Global Cannabis Based Alcoholic Beverages Market

市场规模(十亿美元)

CAGR :

%

USD

42.61 Million

USD

67.40 Million

2025

2033

USD

42.61 Million

USD

67.40 Million

2025

2033

| 2026 –2033 | |

| USD 42.61 Million | |

| USD 67.40 Million | |

|

|

|

|

Global Cannabis-Based Alcoholic Beverages Market Segmentation, By Product (Cannabis-infused Beers, Cannabis-infused Infused Vodka Cannabis-Infused Gin, Cannabis-infused Wines, and Others), Cannabis Beverages Component (Cannabidiol (CBD) and Tetrahydrocannabinol (THC)), End Use (Households, Restaurants, Hotels, and Cafes) - Industry Trends and Forecast to 2033

Cannabis-Based Alcoholic Beverages Market Size

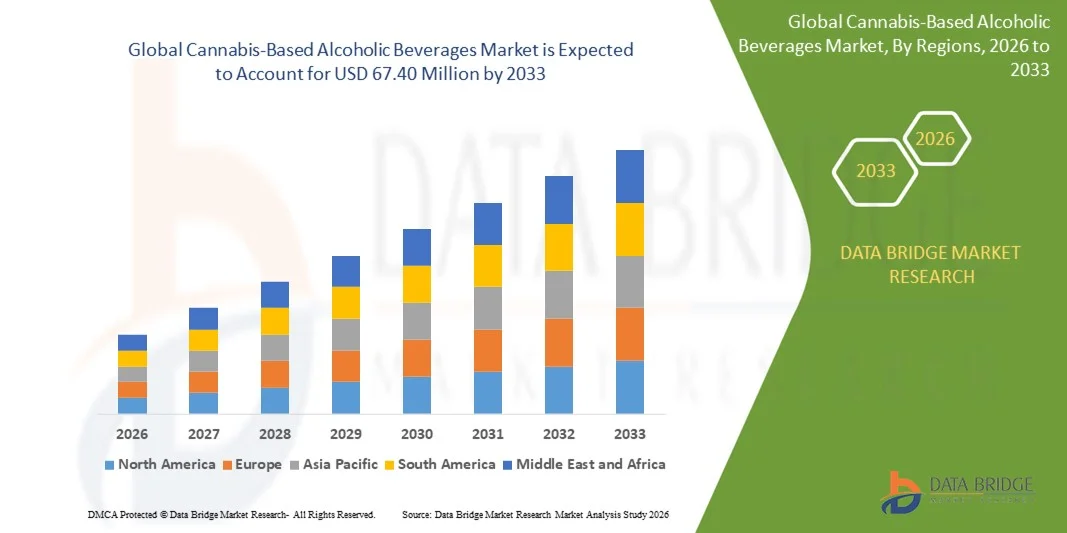

- The global cannabis-based alcoholic beverages market size was valued at USD 42.61 million in 2025 and is expected to reach USD 67.40 million by 2033, at a CAGR of 5.9% during the forecast period

- The market growth is largely driven by increasing consumer preference for low- and no-alcohol alternatives combined with rising acceptance of cannabis-derived ingredients, supporting the emergence of cannabis-based alcoholic beverages across social and recreational settings

- Furthermore, expanding cannabis legalization, product innovation in controlled-dose formulations, and growing interest in wellness-oriented drinking experiences are accelerating adoption. These combined factors are strengthening consumer trial and repeat consumption, thereby significantly boosting overall market growth

Cannabis-Based Alcoholic Beverages Market Analysis

- Cannabis-based alcoholic beverages, which blend traditional alcohol formats with cannabis-derived compounds such as CBD or THC, are gaining prominence as alternative adult beverages due to their differentiated effects, controlled consumption, and evolving social acceptance

- The rising demand for these beverages is primarily fueled by changing consumer drinking habits, increased awareness of functional and relaxation-focused products, and growing availability through licensed retail and on-trade channels

- North America dominated the cannabis-based alcoholic beverages market with a share of around 72% in 2025, due to progressive cannabis legalization, high consumer awareness, and strong demand for innovative adult beverage formats

