Europe Fuse Market

市场规模(十亿美元)

CAGR :

%

1.16

1.87

2024

2032

1.16

1.87

2024

2032

| 2025 –2032 | |

| USD 1.16 | |

| USD 1.87 | |

|

|

|

|

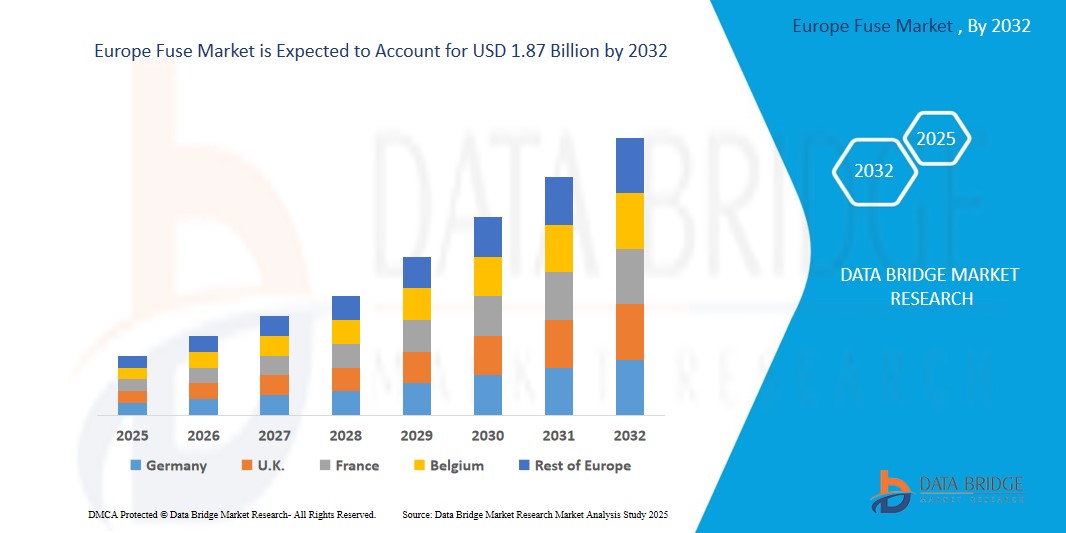

歐洲保險絲市場細分,按類型(電力保險絲及保險絲鏈、管狀及插頭保險絲、配電斷路器等)、電壓(低壓、中壓、高壓)、應用(住宅、商業、工業、公用事業、運輸)、最終用戶(配電、製造、汽車、再生能源等)-產業趨勢及預測(至 2032 年)

保險絲市場規模

- 2024 年歐洲保險絲市場規模為11.6 億美元 ,預計 到 2032 年將達到 18.7 億美元,預測期內 複合年增長率為 5.90%。

- 區域市場擴張主要受工業和住宅領域電氣化程度不斷提高以及風能和太陽能等再生能源日益普及的推動,這些能源都需要可靠的電路保護。

- 此外,包括德國、法國和荷蘭在內的歐洲主要國家電動車(EV)的普及以及對電動車充電基礎設施的需求也極大地促進了對低壓和高壓保險絲的需求增加。

保險絲市場分析

- 保險絲作為電路保護的關鍵部件,在歐洲的工業、商業和住宅領域變得越來越不可或缺。它們在保護電氣系統免受過流、短路和設備損壞方面發揮著重要作用,對於正在進行的數位化和電氣化計劃至關重要。

- 保險絲需求的激增很大程度上是由於歐洲積極推動再生能源整合、電動車(EV)基礎設施的擴張以及對節能建築解決方案的日益重視。這些趨勢需要可靠的電路保護來確保運作安全和系統壽命。

- 英國在歐洲保險絲市場中處於領先地位,到 2025 年其收入份額將達到 40.01%,這得益於智慧電網技術、樓宇自動化和能源現代化計畫的早期採用。強有力的監管支持以及對住宅改造項目和基礎設施升級的強勁投資繼續提振全國範圍內的保險絲需求

- 在預測期內,受城市化進程加快、工業自動化以及電動車生產和普及率激增的推動,德國有望成為歐洲保險絲市場成長最快的國家。政府支持的永續發展目標以及對高速鐵路、再生能源項目和智慧城市的投資預計將擴大對先進保險絲解決方案的需求

- 由於低壓電力在住宅和商業應用中的廣泛使用,預計到 2025 年,低壓電力將佔據市場主導地位,佔 45.0%

報告範圍和保險絲市場細分

|

屬性 |

Fuse Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fuse Market Trends

“Enhanced Convenience Through AI and Voice Integration”

- One of the most prominent trends shaping the Europe Fuse market is the integration of Artificial Intelligence (AI) and voice assistant compatibility with smart home ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. This integration offers enhanced convenience, improved user interaction, and seamless automation capabilities.

- For instance, August Wi-Fi Smart Locks, widely available across European markets, integrate with all major voice platforms, allowing users to unlock or lock their doors using voice commands. Similarly, Level Lock+, available in Apple stores across the UK and Germany, supports Siri and HomeKit for discreet, secure locking.

