Global Aircraft Refuelling Hose Market

市场规模(十亿美元)

CAGR :

%

USD

2.41 Billion

USD

3.56 Billion

2024

2032

USD

2.41 Billion

USD

3.56 Billion

2024

2032

| 2025 –2032 | |

| USD 2.41 Billion | |

| USD 3.56 Billion | |

|

|

|

|

全球飛機加油軟管市場細分,按類型(複合軟管、不銹鋼軟管和橡膠軟管)、應用(直升機、軍用飛機、無人機 (UAV) 和商用飛機)、銷售管道(原始設備製造商 (OEM) 和售後市場) - 行業趨勢和預測到 2032 年

飛機加油軟管市場規模

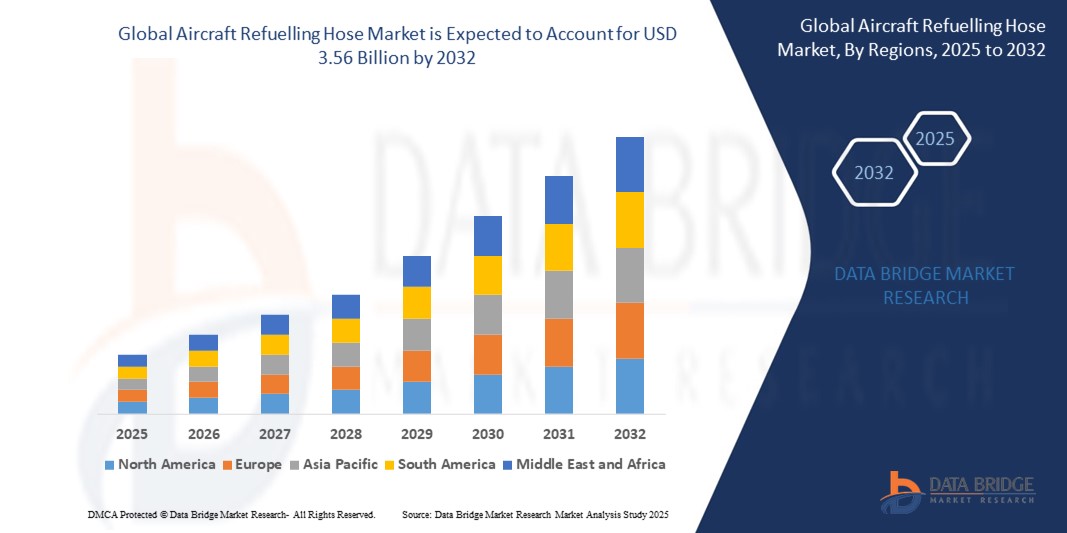

- 2024 年全球飛機加油軟管市場規模為24.1 億美元 ,預計 到 2032 年將達到 35.6 億美元,預測期內 複合年增長率為 5.00%。

- 市場成長主要受到航空旅行需求成長、全球飛機機隊擴大以及發展中地區軍事和商業航空活動增加的推動

飛機加油軟管市場分析

- 由於空中交通量增加和商業航空運營激增,飛機加油軟管市場正在穩步增長,特別是在亞太地區和中東地區

- 機場基礎設施投資的增加、空軍機隊的現代化以及國防行動中對空中加油的日益青睞,都對市場擴張做出了巨大貢獻

- 北美在飛機加油軟管市場佔據主導地位,2024 年其收入份額最大,為 39.8%,這得益於龐大的軍事艦隊、先進的航空基礎設施以及對商業航空旅行投資的增加

- 預計亞太地區將見證全球飛機加油軟管市場的最高成長率,這得益於商用航空的快速擴張、國防預算的增加以及中國、印度和日本等國的大型機場基礎設施項目的推動。

- 複合軟管領域在2024年佔據了最大的市場收入份額,這得益於其輕質結構、高柔韌性以及卓越的燃油降解和極端天氣耐受性。複合軟管因其安全性、耐用性和處理高壓加油作業的能力而被廣泛應用於軍用和商用飛機。它們與多種航空燃料的兼容性也使其在全球加油系統中廣泛應用。

