Dominican Republic Biosurgery Intraoperative Care Market

市场规模(十亿美元)

CAGR :

%

USD

51.74 Million

USD

31.95 Million

2024

2032

USD

51.74 Million

USD

31.95 Million

2024

2032

| 2025 –2032 | |

| USD 51.74 Million | |

| USD 31.95 Million | |

|

|

|

|

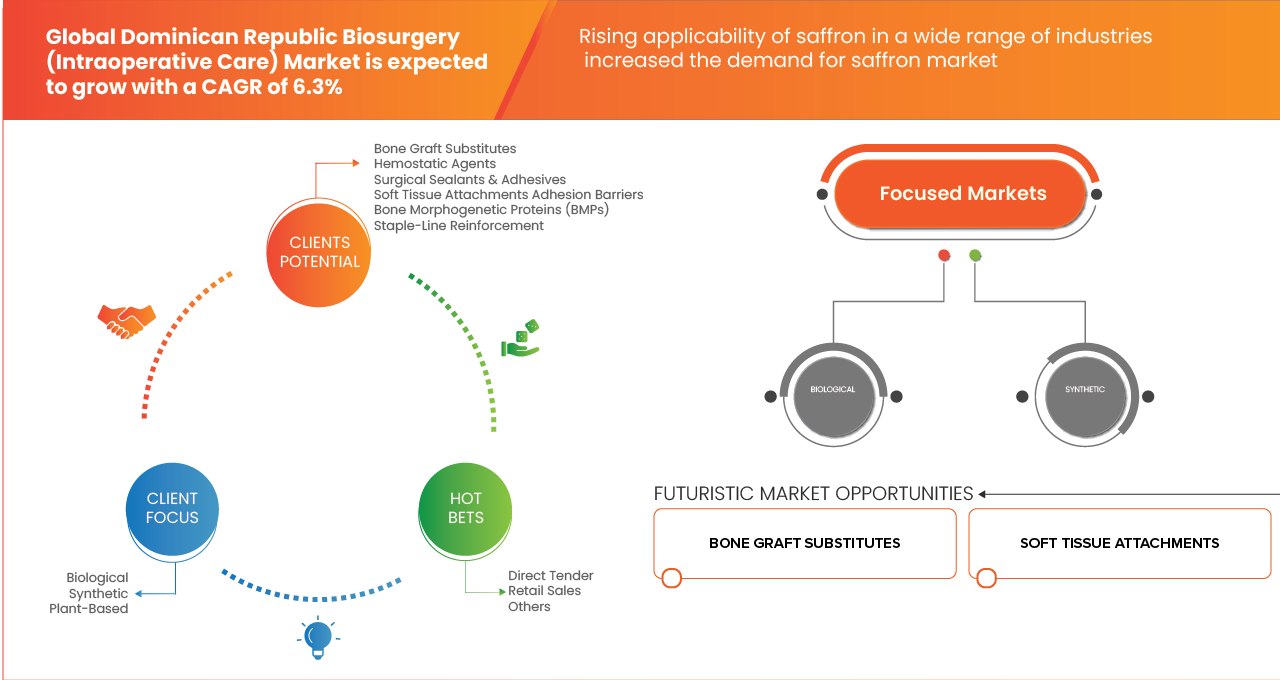

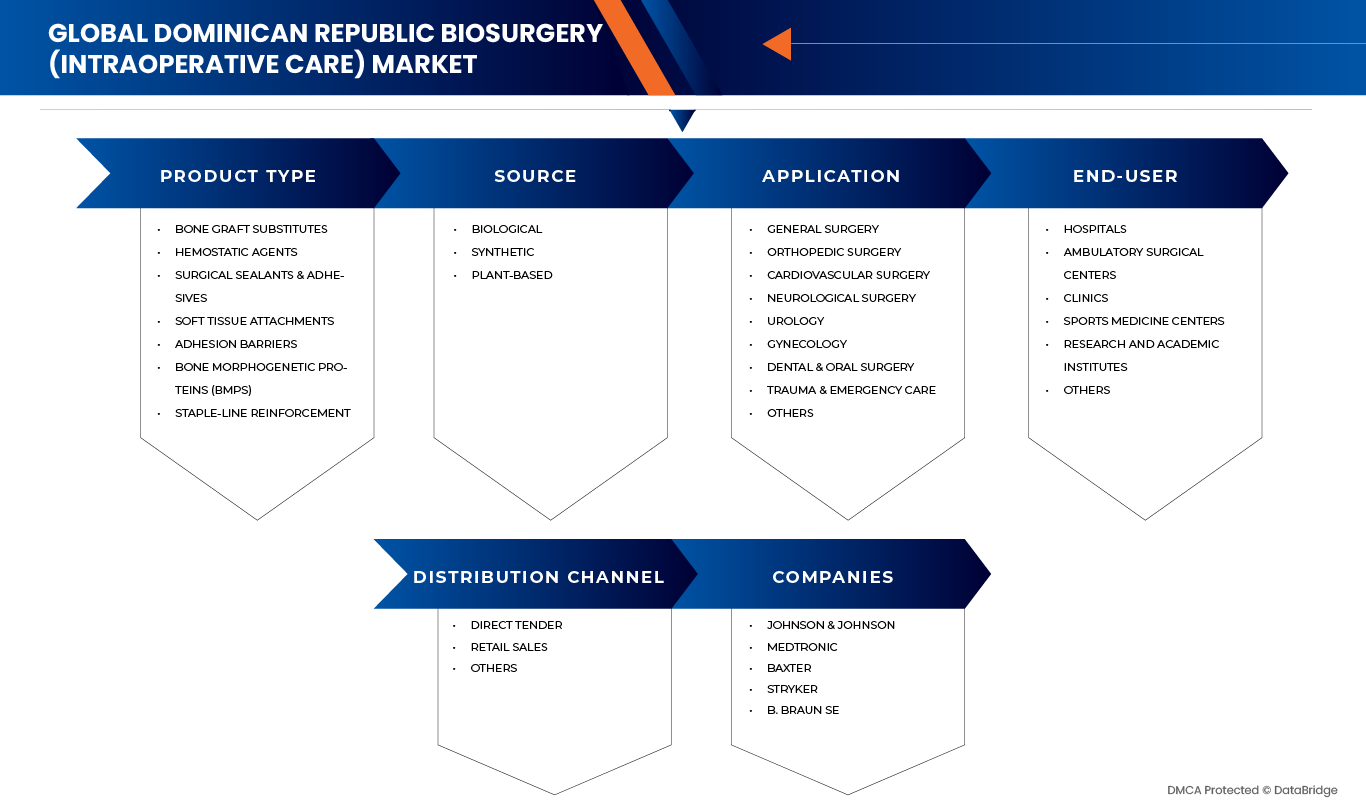

多明尼加共和國生物外科(術中護理)市場細分,按產品類型(骨移植替代物、止血劑、外科密封劑和粘合劑、軟組織附著物、防粘連屏障、骨形態發生蛋白 (BMP)和縫合線加固)、應用領域(一般外科、骨科、心血管外科、神經外科、泌尿外科、婦科、口腔外科、創傷和急診護理及其他)、來源(生物來源、合成來源和植物來源)、最終用戶(醫院、門診手術中心、診所、運動醫學中心、研究和學術機構及其他)、分銷渠道(直接招標、零售及其他)劃分——零售及其他)劃分趨勢

多明尼加共和國生物外科(術中護理)市場規模

- 2024年多明尼加共和國生物外科(術中護理)市場價值為5,174萬美元,預計2032年將達到3,195萬美元。