- AI-backed functionality is becoming a key differentiator. Some Ultraloq models, available in Western Europe, now feature adaptive fingerprint sensors and intelligent alerts based on unusual door behavior—demonstrating the growing demand for proactive and learning-based security systems.

- Brands like WELOCK, which is expanding across Germany and France, now offer AI-integrated Fuses that can auto-lock/unlock based on user presence and support hands-free voice control via Google and Alexa.

- As consumers seek centralized smart home management, Fuses that can integrate with lighting, heating, and surveillance systems are gaining traction, creating a unified smart ecosystem that enhances security and comfort.

Fuse Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- Rising urbanization, coupled with increasing concerns about residential and commercial security, is fueling Fuse adoption across Europe. Countries like the UK, Germany, and France are witnessing a surge in installations, particularly in new-build smart homes and retrofit modernization projects

- In April 2024, Onity (a Honeywell company) announced enhancements to its IoT-based Passport smart lock solution, aiming to improve secure self-storage and residential access control across European markets, including Spain and the Netherlands.

- The DIY smart home trend is particularly strong in the UK and Germany, where consumers prefer affordable, app-controlled Fuses that offer remote access, scheduled locking, and real-time monitoring—convenient features appealing to both tech-savvy users and elderly populations.

- The increasing integration of Fuses with smartphone apps, allowing access customization and visitor logs, has further cemented their relevance in multi-dwelling units, Airbnb rentals, and coworking spaces throughout Europe.

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Despite growing interest, cybersecurity concerns remain a key barrier. As Fuses operate over Wi-Fi and Bluetooth, they are vulnerable to hacking and unauthorized access—prompting hesitation among privacy-conscious European consumers.

- Reports of IoT vulnerabilities in smart locks and related devices have been cited in European Union cybersecurity forums, leading to calls for stricter security regulations and data protection standards.

- Companies such as Level Home and August now emphasize end-to-end encryption and secure biometric authentication, highlighting their commitment to GDPR-compliant security in European advertising campaigns.

- Moreover, premium pricing remains a limiting factor. While entry-level Fuses from brands like Wyze or Yale are affordable, models with advanced features like facial recognition, auto-locking, or integrated cameras often come at a higher price point—deterring cost-sensitive households.

- To address these restraints, European startups and established brands are focusing on affordable product lines without compromising core security, while educating consumers on the benefits of adopting smart security responsibly.

- Overcoming these challenges through enhanced cybersecurity measures, consumer education on security best practices, and the development of more affordable Fuse options will be vital for sustained market growth

Fuse Market Scope

The market is segmented on the basis type, voltage, application, and end user.

By Type

The Europe Fuse market is segmented into Power Fuse & Fuse Link, Cartridge & Plug Fuse, Distribution Cutout, and Others.

Power Fuse & Fuse Link segment holds the largest revenue share in 2025, driven by its extensive deployment in medium and high-voltage networks across Europe’s power grids and industrial setups. Their ability to offer reliable protection for transformers, switchgears, and capacitors supports sustained demand in utilities and manufacturing.

Cartridge & Plug Fuses are expected to witness moderate growth, particularly in residential and small commercial applications, where legacy systems still depend on replaceable fuse solutions. European countries with older building infrastructures, such as Italy and Greece, continue to show stable demand.

The Distribution Cutout segment is projected to grow steadily due to rising rural electrification projects and grid modernization initiatives, especially in Eastern Europe and under EU energy transition programs.

- By Voltage

The market is segmented into Low Voltage, Medium Voltage, and High Voltage.

Low Voltage fuses dominate the market in 2025, attributed to their widespread use in residential, commercial, and low-capacity industrial settings. With increasing installations of smart homes and office buildings in Western Europe, low-voltage protection systems remain essential for consumer electronics, lighting, and HVAC systems.

Medium Voltage fuses are anticipated to register the fastest growth during 2025–2032, fueled by rising investments in renewable energy projects, substations, and smart grid expansion across Germany, France, and the Nordics.

High Voltage fuses continue to find strong application in power transmission and distribution infrastructure, particularly within large-scale utility projects and renewable energy integration into national grids.

- By Application

The Europe Fuse market is segmented into Residential, Commercial, Industrial, Utilities, and Transportation.

Industrial applications lead the market in 2025, owing to stringent safety norms in the EU and heavy use of fuses in machinery, motor protection, and factory automation systems. Germany, the UK, and Italy are key contributors due to robust manufacturing sectors.

The Utilities segment is expected to grow significantly, driven by Europe’s focus on upgrading electrical infrastructure, grid reliability, and the transition to decentralized renewable power generation.

Transportation applications are also expanding, supported by the electrification of railways and public transport, as well as the increasing adoption of electric vehicles (EVs) requiring reliable fuse protection in charging infrastructure.

- By End User

The market is divided into Power Distribution, Manufacturing, Automotive, Renewable Energy, and Others.

