Europe Aluminium Wire Rod Market

市场规模(十亿美元)

CAGR :

%

USD

18.62 Billion

USD

33.57 Billion

2024

2035

USD

18.62 Billion

USD

33.57 Billion

2024

2035

| 2025 –2035 | |

| USD 18.62 Billion | |

| USD 33.57 Billion | |

|

|

|

|

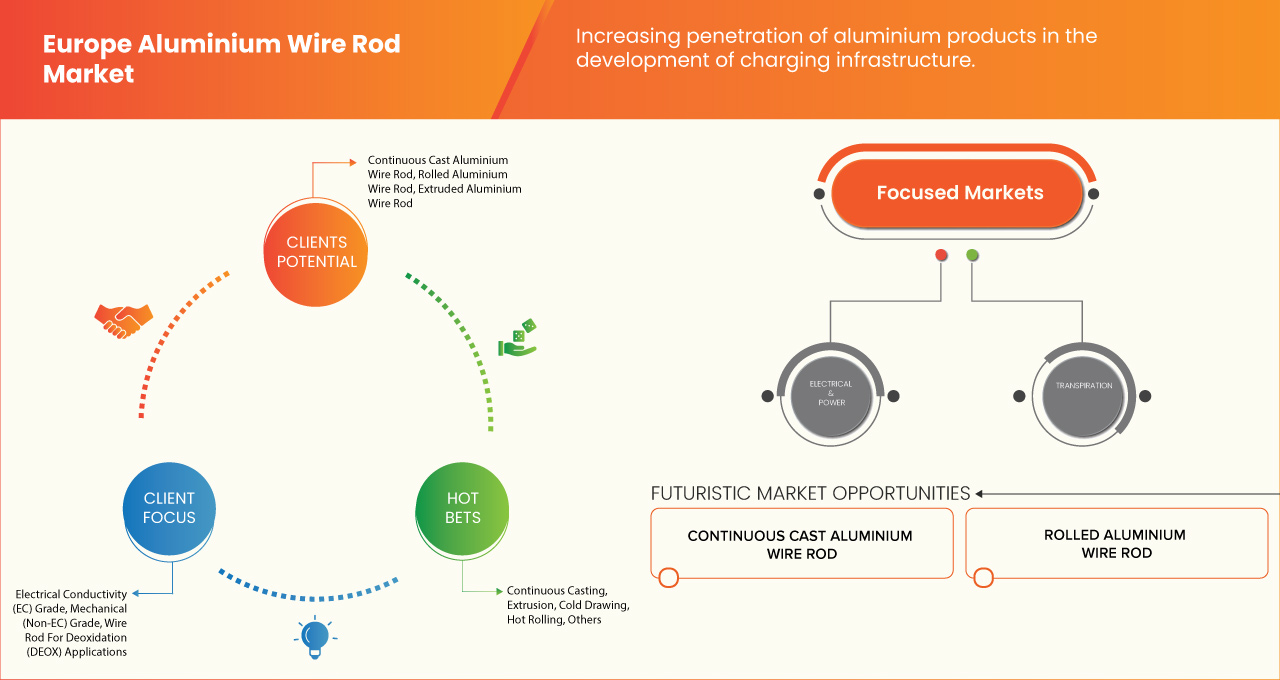

歐洲鋁線材市場按產品類型(連鑄鋁線材、軋製鋁線材、擠壓鋁線材)、按等級(電導率 (EC) 等級、機械(非 EC)等級、脫氧 (DEOX) 用線材)、按直徑(9.5 毫米以下、5 毫米 - 12 毫米、12毫米以上)、按加工方式(連鑄、擠壓、冷拔、熱軋、其他)、按應用(電力、工業製造、交通運輸、其他)、按最終用途(能源與公用事業、電信、汽車、航空航天與國防、建築與施工、工業機械與設備、其他)劃分 – 產業趨勢及預測(至 2035 年)

鋁線材市場分析

鋁線材市場受到電力傳輸、汽車和建築行業不斷增長的需求的推動。隨著對再生能源和電網擴張的投資不斷增加,對高效電導體的需求推動了市場成長。以中國和印度為首的亞太地區因工業化和基礎設施發展而佔據主導地位。主要參與者專注於輕質、高導電性合金以提高性能。然而,鋁價波動和供應鏈中斷帶來了挑戰。在技術進步和全球向節能解決方案轉變的推動下,市場預計將穩定成長。