- 在 2025 年至 2032 年的預測期內,市場可能會以6.3% 的複合年增長率成長,主要驅動力是提高營運效率和港口容量的需求。

- 多明尼加共和國生物外科(術中護理)市場的成長受到以下因素的推動:北美貿易量增加、對高性能貨櫃處理設備的需求不斷增長、自動化和人工智慧領域的技術進步,以及全球製造業和運輸業的擴張。

多明尼加共和國生物外科(術中護理)市場分析

- 在多明尼加共和國,生物外科(術中護理)指的是在手術過程中使用先進的外科解決方案和生物材料,以減少出血、促進組織修復並改善癒合效果。這些產品包括止血劑、手術密封劑、防沾黏屏障和軟組織修復材料,旨在幫助外科醫生處理複雜的術中情況。該市場在多明尼加共和國不斷發展的醫療保健基礎設施中發揮著至關重要的作用,尤其是在三級醫院和專科手術中心,其透過提高患者安全、縮短手術時間和最大限度地減少術後併發症,發揮著重要作用。

- 多明尼加共和國生物外科市場的主要技術之一是將生物材料和合成生物材料結合,以支持微創和精準手術。腹腔鏡和機器人輔助手術的日益普及推動了對先進術中生物外科產品的需求,這些產品能夠在狹小、難以觸及的解剖部位實現有效的止血和組織封閉。此外,醫院現代化投資的增加、擇期手術數量的增長以及私立醫療服務覆蓋範圍的擴大,也促進了生物外科產品的應用。與全球醫療器材製造商的合作以及為外科醫生推出的培訓項目,也提高了多明尼加共和國的手術效率、安全性和患者復健效果。

