Europe Refrigerant Market

市场规模(十亿美元)

CAGR :

%

USD

6.96 Billion

USD

10.12 Billion

2024

2032

USD

6.96 Billion

USD

10.12 Billion

2024

2032

| 2025 –2032 | |

| USD 6.96 Billion | |

| USD 10.12 Billion | |

|

|

|

|

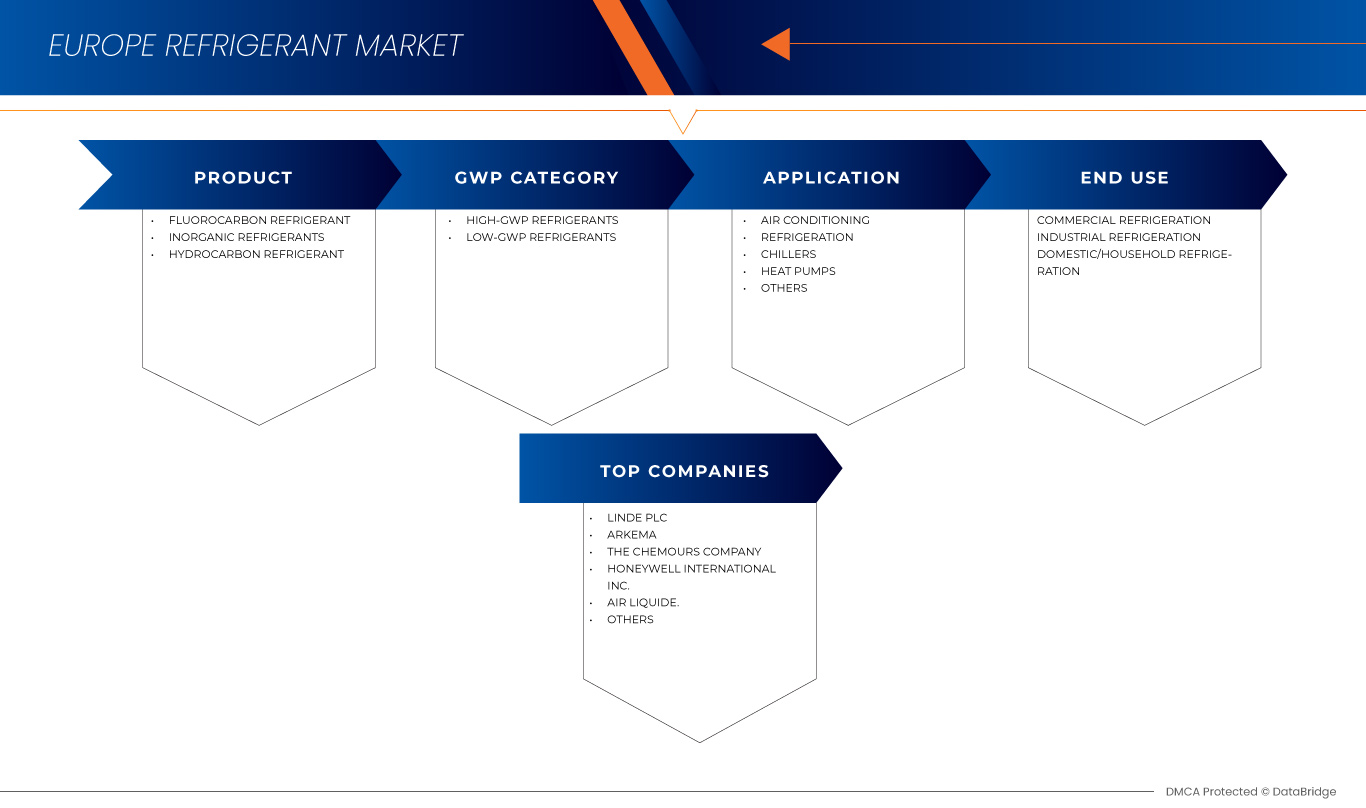

歐洲冷媒市場細分,按產品(氟碳冷媒、無機製冷劑和碳氫冷媒)、GWP 類別(高 GWP 冷媒和低 GWP 冷媒)、應用(空調、冷媒、冷水機組、熱泵等)、最終用途(商用冷凍、工業製冷和家用/家庭冷氣、冷水機組、熱泵等)、最終用途(商用冷氣、工業製冷和家用/家庭冷氣)-

