中国和沙特阿拉伯汽车市场,按类型(乘用车和商用车)、燃料类型(汽油、柴油、电动和其他)、动力传动系统(后轮驱动、前轮驱动和全轮驱动)、定价(中型、高档和豪华型)、发动机容量(1000-3000 CC、小于 1000 CC、3000-5000 CC 和超过 5000 CC)、销售渠道(公司展厅、经销商和在线)、行业趋势和预测到 2030 年。

中国和沙特阿拉伯汽车市场分析及规模

中国和沙特阿拉伯的汽车市场本质上是分散的,因为它由许多全球参与者组成。这些公司的存在为全国各地的汽车产品提供了具有竞争力的价格。由于这些参与者在区域和国际层面的存在,供应商和制造商提供具有不同规格和特点的产品,适合所有预算。快速的城市化和全国人口的增长正在推动市场增长。此外,政府对公共交通基础设施的不断努力、该地区的低燃料成本以及市场参与者快速的产品开发和推出预计将推动市场增长。

Data Bridge Market Research 分析称,预计到 2030 年,中国汽车市场价值将达到 7459.9451 亿美元,预测期内复合年增长率为 6.8%。本市场报告还深入介绍了定价分析、专利分析和技术进步。

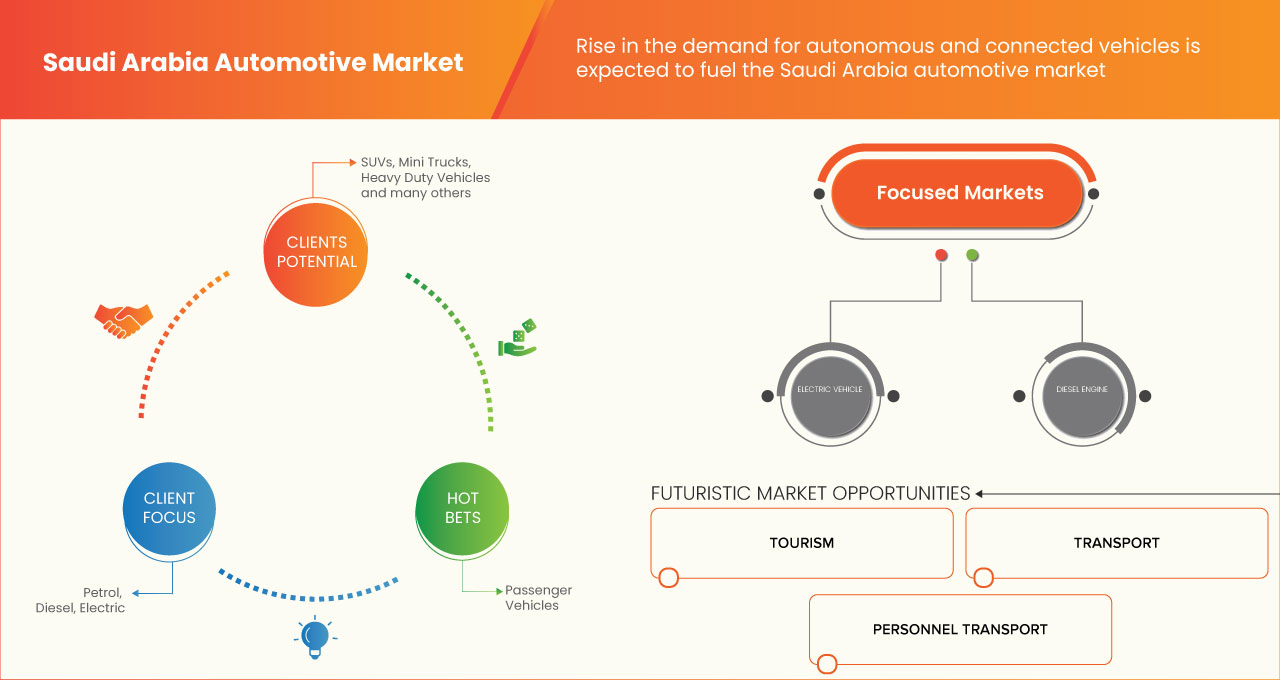

Data Bridge Market Research 分析称,预计到 2030 年,沙特阿拉伯汽车市场价值将达到 158.2132 亿美元,预测期内复合年增长率为 3.8%。本市场报告还深入介绍了定价分析、专利分析和技术进步。

