Global Angio Suites Diagnostic Imaging Market

市场规模(十亿美元)

CAGR :

%

USD

1.51 Billion

USD

1.84 Billion

2025

2033

USD

1.51 Billion

USD

1.84 Billion

2025

2033

| 2026 –2033 | |

| USD 1.51 Billion | |

| USD 1.84 Billion | |

|

|

|

|

全球血管攝影設備(診斷影像)市場細分,按設備(X射線產生器、C臂、手術台和X射線探測器)、應用(血管成形術、治療性支架植入術、阻塞性旁路手術、血管內治療、血管造影術、脊髓造影術、椎體成形術和非創組織標本切除術)、最終用戶(醫院、診斷中心和其他)

血管攝影室(診斷影像)市場規模

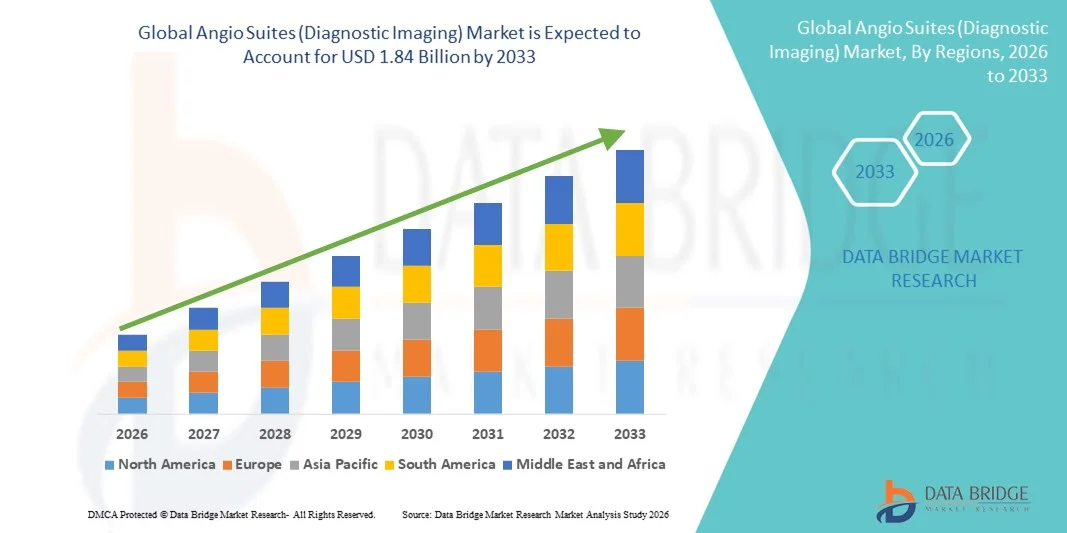

- 2025年全球血管攝影室(診斷影像)市場規模為15.1億美元 ,預計 2033年將達到18.4億美元,預測期內 複合年增長率為2.54%。

- 市場成長主要受心血管和神經血管疾病盛行率上升以及診斷影像系統技術快速發展所推動,這導致醫院和專科護理中心越來越多地採用先進的血管造影室。

- 此外,對微創手術、改善臨床療效和整合影像解決方案日益增長的需求,正使血管造影室成為現代介入性心臟病學、放射學和神經病學部門必不可少的基礎設施。這些因素共同推動了血管造影室(診斷影像)解決方案的普及,從而顯著促進了該行業的成長。

血管攝影套房(診斷影像)市場分析

- 血管攝影室整合了透視、CT 和數位減影血管攝影等先進的診斷影像系統,由於其能夠支持高精度、微創的心血管、神經血管和腫瘤手術,因此已成為現代醫院和專科診所日益重要的組成部分。

- 對血管攝影室的需求不斷攀升,主要受以下因素驅動:心血管疾病負擔日益加重、微創介入治療越來越受歡迎、導管室手術量不斷增加,以及混合手術室、人工智慧成像和輻射劑量管理等技術的持續進步。

- 北美在全球血管攝影室(診斷影像)市場佔據主導地位,預計2025年將佔總收入的約38.5% 。這得益於先進的醫療基礎設施、介入手術的高普及率、有利的報銷機制以及領先成像系統製造商的強大市場地位。美國持續推動區域成長,這主要歸功於大型醫院網路對導管室現代化改造和混合手術室建設的持續投入。