冷媒市場規模

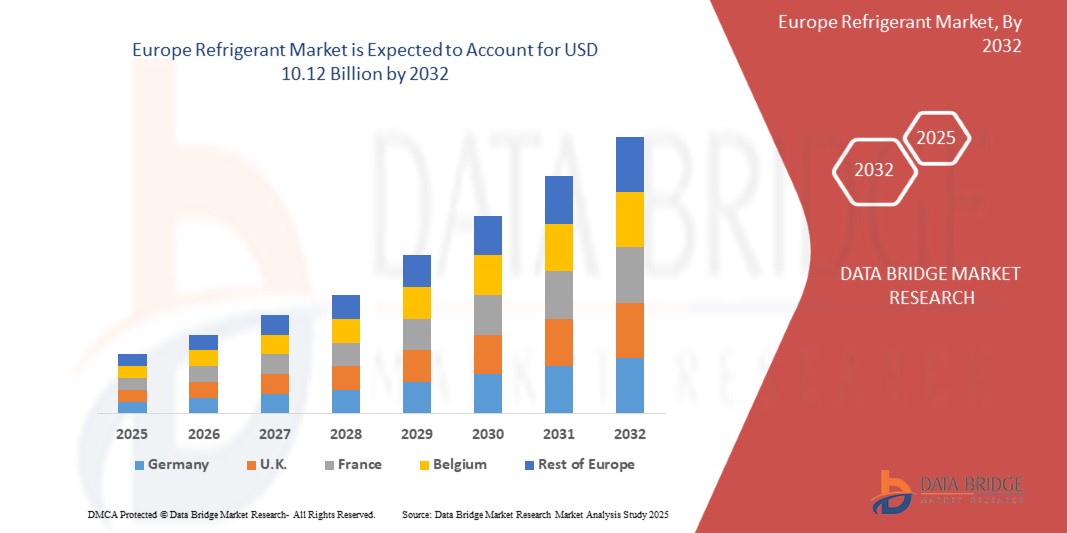

- 2024 年歐洲冷媒市場價值為69.6 億美元,預計到 2032 年將達到 101.2 億美元。

- 在 2025 年至 2032 年的預測期內,市場可能以4.9% 的複合年增長率成長,主要原因是對節能環保冷凍解決方案的需求不斷增長

冷媒市場分析

- 住宅、商業和工業領域對冷凍系統的需求不斷增長。都市化進程加快、氣候變遷以及冷鏈物流的擴張推動了這一成長。

- 對高 GWP 冷媒的嚴格環境法規正在推動市場轉向氫氟烯烴 (HFO) 和天然冷媒等環保替代品

- 德國憑藉其強大的工業基礎、先進的暖通空調技術、嚴格的環境法規(提倡使用低 GWP 冷媒)以及各行業對節能製冷解決方案的高需求,佔據歐洲冷媒市場的主導地位

- 例如,根據生命科學網絡報導,包括疫苗和生物製劑在內的溫度敏感型藥物需要嚴格的溫度控制才能保持其功效。先進的包裝解決方案,例如隔熱容器和相變材料,可確保運輸過程中的穩定性,防止降解,並確保關鍵藥物的安全送達。

報告範圍和冷媒市場細分

|

屬性 |

冷媒關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

德國、英國、俄羅斯、法國、義大利、西班牙、荷蘭、土耳其、比利時、瑞士、丹麥、瑞典、芬蘭、葡萄牙和歐洲其他地區 |

|

主要市場參與者 |

Linde PLC(愛爾蘭)、Arkema(法國)、The Chemours Company(美國)、Honeywell International Inc.(美國)、AIR LIQUIDE(法國)、AGC Chemicals Europe, Ltd.(英國)、A-Gas International Limited(英格蘭)、DAIKIN INDUSTRIES, Ltd(日本)、東集團(中國)、紐約東部集團(中國)、美國) Europeia Europeia(日本)。 Refrigerants Ltd(英國)、Rhodia Chemicals Ltd. UK.(英國)、SOL Spa(義大利)、Tazzetti SpA(義大利) |

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括進出口分析、生產能力概覽、生產消費分析、價格趨勢分析、氣候變遷情景、供應鏈分析、價值鏈分析、原材料/消耗品概覽、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