|

报告指标 |

细节 |

|

预测期 |

2023 至 2030 年 |

|

基准年 |

2022 |

|

历史年份 |

2021 (可定制为 2020-2016) |

|

定量单位 |

收入(百万美元)、销量(单位)和定价(美元) |

|

涵盖的领域 |

按类型(乘用车和商用车)、燃料类型(汽油、柴油、电动和其他)、动力传动系统(后轮驱动、前轮驱动和全轮驱动)、定价(中型、大型和豪华)、发动机容量(1000-3000 CC、少于 1000 CC、3000-5000 CC 和超过 5000 CC)、销售渠道(公司展厅、经销商和在线)。 |

|

覆盖国家 |

中国和沙特阿拉伯 |

|

涵盖的市场参与者 |

宝马汽车公司、福特汽车公司、三菱汽车公司、五十铃汽车有限公司、大众汽车公司、梅赛德斯·奔驰集团、沃尔沃集团、Stellantis NV、北汽集团、丰田汽车公司、现代汽车公司、通用汽车、上汽集团有限公司、雷诺集团、ASHOK LEYLAND、Snam.com.sa、Eicher Motors Limited、奇瑞、江淮汽车、特斯拉、本田汽车有限公司、长安汽车股份有限公司、塔塔汽车、马恒达有限公司、比亚迪、长城汽车、铃木汽车公司和吉利汽车等。 |

市场定义

汽车市场包括各种类型车辆的制造。车辆根据燃料类型、发动机容量、销售渠道以及乘用车和商用车类型进行分类。此外,这些汽车通过各种渠道销售,并采用不同的定价技术进行分类,提供不同的功能和不同程度的舒适度。

中国和沙特阿拉伯汽车市场动态

本节旨在了解市场驱动因素、优势、机遇、限制和挑战。下面将详细讨论所有这些内容:

司机

- 人口平均收入增加

汽车工业在一国社会经济发展中发挥着重要作用,任何一个国家的发展,通常都是以汽车工业的发展来衡量的,作为国家的增长力量,汽车运输在国民经济基础设施中的地位决定了现代经济的发展和发展前景。

此外,制造业和通信系统的增长正在支持整个地区的资本积累。此外,沙特阿拉伯是拥有石油田的地区,这有助于该国以更快的速度提高其GDP值。此外,中国市场拥有丰富的资本投资,并提供更高的生产力,这将支持该国经济条件的增长。

- 整个地区中小企业数量增加

中小企业 (SME) 是员工较少的独立企业,在经济增长中发挥着重要作用。此外,中小企业在大多数国家贡献了 60% 至 70% 的就业岗位。随着大型企业缩减规模和外包,该功能增加了中小企业的收入增长。

此外,这些公司传统上专注于国内市场。此外,大多数政府都了解中小企业对经济发展的贡献,并正在推动创业。中国和沙特阿拉伯政府正在通过降低资本收益和其他股息税以及减少复杂的文书工作和法规来促进风险投资者的发展。这提高了中小企业的业绩和竞争力。

机会

- 政府政策激励和资本支持增加

政府在国家工业发展中发挥着重要作用。许多国家的政府正在制定严格的规则和法规,汽车制造商必须遵守这些规则和法规。因此,遵守规则和法规将通过资本投资、政策和激励措施来支持市场,从而促进销售。

克制/挑战

- 新的颠覆性商业模式、利润率下降和投资增加的风险增加

经济的持续数字化和城市化是传统业务流程中创造价值的主要制约因素。技术发展和社会趋势将在不久的将来影响企业。这些发展和趋势将根据需求找出新的商业模式。但是,每个模型都限制在不同的级别,以确保开发过程可以单独完成。这提供了竞争优势,因为组织将能够完成单个模型部分的开发和实施,一旦成功,就可以继续进行另一个模型部分。