- 預計到2025年,骨移植替代材料將佔據市場主導地位,市佔率達33.51%,主要歸功於其在骨科、創傷、脊椎和重建手術中的重要角色。骨移植替代材料被廣泛用作自體骨移植和異體骨移植的替代方案,具有縮短手術時間、降低供體部位併發症風險以及促進患者康復等優勢。

報告範圍及多明尼加共和國生物外科(術中護理)市場細分

|

屬性 |

生物外科(術中護理)關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場狀況的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、病患流行病學、研發管線分析、定價分析和監管框架。 |

多明尼加共和國生物外科(術中護理)市場趨勢

“手術量和擇期手術數量不斷增加”

- 過去幾年,手術量的增加和擇期手術的擴張已成為多明尼加共和國生物外科(術中護理)市場成長的關鍵驅動因素。

- 無論在公立或私立醫療機構,醫療服務提供者所進行的手術種類日益增多,涵蓋骨科、眼科、一般外科、美容和重建手術,以及日益複雜的微創手術。這一增長得益於為減少新冠疫情期間積壓的手術而採取的各項措施,以及對醫療基礎設施的加大投入、醫療旅遊的蓬勃發展和政府政策的支持。

- 隨著手術量增加,對術中護理耗材、先進設備、一次性用品、影像支援、止血和術中監測工具的需求也隨之成長。在這種情況下,醫療系統安排的擇期手術越多,基礎手術量越高,生物外科領域就越能發揮作用——這使得手術量和擇期手術成為多明尼加共和國術中護理市場成長的根本動力。

- 例如,根據Vitals今日報道,截至2025年1月,多明尼加共和國公立醫院系統在手術室進行了469,784例手術,比2019年增長了31.71%。

- 因此,必要手術和擇期手術數量的增加直接增強了對生物外科產品的需求,使得外科手術的擴張成為多明尼加共和國術中護理領域市場成長的最關鍵驅動因素之一。

多明尼加共和國生物外科(術中護理)市場動態

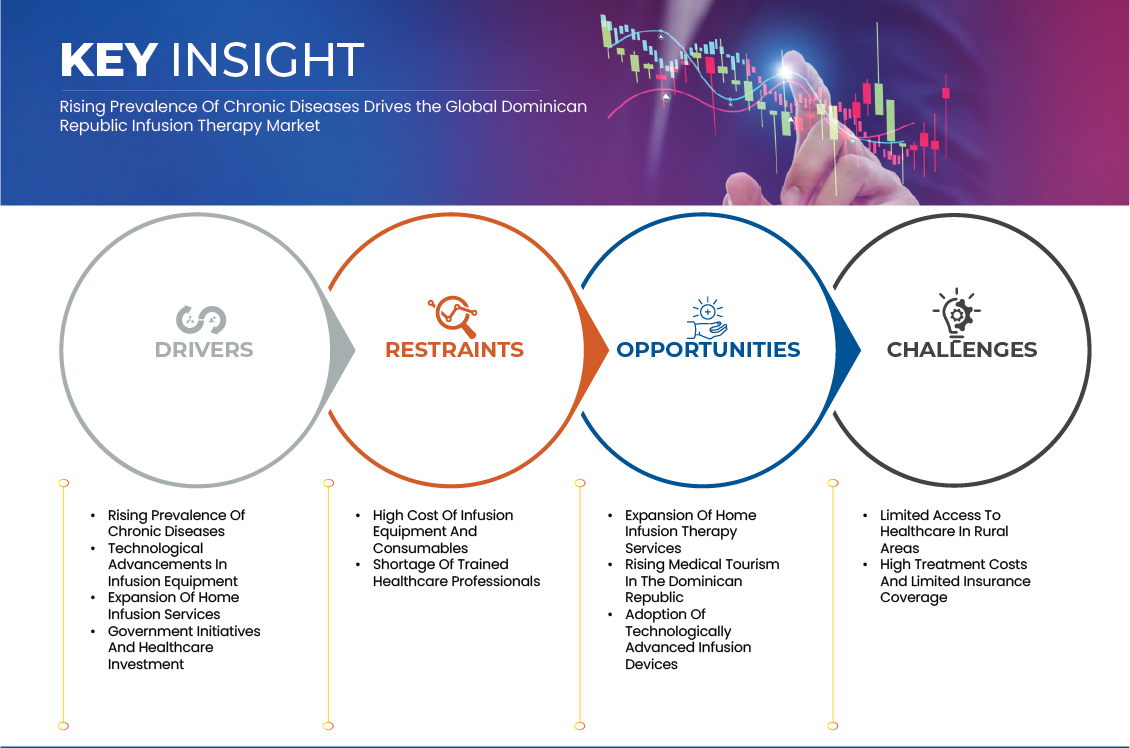

司機

“減少失血與改善患者預後的臨床轉變”