鋁線材市場規模

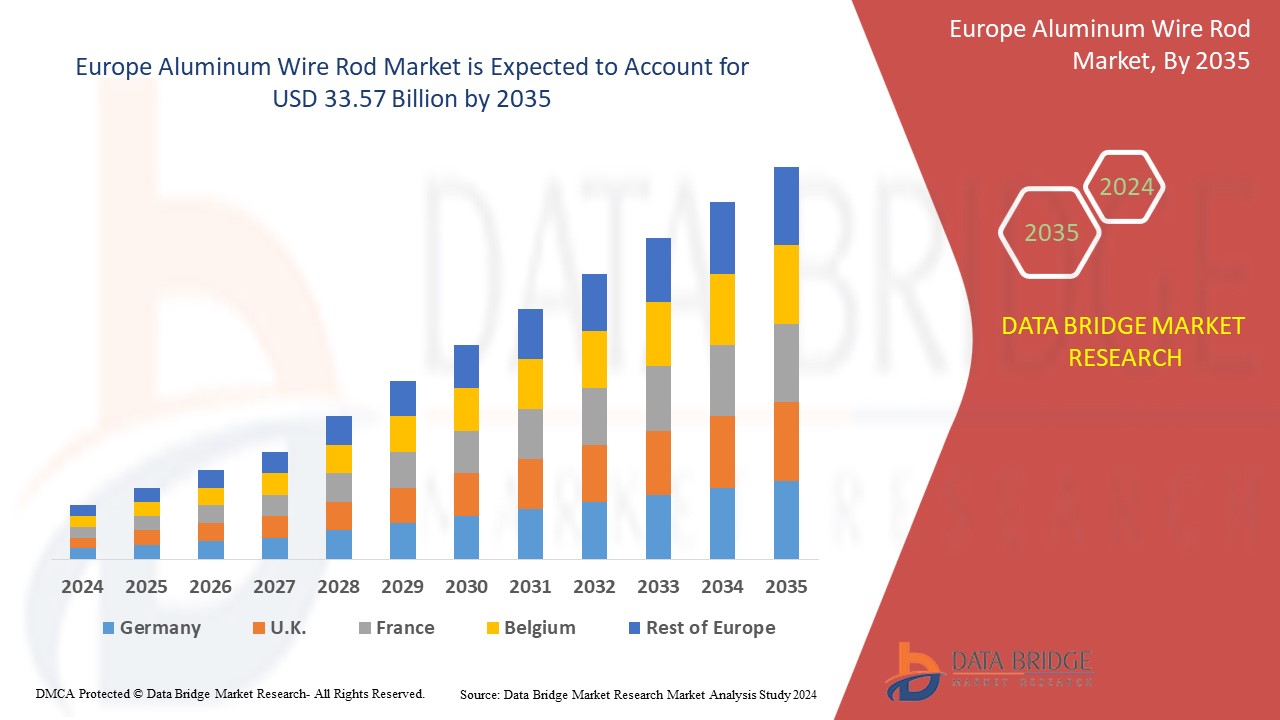

歐洲鋁線材市場預計將從 2024 年的 186.2 億美元增至 2035 年的 335.7 億美元,在 2025 年至 2035 年的預測期內,複合年增長率將大幅增長 5.6%。除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的見解外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。

鋁線材市場趨勢

鋁線材市場正在經歷一些關鍵趨勢,包括電力傳輸和汽車行業對輕質和高導電材料的需求不斷增加。隨著城市基礎設施項目的不斷擴大,向再生能源和智慧電網的轉變正在推動經濟成長。隨著企業注重環保生產,回收和永續發展計畫越來越受到關注。高強度鋁合金技術的進步提高了效率和耐用性。然而,原材料價格波動和供應鏈中斷造成的市場波動仍然是挑戰。總體來看,產業正在走向創新和永續成長。

報告範圍和鋁線材市場細分

|

屬性 |

鋁線材關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

法國、德國、義大利、英國、西班牙、俄羅斯、荷蘭、波蘭、比利時、瑞士、丹麥、挪威、瑞典、土耳其、歐洲其他地區 |

|

主要市場參與者 |

Hindalco Industries Ltd.(印度)、Norsk Hydro ASA(挪威)、Alcoa Corporation(美國)、TRIMET Aluminium SE(德國)、RusAL(俄羅斯)、Hellenic Cables(希臘)、Vimetco NV(荷蘭)、Scepter Inc(美國)、Lamifil(比利時)、JSC“Zaws)、JSC“Zlit)(俄羅斯) Cable(土耳其)等 |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

鋁線材市場定義

鋁線材是由鋁及其合金製成的半成品,主要用於電氣、汽車和建築業。透過連鑄連軋或擠壓生產,它是製造電纜、導體和焊絲的關鍵材料。它重量輕、導電性高、耐腐蝕,是電力傳輸和配電應用的理想選擇。鋁線棒有各種等級,符合行業標準,確保耐用性和效率。對節能解決方案和再生電網的需求不斷增長,並持續推動市場成長。

鋁線材市場動態

驅動程式

電力電纜和架空導線對鋁線材的需求不斷增長

架空導線是將電能從導線的一端輸送到另一端的物理介質,是熱的良好導體,是架空導線和地下電力輸配電系統的重要組成部分。電力電纜中使用的導體是根據可用的不同類型和尺寸的導體來選擇的。理想的導體具有最大的電導率、高抗拉強度,並能承受機械應力等特性。它的比重最小,且易於取得且成本低廉。

電力電纜配有鋁棒連接器,具有任何導體都具備的各種特性,例如,電流直徑更大,從而減少電暈,導電性更低,抗拉強度更小,並且比銅等其他金屬的抗拉強度更低。因此,由於鋁金屬所具有的各種特性,歐洲各地對鋁金屬電纜的需求量很大。鋁產品用於電力電纜;它們能更好地抵禦天氣和化學物質的侵蝕,並防止腐蝕。

鋁線材現在更加受關注,因為各行各業都需要更多的動力和更低成本的材料;它們是良好的熱導體,並且需要的維護較少。

例如,2022年2月,Elcowire宣布收購KME在德國的棒材和線材業務。此次收購是為了使其生產能力翻倍。該公司將能夠擁有更大的員工隊伍

因此,電力電纜和架空導線對鋁線材的需求龐大,有助於做出更好的決策,從而有望推動歐洲鋁線材市場的成長。

提高鋁產品在充電基礎建設的滲透率

The world of charging stations for electric vehicles is developing quickly. The incorporation of aluminium extrusions in E-charging stations is one of the most useful solutions. The charging stations are being developed in various European countries due to hydro eco-design methodology. The methodology has been introduced to manufacture products with the latest sustainability standard. The light-weighting of aluminium is one of the most effective ways to improve the energy efficiency of electric and hybrid vehicles. Light cars need less electricity to travel the same distance. The modular aluminium solutions for electric vehicle packs can lower production and operations costs and offer maximum design flexibility.