Power Distribution is the leading end-user segment, reflecting ongoing investment in modernizing electrical grids, transformer protection, and distribution substations. The EU’s climate targets are catalyzing smart grid projects across countries like France and Spain.

Automotive is one of the fastest-growing segments, driven by Europe’s rapid EV adoption and the increasing integration of electronics in vehicles. Fuses play a critical role in battery management systems, inverters, and onboard chargers.

Renewable Energy is emerging as a key growth area, as wind and solar projects across the region demand high-performance protection solutions to ensure system stability and operational safety.

- By Application

On the basis of application, the Fuse market is segmented into commercial, residential, industrial, government institution, and others. The residential segment accounted for the largest market revenue share in 2024, driven by the increasing adoption of smart home ecosystems, rising awareness about home security, and the convenience of remote locking/unlocking. Real estate developments and the boom in short-term rentals also encourage adoption.

The commercial segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing need for centralized security, employee access control, and audit trails. Businesses benefit from keyless solutions that can be managed remotely, offering flexibility for multiple users and locations.

Fuse Market Regional Analysis

- The Europe Fuse market is projected to witness robust growth throughout the forecast period, driven by stringent building codes, security regulations, and a growing demand for energy-efficient smart technologies.

- Urbanization across Europe, especially in Western and Northern Europe, is increasing the demand for smart and connected home devices like Fuses in residential complexes, offices, and multi-tenant buildings.

- The region also sees rising retrofit installations, as older buildings undergo smart upgrades, with Fuses integrated into broader home automation and access control systems.

- European consumers are particularly focused on privacy, low-energy consumption, and data protection, leading to growing demand for locally compliant, secure, and encrypted Fuse solutions.

- Government initiatives such as the EU Smart Readiness Indicator and various green building standards are also contributing to Fuse adoption in both public and private infrastructure projects

U.K. Fuse Market Insight

The U.K. Fuse market is poised for significant growth during the forecast period, supported by:

- High penetration of smart home technology, driven by consumer appetite for connected living and a rising number of multi-dwelling residential units.

- Concerns around home break-ins and security threats are encouraging consumers to adopt keyless entry solutions and Fuses with remote monitoring capabilities.

- Government incentives and growing demand for accessible smart home solutions are driving sales in both the residential and hospitality sectors.

- The country's mature e-commerce infrastructure also fuels demand for DIY Fuse products, enabling broad consumer access to advanced locking technologies.

Germany Fuse Market Insight

The German Fuse market is set to expand steadily, driven by:

- Strong awareness of data security and environmental sustainability, encouraging the adoption of eco-conscious smart security devices.

- Germany’s well-established real estate and construction sector, particularly in urban centers like Berlin, Munich, and Frankfurt, offers significant opportunities for smart Fuse integration into both new and retrofitted properties.

- Demand is increasing in commercial offices, healthcare, and educational facilities, where centralized access control and security audit trails are required.

- Preference for locally manufactured, GDPR-compliant, and privacy-enhanced Fuse products is further reinforcing market trust and adoption.

Fuse Market Share

The Fuse industry is primarily led by well-established companies, including:

- Siemens AG (Germany)

- Eaton Corporation (Ireland)

- ABB Ltd. (Switzerland)

- Schneider Electric SE (France)

- Littelfuse, Inc. (U.S.)

- Mersen S.A. (France)

- Bel Fuse Inc. (U.S.)

- Schurter Holding AG (Switzerland)

- Legrand SA (France)

- General Electric (U.S.)

Latest Developments in Europe Fuse Market

- In February 2024, ASSA ABLOY Opening Solutions EMEIA launched its new Aperio® H100 wireless door handle in the European market. This smart locking solution is designed for commercial buildings and offers seamless integration with access control systems. The product supports offline and online functionality, catering to growing demand in offices, healthcare, and educational facilities across Europe. It demonstrates ASSA ABLOY’s continued investment in scalable Fuse technologies tailored for complex European infrastructure requirements.

- In January 2024, Nuki Home Solutions GmbH, an Austria-based smart access solutions provider, introduced the Nuki Smart Lock 4.0 Pro in the EU. This latest version includes Matter compatibility, enhancing its interoperability across smart ecosystems like Apple Home, Google Home, and Amazon Alexa. The Smart Lock 4.0 Pro supports energy-efficient operations and stronger encryption, addressing Europe’s demand for sustainable and privacy-compliant Fuse products.

- In November 2023, Salto Systems, headquartered in Spain, expanded its Salto KS (Keys as a Service) cloud-based Fuse platform for small- to medium-sized businesses across the U.K., Germany, and France. The update enables real-time access control with enhanced analytics, helping commercial clients manage multiple locations efficiently. The move reinforces Salto’s strategic focus on cloud-native solutions for the growing European SME segment.

- In October 2023, We.Lock Europe B.V., based in the Netherlands, unveiled its new WELOCK Touch E Series biometric smart locks across major EU retail and online platforms. The product features fingerprint recognition, app-based remote access, and compatibility with Amazon Alexa, catering to rising consumer demand for secure and user-friendly biometric Fuse options in European residential markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。