Global Battery Additives Market

市场规模(十亿美元)

CAGR :

%

USD

1.96 Billion

USD

4.01 Billion

2024

2032

USD

1.96 Billion

USD

4.01 Billion

2024

2032

| 2025 –2032 | |

| USD 1.96 Billion | |

| USD 4.01 Billion | |

|

|

|

|

Global Battery Additives Market Segmentation, By Type (Conductive Additive, Porous Additive, Nucleating Additive, Sulfur-Containing Additives, Electrolyte Additives, Ionic Liquid Additives, and Boron-Containing Additives), Application (Lithium-Ion Battery, Lead Acid Battery, and Others), End- User (Electronics, Automotive, and Others) - Industry Trends and Forecast to 2032

Battery Additives Market Size

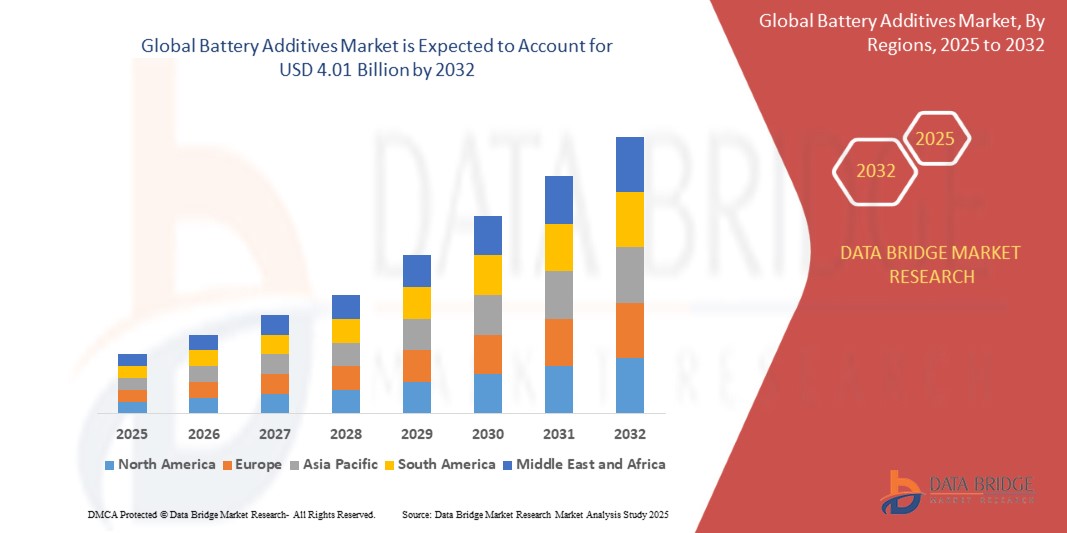

- The global battery additives market was valued atUSD 1.96 billion in 2024and is expected to reachUSD 4.01 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 9.33%,primarily driven by rising demand forelectric vehicles(EVs)

- This growth is driven by the growing renewable energy sector and increasing the need for battery additives that improve conductivity, stability, andthermal management

Battery Additives Market Analysis

- Battery Additives have gained widespread acceptance due to their ability to enhance conductivity, stability, and thermal management, driving demand in electric vehicles (EVs), renewable energy storage, and portable electronics. Their proven capability to extend battery lifespan, improve charge retention, and optimize performance has solidified their role in modern energy storage solutions

- The market is primarily driven by the rising adoption of EVs, increasing energy storage needs, and stringent environmental regulations. In addition, advancements innanotechnology, electrolyte additives, and lithium-ion battery innovations are further accelerating market growth

- Asia-Pacific dominatesthebattery additives market due to its strong battery manufacturing base, expanding EV production, and growing focus on sustainable energy solutions

- For instance, in China and India, demand for advanced battery additives has surged due to increasing EV sales, government incentives, and investments in high-performance energy storage systems

