Canada And Us Point Of Care Testing Market

市场规模(十亿美元)

CAGR :

%

USD

15.25 Billion

USD

31.72 Billion

2024

2032

USD

15.25 Billion

USD

31.72 Billion

2024

2032

| 2025 –2032 | |

| USD 15.25 Billion | |

| USD 31.72 Billion | |

|

|

|

|

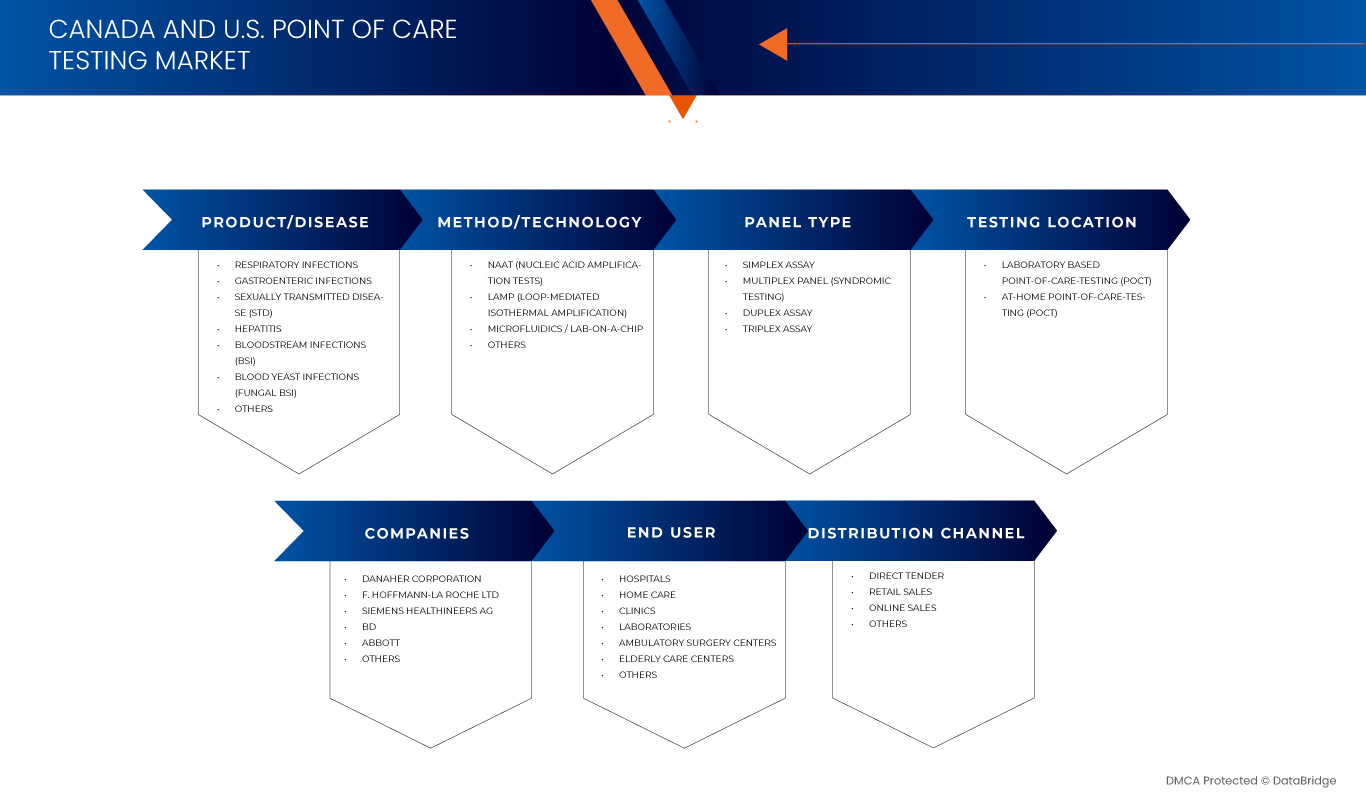

加拿大和美國即時檢測市場細分,按產品/疾病(性傳染病 (STD)、肝炎、呼吸道感染、胃腸道感染、血流感染 (BSI)、血液酵母菌感染及其他)、方法/技術(核酸擴增檢測 (NAAT)、環介導等溫擴增 (LAMP)、微流控/晶片實驗室及其他)檢測類型檢測(單次檢測類型檢測、雙重檢測類型檢測) (POCT)、居家即時檢測 (POCCT))、最終用戶(醫院、診所、實驗室、家庭護理機構、門診手術中心、養老院及其他)、分銷管道(直接招標、零售、線上銷售及其他)劃分-行業趨勢及預測2032

加拿大和美國即時檢測市場規模

- 2024年加拿大和美國的即時檢測市場價值為152.5億美元,預計到2032年將達到317.2億美元。

- 在2025年至2032年的預測期內,該市場預計將以9.6%的複合年增長率成長,主要驅動因素是慢性病和傳染病患者病率的上升。

- 這種增長是由多種因素驅動的,例如在急診和門診環境中對快速診斷的需求不斷增加。

加拿大和美國即時檢測市場分析

- 加拿大和美國的即時檢測市場成長主要受糖尿病和心血管疾病等慢性病盛行率上升以及傳染病負擔日益加重(對快速準確診斷解決方案的需求日益增長)的推動。新冠疫情顯著加速了分子檢測和快速即時檢測的普及,而對呼吸道感染、胃腸道感染、性傳染感染和血液感染檢測組合的持續需求也推動了市場擴張。此外,隨著自測盒和零售藥局診斷產品的廣泛普及,人們對分散式和居家醫療保健的偏好日益增強,這也進一步促進了市場成長。

- 分子檢測、微流控技術和智慧型手機連接的即時檢測(POCT)設備的進步提高了檢測的準確性和可及性,同時醫療系統也採用這些解決方案來降低成本並縮短患者就診週期。此外,加拿大和美國政府的支持性政策、監管審批和報銷機制也促進了POCT在臨床、零售和家庭護理等領域的更廣泛應用。