- 多明尼加共和國的生物外科和術中護理市場正經歷顯著增長,這主要得益於臨床理念向減少出血和改善患者預後轉變。這種模式強調患者血液管理(PBM)策略,旨在最大限度地減少輸血需求及其相關併發症。

- 世界衛生組織(世衛組織)更新了其關於在2025年實施患者血液管理(PBM)的指南,強調了PBM的成本效益及其在改善患者預後方面的作用。此外,術中自體輸血(IABD)技術的進步已被證明能有效減少輸血需求和圍手術期併發症。

- 近期推出的各項措施和指南清楚地表明,減少出血量和改善患者預後的臨床重點正成為多明尼加共和國生物外科和術中護理市場發展的關鍵驅動力。公共衛生部致力於將血液及其衍生物納入社會保障體系,這標誌著該國系統性地致力於確保安全充足的血液供應惠及所有人。

- 同時,諸如《聖克魯斯宣言》和世衛組織分階段患者血液管理指南等國際框架的採納,為圍手術期貧血的管理、減少術中失血和優化凝血功能提供了結構化的方法。這些措施共同提高了病人安全,改善了手術效果,並增強了多明尼加共和國醫療保健系統的效率和可持續性,使減少術中失血成為術中護理領域的重要市場驅動因素。

克制/挑戰

“成本敏感性與有限的公共預算”

- 多明尼加共和國的生物外科和術中護理市場面臨著許多限制因素,包括對成本的敏感度和有限的公共預算。儘管醫療基礎設施取得了進步,但財政資源的分配仍然是一項嚴峻的挑戰。

- 公共衛生系統的預算捉襟見肘,導致服務提供不均衡,相當一部分難以獲得先進的外科手術。這些財政限制阻礙了尖端技術的應用和專科外科服務的擴展,進而影響了生物外科醫療的整體品質和可近性。

- 這些案例凸顯了公共部門資金不足對多明尼加共和國醫療保健的影響。儘管國際貨幣基金組織(IMF)的報告強調了政府資金持續短缺限制了公共醫療保健投資,但Médico Express公司推出的先進門診手術中心表明,私營部門正在積極填補公共部門資金不足造成的空白。

- 這一對比表明,儘管經濟充滿活力,但公共部門的財政限制制約了先進外科手術市場的發展。

多明尼加共和國生物外科(術中護理)市場範圍

多明尼加共和國生物外科(術中護理)市場分為五個主要部分:產品類型、應用、來源、最終用戶和分銷管道。

- 依產品類型

根據產品類型,多明尼加共和國生物外科(術中護理)市場可細分為骨移植替代物、止血劑、外科密封劑和粘合劑、軟組織固定物、防粘連屏障、骨形態發生蛋白 (BMP) 以及縫合線加固。預計到 2025 年,骨移植替代物細分市場將佔據主導地位,市場份額達到 33.51%,這主要得益於其在骨科和脊椎手術中的廣泛應用以及市場對有效骨再生解決方案日益增長的需求。

預計在 2025 年至 2032 年的預測期內,骨移植替代材料領域將以 6.7% 的複合年增長率獲得增長,這主要得益於骨骼相關疾病發病率的上升、人口老齡化以及合成和生物活性移植技術的不斷進步,這些進步改善了手術效果。

- 透過申請

根據應用領域,市場可細分為一般外科、骨科、心血管外科、神經外科、泌尿外科、婦科、口腔外科、創傷及急診護理等領域。預計到2025年,一般外科將佔據主導地位,市場份額達到29.27%,這主要得益於全球手術量巨大、止血劑、密封劑和組織黏合劑等先進生物外科產品的應用日益廣泛,以及人們越來越重視減少術中併發症和改善患者預後。

預計在 2025 年至 2032 年的預測期內,普通外科手術領域將以 6.5% 的複合年增長率獲得增長,這主要得益於手術量的增加、人們對微創手術的認識不斷提高、醫院對先進的術中護理產品的投資增加,以及生物外科技術的持續創新提高了安全性和有效性。

- 按來源

根據來源,多明尼加共和國生物外科(術中護理)市場可分為生物基、合成基和植物基三大類。預計到2025年,生物基材料將佔據主導地位,市場份額達到52.28%,這主要得益於其在骨移植、止血和組織修復等領域的廣泛應用,以及臨床上對具有更高生物相容性和改善患者預後的天然來源材料的高度偏好。

