Global Carbonated Soft Drinks Market

市场规模(十亿美元)

CAGR :

%

USD

697.15 Million

USD

1,117.87 Million

2025

2033

USD

697.15 Million

USD

1,117.87 Million

2025

2033

| 2026 –2033 | |

| USD 697.15 Million | |

| USD 1,117.87 Million | |

|

|

|

|

Global Carbonated Soft Drinks Market Segmentation, By Flavor (Cola, Lime, Lemon, Orange, and Others), Packaging Type (Bottles and Cans), Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online, and Others) - Industry Trends and Forecast to 2033

Carbonated Soft Drinks Market Size

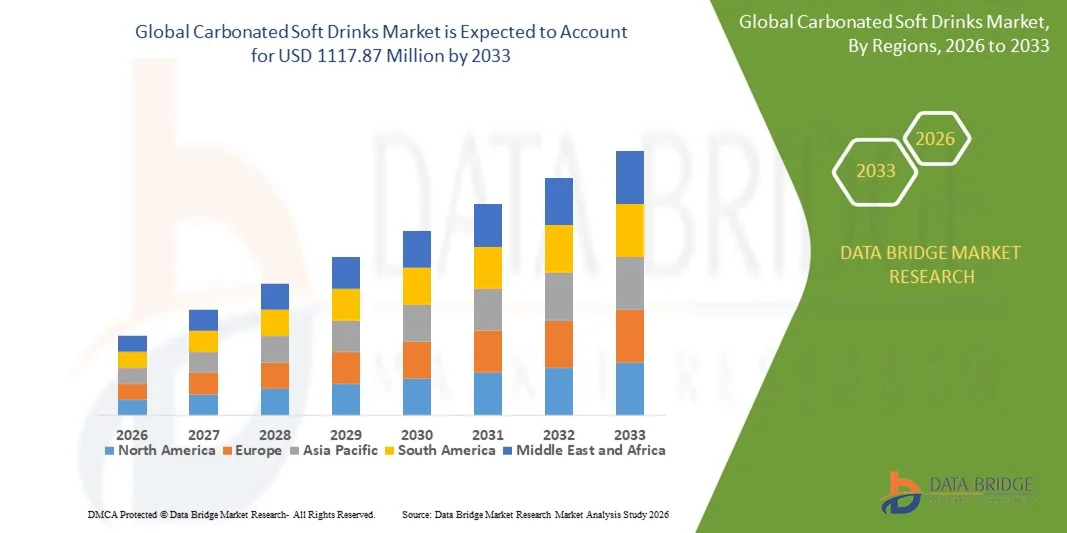

- The global carbonated soft drinks market size was valued at USD 697.15 million in 2025 and is expected to reach USD 1117.87 million by 2033, at a CAGR of 6.08% during the forecast period

- The market growth is largely fueled by rising global consumption of ready-to-drink beverages, driven by changing lifestyles, urbanization, and increasing preference for convenient refreshment options across all age groups

- Furthermore, strong brand influence, continuous flavor innovation, and extensive availability across modern retail and foodservice channels are reinforcing consumer demand. These combined factors are accelerating consumption frequency and volume, thereby significantly supporting the growth of the carbonated soft drinks market

Carbonated Soft Drinks Market Analysis

- Carbonated soft drinks are non-alcoholic beverages infused with carbon dioxide, available in a wide range of flavors and formulations, and consumed across residential, commercial, and on-the-go settings

- The increasing demand for carbonated soft drinks is primarily driven by strong brand loyalty, aggressive marketing strategies, expanding distribution networks, and evolving consumer preferences for flavored and functional beverage variants

- North America dominated the carbonated soft drinks market with a share of 45.5% in 2025, due to high per capita consumption, strong brand loyalty, and the widespread presence of established beverage manufacturers

- Asia-Pacific is expected to be the fastest growing region in the carbonated soft drinks market during the forecast period due to rapid urbanization, rising disposable incomes, and expanding young population demographics

- Cola segment dominated the market with a market share of 45.5% in 2025, due to its strong global brand presence, long-standing consumer preference, and wide acceptance across age groups. Cola beverages benefit from extensive marketing investments and consistent taste profiles that reinforce repeat consumption. Their strong positioning in both on-trade and off-trade channels further supports high sales volumes. Broad availability across price points and pack sizes continues to sustain demand. The dominance of cola is also supported by its pairing with meals and social occasions