For instance, In September 2021, according to an article by ET Times, it was announced that the U.K. government had pledged £440m to improve the infrastructure around electric vehicles, local authorities devised plans for Clean Air Zones, and the Plug-In Car Grant attracted new buyers to the electric car market every month, which could help the aluminium wire rod business According to a survey conducted by autostat, the Europe public charging infrastructure comprises 285,496 publicly accessible charging points and has been growing immensely over the years.

As per the above instances, Europe has many charging stations and is growing immensely due to a proper resource management system. This is expected to act as a driving factor for the Europe aluminium wire rod.

Opportunities

Increase in Various Strategic Decisions such as Partnerships and Mergers

The strategic partnership helps both companies to work for the desired goal. As the marketplace is changing and evolving, customers are consistently looking for newly developed products. By forming a strategic partnership, companies can understand the market well before entering, which will assist in targeting potential customers and expanding their network in the market. Few market leaders in electronic components are signing an agreement to work with continuous process improvement by making the best use of advanced technology to meet the users' needs in the market. Therefore, the companies can increase their brand awareness and broaden their product line with all advanced instruments and solutions. Hence, a rise in partnerships and mergers among market players is expected to foster the market's growth.

For instance, In May 2022, Midal Cables Ltd announced a partnership between Imerys' Al Zayani, Yellow Door Energy, and Midal to install a solar power plant in Bahrain. The partnership will help the companies to increase solar energy production. This will help the company increase its profit margin and diversify its energy portfolio solutions

These strategic partnerships or mergers can result in technological advancement and improved product portfolios for involved parties. This may give companies a cutting edge or an opportunity in a highly competitive Europe market.

Technological Advancements in Alloy Development

Innovations in aluminium alloys are enhancing material properties such as conductivity, strength, corrosion resistance, and durability, making wire rods more suitable for a broader range of applications. These advancements enable aluminium wire rods to compete more effectively with alternative materials, such as copper, in industries where performance and efficiency are critical. One key area of development is high-conductivity aluminium alloys, which improve electrical transmission efficiency while maintaining the lightweight benefits of aluminium. This makes them particularly valuable for power grids, renewable energy infrastructure, and electric vehicle (EV) wiring, where energy efficiency and sustainability are major concerns. As governments and industries push for energy transition and decarbonization, the demand for such advanced alloys is expected to rise, driving new opportunities for aluminium wire rod manufacturers.

In the automotive and aerospace sectors, the development of high-strength aluminium alloys is expanding the use of aluminium wire rods in lightweight structural components and electrical systems. As industries prioritize weight reduction for fuel efficiency and lower emissions, advanced aluminium alloys provide an ideal solution, further increasing demand.

In addition to above, improvements in alloy processing techniques, such as grain refinement and nanostructured alloys, are enhancing the mechanical properties of aluminium wire rods. These innovations enable manufacturers to produce superior-quality wire rods with greater reliability, reducing material wastage and production costs.

For instance, The offshore wind industry in Scotland has benefited from the development of corrosion-resistant aluminium alloys, which extend the lifespan of electrical components exposed to harsh marine environments. Specialised aluminium wire rods with enhanced anti-corrosion properties are now being used in cable connections, supporting the growth of offshore renewable energy projects

With continuous research and development in alloy formulations, European aluminium wire rod manufacturers have the opportunity to differentiate their products, expand into high-performance applications, and strengthen their position in both domestic and international markets.

Restraints/Challenges

Potential Risks Associated with Aluminium Wiring

The potential risks associated with aluminum wiring pose significant challenges for the Europe aluminum wire rod market, impacting its adoption and market perception. One of the primary concerns is the inherent property of aluminum to oxidize when exposed to air, leading to the formation of a resistive layer on the wire surface. This oxidation can result in poor electrical connections, increased resistance, and overheating, raising safety concerns such as fire hazards. These risks have historically deterred industries, particularly in residential and commercial construction, from fully embracing aluminum wiring, despite its cost advantages over copper.

Another challenge lies in the mechanical properties of aluminum. Compared to copper, aluminum is more prone to creep and fatigue under mechanical stress, which can cause connections to loosen over time. This necessitates the use of specialized connectors, installation techniques, and regular maintenance, increasing the overall cost and complexity of using aluminum wire rods. For manufacturers, this means investing in research and development to create improved alloys and coatings that mitigate these risks, adding to production costs.

Furthermore, the lingering stigma from past incidents involving aluminum wiring continues to affect market confidence. Educating end-users and stakeholders about the advancements in aluminum wire rod technology and its safe application is essential but challenging. Overcoming these perceptions requires significant effort in marketing, certification, and collaboration with regulatory bodies to establish trust.