- 預計在預測期內,亞太地區將成為血管攝影室(診斷影像)市場成長最快的地區,這主要得益於醫療基礎設施的不斷完善、醫療支出的持續成長、心血管疾病發生率的上升,以及中國、印度和日本等國家對先進診斷技術的日益普及。

- 預計到2025年,C型臂設備將佔據最大的市場份額,達到38.6%,這主要得益於其在介入和血管手術中提供即時、高解析度透視成像的關鍵作用。

報告範圍和血管造影套件(診斷成像)市場細分

|

屬性 |

血管攝影套件(診斷影像)關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、患者流行病學、產品線分析、定價分析和監管框架。 |

血管攝影套房(診斷影像)市場趨勢

邁向混合式和影像引導介入平台

- A significant and accelerating trend in the global angio suites (diagnostic imaging) market is the growing adoption of hybrid operating rooms and advanced image-guided interventional platforms that combine angiography, CT, and real-time imaging within a single suite. This trend is driven by the rising preference for minimally invasive and image-guided cardiovascular, neurovascular, and oncology procedures

- For instance, in February 2023, Siemens Healthineers expanded its ARTIS icono angiography platform, integrating robotic C-arms and advanced 3D imaging to support complex interventional cardiology and neurovascular procedures within hybrid angio suites. This development enables clinicians to perform multiple diagnostic and therapeutic procedures in one setting with improved precision and workflow efficiency

- Modern angio suites are increasingly equipped with high-resolution flat-panel detectors, real-time 3D visualization, and dose-optimization technologies, improving procedural accuracy while reducing radiation exposure for both patients and clinicians

- The integration of angiography systems with surgical navigation tools and intraoperative imaging supports complex interventions such as transcatheter heart valve replacement (TAVR), endovascular aneurysm repair (EVAR), and stroke thrombectomy

- This shift toward multifunctional, high-performance angio suites is reshaping clinical workflows by reducing procedure times, minimizing patient transfers, and improving overall procedural outcomes

- As a result, leading manufacturers such as GE HealthCare, Philips, and Canon Medical Systems are focusing on modular and scalable angio suite designs that can be customized to hospital requirements and evolving procedural needs

Angio Suites (Diagnostic Imaging) Market Dynamics

Driver

Rising Prevalence of Cardiovascular and Neurovascular Disorders

- The increasing global burden of cardiovascular diseases, stroke, and peripheral vascular disorders is a major driver for the growing demand for advanced angio suites, as these conditions often require precise diagnostic imaging and minimally invasive interventional procedures

- For instance, in July 2024, Philips announced the installation of its Azurion angiography systems across multiple European tertiary hospitals, aimed at supporting high-volume interventional cardiology and neurovascular procedures, reflecting strong clinical demand for advanced imaging-guided treatment environments

- Angio suites enable clinicians to perform complex procedures such as coronary angioplasty, embolization, and catheter-based interventions with enhanced visualization and accuracy, leading to improved patient outcomes

- The growing adoption of minimally invasive procedures, driven by shorter hospital stays and reduced complication rates, is further increasing the utilization of angio suites in hospitals and specialty clinics

- In addition, expanding healthcare infrastructure and increased investment in advanced diagnostic imaging technologies, particularly in emerging economies, are accelerating the installation of new angio suites

- These factors collectively position angio suites as essential components of modern interventional healthcare facilities, supporting sustained market growth

Restraint/Challenge

High Capital Investment and Infrastructure Requirements

- The high upfront cost associated with purchasing, installing, and maintaining angio suites represents a significant challenge, particularly for small and mid-sized hospitals and healthcare facilities in cost-sensitive regions

- For instance, in October 2022, several public hospitals in Latin America delayed planned angio suite upgrades due to budget constraints and rising equipment costs, highlighting how financial limitations can slow market adoption despite clinical demand

- Angio suites require specialized infrastructure, including radiation-shielded rooms, advanced cooling systems, and integration with hospital IT networks, which further increases total project costs

- Ongoing expenses related to system upgrades, software updates, and trained personnel add to the long-term financial burden for healthcare providers

- In developing regions, limited access to skilled interventional radiologists and trained technicians can also restrict optimal utilization of installed angio suites

- Addressing these challenges through flexible financing models, modular system designs, and expanded training programs will be critical for broader adoption and sustained market expansion

Angio Suites (Diagnostic Imaging) Market Scope

The market is segmented on the basis of equipment, application, and end users.

