Global Bentonite Market

市场规模(十亿美元)

CAGR :

%

USD

2.00 Billion

USD

2.84 Billion

2024

2032

USD

2.00 Billion

USD

2.84 Billion

2024

2032

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 2.84 Billion | |

|

|

|

|

Global Bentonite Market Segmentation, By Product (Sodium, Calcium, and Others), Application (Foundry Sands, Iron Ore Pelletizing, Cat Litter, Drilling Mud, Civil Engineering, Refining, and Others) - Industry Trends and Forecast to 2032

Bentonite Market Size

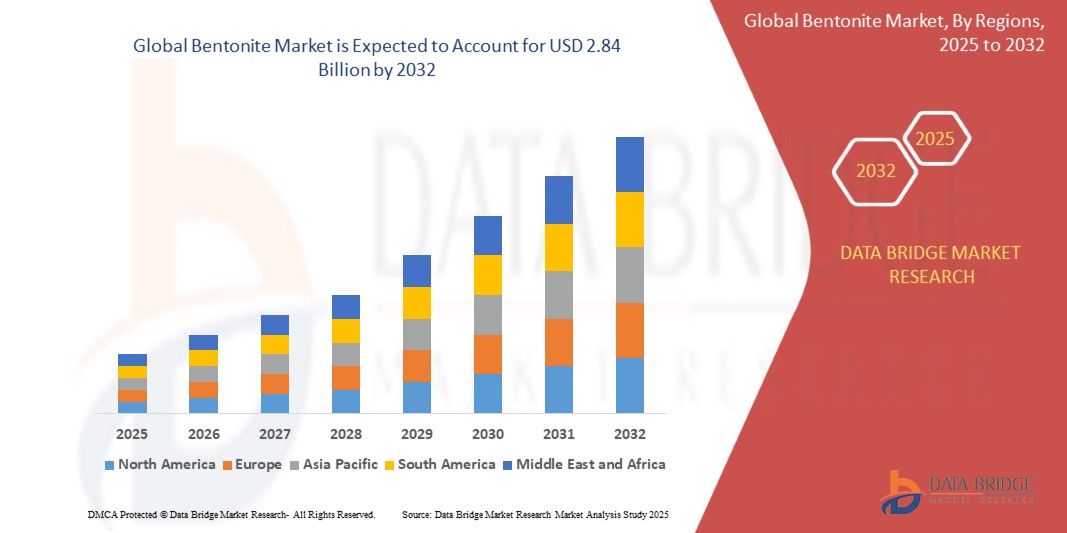

- The global bentonite market was valued atUSD 2.00 billion in 2024and is expected to reachUSD 2.84 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 4.50%,primarily driven by the growth in agriculture and animal feed sectors

- This growth is driven by factors such as sustainable farming, rising meat & dairy demand and climate adaptation

Bentonite Market Analysis

- Bentonite is a versatile industrial mineral widely used in various sectors, including construction, drilling, agriculture, andanimal feed. Known for its excellent absorption, swelling, and binding properties, bentonite enhances performance across multiple applications, ranging from soil conditioning to industrial sealants

- The market is growing due to increasing demand from oil & gas drilling, expanding infrastructure projects, and the rising adoption of bentonite in environmental protection applications. As industries seek cost-effective and sustainable solutions, bentonite is being integrated into various processes to improve efficiency and effectiveness

- The adoption of advanced processing techniques and product innovations is transforming the bentonite market by enhancing product quality, optimizing supply chains, and expanding its application range

- For instance,leading companies are developing high-performance bentonite-based drilling fluidsto improve well stability and reduce operational costs in oil exploration

- The bentonite market is poised for sustained growth, driven by technological advancements, regulatory support for environmental applications, and increasing industrial usage. The focus on sustainability, efficiency, and new application development will continue to shape market dynamics, with manufacturers investing in innovation to maintain a competitive edge

Report Scope and BentoniteMarket Segmentation

|

Attributes |

Bentonite Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bentonite Market Trends