報告範圍和飛機加油軟管市場細分

|

屬性 |

飛機加油軟管關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

• 擴大軍事空中加油行動 • 越來越多採用永續航空燃料系統 |

|

加值資料資訊集 |

除了市場價值、成長率、市場區隔、地理覆蓋範圍、市場參與者和市場情景等市場洞察之外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 pestle 分析。 |

飛機加油軟管市場趨勢

“輕質耐用複合材料在軟管設計中的應用”

- 熱塑性複合材料和芳綸纖維的日益融合提高了軟管的耐用性、柔韌性和耐壓性,尤其是在惡劣的操作條件下

- 這些材料減輕了整體系統的重量,有助於提高飛機的燃油效率,並使地面操作期間的操作更加容易。

- 複合軟管具有更高的抗紫外線、抗靜電和抗燃料降解性能,使其成為商用和軍用航空中頻繁使用的理想選擇

- 對支援生物燃料和替代燃料相容性的軟管的需求不斷增長,推動製造商在材料科學方面進行創新

- 多家航空設備供應商正致力於生產符合新環境和機械基準且性能不受影響的軟管

- 例如,GKN Aerospace 推出了採用增強聚合物層的高性能輕型軟管,目前已用於先進的軍用加油系統,以改善極端壓力下的燃料處理

飛機加油軟管市場動態

司機

“商業航空旅行需求不斷增長和全球機隊擴張”

- 中產階級人口的增加、旅遊業的繁榮以及航空連結性的改善,導致全球航空客運量顯著增長

- Airlines are expanding their fleets with newer fuel-efficient aircraft, requiring compatible, high-specification refuelling hoses for both hydrant and overwing operations

- Airport modernization projects across emerging economies are driving investments in upgraded refuelling infrastructure, including hose reels and couplings

- Aircraft turnaround time is becoming a critical factor, leading ground support operators to adopt more efficient and fast-refuelling hose systems

- Regulatory support for expanding regional connectivity and fleet renewal programs is further boosting demand for certified hose assemblies

- For instance, India’s UDAN (Ude Desh ka Aam Nagrik) scheme has triggered a sharp increase in regional air services, prompting new airport developments that include advanced refuelling systems supported by premium-grade hoses

Restraint/Challenge

“Stringent Safety Regulations and Certification Standards”

- Refuelling hoses are required to pass rigorous safety, pressure, conductivity, and flammability tests under international aviation regulations, including EN, SAE, and FAA standards

- Achieving these certifications demands significant investment in R&D, laboratory infrastructure, and compliance documentation, increasing time-to-market

- Small and mid-sized players often face competitive disadvantages due to the financial burden and technical expertise required for certification

- Constant revisions in safety protocols—especially with the growing use of alternative fuels—can render existing hose products non-compliant, leading to recalls or redevelopment

- Delays in certification approvals can stall production schedules, disrupt supplier contracts, and limit product availability in fast-growing aviation markets

- For instance, a European aerospace supplier experienced an 8-month delay in deploying new biofuel-compatible hoses due to updated EN 1361 aviation standards, resulting in lost contracts with two regional airports

Aircraft Refuelling Hose Market Scope

The market is segmented on the basis of type, application, and sales channel.

• By Type

On the basis of type, the aircraft refuelling hose market is segmented into composite hose, stainless steel hose, and rubber hose. The composite hose segment held the largest market revenue share in 2024, driven by its lightweight construction, high flexibility, and superior resistance to fuel degradation and extreme weather. Composite hoses are widely used in military and commercial aircraft due to their safety features, durability, and ability to handle high-pressure refuelling operations. Their compatibility with a range of aviation fuels also contributes to their widespread adoption across global refuelling systems.

