Europe Next Generation Anode Materials Market

市场规模(十亿美元)

CAGR :

%

USD

2.90 Billion

USD

8.06 Billion

2025

2033

USD

2.90 Billion

USD

8.06 Billion

2025

2033

| 2026 –2033 | |

| USD 2.90 Billion | |

| USD 8.06 Billion | |

|

|

|

|

欧洲下一代阳极材料市场,按材料(硅/硅氧化物混合物、锂钛氧化物、硅碳纤维、硅石墨烯、锂金属等)和应用(运输、电气和电子、储能等)、国家(德国、法国、意大利、英国、比利时、西班牙、俄罗斯、土耳其、荷兰、瑞士、欧洲其他地区)行业趋势和预测到 2028 年。

市场分析和洞察:欧洲下一代阳极材料市场

市场分析和洞察:欧洲下一代阳极材料市场

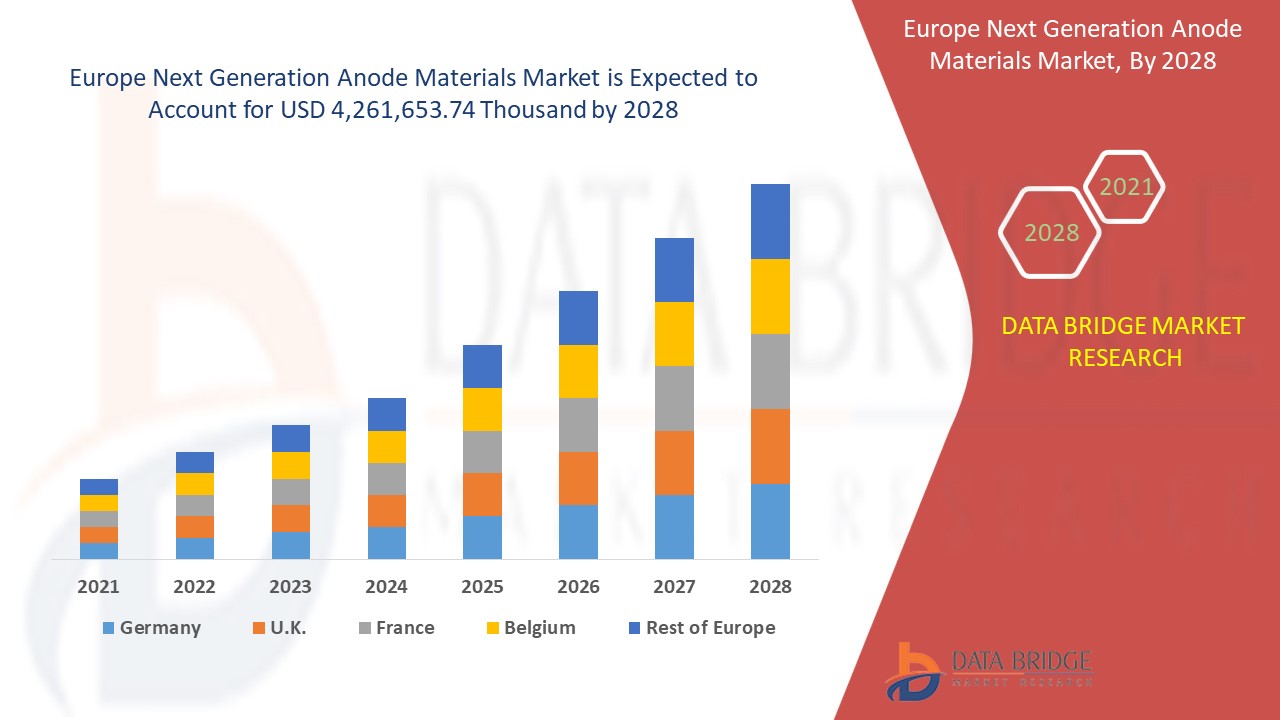

欧洲下一代阳极材料市场预计将在 2021 年至 2028 年的预测期内实现市场增长。Data Bridge Market Research 分析称,在 2021 年至 2028 年的预测期内,该市场的复合年增长率为 13.6%,预计到 2028 年将达到 4,261,653.74 万美元。