- 加拿大和美國的醫療服務提供者和政策制定者越來越認識到即時檢測(POCT)在應對日益嚴重的疾病負擔方面的價值,尤其是在社區健康中心、急診護理機構和偏遠地區,這些地區集中式實驗室的資源有限。這種不斷增長的需求正在推動公共和私人部門對先進診斷平台的投資,以支持快速的臨床決策。

- 新冠疫情加速了分散式檢測解決方案的廣泛應用,推動了北美各地醫院、藥房和其他醫療機構部署即時檢測(POCT)技術。隨著醫療系統持續關注可近性、早期檢測和價值導向醫療,對高效、近患者診斷的需求預計將繼續成為市場成長的關鍵驅動力。

- 由於美國擁有先進的醫療基礎設施、快速診斷技術普及率高、政府大力支持以及龐大的患者群體,這些因素共同推動了對高效、精準檢測解決方案的需求,預計美國將以88.56%的市場份額主導加拿大和美國的即時檢測市場。

報告範圍及加拿大及美國即時檢測市場細分

|

屬性 |

加拿大和美國即時檢測關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、患者流行病學、產品線分析、定價分析和監管框架。 |

加拿大和美國即時檢測市場趨勢

慢性病和傳染病患者病率不斷上升,對快速、分散式診斷的需求日益增長。

- 加拿大和美國慢性病和傳染病的日益流行,使得快速、分散的診斷解決方案變得迫切需要,以便及時發現疾病並進行有效管理。

- 加拿大和美國的醫療服務提供者和政策制定者越來越認識到即時檢測(POCT)在應對日益嚴重的疾病負擔方面的價值,尤其是在社區健康中心、急診護理機構和偏遠地區,這些地區獲得集中式實驗室檢測的機會有限。

- 例如,2025年5月,人雲(湖南)母線有限公司在其總部接待了一位重要客戶,這標誌著公司在建立牢固的長期合作夥伴關係方面又邁出了重要一步。此次訪問包括參觀人雲先進的生產設施,客戶親眼目睹了先進的生產流程、嚴格的品質檢測和創新的產品設計。

- 在資料中心,正常運作時間至關重要。加拿大和美國的即時檢測中心正在整合資源,以提供精簡且可重構的電力供應,使營運商能夠在不延長停機時間的情況下擴展基礎設施。其即插即用的特性因其能夠快速連接機架電源並支援動態負載轉移而備受青睞——這些需求在超大規模和邊緣運算場景中已成為普遍現象。

- 世界銀行的能源發展計畫進一步強調了電氣化如何與新興經濟體的永續工業成長連結。在智慧工業區和政府主導的基礎設施走廊中,加拿大和美國的即時檢測正被納入低壓配電戰略——尤其是在需要速度、靈活性和長期安全性的領域。

加拿大和美國即時偵測市場動態

司機

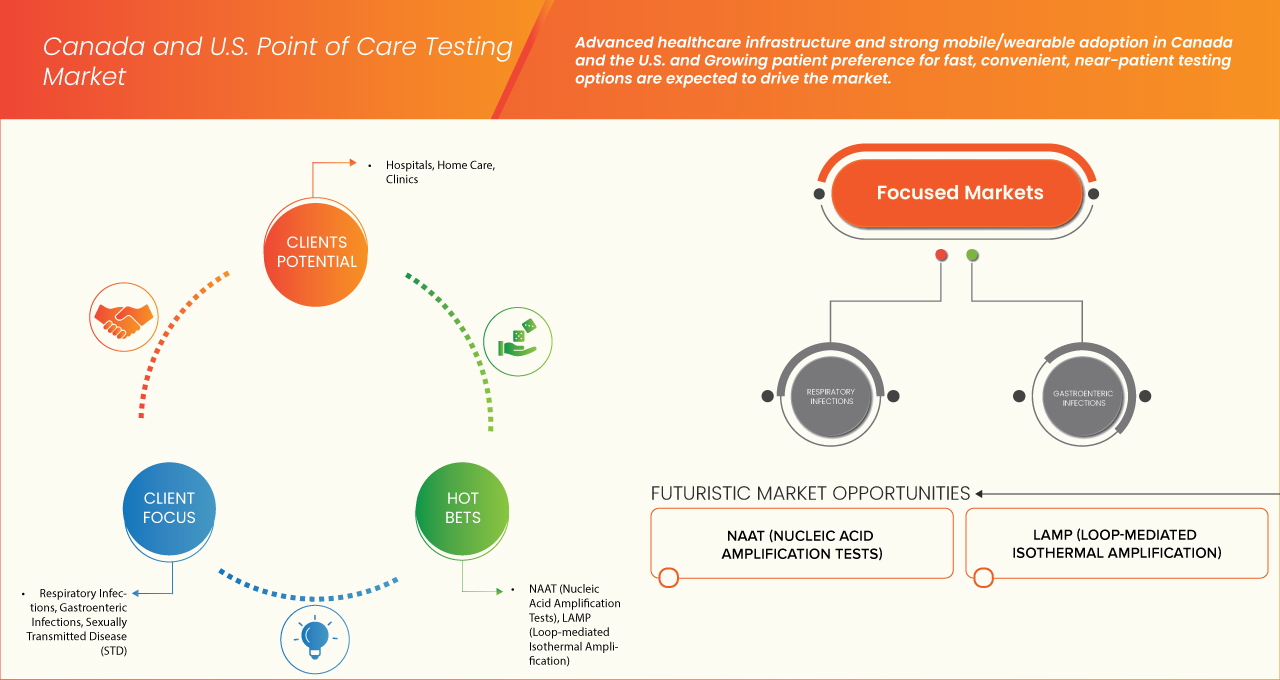

加拿大和美國擁有先進的醫療保健基礎設施,且行動/穿戴式裝置應用普及率很高。

- 推動加拿大和美國即時檢測市場發展的關鍵趨勢之一是快速診斷流程、即時數據共享和簡化的臨床決策,這些因素共同改善了患者的治療效果。

- 伴隨這些基礎設施的完善,加拿大和美國消費者對行動和穿戴式健康技術的廣泛接受,也推動了對互聯且用戶友好的即時檢測設備的需求。

- 例如,2025年8月,加拿大健康資訊之路(Canada Health Infoway)啟動了「互聯護理臨床學生獎學金」(Connected Care Clinical Student Scholarship),為每位學生提供高達3000美元的獎學金,以支持在加拿大認可的高等院校攻讀數位健康教育課程的臨床學習者。

