Europe C Arms Market

市场规模(十亿美元)

CAGR :

%

USD

2.34 Billion

USD

3.45 Billion

2024

2032

USD

2.34 Billion

USD

3.45 Billion

2024

2032

| 2025 –2032 | |

| USD 2.34 Billion | |

| USD 3.45 Billion | |

|

|

|

|

Europe C-Arms Market Segmentation, By Type (Mobile C-Arms, and Fixed C-Arms), Technology (Image Intensifiers, and Flat Panel), Model Type (Floor Mounted, Ceiling Mounted), Application (Orthopedic and Trauma Surgeries, Cardiovascular Surgeries, Neuro Surgeries, Gastrointestinal Surgeries, Urology, Pain Management, General Surgery, and Others) End-User (Hospital, Diagnostic Centres, Speciality Clinics, and ssOthers) - Industry Trends and Forecast to 2032

Europe C-Arms Market Size

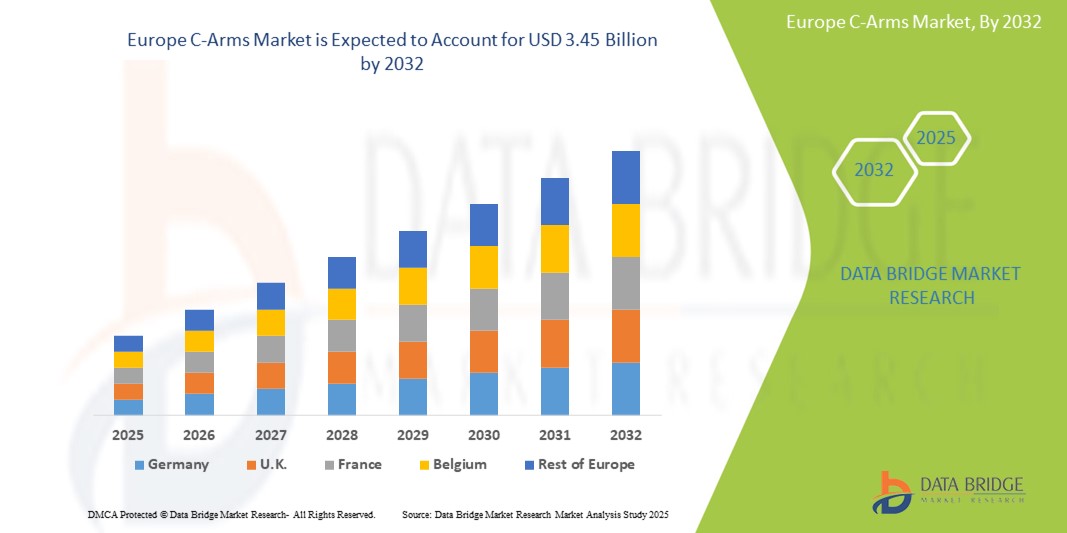

- The Europe C-Arms market size was valued atUSD 2.34 billion in 2024and is expected to reachUSD 3.45 billion by 2032, at aCAGR of 5.00%during the forecast period

- This growth is driven by factors such as the increasing prevalence of chronic diseases, rising demand for minimally invasive surgeries, advancements in imaging technologies, and growing geriatric population across Europe

Europe C-Arms Market Analysis

- The Europe C-Arms market is witnessing steady growth due to increasing preference for real-time imaging systems that enhance surgical precision and reduce operation time across various medical procedures

- Surgeons and healthcare providers are increasingly adopting these systems for better intraoperative visualization, improving patient outcomes and streamlining workflow in operating rooms

- Germany is expected to dominate the Europe C-Arms market due to its well-established healthcare infrastructure

- Turkey is expected to be the fastest growing region in the Europe C-Arms market during the forecast period due to increasing healthcare investments and infrastructure development

- The cardiovascular surgeries segment is expected to dominate the Europe C-Arms market with the largest in 2025 due to the increasing prevalence of cardiovascular diseases and the growing demand for minimally invasive procedures. C-arms provide real-time imaging, allowing surgeons to perform precise interventions such as angioplasties and stent placements with enhanced accuracy. The use of C-arms in these procedures significantly reduces the need for large incisions, promoting faster recovery times and better patient outcomes.

Report Scope and Europe C-Arms Market Segmentation

|

Attributes |

Europe C-Arms Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe C-Arms Market Trends

“Advancement of Imaging Technologies in C-Arms Market”

- The Europe C-arms market is experiencing a significant trend toward the integration of advanced imaging technologies that enhance real-time visualization during surgical procedures

- Healthcare providers are increasingly adopting mobile C-arms equipped with flat-panel detectors to improve image quality and reduce radiation exposure for both patients and medical staff

- Technological innovation is focusing on digital advancements that allow for seamless image sharing, remote consultation, and better workflow efficiency within hospitals and diagnostic centers

- Manufacturers are prioritizing the development of user-friendly interfaces and AI-based imaging tools to assist surgeons with precision and faster decision-making during complex surgeries

- There is a growing shift toward hybrid operating rooms where advanced C-arms play a critical role in enabling minimally invasive surgeries by offering high-resolution intraoperative imaging