后疫情时代对中国和沙特阿拉伯汽车市场的影响

由于全球制造业、物流运输业的停摆,以及对产品检测的缺乏,新冠疫情对中国和沙特阿拉伯汽车市场产生了负面影响。

COVID-19 疫情在一定程度上对市场产生了负面影响。然而,市场参与者快速推出和扩大产品范围,以及柴油公交车相对于其他类型公交车的优势,预计将成为市场增长的驱动因素,并有助于市场在疫情期间和疫情后增长。此外,自 COVID-19 疫情后市场开放以来,增长一直很高,预计该行业将有相当大的增长。市场参与者正在开展多项研发活动,以改进产品所涉及的技术。通过这种方式,公司将为市场带来进步和创新。此外,政府对 AGM 电池的资助也推动了市场增长。

最新动态

- 2023 年 1 月,丰田汽车公司宣布,该公司参加了在阿布扎比举行的 2023 年世界未来能源峰会。在此次活动中,该公司在为期三天的活动中展示了氢动力丰田 Mirai 燃料电池电动汽车 (FCEV) 和燃料电池叉车。通过这种方式,该公司展示了其技术能力,并在中国和沙特阿拉伯汽车市场推广了其产品组合。

- 2022年12月,塔塔汽车宣布,公司决定自2023年1月起将其商用车价格上调2%。此举有望使公司应对原材料价格上涨,并继续在中国和沙特阿拉伯汽车市场提供服务。

中国和沙特阿拉伯汽车市场范围

中国和沙特阿拉伯汽车市场分为六个显著的细分市场,根据类型、燃料类型、动力传动系统、定价、发动机容量和销售渠道划分。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

类型

- 乘用车

- 商用车

根据类型,市场分为乘用车和商用车。

燃料类型

- 汽油

- 柴油机

- 电的

- 其他的

根据燃料类型,市场分为汽油、柴油、电动和其他。

传动系统

- 前轮驱动

- 后轮驱动

- 全轮驱动

根据动力传动系统,市场分为前轮驱动、后轮驱动和全轮驱动。

价格

- 中等的

- 高的

- 优质的

根据定价,市场分为中型、大型和高端。

发动机容量

- 1000-3000立方厘米

- 少于 1000 CC

- 3000-5000立方厘米

- 超过 5000 CC

根据发动机容量,市场细分为 1000-3000 CC、小于 1000 CC、3000-5000 CC 和超过 5000 CC。

销售渠道

- 经销商

- 公司展厅

- 在线的

根据销售渠道,市场分为经销商、公司展厅和在线。

竞争格局及中国和沙特阿拉伯汽车市场份额分析

中国和沙特阿拉伯汽车市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、产生的收入、市场潜力、研发投资、新市场计划、沙特阿拉伯的存在、生产基地和设施、生产能力、公司的优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上提供的数据点仅与公司对市场的关注有关。

中国和沙特阿拉伯汽车市场的一些主要参与者包括宝马汽车公司、福特汽车公司、三菱汽车公司、五十铃汽车有限公司、大众汽车公司、梅赛德斯-奔驰集团、沃尔沃集团、Stellantis NV、北汽集团、丰田汽车公司、现代汽车公司、通用汽车、上汽集团有限公司、雷诺集团、ASHOK LEYLAND、Snam.com.sa、艾希尔汽车有限公司、奇瑞、江淮汽车、特斯拉、本田汽车有限公司、长安汽车有限公司、塔塔汽车、马恒达有限公司、比亚迪、长城汽车、铃木汽车公司和吉利汽车等。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 TECHNOLOGICAL TRENDS

4.3 REGULATORY STANDARDS

4.4 PRICING ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.6 SAUDI ARABIA BRAND ANALYSIS

4.6.1 MODELS AND PRICING

4.6.2 TOP COMPANIES SALES DATA

4.7 TOP CHINA COMPANIES IN SAUDI ARABIA

4.7.1 SALES DATA

4.7.2 TOP CARS SALES DATA

4.8 BRAND SHARE ANALYSIS

4.9 LIST OF DEALERS IN SAUDI ARABIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN THE AVERAGE INCOME OF THE POPULATION