- 這項隸屬於數位健康臨床創新中心 (CIDH) 的計畫旨在透過提升學生在電子健康記錄、醫療保健人工智慧和醫療保健數據分析等領域的知識水平,促進互通性和互聯醫療的發展。該獎學金與加拿大資訊之路 (Infoway) 的《泛加拿大共享互通性路線圖》相契合,並支持分散式診斷能力和數位健康解決方案的開發。

- 穿戴式裝置和行動健康應用程式使患者能夠持續監測自身健康狀況,從而創造一個數據豐富的環境,POCT解決方案可以利用這些數據提供及時、個人化的診斷。

- 這些技術的整合促進了遠距患者監測、慢性病管理和預防保健,從而減少了患者就診次數,減輕了醫療系統的負擔。隨著行動裝置和穿戴式裝置的普及,這將日益推動即時檢測(POCT)的擴展和應用,使其成為現代醫療服務的重要組成部分。

機會

在藥物濫用、傳染病和腫瘤篩檢領域的應用日益廣泛,推動市場多元化

- 在即時檢測(POCT)日益普及的推動下,加拿大和美國的醫療保健格局正在經歷一場重大變革。這種轉變尤其體現在其應用領域的多元化,已超越傳統診斷,拓展至新興的高成長領域。

- 即時檢測(POCT)在藥物濫用、傳染病和腫瘤篩檢等領域的拓展,正在為及時、便捷的患者護理創造一種新的模式。這一發展趨勢源於對更快檢測結果的需求,這有助於更快地做出治療決策,並改善患者的治療效果。

- 例如,根據加拿大和美國藥品管理局的數據,2025年8月,新冠肺炎疫情的爆發促使即時檢測(POCT)技術得到廣泛應用,使人們更加了解這些檢測方法在醫學各個領域的應用,例如愛滋病毒快速診斷檢測和基於生物標誌物的輕度創傷性腦損傷檢測。

- 在診所、藥局甚至偏遠地區等非集中式實驗室環境下進行這些檢測的能力,是推動這一趨勢的關鍵因素。隨著技術日趨成熟和便捷,可在診療現場篩檢的疾病範圍不斷擴大,為醫護人員和患者都帶來了新的機會。這種多樣化不僅有助於解決醫療服務取得方面長期存在的挑戰,而且有望簡化臨床工作流程,減輕傳統實驗室基礎設施的負擔。

- 美國的即時檢測(POCT)領域正日益涵蓋從濫用藥物檢測到傳染病檢測和腫瘤生物標記檢測等多種篩檢應用,其影響範圍不斷擴大,遍及醫療保健的各個領域。例如,居家傳染病檢測,如SARS-CoV-2抗原檢測試劑盒,已在60天內節省了約1,250萬美元的成本,凸顯了市場對分散式檢測的需求。同時,腫瘤診斷領域的進步,例如機器學習增強的血液檢測能夠以約92%的準確率檢測出早期卵巢癌,預示著POCT在癌症篩檢領域也將得到類似的擴展。

克制/挑戰

先進的即時檢測設備和試劑成本高昂

- 在加拿大和美國,先進的即時檢測(POCT)設備的普及往往受到高昂成本的阻礙。這些技術通常包含複雜的組件,並且需要專用試劑,導致更高的製造成本和採購成本。

- 耗材、維護和設備校準等經常性支出進一步加重了整體財務負擔。在許多情況下,醫療機構在投資先進的即時檢測(POCT)系統之前必須仔細評估成本效益比,這可能導致這些技術的採用延遲或選擇性使用。

- 例如,2025年6月,《應用科學》雜誌發表的一項研究探討了在工作場所環境中整合即時檢測(POCT)技術用於癌症和慢性病管理的問題。研究強調,不同製造商生產的POCT設備在性能和品質上的差異,為標準化工作帶來了重大挑戰。

- 這種不一致使得建立統一的檢測方案和品質保證措施變得複雜,導致臨床應用和融入常規醫療實踐方面存在困難。缺乏標準化的設備和流程會導致檢測結果出現差異,影響患者護理,並阻礙即時檢測(POCT)解決方案的廣泛實施。

- 解決成本限制問題對市場成長至關重要。這可能需要透過創新來降低生產成本、實現規模經濟,並可能需要政府或私部門的財政支持,以提高不同醫療保健機構的可負擔性和可近性。

- 先進的即時檢測(POCT)設備和試劑的高昂成本仍然是其在加拿大和美國廣泛應用的一大障礙。透過降低成本、提高生產效率和建立支持性融資機制來克服這一財務挑戰,對於使這些技術在不同的醫療機構中更容易獲得應用,並推動市場成長至關重要。

加拿大和美國即時檢測市場範圍

加拿大和美國的即時檢測市場根據產品/疾病、方法/技術、檢測組類型、檢測地點、最終用戶和分銷管道細分為六個部分。

- 按產品/疾病分類

根據產品/疾病類型,加拿大和美國的即時檢測市場可細分為呼吸道感染、胃腸道感染、性傳染病 (STD)、肝炎、血流感染 (BSI)、真菌性血流感染 (Fungal BSI) 和其他疾病。預計到 2025 年,呼吸道感染細分市場將佔據主導地位,在美國和加拿大分別佔 48.15% 和 34.50% 的市場份額,這主要歸因於其高發病率、快速傳播以及臨床上對及時診斷的需求。新冠肺炎疫情凸顯了分散式快速分子檢測的重要性,顯著加速了對即時檢測平台的投資。

預計在 2025 年至 2032 年的預測期內,性傳播疾病 (STD) 細分市場將在美國以 10.1% 的複合年增長率增長,在加拿大以 9.4% 的複合年增長率增長,這主要得益於性傳播疾病的流行率上升、對快速和保密檢測的需求不斷增長、產品化的需求不斷增長、產品和診所的持續性發展以及日益創新和診所發展需求

