Europe Small Molecule Sterile Injectable Drugs Market

市场规模(十亿美元)

CAGR :

%

USD

49.44 Billion

USD

83.68 Billion

2025

2033

USD

49.44 Billion

USD

83.68 Billion

2025

2033

| 2026 –2033 | |

| USD 49.44 Billion | |

| USD 83.68 Billion | |

|

|

|

|

歐洲小分子無菌注射市場細分,依產品(西林瓶填充、注射器填充、藥筒填充及其他)、應用(腫瘤科、傳染病科、心血管疾病科、代謝性疾病科、神經科、皮膚科、泌尿科、自體免疫性疾病科、呼吸系統疾病科及其他)、終端使用者(醫院、專科診所、家庭護理機構及其他)、通路(直接招標、零售藥局、線上藥局及其他)劃分-產業趨勢及至2033年的預測

歐洲小分子無菌注射劑市場規模

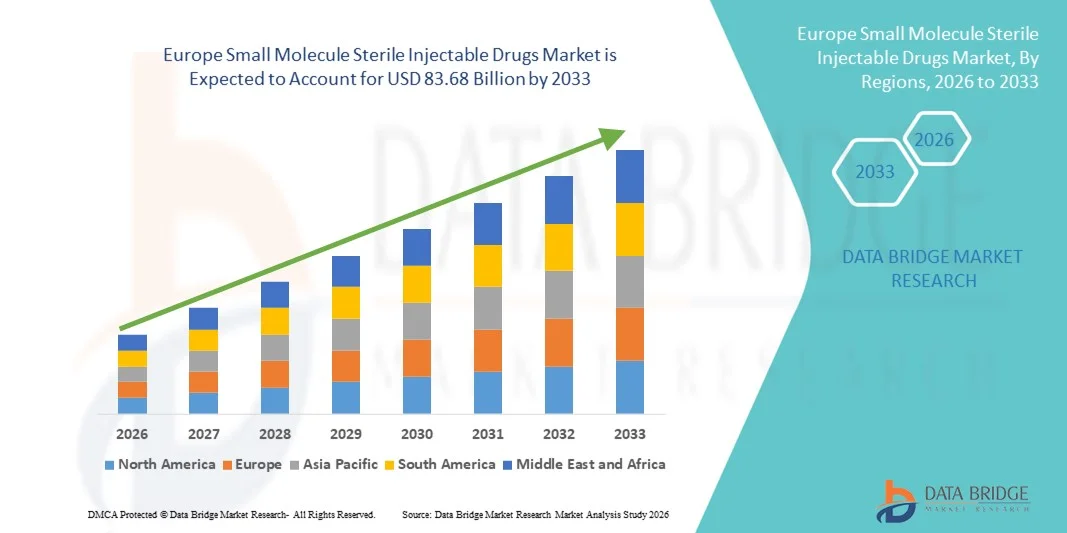

- 2025年歐洲小分子無菌注射劑市場規模為494.4億美元 ,預計 2033年將達到836.8億美元,預測期內 複合年增長率為6.8%。

- 市場成長主要得益於慢性病和傳染病患者病率的上升、主要國家強大的製藥生產基地以及嚴格的監管標準,這些因素共同確保了歐洲各地無菌注射劑的高品質。

- 此外,醫療保健支出不斷增長、醫院和專科診所服務不斷擴展,以及對無菌加工技術的持續投資,正在推動醫院和門診機構對小分子無菌注射劑的需求。這些因素共同促進了對即用型無菌注射劑的需求,並加速了該地區市場的成長。

歐洲小分子無菌注射劑市場分析

- 小分子無菌注射藥物因其高效、安全、易於給藥等優點,可提供高純度、即用型治療方案,在現代醫療保健系統中,包括醫院、診所和門診護理機構,正日益成為至關重要的組成部分。

- 這些藥物需求的不斷增長主要受以下因素推動:慢性病和傳染病的日益普及、對無菌製劑的嚴格監管要求以及先進無菌生產技術的日益普及。

- 德國憑藉其完善的製藥生產基礎設施、健全的監管框架和高額的醫療保健支出,在2025年佔據歐洲小分子無菌注射劑市場的主導地位,市場份額高達28.7%。其中,用於傳染病和心血管疾病治療的西林瓶填充和注射器填充產品貢獻尤為顯著。