- Asia-Pacific is expected to be the fastest growing region in the cannabis-based alcoholic beverages market during the forecast period due to rising urbanization, changing social drinking habits, and increasing awareness of cannabis-derived wellness products

- Cannabis-infused beers segment dominated the market with a market share of 42.5% in 2025, due to strong consumer familiarity with beer as a mainstream alcoholic format and its suitability for controlled-dose cannabis infusion. Brewers benefit from established brewing infrastructure and flavor masking capabilities that align well with cannabis profiles. Consumers perceive cannabis-infused beers as an entry-level option due to moderate alcohol content and sessionable consumption patterns. Regulatory approvals for low-dose cannabis beverages have also favored beer formats in early commercialization stages. Brand collaborations between craft breweries and cannabis producers have reinforced trust and product visibility. The segment continues to benefit from innovation in non-alcoholic and low-alcohol variants infused with cannabis compounds

Report Scope and Cannabis-Based Alcoholic Beverages Market Segmentation

|

Attributes |

Cannabis-Based Alcoholic Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cannabis-Based Alcoholic Beverages Market Trends

Premiumization of Low- and Controlled-Dose Cannabis-Infused Alcoholic Beverages

- A key trend in the cannabis-based alcoholic beverages market is the increasing premiumization of products with low and controlled cannabis dosages, driven by consumer demand for refined drinking experiences that balance relaxation with social consumption. Premium formulations are gaining traction as consumers seek better taste profiles, predictable effects, and responsible consumption options that align with modern lifestyle preferences

- For instance, Lagunitas Brewing Company, a subsidiary of Heineken, introduced cannabis-infused beverages positioned around precise dosing and craft-quality standards, reinforcing the premium perception of cannabis-infused drink formats. Such initiatives demonstrate how established beverage brands are leveraging quality, branding, and formulation control to elevate consumer trust and acceptance

- The rise of premium cannabis-infused beers and spirits is also supported by advancements in nano-emulsion and infusion technologies that ensure consistency and faster onset times. These technological improvements enhance the overall drinking experience and differentiate premium products from early-generation cannabis beverages

- Premium positioning is further strengthened by sophisticated packaging, transparent labeling, and clear cannabinoid content disclosure, which resonate with informed consumers. This approach supports higher price points and improves brand loyalty in competitive adult beverage markets

- Hospitality venues and specialty retailers are increasingly prioritizing premium cannabis-based alcoholic beverages to cater to experience-driven consumers. This growing emphasis on quality, controlled dosing, and brand storytelling is shaping a more mature and premium-oriented market landscape

- Overall, premiumization is redefining cannabis-based alcoholic beverages from novelty products into credible alternatives within the broader alcoholic beverage industry, supporting sustained market growth

Cannabis-Based Alcoholic Beverages Market Dynamics

Driver

Rising Consumer Shift Toward Low-Alcohol Alternatives

- The increasing shift among consumers toward low-alcohol and moderated drinking options is a major driver of the cannabis-based alcoholic beverages market. Health-conscious consumers are actively seeking alternatives that reduce alcohol intake while still offering relaxation and social engagement

- For instance, Canopy Growth Corporation, through its beverage-focused cannabis portfolio, has actively developed low-dose cannabis-infused drinks aimed at consumers looking to replace or reduce traditional alcohol consumption. These offerings align with broader wellness and mindful drinking trends

- The growing popularity of the sober-curious movement is encouraging experimentation with cannabis-infused alcoholic beverages that provide controlled effects without excessive intoxication. This behavioral shift is particularly evident among younger adult demographics

- Beverage manufacturers are responding by formulating products with lower alcohol content combined with CBD or THC to meet evolving consumer expectations. This convergence of cannabis and low-alcohol trends is expanding the addressable consumer base

- Retailers and hospitality operators are also supporting this driver by expanding shelf space and menu placements for alternative adult beverages. The sustained movement toward moderation continues to reinforce demand and accelerate market adoption

