Global Apheresis Equipment Market

市场规模(十亿美元)

CAGR :

%

USD

4.11 Billion

USD

9.61 Billion

2024

2032

USD

4.11 Billion

USD

9.61 Billion

2024

2032

| 2025 –2032 | |

| USD 4.11 Billion | |

| USD 9.61 Billion | |

|

|

|

|

全球血液分離設備市場細分,按設備類型(一次性血液分離套件和血液分離機)、技術類型(離心和膜過濾)、程序類型(光分離、血漿分離、低密度脂蛋白分離、血小板分離、白血球分離、紅血球分離等)、應用(腎臟疾病、神經系統疾病、血液疾病和其他疾病)、最終用途(醫院和診所、門診、門診等手術中心、捐血中心等手術中心

血液分離設備市場規模

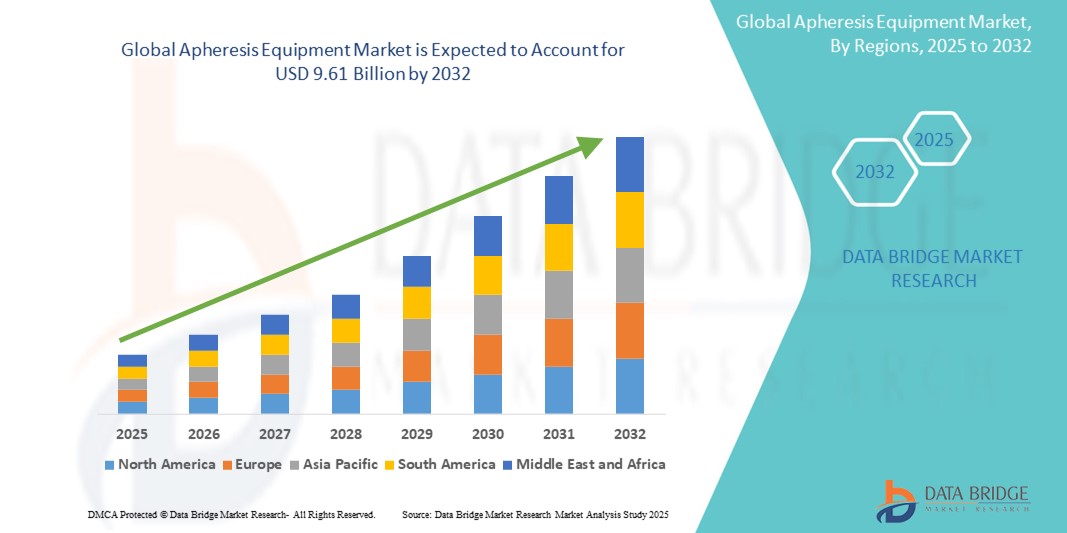

- 2024 年全球血液分離設備市場規模為41.1 億美元 ,預計 到 2032 年將達到 96.1 億美元,預測期內 複合年增長率為 11.20%。

- 市場成長主要受到癌症、自體免疫疾病和血液疾病等慢性疾病盛行率上升的推動,這些疾病需要治療性血液分離程序作為疾病管理和治療的一部分

- 此外,血液分離機的技術進步(例如自動化、便攜性和精確度的提高)加上個人化醫療需求的不斷增長和血液成分捐贈的增加,極大地推動了醫院、血庫和研究中心對血液分離機的採用

血液分離設備市場分析

- 單採設備專為分離和收集血漿、血小板和白血球等特定血液成分而設計,由於其精確度、效率和針對單一血液成分的能力,正日益成為醫院、血庫和研究機構在治療和捐獻過程中的重要工具

- 血液分離設備需求的不斷增長主要是由於慢性和自體免疫疾病發病率的上升、腫瘤學、神經病學和血液學中血液分離技術的日益普及,以及需要成分分離的捐血和輸血程序數量的增加

- 北美在血液分離設備市場佔據主導地位,2024 年其收入份額最大,為 35.4%,其特點是醫療保健基礎設施先進、人們對治療性血液分離應用的認識不斷提高,以及擁有提供技術先進系統的領先製造商

- 由於醫療保健投資不斷增加、慢性病患者人數不斷增加以及政府對採血和輸血服務的支持不斷增加,預計亞太地區將成為預測期內血液分離設備市場成長最快的地區

- 一次性血液採集套件佔據血液採集設備市場的主導地位,2024 年的市場份額為 72.22%,這得益於其一次性使用的安全性、降低的交叉污染風險,以及醫院和血庫對經濟高效的無菌程序的需求不斷增長