- 由於醫療基礎設施的改善、醫院容量的增加以及代謝和神經系統應用領域對灌裝式藥物和其他先進給藥方式的日益普及,預計波蘭將在預測期內成為該市場成長最快的國家。

- 預計到2025年,西林瓶灌裝細分市場將以43.2%的市場份額佔據主導地位,這主要得益於其在傳染病和心血管治療領域的廣泛應用、與醫院管理系統良好的兼容性以及保持高無菌性和劑量準確性的能力。

報告範圍及歐洲小分子無菌注射劑市場細分

|

屬性 |

歐洲小分子無菌注射劑市場關鍵洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

歐洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了提供市場價值、成長率、市場細分、地理覆蓋範圍和主要參與者等市場概況外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、患者流行病學、產品線分析、定價分析和監管框架。 |

歐洲小分子無菌注射劑市場趨勢

轉向預填式和即用型格式

- 歐洲小分子無菌注射藥物市場的一個顯著且加速發展的趨勢是,預灌封注射器、藥筒和即用型製劑的採用率不斷提高,這提高了給藥精度,並縮短了醫院和診所的配藥時間。

- 例如,B. Braun 的預充式註射器和藥筒簡化了給藥流程,最大限度地減少了配藥錯誤,並提高了門診和住院患者的安全性。

- 預填充式即用注射劑可減少用藥錯誤,降低污染風險,提高護理人員和護理人員的工作效率,同時支援在緊急情況和重症監護情況下快速回應。

- 這些先進的給藥方式與醫院藥房自動化系統的無縫集成,有助於集中式藥物管理和高效的庫存控制,使臨床醫生能夠專注於患者護理。

- 這種朝向更便利、更安全、更自動化的注射解決方案發展的趨勢正在重塑醫院的採購重點,並影響藥物生產策略。

- 在已開發和新興的歐洲醫療保健市場,預灌封、即用型無菌注射劑的需求正在迅速增長,因為醫療機構越來越重視安全性、效率和工作流程優化。

- 患者越來越傾向於在居家照護環境中採用微創和可自行注射的治療方法,這進一步推動了歐洲各地創新給藥方式的普及。

歐洲小分子無菌注射劑市場動態

司機

慢性病和傳染病症率不斷上升

- 心血管疾病、代謝性疾病、自體免疫疾病以及傳染病等慢性疾病的日益流行,是推動小分子無菌注射劑需求成長的重要因素。

- 例如,輝瑞公司的注射用心血管治療藥物和抗感染藥物在德國和法國的醫院使用量增加,反映出疾病負擔和治療需求的日益加重。

- 隨著醫療機構尋求安全有效的關鍵療法給藥方式,與傳統口服製劑相比,無菌注射劑可提供精確的劑量、降低污染風險並改善患者療效。

- 此外,政府和醫院為提高治療可及性和確保藥品品質穩定而採取的舉措,正在增加無菌注射劑的採購量,使其成為現代醫療保健服務的重要組成部分。

- 即用型製劑的便利性,加上其在重大疾病治療領域獲得監管部門批准,正推動無菌注射劑在醫院、專科診所和家庭護理機構的廣泛應用。

- 歐洲對醫院準備和應對疫情準備工作的日益重視,加速了對注射抗感染藥物、疫苗和緊急治療藥物的需求。

- 製藥公司與醫療服務提供者之間的合作,旨在擴大無菌注射劑的供應鏈,從而提高產品供應量並促進市場成長。

克制/挑戰

監理合規和冷鏈管理方面的障礙

- 無菌注射劑生產的嚴格監管要求,包括無菌操作、GMP合規性和批次檢測,對新進入市場的企業和小型生產商構成了重大挑戰。

- For instance, recent inspections by the European Medicines Agency (EMA) highlighted deficiencies in aseptic processing controls, causing production delays for certain cardiovascular and metabolic injectables