For instance, Aluminum's tendency to creep under mechanical stress has been a significant issue in electrical applications. In industrial settings where vibrations are common, aluminum wiring connections have been known to loosen over time, leading to arcing and potential fire risks. This has forced industries to adopt more expensive and complex installation methods, such as using specialized connectors and anti-oxidant pastes, increasing overall costs

Collectively, these risks create barriers to the widespread adoption of aluminum wire rods in Europe, challenging manufacturers to innovate while addressing safety and reliability concerns to remain competitive in the market.

Rise in Dependency of Manufacturers on Different Suppliers

Different aluminium components such as wires, cables, and rods are required to manufacture electrical devices and build charging infrastructure. Consumer demand for advanced devices has raised the requirement for aluminium products. Manufacturing companies mostly get these components such as ICs, semiconductors, PCBs, and others from their supplier as they mostly give those discounts and provide the products in bulk. COVID-19 has disrupted the global supply chain of several electronic companies.

歐洲鋁線材的供應鏈始於原料的收集、製造和組裝,將固態材料轉化為液態材料,將鋁塑造成線材形狀。供應鏈分析的下一階段是根據各行業的要求將棒材、電線和電纜等材料轉移到各個行業。

供應鏈中最重要的階段是涵蓋市場,將產品分銷給各個零售商和消費者。由於鋁產品具有高度可持續性且可用於電源等各種連接,因此對鋁線材的需求日益增加。供應鏈對任何製造商來說都是最重要的部分,因為它在將成品運送給消費者的過程中發揮著重要作用。

例如,2021年3月,AMAG Austria Metall AG獲得了IATF 16949:2016證書。此認證適用於生產鋁和鋁合金壓延產品。此認證將使公司的產品在市場上獲得認可。對於新創公司來說,與經過認證的製造商一起生產合金是件很困難的事。因此,這可能會對市場產生挑戰

因此,製造商對不同供應商的依賴預計將對歐洲鋁線材市場構成挑戰。

原材料短缺和運輸延誤的影響和當前市場情勢

Data Bridge Market Research 提供高水準的市場分析,並透過考慮原材料短缺和運輸延遲的影響和當前市場環境來提供資訊。這意味著評估策略可能性、制定有效的行動計劃並協助企業做出重要決策。

除了標準報告外,我們還提供對採購層面的深入分析,包括預測運輸延遲、按地區劃分的經銷商映射、商品分析、生產分析、價格映射趨勢、採購、類別績效分析、供應鏈風險管理解決方案、高級基準測試以及其他採購和戰略支援服務。

經濟放緩對產品定價和供應的預期影響

當經濟活動放緩時,各行各業就開始受到影響。 DBMR 提供的市場洞察報告和情報服務考慮了經濟衰退對產品定價和可及性的預測影響。透過這種方式,我們的客戶通常可以領先競爭對手一步,預測他們的銷售額和收入,並估算他們的盈虧支出。

鋁線材市場範圍

市場根據產品種類、等級、直徑、加工、應用進行細分。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場來源。

歐洲鋁線材市場(依產品類型)

- 連鑄鋁線材

- 軋製鋁線材

- 擠壓鋁線材

歐洲鋁線材市場(依等級)

- 電導率(Ec)等級

- 電導率 (Ec) 等級,依等級

- 高純度鋁(99.5%以上)

- 高純度鋁(99.5%以上),依等級

- 1350 EC 鋁線材

- 1370 EC 鋁線材

- 其他高導電性等級

- 合金 Ec 級棒材

- 合金 Ec 級棒材(依等級)

- 6101鋁線材

- 6201鋁線材

- 合金 Ec 級棒材(依等級)

- 機械(非EC)等級

- 機械(非 EC)等級,依等級

- 5005鋁線材

- 5052鋁線材

- 8176鋁線材

- 6xxx系列機械桿

- 機械(非 EC)等級,依等級

- 脫氧(Deox)應用線材

- 脫氧(Deox)用盤條(依等級)

- 原鋁脫氧棒

- 再生鋁脫氧棒

- 脫氧(Deox)用盤條(依等級)

- 電導率 (Ec) 等級,依等級

歐洲鋁線材市場(依直徑)

- 9.5毫米以下

- 5毫米-12毫米

- 12毫米以上

歐洲鋁線材市場,依加工方式

- 連鑄

- 擠壓

- 冷拔

- 熱軋

- 其他的

歐洲鋁線材市場(按應用)

- 電氣與電力

- 電氣和電力,按應用

- 架空導線

- 架空導線(依用途)

- 加氣混凝土

- 航空發動機控制協會

- AAAC

- 鋼芯鋁絞線

- 架空導線(依用途)

- 變壓器繞組

- 地下電力電纜

- 母線和開關設備組件

- 其他的

- 架空導線

- 電氣和電力,按應用

- 工業與製造業

- 工業和製造業,按應用

- 焊絲

- 機械零件

- 鋁網

- 脫氧(Deox)應用線材

- 其他的

- 工業和製造業,按應用

- 運輸

- 運輸,按應用

- 汽車線束

- 電動車 (Ev) 零件

- 鐵路和地鐵應用

- 其他的

- 運輸,按應用

- 其他的

歐洲鋁線材市場(依最終用途劃分)

- 能源與公用事業

- 電信

- 汽車

- 航空航太與國防

- 建築施工

- 工業機械與設備

- 其他的

歐洲鋁線材市場(按國家)

- 法國

- 德國

- 義大利

- 英國

- 西班牙

- 俄羅斯

- 荷蘭

- 波蘭

- 比利時

- 瑞士

- 丹麥

- 挪威

- 瑞典

- 火雞

- 歐洲其他地區

鋁線材市場區域分析

對市場進行分析,並根據產品類型、類型、形式、來源、功能、最終用途和應用提供六個值得注意的部分,如上文參考。

市場涵蓋的國家包括法國、德國、義大利、英國、西班牙、俄羅斯、荷蘭、波蘭、比利時、瑞士、丹麥、挪威、瑞典、土耳其、歐洲其他地區

The highest growing country in the Europe Aluminium Wire Market is France due to increasing demand in industries like automotive, construction, and electrical. The country benefits from advanced manufacturing technologies, strong infrastructure, and a shift towards sustainable, lightweight materials for various applications.