阳极材料是锂离子电池中的负极,与锂离子电池中的阴极材料协同工作。锂离子电池中的这些阳极材料起着“主力”的作用,允许锂离子在充电和放电循环期间嵌入和脱嵌,并且必须对所需的氧化过程具有电化学活性。为了适合锂离子电池制造,阳极材料必须具有出色的孔隙率,并且应是良好的电导体。

快速充电电池需求的增长对下一代阳极材料市场的扩张产生了重大影响。与此同时,改进电池化学的研发计划数量的快速增加,以及电动汽车和其他消费电子设备对高效锂离子电池的持续需求,是预测期内有利于下一代阳极材料市场增长的关键决定因素。然而,与锂金属电池生产相关的各种挑战,以及无法以低成本大规模生产高质量石墨烯,可能会成为下一代阳极材料市场增长率的主要制约因素。

开发锂金属电池的新电解质可能成为市场的新机遇。相反,硅阳极的快速增加和退化可能会在预测期内对下一代阳极材料市场的增长构成挑战。

这份下一代阳极材料市场报告提供了市场份额、新发展和产品线分析的详细信息,国内和本地市场参与者的影响,分析了新兴收入领域、市场法规变化、产品审批、战略决策、产品发布、地域扩张和市场技术创新方面的机会。要了解分析和市场情况,请联系我们获取分析师简报。我们的团队将帮助您创建收入影响解决方案,以实现您的预期目标。

欧洲下一代阳极材料市场范围和市场规模

欧洲下一代阳极材料市场范围和市场规模

欧洲下一代阳极材料市场分为两个显著的细分市场,基于材料和应用。细分市场之间的增长有助于您分析利基增长领域和进入市场的策略,并确定您的核心应用领域和目标市场的差异。

- 根据材料,欧洲下一代阳极材料市场细分为硅/氧化硅混合物、锂钛氧化物、硅碳纤维、硅石墨烯、锂金属等。2021 年,在欧洲,硅/氧化硅混合物市场预计将占据市场主导地位,因为硅/氧化硅混合物非常轻且具有高电阻率,这增加了其在欧洲的需求。