Restraint/Challenge

Regulatory Complexity and Inconsistent Legalization Frameworks Across Regions

- The cannabis-based alcoholic beverages market faces significant challenges due to complex and inconsistent regulatory frameworks governing cannabis and alcohol across different regions. Regulations often vary widely at national, state, and provincial levels, creating barriers to uniform product development and distribution

- For instance, Heineken N.V. has limited its cannabis beverage initiatives to specific markets due to strict regulations surrounding the combination of alcohol and THC in many jurisdictions. Such regulatory constraints restrict scalability and delay broader commercialization

- Compliance requirements related to labeling, dosage limits, advertising, and distribution increase operational complexity for manufacturers. Navigating dual regulatory oversight from alcohol and cannabis authorities further complicates market entry

- Uncertainty around future legalization timelines and policy changes creates investment risks and discourages long-term planning for some beverage companies. Smaller players, in particular, face difficulties managing compliance costs and regulatory approvals

- These regulatory challenges continue to limit market expansion and slow cross-border trade of cannabis-based alcoholic beverages. Overcoming legal inconsistencies remains critical for unlocking the full growth potential of the market and enabling wider global adoption

Cannabis-Based Alcoholic Beverages Market Scope

The market is segmented on the basis of product type, cannabis beverage component, and end use.

- By Product

On the basis of product, the cannabis-based alcoholic beverages market is segmented into cannabis-infused beers, cannabis-infused vodka, cannabis-infused gin, cannabis-infused wines, and others. The cannabis-infused beers segment dominated the market with the largest revenue share of 42.5% in 2025, supported by strong consumer familiarity with beer as a mainstream alcoholic format and its suitability for controlled-dose cannabis infusion. Brewers benefit from established brewing infrastructure and flavor masking capabilities that align well with cannabis profiles. Consumers perceive cannabis-infused beers as an entry-level option due to moderate alcohol content and sessionable consumption patterns. Regulatory approvals for low-dose cannabis beverages have also favored beer formats in early commercialization stages. Brand collaborations between craft breweries and cannabis producers have reinforced trust and product visibility. The segment continues to benefit from innovation in non-alcoholic and low-alcohol variants infused with cannabis compounds.

The cannabis-infused spirits segment, particularly vodka and gin, is expected to witness the fastest growth rate from 2026 to 2033, driven by premiumization trends and rising demand for alternative functional spirits. These products attract consumers seeking novel experiences with customizable cocktails and precise dosing. Distillers are leveraging cannabis infusions to differentiate premium offerings in competitive spirits markets. The clear base of vodka and botanical profile of gin allow better control over flavor balance and cannabinoid stability. On-trade adoption in upscale bars and lounges is accelerating trial and repeat consumption. Expanding legalization and clearer labeling standards further support rapid uptake across urban markets.

- By Cannabis Beverages Component

On the basis of cannabis beverage component, the market is segmented into cannabidiol (CBD) and tetrahydrocannabinol (THC). The CBD segment accounted for the dominant revenue share in 2025, supported by its non-psychoactive nature and broader regulatory acceptance across multiple regions. Consumers associate CBD beverages with relaxation, stress relief, and wellness positioning, aligning with social drinking occasions. Manufacturers favor CBD due to fewer restrictions in formulation, distribution, and marketing. CBD-infused alcoholic beverages appeal to health-conscious consumers seeking reduced intoxication effects. Consistent dosing and stability in liquid formulations have improved product reliability. The segment continues to expand through innovation in flavor profiles and functional positioning.

The THC segment is projected to register the fastest CAGR during the forecast period, driven by increasing legalization of recreational cannabis and rising consumer curiosity toward psychoactive beverage formats. THC-infused alcoholic beverages offer an alternative to traditional edibles with faster onset and more predictable effects. Younger adult consumers are driving demand for experiential and social cannabis consumption. Beverage producers are investing in nano-emulsion technologies to enhance bioavailability and consistency. Controlled serving sizes are supporting responsible consumption messaging. Growth is expected to accelerate as regulatory clarity improves and on-premise consumption expands.