冷媒市場趨勢

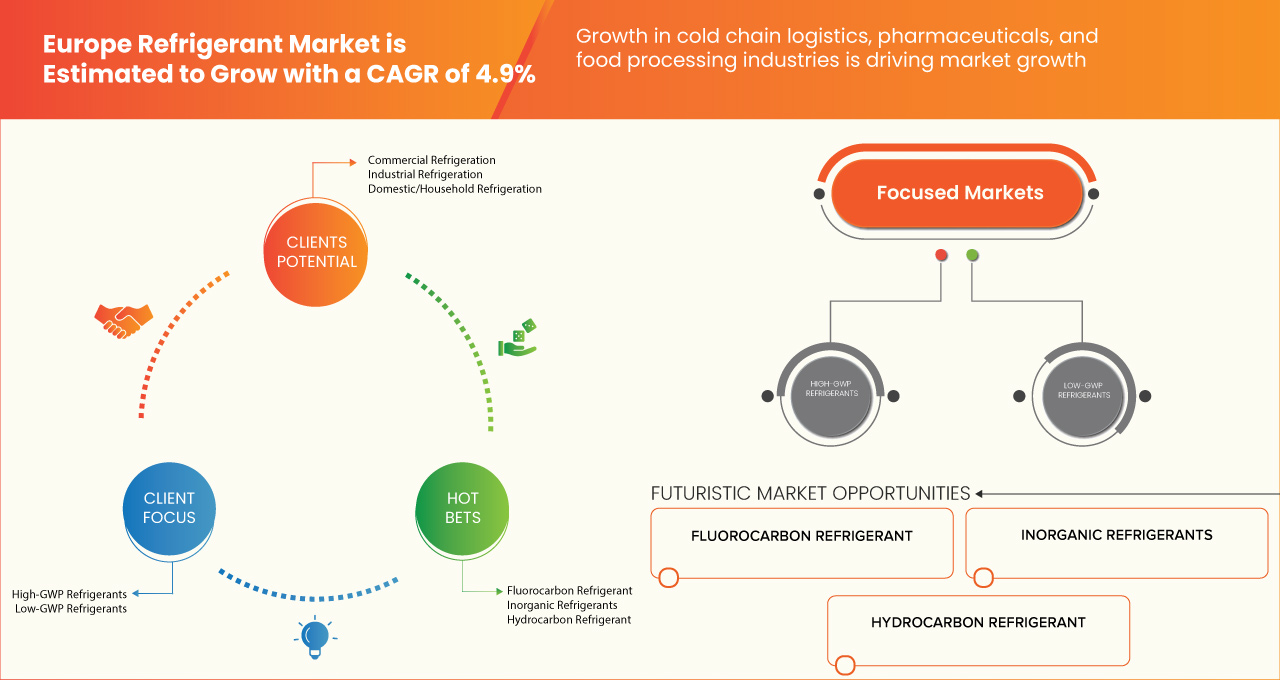

“受法規和可持續性驅動,歐洲轉向低GWP冷媒”

- 冷媒市場的成長動力源自於住宅、商業和工業領域對冷凍系統日益增長的需求。都市化進程加快、氣候變遷以及冷鏈物流的擴張也推動了冷媒市場的成長。

- 針對高全球暖化潛勢 (GWP) 冷媒的嚴格環境法規正推動市場轉向氫氟烯烴 (HFO) 和天然冷媒等環保替代品。亞太地區由於快速的工業化和暖通空調 (HVAC) 普及率的上升而佔據主導地位,而北美和歐洲則注重法規合規性。

冷媒市場動態

司機

冷鏈物流、製藥和食品加工產業的成長

冷鏈物流、製藥和食品加工行業的蓬勃發展推動了製冷需求的不斷增長。隨著越來越多的人依賴新鮮和冷凍食品,高效的儲存和運輸變得至關重要。超市、餐廳和線上雜貨店都需要可靠的冷凍系統來長時間保持食品的新鮮和安全。

在製藥業,對溫度敏感的藥物、疫苗和生物製劑需要適當的冷卻才能保持其有效性。隨著醫療保健需求的不斷增長,越來越多的配備先進冷凍系統的倉儲和運輸設施正在開發,以確保這些關鍵產品的安全交付。

同樣,食品加工產業也嚴重依賴冷凍來儲存原料和成品。肉類、乳製品、海鮮和其他易腐爛食品需要控制溫度以防止腐敗並維持品質。隨著加工和包裝食品需求的成長,對高效冷卻解決方案的需求也隨之成長。

總體而言,這些產業的擴張正在推動對更優質冷凍系統的需求。企業正在投資先進的冷凍技術,以滿足安全和品質標準。隨著這些產業的持續成長,未來幾年對高效環保冷凍的需求只會越來越大。

例如,

- 根據生命科學網絡報導,包括疫苗和生物製劑在內的溫度敏感型藥物需要嚴格的溫度控制才能保持其功效。先進的包裝解決方案,例如隔熱容器和相變材料,可確保運輸過程中的穩定性,防止降解,並確保關鍵藥物的安全送達。

- 根據World BI Group發布的博客,包括疫苗和生物製劑在內的溫度敏感型藥物需要精確的溫度控制才能保持其功效。冷鏈確保安全儲存和運輸,防止變質。先進的冷凍系統和物流解決方案有助於維持產品的穩定性和完整性。

- Refcold 的一項研究表明,冷藏在食品加工行業中對於保存肉類、乳製品和海鮮等易腐爛食品至關重要。隨著加工食品需求的不斷增長,冷藏可以防止食品變質、延長保質期並保持質量,從而確保食品安全。

總而言之,冷凍需求的成長是由冷鏈物流、製藥和食品加工產業推動的。對新鮮食品、溫敏藥品和加工食品的需求成長,推動了對先進冷凍解決方案的投資。隨著這些產業的擴張,高效環保的冷凍系統對於確保安全、品質和永續性至關重要。

機會

天然冷媒的採用日益增多

越來越多的企業和產業正在轉向使用天然冷媒,因為它們更環保,並有助於滿足嚴格的政府法規。氨 (NH₃)、二氧化碳 (CO₂) 和碳氫化合物(如丙烷)等天然冷媒不會破壞臭氧層,也不會對全球暖化造成太大影響,因此是傳統冷媒的明智替代品。

各國政府正逐步淘汰有害冷媒,並為環保冷凍解決方案提供誘因,以鼓勵這項轉變。採用天然冷媒的企業可以降低能源成本,並避免因使用過時系統而遭受的高額罰款。許多超市、食品加工廠和工業設施正在升級其冷凍系統,以應對不斷變化的法規。

儘管天然冷媒需要一些調整,例如更換新設備或增加安全措施,但從長遠來看,它們能夠節省成本並提高效率。例如,基於二氧化碳的製冷系統在雜貨店中越來越受歡迎,因為它們即使在高溫氣候下也能運作良好。同樣,氨因其卓越的製冷性能,也被廣泛用於大型冷藏倉庫。

With the growing focus on sustainability and stricter environmental laws, businesses that switch to natural refrigerants now will have a competitive advantage, avoiding future costs and contributing to a greener planet.