預計在 2025 年至 2032 年的預測期內,生物技術領域將以 7.0% 的複合年增長率獲得增長,這主要得益於骨科、心血管和普通外科手術中生物製品的日益普及,對安全有效的術中護理解決方案的需求不斷增長,以及對先進生物來源材料的持續研究和開發。

- 由最終用戶

根據最終用戶劃分,多明尼加共和國生物外科(術中護理)市場可細分為醫院、門診手術中心、診所、運動醫學中心、研究和學術機構以及其他機構。預計到2025年,醫院細分市場將佔據主導地位,市場份額達50.79%,這主要得益於醫院手術量大、擁有先進的手術基礎設施,以及醫院對綜合性術中護理解決方案的偏好。

預計在 2025 年至 2032 年的預測期內,醫院行業將以 6.2% 的複合年增長率獲得增長,這主要得益於醫療保健支出增加、手術數量增加、先進生物外科產品日益普及以及醫院對改善手術效果和患者安全的重視。

- 按分銷管道

根據分銷管道,多明尼加共和國生物外科(術中護理)市場可分為直接招標、零售和其他管道。預計到2025年,直接招標管道將佔據主導地位,市場份額達57.14%,這主要歸功於醫院和大型醫療機構傾向於直接從製造商處批量採購,以確保成本效益、穩定的供應以及獲得最新的生物外科產品。

預計在 2025 年至 2032 年的預測期內,直接招標領域將以 6.4% 的複合年增長率獲得增長,這主要得益於政府和私人招標中醫院採購量的增加、先進術中護理產品的日益普及以及製造商加強共和國直接供應鏈的戰略。

多明尼加共和國生物外科(術中護理)市場份額

市場競爭格局部分按競爭對手提供詳細信息,包括公司概況、財務狀況、收入、市場潛力、研發投入、新市場拓展計劃、北美市場佈局、生產基地及設施、產能、公司優勢與劣勢、產品發布、產品線寬度與廣度以及應用領域優勢。以上數據僅與各公司在市場上的業務重點相關。

市場上的主要市場領導者包括:

- GE醫療(美國)

- 美敦力(愛爾蘭)

- 百特(美國)

- ICU醫療(美國)

- B. Braun SE(德國)

- Apothecaries Sundries Mfg. Pvt. Ltd (印度)

- 泰爾茂株式會社(日本)

- KORU醫療系統(美國)

- Farmaconol(愛爾蘭)

- 長沙天福醫療器材(中國)

- Ariss Medical Inc.(美國)

- Grupo Hospifar(美國)

- BD(美國)

- Micrel Medical Devices SA(希臘)

- SternMed GmbH(德國)

- 泰利福公司(美國)

- 全球健康(多明尼加共和國)

- EPSIMED(美國)

- KALSTEIN FRANCE - SIREN(法國)

- medzell(Eightwe Digital Transforma)(印度)

- INSUMERD(多明尼加共和國)

- 湖南博遠醫療科技股份有限公司(中國)

- Avante(美國)

- 瑙格拉醫學實驗室(印度)

- Jaincolab(印度)

- 維貢(法國)

多明尼加共和國生物外科(術中護理)市場最新發展

- 2024年12月,Artivion公司獲得美國食品藥物管理局(FDA)人道器材豁免(HDE)批准,用於其AMDS混合型人工主動脈剝離,這標誌著其監管審批流程的一個重要里程碑。此核准使AMDS得以在美國早期商業化,用於治療伴有灌注不良的急性DeBakey I型主動脈剝離-約佔此類病例的40%。由於該器械在治療這種罕見且高風險的疾病方面具有挽救生命的潛力,因此也獲得了突破性醫療器材認定和人道主義用途認定。這項進展鞏固了Artivion在結構性心臟和主動脈外科手術市場的領先地位,擴大了其臨床應用範圍,並為未來更廣泛的上市前批准(PMA)鋪平了道路。

- 2023年1月,Orthofix Medical Inc.和SeaSpine Holdings完成了平等合併,創建了一家全球領先的脊椎和骨科公司。合併後的公司提供互補的產品組合,包括生物製劑、脊椎硬體、骨骼生長療法、骨科解決方案和手術導航系統,業務遍及68個國家。

- 2025年3月,史密斯醫療(Smith & Nephew)繼續在運動醫學領域開拓創新,推出了名為「太空手術」(Spatial Surgery)的全新類別,這是關節鏡手術創新領域的革命性突破。 TESSA太空手術系統(全名:追蹤式太空手術輔助系統)將個人化手術計畫與即時追蹤設備相結合,利用先進的影像和擴增實境技術輔助外科醫生進行決策。

