Global Chemical Detection Technology Market

市场规模(十亿美元)

CAGR :

%

USD

27.46 Billion

USD

49.86 Billion

2024

2032

USD

27.46 Billion

USD

49.86 Billion

2024

2032

| 2025 –2032 | |

| USD 27.46 Billion | |

| USD 49.86 Billion | |

|

|

|

|

Global Chemical Detection Technology Market Segmentation, By Application (Anti-Terrorism, First Responder Market, Fire Fighting Control, Monitoring of Toxic and Hazardous Industrial Chemicals, Chemical Disaster Management, and Air-Borne Chemical Threats), Portability (Portable and Non-Portable), Technology (Infrared Spectroscopy, Raman Spectroscopy and Others), End User (Defence Sector, Government Authorities, Civil Sector, and Commercial Sector) - Industry Trends and Forecast to 2032

Chemical Detection Technology Market Size

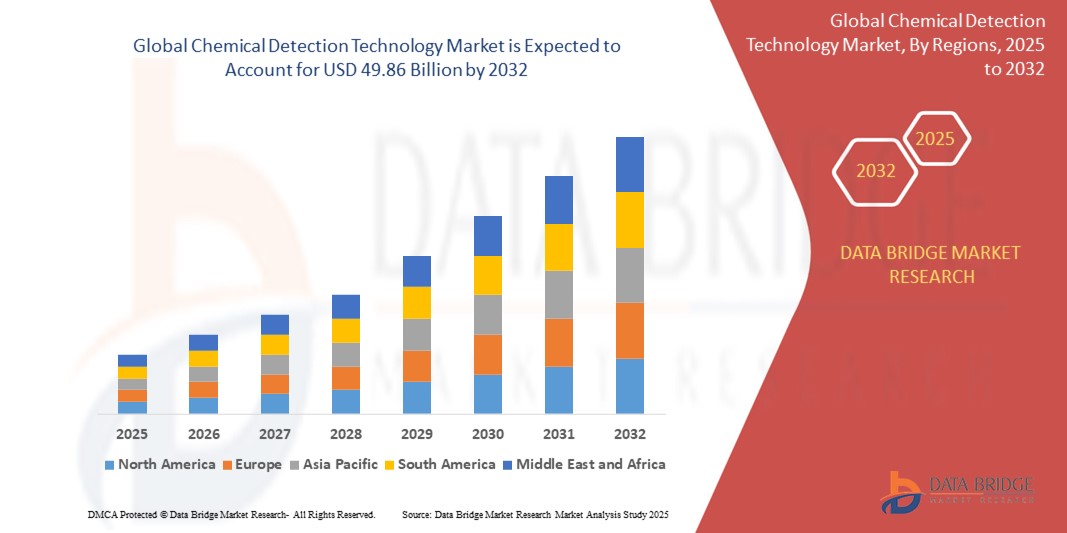

- The global chemical detection technology market size was valued atUSD 27.46 billion in 2024and is expected to reachUSD 49.86 billion by 2032, at aCAGR of 7.26%during the forecast period

- This growth is driven by factors such as the increasing demand for advanced chemical detection systems in security and defense applications, the growing focus on environmental monitoring and safety regulations, the expansion of industries such as healthcare, food safety, and manufacturing, and the rapid advancements in sensor technologies

Chemical Detection Technology Market Analysis

- Chemical detection technology is a technology that alerts the users of potential chemical threats. Chemical sensors are used to detect all sorts of toxic industrial agents, chemical agents, and toxic industrial materials.

- Chemical sensors respond to the threats in selective and reversible manners. Chemical sensors transform and convert the chemical information into analytically vital signals.

- North America is expected to dominate the chemical detection technology market due to well-established defense and homeland security sector, which requires advanced chemical detection technologies for various applications

- Asia-Pacific is expected to be the fastest growing region in the chemical detection technology market during the forecast period due to rapid industrialization and technological advancements

- Monitoring of toxic and hazardous industrial chemicals segment is expected to dominate the market with a market share due to increasing need for safety and regulatory compliance in industries such as manufacturing, oil & gas, chemicals, and pharmaceuticals

Report Scope and Chemical Detection Technology Market Segmentation

|

Attributes |

Chemical Detection Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chemical Detection Technology Market Trends

“Growing Demand for Multi-Function Chemical Detection Systems”

- One key trend in the global chemical detection technology market is the increasing demand for multi-functional, integrated detection systems that combine multiple technologies such as infrared spectroscopy, Raman spectroscopy, and mass spectrometry. These systems provide comprehensive chemical detection, monitoring, and analysis in one device, which is especially valuable for first responders, military, and industrial applications

- The shift towards portability is another trend shaping the market. Portable chemical detectors that can be easily used in the field by emergency responders or security personnel are becoming more popular. These devices allow for real-time chemical analysis in a wide range of environments, from hazardous industrial zones to urban areas exposed to potential terrorist threats