- For instance, many hospitals in Germany have recently upgraded to digital flat-panel C-arms, which are proving essential in orthopedic and cardiovascular procedures due to their accuracy and real-time imaging capabilities

- In conclusion, the trend toward advanced imaging in C-arms is transforming surgical precision and efficiency across healthcare settings in Europe

Europe C-Arms Market Dynamics

Driver

“Increasing Adoption of Mobile C-Arms”

- Mobile C-arms are gaining traction in Europe due to their flexibility, compactness, and ability to provide high-quality imaging during various procedures

- These devices can be easily transported and positioned around patients, offering dynamic imaging for complex surgeries like orthopedic and cardiovascular procedures

- For instance, hospitals in the U.K. are increasingly using mobile C-arms in orthopedic surgeries to provide real-time, high-definition images, ensuring precision during minimally invasive procedures

- Mobile C-arms with flat-panel detectors deliver superior image quality and reduced radiation exposure, making them essential for environments where radiation safety is crucial, such as in pediatric surgeries

- The mobility of these units streamlines operating room workflows by minimizing patient repositioning, improving surgical efficiency, and reducing operating time

- In conclusion, the adoption of mobile C-arms is driving market growth by providing healthcare providers with effective, adaptable, and safer imaging solutions

Opportunity

“Technological Advancements in Imaging Software”

- The C-arms market in Europe is witnessing significant opportunities driven by technological advancements in imaging software, particularly AI and machine learning integration

- AI algorithms can analyze images faster than human clinicians, providing real-time insights that assist surgeons in making precise, timely decisions during complex surgeries

- For instance, hospitals in France are utilizing AI-enhanced C-arms in spinal surgeries, where rapid image analysis helps guide the surgeon in real-time, ensuring higher precision and better patient outcomes

- The integration of AI-based software also enables automatic image optimization, noise reduction, and contrast enhancement, leading to clearer visuals and lower radiation doses for patients and medical staff

- Advancements in 3D imaging and image-guided surgery allow surgeons to visualize complex structures like bones, blood vessels, and tissues in greater detail, improving accuracy during high-stakes procedures

- In conclusion, these technological innovations present a substantial growth opportunity for manufacturers to develop next-generation C-arm systems that cater to the evolving needs of modern medicine

Restraint/Challenge

“High Initial Cost and Maintenance”

- A major restraint in the growth of the C-arms market in Europe is the high initial cost and ongoing maintenance of C-arm systems

- The financial investment for acquiring advanced C-arm systems, particularly mobile units with features like flat-panel detectors and 3D imaging, can exceed hundreds of thousands of euros, making it difficult for small and medium-sized hospitals to justify the purchase

- For instance, many outpatient clinics in Spain are hesitant to upgrade their outdated C-arm systems due to the substantial upfront costs and competing budget priorities for other essential healthcare needs

- In addition to the initial purchase, the ongoing expenses of maintenance, calibration, and repairs can significantly burden healthcare facilities, especially those operating at high volumes

- This financial challenge restricts the adoption of C-arm systems, particularly in countries with constrained healthcare budgets, creating a need for more cost-effective solutions or financing options

- In conclusion, the high costs of acquisition and maintenance continue to limit the widespread adoption of advanced C-arms, posing a barrier to market growth in certain regions

Europe C-Arms Market Scope

The market is segmented on the basis of type, technology, model type, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

Mobile C-Arms, and Fixed C-Arms |

|

By Technology |

Image Intensifiers, and Flat Panel |

|

By Model Type |

Floor Mounted, and Ceiling Mounted |

|

By Application

|

Orthopedic and Trauma Surgeries, Cardiovascular Surgeries, Neuro Surgeries, Gastrointestinal Surgeries, Urology, Pain Management, General Surgery, and Others |

|

By End User |

Hospital, Diagnostic Centres, Speciality Clinics, and Others |

In 2025, the Cardiovascular Surgeries segment is projected to dominate the market with a largest share in application segment

The cardiovascular surgeries segment is expected to dominate the Europe C-Arms market with the largest in 2025 due to the increasing prevalence of cardiovascular diseases and the growing demand for minimally invasive procedures. C-arms provide real-time imaging, allowing surgeons to perform precise interventions such as angioplasties and stent placements with enhanced accuracy. The use of C-arms in these procedures significantly reduces the need for large incisions, promoting faster recovery times and better patient outcomes.

The Image Intensifiers segment is expected to account for the largest share during the forecast period in technology segment

In 2025, the Image Intensifiers segment is expected to dominate the market with the largest market due to their cost-effectiveness and ability to provide high-quality imaging in various clinical settings. Image intensifiers are widely used in both mobile and fixed C-arms for procedures that require real-time, high-resolution imaging, such as orthopedic, pain management, and vascular surgeries. Their ability to enhance low-light images makes them suitable for environments where clear visualization is crucial.