France is dominating the European aluminium wire rod market due to its robust industrial base, technological advancements, and strong demand from sectors like automotive, construction, and electrical. The country’s established infrastructure, skilled workforce, and emphasis on sustainability and energy efficiency contribute significantly to its leadership in the market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of U.S. brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Aluminum Wire Rod Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Source dominance. The above data points provided are only related to the companies' focus related to market.

Aluminum Wire Rod Market Leaders Operating in the Market Are:

- Hindalco Industries Ltd. (India)

- Norsk Hydro ASA (Norway)

- Alcoa Corporation (United States)

- TRIMET Aluminium SE (Germany)

- RusAL (Russia), Hellenic Cables (Greece)

- Vimetco NV (Netherlands)

- Scepter Inc (United States)

- Lamifil (Belgium)

- JSC “Zvetlit” (Belarus)

- Esal Rod Alloys, S.A. (Spain)

- NPA Skawina (Poland)

- Emta Cable (Turkey)

Latest Developments in Aluminum Wire Rod Market

- In March 2021, Norsk Hydro ASA has decide to launch a plant with an ambition of total primary production in Norway to reduce cost and increase the production capacity. The launch will help the company to utilise their resources according to the demand of market.

- In September 2023, Hindalco Industries Limited, an aluminium rolling and recycling company, has partnered with Italy’s Metra SpA, a leader in aluminium extrusions. This collaboration aims to develop advanced aluminium extrusion and fabrication technologies for high-speed rail coaches in India, supporting the Indian Government’s vision to boost domestic manufacturing. By combining Hindalco’s expertise in aluminium with Metra’s advanced technology in extrusion, machining, and welding, this partnership will bring world-class technology—currently limited to Europe, China, Japan, and a few other countries—to India, aiding the modernization of Indian Railways.

- In August 2023, Hindalco has formed a strategic alliance with Texmaco Rail & Engineering Ltd., a specialized engineering firm, to develop and manufacture aluminium rail wagons and coaches. This collaboration aims to help Indian Railways meet its emission targets and enhance operational efficiency. In this partnership, Hindalco will provide its advanced aluminium alloys, including profiles, sheets, and plates, along with fabrication and welding expertise. The company's aluminium freight rake, launched last year, is 180 tonnes lighter, offers a 19% higher payload-to-tare weight ratio, and is energy-efficient with minimal wear and tear. Texmaco, with 80 years of experience in manufacturing freight cars, will contribute its design expertise, set up the production facility, and manage production and skilled workforce.

- In January 2021, Emta Cable was awarded with certificate ISO 9001:2015 for manufacture of all aluminium products quality. This certification will help the company to diversify their product portfolio with best possible quality. This will help the company to increase its brand value.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 PRODUCTION CAPACITY OUTLOOK