- 2025年7月,Zimmer Biomet與Getinge達成策略合作,向其門診手術中心(ASC)客戶分銷Getinge的手術室設備產品。此次合作旨在為ASC客戶提供全面的解決方案,將Zimmer Biomet的手術機器人和植入物產品與Getinge的感染控制和手術產品組合相結合。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.3 INDUSTRY INSIGHTS– DOMINICAN REPUBLIC BIOSURGERY(INTRAOPERATIVE CARE) MARKET

4.3.1 PATENT ANALYSIS

4.3.2 PATENT LANDSCAPE

4.3.3 USPTO NUMBER

4.3.4 PATENT EXPIRY

4.3.5 EPIO NUMBER

4.3.6 PATENT STRENGTH AND QUALITY

4.3.7 PATENT CLAIMS

4.3.8 PATENT CITATIONS

4.3.9 FILE OF PATENT

4.3.10 PATENT RECEIVED COUNTRIES

4.3.11 TECHNOLOGY BACKGROUND

4.3.12 DRUG TREATMENT RATE BY MATURED MARKETS

4.3.13 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.3.14 PATIENT FLOW DIAGRAM

4.3.15 KEY PRICING STRATEGIES

4.3.16 KEY PATIENT ENROLLMENT STRATEGIES

4.4 MARKET ACCESS LANDSCAPE: DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) THERAPY

4.4.1 INTRODUCTION

4.4.2 ANNUAL NEW FDA-APPROVED DRUGS

4.4.3 DRUG MANUFACTURER AND DEALS

4.4.4 MAJOR DRUG UPTAKE

4.4.5 CURRENT TREATMENT PRACTICES

4.4.6 IMPACT OF UPCOMING THERAPY

4.4.7 CONCLUSION

4.5 PIPELINE ANALYSIS – BIOSURGERY (INTRAOPERATIVE CARE) THERAPY IN THE DOMINICAN REPUBLIC

4.5.1 OVERVIEW OF PIPELINE LANDSCAPE

4.5.2 CLINICAL TRIAL LANDSCAPE

4.5.3 STUDY STATUS AND DEVELOPMENT STAGES

4.5.4 KEY INDICATIONS ADDRESSED

4.5.5 INTERVENTIONS AND THERAPEUTIC MODALITIES

4.5.6 SPONSORS AND COLLABORATORS

4.5.7 PHASE DISTRIBUTION INSIGHTS

4.5.8 THERAPEUTIC EQUIPMENT AND DEVICES

4.5.9 FUTURE OUTLOOK

4.5.10 CONCLUSION

5 REGULATORY FRAMEWORK FOR BIOSURGERY (INTRAOPERATIVE CARE) THERAPY IN THE DOMINICAN REPUBLIC

5.1 REGULATORY APPROVAL PROCESS

5.1.1 INSTITUTIONAL AUTHORITY AND LEGAL BASIS

5.1.2 DOSSIER STRUCTURE AND EVIDENCE EXPECTATIONS

5.1.3 SUBMISSION CHANNELS AND PROCEDURAL MODERNIZATION

5.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.2.1 RELIANCE AND REGIONAL HARMONIZATION MECHANISMS

5.2.2 DIFFERENTIAL EASE ACROSS PRODUCT TYPES

5.3 REGULATORY APPROVAL PATHWAYS

5.3.1 STANDARD COMPLETE ASSESSMENT PATHWAY

5.3.2 RELIANCE AND EXPEDITED ROUTES

5.3.3 SPECIFIC CONSIDERATIONS FOR BIOLOGICS AND ADVANCED BIOSURGERY PRODUCTS

5.4 LICENSING AND REGISTRATION

5.4.1 LOCAL REPRESENTATION AND ADMINISTRATIVE REQUIREMENTS

5.4.2 MANUFACTURING LICENSES, GMP EVIDENCE, AND INSPECTIONS

5.4.3 ADVERTISING, PROMOTIONAL CONTROLS, AND COMPLIANCE

5.5 POST-MARKETING SURVEILLANCE

5.5.1 PHARMACOVIGILANCE ARCHITECTURE AND REPORTING OBLIGATIONS

5.5.2 MARKET SURVEILLANCE AND CORRECTIVE ACTIONS

5.6 GOOD MANUFACTURING PRACTICES (GMP) GUIDELINES

5.6.1 EXPECTATIONS AND INTERNATIONAL ALIGNMENT

5.6.2 PREPAREDNESS FOR INSPECTIONS AND CONTINUOUS COMPLIANCE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING SURGICAL VOLUME & ELECTIVE PROCEDURES