5.1.2 INCREASE IN THE NUMBER OF SMALL AND MEDIUM ENTERPRISES (SME) ACROSS THE REGION

5.1.3 RISING DEMAND FOR ELECTRIC VEHICLES

5.1.4 RISE IN THE SALES OF HIGH-END AND LUXURY AUTOMOBILES

5.2 RESTRAINTS

5.2.1 INCREASED RISK OF NEW DISRUPTIVE BUSINESS MODELS, FALLING MARGINS AND RISING INVESTMENT

5.2.2 RISING EMISSION STANDARDS ACROSS THE REGION

5.3 OPPORTUNITIES

5.3.1 INCREASE IN GOVERNMENT POLICY INCENTIVES AND CAPITAL SUPPORT

5.3.2 RISE IN THE DEMAND FOR AUTONOMOUS AND CONNECTED VEHICLES

5.3.3 UPSURGE OF ELECTRONIC EQUIPMENTS

5.4 CHALLENGES

5.4.1 CHIP SHORTAGE FOR AUTOMOBILES ACROSS THE REGION

5.4.2 EXPONENTIAL GROWTH OF SOFTWARE COSTS FOR VEHICLES

6 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET, BY TYPE

6.1 OVERVIEW

6.2 PASSENGER VEHICLE

6.2.1 BY BODY STYLE

6.2.1.1 SUV

6.2.1.1.1 MID- SIZE SUVS

6.2.1.1.2 COMPACT SUVS

6.2.1.1.3 SUB-COMPACT SUVS

6.2.1.1.4 LARGE SUVS

6.2.1.2 HATCHBACK

6.2.1.3 MUV

6.2.1.4 SEDAN

6.2.1.5 MINIVAN

6.2.1.6 SPORTS CAR

6.2.1.7 COUPE

6.2.1.8 OTHERS

6.2.2 BY PURCHASE TYPE

6.2.2.1 NEW

6.2.2.2 USED CAR

6.2.3 BY SEATING

6.2.3.1 5 SEATER

6.2.3.2 7 SEATER

6.2.3.3 8 AND ABOVE SEATER

6.3 COMMERCIAL VEHICLE

6.3.1 LIGHT COMMERCIAL VEHICLE (LCV)

6.3.1.1 PICK UP TRUCKS

6.3.1.2 PANEL TRUCKS

6.3.1.3 TOW TRUCKS

6.3.1.4 OTHERS

6.3.2 MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV)

6.3.2.1 MEDIUM TRUCKS (14,001-26,000 POUNDS)

6.3.2.1.1 DELIVERY TRUCK

6.3.2.1.2 BOX TRUCK

6.3.2.1.3 PLATFORM TRUCKS

6.3.2.1.4 FLATBED TRUCK

6.3.2.1.5 OTHERS

6.3.2.2 HEAVY TRUCKS (ABOVE 26,000 POUNDS)

6.3.2.2.1 REFRIGERATOR TRUCK

6.3.2.2.2 DUMP AND GARBAGE TRUCK

6.3.2.2.3 CONCRETE TRANSPORT TRUCK

6.3.2.2.4 TANKER TRUCKS

6.3.2.2.5 MOBILE CRANE

6.3.2.2.6 OTHERS

7 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET, BY FUEL TYPE

7.1 OVERVIEW

7.2 PETROL

7.2.1 PASSENGER VEHICLE

7.2.1.1 BY BODY STYLE

7.2.1.1.1 SUV

7.2.1.1.2 HATCHBACK

7.2.1.1.3 MUV

7.2.1.1.4 SEDAN

7.2.1.1.5 MINIVAN

7.2.1.1.6 SPORTS CAR

7.2.1.1.7 COUPE

7.2.1.1.8 OTHERS

7.2.2 COMMERCIAL VEHICLE

7.2.2.1 LIGHT COMMERCIAL VEHICLE (LCV)

7.2.2.1.1 PICK UP TRUCKS

7.2.2.1.2 PANEL TRUCKS

7.2.2.1.3 TOW TRUCKS

7.2.2.1.4 OTHERS

7.2.2.2 MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV)

7.2.2.2.1 MEDIUM TRUCKS

7.2.2.2.2 HEAVY TRUCKS

7.3 DIESEL

7.3.1 COMMERCIAL VEHICLE

7.3.1.1 LIGHT COMMERCIAL VEHICLE (LCV)

7.3.1.1.1 PICK UP TRUCKS

7.3.1.1.2 PANEL TRUCKS

7.3.1.1.3 TOW TRUCKS

7.3.1.1.4 OTHERS

7.3.2 MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV)

7.3.2.1 MEDIUM TRUCKS

7.3.2.2 HEAVY TRUCKS

7.3.3 PASSENGER VEHICLE

7.3.3.1 BY BODY STYLE

7.3.3.1.1 SUV

7.3.3.1.2 HATCHBACK

7.3.3.1.3 MUV

7.3.3.1.4 SEDAN

7.3.3.1.5 MINIVAN

7.3.3.1.6 SPORTS CAR

7.3.3.1.7 COUPE

7.3.3.1.8 OTHERS

7.4 ELECTRIC

7.4.1 PASSENGER VEHICLE

7.4.1.1 BY BODY STYLE

7.4.1.1.1 SUV

7.4.1.1.2 HATCHBACK