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATIONS

4.5.5 CONCLUSION

4.6 COMPETITIVE ANALYSIS: ALUMINIUM WIRE RODS/CABLES VS COPPER WIRE ROD/CABLES

4.6.1 KEY PLAYERS IN THE ALUMINIUM AND COPPER WIRE ROD/CABLE MARKET

4.6.2 TECHNICAL COMPARISON OF ALUMINIUM VS. COPPER WIRE RODS/CABLES

4.6.3 INDUSTRY-SPECIFIC DEMAND TRENDS IN EUROPE

4.6.4 COMPETITIVE POSITIONING AND MARKET SHARE IN EUROPE

4.6.5 FUTURE MARKET TRENDS AND GROWTH DRIVERS

4.6.6 CONCLUSION

4.7 IMPORT ANALYSIS

4.7.1 IMPORT VOLUME OF ALUMINIUM WIRE ROD INTO EUROPE

4.7.1.1 APPLICATIONS AND DEMAND DRIVERS

4.7.1.2 TRADE DYNAMICS AND GEOPOLITICAL FACTORS

4.7.1.3 OUTLOOK AND STRATEGIC CONSIDERATIONS

4.7.2 MAJOR IMPORTERS

4.7.2.1 MAJOR IMPORTING COUNTRIES IN EUROPE

4.7.2.1.1 GERMANY

4.7.2.1.2 FRANCE

4.7.2.1.3 U.K.

4.7.2.1.4 ITALY

4.7.2.1.5 SPAIN AND EASTERN EUROPE (POLAND, HUNGARY, CZECH REPUBLIC)

4.7.2.2 KEY SUPPLIERS AND ALTERNATIVE IMPORT SOURCES OF ALUMINIUM WIRE ROD FOR EUROPE

4.7.2.2.1 MALAYSIA

4.7.2.2.2 TURKEY

4.7.2.2.3 INDIA

4.7.2.2.4 BAHRAIN

4.7.2.2.5 OMAN

4.7.2.2.6 EGYPT

4.7.2.2.7 UNITED ARAB EMIRATES

4.7.3 FUTURE OUTLOOK FOR ALUMINUM WIRE ROD IMPORTS IN EUROPE

4.7.3.1 DECLINING DEPENDENCE ON RUSSIAN ALUMINUM

4.7.3.2 THE RISE OF ALTERNATIVE SUPPLIERS

4.7.3.3 TRADE REGULATIONS AND MARKET POLICIES WILL SHAPE IMPORT STRATEGIES

4.7.3.4 GROWTH IN DEMAND FOR SUSTAINABLE AND RECYCLED ALUMINUM

4.7.4 FLUCTUATING RAW MATERIAL AND ENERGY PRICES

4.7.4.1 TECHNOLOGICAL ADVANCEMENTS IN ALUMINUM PROCESSING

4.7.5 FUTURE IMPORT VOLUMES AND MARKET GROWTH EXPECTATIONS

4.7.6 CONCLUSION

4.8 RAW MATERIAL COVERAGE

4.8.1 PRIMARY RAW MATERIALS USED IN ALUMINUM WIRE ROD PRODUCTION

4.8.2 SUPPLY CHAIN AND IMPORT TRENDS

4.8.3 CONCLUSION

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9.4 CONCLUSION

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.10.1 ADVANCEMENTS IN SMELTING AND REFINING TECHNOLOGIES

4.10.2 INNOVATIONS IN CONTINUOUS CASTING AND ROLLING TECHNOLOGIES

4.10.3 SURFACE TREATMENT AND COATING TECHNOLOGIES

4.10.4 RECYCLING AND CIRCULAR ECONOMY INNOVATIONS

4.10.5 INDUSTRY 4.0 AND DIGITALIZATION IN ALUMINUM WIRE ROD PRODUCTION

4.10.6 ADVANCEMENTS IN ALUMINUM WIRE RODS FOR ELECTRICAL AND AUTOMOTIVE APPLICATIONS

4.10.7 CONCLUSION

4.11 VENDOR SELECTION CRITERIA

4.11.1 PRODUCT QUALITY AND COMPLIANCE

4.11.2 RAW MATERIAL SOURCING AND PURITY

4.11.3 MANUFACTURING PROCESS AND TECHNOLOGY

4.11.4 SUPPLY CHAIN RELIABILITY AND LOGISTICS

4.11.5 SUSTAINABILITY AND ENVIRONMENTAL COMPLIANCE

4.11.6 PRICING AND COST COMPETITIVENESS

4.11.7 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR ALUMINIUM WIRE RODS IN POWER CABLES AND OVERHEAD CONDUCTORS

6.1.2 INCREASING PENETRATION OF ALUMINIUM PRODUCTS IN THE DEVELOPMENT OF CHARGING INFRASTRUCTURE

6.1.3 INCREASING NEED FOR ALLOY GRADE WIRES

6.2 RESTRAINTS

6.2.1 HIGH COST OF DIFFERENT TYPES OF ALUMINIUM WIRES

6.2.2 CHANGE IN ECONOMIC AND POLITICAL OUTLOOK

6.3 OPPORTUNITIES

6.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIPS AND MERGERS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN ALLOY DEVELOPMENT

6.4 CHALLENGES

6.4.1 POTENTIAL RISKS ASSOCIATED WITH ALUMINIUM WIRING

6.4.2 RISE IN DEPENDENCY OF MANUFACTURERS ON DIFFERENT SUPPLIERS

7 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CONTINUOUS CAST ALUMINIUM WIRE ROD