報告範圍和血液分離設備市場細分

|

屬性 |

血液分離設備關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

血液分離設備市場趨勢

“自動化、可移植性和與數位健康系統的整合”

- A significant and accelerating trend in the global apheresis equipment market is the evolution of automated, portable, and digitally integrated apheresis systems, which are enhancing procedure efficiency, patient comfort, and overall clinical outcomes. These advancements are transforming apheresis from a hospital-centric treatment into a more flexible and accessible therapeutic solution

- For instance, devices such as the Terumo BCT Spectra Optia offer real-time monitoring, user-friendly touch-screen interfaces, and protocol customization capabilities, allowing clinicians to perform multiple types of procedures with a single platform. Similarly, Haemonetics’ NexSys PCS system incorporates automation and digital connectivity to optimize plasma collection and donor management

- Automation in apheresis equipment improves consistency and safety by reducing manual interventions, while digital integration with electronic medical records (EMRs) and data analytics platforms supports better tracking of patient treatments and outcomes. These systems also enable predictive maintenance and remote diagnostics, ensuring higher operational efficiency for healthcare providers

- Portability is emerging as a key design focus, with lightweight, compact devices being deployed in mobile blood drives and outpatient clinics. This shift is particularly impactful in developing regions where access to fixed healthcare infrastructure is limited

- This trend towards more intelligent, portable, and digitally connected apheresis systems is redefining operational workflows in blood centers and hospitals. Companies such as Fresenius Kabi are investing in next-generation devices with wireless data transmission, smart sensors, and simplified setup procedures to meet the growing need for flexible, tech-enabled solutions

- The demand for advanced apheresis systems is rapidly increasing across both developed and emerging markets, as healthcare providers seek greater efficiency, scalability, and precision in therapeutic blood processing and component collection

Apheresis Equipment Market Dynamics

Driver

“Rising Prevalence of Chronic Diseases and Demand for Blood Component Therapy”

- The increasing global burden of chronic diseases such as cancer, autoimmune disorders, and hematological conditions is a major driver for the growing demand for apheresis equipment, as these conditions often require therapeutic apheresis for effective treatment

- For instance, in January 2024, Terumo Blood and Cell Technologies announced the expansion of its Rika Plasma Donation System into emerging markets, aiming to improve access to high-efficiency, donor-friendly plasma collection technologies. Such developments from key players are expected to drive sustained growth in the apheresis equipment industry

- As medical professionals and healthcare systems increasingly adopt personalized treatment approaches, apheresis enables the targeted removal or collection of specific blood components, offering a precise, patient-centric therapeutic option

- Furthermore, the rise in voluntary blood and plasma donations, supported by government initiatives and awareness campaigns, has boosted the demand for apheresis equipment in blood banks and donation centers, particularly for plasma-derived therapies and component separation

- The demand is further propelled by advancements in apheresis technology, including automation, enhanced safety profiles, and user-friendly interfaces, making these systems more accessible for use in a variety of clinical and outpatient settings. The adoption of digitally connected and portable systems is also contributing to the expansion of therapeutic apheresis beyond tertiary care hospitals into mobile units and satellite clinics

Restraint/Challenge

“High Cost of Equipment and Limited Accessibility in Low-Resource Settings”

- The high initial cost associated with acquiring and maintaining apheresis equipment presents a significant barrier to widespread adoption, particularly in low- and middle-income countries and smaller healthcare facilities. These costs include not only the equipment itself but also disposable kits, maintenance, and the need for trained operators.

- For instance, advanced systems such as Spectra Optia or NexSys PCS are technologically sophisticated but come at a premium, making them less accessible in resource-constrained healthcare environments, which may opt for more conventional blood collection and transfusion methods

- In addition, the requirement for skilled personnel to operate the machines, monitor patients, and manage potential complications during procedures further limits the implementation of apheresis systems, especially in rural or underserved areas lacking specialized training infrastructure

- The availability of support infrastructure, such as proper storage, power supply, and reliable supply chains for consumables such as disposable kits, also remains a concern in several developing regions, restricting consistent and safe usage of apheresis technology

- Overcoming these challenges will require public-private partnerships, subsidized pricing models, localized training programs, and the development of cost-effective, simplified apheresis systems that can function in diverse clinical settings with minimal setup and operation complexities

Apheresis Equipment Market Scope

The market is segmented on the basis of equipment type, technology type, procedure type, application, and end use.