- Maintaining cold chain integrity and ensuring product stability during transportation and storage are critical, as deviations can lead to reduced potency, contamination, or product recalls

- In addition, the high costs of sterile manufacturing facilities and validated processes can limit scalability and slow adoption in emerging European markets, despite growing demand

- Overcoming these challenges through investment in state-of-the-art manufacturing technologies, robust quality assurance, and cold chain infrastructure is vital for sustained growth and market competitiveness

- Limited availability of skilled personnel trained in aseptic techniques and injectable production can hinder production efficiency and quality assurance in some European countries

- Evolving regulatory updates across different European countries require continuous compliance adaptation, increasing operational complexity and cost for manufacturers

Europe Small Molecule Sterile Injectable Drugs Market Scope

The market is segmented on the basis of product, application, end-users, and distribution channels.

- By Product

On the basis of product, the market is segmented into vial filling, syringe filling, cartridge filling, and others. The vial filling segment dominated the market with the largest revenue share of 43.2% in 2025, driven by its widespread adoption in hospitals and specialty clinics. Vials are highly versatile, allowing multiple doses per container, which reduces packaging costs and improves inventory management. Healthcare providers prefer vials for their compatibility with automated filling lines and established aseptic processing systems. The segment also benefits from strong regulatory familiarity, ensuring compliance with stringent European pharmacopeia standards. In addition, vials are widely used for infectious disease and cardiovascular therapies, which represent a significant portion of sterile injectable demand. Their long-standing presence in clinical practice and ease of storage further reinforce their dominance.

The syringe filling segment is expected to witness the fastest growth with a CAGR of 11.8% from 2026 to 2033, fueled by increasing demand for ready-to-administer solutions in hospitals and home care. Prefilled syringes reduce preparation errors, improve patient safety, and enhance workflow efficiency for healthcare professionals. Their growing use in metabolic, neurological, and autoimmune treatments is boosting adoption across Europe. Syringes are particularly favored in outpatient and homecare settings due to ease of administration and reduced risk of contamination. Technological advancements in automated syringe filling are also enabling higher production capacities, supporting faster market growth.

- By Application

On the basis of application, the market is segmented into oncology, infectious diseases, cardiovascular diseases, metabolic diseases, neurology, dermatology, urology, autoimmune diseases, respiratory disorders, and others. The infectious diseases segment dominated the market in 2025 with a share of 38.6%, driven by high prevalence of bacterial and viral infections across Europe. Hospitals and clinics rely heavily on sterile injectables for rapid treatment of critical infections. This segment benefits from government programs to improve vaccination and anti-infective availability. Injectable anti-infectives offer precise dosing and ensure treatment efficacy, reducing mortality in hospitalized patients. Strong R&D pipelines and manufacturing capabilities in Germany, France, and Italy also support the supply of sterile anti-infectives. Moreover, the segment’s stability in cold chain storage and long shelf-life make it a preferred choice for healthcare providers.

The cardiovascular diseases segment is expected to witness the fastest growth from 2026 to 2033, driven by rising prevalence of heart failure, thrombosis, and hypertension in aging European populations. Injectable cardiovascular drugs, particularly prefilled syringes and vials, are increasingly used in hospital critical care and outpatient settings. Advancements in formulation, such as long-acting injectables, are improving patient adherence and therapeutic outcomes. The growing focus on emergency and intensive care treatments further accelerates segment growth. Countries with high healthcare expenditure, such as Germany and the U.K., are early adopters of these advanced injectables.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, specialty clinics, home care settings, and others. The hospital segment dominated the market with the largest share of 45.3% in 2025, due to high patient volume and the requirement for critical care and emergency treatments. Hospitals benefit from economies of scale in purchasing sterile injectables and rely on vial and syringe formats for multiple therapeutic applications. Established hospital pharmacy systems facilitate inventory control, ensuring continuous availability of injectables. Regulatory compliance and quality assurance protocols are easier to maintain in hospital environments. In addition, hospitals drive demand for both high-volume production and ready-to-administer injectables, strengthening this segment’s dominance. European hospitals, especially in Germany, France, and Italy, remain key consumers of sterile injectables.