For instance,

- As per blog published by GEA Group, natural refrigerants like ammonia (NH₃), carbon dioxide (CO₂), and hydrocarbons provide climate-neutral cooling solutions with minimal Global Warming Potential. Their adoption helps industries comply with environmental regulations while improving energy efficiency and reducing long-term operational costs

- According to Airgas Refrigerants, natural refrigerants like ammonia (NH₃), carbon dioxide (CO₂), and hydrocarbons offer sustainable cooling solutions with low environmental impact. These alternatives help industries reduce greenhouse gas emissions, comply with regulations, and improve energy efficiency in refrigeration systems

In summary, businesses are shifting to natural refrigerants like ammonia, CO₂, and hydrocarbons due to environmental benefits and strict regulations. Governments offer incentives, while companies gain cost savings and compliance. Despite equipment adjustments, these refrigerants improve efficiency, making them a smart, sustainable choice for long-term success in refrigeration.

Restraint/Challenge

High Initial Investment in Transitioning to New Refrigerants and Equipment

Upgrading to new, eco-friendly refrigerants and modern cooling equipment is a great step, but it comes with a big price tag. Many businesses and homeowners want to make the switch, but the high upfront cost can be a major hurdle.

New refrigerants often require new or modified equipment, since older systems may not be compatible. This means businesses must spend money not just on the refrigerants themselves but also on buying and installing updated cooling units. For industries like food storage, supermarkets, and manufacturing, these costs can be very high.

Even though modern systems are more energy-efficient and save money on electricity in the long run, the initial expense can slow down adoption. Small businesses and households may find it difficult to afford the switch, even though it leads to lower energy bills and reduced maintenance costs over time.

To help with this transition, some governments and organizations are offering financial support, like tax breaks and subsidies. As demand for eco-friendly cooling grows, technology will improve, and prices will eventually come down. While the upfront cost is high, switching to modern refrigeration systems ensures compliance with new regulations, cuts long-term costs, and supports a more sustainable future.

For instance,

- In October 2024 article by Refindustry highlighted that the price of high-GWP refrigerants in Europe has surged by up to 1000%, rising from €3–5/kg in 2014 to €30–45/kg in 2024. Meanwhile, natural alternatives like CO₂ and propane remain stable at €5–15/kg

In summary, transitioning to new refrigerants and equipment requires a high upfront cost, making it challenging for businesses and homeowners. While modern systems offer long-term savings and efficiency, initial expenses slow adoption. Government incentives and technological advancements are helping ease the transition, ensuring compliance, cost reduction, and a sustainable future.

- Complex Retrofitting Requirements for Existing Refrigeration Systems

Upgrading old refrigeration systems to use eco-friendly refrigerants is not as simple as swapping out the gas. Many existing cooling units are designed for high-GWP (Global Warming Potential) refrigerants, meaning they aren’t compatible with natural alternatives like CO₂, ammonia, or hydrocarbons. Retrofitting these systems requires major modifications, including replacing compressors, heat exchangers, and piping. In some cases, businesses must install entirely new refrigeration units, which can cost anywhere from €50,000 to over €1 million, depending on the system size and complexity.

One big challenge is safety. Ammonia, for example, is highly efficient but toxic in case of leaks, requiring advanced detection and ventilation systems. Similarly, hydrocarbons are flammable, meaning businesses must add explosion-proof components to ensure safety. These additional upgrades add to the already high costs of retrofitting.

For supermarkets, cold storage warehouses, and industrial facilities, downtime during retrofitting is another concern. Installing a new system can take weeks, leading to potential revenue losses. Because of these challenges, many businesses delay upgrades, despite government incentives and regulatory pressure.

While retrofitting is expensive and complex, companies that invest in modern, energy-efficient refrigeration will benefit from lower operating costs and compliance with future environmental regulations, avoiding penalties and higher expenses later.

For instance,

- As per news published by Ecacool, Germany’s Federal Ministry for the Environment provides subsidies of up to €150,000 per installation to support retrofitting refrigeration systems with natural refrigerants. This initiative helps businesses reduce energy consumption and comply with environmental regulations

- Aa per study of Entropic, the European standard EN 378 establishes safety requirements for refrigeration systems using natural refrigerants like ammonia (R717) and hydrocarbons (R290). Businesses must implement leak detection, ventilation, and explosion-proof components to ensure safety, increasing retrofitting complexity and costs

In summary, retrofitting old refrigeration systems is costly and complex, requiring equipment upgrades costing €50,000 to over €1 million. Safety concerns, system downtime, and compatibility issues make the process challenging. Despite incentives, many businesses delay retrofits. However, upgrading improves efficiency, lowers costs, and ensures compliance with environmental regulations, avoiding future penalties.