7.3 ROLLED ALUMINIUM WIRE ROD

7.4 EXTRUDED ALUMINIUM WIRE ROD

8 EUROPE ALUMINIUM WIRE ROD MARKET, BY GRADE

8.1 OVERVIEW

8.2 ELECTRICAL CONDUCTIVITY (EC) GRADE

8.2.1 ELECTRICAL CONDUCTIVITY (EC) GRADE, BY GRADE

8.2.1.1 HIGH-PURITY ALUMINIUM (99.5%+), BY GRADE

8.2.1.2 ALLOYED EC GRADE RODS, BY GRADE

8.3 MECHANICAL (NON-EC) GRADE

8.3.1 MECHANICAL (NON-EC) GRADE, BY GRADE

8.4 WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS

8.4.1 WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS, BY GRADE

9 EUROPE ALUMINIUM WIRE ROD MARKET, BY DIAMETER

9.1 OVERVIEW

9.2 BELOW 9.5 MM

9.3 5 MM - 12 MM

9.4 ABOVE 12 MM

10 EUROPE ALUMINIUM WIRE ROD MARKET, BY PROCESSING

10.1 OVERVIEW

10.2 CONTINUOUS CASTING

10.3 EXTRUSION

10.4 COLD DRAWING

10.5 HOT ROLLING

10.6 OTHERS

11 EUROPE ALUMINIUM WIRE ROD MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ELECTRICAL & POWER

11.2.1 ELECTRICAL & POWER, BY APPLICATION

11.2.1.1 OVERHEAD CONDUCTORS, BY APPLICATION

11.3 INDUSTRIAL & MANUFACTURING

11.3.1 INDUSTRIAL & MANUFACTURING, BY APPLICATION

11.4 TRANSPORTATION

11.4.1 TRANSPORTATION, BY APPLICATION

11.5 OTHERS

12 EUROPE ALUMINIUM WIRE ROD MARKET, BY END-USE

12.1 OVERVIEW

12.2 ENERGY & UTILITIES

12.3 TELECOMMUNICATIONS

12.4 AUTOMOTIVE

12.5 AEROSPACE & DEFENSE

12.6 BUILDING & CONSTRUCTION

12.7 INDUSTRIAL MACHINERY & EQUIPMENT

12.8 OTHERS

13 EUROPE ALUMINIUM WIRE ROD MARKET, BY COUNTRIES

13.1 EUROPE

13.1.1 FRANCE

13.1.2 GERMANY

13.1.3 ITALY

13.1.4 U.K.

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 NETHERLANDS

13.1.8 POLAND

13.1.9 BELGIUM

13.1.10 SWITZERLAND

13.1.11 DENMARK

13.1.12 NORWAY

13.1.13 SWEDEN

13.1.14 TURKEY

13.1.15 REST OF EUROPE

14 EUROPE ALUMINIUM WIRE ROD MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 NORSK HYDRO ASA

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 TRIMET ALUMINIUM SE

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 HINDALCO INDUSTRIES LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 ALCOA CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 HELLENIC CABLES

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 EMTA CABLE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 ESAL ROD ALLOYS, S.A.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 JSC "ZVETLIT"

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 LAMIFIL

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 NPA SKAWINA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 RUSAL

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 SCEPTER INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 VIMETCO NV

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

表格列表

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 4 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 5 EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD/KG)

TABLE 6 EUROPE ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 7 EUROPE ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 8 EUROPE HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 9 EUROPE ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 10 EUROPE MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 11 EUROPE WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 12 EUROPE ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 13 EUROPE ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 14 EUROPE ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 15 EUROPE ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 16 EUROPE OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 17 EUROPE INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 18 EUROPE TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 19 EUROPE ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 20 EUROPE ALUMINIUM WIRE ROD MARKET, BY COUNTRY, 2018-2035 (USD THOUSAND)

TABLE 21 EUROPE ALUMINIUM WIRE ROD MARKET, BY COUNTRY, 2018-2035 (TONS)

TABLE 22 FRANCE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 23 FRANCE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 24 FRANCE ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 25 FRANCE ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 26 FRANCE HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 27 FRANCE ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 28 FRANCE MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 29 FRANCE WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 30 FRANCE ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 31 FRANCE ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 32 FRANCE ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 33 FRANCE ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 34 FRANCE OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 35 FRANCE INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 36 FRANCE TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 37 FRANCE ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 38 GERMANY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 39 GERMANY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 40 GERMANY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 41 GERMANY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 42 GERMANY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 43 GERMANY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 44 GERMANY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 45 GERMANY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 46 GERMANY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 47 GERMANY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 48 GERMANY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 49 GERMANY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 50 GERMANY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 51 GERMANY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 52 GERMANY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 53 GERMANY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 54 ITALY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 55 ITALY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 56 ITALY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 57 ITALY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 58 ITALY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 59 ITALY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 60 ITALY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 61 ITALY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 62 ITALY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 63 ITALY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 64 ITALY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 65 ITALY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 66 ITALY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 67 ITALY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 68 ITALY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 69 ITALY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 70 U.K. ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 71 U.K. ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 72 U.K. ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 73 U.K. ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 74 U.K. HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 75 U.K. ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 76 U.K. MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 77 U.K. WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 78 U.K. ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 79 U.K. ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 80 U.K. ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 81 U.K. ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 82 U.K. OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 83 U.K. INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 84 U.K. TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 85 U.K. ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 86 SPAIN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 87 SPAIN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 88 SPAIN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 89 SPAIN ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 90 SPAIN HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 91 SPAIN ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 92 SPAIN MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 93 SPAIN WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 94 SPAIN ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 95 SPAIN ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 96 SPAIN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 97 SPAIN ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 98 SPAIN OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 99 SPAIN INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 100 SPAIN TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 101 SPAIN ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 102 RUSSIA ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 103 RUSSIA ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 104 RUSSIA ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 105 RUSSIA ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 106 RUSSIA HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 107 RUSSIA ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 108 RUSSIA MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 109 RUSSIA WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 110 RUSSIA ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 111 RUSSIA ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 112 RUSSIA ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 113 RUSSIA ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 114 RUSSIA OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 115 RUSSIA INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 116 RUSSIA TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 117 RUSSIA ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 118 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 119 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 120 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 121 NETHERLANDS ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 122 NETHERLANDS HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 123 NETHERLANDS ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 124 NETHERLANDS MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 125 NETHERLANDS WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 126 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 127 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 128 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 129 NETHERLANDS ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 130 NETHERLANDS OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 131 NETHERLANDS INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 132 NETHERLANDS TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 133 NETHERLANDS ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 134 POLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 135 POLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 136 POLAND ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 137 POLAND ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 138 POLAND HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 139 POLAND ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 140 POLAND MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 141 POLAND WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 142 POLAND ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 143 POLAND ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 144 POLAND ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 145 POLAND ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 146 POLAND OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 147 POLAND INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 148 POLAND TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 149 POLAND ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 150 BELGIUM ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 151 BELGIUM ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 152 BELGIUM ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 153 BELGIUM ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 154 BELGIUM HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 155 BELGIUM ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 156 BELGIUM MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 157 BELGIUM WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 158 BELGIUM ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 159 BELGIUM ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 160 BELGIUM ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 161 BELGIUM ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 162 BELGIUM OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 163 BELGIUM INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 164 BELGIUM TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 165 BELGIUM ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 166 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 167 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 168 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 169 SWITZERLAND ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 170 SWITZERLAND HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 171 SWITZERLAND ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 172 SWITZERLAND MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 173 SWITZERLAND WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 174 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 175 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 176 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 177 SWITZERLAND ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 178 SWITZERLAND OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 179 SWITZERLAND INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 180 SWITZERLAND TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 181 SWITZERLAND ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 182 DENMARK ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 183 DENMARK ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 184 DENMARK ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 185 DENMARK ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 186 DENMARK HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 187 DENMARK ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 188 DENMARK MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 189 DENMARK WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 190 DENMARK ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 191 DENMARK ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 192 DENMARK ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 193 DENMARK ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 194 DENMARK OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 195 DENMARK INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 196 DENMARK TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 197 DENMARK ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 198 NORWAY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 199 NORWAY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 200 NORWAY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 201 NORWAY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 202 NORWAY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 203 NORWAY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 204 NORWAY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 205 NORWAY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 206 NORWAY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 207 NORWAY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 208 NORWAY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 209 NORWAY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 210 NORWAY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 211 NORWAY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 212 NORWAY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 213 NORWAY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 214 SWEDEN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 215 SWEDEN ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 216 SWEDEN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 217 SWEDEN ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 218 SWEDEN HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 219 SWEDEN ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 220 SWEDEN MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 221 SWEDEN WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 222 SWEDEN ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 223 SWEDEN ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 224 SWEDEN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 225 SWEDEN ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 226 SWEDEN OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 227 SWEDEN INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 228 SWEDEN TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 229 SWEDEN ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 230 TURKEY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 231 TURKEY ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