- Globally, Battery Additives remain critical for next-generation battery technologies, with innovations such as solid-state electrolytes,graphene-based materials, and bio-derived additives driving industry transformation and ensuring long-term market sustainability

Report Scope and Battery Additives Market Segmentation

|

Attributes |

Battery Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Battery Additives Market Trends

“Rising Integration of Battery Additives in Sustainable Energy Storage”

- The growing focus on sustainability is driving demand for battery additives, widely recognized for their role in enhancing battery efficiency, longevity, and thermal stability

- Manufacturers are expanding the use ofhigh-performance additives in lithium-ion batteries (Li-ion), solid-state batteries, and energy storage systems to optimize charge retention and durability while reducing environmental impact

- The increasing adoption of graphene-based materials and bio-derived additives is accelerating the shift towards eco-friendly battery production, aligning with stringent government regulations on energy storage and emissions

For instance,

- In February 2024, Teslaintegrated next-generation electrolyte additives in its latest EV batteries, improving charging speed and thermal performance

- In October 2023, Panasoniclaunched a new high-performance lithium-ion battery, utilizing advanced conductive additives for better energy density and lifespan

- In July 2023, LG Energy Solutionpartnered with key automakers to develop sustainable battery materials, ensuring higher efficiency and reduced carbon footprint

- As the energy storage industry continues to prioritize sustainability, Battery Additives will play a crucial role in next-generation battery innovation, driving efficiency, durability, and compliance with global environmental standards

Battery Additives Market Dynamics

Driver

“Growing Demand for High-Performance Battery Additives”

- Enhancing battery efficiency, lifespan, and thermal stability has become a priority for electric vehicles (EVs), energy storage systems, and consumer electronics, driving the adoption of advanced Battery Additives

- Manufacturers are incorporatinghigh-performance electrolyte additives, conductive agents, and stabilizers to improve charge retention, cycling performance, and overall safety in next-generation battery technologies

- The rising penetration of EVs and renewable energy storage solutions further accelerates the need for optimized battery formulations, ensuring higher energy density and long-term reliability

For instance,

- In March 2024, Teslaintroduced next-gen electrolyte additives in its new EV battery lineup, improving thermal stability and charging efficiency

- In November 2023, Panasonicpartnered withLG Energy Solutionto develop high-performance lithium-ion batteries, integrating advanced conductive additives for better energy retention

- In August 2023,Samsung SDIannounced the use of graphene-based battery additives in its latest solid-state battery, enhancing durability and power output

- With the growing adoption of EVs and grid-scale energy storage, the demand for Battery Additives will continue to rise, driving innovation in battery chemistry and sustainable energy solutions

Opportunity

“Expansion of Bio-Based and Recyclable Battery Additives”

- Growing environmental concerns and stringent government regulations are creating opportunities for bio-based and recyclable Battery Additives, reducing reliance on synthetic and fossil fuel-derived materials

- Battery manufacturersare investing insustainable additivesto improvebattery longevity, recyclability, and overall eco-friendliness, aligning withcarbon neutrality goalsand global sustainability efforts

- The increasing adoption of circular economy principles in battery production is driving demand for recycled and biodegradable additives, minimizing waste generation and reducing manufacturing costs

For instance,

- In January 2024, Teslalaunched a new initiative to incorporate recycled electrolyte additives into its next-generation EV batteries, supporting its sustainability strategy

- In September 2023, Panasonicpartnered with biopolymer manufacturers to integrate plant-based conductive additives into its upcoming solid-state battery models

- In June 2023, LG Energy Solutioncommitted to using at least 50% recycled battery additives in its next-gen lithium-ion batteries, reducing environmental impact

- As the energy storage industry accelerates its shift towards eco-friendly materials, bio-based and recyclable Battery Additives will unlock new growth avenues, enhancing sustainability, innovation, and regulatory compliance

Restraint/Challenge

“Supply Chain Disruptions in Battery Additives”