Refrigerant Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By GWP Category |

|

|

By Application |

|

|

By End Use

|

|

Refrigerant Market Regional Analysis

Germany is the Dominant Region in the Refrigerant Market”

- Germany is expected to dominate the European refrigerant market due to its strong industrial base, advanced HVAC and automotive sectors, and commitment to sustainable cooling solutions. The country leads in the adoption of low-GWP refrigerants, driven by stringent EU regulations and environmental policies. Germany’s strong R&D investments foster innovations in eco-friendly refrigerants like CO₂, ammonia, and hydrofluoroolefins (HFOs). Additionally, the presence of major refrigerant manufacturers and a well-established cold chain infrastructure further strengthen its market position. With increasing demand for energy-efficient cooling technologies and a focus on climate-friendly alternatives, Germany continues to be the key driver of Europe’s refrigerant market growth.

“Germany is Projected to Register the Highest Growth Rate”

- 由於受歐盟《含氟氣體法規》等嚴格法規的推動,德國正快速向低全球暖化潛勢和環保冷媒轉型,預計其複合年增長率將位居歐洲冷媒市場榜首。德國在研發方面的大力投入,促進了二氧化碳、氨和氫氟烯烴 (HFO) 等永續冷媒的創新。節能暖通空調系統需求的不斷增長、汽車空調應用的不斷拓展以及熱泵的興起,進一步推動了市場成長。此外,德國發達的工業和冷鏈基礎設施,以及先進製冷技術的日益普及,使其成為歐洲成長最快的冷媒市場,未來潛力巨大。

冷媒市場佔有率

市場競爭格局按競爭對手提供詳細資料。詳細資訊包括公司概況、公司財務狀況、收入、市場潛力、研發投入、新市場計劃、全球影響力、生產基地和設施、生產能力、公司優勢和劣勢、產品發布、產品寬度和廣度以及應用主導地位。以上提供的數據點僅與公司在市場中的重點相關。

市場中主要的市場領導者有:

- 林德公司(愛爾蘭)

- 阿科瑪(法國)

- 科慕公司(美國)

- 霍尼韋爾國際公司(美國)

- 液化空氣集團(法國)

- AGC Chemicals Europe, Ltd.(英國)

- A-Gas國際有限公司(英國)

- 大金工業株式會社(日本)

- 東岳集團(中國)

- Entalpia Europe(波蘭)

- Gas Servei(西班牙)

- GTS SPA(義大利)

- 英國國家冷媒有限公司

- 英國羅地亞化學有限公司(英國)

- SOL Spa(義大利)

- Tazzetti SpA(義大利)

歐洲冷媒市場最新動態

- 2024年11月,A-Gas參加了第36屆蒙特婁氣候變遷大會(MOP 36)和第29屆聯合國氣候變遷大會(COP29),強調了其對生命週期冷媒管理(LRM)的承諾。該公司參與了關於冷媒回收、再利用和融資的小組討論,並強調了對碳市場的投資。 A-Gas也舉辦了一場關於激勵私人投資LRM的會外活動。他們的參與展現了其在永續冷媒解決方案領域的全球領導地位。

- 2021年12月,液化空氣集團透過與勞倫蒂斯能源合作夥伴公司(Laurentis Energy Partners)的合作,獲得了長期氦-3供應,該供應將作為副產品從加拿大達靈頓發電站提取。氦-3的獨特性能使稀釋製冷機能夠達到超低溫,這對於量子計算和科學研究至關重要。該協議增強了液化空氣集團在極低溫技術方面的能力,支持量子技術的進步。

- 2021年8月,A-Gas入圍2021年商業領袖獎「年度綠色企業獎」。該提名表彰了A-Gas對永續發展、道德領導力和環境影響的承諾。 A-Gas強調了其在生命週期冷媒管理 (LRM) 和實現淨零碳未來的努力。

- 2021年7月,National Refrigerants Ltd. 連續第三年榮獲霍尼威爾年度經銷商獎。這項成就凸顯了其強勁的銷售業績,尤其是在英國汽車售後市場的R1234yf冷媒方面。他們對客戶服務和永續發展的承諾對其成功起到了關鍵作用。作為市場領導者,他們持續推動低GWP冷媒的成長。

- 2020年7月,國家冷媒有限公司(National Refrigerants Ltd)榮幸地贊助了2020年世界冷凍日活動。這項國際活動旨在強調冷凍、空調和熱泵技術在現代生活中的重要性。這項活動旨在提高公眾對製冷在舒適性、食品保鮮、醫療保健和整體社會發展中所發揮的關鍵作用的認識。透過贊助,國家冷媒有限公司進一步強化了其致力於推動產業永續發展和創新的承諾。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 BARGAINING POWER OF SUPPLIERS

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.6 PRODUCTION CONSUMPTION ANALYSIS