- 依方法/技術

根據檢測方法/技術,加拿大和美國的即時檢測市場可細分為核酸擴增檢測 (NAAT)、環介導等溫擴增 (LAMP)、微流控/晶片實驗室以及其他技術。預計到 2025 年,核酸擴增檢測 (NAAT) 將佔據市場主導地位,在美國和加拿大分別佔 55.27% 和 55.58% 的市場份額,這主要得益於基於 PCR 的快速檢測已成為大規模篩檢和快速臨床決策的必要手段。除了新冠病毒 (COVID-19) 之外,核酸擴增檢測 (NAAT) 也越來越多地應用於呼吸道病原體、性傳播感染 (STI)、胃腸道感染和血液感染的檢測,與傳統的實驗室 PC 檢測相比,能夠實現更快速的診斷。

預計在 2025 年至 2032 年的預測期內,LAMP(環介導等溫擴增)技術在美國的複合年增長率將達到 10.2%,在加拿大將達到 9.5%,這主要得益於其高靈敏度和快速檢測能力、在傳染病診斷中日益增長、產品不斷創新以及普及和分子護理的環境中有效的解決方案。

- 按面板類型

根據檢測類型,加拿大和美國的即時檢測市場可分為單重檢測、多重檢測(綜合徵檢測)、雙聯檢測和三聯檢測。預計到2025年,單重檢測將佔據市場主導地位,在美國和加拿大分別佔52.50%和52.38%的市場份額,因為單重檢測具有成本效益高、操作簡便、應用廣泛等優點,被廣泛應用於常規診斷領域。這些檢測每次僅檢測一種分析物或病原體,因此特別適用於血糖監測、懷孕和生育力檢測、傳染病篩檢(如HIV和COVID-19快速抗原檢測)以及心臟標記檢測等高通量檢測需求。

預計在 2025 年至 2032 年的預測期內,多重檢測(綜合徵檢測)領域將在美國以 10.1% 的複合年增長率增長,在加拿大以 9.3% 的複合年增長率增長,這主要得益於對快速、全面的診斷解決方案的需求不斷增長、產品持續檢測、在臨床普及和床邊測試環境中的日益準確,以及在多種病原體的需求中日益準確。

- 通過測試位置

根據檢測地點,加拿大和美國的即時檢測市場可分為實驗室即時檢測 (POCT) 和居家即時檢測 (POCT)。預計到 2025 年,實驗室即時檢測 (POCT) 將佔據市場主導地位,在美國和加拿大分別佔 60.13% 和 59.87% 的市場份額。這主要得益於其更高的準確性、可靠性以及與醫院和臨床工作流程的更佳整合性。這些檢測通常在醫療機構(例如醫院、診斷實驗室和急診中心)進行,由訓練有素的專業人員確保樣本的正確處理、品質控制和結果解讀。

預計在 2025 年至 2032 年的預測期內,居家即時檢測 (POCT) 細分市場將在美國以 9.9% 的複合年增長率增長,在加拿大以 9.2% 的複合年增長率增長,這主要得益於自測試劑盒的普及、產品創新不斷增加、在線和零售渠道的廣泛普及以及對患者日益增長的需求的需求。

- 最終用戶

根據最終用戶劃分,加拿大和美國的即時檢測市場可細分為醫院、家庭護理機構、診所、實驗室、門診手術中心、老年護理中心和其他機構。預計到2025年,由於患者數量龐大、基礎設施先進以及快速診斷與臨床工作流程的緊密結合,醫院將分別佔據美國和加拿大市場42.86%和43.28%的最大份額。即時檢測廣泛應用於醫院的急診室、重症監護室、手術室和住院監護等場所,在這些場所,及時獲得檢測結果對於治療決策至關重要。醫院也廣泛應用即時檢測技術,包括血糖監測、心臟標記檢測、凝血功能檢測和傳染病診斷,特別是呼吸道感染和血液感染的綜合檢測。

預計在 2025 年至 2032 年的預測期內,美國家庭護理領域將以 10.1% 的複合年增長率獲得增長,而加拿大醫院領域預計將以 9.6% 的複合年增長率增長,這主要得益於對快速診斷的需求不斷增長、創新型 POCT 設備日益增長、患者更常對家庭進行監測

- 透過分銷管道

根據分銷管道,加拿大和美國的即時檢測市場可分為直接招標、零售、線上銷售和其他管道。預計到2025年,直接招標管道將佔據市場主導地位,在美國和加拿大分別佔44.13%和43.74%的市場份額。這主要得益於醫院、診斷實驗室和政府資助的醫療機構等大型醫療機構的主要採購方式。透過直接招標,醫療機構與製造商或授權經銷商之間簽訂批量採購協議,從而確保更低的單位成本、穩定的供應和標準化的產品供應。

在 2025 年至 2032 年的預測期內,POCT 市場的線上銷售部分預計將在美國以 10.3% 的複合年增長率增長,在加拿大以 9.6% 的複合年增長率增長,這主要得益於數位健康平台的日益增長、透過電子商務提供診斷設備的日益增長、患者對居家檢測的需求增加的便利性以及直接面向消費者的便利性模式。

市場上的主要市場領導者包括:

- 丹納赫公司(美國)

- F. Hoffmann-La Roche Ltd(瑞士)

- 西門子醫療股份公司(德國)

- BD(貝克頓迪金森公司)(美國)

- 雅培實驗室(美國)

- 康德樂(美國)

- 安捷倫科技公司(美國)

- Medline Industries, LP(美國)

- Trinity Biotech(愛爾蘭)

- OraSure Technologies Inc(美國)

- Bio-Rad Laboratories, Inc.(美國)

- 比奧梅里埃(法國)

- 凱傑(德國)

- 賽默飛世爾科技公司(美國)

- QuidelOrtho公司(美國)

- Trimedic Inc(加拿大)

- Abaxis公司(美國)

- Sysmex公司(日本)

- NIPRO(日本)

- 積水診斷(美國)

- SANNER(德國)

- PTS Diagnostics(美國)

- 史蒂文斯有限公司(加拿大)

- QuantuMDx集團有限公司(英國)

- EKF Diagnostics Holdings plc(英國)