- Global supply chain constraints, including raw material shortages, geopolitical tensions, and transportation delays, are significantly impacting the availability and pricing of battery additives

- Battery manufacturersare struggling withfluctuating costsofkey materialssuch asconductive agents, electrolyte additives, and stabilizers, leading toproduction slowdowns and higher operational expenses

- The rising dependence on specific regions for critical battery components has heightened market vulnerabilities, pushing companies to explore alternative sourcing strategies and localized manufacturing

For instance,

- In February 2024, LG Energy Solutionreported delays in securing lithium-based additives, affecting its battery production timelines and increasing manufacturing costs

- Mitigating supply chain risks will be essential for the battery additives industry, ensuring stable material availability, reducing cost fluctuations, and supporting the scalability of next-generation energy storage solutions

Battery Additives Market Scope

The market is segmented on the basis of type, application, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By End-User |

|

Battery Additives Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Battery Additives Market”

- Asia-Pacific leadsthe global battery additives market, driven by rapid industrialization, increasing automobile production, and strong demand for lightweight materials

- ChinaandIndia dominatethe region due to their expanding automotive manufacturing, rising vehicle sales, and strong government incentives for fuel efficiency

- Advancements in polymer technology, increasing adoption of electric vehicles (EVs), and rising consumer preference for sustainable materials have further accelerated market growth

- In addition, the presence of major automotive suppliers, expanding OEM production, and growing investments in research & development contribute to the region’s market leadership

“Europe is projected to register the Highest Growth Rate”

- Europeis expected to witness thehighest growth ratein the battery additives market, driven by rapid urbanization, increasing vehicle production, and growing demand for lightweight components

- GermanyandFranceare emerging as key markets due to strong automotive manufacturing, supportive government policies, and rising investments in electric mobility

- Germany leadsthe region in Battery Additives production, with advanced polymer processing technologies and increasing adoption of sustainable materials for vehicle components

- Franceis experiencingstrong market growthdue to rising automobile exports, expanding EV infrastructure, and growing consumer preference for fuel-efficient vehicles

- Stringent emission regulations, increasing R&D in bioplastics, and strategic collaborations between automotive OEMs further contribute to Europe’s market expansion

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cabot Corporation (U.S.)

- The Hammond Group (U.S.)

- Orion S.A. (Luxembourg)

- Imerys S.A. (France)

- 3M (U.S.)

- Altana AG (Germany)

- Borregaard AS (Norway)

- HOPAX (Taiwan)

- PENOX S.A. (Germany)

- SGL Carbon (Germany)

- Vibrantz (U.S.)

- Re-Tron Technologies (U.S.)

- MSC Industrial Direct Co., Inc. (U.S.)

- Atomized Products Group, Inc. (U.S.)

- Tableting Pro LLC. (U.S.)

- Fastenal Company (U.S.)

- Tokyo Chemical Industry (India) Pvt. Ltd. (India)

- Total Battery (Canada)

- US Research Nanomaterials, Inc. (U.S.)

Latest Developments in Global Battery Additives Market

- In March 2025, EOS Energya U.S.-based start-up, introduced its latest Z3 battery, designed for 3-to-12-hour discharge durations, featuring a zinc hybrid cathode for enhanced performance

- In November 2024, Graphene Manufacturing Group LtdunveiledSUPER G, a graphene slurry engineered to improve lithium-ion battery performance, boosting efficiency, power, and longevity

- In May 2022, Orion Engineered Carbonsexpanded its credit facility by 108 million USD, increasing its senior secured revolving facility to 379 million USD

- In May 2022, Univar Solutions Inc.was appointed as the exclusive distributor of Cobalt Corporation’s specialty carbon black products, catering to the Brazilian plastics and battery industries

- In November 2021, Cabot Corporationfinalized an agreement to sell its Purification Solutions business, a global leader in high-performance activated carbon used in environmental, health, safety, and industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。