- By Equipment

On the basis of equipment, the Global Angio Suites (Diagnostic Imaging) market is segmented into X-Ray Generator, C-Arm, Operating Table, and X-Ray Detector. The C-Arm segment dominated the largest market revenue share of 38.6% in 2025, driven by its critical role in providing real-time, high-resolution fluoroscopic imaging during interventional and vascular procedures. C-Arms enable precise visualization of blood vessels, improving procedural accuracy in angioplasty, stenting, and embolization procedures. Their flexibility, mobility, and compatibility with advanced imaging software make them indispensable in modern angio suites. Increasing adoption of minimally invasive procedures and rising cardiovascular disease prevalence further support demand. Hospitals prefer advanced C-Arm systems due to reduced radiation exposure and improved workflow efficiency. Technological advancements such as flat-panel detectors and 3D imaging capabilities also reinforce dominance. High utilization rates across hybrid operating rooms boost recurring demand. Strong capital investment by large hospitals sustains revenue leadership.

The X-Ray Detector segment is expected to witness the fastest CAGR of 21.2% from 2026 to 2033, fueled by rapid technological innovation and growing demand for high-definition imaging. Advanced digital detectors offer superior image clarity, lower radiation doses, and faster image acquisition, which are critical for complex interventional procedures. The shift from analog to digital imaging systems significantly accelerates adoption. Rising investments in next-generation flat-panel detectors across emerging economies further drive growth. Increasing installation of hybrid angio suites supports detector upgrades. Demand is also boosted by regulatory emphasis on patient safety and dose reduction. Expanding outpatient and minimally invasive procedures contribute to sustained momentum.

- By Application

On the basis of application, the Angio Suites (Diagnostic Imaging) market is segmented into Angioplasty, Therapeutic Stenting, Obstruction Bypasses, Intravascular Therapy, Angiograms, Myelograms, Vertebroplasty, and Surgery-Free Removal of Tissue Specimens. The Angioplasty segment held the largest market revenue share of 34.9% in 2025, owing to the rising global burden of cardiovascular diseases and increasing adoption of catheter-based interventions. Angio suites are essential for real-time imaging guidance during angioplasty procedures, ensuring precision and reduced complication risks. The growing elderly population significantly increases procedure volumes worldwide. Favorable reimbursement policies in developed regions support widespread adoption. Technological improvements enabling faster and safer procedures further strengthen dominance. High procedure frequency across hospitals drives consistent equipment utilization. Increasing awareness of early cardiac intervention sustains long-term demand.

The Surgery-Free Removal of Tissue Specimens segment is projected to grow at the fastest CAGR of 22.5% from 2026 to 2033, driven by the increasing preference for minimally invasive, image-guided diagnostic and therapeutic techniques. Angio suites enable precise targeting, reducing the need for open surgical biopsies. Rising cancer incidence and demand for early diagnosis significantly boost adoption. Patients benefit from shorter recovery times and lower complication rates. Advancements in imaging resolution and navigation technologies enhance procedural success. Growing use in outpatient settings accelerates growth. Expanding clinical applications across oncology and neurology further support rapid expansion.

- By End Users

根據最終用戶,血管攝影手術室(診斷影像)市場可細分為醫院、診斷影像中心和其他機構。到2025年,醫院細分市場將佔據最大的市場份額,達到62.8%,這主要得益於醫院進行的大量介入性心臟病學、神經病學和血管手術。醫院擁有雄厚的資本投資能力,能夠安裝先進的血管攝影手術室。熟練的專業人員和多學科團隊的配備進一步鞏固了其市場主導地位。需要混合手術室的複雜手術主要在醫院進行。心血管事件急診入院人數的增加提高了設備的使用率。政府的資金支持和報銷政策促進了醫院的大規模採用。持續的設備升級也維持了其收入領先地位。