- By Equipment Type

根據設備類型,血液分離設備市場可細分為一次性血液分離試劑盒和血液分離機。一次性血液分離試劑盒佔據市場主導地位,2024 年其收入份額最高,為 72.22%,這得益於對降低交叉污染風險、確保無菌並簡化合規性要求的一次性組件的需求不斷增長。這些試劑盒廣泛應用於治療性血液分離和捐贈者血液分離程序,確保一致性和易用性。

預計2025年至2032年,血液分離機市場將迎來最快的成長速度,這得益於機器自動化、精確度和使用者友善介面的不斷進步。醫院和捐血場所對便攜式和智慧機器的日益普及,進一步支持了該市場的快速成長。

- 依技術類型

根據技術類型,市場細分為離心法和薄膜過濾法。離心法在2024年佔據了最大的市場份額,因為它長期以來一直用於有效分離血液成分,用於治療和採集。由於其可靠性和可擴展性,它仍然是大多數臨床和血庫環境中的首選方法。

預計膜過濾領域將在2025年至2032年間以最快的速度成長,這得益於其在精密過濾、最小細胞損傷以及低密度脂蛋白(LDL)分離和免疫療法領域日益增長的應用方面的優勢。該技術與新型生物相容性材料的兼容性也促進了其應用的不斷增長。

- 依手術類型

根據操作類型,市場細分為光分離術、血漿分離術、低密度脂蛋白單採術、血小板單採術、白血球單採術、紅血球單採術和其他。血漿分離術將在2024年佔據市場主導地位,這歸因於其在治療性血漿置換和血漿捐獻中的廣泛應用,以及在治療一系列自體免疫疾病和血液疾病方面的應用。

預計光分離療法領域將在 2025 年至 2032 年間以最快的速度增長,這得益於其在移植物抗宿主病和皮膚 T 細胞淋巴瘤等免疫相關疾病中的使用日益增加,以及臨床對其治療益處的認識不斷提高。

- 按應用

根據應用,血液分離設備市場可分為腎臟疾病、神經系統疾病、血液系統疾病和其他疾病。血液系統疾病領域將在2024年引領市場,這主要得益於多發性骨髓瘤、白血病和血小板增多症等需要定期進行血液分離術進行血液成分管理的疾病發生率的不斷上升。

由於多發性硬化症和格林巴利症候群等自體免疫神經系統疾病的盛行率不斷上升,且越來越多地採用血漿置換療法進行治療,預計神經系統疾病領域將在 2025 年至 2032 年間實現最快成長。

- 按最終用戶

根據最終用途,市場細分為醫院和診所、門診手術中心、捐血中心和其他。醫院和診所由於患者數量高、血液分離技術在多個科室的廣泛應用以及先進的基礎設施,將在2024年佔據全球市場的主導地位。

受全球對血漿衍生藥品的需求不斷增長、自願捐血量增加以及發展中地區採血網絡擴大的推動,預計 2025 年至 2032 年間,捐血中心領域將呈現最快的增長速度。

血液分離設備市場區域分析

- 北美在血液分離設備市場佔據主導地位,2024 年其收入份額最大,為 35.4%,這得益於先進的醫療基礎設施、治療性血液分離應用意識的不斷提高以及提供技術先進系統的領先製造商的存在

- 該地區擁有完善的醫療基礎設施、高額的醫療支出,以及積極參與產品創新和臨床研究的領先市場參與者。

- 此外,優惠的報銷政策、先進醫療技術的早期採用以及捐血數量的不斷增長,進一步加速了該地區醫院、診所和血液中心對單採設備的使用

美國血液分離設備市場洞察

2024年,美國血液分離設備市場佔據北美地區80.5%的最高收入份額,這得益於自體免疫疾病和血液疾病的高發生率以及先進的醫療基礎設施。領先製造商的出現、臨床環境中治療性血液分離技術的廣泛應用以及優惠的報銷框架,正在推動市場需求。此外,捐血和輸血服務的普及,以及血漿療法認知度的不斷提高,也顯著促進了市場的成長。

歐洲血液分離設備市場洞察

預計在預測期內,歐洲血液分離設備市場將以顯著的複合年增長率擴張,這得益於政府資助的醫療保健系統以及對先進血液淨化技術的強勁需求。該地區受益於血液分離技術在罕見疾病和神經系統疾病治療中的應用日益增多,以及強勁的臨床研究活動。此外,衛生當局為確保充足的血液供應而採取的舉措,以及醫院對醫療設備升級的持續投資,也正在推動市場擴張。

英國血液分離設備市場洞察

The U.K. apheresis equipment market is expected to witness notable growth, driven by the rising need for plasma-derived therapies and increasing cases of chronic illnesses such as Guillain-Barré syndrome and multiple sclerosis. The country’s emphasis on personalized medicine and growing adoption of innovative therapeutic techniques in the NHS system are driving demand. In addition, collaborations between academic centers and medical device companies are accelerating the development and availability of advanced apheresis technologies.

