4 OTHERS

10 BANGLADESH READY MADE GARMENTS MARKET, BY FIBER

10.1 OVERVIEW

10.2 BANGLADESH READY MADE GARMENTS MARKET, BY FIBER, 2018-2033 (USD THOUSAND)

10.2.1 NATURAL FIBERS

10.2.2 MAN-MADE FIBERS

10.2.3 SPECIALTY FIBERS

10.2.4 OTHERS

10.3 BANGLADESH NATURAL FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.3.1 COTTON

10.3.2 LINEN

10.3.3 HEMP

10.3.4 OTHERS

10.4 BANGLADESH MAN-MADE FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.4.1 POLYESTER

10.4.2 NYLON

10.4.3 ACRYLIC

10.4.4 OTHERS

10.5 BANGLADESH SPECIALTY FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.5.1 RECYCLED POLYESTER

10.5.2 BAMBOO

10.5.3 MODAL

10.5.4 OTHERS

11 BANGLADESH READY MADE GARMENTS MARKET, BY BUSINESS MODEL

11.1 OVERVIEW

11.2 BANGLADESH READY MADE GARMENTS MARKET, BY BUSINESS MODEL , 2018-2033 (USD THOUSAND)

11.2.1 OFFLINE

11.2.2 ONLINE

12 BANGLADESH READY MADE GARMENTS MARKET, BY PRICE

12.1 OVERVIEW

12.2 BANGLADESH READY MADE GARMENTS MARKET, BY PRICE, 2018-2033 (USD THOUSAND)

12.2.1 LOW COST OR MASS

12.2.2 MID-MARKET BRANDED

12.2.3 PREMIUM FAST FASHION

12.2.4 LUXURY AND DESIGNER

13 BANGLADESH READY MADE GARMENTS MARKET, BY CONSUMER GROUP

13.1 OVERVIEW

13.2 BANGLADESH READY MADE GARMENTS MARKET, BY CONSUMER GROUP, 2018-2033 (USD THOUSAND)

13.2.1 WOMEN

13.2.2 MEN

13.2.3 KIDS

14 BANGLADESH READY MADE GARMENTS MARKET, BY FACTORY SIZE

14.1 OVERVIEW

14.2 BANGLADESH READY MADE GARMENTS MARKET, BY FACTORY SIZE, 2018-2033 (USD THOUSAND)

14.2.1 MEGA FACTORIES WITH LARGE WORKFORCE

14.2.2 LARGE-SCALE FACTORIES

14.2.3 SMALL AND MEDIUM ENTERPRISES

15 BANGLADESH READY MADE GARMENTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: BANGLADESH

16 SWOT ANALYSIS

17 COMAPANY PROFILES

17.1 ANANTA GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 4A YARN DYEING LTD

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 PACIFIC JEANS

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 NASSA GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 SQUARE FASHIONS LIMITED

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 3N FASHION (BD) LTD

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 4 STAR FASHIONS LTD

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 9 STAR APPARELS INDUSTRIES LIMITED

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 AAZTEX

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 ANLIMA GROUP.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 ARM FASHION BD

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 A.R. FASHION OUTFIT LTD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 ASIAN ERP (ASIAN APPARELS)

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 BD WEAR

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 BISHWORANG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 BITOPI GROUP

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 BLUE DREAM

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 BRANDSTORE (GG FASHION SOURCING)

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 BUSANA APPAREL GROUP

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 CLIFTON GROUP

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 DESH GROUP

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 ENVOY GROUP

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 ENVOY TEXTILES

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 EPIC GROUP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 EPYLLION GROUP

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

17.26 FAKIRFASHION.COM.

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 HA-MEEM GROUP.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 HULA GLOBAL