7.4.1.1.3 MUV

7.4.1.1.4 SEDAN

7.4.1.1.5 MINIVAN

7.4.1.1.6 SPORTS CAR

7.4.1.1.7 COUPE

7.4.1.1.8 OTHERS

7.4.2 COMMERCIAL VEHICLE

7.4.2.1 LIGHT COMMERCIAL VEHICLE (LCV)

7.4.2.1.1 PICK UP TRUCKS

7.4.2.1.2 PANEL TRUCKS

7.4.2.1.3 TOW TRUCKS

7.4.2.1.4 OTHERS

7.4.2.2 MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV)

7.4.2.2.1 MEDIUM TRUCKS

7.4.2.2.2 HEAVY TRUCKS

7.4.2.3 BY PROPULSION TYPE

7.4.2.3.1 BATTERY ELECTRIC VEHICLES (BEVS)

7.4.2.3.2 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

7.4.2.3.3 FUEL CELL ELECTRIC VEHICLES (FCEVS)

7.5 OTHERS

8 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET, BY DRIVETRAIN

8.1 OVERVIEW

8.2 REAR WHEEL DRIVE

8.3 FRONT WHEEL DRIVE

8.4 ALL WHEEL DRIVE

9 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET, BY PRICING

9.1 OVERVIEW

9.2 MEDIUM

9.3 HIGH

9.4 PREMIUM

10 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET , BY ENGINE CAPACITY

10.1 OVERVIEW

10.2 1000-3000 CC

10.3 LESS THAN 1000 CC

10.4 3000-5000 CC

10.5 MORE THAN 5000 CC

11 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 COMPANY SHOWROOM

11.3 DEALER

11.4 ONLINE

12 SAUDI ARABIA AUTOMOTIVE MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

12.2 COMPANY SHARE ANALYSIS: CHINA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 MITSUBISHI CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 VOLKSWAGEN AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCTS PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 STELLANTIS NV

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 MERCEDES-BENZ GROUP AG

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 TOYOTA MOTOR CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 AB VOLVO

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 ASHOK LEYLAND

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BAIC

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 BMW AG

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BYD COMPANY LTD.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 CHANGAN AUTOMOBILE COMPANY LIMITED

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCTS PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 CHERY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 EICHER MOTORS LIMITED

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 FORD MOTOR COMPANY

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCTS PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 GEELY AUTO

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 GENERAL MOTORS

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCTS PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 GREAT WALL MOTOR

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 HONDA MOTOR CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCTS PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 HYUNDAI MOTOR COMPANY