- There is an increasing trend towards the automation of chemical detection processes. Real-time monitoring capabilities allow for continuous detection, which is crucial in applications such as monitoring industrial chemicals or environmental pollution. The rise of the Internet of Things (IoT) has also facilitated more connected systems that can send alerts and reports remotely, enhancing safety and operational efficiency

- Governments and regulatory bodies are pushing for more stringent safety measures in industries dealing with hazardous chemicals. This is leading to the demand for advanced detection systems to comply with safety and environmental standards

- For Instance, In 2020, the U.S. Department of Homeland Security rolled out funding to upgrade chemical detection systems at U.S. airports, enhancing the trend towards multi-functionality and real-time detection

Chemical Detection Technology Market Dynamics

Driver

“Increasing Government Regulations and Safety Concerns”

- One of the primary drivers of the chemical detection technology market is the increasing number of stringent safety and environmental regulations worldwide. Governments, particularly in developed economies such as the U.S., EU, and Japan, are enacting laws that mandate the use of chemical detection systems in industries such as manufacturing, healthcare, and food safety to ensure public health and environmental protection

- The growing threat of chemical warfare and terrorism also plays a critical role in driving the market. Nations are investing in advanced chemical detection systems for national security purposes, including the detection of toxic substances in public spaces, airports, and critical infrastructure. This has led to significant investment in chemical detection technologies in defense and homeland security sectors

- The rise of environmental hazards, such as chemical spills, industrial leaks, and air pollution, is another factor driving demand. Governments are under increasing pressure to regulate hazardous chemicals more strictly, promoting the adoption of chemical detection systems to minimize the risks associated with industrial accidents and environmental contamination

- Chemical detection technologies are increasingly being adopted by first responders for emergency situations, such as chemical spills or terrorist attacks. With growing concerns over chemical threats, both natural and man-made, authorities are prioritizing the acquisition of real-time detection solutions to ensure public safety

- For Instance, the European Union has implemented a variety of regulations, including REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), to ensure better environmental monitoring and industrial safety, driving the demand for chemical detection technologies

Opportunity

“Expansion of Chemical Detection in Emerging Markets”

- As emerging economies, especially in Asia-Pacific and Latin America, continue to industrialize and urbanize, the demand for chemical detection technologies is expected to rise sharply. Countries such as China, India, and Brazil are witnessing rapid industrial growth, leading to an increased need for monitoring and detection systems to ensure worker safety, environmental compliance, and public health

- Developing nations are increasingly focusing on environmental protection and pollution control. With rising industrialization, the risk of hazardous chemical exposure has increased, prompting governments to adopt stricter safety measures. This creates significant opportunities for the deployment of chemical detection systems in industries such as manufacturing, oil & gas, agriculture, and waste management

- The expanding healthcare and pharmaceutical industries in emerging markets present a significant opportunity for chemical detection technologies. These technologies are crucial for pharmaceutical production processes, environmental testing in healthcare settings, and food safety. As these sectors continue to grow, the demand for chemical detection systems will increase, especially for applications such as drug testing and foodborne pathogen detection

- Many developing countries are investing heavily in upgrading their infrastructure, including smart cities and environmental monitoring systems. These investments create opportunities for the adoption of advanced chemical detection technologies to monitor air quality, chemical waste, and hazardous materials in urban settings

- For Instance, India’s growing industrial sector and focus on environmental pollution control are driving investments in chemical detection technology, especially in sectors such as chemical manufacturing, mining, and agriculture

Restraint/Challenge

“High Costs and Complexities in Adoption”

- One of the biggest challenges in the adoption of chemical detection technologies is the high upfront cost of these systems, especially advanced technologies such as Raman spectroscopy and mass spectrometry. For small and medium-sized enterprises (SMEs), the cost of purchasing, installing, and maintaining these systems can be prohibitive, limiting their widespread adoption

- The integration of advanced chemical detection technologies into existing infrastructure can be complex and time-consuming. In many industries, especially in smaller organizations, there is a lack of technical expertise to effectively use and maintain such systems. This can lead to lower adoption rates, particularly in developing markets where technological infrastructure is still evolving

- While increasing government regulations drive demand, they also pose a challenge to businesses that may struggle to meet the strict standards set by authorities. Many organizations need to invest in upgrading their chemical detection systems to comply with evolving regulations, which can be a costly and resource-intensive process

- Despite the growing demand, there is limited awareness about the importance of chemical detection technology in some emerging markets. In these regions, there may be a lack of understanding of the value these technologies offer in preventing industrial accidents, managing chemical risks, and ensuring environmental safety

- For Instance, in some parts of Southeast Asia, smaller industries lack the resources to implement chemical detection systems, hindering their ability to meet global safety standards and regulatory requirements, despite increasing industrial growth

Chemical Detection Technology Market Scope

The market is segmented on the basis of application, portability, technology, end users.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

|

By Portability |

|

|

By Technology |

|

|

By End User |

|

In 2025, the monitoring of toxic and hazardous industrial chemicals is projected to dominate the market with a largest share in application segment

The monitoring of toxic and hazardous industrial chemicals segment is expected to dominate the chemical detection technology market with the largest share in 2025 due to due to the increasing need for safety and regulatory compliance in industries such as manufacturing, oil & gas, chemicals, and pharmaceuticals. Monitoring hazardous chemicals helps to ensure environmental safety, worker health, and compliance with stringent government regulations, driving the demand for advanced detection technologies.