The home care settings segment is expected to witness the fastest growth over the forecast period, fueled by increasing adoption of self-administered injectable therapies for chronic and metabolic diseases. Prefilled syringes and cartridges allow patients to safely administer treatments outside hospitals. Aging populations and the push for decentralized healthcare delivery are supporting homecare expansion. Telemedicine and home health services further facilitate adoption of sterile injectables in residential settings. Convenience, reduced hospitalization costs, and improved patient compliance are driving growth in this segment. Countries such as Poland, Spain, and the Nordics are leading this trend in Europe.

- By Distribution Channels

On the basis of distribution channels, the market is segmented into direct tender, retail pharmacy, online pharmacy, and others. The direct tender segment dominated the market with a share of 50.1% in 2025, driven by bulk procurement by hospitals and government healthcare programs. Direct tendering ensures lower costs, consistent supply, and regulatory compliance for sterile injectable drugs. This channel is particularly strong for critical care and high-demand anti-infective and cardiovascular injectables. Contracts via tenders also support long-term supplier relationships and facilitate large-scale distribution across European healthcare systems. The segment’s dominance is reinforced by strong participation from key pharmaceutical manufacturers. Countries with centralized healthcare systems, such as Germany and France, heavily utilize this channel.

The online pharmacy segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising e-commerce adoption and demand for home-delivered injectable therapies. Online channels provide convenient access to prefilled syringes and specialty injectables for homecare patients. Integration with telemedicine and digital prescription services is expanding the reach of online pharmacies. Enhanced logistics and cold chain capabilities are enabling safe delivery of sensitive injectable products. Younger and tech-savvy patients are increasingly preferring online pharmacies for chronic and metabolic therapies. Countries such as the U.K., Germany, and the Nordics are early adopters of this distribution channel

Europe Small Molecule Sterile Injectable Drugs Market Regional Analysis

- Germany dominated the Europe small molecule sterile injectable drugs market with the largest revenue share of 28.7% in 2025, characterized by its well-established pharmaceutical manufacturing infrastructure, strong regulatory frameworks, and high healthcare expenditure, with major contributions from vial filling and syringe filling products used across infectious disease and cardiovascular therapies

- 德國的醫院和專科診所高度重視用於重症監護、傳染病和心血管治療的高品質無菌注射劑的供應,以及能夠提高工作流程效率和病人安全性的即用型製劑。

- 德國的廣泛應用得益於先進的醫院系統、政府對醫療保健的支持,以及許多國內外領先製藥企業的強大實力,這些因素共同促成了德國作為歐洲無菌注射劑生產和消費中心的地位。

德國小分子無菌注射劑市場洞察

2025年,德國市場將以最大的收入份額主導歐洲市場,這得益於其完善的製藥生產基地、高額的醫療保健支出以及強有力的監管。醫院和專科診所高度重視用於傳染病、心血管疾病和代謝性疾病治療的高品質無菌注射劑的供應。預充式註射器和自動化小瓶灌裝系統的應用提高了工作流程效率,並減少了用藥錯誤。德國對創新的重視、先進的製造能力以及對歐洲藥典標準的嚴格遵守,促進了無菌注射劑的廣泛應用。此外,政府的醫療保健計劃和針對關鍵療法的強大研發管線也為市場的持續擴張提供了支持。

英國小分子無菌注射市場洞察

預計在預測期內,英國市場將以顯著的複合年增長率成長,這主要得益於慢性病盛行率的上升和家庭注射療法的日益普及。醫療服務提供者正著力推廣即用型產品,以提高病患依從性並減輕醫院的工作量。英國完善的醫療基礎設施和集中採購機制有助於無菌注射劑的高效分銷。對病人安全、精準給藥和無菌操作的關注,促使醫療機構採用先進的注射解決方案。此外,門診診所和專科中心數量的不斷增長,預計將推動多個治療領域的需求成長。