- Creative Diagnostics(美國)

- 希普羅生物科技有限公司(中國)

- 加拿大醫院專科有限公司(加拿大)

- Radiometer Medical ApS(丹麥)

- Meridian Bioscience, Inc.(美國)

- 亨利·謝恩公司(美國)

- Nova Biomedical(美國)

- binx health, inc.(美國)

- 血紅素(美國)

加拿大和美國即時檢測市場最新發展動態

- 2025年2月,賽默飛世爾科技以41億美元收購了Solventum的純化和過濾業務,從而增強了其生物加工能力。此次收購豐富了賽默飛世爾的過濾和純化技術產品組合,這些技術利用先進的表面分析技術來優化生物製劑和工業應用中的材料相互作用。

- 2025年7月,OraSure公司透過其子公司DNA Genotek推出了HEMAcollect PROTEIN血液採集管,這是一款用於蛋白質體學研究的新型設備。本產品是一種真空採血管,內含專有的穩定液,旨在常溫下保存和穩定全血中的血漿蛋白長達7天。這無需立即進行處理或冷鏈運輸,從而提高了樣本採集和運輸的效率和成本效益。本產品採用ProteoPrecision技術,可最大限度地減少溶血和血小板活化,確保採集的樣本能夠準確反映體內狀態,從而為腫瘤學、神經病學和心臟病學等領域的研究提供更高品質的數據。

- 根據《時代》雜誌2025年7月報道,微軟的MAI DxO系統展現出比人類醫生更高的診斷準確率——約為85%對20%——並將患者檢測成本降低了20%。

- 根據路透社報道,2025年8月,一個美國團隊開發出一種人工智慧血液檢測方法,能夠以超過90%的準確率檢測出早期卵巢癌,為腫瘤學領域的即時診斷開闢了新的途徑。

- 根據國家傳染病合作中心的報告,到2025年8月,即時檢測(POCT)可以為那些面臨傳統服務障礙的人提供便捷的檢測,從而改善偏遠或資源匱乏地區的醫療服務可及性。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 ENVIRONMENTAL FACTORS

4.2.6 LEGAL FACTORS

4.3 R&D ANALYSIS

4.3.1 COMPARATIVE ANALYSIS

4.3.2 DRUG DEVELOPMENTAL LANDSCAPE

4.3.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

4.3.4 THERAPEUTIC ASSESSMENT

4.3.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

4.4 HEALTHCARE TARIFFS IMPACT ANALYSIS

4.4.1 OVERVIEW

4.4.2 TARIFF STRUCTURES

4.4.2.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

4.4.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.4.3.1 IMPORT DUTIES ON PRESCRIPTION DRUGS VS. GENERICS

4.4.3.2 IMPACT ON DRUG AFFORDABILITY AND ACCESS

4.4.3.3 KEY TRADE AGREEMENTS AFFECTING TARIFFS

4.4.4 IMPACT OF TARIFFS ON PROVIDERS AND PATIENTS

4.4.4.1 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

4.4.4.2 EFFECT ON PATIENT AFFORDABILITY AND INSURANCE COVERAGE

4.4.4.3 TARIFFS AND MEDICAL TOURISM

4.4.5 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.4.5.1 WTO REGULATIONS

4.4.5.2 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

4.4.5.3 ROLE OF FREE TRADE AGREEMENTS (FTAS) IN REDUCING TARIFFS

4.4.6 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.4.7 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