The rubber hose segment is expected to witness a fastest growth rate from 2025 to 2032, owing to its cost-effectiveness, flexibility, and ease of handling during ground operations. These hoses are particularly favored for commercial ground support at smaller airports and helipads where lower pressure tolerance is sufficient. In addition, advancements in synthetic rubber formulations have enhanced the hose’s lifespan and resistance to abrasion and chemical exposure.

• By Application

On the basis of application, the market is segmented into helicopters, military aircraft, unmanned aerial vehicle (UAV), and commercial aircraft. The military aircraft segment led the market with the largest revenue share in 2024, driven by the growing emphasis on aerial refuelling capabilities and increased global defense spending. High-performance hose systems are critical in mid-air refuelling missions, requiring exceptional pressure durability and anti-static features.

The UAV segment is to expected witness a fastest growth rate from 2025 to 2032, due to rising defense and surveillance applications. As UAVs become more sophisticated and long-range capable, the need for compact, lightweight, and efficient refuelling hoses has risen, prompting manufacturers to develop customized solutions for unmanned systems.

• By Sales Channel

On the basis of sales channel, the market is segmented into original equipment manufacturer (OEM) and aftermarket. The OEM segment accounted for the largest market share in 2024, supported by ongoing aircraft production and increasing orders for next-generation military and commercial aircraft. OEMs prioritize durable, certified hose systems that can be integrated into new aircraft during assembly.

The aftermarket segment is expected to witness a fastest growth rate from 2025 to 2032 due to the frequent need for hose replacement, maintenance, and retrofitting in existing aircraft fleets. Airlines and defense forces regularly procure high-performance hoses through aftermarket suppliers to ensure fuel system integrity and compliance with updated safety standards.

Aircraft Refuelling Hose Market Regional Analysis

• North America dominated the aircraft refuelling hose market with the largest revenue share of 39.8% in 2024, driven by the presence of a large military fleet, advanced aviation infrastructure, and increasing investments in commercial air travel

• The region benefits from a robust aerospace manufacturing ecosystem, frequent technological upgrades, and widespread adoption of aerial refuelling systems across defense and civil aviation sectors

• High demand for durable and certified refuelling hoses, particularly in military air-to-air refuelling and commercial ground support operations, continues to fuel market expansion in both the U.S. and Canada

U.S. Aircraft Refuelling Hose Market Insight

2024年,美國飛機加油軟管市場佔據北美最大的市場份額,達82%,這得益於美國龐大的國防開支和主要航空航天原始設備製造商的參與。美國日益重視空軍加油機隊的升級,加上國內和國際航班的頻繁飛行,推動了對高性能軟管的需求。此外,KC-46「飛馬」等先進加油機對複合軟管的使用也促進了市場的成長。

歐洲飛機加油軟管市場洞察

受嚴格的航空燃油安全法規和綠色航空基礎設施投資不斷增加的推動,歐洲飛機加油軟管市場預計將在2025年至2032年期間實現最快成長。由於北約主導的防禦計劃和多國軍事演習,該地區的空中加油需求也在增加。此外,歐洲商業機場正致力於高效的地面支援系統,包括更換老化的加油軟管組件,以滿足環境和營運標準。

英國飛機加油軟管市場洞察

英國飛機加油軟管市場預計將在2025年至2032年期間實現最快成長,這得益於英國皇家空軍現代化建設以及對永續航空技術的持續投資。高性能軟管與地面加油車輛和空對空加油系統的整合正日益受到關注,尤其是在英國為應對全球地緣政治形勢而提升國防機動性和機場服務能力的情況下。

德國飛機加油軟管市場洞察

由於德國致力於升級民用和軍用航空基礎設施,預計其飛機加油軟管市場將在2025年至2032年間實現最快成長。德國致力於實現歐盟氣候目標,已在主要機場採用相容生物燃料的軟管系統。此外,德國在工程和航空航天創新領域的領先地位,也為旨在延長使用壽命和提高燃油效率的先進軟管材料的開發和部署提供了支援。