TABLE 232 TURKEY ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 233 TURKEY ELECTRICAL CONDUCTIVITY (EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 234 TURKEY HIGH-PURITY ALUMINIUM (99.5%+) IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 235 TURKEY ALLOYED EC GRADE RODS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 236 TURKEY MECHANICAL (NON-EC) GRADE IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 237 TURKEY WIRE ROD FOR DEOXIDATION (DEOX) APPLICATIONS IN ALUMINIUM WIRE ROD MARKET, BY GRADE, 2018-2035 (USD THOUSAND)

TABLE 238 TURKEY ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2018-2035 (USD THOUSAND)

TABLE 239 TURKEY ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2018-2035 (USD THOUSAND)

TABLE 240 TURKEY ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 241 TURKEY ELECTRICAL & POWER IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 242 TURKEY OVERHEAD CONDUCTORS IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 243 TURKEY INDUSTRIAL & MANUFACTURING IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 244 TURKEY TRANSPORTATION IN ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2018-2035 (USD THOUSAND)

TABLE 245 TURKEY ALUMINIUM WIRE ROD MARKET, BY END-USE, 2018-2035 (USD THOUSAND)

TABLE 246 REST OF EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (USD THOUSAND)

TABLE 247 REST OF EUROPE ALUMINIUM WIRE ROD MARKET, BY PRODUCT TYPE, 2018-2035 (TONS)

图片列表

FIGURE 1 EUROPE ALUMINIUM WIRE ROD MARKET

FIGURE 2 EUROPE ALUMINIUM WIRE ROD MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ALUMINIUM WIRE ROD MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ALUMINIUM WIRE ROD MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ALUMINIUM WIRE ROD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ALUMINIUM WIRE ROD MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE ALUMINIUM WIRE ROD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE ALUMINIUM WIRE ROD MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE ALUMINIUM WIRE ROD MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE ALUMINIUM WIRE ROD MARKET: APPLICATION COVERAGE GRID

FIGURE 11 EUROPE ALUMINIUM WIRE ROD MARKET: SEGMENTATION

FIGURE 12 GROWING DEMAND FOR ALUMINIUM WIRE RODS IN POWER CABLES AND OVERHEAD CONDUCTORS IS EXPECTED TO DRIVE THE EUROPE ALUMINIUM WIRE ROD MARKET IN THE FORECAST PERIOD

FIGURE 13 THE CONTINUOUS CAST ALUMINIUM WIRE ROD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ALUMINIUM WIRE ROD MARKET IN 2025 AND 2035

FIGURE 14 EXECUTIVE SUMMARY

FIGURE 15 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE ALUMINIUM WIRE ROD MARKET

FIGURE 18 EUROPE ALUMINIUM WIRE ROD MARKET: BY PRODUCT TYPE, 2024

FIGURE 19 EUROPE ALUMINIUM WIRE ROD MARKET, BY GRADE, 2024

FIGURE 20 EUROPE ALUMINIUM WIRE ROD MARKET, BY DIAMETER, 2024

FIGURE 21 EUROPE ALUMINIUM WIRE ROD MARKET, BY PROCESSING, 2024

FIGURE 22 EUROPE ALUMINIUM WIRE ROD MARKET, BY APPLICATION, 2024

FIGURE 23 EUROPE ALUMINIUM WIRE ROD MARKET, BY END-USE, 2024

FIGURE 24 EUROPE ALUMINIUM WIRE ROD MARKET

FIGURE 25 EUROPE ALUMINUM WIRE ROD MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。