4.6.1 PRODUCTION AND CONSUMPTION ANALYSIS OF THE EUROPE REFRIGERANT MARKET

4.6.1.1 PRODUCTION ANALYSIS

4.6.1.1.1 KEY MANUFACTURING COUNTRIES

4.6.1.1.2 TYPES OF REFRIGERANTS PRODUCED

4.6.2 PRODUCTION CONSTRAINTS

4.6.3 CONSUMPTION ANALYSIS

4.6.3.1 END-USE INDUSTRIES

4.6.3.2 MARKET TRENDS

4.6.4 CONCLUSION

4.7 VENDOR SELECTION CRITERIA

4.7.1 VENDOR SELECTION CRITERIA FOR THE EUROPE REFRIGERANT MARKET

4.7.2 REGULATORY COMPLIANCE

4.7.3 PRODUCT QUALITY AND CERTIFICATION

4.7.4 RANGE OF REFRIGERANTS OFFERED

4.7.5 RELIABILITY AND SUPPLY CHAIN EFFICIENCY

4.7.6 PRICING AND COST-EFFECTIVENESS

4.7.7 SUSTAINABILITY AND ENVIRONMENTAL IMPACT

4.7.8 TECHNICAL SUPPORT AND AFTER-SALES SERVICE

4.7.9 REPUTATION AND CUSTOMER REVIEWS

4.7.10 INNOVATION AND FUTURE-READINESS

4.7.11 SAFETY AND STORAGE FACILITIES

4.7.12 CONCLUSION

4.8 CLIMATE CHANGE SCENARIO

4.8.1 REGULATORY PUSH FOR LOW-GWP REFRIGERANTS

4.8.2 INCREASING DEMAND FOR COOLING SOLUTIONS

4.8.3 RISE OF NATURAL AND LOW-GWP REFRIGERANTS

4.8.4 ADVANCEMENTS IN SUSTAINABLE COOLING TECHNOLOGIES

4.8.5 EMPHASIS ON REFRIGERANT RECOVERY AND RECYCLING

4.8.6 COMPETITIVE LANDSCAPE AND INDUSTRY COLLABORATION

4.9 RAW MATERIAL COVERAGE OF THE EUROPE REFRIGERANT MARKET

4.9.1 INTRODUCTION

4.9.2 KEY RAW MATERIALS IN REFRIGERANT PRODUCTION

4.9.2.1 FLUORINE-BASED COMPOUNDS

4.9.2.2 HYDROCARBONS (METHANE, ETHANE, PROPANE, AND BUTANE)

4.9.2.3 CHLORINE-BASED COMPOUNDS

4.9.2.4 CARBON DIOXIDE (CO₂)

4.9.2.5 AMMONIA (NH₃)

4.9.3 SUPPLY CHAIN AND PRICING DYNAMICS

4.9.4 CONCLUSION

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 RAW MATERIAL SOURCING AND PRODUCTION

4.10.2 DISTRIBUTION AND LOGISTICS

4.10.3 REFRIGERANT STORAGE AND SAFETY COMPLIANCE

4.10.4 END-USER APPLICATIONS AND MARKET DEMAND

4.10.5 RECOVERY, RECYCLING, AND RECLAMATION

4.10.6 CHALLENGES AND EVOLVING TRENDS

4.11 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURER

4.11.1 TRANSITION TO LOW-GWP AND NATURAL REFRIGERANTS

4.11.2 RISE OF HYDROFLUOROOLEFINS (HFOS) AS NEXT-GENERATION REFRIGERANTS

4.11.3 INTEGRATION OF SMART AND ENERGY-EFFICIENT REFRIGERATION SYSTEMS

4.11.4 ADVANCEMENTS IN REFRIGERANT RECOVERY AND RECYCLING TECHNOLOGIES

4.11.5 DEVELOPMENT OF HYBRID REFRIGERATION SYSTEMS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN COLD CHAIN LOGISTICS, PHARMACEUTICALS, AND FOOD PROCESSING INDUSTRIES