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 JMS GROUP LTD

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 JUSITEX

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

17.31 KEMS GROUP LTD

17.31.1 COMPANY SNAPSHOT

17.31.2 PRODUCT PORTFOLIO

17.31.3 RECENT DEVELOPMENTS

17.32 MASCO GROUP

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENT

17.33 MEERAB INDUSTRIES LTD.

17.33.1 COMPANY SNAPSHOT

17.33.2 PRODUCT PORTFOLIO

17.33.3 RECENT DEVELOPMENTS

17.34 MODELE GROUP

17.34.1 COMPANY SNAPSHOT

17.34.2 PRODUCT PORTFOLIO

17.34.3 RECENT DEVELOPMENT

17.35 MOHAMMADI GROUP

17.35.1 COMPANY SNAPSHOT

17.35.2 PRODUCT PORTFOLIO

17.35.3 RECENT DEVELOPMENT

17.36 MONNO GROUP

17.36.1 COMPANY SNAPSHOT

17.36.2 REVENUE ANALYSIS

17.36.3 PRODUCT PORTFOLIO

17.36.4 RECENT DEVELOPMENT

17.37 PARTEX GROUP

17.37.1 COMPANY SNAPSHOT

17.37.2 PRODUCT PORTFOLIO

17.37.3 RECENT DEVELOPMENT

17.38 POSH GARMENTS

17.38.1 COMPANY SNAPSHOT

17.38.2 PRODUCT PORTFOLIO

17.38.3 RECENT DEVELOPMENT

17.39 PLUMMY FASHION

17.39.1 COMPANY SNAPSHOT

17.39.2 PRODUCT PORTFOLIO

17.39.3 RECENT DEVELOPMENT

17.4 PRIDE GROUP

17.40.1 COMPANY SNAPSHOT

17.40.2 PRODUCT PORTFOLIO

17.40.3 RECENT DEVELOPMENT

17.41 SDF CLOTHING

17.41.1 COMPANY SNAPSHOT

17.41.2 PRODUCT PORTFOLIO

17.41.3 RECENT DEVELOPMENTS

17.42 SIATEX

17.42.1 COMPANY SNAPSHOT

17.42.2 PRODUCT PORTFOLIO

17.42.3 RECENT DEVELOPMENT

17.43 STANDARD GROUP

17.43.1 COMPANY SNAPSHOT

17.43.2 PRODUCT PORTFOLIO

17.43.3 RECENT DEVELOPMENT

17.44 STERLING GROUP

17.44.1 COMPANY SNAPSHOT

17.44.2 PRODUCT PORTFOLIO

17.44.3 RECENT DEVELOPMENT

17.45 STUFF LIMITED

17.45.1 COMPANY SNAPSHOT

17.45.2 PRODUCT PORTFOLIO

17.45.3 RECENT DEVELOPMENTS

17.46 STYLECRAFT LIMITED

17.46.1 COMPANY SNAPSHOT

17.46.2 REVENUE ANALYSIS

17.46.3 PRODUCT PORTFOLIO

17.46.4 RECENT DEVELOPMENT

17.47 SYLVAN APPAREL

17.47.1 COMPANY SNAPSHOT

17.47.2 PRODUCT PORTFOLIO

17.47.3 RECENT DEVELOPMENT

17.48 TOUCH APPAREL

17.48.1 COMPANY SNAPSHOT

17.48.2 PRODUCT PORTFOLIO

17.48.3 RECENT DEVELOPMENT

17.49 WENEXT APPARELS

17.49.1 COMPANY SNAPSHOT

17.49.2 PRODUCT PORTFOLIO

17.49.3 RECENT DEVELOPMENTS

17.5 WINGS2FASHION

17.50.1 COMPANY SNAPSHOT

17.50.2 PRODUCT PORTFOLIO

17.50.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

表格列表

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 PRODUCT CATEGORY PENETRATION, BY CATEGORY

TABLE 3 PRODUCT CATEGORY PENETRATION, BY REGION

TABLE 4 GROWTH BY EXPORT MARKET

TABLE 5 TECHNOLOGY MATRIX

TABLE 6 TARRIF ANALYSIS BY REGIONS

TABLE 7 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 8 BANGLADESH APPAREL IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 BANGLADESH T-SHIRTS AND SHIRTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 BANGLADESH BOTTOMS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 BANGLADESH UNIFORMS & WORKWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 BANGLADESH SLEEPWEAR/LOUNGEWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 BANGLADESH SUITS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 BANGLADESH OUTERWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 BANGLADESH ACCESSORIES IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 17 BANGLADESH WOVEN GARMENTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 BANGLADESH KNIT GARMENTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 BANGLADESH READY MADE GARMENTS MARKET, BY FIBER, 2018-2033 (USD THOUSAND)