- By End Use

On the basis of end use, the cannabis-based alcoholic beverages market is segmented into households, restaurants, hotels, and cafes. The household segment dominated the market in 2025, driven by rising at-home consumption trends and consumer preference for private, controlled environments. Home consumption allows users to manage dosage, timing, and pairing with meals or social settings. E-commerce and licensed retail channels have improved product accessibility for household buyers. Pandemic-led behavioral shifts have sustained demand for premium beverages consumed at home. Packaging innovations supporting single-serve and resealable formats have further strengthened this segment. Brand education through digital platforms has also influenced informed purchasing decisions.

The restaurants and hotels segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by the emergence of cannabis-inclusive menus and experiential dining concepts. Hospitality venues are using cannabis-based alcoholic beverages to differentiate offerings and attract novelty-seeking customers. Trained staff and curated pairings enhance consumer confidence and trial rates. Premium positioning and higher margins support profitability for on-trade operators. Regulatory approvals for licensed on-premise consumption are expanding in select regions. This segment is expected to play a critical role in normalizing social consumption of cannabis-infused alcoholic beverages.

Cannabis-Based Alcoholic Beverages Market Regional Analysis

- North America dominated the cannabis-based alcoholic beverages market with the largest revenue share of around 72% in 2025, driven by progressive cannabis legalization, high consumer awareness, and strong demand for innovative adult beverage formats

- Consumers in the region show strong interest in alternative alcoholic beverages that offer controlled cannabis experiences, particularly CBD- and low-dose THC-infused options positioned around wellness and social relaxation

- This dominance is further supported by well-established cannabis supply chains, robust beverage innovation ecosystems, and higher disposable incomes, positioning cannabis-based alcoholic beverages as a rapidly evolving category across both retail and on-trade channels

U.S. Cannabis-Based Alcoholic Beverages Market Insight

The U.S. cannabis-based alcoholic beverages market accounted for the largest revenue share within North America in 2025, supported by state-level legalization, a mature cannabis consumer base, and strong experimentation with infused beverage formats. Consumers are increasingly seeking alternatives to traditional alcohol, driving interest in cannabis-infused beers and spirits with predictable dosing. The presence of leading cannabis brands, craft breweries, and beverage startups accelerates product launches and innovation. Growing retail penetration through licensed dispensaries and select hospitality venues further strengthens market expansion.

Europe Cannabis-Based Alcoholic Beverages Market Insight

The Europe cannabis-based alcoholic beverages market is expected to grow at a steady CAGR during the forecast period, driven by rising acceptance of CBD-infused beverages and evolving regulatory frameworks. European consumers are increasingly drawn toward low-alcohol and functional beverage trends, aligning well with cannabis-infused formulations. Innovation in non-psychoactive CBD beverages is gaining traction across urban markets. Expanding wellness-focused consumption patterns and premium beverage positioning continue to support regional growth.

U.K. Cannabis-Based Alcoholic Beverages Market Insight

The U.K. cannabis-based alcoholic beverages market is projected to grow at a notable CAGR, supported by strong demand for CBD-infused drinks and a well-developed premium beverage culture. Consumers are increasingly adopting cannabis-infused beverages positioned around relaxation and stress reduction rather than intoxication. The country’s advanced retail and e-commerce infrastructure supports product visibility and accessibility. Regulatory clarity around CBD continues to encourage brand entry and portfolio expansion.

Germany Cannabis-Based Alcoholic Beverages Market Insight

The Germany cannabis-based alcoholic beverages market is anticipated to expand at a considerable CAGR, driven by growing discussions around cannabis legalization and high consumer preference for functional and wellness-oriented beverages. Germany’s strong beer and spirits culture provides a favorable foundation for cannabis-infused product innovation. Consumers are showing increased interest in low-dose, responsibly marketed cannabis beverages. A focus on quality standards and transparency further supports market confidence and adoption.

Asia-Pacific Cannabis-Based Alcoholic Beverages Market Insight

The Asia-Pacific cannabis-based alcoholic beverages market is expected to register the fastest CAGR during the forecast period of 2026 to 2033, driven by rising urbanization, changing social drinking habits, and increasing awareness of cannabis-derived wellness products. Growing interest in premium and experiential beverages is supporting early-stage adoption in select markets. Regulatory experimentation around CBD products is opening opportunities for beverage manufacturers. The region’s expanding middle-class population further enhances long-term growth potential.