The anti-terrorism is expected to account for the largest share during the forecast period in application market

In 2025, the anti-terrorism segment is expected to dominate the market with the largest market share due to it is crucial for homeland security and defense, driving significant growth in the market due to the increasing global threat of chemical terrorism, including the use of chemical weapons and industrial chemicals in terrorist attacks.

Chemical Detection Technology Market Regional Analysis

“North America Holds the Largest Share in the Chemical Detection Technology Market”

- North America, particularly the U.S., is the dominant region in the global chemical detection technology market. The region has a well-established defense and homeland security sector, which requires advanced chemical detection technologies for various applications such as counter-terrorism, border security, and military operations

- The U.S. is a global leader in technological innovation and R&D. This focus on developing state-of-the-art chemical detection systems, including sensors and detection instruments, drives the market's growth in North America. Government agencies, such as the Department of Homeland Security, are investing heavily in chemical detection technologies

- North America has a mature industrial base, with sectors such as manufacturing, healthcare, and food safety requiring chemical detection technologies for quality control, environmental monitoring, and public health protection. The demand for chemical sensors in these industries continues to grow as safety regulations become more stringent

- The region benefits from robust regulations that mandate the use of chemical detection systems in various industries. The U.S. Environmental Protection Agency (EPA) and other regulatory bodies set high standards for environmental and safety monitoring, ensuring sustained demand for chemical detection technologies

- For Instance, the U.S. military's significant investments in chemical warfare detection technologies, including sensors and detection systems, highlight the continued dominance of North America in the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Chemical Detection Technology Market”

- The Asia-Pacific region is the fastest-growing market for chemical detection technologies. With rapid industrialization and technological advancements, particularly in countries such as China, India, and Japan, there is a rising need for chemical detection systems across various sectors, including manufacturing, environmental monitoring, and agriculture

- Several APAC countries are strengthening their environmental policies and industrial regulations. For example, China's focus on improving air quality and reducing industrial pollution is driving the demand for chemical detection technologies. Additionally, governments in the region are investing in advanced technologies to ensure public safety, further boosting the market

- As urbanization increases in APAC, there is a heightened focus on environmental health, food safety, and disaster management. Chemical detection technologies are crucial for monitoring hazardous materials, air quality, and ensuring food and water safety, leading to a growing demand in this region

- As APAC countries become manufacturing hubs, the need for chemical detection technologies in industrial processes, agriculture (to detect harmful chemicals in food products), and waste management is also increasing. The growth in these sectors is contributing to the fast-paced expansion of the chemical detection market

- For Instance, India's increasing investments in environmental monitoring and China's drive for smart cities with integrated safety systems are contributing to the high growth rate in the APAC region

Chemical Detection Technology Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- S.E. International, Inc.(U.S.)

- ROM Technologies, Inc.(U.S.)

- ChemImage Corporation(U.S.)

- Bruker(U.S.)

- S2 Threat Detection Technologies(U.S.)

- Bioquell (U.K.)

- Honeywell International Inc. (U.S.)

- Environics Oy (Finland)

- Federal Resources (U.S.)

- General Dynamics Corporation (U.S.)

- FLIR Systems, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Smiths Detection Group Ltd. (U.K.)

- Secure Point Technologies LLC (U.S.)

- General Electric (U.S.)

- MSA (U.S.)

- Pepperl+Fuchs (Germany)

- Hans Turck GmbH & Co. KG (Germany)

- SICK AG (Germany)

Latest Developments in Global Chemical Detection Technology Market

- In June 2024,Baker Hughesannounced the launch of three new sensor technologies for gas, flow, and moisture measurements, aimed at enhancing safety and productivity in oil and gas, hydrogen, and other industrial applications. The new Panametrics solutions offer advanced accuracy, reliability, and durability. These technologies are designed to operate in harsh environments and can be used in sectors such as oil and gas, hydrogen, metals, chemicals, biogas, power generation, and CCUS.

- In April 2024,onsemiintroduced theCEM102, a cutting-edge analog front-end (AFE) that enables precise electrochemical sensing with minimal power consumption. This miniaturized solution is ideal for industrial, environmental, and healthcare applications, offering unmatched accuracy in measuring biochemicals, air quality, gases, and hazardous chemicals. Designed to work seamlessly with the RSL15 Bluetooth® 5.2 enabled microcontroller, it provides industry-leading power efficiency and wide supply voltage range, making it suitable for battery-operated sensors.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。