Report Scope and Carbonated Soft Drinks Market Segmentation

|

Attributes |

Carbonated Soft Drinks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Carbonated Soft Drinks Market Trends

Rising Demand for Low-Sugar and Zero-Calorie Carbonated Beverages

- A major trend in the carbonated soft drinks market is the growing consumer shift toward low-sugar and zero-calorie beverage options, driven by increasing health awareness and changing dietary preferences. Consumers are actively reducing sugar intake while still seeking the taste and refreshment associated with carbonated drinks, which is reshaping product portfolios across the industry

- For instance, Coca-Cola has expanded its Coca-Cola Zero Sugar and Diet Coke offerings across multiple regions to address rising demand for reduced-calorie alternatives. These products have gained strong traction among health-conscious consumers while maintaining brand familiarity and taste consistency

- The trend is further supported by reformulation efforts that focus on alternative sweeteners and improved flavor profiles to meet evolving consumer expectations. Beverage manufacturers are investing in research to balance taste, mouthfeel, and calorie reduction without compromising product appeal

- Retail shelves are increasingly dominated by low- and no-sugar variants, reflecting higher shelf allocation and promotional focus by retailers. This shift is encouraging faster adoption among consumers who previously limited carbonated soft drink consumption due to health concerns

- Younger demographics are particularly driving this trend as they show greater preference for transparency in nutritional content and functional benefits. Their purchasing behavior is influencing brand strategies and accelerating the launch of better-for-you carbonated beverages

- The sustained momentum of low-sugar and zero-calorie offerings is redefining competitive positioning within the market. This trend is reinforcing long-term demand by aligning carbonated soft drinks with healthier lifestyle choices while preserving mass-market appeal

Carbonated Soft Drinks Market Dynamics

Driver

Strong Brand Loyalty and Extensive Global Distribution Networks

- Strong brand loyalty and well-established global distribution networks remain a key driver of the carbonated soft drinks market, enabling consistent product availability and sustained consumption across regions. Leading brands benefit from decades of consumer trust and recognition, which supports repeat purchases and stable demand

- For instance, PepsiCo leverages its extensive global bottling and distribution network to ensure wide availability of its carbonated beverage portfolio across supermarkets, convenience stores, and foodservice outlets. This reach allows the company to maintain strong market penetration even in highly competitive environments

- Large-scale marketing investments and sponsorships further strengthen brand attachment and consumer recall. These efforts reinforce emotional connections with consumers and sustain long-term brand preference

- The ability to efficiently distribute products across urban and rural markets supports volume-driven growth. Established logistics capabilities reduce supply disruptions and ensure consistent shelf presence

- As consumption remains closely tied to brand familiarity and accessibility, this driver plays a central role in supporting the resilience and scale of the carbonated soft drinks market

Restraint/Challenge

Increasing Health Concerns and Regulatory Pressure on Sugar Content

- The carbonated soft drinks market faces growing challenges from rising health concerns and increasing regulatory scrutiny related to sugar consumption. Governments and health organizations are actively highlighting the links between excessive sugar intake and lifestyle-related diseases, influencing consumer behavior and policy decisions

- For instance, the World Health Organization has consistently recommended reducing free sugar intake, prompting several countries to introduce sugar taxes on carbonated beverages. Such regulations have directly impacted pricing strategies and consumption patterns in multiple markets

- Manufacturers are required to invest heavily in reformulation and compliance efforts to meet regulatory standards. These changes often involve higher costs related to ingredient sourcing, testing, and labeling updates

- Shifting consumer perceptions toward sugary beverages are reducing demand for traditional full-sugar carbonated drinks. This creates pressure on legacy products that historically contributed significant revenue volumes

- These regulatory and health-related constraints are reshaping competitive dynamics and compelling market players to adapt rapidly. The challenge continues to influence strategic planning and long-term growth trajectories within the carbonated soft drinks market

Carbonated Soft Drinks Market Scope

The market is segmented on the basis of flavor, packaging type, and distribution channel.

- By Flavor

On the basis of flavor, the carbonated soft drinks market is segmented into cola, lime, lemon, orange, and others. The cola segment dominated the largest market revenue share of 45.5% in 2025, driven by its strong global brand presence, long-standing consumer preference, and wide acceptance across age groups. Cola beverages benefit from extensive marketing investments and consistent taste profiles that reinforce repeat consumption. Their strong positioning in both on-trade and off-trade channels further supports high sales volumes. Broad availability across price points and pack sizes continues to sustain demand. The dominance of cola is also supported by its pairing with meals and social occasions.