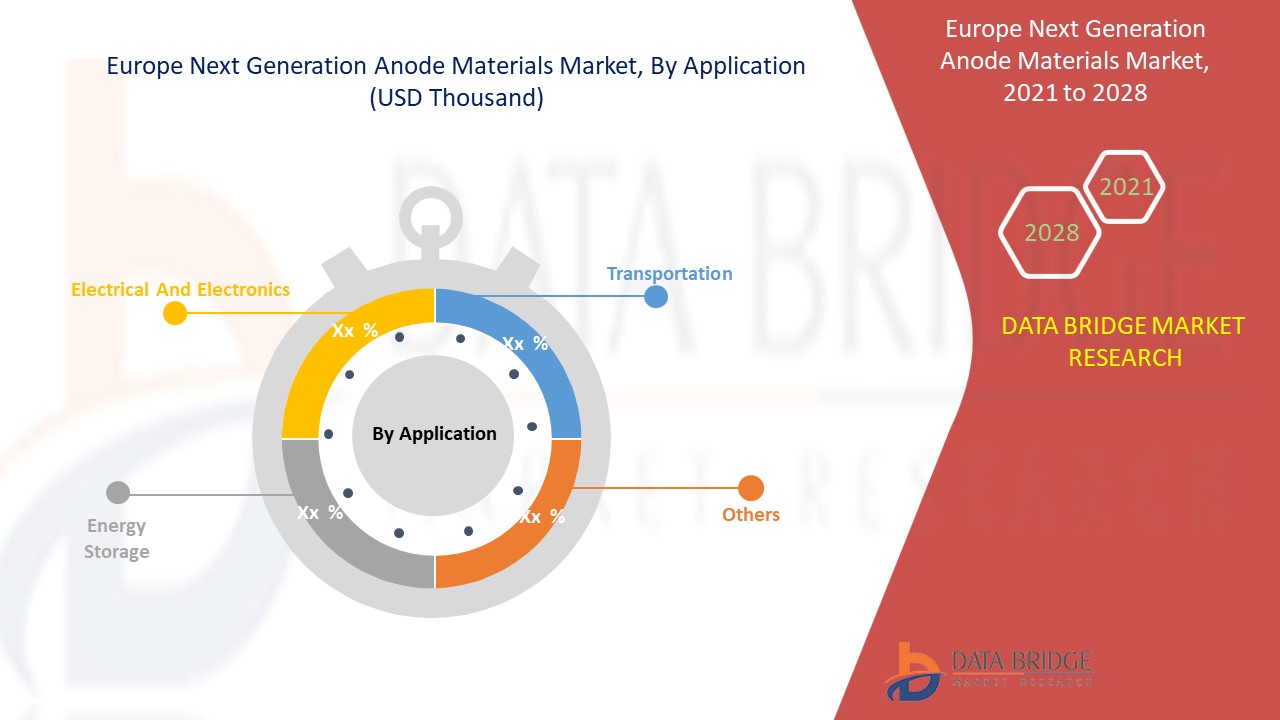

- 根据应用,欧洲下一代阳极材料市场细分为运输、电气和电子、储能等。预计 2021 年运输领域将主导欧洲下一代阳极材料市场,因为阳极材料主要用于电动汽车的生产,这增加了欧洲对阳极材料的需求。

欧洲下一代阳极材料市场国家级分析

欧洲下一代阳极材料市场根据材料和应用分为两个显著的部分。

欧洲下一代阳极材料市场报告涵盖的国家包括德国、法国、意大利、英国、比利时、西班牙、俄罗斯、土耳其、荷兰、瑞士和欧洲其他国家。由于该地区的下一代阳极材料成本较低,预计德国将主导欧洲下一代阳极材料市场。

报告的国家部分还提供了影响单个市场因素和国内市场监管变化,这些因素和变化会影响市场的当前和未来趋势。新销售、替代销售、国家人口统计、监管法案和进出口关税等数据点是用于预测单个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了欧洲品牌的存在和可用性以及它们因来自本地和国内品牌的激烈或稀少竞争而面临的挑战、销售渠道的影响。

快速充电电池需求日益增加

快速充电是一种越来越常见的技术,它允许在正常充电时间的一小部分内为任何设备充电。传统的有线充电器并不是唯一支持各种标准和速度的充电器。无线充电也在兴起,其速度快如闪电,超过大多数手机的有线充电能力。快速充电电池有可能彻底改变汽车行业对电动汽车的主流采用。超快速充电,目标充电时间为 15 分钟,旨在加速电动汽车的大众市场采用,减少温室气体排放,并为政府提供更好的能源安全。现有的锂离子电池使用石墨作为一个电极来驱动锂离子来存储电荷。因此,世界各地正在展开一场激烈的竞争,以增加快速充电站的数量和功率。

此外,近年来,为减轻气候变化和当地空气污染的影响,各国采取的措施加速了锂离子(Li-ion)电池驱动的电动汽车(EV)的发展,导致汽车行业对快速充电电池的需求增加。这反过来又促进了欧洲下一代阳极材料市场的增长。

竞争格局和下一代阳极材料市场份额分析

欧洲下一代阳极材料市场竞争格局提供了竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、欧洲业务、生产基地和设施、公司优势和劣势、产品发布、临床试验渠道、品牌分析、产品批准、专利、产品宽度和广度、应用主导地位、技术生命线曲线。以上提供的数据点仅与公司对亚太下一代阳极材料市场的关注有关。

欧洲下一代阳极材料市场的主要市场参与者包括Albemarle Corporation、LeydenJar Technologies、NEXEON LTD、Talga Group Ltd、JSR Corporation等。

例如,

- 2020 年 7 月,LeydenJar Technologies 开发了一种新型阳极,将彻底改变电池行业。这项新产品的实施帮助该公司在未来几年大幅扩大了生产能力

- 2021 年 7 月,Talga Group Ltd 在瑞典的 Talga 石墨项目中启动了一项增长战略,旨在在电动汽车和电池需求激增的情况下扩大资源基础。此次扩张帮助该公司巩固了其在欧洲的地位

- 2021 年 7 月,JSR 公司宣布在川崎市 King Skyfront 设立新的研发设施——JSR 生物科学和信息学研发中心 (JSR BiRD),以增加其生命科学业务的生产活动。此次扩建帮助该公司通过以下三项活动创造了新业务

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。