Europe C-Arms Market Regional Analysis

This dominant position can be attributed to a rise in minimally invasive procedures, increasing demand for advanced imaging technologies, and a surge in strategic initiatives by key market players. For example, in January 2022, Koninklijke Philips N.V. entered into a long-term partnership with Brandenburg an der Havel University Hospital in Germany to enhance diagnostic and therapeutic capabilities through the provision of advanced imaging technologies, including mobile X-ray, ultrasound, and MR systems. Italy is projected to be the fastest-growing country in the Europe C-Arms market over the forecast period. This rapid growth is driven by continuous improvements in healthcare infrastructure and increased adoption of cutting-edge diagnostic technologies. Additionally, Italy’s healthcare system is bolstered by strong support from research institutions and universities focusing on digital diagnostics. In support of this growth, the Italian government announced in 2023 an investment of EUR 136.83 billion into public healthcare infrastructure, aimed at accelerating technological advancement and ensuring broader access to quality treatment options.

“Germany Holds the Largest Share in the Europe C-Arms Market”

- Germany holds a leading position in the European C-Arms market due to its well-established healthcare infrastructure

- The country is experiencing growth in both fixed and mobile C-Arms, with mobile C-Arms being the fastest-growing segment

- Germany’s strong demand for advanced imaging solutions is driven by increasing healthcare requirements and technological advancements

- Leading market players in Germany include top medical imaging companies that provide innovative C-Arms technology

- For instance, the January 2022 partnership between Koninklijke Philips N.V. and Brandenburg an der Havel University Hospital, aimed at enhancing the hospital's diagnostic and therapeutic capabilities through the provision of advanced imaging systems, including mobile X-ray, ultrasound, and MR technologies

- The country’s healthcare providers are investing heavily in advanced imaging equipment for better surgical and diagnostic outcomes

“Italy is Projected to Register the HighestCAGR in the Europe C-Arms Market”

- Italy is projected to register the highest growth rate in the European C-Arms market over the forecast period

- This expansion is fueled by continuous advancements in healthcare infrastructure and the growing adoption of innovative diagnostic solutions

- Italy's healthcare ecosystem is further supported by strong collaboration between research institutions and universities, particularly in the field of digital diagnostics

- Reinforcing this growth trajectory, the Italian government announced in 2023 a public healthcare investment of EUR 136.83 billion, aimed at accelerating technological modernization and improving access to advanced treatment options

Europe C-Arms Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Assing S.p.A (Italy)

- BMI Biomedical International s.r.l. (Italy)

- AADCO Medical, Inc. (U.S.)

- Eurocolumbus s.r.l. (Italy)

- Shimadzu Corporation (Japan)

- ITALRAY (Italy)

- Hologic Inc. (U.S.)

- Villa Sistemi Medicali Spa. (Italy)

- STEPHANIX (Netherlands)

- MS WESTFALIA GMBH (Germany)

- Siemens Healthcare GmbH. (Germany)

- Ziehm Imaging GmbH (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Canon India Pvt Ltd. (Japan)

- EcoRay (South Korea)

- ECOTRON LLC (U.S.)

- GE Healthcare (U.S.)

Latest Developments in Europe C-Arms Market

- In September 2023, Philips extended its mobile C-arm range with the introduction of the Zenition 30. This new system enhances imaging capabilities for complex surgeries by offering advanced technology in a compact design. The Zenition 30 is designed to improve workflow and provide high-quality imaging with reduced radiation exposure, benefiting both healthcare providers and patients

- In March 2023 Ziehm Imaging, Inc. entered into a strategic partnership with NXC Imaging, a leading provider of integrated diagnostic solutions. This collaboration allows NXC Imaging to offer their customers an extensive range of advanced C-arm imaging systems. Through this partnership, NXC will distribute Ziehm Imaging’s diverse C-arm lineup, including the compact Ziehm Solo and the innovative intraoperative Ziehm Vision RFD 3D, aimed at enhancing the quality of imaging during surgical procedures

- In May 2022 Siemens Healthineers formed a partnership with PrecisionOS, a company specializing in virtual reality (VR) surgical training solutions for the medical field. This collaboration focuses on providing VR-based training to technicians and surgeons, enabling them to efficiently practice the use of Siemens Healthineers’ mobile 3D C-arm, the Cios Spin. The VR training aims to improve surgical workflow, enhance intraoperative quality control, and ensure optimal usage of advanced imaging technology

- In April 2022 GE Healthcare and Medtronic, a global leader in medical technology and services, joined forces to address the specific needs and demands of Office-Based Labs (OBLs) and Ambulatory Surgery Centers (ASCs). This partnership offers customers access to a broad range of advanced medical products, financial solutions, and exceptional services, ensuring that healthcare providers have the tools and support required to deliver high-quality care in these specialized settings

- In April 2021 Ziehm Imaging collaborated with Carestream Health, a global provider of medical imaging solutions, to enhance its mobile C-arm offerings. Through this partnership, Carestream expanded its innovative product portfolio by integrating the Ziehm Vision RFD C-arm into its lineup. This addition strengthens Carestream’s mobile and fluoroscopic product offerings, enabling healthcare providers to benefit from advanced, high-performance imaging solutions in a variety of clinical settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。