6.1.2 INCREASING DEMAND FOR ENERGY-EFFICIENT AND ECO-FRIENDLY REFRIGERATION SOLUTIONS

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN REFRIGERANT SYSTEMS

6.1.4 STRINGENT ENVIRONMENTAL REGULATIONS PROMOTING LOW-GWP REFRIGERANTS

6.2 RESTRAINTS

6.2.1 HIGH INITIAL INVESTMENT IN TRANSITIONING TO NEW REFRIGERANTS AND EQUIPMENT

6.2.2 SAFETY CONCERNS RELATED TO FLAMMABLE OR TOXIC REFRIGERANTS

6.3 OPPORTUNITIES

6.3.1 GROWING ADOPTION OF NATURAL REFRIGERANTS

6.3.2 GOVERNMENT INCENTIVES FOR GREEN AND ENERGY-EFFICIENT REFRIGERATION TECHNOLOGIES

6.4 CHALLENGES

6.4.1 HIGH COSTS OF R&D IN SUSTAINABLE REFRIGERANT

6.4.2 COMPLEX RETROFITTING REQUIREMENTS FOR EXISTING REFRIGERATION SYSTEMS

7 EUROPE REFRIGERANT MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 FLUOROCARBON REFRIGERANT

7.2.1 FLUOROCARBON REFRIGERANT, BY PRODUCT

7.2.1.1 HYDROFLUOROOLEFINS (HFOS), BY PRODUCT

7.3 INORGANIC REFRIGERANTS

7.3.1 INORGANIC REFRIGERANT, BY PRODUCT

7.4 HYDROCARBON REFRIGERANT

7.4.1 HYDROCARBON REFRIGERANT, BY PRODUCT

8 EUROPE REFRIGERANT MARKET, BY GWP CATEGORY

8.1 OVERVIEW

8.2 HIGH-GWP REFRIGERANTS

8.3 LOW-GWP REFRIGERANTS

9 EUROPE REFRIGERANT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 AIR CONDITIONING

9.2.1 AIR CONDITIONING, BY TYPE

9.3 REFRIGERATION

9.4 CHILLERS

9.5 HEAT PUMPS

9.6 OTHERS

10 EUROPE REFRIGERANT MARKET, BY END USE

10.1 OVERVIEW

10.2 COMMERCIAL REFRIGERATION

10.2.1 COMMERCIAL REFRIGERATION, BY TYPE

10.3 INDUSTRIAL REFRIGERATION

10.3.1 INDUSTRIAL REFRIGERATION, BY TYPE

10.3.1.1 AUTOMOTIVE, BY TYPE

10.4 DOMESTIC/HOUSEHOLD REFRIGERATION

11 EUROPE REFRIGERANT MARKET BY COUNTRY

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 RUSSIA

11.1.4 FRANCE

11.1.5 ITALY

11.1.6 SPAIN

11.1.7 NETHERLANDS

11.1.8 TURKEY

11.1.9 BELGIUM

11.1.10 SWITZERLAND

11.1.11 DENMARK

11.1.12 SWEDEN

11.1.13 FINLAND

11.1.14 PORTUGAL

11.1.15 REST OF EUROPE

12 EUROPE REFRIGERANT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LINDE PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 ARKEMA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT/NEWS

14.3 THE CHEMOURS COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT/NEWS

14.4 HONEYWELL INTERNATIONAL INC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS/NEWS

14.5 AIR LIQUIDE

14.5.1 COMPANY SNAPSHOT

1.1.4 REVENUE ANALYSIS 185

1.1.4 PRODUCT PORTFOLIO 186

14.5.2 RECENT DEVELOPMENT

14.6 A-GAS INTERNATIONAL LIMITED

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT NEWS

14.7 AGC CHEMICALS EUROPE, LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 DAIKIN INDUSTRIES, LTD.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 DONGYUE GROUP