預計從2026年到2033年,診斷影像中心板塊將以19.6%的複合年增長率實現最快增長,這主要得益於門診診斷服務的日益普及。這些中心提供經濟高效的影像解決方案,並能縮短患者等待時間。對當日診斷程序的需求不斷增長,加速了此類中心的普及。技術進步使得緊湊型高性能血管攝影系統成為可能,適用於獨立運作的中心。新興市場私人影像網路的擴張也推動了成長。醫療旅遊的興起也惠及了獨立的診斷機構。有利的監管審批進一步促進了其快速擴張。

血管攝影套房(診斷影像)市場區域分析

- 北美在全球血管造影室(診斷成像)市場佔據主導地位,預計到2025年將佔總收入的約38.5% ,這得益於其先進的醫療基礎設施、介入手術的高普及率、有利的報銷機制以及領先成像系統製造商的強大影響力。

- 該地區受益於完善的醫院網絡和較高的人均醫療保健支出,從而得以廣泛採用先進的血管造影室。心血管疾病發生率的上升導致對微創診斷和治療幹預的需求不斷增長。此外,北美擁有多家主要市場參與者,他們在研發和技術創新方面投入巨資,這進一步鞏固了其市場主導地位。

- 各大醫院導管室現代化改造和混合手術室安裝的日益普及也推動了市場成長。此外,政府對介入治療的優惠政策和報銷支持也持續刺激市場需求。醫療機構和設備製造商之間的密切合作也促進了設備的持續升級。

美國血管攝影室(診斷影像)市場洞察:

由於大型醫院網路不斷增加對導管室現代化改造和混合手術室建設的投資,美國血管造影室(診斷影像)市場持續推動區域成長。美國市場受益於高額的醫療保健支出、強勁的公私資金支持以及先進成像解決方案的快速普及。心血管疾病盛行率的上升和微創手術需求的成長是主要的成長驅動因素。醫院和診斷中心正在升級現有系統,以提高工作流程效率和病患療效。領先的成像設備製造商的存在也促進了市場的強勁擴張。此外,有利的報銷政策和患者能夠便捷地獲得先進的醫療服務也為市場的持續成長提供了支持。

歐洲血管攝影室(診斷影像)市場洞察:

受微創介入治療日益普及和心血管疾病盛行率不斷上升的推動,預計歐洲血管造影室(診斷影像)市場在預測期內將穩步增長。歐洲醫療系統正增加對先進診斷影像解決方案的投資,以改善病患預後並縮短住院時間。對醫療基礎設施建設和導管室現代化改造的高度重視也促進了市場成長。此外,政府為提升醫療服務水準所採取的措施以及有利的報銷機制也有助於市場擴張。

英國血管造影室(診斷成像)市場洞察:

預計在預測期內,英國血管造影室(診斷成像)市場將以顯著的複合年增長率增長,這主要得益於對先進介入成像解決方案的需求不斷增長以及醫院基礎設施投資的增加。微創手術的日益普及和診斷中心的不斷擴張也是推動市場成長的主要因素。

德國血管攝影室(診斷影像)市場洞察:

德國血管攝影室(診斷影像)市場預計仍將是歐洲的關鍵市場,這得益於其強大的醫療基礎設施、高額的醫療支出以及對先進醫療技術應用的重視。完善的醫院體係以及導管室和手術室日益現代化,都為該市場的發展提供了支撐。

Asia-Pacific Angio Suites (Diagnostic Imaging) Market Insight

Asia-Pacific angio suites (diagnostic imaging) market is expected to be the fastest-growing region in the Angio Suites (Diagnostic Imaging) market during the forecast period, driven by expanding healthcare infrastructure, rising healthcare expenditure, increasing incidence of cardiovascular disorders, and growing adoption of advanced diagnostic technologies in countries such as China, India, and Japan. Rapid urbanization and rising medical tourism in the region are fueling demand for advanced imaging services. Increasing government investments in healthcare and growing private hospital networks further support market growth.

Japan Angio Suites (Diagnostic Imaging) Market Insight

The Japan angio suites (diagnostic imaging) market is witnessing strong growth due to increasing healthcare modernization, aging population, and rising demand for advanced diagnostic imaging systems. Japan is focusing on improving healthcare infrastructure and expanding access to minimally invasive procedures, supporting market expansion.