4.5 PATENT ANALYSIS-

4.6 MARKETED DRUG ANALYSIS

4.6.1 10-YEAR MARKET FORECAST

4.6.2 DRUGS

4.6.3 BRANDED DRUGS

4.6.4 GENERIC DRUGS

4.6.5 THERAPEUTIC INDICATION

4.6.6 PHARMACOLOGICAL CLASS OF THE DRUG

4.6.7 DRUG PRIMARY INDICATION

4.6.8 MARKET STATUS

4.6.9 MEDICATION TYPE

4.6.10 DRUG DOSAGE FORM

4.6.11 DOSAGE AVAILABILITY

4.6.12 PACKAGING TYPE

4.6.13 DRUG ROUTE OF ADMINISTRATION

4.6.14 DOSING FREQUENCY

4.6.15 DRUG INSIGHT

4.6.16 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES

4.6.17 REGULATORY MILESTONE, SAFETY DATA, AND EFFICACY DATA

4.6.18 MARKET EXCLUSIVITY DATA

4.6.19 FORECAST MARKET OUTLOOK

4.6.20 CROSS COMPETITION

4.6.21 THERAPEUTIC PORTFOLIO

4.6.22 CURRENT DEVELOPMENT SCENARIO

4.7 MARKET ACCESS

4.7.1 10-YEAR MARKET FORECAST

4.7.2 CLINICAL TRIAL RECENT UPDATES

4.7.3 ANNUAL NEW FDA-APPROVED DRUGS

4.7.4 DRUG MANUFACTURER AND DEALS

4.7.5 MAJOR DRUG UPTAKE

4.7.6 CURRENT TREATMENT PRACTICES

4.7.7 IMPACT OF UPCOMING THERAPY

4.8 EPIDEMOLOGY

4.8.1 INCIDENCE BY GENDER: POCT-RELEVANT CONDITIONS

4.8.2 TREATMENT RATE: IMPACT ON POCT

4.8.3 MORTALITY RATE: THE NEED FOR TIMELY DIAGNOSIS

4.8.4 DRUG ADHERENCE AND THERAPY SWITCH: POCT'S ROLE IN MANAGEMENT

4.8.5 PATIENT TREATMENT SUCCESS RATES: THE POCT ADVANTAGE

4.9 SUPPLY CHAIN ECOSYSTEM

4.9.1 PROMINENT COMPANIES

4.9.2 KEY COMPONENTS OF THE ECOSYSTEM:

4.9.3 SMALL & MEDIUM SIZE COMPANIES (INNOVATORS)

4.9.4 END USERS

4.1 INNOVATION TRACKER & STRATEGIC ANALYSIS

4.10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.10.1.1 JOINT VENTURES

4.10.1.2 MERGERS & ACQUISITIONS

4.10.1.3 LICENSING & PARTNERSHIPS

4.10.1.4 TECHNOLOGY COLLABORATIONS

4.10.1.5 STRATEGIC DIVESTMENTS

4.10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

4.10.3 STAGE OF DEVELOPMENT

4.10.4 TIMELINES & MILESTONES

4.10.5 INNOVATION STRATEGIES & METHODOLOGIES

4.10.6 RISK ASSESSMENT & MITIGATION

4.10.7 FUTURE OUTLOOK

4.11 PIPELINE ANALYSIS – CANADA AND USA POINT OF CARE TESTING MARKET

4.11.1 CLINICAL TRIALS AND PHASE ANALYSIS

4.11.2 TECHNOLOGY PIPELINE

4.11.3 PHASE III CANDIDATES

4.11.4 PHASE II CANDIDATES

4.11.5 PHASE I CANDIDATES

4.11.6 OTHERS (PRE-CLINICAL AND RESEARCH)

4.11.7 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC AND INFECTIOUS DISEASES INCREASING DEMAND FOR RAPID, DECENTRALIZED DIAGNOSTICS

6.1.2 ADVANCED HEALTHCARE INFRASTRUCTURE AND STRONG MOBILE/WEARABLE ADOPTION IN CANADA AND THE U.S.

6.1.3 GROWING PATIENT PREFERENCE FOR FAST, CONVENIENT, NEAR-PATIENT TESTING OPTIONS

6.1.4 INCREASING GOVERNMENT INITIATIVES AND FUNDING TO SUPPORT DIGITAL HEALTH AND DECENTRALIZED DIAGNOSTICS

6.2 RESTRAINTS

6.2.1 HIGH COSTS FOR ADVANCED POCT DEVICES AND REAGENTS

6.2.2 VARIABILITY IN DEVICE PERFORMANCE AND QUALITY ACROSS BRANDS, COMPLICATING STANDARDIZATION AND CLINICAL ADOPTION

6.3 OPPORTUNITIES

6.3.1 INCREASING USE IN DRUG ABUSE, INFECTIOUS DISEASE, AND ONCOLOGY SCREENING, DRIVING MARKET DIVERSIFICATION

6.3.2 EXPANDING USE OF MOLECULAR POCT AND LATERAL FLOW IMMUNOASSAYS, INCLUDING PHARMACIES AND REMOTE/RURAL CARE

6.3.3 INTEGRATION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING FOR ENHANCED DIAGNOSTIC ACCURACY AND CLINICAL DECISION SUPPORT

6.4 CHALLENGES

6.4.1 MAINTAINING ACCURACY, RELIABILITY, AND REGULATION COMPLIANCE ACROSS DECENTRALIZED TESTING ENVIRONMENTS

6.4.2 ADDRESSING DATA PRIVACY AND CYBERSECURITY RISKS AS MORE POCT DEVICES CONNECT TO HEALTH NETWORKS

7 CANADA AND U.S. POINT OF CARE TESTING MARKET, BY PRODUCT/DISEASE

7.1 OVERVIEW

7.2 RESPIRATORY INFECTION

7.2.1 SARS-COV-2

7.2.2 INFLUENZA A/B

7.2.3 RESPIRATORY SYNCYTIAL VIRUS (RSV)

7.2.4 BORDETELLA PERTUSSIS

7.2.5 OTHERS

7.3 GASTROENTERIC INFECTIONS

7.3.1 CLOSTRIDIOIDES DIFFICILE

7.3.2 NOROVIRUS

7.3.3 ROTAVIRUS

7.3.4 SALMONELLA, SHIGELLA, CAMPYLOBACTER, E. COLI (STEC)

7.3.5 GIARDIA

7.4 SEXUALLY TRANSMITTED DISEASE (STD)

7.5 HEPATITIS

7.6 BLOODSTREAM INFECTIONS (BSI)

7.7 BLOOD YEAST INFECTIONS (FUNGAL BSI)

7.8 OTHERS

8 CANADA AND U.S. OF CARE TESTING MARKET, BY METHOD/TECHNOLOGY

8.1 OVERVIEW

8.2 NAAT (NUCLEIC ACID AMPLIFICATION TESTS)

8.3 LAMP (LOOP-MEDIATED ISOTHERMAL AMPLIFICATION)

8.4 MICROFLUIDICS / LAB-ON-A-CHIP

8.5 OTHERS

9 CANADA AND U.S. POINT OF CARE TESTING MARKET, BY PANEL TYPE

9.1 OVERVIEW

9.2 SIMPLEX ASSAY

9.3 MULTIPLEX PANEL (SYNDROMIC TESTING)

9.4 DUPLEX ASSAY

9.5 TRIPLEX ASSAY

10 CANADA AND U.S. POINT OF CARE TESTING MARKET, BY TESTING LOCATION

10.1 OVERVIEW

10.2 LABORATORY BASED POINT-OF-CARE-TESTING (POCT)

10.3 AT-HOME POINT-OF-CARE-TESTING (POCT)

11 CANADA AND U.S. POINT OF CARE TESTING MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 HOME CARE

11.4 CLINICS

11.5 LABORATORIES

11.6 AMBULATORY SURGERY CENTERS

11.7 ELDERLY CARE CENTERS

11.8 OTHERS

12 CANADA AND U.S. POINT OF CARE TESTING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

12.4 ONLINE SALES

12.5 OTHERS

13 CANADA AND U.S. POINT OF CARE TESTING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

13.2 COMPANY SHARE ANALYSIS: CANADA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 DANAHER CORPORATION.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 F. HOFFMANN-LA ROCHE LTD

15.2.1 COMPANY SNAPSHOT

15.2.2 RECENT FINANCIALS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 SIEMENS HEALTHINEERS AG

15.3.1 COMPANY SNAPSHOT

15.3.2 RECENT FINANCIALS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 BD

15.4.1 COMPANY SNAPSHOT

15.4.2 RECENT FINANCIALS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 ABBOTT

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AGILENT TECHNOLOGIES INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 RECENT FINANCIALS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ABAXIS, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BINX HEALTH, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 BIOMERIEUX