“Increasing Adoption of Eco-Friendly & Sustainable Bentonite-Based Products”

- One prominent trend in the global bentonite market is theincreasing adoption of eco-friendly and sustainable bentonite-based products

- This trend is driven by the growing demand for natural, biodegradable, and low-impact materials in applications such as wastewater treatment, landfill sealing, and green construction, prompting manufacturers to develop modified bentonite solutions with enhanced performance and reduced environmental impact

- For instance,Clarianthas introducedsustainable bentonite-based solutions forindustrial wastewater treatment, helping companies meet stringent environmental standards while improving efficiency

- As industries seek sustainable and high-performance materials, bentonite applications are expanding in soil remediation, renewable energy projects, and eco-friendly consumer goods, reinforcing its role in green initiatives

- This shift is expected to drive technological advancements and product innovation, ensuring long-term growth in the bentonite market as companies align with global sustainability goals and stricter environmental regulations

Bentonite Market Dynamics

Driver

“Growing Demand from Foundry and Metallurgy Industries”

- The growing demand from the foundry and metallurgy industries is a key driver of the bentonite market, as its superior binding, swelling, and thermal stability properties make it essential for mold casting, metal shaping, and precision metallurgy

- The increasing need for high-quality, defect-free metal components in automotive, construction, and heavy machinery sectors is driving the widespread adoption of bentonite in foundry applications

- Bentonite is widely used in green sand molding and ductile iron casting, where it enhances mold strength, moisture retention, and thermal durability, ensuring high precision in metal castings. As global industries shift toward lightweight and high-performance metal components, foundries are incorporating advanced bentonite formulations to optimize casting efficiency and reduce defects

- The rising investments in industrial expansion and infrastructure development, particularly inAsia-Pacific, North America, and Europe, have further fueled demand for metallurgical-grade bentonite

- Governments and private industries are modernizing foundry operations, leading to the adoption of automation and innovative casting techniques that rely on high-performance bentonite solutions

For instance,

- Black Hills Bentonite LLCsupplies premium-grade bentonite binders for major foundries, enhancing mold stability and casting precision while minimizing defects

- Clariant’s foundry-grade bentonite solutionsare designed to improve casting efficiency and meet stringent industry standards

- With ongoing innovations in metallurgy and foundry technologies, the bentonite market is set for sustained growth as manufacturers expand their production capacities, develop high-performance formulations, and align with evolving industry requirements to enhance casting efficiency and product quality

Opportunity

“Growing Demand in Oil & Gas Drilling”

- The growing demand for bentonite in oil & gas drilling presents a significant opportunity for market expansion, as the industry increasingly relies on high-performancedrilling fluidsto enhance wellbore stability, lubrication, and filtration control in both conventional and unconventional drilling operations

- Energy companies are investing in advanced bentonite-based formulations to optimize drilling efficiency, reduce environmental impact, and improve operational safety, particularly in deepwater and shale exploration projects

- In addition to oil & gas companies, service providers and drilling contractors are forming partnerships with bentonite manufacturers to develop customized drilling muds that cater to specific geological conditions

For instance,

- Halliburton has integrated specialized bentonite additives into its drilling fluid solutionsto enhance rheological properties and cuttings suspension, improving drilling efficiency in challenging environments

- Clariant’s advanced bentonite-based drilling fluidsfocus on reducing formation damage and optimizing borehole stability

- As the demand for energy resources continues to rise, the oil & gas sector presents a major opportunity for bentonite manufacturers to expand their product offerings, invest in research & development, and strengthen industry partnerships to meet evolving drilling requirements and sustainability goals

Restraint/Challenge

“Stringent Regulations on Chemical Additives in Drilling Mud”

- Stringent regulations on chemical additives in drilling mud pose a significant challenge for the bentonite market, as governments and environmental agencies enforce stricter guidelines on drilling fluid compositions to minimize ecological impact and ensure safer disposal practices

- Regulatory bodies are imposing limits on the use of synthetic additives and heavy metals in drilling mud formulations, compelling oil & gas companies to seek eco-friendly alternatives that comply with environmental standards.