The lemon segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by rising consumer interest in refreshing and citrus-based flavors. Lemon-flavored carbonated drinks are increasingly perceived as lighter and more thirst-quenching, which appeals to health-conscious and younger consumers. Product innovations focusing on low-sugar and natural flavor formulations are strengthening adoption. Seasonal demand during warmer climates also contributes to higher consumption. Expanding availability in emerging markets is further accelerating growth.

- By Packaging Type

On the basis of packaging type, the carbonated soft drinks market is segmented into bottles and cans. The bottles segment accounted for the largest market revenue share in 2025, driven by convenience, re-sealability, and suitability for family or multi-serve consumption. Plastic and glass bottles offer flexibility in size variants, supporting both single-use and bulk purchases. Bottles are widely preferred in retail environments due to ease of storage and transportation. Strong penetration in supermarkets and convenience stores further reinforces dominance. Brand visibility through labeling and packaging design also supports higher sales.

The cans segment is expected to register the fastest growth rate during the forecast period, supported by increasing demand for single-serve and on-the-go consumption. Cans offer faster chilling, improved portability, and reduced risk of contamination, making them popular in urban settings. Growing environmental focus on recyclability is improving the perception of aluminum cans. Rising consumption through vending machines and foodservice outlets is also driving growth. Premiumization trends are further supporting can-based offerings.

- By Distribution Channel

On the basis of distribution channel, the carbonated soft drinks market is segmented into supermarkets & hypermarkets, convenience stores, online, and others. Supermarkets and hypermarkets dominated the largest market revenue share in 2025, driven by extensive product assortments and high consumer footfall. These channels enable bulk purchasing and promotional pricing, encouraging higher volume sales. Strong shelf visibility and in-store marketing support brand-driven purchases. Established supply chains ensure consistent product availability. Consumer preference for one-stop shopping further strengthens dominance.

The online segment is projected to witness the fastest growth rate from 2026 to 2033, supported by increasing digital penetration and evolving purchasing behavior. Online platforms provide convenience, home delivery, and access to a wider range of brands and pack sizes. Subscription-based models are encouraging repeat purchases of beverages. Growth in quick-commerce and app-based grocery services is accelerating adoption. Attractive discounts and personalized recommendations further enhance channel expansion.

Carbonated Soft Drinks Market Regional Analysis

- North America dominated the carbonated soft drinks market with the largest revenue share of 45.5% in 2025, driven by high per capita consumption, strong brand loyalty, and the widespread presence of established beverage manufacturers

- Consumers in the region show a strong preference for carbonated beverages across multiple occasions, supported by aggressive marketing, frequent product innovations, and extensive availability across retail and foodservice channels

- This dominance is further supported by well-developed distribution infrastructure, high disposable incomes, and the growing demand for convenient, ready-to-drink beverages, reinforcing the region’s leadership in the global market

U.S. Carbonated Soft Drinks Market Insight

The U.S. carbonated soft drinks market captured the largest revenue share in 2025 within North America, supported by the strong presence of global beverage brands and a mature retail ecosystem. High consumption of cola-based drinks, combined with continuous flavor innovation and packaging diversification, continues to drive demand. The expansion of convenience stores and foodservice outlets further strengthens market growth. In addition, strong promotional activities and brand-driven consumer loyalty play a key role in sustaining sales volumes.

Europe Carbonated Soft Drinks Market Insight

The Europe carbonated soft drinks market is projected to grow at a steady CAGR during the forecast period, driven by changing consumer preferences and increasing demand for flavored and low-sugar carbonated beverages. Rising urbanization and evolving lifestyles are supporting consistent consumption across both Western and Eastern Europe. Manufacturers are increasingly focusing on reformulation and premium offerings to align with regulatory standards and consumer expectations. The region shows balanced growth across retail and on-trade channels.

U.K. Carbonated Soft Drinks Market Insight

The U.K. carbonated soft drinks market is expected to register notable growth during the forecast period, driven by strong demand for flavored and sugar-free carbonated beverages. Health awareness and regulatory measures on sugar content are influencing product innovation and portfolio diversification. Consumers continue to favor carbonated drinks for social and at-home consumption. The country’s strong retail penetration and promotional pricing strategies further support market expansion.