Japan Cannabis-Based Alcoholic Beverages Market Insight

The Japan cannabis-based alcoholic beverages market is gradually gaining traction, supported by consumer interest in functional beverages and stress-relief solutions. While THC remains restricted, CBD-infused alcoholic beverages are attracting attention for their perceived wellness benefits. Japan’s strong emphasis on product quality, safety, and innovation aligns with premium cannabis beverage positioning. The popularity of ready-to-drink formats further supports niche market growth.

China Cannabis-Based Alcoholic Beverages Market Insight

The China cannabis-based alcoholic beverages market is emerging, primarily driven by the growing acceptance of hemp-derived CBD ingredients in beverage formulations. Rising health consciousness and interest in functional alcohol alternatives are influencing early demand patterns. Domestic beverage manufacturers are exploring CBD-infused alcoholic products within regulatory boundaries. Urban consumers and premium hospitality venues are expected to play a key role in shaping future market development.

Cannabis-Based Alcoholic Beverages Market Share

The cannabis-based alcoholic beverages industry is primarily led by well-established companies, including:

- The Alkaline Water Company Inc. (U.S.)

- VCC Brand (U.S.)

- Keef Brands (U.S.)

- Canopy Growth Corporation (Canada)

- Hemp Co. (U.S.)

- Coalition Brewing Co Ltd. (U.K.)

- Green Monkey CBD (U.K.)

- GREEN TIMES BREWING (U.S.)

- Two Roots Brewing Co. (U.S.)

- CERIA, Inc. (U.S.)

- FAT DOG SPIRITS (U.S.)

- The Wee Hemp Company (U.K.)

- Dutch Windmill Spirits B.V. (Netherlands)

- Heineken N.V. (Netherlands)

Latest Developments in Global Cannabis-Based Alcoholic Beverages Market

- In January 2024, Lagunitas Brewing Company launched a low-dose THC-infused beer in select legalized markets, positioned around controlled consumption and social drinking occasions. This development highlights the increasing participation of established craft brewers in the cannabis-based alcoholic beverages space, strengthening market credibility and consumer trust. The launch supports category expansion beyond CBD-focused offerings and reflects growing regulatory confidence in THC-infused alcoholic formats. It is expected to accelerate product innovation, attract experience-driven consumers, and contribute to the gradual maturation of the overall market

- In May 2023, Naka introduced Naka Moonlight, an all-natural CBD-infused water positioned as an alternative to alcoholic beverages, containing 30 mg equivalent CBD per can. This launch reflects the growing shift toward low- or no-alcohol consumption trends, supporting market expansion by attracting consumers seeking relaxation and social drinking experiences without alcohol-related effects. The product strengthens the role of CBD beverages in reducing alcohol intake while broadening the appeal of cannabis-infused drink formats

- In November 2022, Ablis expanded its CBD beverage portfolio by launching higher-potency variants with doubled CBD isolate content across its drinks and shooters. This development highlights increasing consumer demand for stronger, more effective CBD-infused beverages, driving product differentiation and premiumization within the market. The focus on all-natural ingredients and pure hemp CBD isolate enhances consumer trust and supports wider adoption

- In September 2022, Legacy Distribution Group acquired the Direct Store Distribution (DSD) operations from New Age Beverage and NABC Properties. This acquisition significantly strengthened distribution capabilities for cannabis and CBD-infused beverages, improving market reach and retail penetration. Enhanced logistics and shelf presence are expected to accelerate commercialization and competitive positioning across regional markets

- In April 2022, PepsiCo-owned Rockstar Energy launched hemp-infused drinks in Germany, incorporating hemp seed oil and herbal ingredients to target younger adult consumers. This move underscores the entry of major beverage players into the cannabis-adjacent space, increasing market credibility and visibility. The launch also supports consumer normalization of hemp-infused beverages within mainstream retail channels

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。