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 ISUZU MOTORS LIMITED

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENTS

14.21 JAC

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

14.22 MAHINDRA&MAHINDRA

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 PRODUCT PORTFOLIO

14.22.4 RECENT DEVELOPMENTS

14.23 MAZDA MOTOR CORPORATION

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 PRODUCT PORTFOLIO

14.23.4 RECENT DEVELOPMENTS

14.24 RENAULT GROUP

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 PRODUCTS PORTFOLIO

14.24.4 RECENT DEVELOPMENTS

14.25 SAIC MOTOR CORPORATION LIMITED

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENTS

14.26 SNAM.COM.SA

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT DEVELOPMENT

14.27 SUZUKI MOTOR CORPORATION

14.27.1 COMPANY SNAPSHOT

14.27.2 REVENUE ANALYSIS

14.27.3 PRODUCTS PORTFOLIO

14.27.4 RECENT DEVELOPMENTS

14.28 TATA MOTORS

14.28.1 COMPANY SNAPSHOT

14.28.2 REVENUE ANALYSIS

14.28.3 PRODUCT PORTFOLIO

14.28.4 RECENT DEVELOPMENTS

14.29 TESLA

14.29.1 COMPANY SNAPSHOT

14.29.2 REVENUE ANALYSIS

14.29.3 PRODUCTS PORTFOLIO

14.29.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 SAUDI ARABIA AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 CHINA AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 3 SAUDI ARABIA AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 4 CHINA AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 5 SAUDI ARABIA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY BODY STYLE, 2021-2030 (USD MILLION)

TABLE 6 CHINA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY BODY STYLE, 2021-2030 (USD MILLION)

TABLE 7 SAUDI ARABIA SUV IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 CHINA SUV IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 SAUDI ARABIA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY PURCHASE TYPE, 2021-2030 (USD MILLION)

TABLE 10 CHINA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY PURCHASE TYPE, 2021-2030 (USD MILLION)

TABLE 11 SAUDI ARABIA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY SEATING, 2021-2030 (USD MILLION)

TABLE 12 CHINA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY SEATING, 2021-2030 (USD MILLION)

TABLE 13 SAUDI ARABIA COMMERCIAL VEHICLE IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 CHINA COMMERCIAL VEHICLE IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 SAUDI ARABIA LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 CHINA LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 SAUDI ARABIA MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 CHINA MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 SAUDI ARABIA MEDIUM TRUCKS (14,001-26,000 POUNDS) AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 CHINA MEDIUM TRUCKS (14,001-26,000 POUNDS) AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 SAUDI ARABIA HEAVY TRUCKS (ABOVE 26,000 POUNDS) AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 CHINA HEAVY TRUCKS (ABOVE 26,000 POUNDS) AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 SAUDI ARABIA AUTOMOTIVE MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 24 CHINA AUTOMOTIVE MARKET, BY FUEL TYPE, 2021-2030 (USD MILLION)

TABLE 25 SAUDI ARABIA PETROL IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 CHINA PETROL IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 SAUDI ARABIA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY BODY STYLE, 2021-2030 (USD MILLION)

TABLE 28 CHINA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY BODY STYLE, 2021-2030 (USD MILLION)

TABLE 29 SAUDI ARABIA COMMERCIAL VEHICLE IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 CHINA COMMERCIAL VEHICLE IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 CHINA LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 SAUDI ARABIA MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 CHINA MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 SAUDI ARABIA DIESEL IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 CHINA DIESEL IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA COMMERCIAL VEHICLE IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 CHINA COMMERCIAL VEHICLE IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 SAUDI ARABIA LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 CHINA LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 SAUDI ARABIA MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 CHINA MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 SAUDI ARABIA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY BODY STYLE, 2021-2030 (USD MILLION)

TABLE 44 CHINA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY BODY STYLE, 2021-2030 (USD MILLION)

TABLE 45 SAUDI ARABIA ELECTRIC IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA ELECTRIC IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 SAUDI ARABIA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY BODY STYLE, 2021-2030 (USD MILLION)

TABLE 48 CHINA PASSENGER VEHICLE IN AUTOMOTIVE MARKET, BY BODY STYLE, 2021-2030 (USD MILLION)

TABLE 49 SAUDI ARABIA COMMERCIAL VEHICLE IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CHINA COMMERCIAL VEHICLE IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 SAUDI ARABIA LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 CHINA LIGHT COMMERCIAL VEHICLE (LCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 SAUDI ARABIA MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 CHINA MEDIUM AND HEAVY COMMERCIAL VEHICLE (HCV) IN AUTOMOTIVE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 SAUDI ARABIA ELECTRIC IN AUTOMOTIVE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 56 CHINA ELECTRIC IN AUTOMOTIVE MARKET, BY PROPULSION TYPE, 2021-2030 (USD MILLION)