Germany Carbonated Soft Drinks Market Insight

The Germany carbonated soft drinks market is anticipated to expand at a moderate CAGR, supported by high consumption of carbonated beverages and a strong preference for flavored and fruit-based variants. Germany’s well-established beverage manufacturing base and efficient distribution networks support consistent supply. Increasing demand for sustainable packaging and recyclable cans and bottles is influencing market dynamics. The focus on quality and ingredient transparency aligns with evolving consumer expectations.

Asia-Pacific Carbonated Soft Drinks Market Insight

The Asia-Pacific carbonated soft drinks market is expected to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, rising disposable incomes, and expanding young population demographics. Increasing westernization of diets and growing exposure to global beverage brands are accelerating consumption. The expansion of modern retail formats and convenience stores further supports market growth. Manufacturers are actively introducing region-specific flavors to capture local demand.

Japan Carbonated Soft Drinks Market Insight

The Japan carbonated soft drinks market is witnessing steady growth due to strong consumer demand for innovative flavors and premium carbonated beverages. The market benefits from advanced packaging technologies and a high level of product differentiation. Carbonated drinks are widely consumed across vending machines, convenience stores, and foodservice outlets. The preference for smaller pack sizes and functional beverage variants continues to shape market trends.

China Carbonated Soft Drinks Market Insight

The China carbonated soft drinks market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, a growing middle-class population, and strong brand penetration. Increasing consumption among younger consumers and rising demand for flavored carbonated beverages are key growth drivers. The expansion of e-commerce and modern retail channels is significantly improving product accessibility. Strong domestic manufacturers and competitive pricing strategies are further accelerating market expansion.

Carbonated Soft Drinks Market Share

The carbonated soft drinks industry is primarily led by well-established companies, including:

- Coca-Cola (U.S.)

- PepsiCo (U.S.)

- Dr Pepper Snapple Group (U.S.)

- Nestlé S.A. (Switzerland)

- Monster Beverage Corporation (U.S.)

- Red Bull GmbH (Austria)

- Britvic plc (U.K.)

- Keurig Dr Pepper Inc. (U.S.)

- Fanta (U.S.)

- Asahi Group Holdings, Ltd. (Japan)

- Danone S.A. (France)

- Suntory Holdings Limited (Japan)

- The Kraft Heinz Company (U.S.)

- Tingyi Holding Corp. (China)

Latest Developments in Global Carbonated Soft Drinks Market

- In November 2025, Coca-Cola (U.S.) entered into a strategic partnership with a leading technology firm to strengthen its digital marketing capabilities, with a direct impact on consumer engagement and brand positioning. The collaboration enables the use of advanced analytics and data-driven personalization, allowing Coca-Cola to tailor marketing campaigns more precisely to consumer preferences. This approach is expected to enhance brand loyalty, improve campaign efficiency, and support sustained market share growth in a highly competitive carbonated soft drinks landscape. Deeper consumer insights may also guide future flavor and product innovations

- In September 2025, PepsiCo (U.S.) introduced a new portfolio of organic carbonated sodas, reinforcing its strategic focus on health and wellness-driven consumption trends. This development expands PepsiCo’s presence in the premium and organic beverage segment, which is gaining traction among health-conscious consumers. By diversifying its carbonated soft drinks offerings, the company is positioned to attract new customer segments while strengthening its competitive edge. The move also supports long-term portfolio resilience amid shifting consumer preferences

- In August 2025, Keurig Dr Pepper (U.S.) announced investments in sustainable packaging solutions for its carbonated soft drinks portfolio, aiming to reduce plastic usage and improve recyclability. This initiative is expected to enhance brand perception among environmentally conscious consumers and align the company with evolving regulatory and sustainability expectations. Improved packaging efficiency may also contribute to cost optimization over time. The focus on sustainability supports long-term market competitiveness and consumer trust

- In July 2025, Dr Pepper Snapple Group (U.S.) expanded its distribution footprint across Southeast Asia to capitalize on rising demand for carbonated beverages in emerging economies. This expansion strengthens the company’s access to high-growth markets characterized by increasing urbanization and young consumer populations. Enhanced distribution capabilities are likely to improve product availability and brand visibility across the region. As a result, the company is positioned to capture incremental market share and reinforce its global growth strategy

- In June 2025, The Coca-Cola Company (U.S.) launched region-specific flavored carbonated beverages across select Asia-Pacific markets to address local taste preferences. This localized product strategy is expected to drive higher consumer acceptance and trial rates in diverse regional markets. Tailoring flavors to cultural preferences enhances competitive differentiation and strengthens regional market penetration. The initiative supports volume growth and reinforces Coca-Cola’s adaptability in dynamic global markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。