15.9.1 COMPANY SNAPSHOT

15.9.2 RECENT FINANCIALS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 BIO-RAD LABORATORIES, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 CREATIVE DIAGNOSTICS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 CARDINAL HEALTH

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 CANADIAN HOSPITAL SPECIALTIES LIMITED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 EKF DIAGNOSTICS HOLDINGS PLC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 HENRY SCHEIN, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 HIPRO BIOTECHNOLOGY CO.,LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 MEDLINE INDUSTRIES, LP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 MERIDIAN BIOSCIENCE, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 NIPRO

15.19.1 COMPANY SNAPSHOT

15.19.2 RECENT FINANCIALS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 NOVA BIOMEDICAL

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 ORASURE TECHNOLOGIES INC

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 PTS DIAGNOSTICS

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 QIAGEN

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENT

15.24 QUANTUMDX GROUP LTD.

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 QUIDELORTHO CORPORATION.

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENTS

15.26 RADIOMETER MEDICAL APS

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT UPDATES

15.27 SANNER

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 SEKISUI DIAGNOSTICS

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 SYSMEX CORPORATION

15.29.1 COMPANY SNAPSHOT

15.29.2 REVENUE ANALYSIS

15.29.3 PRODUCT PORTFOLIO

15.29.4 RECENT DEVELOPMENT

15.3 SANGUNIA

15.30.1 COMPANY SNAPSHOT

15.30.2 PRODUCT PORTFOLIO

15.30.3 RECENT DEVELOPMENTS

15.31 THE STEVENS COMPANY LIMITED

15.31.1 COMPANY SNAPSHOT

15.31.2 PRODUCT PORTFOLIO

15.31.3 RECENT DEVELOPMENT

15.32 THERMO FISHER SCIENTIFIC INC.

15.32.1 COMPANY SNAPSHOT

15.32.2 REVENUE ANALYSIS

15.32.3 PRODUCT PORTFOLIO

15.32.4 RECENT DEVELOPMENT

15.33 TRIMEDIC INC

15.33.1 COMPANY SNAPSHOT

15.33.2 PRODUCT PORTFOLIO

15.33.3 RECENT DEVELOPMENT

15.34 TRINITY BIOTECH

15.34.1 COMPANY SNAPSHOT

15.34.2 REVENUE ANALYSIS

15.34.3 PRODUCT PORTFOLIO

15.34.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

表格列表

TABLE 1 PHASE-WISE DISTRIBUTION

TABLE 2 REGULATORY COVERAGE

TABLE 3 U.S. POINT OF CARE TESTING MARKET, BY PRODUCT/DISEASE, 2018-2032 (USD THOUSAND)

TABLE 4 CANADA POINT OF CARE TESTING MARKET, BY PRODUCT/DISEASE, 2018-2032 (USD THOUSAND)

TABLE 5 U.S. RESPIRATORY INFECTIONS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 CANADA RESPIRATORY INFECTIONS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 U.S. GASTROENTERIC INFECTIONS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 CANADA GASTROENTERIC INFECTIONS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 U.S. SEXUALLY TRANSMITTED DISEASE (STD) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 CANADA SEXUALLY TRANSMITTED DISEASE (STD) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 U.S. HEPATITIS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 CANADA HEPATITIS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 U.S. BLOODSTREAM INFECTIONS (BSI) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 CANADA BLOODSTREAM INFECTIONS (BSI) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 U.S. BLOOD YEAST INFECTIONS (FUNGAL BSI) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 CANADA BLOOD YEAST INFECTIONS (FUNGAL BSI) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. OTHERS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 CANADA OTHERS IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. POINT OF CARE TESTING MARKET, BY METHOD/TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 20 CANADA POINT OF CARE TESTING MARKET, BY METHOD/TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 21 U.S. NAAT (NUCLEIC ACID AMPLIFICATION TESTS) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 CANADA NAAT (NUCLEIC ACID AMPLIFICATION TESTS) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 U.S. POINT OF CARE TESTING MARKET, BY PANEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 CANADA POINT OF CARE TESTING MARKET, BY PANEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 U.S. MULTIPLEX PANEL (SYNDROMIC TESTING) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 CANADA MULTIPLEX PANEL (SYNDROMIC TESTING) IN POINT OF CARE TESTING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 U.S. POINT OF CARE TESTING MARKET, BY TESTING LOCATION, 2018-2032 (USD THOUSAND)

TABLE 28 CANADA POINT OF CARE TESTING MARKET, BY TESTING LOCATION, 2018-2032 (USD THOUSAND)

TABLE 29 U.S. POINT OF CARE TESTING MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 30 CANADA POINT OF CARE TESTING MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 31 U.S. POINT OF CARE TESTING MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 32 CANADA POINT OF CARE TESTING MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 CANADA AND U.S. POINT OF CARE TESTING MARKET: SEGMENTATION

FIGURE 2 GEOGRAPHICAL SCOPE

FIGURE 3 CANADA AND U.S. POINT OF CARE TESTING MARKET: DATA TRIANGULATION

FIGURE 4 CANADA AND U.S. POINT OF CARE TESTING MARKET: DROC ANALYSIS

FIGURE 5 U.S. POINT OF CARE TESTING MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 6 CANADA POINT OF CARE TESTING MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 7 CANADA AND U.S. POINT OF CARE TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 CANADA AND U.S. POINT OF CARE TESTING MARKET: MULTIVARIATE MODELING

FIGURE 9 U.S. POINT OF CARE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 CANADA POINT OF CARE TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 11 CANADA AND U.S. POINT OF CARE TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 12 U.S. POINT OF CARE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 CANADA POINT OF CARE TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 14 U.S. POINT OF CARE TESTING MARKET: END USER COVERAGE GRID

FIGURE 15 CANADA POINT OF CARE TESTING MARKET: END USER COVERAGE GRID

FIGURE 16 CANADA AND U.S. POINT OF CARE TESTING MARKET: SEGMENTATION

FIGURE 17 CANADA POINT OF CARE TESTING MARKET: EXECUTIVE SUMMARY

FIGURE 18 U.S. POINT OF CARE TESTING MARKET: EXECUTIVE SUMMARY

FIGURE 19 SEVEN SEGMENTS COMPRISE THE U.S. POINT OF CARE TESTING MARKET, BY PRODUCT/DISEASE (2024)