6.1.2 CLINICAL SHIFT ON BLOOD-LOSS REDUCTION & PATIENT OUTCOMES

6.1.3 HOSPITAL MODERNIZATION & PRIVATE SECTOR EXPANSION

6.2 RESTRAINS

6.2.1 COST SENSITIVITY & LIMITED PUBLIC BUDGETS

6.2.2 REGULATORY COMPLEXITY AND VARIABLE TIMELINES

6.3 OPPORTUNITIES

6.3.1 COLLABORATION BETWEEN PUBLIC AND PRIVATE HEALTHCARE FACILITIES

6.3.2 VALUE-BASED BUNDLES & COST-PER-PROCEDURE MESSAGING

6.4 CHALLENGES

6.4.1 DISTRIBUTION & LOGISTICS INFRASTRUCTURE

6.4.2 LACK OF TRAINING AND KNOWLEDGE ABOUT SURGICAL PRODUCTS

7 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 BONE GRAFT SUBSTITUTES

7.3 HEMOSTATIC AGENTS

7.4 SURGICAL SEALANTS & ADHESIVES

7.5 SOFT TISSUE ATTACHMENTS

7.6 SOFT TISSUE ATTACHMENTS

7.7 ADHESION BARRIERS

7.8 ADHESION BARRIERS

7.9 BONE MORPHOGENETIC PROTEINS (BMPS)

7.1 STAPLE-LINE REINFORCEMENT

7.11 STAPLE-LINE REINFORCEMENT

8 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY SOURCE

8.1 OVERVIEW

8.2 BIOLOGICAL

8.3 SYNTHETIC

8.4 PLANT-BASED

9 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 GENERAL SURGERY

9.3 ORTHOPEDIC SURGERY

9.4 CARDIOVASCULAR SURGERY

9.5 NEUROLOGICAL SURGERY

9.6 UROLOGY

9.7 GYNECOLOGY

9.8 DENTAL & ORAL SURGERY

9.9 TRAUMA & EMERGENCY CARE

9.1 OTHERS

10 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY END-USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 AMBULATORY SURGICAL CENTERS

10.4 CLINICS

10.5 SPORTS MEDICINE CENTERS

10.6 RESEARCH AND ACADEMIC INSTITUTES

10.7 OTHERS

11 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 RETAIL SALES

11.4 OTHERS

12 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET

12.1 COMPANY SHARE ANALYSIS: DOMINICAN REPUBLIC

13 COMPANY PROFILES

13.1 JOHNSON & JOHNSON

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 MEDTRONIC

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 BAXTER

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 STRYKER

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 B.BRAUN SE.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 ADVANCED MEDICAL SOLUTIONS GROUP PLC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ARTIVION, INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 BAUMER SA

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BD

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENT

13.1 BIOVENTUS

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 DEROYAL INDUSTRIES, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 FIN-CERAMICA FAENZA S.P.A.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 FZIOMED, INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 GDT DENTAL IMPLANTS

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 GEISTLICH PHARMA AG

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 HEMOSTASIS, LLC

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENT

13.17 INTEGRA LIFESCIENCES CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 MEDZELL (EIGHTWE DIGITAL TRANSFORMATIONS PVT. LTD)

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 MERIL

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 ORTHOFIX MEDICAL INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

13.21 REGENITY

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 SMITH+NEPHEW

13.22.1 COMPANY SNAPSHOT

13.22.2 REVENUE ANALYSIS

13.22.3 PRODUCT PORTFOLIO

13.22.4 RECENT DEVELOPMENT

13.23 TECH MEDICAL GROUP INC.

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCT PORTFOLIO

13.23.3 RECENT DEVELOPMENT

13.24 TELEFLEX INCORPORATED

13.24.1 COMPANY SNAPSHOT

13.24.2 REVENUE ANALYSIS

13.24.3 PRODUCT PORTFOLIO

13.24.4 RECENT DEVELOPMENT

13.25 ZIMMER BIOMET

13.25.1 COMPANY SNAPSHOT

13.25.2 REVENUE ANALYSIS

13.25.3 PRODUCT PORTFOLIO

13.25.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

表格列表

TABLE 1 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 3 DOMINICAN REPUBLIC BONE GRAFT SUBSTITUTES IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 DOMINICAN REPUBLIC DEMINERALIZED BONE MATRIX IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 DOMINICAN REPUBLIC DEMINERALIZED BONE MATRIX IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 6 DOMINICAN REPUBLIC SYNTHETIC BONE GRAFTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 DOMINICAN REPUBLIC CERAMICS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 DOMINICAN REPUBLIC HEMOSTATIC AGENTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY FORMULATION, 2018-2032 (USD THOUSAND)