TABLE 57 SAUDI ARABIA AUTOMOTIVE MARKET, BY DRIVETRAIN, 2021-2030 (USD MILLION)

TABLE 58 CHINA AUTOMOTIVE MARKET, BY DRIVETRAIN, 2021-2030 (USD MILLION)

TABLE 59 SAUDI ARABIA AUTOMOTIVE MARKET, BY PRICING, 2021-2030 (USD MILLION)

TABLE 60 CHINA AUTOMOTIVE MARKET, BY PRICING, 2021-2030 (USD MILLION)

TABLE 61 SAUDI ARABIA AUTOMOTIVE MARKET, BY ENGINE CAPACITY, 2021-2030 (USD MILLION)

TABLE 62 CHINA AUTOMOTIVE MARKET, BY ENGINE CAPACITY, 2021-2030 (USD MILLION)

TABLE 63 SAUDI ARABIA AUTOMOTIVE MARKET, BY SALES CHANNEL,2021-2030 (USD MILLION)

TABLE 64 CHINA AUTOMOTIVE MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

图片列表

FIGURE 1 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 2 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET: DATA TRIANGULATION

FIGURE 3 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET: DROC ANALYSIS

FIGURE 4 CHINA AUTOMOTIVE MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA AUTOMOTIVE MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 6 CHINA AUTOMOTIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 SAUDI ARABIA AUTOMOTIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET: MULTIVARIATE MODELING

FIGURE 12 CHINA AUTOMOTIVE MARKET: TYPE TIMELINE CURVE

FIGURE 13 SAUDI ARABIA AUTOMOTIVE MARKET: TYPE TIMELINE CURVE

FIGURE 14 CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET: SEGMENTATION

FIGURE 15 A RISE IN THE AVERAGE INCOME OF THE POPULATION IS EXPECTED TO DRIVE CHINA AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 16 THE PASSENGER VEHICLE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF CHINA AUTOMOTIVE MARKET IN 2023 & 2030

FIGURE 17 A RISE IN THE AVERAGE INCOME OF THE POPULATION IS EXPECTED TO DRIVE SAUDI ARABIA AUTOMOTIVE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 18 THE PASSENGER VEHICLE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SAUDI ARABIA AUTOMOTIVE MARKET IN 2023 & 2030

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE CHINA AND SAUDI ARABIA AUTOMOTIVE MARKET

FIGURE 20 CHINA GDP PER CAPITA

FIGURE 21 SAUDI ARBIA GDP PER CAPITA (USD)

FIGURE 22 AUTOMOTIVE AI MARKET SIZE

FIGURE 23 WORLDWIDE ELECTRONIC SYSTEM CAGR (%)

FIGURE 24 SAUDI ARABIA AUTOMOTIVE MARKET , BY TYPE, 2022

FIGURE 25 CHINA AUTOMOTIVE MARKET , BY TYPE, 2022

FIGURE 26 SAUDI ARABIA AUTOMOTIVE MARKET, BY FUEL TYPE, 2022

FIGURE 27 CHINA AUTOMOTIVE MARKET, BY FUEL TYPE, 2022

FIGURE 28 SAUDI ARABIA AUTOMOTIVE MARKET, BY DRIVETRAIN, 2022

FIGURE 29 CHINA AUTOMOTIVE MARKET, BY DRIVETRAIN, 2022

FIGURE 30 SAUDI ARABIA AUTOMOTIVE MARKET, BY PRICING, 2022

FIGURE 31 CHINA AUTOMOTIVE MARKET, BY PRICING, 2022

FIGURE 32 SAUDI ARABIA AUTOMOTIVE MARKET, BY ENGINE CAPACITY, 2022

FIGURE 33 CHINA AUTOMOTIVE MARKET, BY ENGINE CAPACITY, 2022

FIGURE 34 SAUDI ARABIA AUTOMOTIVE MARKET, BY SALES CHANNEL, 2022

FIGURE 35 CHINA AUTOMOTIVE MARKET, BY SALES CHANNEL, 2022

FIGURE 36 SAUDI ARABIA AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

FIGURE 37 CHINA AUTOMOTIVE MARKET: COMPANY SHARE 2022 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。