亞太地區飛機加油軟管市場洞察

預計亞太地區飛機加油軟管市場將在2025年至2032年間實現最快成長,這得益於中國、印度和日本等國飛機機隊的快速擴張、國防預算的增加以及航空旅行需求的不斷增長。政府主導的機場和軍事加油能力現代化計畫正在加速先進軟管系統的部署。此外,不斷增長的航空零件製造基地也正在提高該地區的可及性和可負擔性。

日本飛機加油軟管市場洞察

由於日本的戰略國防升級以及對高彈性地面支援系統日益增長的需求,預計日本飛機加油軟管市場將在2025年至2032年間實現最快成長。日本採用先進的軍用飛機以及日益深入的國際防務合作,正在推動對高規格加油軟管的需求。此外,對智慧機場基礎設施的投資也促進了耐用且環保的軟管技術的廣泛應用。

中國飛機加油軟管市場洞察

2024年,中國飛機加油軟管市場佔據亞太地區最大收入份額,這得益於中國快速發展的商用航空業以及對軍事現代化的大量投資。中國自主研發的加油機和不斷壯大的民航機隊,正在推動OEM和售後軟管解決方案的需求。中國政府對基礎設施建設的高度重視,包括機場擴建和智慧城市項目,進一步支持了該市場的持續成長。

飛機加油軟管市場份額

飛機加油軟管產業主要由知名公司主導,其中包括:

- 伊頓(愛爾蘭)

- 派克漢尼汾公司(美國)

- RYCO 液壓公司(澳洲)

- Kurt Manufacturing(美國)

- NORRES Schlauchtechnik GmbH(德國)

- Transfer Oil SpA(義大利)

- 康迪泰克股份公司(德國)

- Kanaflex Corporation Co.,ltd.(日本)

- 太平洋迴聲(美國)

- Colex國際股份有限公司(英國)

- 蓋茲公司(美國)

- Semperit AG Holding(奧地利)

- KURIYAMA OF AMERICA, INC.(美國)

- Titeflex(美國)

- 特瑞堡集團(瑞典)

- Flexaust Inc.(美國)

- 塞勒姆共和國橡膠公司(美國)

- PIRTEK(澳洲)

- Dixon Valve & Coupling Company, LLC(美國)

- 泰坦配件(美國)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AIRCRAFT REFUELLING HOSE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIO

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AIRCRAFT REFUELLING HOSE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AIRCRAFT REFUELLING HOSE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 VALUE CHAIN ANALYSIS