China Angio Suites (Diagnostic Imaging) Market Insight

China angio suites (diagnostic imaging) market is expected to witness rapid growth in the angio suites market, driven by expanding healthcare infrastructure, rising healthcare spending, and increasing incidence of cardiovascular diseases. Growing adoption of advanced diagnostic technologies, expanding hospital networks, and strong government initiatives for healthcare modernization further accelerate market growth.

Angio Suites (Diagnostic Imaging) Market Share

The Angio Suites (Diagnostic Imaging) industry is primarily led by well-established companies, including:

• Siemens Healthineers (Germany)

• GE Healthcare (U.S.)

• Philips Healthcare (Netherlands)

• Canon Medical Systems (Japan)

• Fujifilm Healthcare (Japan)

• Shimadzu Medical Systems (Japan)

• Hologic (U.S.)

• Hitachi Medical Systems (Japan)

• Toshiba Medical Systems (Japan)

• Carestream Health (U.S.)

• Neusoft Medical Systems (China)

• United Imaging Healthcare (China)

• Mindray (China)

• Stryker (U.S.)

• Medtronic (Ireland)

• Zimmer Biomet (U.S.)

• Boston Scientific (U.S.)

• Abbott (U.S.)

• B. Braun (Germany)

• Koninklijke Philips (Netherlands)

Latest Developments in Global Angio Suites (Diagnostic Imaging) Market

- In November 2021, Philips Healthcare completed the acquisition of Cardiovascular Systems, Inc., a medical technology company specializing in interventional treatment of peripheral and coronary artery disease. This acquisition expanded Philips’ portfolio in diagnostic and interventional imaging, strengthening its angio suite solutions by integrating complementary vascular intervention capabilities.

- In April 2022, GE Healthcare announced a strategic partnership with Prismatic Sensors AB, a Swedish medical technology company focused on advanced X-ray sensor technology. The collaboration aimed to co-develop next-generation imaging solutions for interventional procedures, improving image quality and expanding capabilities of angiography and image-guided therapy systems

- In June 2022, Philips Healthcare launched the Azurion 7 C20 angio suite, featuring advanced 3D image guidance, enhanced workflow automation, and AI-assisted tools. This system was designed to support complex cardiovascular and neurovascular interventions with improved imaging precision, procedural flexibility, and reduced radiation exposure

- In August 2022, Hitachi, Ltd. received U.S. FDA clearance for its SCENARIA View64 CT angio system, integrating high-resolution CT imaging with angiographic capabilities for comprehensive cardiovascular diagnostics and interventional procedures. This clearance enabled Hitachi to expand its presence in the highly regulated U.S. market

- In December 2022, Canon Medical Systems Corporation introduced the Alphenix Sky+ angio suite, an advanced imaging system with enhanced flat-panel detector technology and cybersecurity features. The launch targeted improved procedural accuracy and workflow efficiency for interventional cardiology and radiology suites worldwide

- In March 2023, Siemens Healthineers introduced the ARTIS icono biplane angio suite, a high-end angiography system aimed at supporting both cardiovascular and neurovascular interventions with improved imaging performance, flexible configurations, and integration of advanced procedural support technologies

- In January 2023, Siemens Healthineers completed its acquisition of Corindus Vascular Robotics, a company specializing in robotic-assisted vascular intervention technologies. The acquisition strengthened Siemens’ position in the interventional imaging market by adding robotic precision and automation capabilities relevant to angio suite procedures

- In November 2024, Siemens Healthineers and Philips signed a strategic co-development partnership to jointly design next-generation angio suite technologies. The collaboration was intended to integrate advanced imaging capabilities, artificial intelligence innovations, and improved interventional workflows to elevate diagnostic accuracy and procedural outcomes across global markets

- 2025年1月,GE醫療獲得一份重要合同,將向美國一家大型醫療系統供應多套介入成像系統,包括新的血管造影室。該合約涵蓋安裝和後續服務協議,標誌著大型醫療網路對先進血管造影平台的廣泛應用。

- 2025年2月,波士頓科學公司完成了對BTG plc的收購,其中包括BTG的介入醫學資產,例如用於週邊血管手術的AngioSculpt系統。此次收購擴展了波士頓科學的介入產品組合,並提升了其在血管攝影手術生態系統中的地位。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。