- This shift increases the demand for high-purity bentonite while restricting the use of certain chemical enhancers, potentially affecting drilling fluid performance and cost-effectiveness

For instance,

- U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA)have introduced stringent guidelines on the use of non-biodegradable additives in drilling fluids, pushing the industry toward natural and less hazardous alternatives. This has led companies to invest in modified bentonite-based solutions that meet regulatory standards without compromising performance

- As regulatory pressures continue to intensify, bentonite manufacturers must focus on developing compliant, high-performance drilling fluid solutions, securing certifications, and engaging in sustainable innovation to remain competitive in the oil & gas sector

Bentonite Market Scope

The market is segmented on the basis of product and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

Bentonite Market Regional Analysis

“North America is the Dominant Region in the BentoniteMarket”

- North Americadominates thebentonitemarket, driven bythelarge-scale exploration and drilling activities, particularly in the United States and Canada,where bentonite is extensively used in oil & gas drilling, foundry applications, and environmental engineering

- TheU.S.holds a significant share due toits thriving shale gas industry, expanding construction sector, and increasing use of bentonite in environmental protection applications such as landfill sealing, wastewater treatment, and soil remediation

- The presence of major bentonite manufacturers and suppliers, coupled with technological advancements in mining and processing, further reinforces North America’s dominance

- In addition, stringent environmental regulations imposed by agencies such as the U.S. Environmental Protection Agency (EPA) and Canada’s regulatory bodies are driving the demand for high-quality bentonite in drilling mud applications, pushing companies to develop eco-friendly formulations that comply with sustainability mandates

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- TheAsia-Pacificregion is expected to witness the highest growth rate in thebentonitemarket, drivenby rapid industrialization, urbanization, and increasing demand from key industries such as construction, metallurgy, and oil & gas. The rising population, infrastructure development, and expanding manufacturing sector in the region further boost bentonite consumption

- Countries such asChina, India, Japan, and South Koreaare witnessing surging demand for bentonite-based applications, including civil engineering, steel production, cat litter, and drilling fluids. Government initiatives promoting infrastructure development, smart cities, and sustainable construction practices are expected to drive market growth in the coming years

- The expansion of global and local bentonite manufacturers in the region is also contributing to market growth

- In addition, the adoption of advanced processing technologies, increasing investments in R&D for performance-enhanced bentonite, and rising awareness about eco-friendly solutions are expected to accelerate Asia-Pacific’s growth in the bentonite market, making it the fastest-growing region during the forecast period

Bentonite Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Wyo-Ben, Inc. (U.S.)

- The Hindusthan Group (India)

- CB MINERALS (U.S.)

- CIMBAR PERFORMANCE MINERALS (U.S.)

- AMSYN Incorporated (U.S.)

- Clariant (Switzerland)

- Black Hills Bentonite LLC (U.S.)

- KUNIMINE INDUSTRIES CO., LTD (Japan)

- Halliburton (U.A.E.)

- Minerals Technologies Inc. (U.S.)

- Bentonite Performance Minerals LLC (U.S.)

- Delmon Group (Saudi Arabia)

- LKAB (Sweden)

- Star Bentonite Exports (India)

- Laviosa S.p.A. (Italy)

Latest Developments in Global Bentonite Market

- In June 2023,Clariant launched Desi Pak® ECO,a sustainable, bentonite-based desiccant, highlighting the growing demand for eco-friendly bentonite applications. With plastic-free, responsibly sourced packaging and a lower lifecycle impact than synthetic alternatives, this innovation reinforces the market shift toward sustainable bentonite solutions

- In September 2023,BASF launched a new line of organic bentonites for the cosmetics industry, expanding bentonite’s role in skincare, makeup, and haircare formulations. This innovation highlights the growing demand for natural, high-performance cosmetic ingredients, driving market diversification and new opportunities for specialty bentonite applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。