5.5 PATENT ANALYSIS

5.6 COMPANY COMPARITIVE ANALYSIS

5.7 PRICING ANALYSIS

6 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY TYPE

6.1 OVERVIEW

6.2 COMPOSITE HOSE

6.3 STAINLESS STEEL HOSE

6.4 RUBBER HOSE

6.5 OTHERS

7 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY WORKING PRESSURE

7.1 OVERVIEW

7.2 LESS THAN 200 PSI

7.3 MORE THAN 200 PSI

8 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY SIZE

8.1 OVERVIEW

8.2 LESS 2 INCH

8.3 ABOVE 2 INCH

9 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY AIRCRAFT TYPE

9.1 OVERVIEW

9.2 NARROW BODY

9.3 WIDE BODY

9.4 ROTOCRAFT

10 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 REEL HOSES

10.3 PLATFORM (DECK) HOSES

10.4 HYDRANT DISPENSER INLET HOSES

10.5 FUELLER LOADING HOSES

11 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY FUEL TYPE

11.1 OVERVIEW

11.2 AVIATION GASOLINE

11.3 JET FUELS

11.4 OTHERS (ANTI-ICINGS FLUIDS AND MOTOR OILS)

12 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY END USER

12.1 OVERVIEW

12.2 COMMERCIAL AVIATION

12.2.1 BY TYPE

12.2.1.1.1. COMPOSITE HOSE

12.2.1.1.2. STAINLESS STEEL HOSE

12.2.1.1.3. RUBBER HOSE

12.2.1.1.4. OTHERS

12.3 MILITARY AVIATION

12.3.1 MILITARY AVIATION, BY TYPE

12.3.1.1.1. TRAINING AIRCRAFT

12.3.1.1.2. COMBAT AIRCRAFT

12.3.1.1.3. HELICOPTERS

12.3.1.1.4. TRANSPORT AIRCRAFT

12.3.2 BY TYPE

12.3.2.1.1. COMPOSITE HOSE

12.3.2.1.2. STAINLESS STEEL HOSE

12.3.2.1.3. RUBBER HOSE

12.3.2.1.4. OTHERS

12.4 OTHERS

13 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY SALES CHANNEL

13.1 OVERVIEW

13.2 OEM

13.3 AFTERMARKET

14 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, BY REGION

14.1 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1.1 NORTH AMERICA

14.1.1.1.1. U.S.

14.1.1.1.2. CANADA

14.1.1.1.3. MEXICO

14.1.2 EUROPE

14.1.2.1.1. GERMANY

14.1.2.1.2. FRANCE

14.1.2.1.3. U.K.

14.1.2.1.4. ITALY

14.1.2.1.5. SPAIN

14.1.2.1.6. RUSSIA

14.1.2.1.7. TURKEY

14.1.2.1.8. BELGIUM

14.1.2.1.9. NETHERLANDS

14.1.2.1.10. SWITZERLAND

14.1.2.1.11. SWEDEN

14.1.2.1.12. DENMARK

14.1.2.1.13. NORWAY

14.1.2.1.14. POLAND

14.1.2.1.15. CZECH REPUBLIC

14.1.2.1.16. REST OF EUROPE

14.1.3 ASIA PACIFIC

14.1.3.1.1. JAPAN

14.1.3.1.2. CHINA

14.1.3.1.3. SOUTH KOREA

14.1.3.1.4. INDIA

14.1.3.1.5. AUSTRALIA

14.1.3.1.6. SINGAPORE

14.1.3.1.7. THAILAND

14.1.3.1.8. MALAYSIA

14.1.3.1.9. INDONESIA

14.1.3.1.10. PHILIPPINES

14.1.3.1.11. VIETNAM

14.1.3.1.12. TAIWAN

14.1.3.1.13. REST OF ASIA PACIFIC

14.1.4 SOUTH AMERICA

14.1.4.1.1. BRAZIL

14.1.4.1.2. ARGENTINA

14.1.4.1.3. COLOMBIA

14.1.4.1.4. PERU

14.1.4.1.5. CHILE

14.1.4.1.6. ECUADOR

14.1.4.1.7. REST OF SOUTH AMERICA

14.1.5 MIDDLE EAST AND AFRICA

14.1.5.1.1. SOUTH AFRICA

14.1.5.1.2. EGYPT

14.1.5.1.3. SAUDI ARABIA

14.1.5.1.4. U.A.E

14.1.5.1.5. ISRAEL

14.1.5.1.6. KUWAIT

14.1.5.1.7. QATAR

14.1.5.1.8. OMAN

14.1.5.1.9. REST OF MIDDLE EAST AND AFRICA

14.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL AIRCRAFT REFUELLING HOSE MARKET, SWOT & DBMR ANALYSIS

17 GLOBAL AIRCRAFT REFUELLING HOSE MARKET , COMPANY PROFILE

17.1 CONTITECH

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 PARKER HANNIFI N CORPORATION

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 POLYHOSE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 EATON

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 APACHE MOTION IND.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 DELAFIELD CORPORATION

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 AERO-HOSE, CORP.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 SEMPERIT AG HOLDING

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 TITEFLEX.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 TRELLEBORG GROUP

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 FLEXAUST INC

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 SALEM-REPUBLIC RUBBER COMPANY

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 PIRTEK

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 DIXON VALVE & COUPLING COMPANY

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 AIRBUS S.A.S

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 LOCKHEED MARTIN

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 TITAN ASIA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 BOEING.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 SAFRAN

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 IAI

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 HUSKY CORPORATION

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 AERO-HOSE, CORP.

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 CONCLUSION

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。