FIGURE 20 SEVEN SEGMENTS COMPRISE THE CANADA POINT OF CARE TESTING MARKET, BY PRODUCT/DISEASE (2024)

FIGURE 21 STRATEGIC DECISIONS

FIGURE 22 RISING PREVALENCE OF CHRONIC AND INFECTIOUS DISEASES INCREASING DEMAND FOR RAPID, DECENTRALIZED DIAGNOSTICS IS DRIVING THE GROWTH OF CANADA POINT OF CARE TESTING MARKET FROM 2025 TO 2032

FIGURE 23 GROWING PATIENT PREFERENCE FOR FAST, CONVENIENT, NEAR-PATIENT TESTING OPTIONS IS DRIVING THE GROWTH OF U.S. POINT OF CARE TESTING MARKET FROM 2025 TO 2032

FIGURE 24 THE RESPIRATORY INFECTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CANADA POINT OF CARE TESTING MARKET IN 2025 AND 2032

FIGURE 25 THE RESPIRATORY INFECTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. POINT OF CARE TESTING MARKET IN 2025 AND 2032

FIGURE 26 PESTEL ANALYSIS

FIGURE 27 PATENT FILINGS ACROSS SEVERAL KEY JURISDICTIONS:

FIGURE 28 U.S.: KEY APPLICANTS V/S NUMBER OF PATENTS.

FIGURE 29 CANADA: KEY APPLICANTS V/S NUMBER OF PATENTS

FIGURE 30 U.S.: IPC CODES V/S PATENT COUNT

FIGURE 31 CANADA: IPC CODES V/S PATENT COUNT.

FIGURE 32 U.S.: YEAR V/S NUMBER OF PATENT PUBLISHED

FIGURE 33 CANADA: YEAR V/S NUMBER OF PATENT PUBLISHED

FIGURE 34 DROC ANALYSIS

FIGURE 35 U.S. POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, 2024

FIGURE 36 U.S. POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, 2025 TO 2032 (USD THOUSAND)

FIGURE 37 U.S. POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, CAGR (2025- 2032)

FIGURE 38 U.S. POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, LIFELINE CURVE

FIGURE 39 CANADA POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, 2024

FIGURE 40 CANADA POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, 2025 TO 2032 (USD THOUSAND)

FIGURE 41 CANADA POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, CAGR (2025- 2032)

FIGURE 42 CANADA POINT OF CARE TESTING MARKET: BY PRODUCT/DISEASE, LIFELINE CURVE

FIGURE 43 U.S. POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, 2024

FIGURE 44 U.S. POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, 2025 TO 2032 (USD THOUSAND)

FIGURE 45 U.S. POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, CAGR (2025- 2032)

FIGURE 46 U.S. POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, LIFELINE CURVE

FIGURE 47 CANADA POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, 2024

FIGURE 48 CANADA POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, 2025 TO 2032 (USD THOUSAND)

FIGURE 49 CANADA POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, CAGR (2025- 2032)

FIGURE 50 CANADA POINT OF CARE TESTING MARKET: BY METHOD/TECHNOLOGY, LIFELINE CURVE

FIGURE 51 U.S. POINT OF CARE TESTING MARKET: BY PANEL TYPE, 2024

FIGURE 52 U.S. POINT OF CARE TESTING MARKET: BY PANEL TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 53 U.S. POINT OF CARE TESTING MARKET: BY PANEL TYPE, CAGR (2025- 2032)

FIGURE 54 U.S. POINT OF CARE TESTING MARKET: BY PANEL TYPE, LIFELINE CURVE

FIGURE 55 CANADA POINT OF CARE TESTING MARKET: BY PANEL TYPE, 2024

FIGURE 56 CANADA POINT OF CARE TESTING MARKET: BY PANEL TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 57 CANADA POINT OF CARE TESTING MARKET: BY PANEL TYPE, CAGR (2025- 2032)

FIGURE 58 CANADA POINT OF CARE TESTING MARKET: BY PANEL TYPE, LIFELINE CURVE

FIGURE 59 U.S. POINT OF CARE TESTING MARKET: BY TESTING LOCATION, 2024

FIGURE 60 U.S. POINT OF CARE TESTING MARKET: BY TESTING LOCATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 61 U.S. POINT OF CARE TESTING MARKET: BY TESTING LOCATION, CAGR (2025- 2032)

FIGURE 62 U.S. POINT OF CARE TESTING MARKET: BY TESTING LOCATION, LIFELINE CURVE

FIGURE 63 CANADA POINT OF CARE TESTING MARKET: BY TESTING LOCATION, 2024

FIGURE 64 CANADA POINT OF CARE TESTING MARKET: BY TESTING LOCATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 65 CANADA POINT OF CARE TESTING MARKET: BY TESTING LOCATION, CAGR (2025- 2032)

FIGURE 66 CANADA POINT OF CARE TESTING MARKET: BY TESTING LOCATION, LIFELINE CURVE

FIGURE 67 U.S. POINT OF CARE TESTING MARKET: BY END USER, 2024

FIGURE 68 U.S. POINT OF CARE TESTING MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 69 U.S. POINT OF CARE TESTING MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 70 U.S. POINT OF CARE TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 71 CANADA POINT OF CARE TESTING MARKET: BY END USER, 2024

FIGURE 72 CANADA POINT OF CARE TESTING MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 73 CANADA POINT OF CARE TESTING MARKET: BY END USER, CAGR (2025- 2032)

FIGURE 74 CANADA POINT OF CARE TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 75 U.S. POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 76 U.S. POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 77 U.S. POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 78 U.S. POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 79 CANADA POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 80 CANADA POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 81 CANADA POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 82 CANADA POINT OF CARE TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 83 U.S. POINT OF CARE TESTING MARKET: COMPANY SHARE 2024 (%)

FIGURE 84 CANADA POINT OF CARE TESTING MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。