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

1.1.4 PRODUCT PORTFOLIO 194

14.9.3 RECENT DEVELOPMENT

14.1 ENTALPIA EUROPE

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 GAS SERVICE

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 GTS SPA

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 NATIONAL REFRIGERANTS LTD

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT NEWS

14.14 RHODIA CHEMICALS LTD. UK.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 SOL SPA

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

1.1.4 PRODUCT PORTFOLIO 207

14.15.3 RECENT DEVELOPMENT

14.16 TAZZETTI S.P.A.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表格列表

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 4 EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 5 EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 6 EUROPE FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE REFRIGERANT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE REFRIGERANT MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 19 GERMANY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 20 GERMANY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 21 GERMANY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 22 GERMANY FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 23 GERMANY HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 24 GERMANY INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 25 GERMANY HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 26 GERMANY REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 27 GERMANY REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 28 GERMANY AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 GERMANY REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 30 GERMANY COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 GERMANY INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 GERMANY AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 U.K. REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 34 U.K. REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 35 U.K. REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 36 U.K. FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 37 U.K. HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 38 U.K. INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 39 U.K. HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 40 U.K. REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 41 U.K. REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 42 U.K. AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.K. REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 44 U.K. COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.K. INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 U.K. AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 RUSSIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 48 RUSSIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 49 RUSSIA REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 50 RUSSIA FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 51 RUSSIA HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 52 RUSSIA INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 53 RUSSIA HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 54 RUSSIA REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 55 RUSSIA REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 RUSSIA AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 RUSSIA REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 58 RUSSIA COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 RUSSIA INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 RUSSIA AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 FRANCE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 62 FRANCE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 63 FRANCE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 64 FRANCE FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 65 FRANCE HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 66 FRANCE INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 67 FRANCE HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 68 FRANCE REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 69 FRANCE REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 70 FRANCE AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 FRANCE REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 72 FRANCE COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 FRANCE INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 FRANCE AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 ITALY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 76 ITALY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 77 ITALY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 78 ITALY FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 79 ITALY HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 80 ITALY INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 81 ITALY HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 82 ITALY REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 83 ITALY REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 ITALY AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 ITALY REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 86 ITALY COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 ITALY INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 ITALY AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 SPAIN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 90 SPAIN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 91 SPAIN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 92 SPAIN FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 93 SPAIN HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 94 SPAIN INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 95 SPAIN HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 96 SPAIN REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 97 SPAIN REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 98 SPAIN AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SPAIN REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 100 SPAIN COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SPAIN INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SPAIN AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 NETHERLANDS REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 104 NETHERLANDS REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 105 NETHERLANDS REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 106 NETHERLANDS FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 107 NETHERLANDS HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 108 NETHERLANDS INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 109 NETHERLANDS HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 110 NETHERLANDS REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 111 NETHERLANDS REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 NETHERLANDS AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 NETHERLANDS REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 114 NETHERLANDS COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NETHERLANDS INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NETHERLANDS AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 TURKEY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 118 TURKEY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 119 TURKEY REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 120 TURKEY FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 121 TURKEY HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 122 TURKEY INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 123 TURKEY HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 124 TURKEY REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 125 TURKEY REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 TURKEY AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 TURKEY REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 128 TURKEY COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 TURKEY INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 TURKEY AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 BELGIUM REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 132 BELGIUM REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 133 BELGIUM REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 134 BELGIUM FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 135 BELGIUM HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 136 BELGIUM INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 137 BELGIUM HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 138 BELGIUM REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 139 BELGIUM REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 140 BELGIUM AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 BELGIUM REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 142 BELGIUM COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 BELGIUM INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 BELGIUM AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SWITZERLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 146 SWITZERLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 147 SWITZERLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 148 SWITZERLAND FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 149 SWITZERLAND HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 150 SWITZERLAND INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 151 SWITZERLAND HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 152 SWITZERLAND REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 153 SWITZERLAND REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 154 SWITZERLAND AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SWITZERLAND REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 156 SWITZERLAND COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SWITZERLAND INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SWITZERLAND AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 DENMARK REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 160 DENMARK REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 161 DENMARK REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 162 DENMARK FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 163 DENMARK HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 164 DENMARK INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 165 DENMARK HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 166 DENMARK REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 167 DENMARK REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 DENMARK AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 DENMARK REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 170 DENMARK COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 DENMARK INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 DENMARK AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 SWEDEN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 174 SWEDEN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 175 SWEDEN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 176 SWEDEN FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 177 SWEDEN HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 178 SWEDEN INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 179 SWEDEN HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 180 SWEDEN REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 181 SWEDEN REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 182 SWEDEN AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SWEDEN REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 184 SWEDEN COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 SWEDEN INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 SWEDEN AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 FINLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 188 FINLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 189 FINLAND REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 190 FINLAND FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 191 FINLAND HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 192 FINLAND INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 193 FINLAND HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 194 FINLAND REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 195 FINLAND REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 196 FINLAND AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 FINLAND REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 198 FINLAND COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 FINLAND INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 FINLAND AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 PORTUGAL REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 202 PORTUGAL REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 203 PORTUGAL REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

TABLE 204 PORTUGAL FLUOROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 205 PORTUGAL HYDROFLUOROOLEFINS (HFOS) IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 206 PORTUGAL INORGANIC REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 207 PORTUGAL HYDROCARBON REFRIGERANT IN REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 208 PORTUGAL REFRIGERANT MARKET, BY GWP CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 209 PORTUGAL REFRIGERANT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 210 PORTUGAL AIR CONDITIONING IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 PORTUGAL REFRIGERANT MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 212 PORTUGAL COMMERCIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 PORTUGAL INDUSTRIAL REFRIGERATION IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 PORTUGAL AUTOMOTIVE IN REFRIGERANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 REST OF EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 216 REST OF EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (TONS)

TABLE 217 REST OF EUROPE REFRIGERANT MARKET, BY PRODUCT, 2018-2032 (USD/KG)

图片列表

FIGURE 1 EUROPE REFRIGERANT MARKET

FIGURE 2 EUROPE REFRIGERANT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE REFRIGERANT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE REFRIGERANT MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE REFRIGERANT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE REFRIGERANT MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE REFRIGERANT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE REFRIGERANT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE REFRIGERANT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MARKET APPLICATION COVERAGE GRID: EUROPE REFRIGERANT MARKET

FIGURE 11 EUROPE REFRIGERANT MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 THREE SEGMENTS COMPRISE THE EUROPE REFRIGERANT MARKET, BY PRODUCT (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 GROWTH IN COLD CHAIN LOGISTICS, PHARMACEUTICALS, AND FOOD PROCESSING INDUSTRIES IS EXPECTED TO DRIVE THE EUROPE REFRIGERANT MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE FLUOROCARBON REFRIGERANT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE REFRIGERANT MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 EUROPE REFRIGERANT MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/ KG)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE REFRIGERANT MARKET

FIGURE 24 EUROPE REFRIGERANT MARKET: BY PRODUCT, 2024

FIGURE 25 EUROPE REFRIGERANT MARKET, BY GWP CATEGORY, 2024

FIGURE 26 EUROPE REFRIGERANT MARKET: BY APPLICATION, 2024

FIGURE 27 EUROPE REFRIGERANT MARKET: BY END USE, 2024

FIGURE 28 GLOBAL REFRIGERANT MARKET: SNAPSHOT (2024)

FIGURE 29 EUROPE REFRIGERANT MARKET: COMPANY SHARE 2024 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。