TABLE 20 BANGLADESH NATURAL FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 BANGLADESH MAN-MADE FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 BANGLADESH SPECIALTY FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 BANGLADESH READY MADE GARMENTS MARKET, BY BUSINESS MODEL , 2018-2033 (USD THOUSAND)

TABLE 24 BANGLADESH READY MADE GARMENTS MARKET, BY PRICE, 2018-2033 (USD THOUSAND)

TABLE 25 BANGLADESH READY MADE GARMENTS MARKET, BY CONSUMER GROUP, 2018-2033 (USD THOUSAND)

TABLE 26 BANGLADESH READY MADE GARMENTS MARKET, BY FACTORY SIZE, 2018-2033 (USD THOUSAND)

图片列表

FIGURE 1 BANGLADESH READY MADE GARMENTS MARKET: SEGMENTATION

FIGURE 2 BANGLADESH READY MADE GARMENTS MARKET: DATA VALIDATION MODEL

FIGURE 3 BANGLADESH READY MADE GARMENTS MARKET: DROC ANALYSIS

FIGURE 4 BANGLADESH READY MADE GARMENTS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 BANGLADESH READY MADE GARMENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BANGLADESH READY MADE GARMENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 BANGLADESH READY MADE GARMENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 BANGLADESH READY MADE GARMENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 BANGLADESH READY-MADE GARMENTS MARKET: SEGMENTATION

FIGURE 10 BNAGLADESH READY MADE GARMENTS MARKET: EXECUTIVE SUMMARY

FIGURE 11 TWO SEGMENTS COMPARISE THE GABGLADESH READY MADE GARMENTS MARKET, BY PRODUCT TYPE

FIGURE 12 STRATEGIC DECISIONS BY KEY PLAYERS

FIGURE 13 APPAREL SEGMENTS IS EXPECTED TO DOMINATE AND GROW WITH THE FASTEST GROWTH RATE IN BANGLADESH READY MADE GARMENTS MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 14 BANGLADESH READYMADE GARMENTS IS EXPECTED TO GROW WITH A CAGR OF 5.5% DURING THE FORECAST PERIOD

FIGURE 15 APPAREL SEGMENT HOLDS THE LARGEST MARKET SHARE, AND IS EXPECTED TO INCREASE ITS SHARE IN THE MARKET BY 2033

FIGURE 16 COMPANY EVALUATION QUADRANT

FIGURE 17 BANGLADESH READY MADE GARMENTS MARKET, 2025-2033, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 18 VALUE CHAIN ANALYSIS OF BANGLADESH READY-MADE GARMENTS MARKET

FIGURE 19 DROC ANALYSIS

FIGURE 20 BANGLADESH READY-MADE GARMENTS MARKET, BY PRODUCT, 2025

FIGURE 21 BANGLADESH READY-MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2025

FIGURE 22 BANGLADESH READY-MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2025

FIGURE 23 BANGLADESH READY-MADE GARMENTS MARKET, BY BUSINESS MODEL, 2025

FIGURE 24 BANGLADESH READY-MADE GARMENTS MARKET, BY PRICE, 2025

FIGURE 25 BANGLADESH READY-MADE GARMENTS MARKET, BY CONSUMER GROUP , 2025

FIGURE 26 BANGLADESH READY-MADE GARMENTS MARKET, BY FACTORY SIZE, 2025

FIGURE 27 BANGLADESH READY MADE GARMENTS MARKET: COMPANY SHARE 2025 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。