TABLE 9 DOMINICAN REPUBLIC HEMOSTATIC AGENTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 10 DOMINICAN REPUBLIC SURGICAL SEALANTS & ADHESIVES IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 DOMINICAN REPUBLIC NATURAL/BIOLOGICAL SEALANTS AND ADHESIVES IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 DOMINICAN REPUBLIC SYNTHETIC AND SEMI-SYNTHETIC SEALANTS AND ADHESIVES IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 DOMINICAN REPUBLIC SOFT TISSUE ATTACHMENTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 DOMINICAN REPUBLIC TISSUE MATRIX IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 DOMINICAN REPUBLIC SYNTHETIC MESH IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 DOMINICAN REPUBLIC BIOLOGICAL MESH IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 DOMINICAN REPUBLIC TISSUE FIXATION PRODUCTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 DOMINICAN REPUBLIC SOFT TISSUE ATTACHMENTS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 DOMINICAN REPUBLIC ORTHOPEDIC SURGERY IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 DOMINICAN REPUBLIC GENERAL SURGERY IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 DOMINICAN REPUBLIC GYNECOLOGICAL SURGERY IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 DOMINICAN REPUBLIC PLASTIC AND RECONSTRUCTIVE SURGERY IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 DOMINICAN REPUBLIC SPORTS MEDICINE IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 DOMINICAN REPUBLIC ADHESION BARRIERS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 DOMINICAN REPUBLIC SYNTHETIC ADHESION BARRIERS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 DOMINICAN REPUBLIC NATURAL/BIOLOGICAL ADHESION BARRIERS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 DOMINICAN REPUBLIC ADHESION BARRIERS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY FORMULATIONS, 2018-2032 (USD THOUSAND)

TABLE 28 DOMINICAN REPUBLIC BONE MORPHOGENETIC PROTEINS (BMPS) IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 DOMINICAN REPUBLIC BONE MORPHOGENETIC PROTEINS (BMPS) IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 DOMINICAN REPUBLIC STAPLE-LINE REINFORCEMENT IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 31 DOMINICAN REPUBLIC SYNTHETIC REINFORCEMENT MATERIALS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 DOMINICAN REPUBLIC BIOLOGIC REINFORCEMENT MATERIALS IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 DOMINICAN REPUBLIC STAPLE-LINE REINFORCEMENT IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 DOMINICAN REPUBLIC STAPLE-LINE REINFORCEMENT IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY RESORBABILITY, 2018-2032 (USD THOUSAND)

TABLE 35 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 36 DOMINICAN REPUBLIC BIOLOGICAL IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 DOMINICAN REPUBLIC ANIMAL-DERIVED IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 DOMINICAN REPUBLIC SYNTHETIC IN BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 40 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 41 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

图片列表

FIGURE 1 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: SEGMENTATION

FIGURE 2 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: DATA TRIANGULATION

FIGURE 3 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: DROC ANALYSIS

FIGURE 4 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: MULTIVARIATE MODELLING

FIGURE 8 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: SEGMENTATION

FIGURE 12 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: EXECUTIVE SUMMARY

FIGURE 13 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: STRATEGIC DECISIONS

FIGURE 14 SEVEN SEGMENTS COMPRISE THE DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET, BY PRODUCT TYPE (2024)

FIGURE 15 RISING SURGICAL VOLUME & ELECTIVE PROCEDURES IS EXPECTED TO DRIVE THE GROWTH OF THE DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET FROM 2025 TO 2032

FIGURE 16 THE BONE GRAFT SUBSTITUTES BIOSURGERY (INTRAOPERATIVE CARE) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET IN 2025 & 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PATENT ANALYSIS BY APPLICANTS

FIGURE 20 PATENT ANALYSIS BY YEAR

FIGURE 21 PATENT ANALYSIS BY COUNTRIES

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET

FIGURE 23 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY PRODUCT TYPE, 2024

FIGURE 24 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 25 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY PRODUCT TYPE, CAGR (2025- 2032)

FIGURE 26 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 27 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY SOURCE, 2024

FIGURE 28 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY SOURCE, 2025 TO 2032 (USD THOUSAND)

FIGURE 29 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY SOURCE, CAGR (2025- 2032)

FIGURE 30 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 31 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY APPLICATION, 2024

FIGURE 32 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND

FIGURE 33 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY APPLICATION, CAGR (2025- 2032)

FIGURE 34 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 35 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY END-USER, 2024

FIGURE 36 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY END-USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 37 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY END-USER, CAGR (2025- 2032)

FIGURE 38 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY END-USER, LIFELINE CURVE

FIGURE 39 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 40 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 41 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025- 2032)

FIGURE 42 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 43 DOMINICAN REPUBLIC BIOSURGERY (INTRAOPERATIVE CARE) MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。