法國小分子無菌注射劑市場洞察

由於傳染病、心血管疾病和代謝紊亂的住院人數不斷增加,法國市場正經歷穩定成長。預充式註射器和瓶裝注射因其能提高劑量精準度並縮短醫護人員的配藥時間而日益受到青睞。法國完善的監管體系確保了所有無菌注射劑的高品質和安全標準。此外,醫院自動化、集中式藥局管理系統和冷鏈基礎設施的投資也進一步推動了市場發展。患者意識的提高以及政府推行的促進基本療法可及性的項目也促進了市場擴張。

波蘭小分子無菌注射市場洞察

預計在預測期內,波蘭市場將實現最快成長,這主要得益於醫院基礎設施的擴建、醫療保健支出的增加以及先進注射療法的普及。預充式註射器和藥筒正迅速應用於代謝性疾病、心血管疾病和傳染病的治療,從而提高了患者的安全性和依從性。居家照護服務和門診的興起也推動了市場需求的成長,因為患者更傾向於便利易用的即用型解決方案。政府為改善基本藥物可近性而採取的措施以及對冷鏈物流的投資也為市場成長提供了支持。對醫療服務現代化和專科診所擴張的日益重視正在加速無菌注射劑的普及。此外,醫護人員對無菌操作和安全給藥規範的認識不斷提高,也促進了波蘭市場的滲透。

歐洲小分子無菌注射劑市場份額

歐洲小分子無菌注射劑產業主要由一些成熟的公司主導,其中包括:

- Recipharm AB(瑞典)

- Vetter Pharma‑Fertigung GmbH & Co. KG(德國)

- Cenexi(法國)

- 西格弗里德控股股份公司(瑞士)

- Unither Pharmaceuticals(法國)

- Famar集團(希臘)

- Aenova集團(德國)

- 百特(美國)

- 龍沙集團股份公司(瑞士)

- Rentschler Biopharma SE(德國)

- 德爾法姆(法國)

- CordenPharma GmbH(德國)

- NextPharma Technologies GmbH(德國)

- BAG Health Care GmbH(德國)

- Lyocontract GmbH(德國)

- Simtra BioPharma Solutions(德國)

- PCI製藥服務(美國)

- 費森尤斯卡比股份公司(德國)

- 輝瑞(美國)

歐洲小分子無菌注射劑市場近期有哪些發展動態?

- 2025年10月,Polpharma Biologics推出了歐洲首個預充式註射器形式的雷珠單抗生物相似藥,旨在改善眼科治療的給藥方式。該公司宣布,預充式註射器形式的Lucentis®生物相似藥Ranivisio® PFS現已在法國上市,可為新生血管性老年黃斑部病變及相關疾病提供精準的劑量控制和更便捷的給藥方式,代表了無菌注射藥物製劑領域的一項重大創新。

- In June 2025, Simtra BioPharma Solutions completed construction of a new sterile injectable manufacturing facility. The expansion added 1,800 m² of production space, increasing total manufacturing area to nearly 12,000 m², introducing prefilled syringe technology and additional freeze dryers. This facility strengthens the company’s sterile fill/finish capacity for vials and syringes to meet growing demand for complex injectable therapeutics

- In February 2025, Recipharm launched a fully operational modular sterile filling system. Recipharm installed a new GMP‑compliant modular aseptic filling line at its Wasserburg facility that supports multiple product types, including syringes and vials. The system improves flexibility, reduces product loss, and broadens sterile processing capacity for clinical and commercial needs

- In February 2025, Sovereign Pharma secured EU approval for multiple sterile injectable products. The company received European Union regulatory approval for a range of aseptic and terminally sterilised formats including vials, ampoules, cartridges, and pre‑filled syringes reinforcing its ability to supply sterile injectables across EU markets

- In February 2023, Switzerland‑based CARBOGEN AMCIS opened a new sterile injectable drug manufacturing facility in France, expanding automated production lines for liquid and freeze‑dried sterile injectables. The new 9,500 m² facility includes two fully automated lines capable of producing highly potent compounds and advanced injectable therapies, boosting Europe’s fill‑finish capacity amid tight global aseptic manufacturing supply

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。