Germany Apheresis Equipment Market Insight

The Germany apheresis equipment market is anticipated to grow steadily due to the country’s strong healthcare infrastructure, rising number of clinical trials, and the increasing prevalence of hematological diseases. The German market shows strong demand for automated apheresis systems, particularly in transplant medicine and immunotherapy. Government initiatives aimed at modernizing hospital technologies and a proactive approach to rare disease treatment further support growth.

Asia-Pacific Apheresis Equipment Market Insight

The Asia-Pacific apheresis equipment market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rising healthcare awareness, increasing investments in medical infrastructure, and a growing patient population in countries such as China, Japan, and India. Government support for blood donation programs, expanding clinical applications of apheresis in renal and autoimmune conditions, and the availability of cost-effective equipment from local manufacturers are key market drivers.

Japan Apheresis Equipment Market Insight

The Japan apheresis equipment market is advancing rapidly, supported by a highly developed healthcare system, strong government backing for therapeutic innovations, and the high prevalence of lifestyle-related chronic diseases. The integration of precision medicine and advanced treatment modalities has increased the adoption of apheresis in oncology, neurology, and nephrology. Furthermore, Japan's leadership in medical technology innovation is fostering the development of compact, user-friendly apheresis machines.

India Apheresis Equipment Market Insight

The India apheresis equipment market accounted for the largest revenue share in Asia-Pacific in 2024, driven by increasing demand for blood components and therapeutic plasma exchange procedures. With a rapidly growing healthcare infrastructure, government support for rare disease management, and rising awareness about blood safety and donation, the market is witnessing strong momentum. Domestic manufacturers and public-private partnerships are playing a crucial role in improving access to apheresis technology across urban and semi-urban healthcare centers.

Apheresis Equipment Market Share

The apheresis equipment industry is primarily led by well-established companies, including:

- Haemonetics Corporation (U.S.)

- Fresenius SE & Co. KGaA (Germany)

- Asahi Kasei Medical Co., Ltd. (Japan)

- Terumo BCT, Inc. (U.S.)

- B. Braun SE (Germany)

- KANEKA CORPORATION (Japan)

- Nikkiso Co., Ltd. (Japan)

- Cerus Corporation (U.S.)

- SB-KAWASUMI LABORATORIES, INC. (Japan)

- Medica SPA (Italy)

- Macopharma (France)

- Miltenyi Biotec (Germany)

- Therakos LLC (U.S.)

- Baxter (U.S.)

- Charles River Laboratories Cell Solutions, Inc. (U.S.)

- Grifols S.A. (Spain)

- Lmb Technologie GmbH (Germany)

- Infomed SA (Switzerland)

- Aferetica srl (Italy)

- Cytosorbents Corporation (U.S.)

Latest Developments in Global Apheresis Equipment Market

- In April 2023, Terumo BCT announced the expansion of its Spectra Optia Apheresis System's capabilities to include therapeutic plasma exchange for pediatric patients. This development underscores the company's commitment to addressing the unique needs of younger patients requiring apheresis treatments

- In March 2023, Fresenius Kabi launched a next-generation apheresis machine, the COM.TEC 2.0, featuring an enhanced user interface and improved efficiency. This advancement aims to streamline blood component collection processes and improve donor comfort during procedures

- In February 2023, Haemonetics Corporation received FDA approval for its NexSys PCS plasma collection system with Persona technology. This system personalizes plasma collection based on individual donor characteristics, optimizing yield and enhancing donor safety

- In January 2023, B. Braun Melsungen AG introduced an updated version of its Plasauto Sigma apheresis device, incorporating advanced monitoring features and improved automation. This upgrade is designed to increase treatment precision and reduce procedure times

- In December 2022, Asahi Kasei Medical Co., Ltd. announced the development of a new membrane-based apheresis filter, aiming to improve the selectivity and efficiency of LDL apheresis treatments. This innovation reflects the company's dedication to advancing therapeutic options for patients with refractory hypercholesterolemia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。