Global Clinical Risk Grouping Solutions Market

市场规模(十亿美元)

CAGR :

%

USD

1.05 Billion

USD

3.02 Billion

2025

2033

USD

1.05 Billion

USD

3.02 Billion

2025

2033

| 2026 –2033 | |

| USD 1.05 Billion | |

| USD 3.02 Billion | |

|

|

|

|

Global Clinical Risk Grouping Solutions Market Segmentation, By Product (Scorecards & Visualization Tools, Dashboard Analytics Solutions, and Risk Reporting Solutions), Deployment Model (Private Cloud, Public Cloud, and Hybrid Cloud), End-User (Hospitals, Payers, Ambulatory Care Centers, Long-Term Care Centers, and Others) - Industry Trends and Forecast to 2033

Clinical Risk Grouping Solutions Market Size

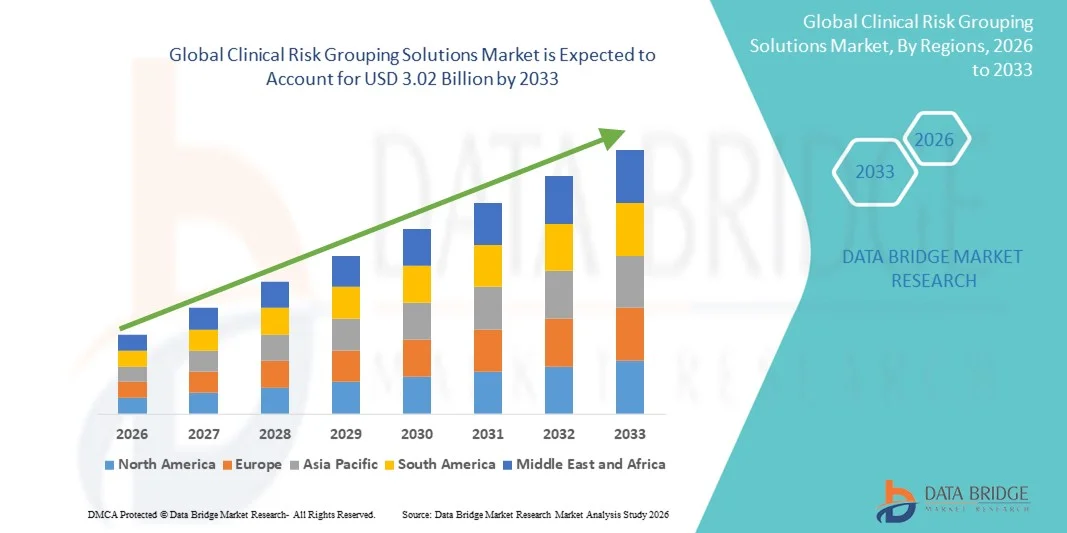

- The global clinical risk grouping solutions market size was valued at USD 1.05 billion in 2025 and is expected to reach USD 3.02 billion by 2033, at a CAGR of 14.15% during the forecast period

- The market growth is largely driven by the increasing adoption of digital healthcare technologies, data-driven patient management, and population health management initiatives, which enable providers and payers to improve care outcomes, optimize costs, and streamline clinical workflows

- Furthermore, rising demand for accurate risk stratification, predictive analytics, and value-based care solutions is accelerating the adoption of Clinical Risk Grouping (CRG) Solutions, thereby significantly boosting industry expansion

Clinical Risk Grouping Solutions Market Analysis

- Clinical Risk Grouping (CRG) Solutions, offering advanced patient risk stratification and predictive analytics, are increasingly vital components of modern healthcare management systems in both hospital and outpatient settings due to their ability to improve care outcomes, optimize resource utilization, and streamline clinical decision-making

- The escalating demand for CRG solutions is primarily fueled by the widespread adoption of digital health technologies, growing emphasis on value-based care, and a rising need for efficient population health management and predictive patient monitoring

- North America dominated the clinical risk grouping solutions market with the largest revenue share of approximately 41% in 2025, supported by advanced healthcare infrastructure, widespread adoption of digital health platforms, favorable reimbursement policies, and the presence of leading healthcare analytics companies. The U.S. accounts for the majority of regional revenue, driven by high adoption rates of risk stratification solutions, robust healthcare IT infrastructure, and significant investment in predictive and value-based care models

- Asia-Pacific is expected to be the fastest-growing region in the clinical risk grouping solutions market during the forecast period, registering a CAGR of around 13% from 2026 to 2033, driven by rising healthcare expenditure, expansion of telemedicine services, growing awareness of population health management, and improving access to advanced healthcare technologies in countries such as China, India, and Japan

- The Private Cloud segment dominated the market with a revenue share of 42.3% in 2025, owing to healthcare organizations’ emphasis on data security, compliance, and control over sensitive patient information

Report Scope and Clinical Risk Grouping Solutions Market Segmentation

|

Attributes |

Clinical Risk Grouping Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Optum (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Clinical Risk Grouping Solutions Market Trends

Expansion of Data-Driven Clinical Decision-Making

- A significant and accelerating trend in the global clinical risk grouping solutions market is the increasing adoption of data-driven decision-making in healthcare, enabling providers to stratify patients based on risk and optimize resource allocation

- For instance, in March 2023, Optum introduced an enhanced version of its Risk Stratification platform, allowing hospitals to more accurately predict patient outcomes and prioritize high-risk individuals

- The integration of electronic health record (EHR) data, claims data, and predictive analytics allows healthcare systems to reduce readmissions, improve preventive care, and enhance operational efficiency. Providers are leveraging predictive modeling, machine learning algorithms, and large-scale health data to identify high-risk patient populations

- The focus on population health management and value-based care is driving the adoption of Clinical Risk Grouping Solutions across hospitals and ambulatory care settings. Payers are using these solutions to refine risk-adjusted payment models and reduce unnecessary expenditure

- The trend is particularly strong in North America and Europe, supported by advanced healthcare infrastructure and regulatory support. Hospitals and Integrated Delivery Networks (IDNs) are actively adopting these platforms to enhance patient outcomes while controlling costs

- Governments and private stakeholders are incentivizing their use for chronic disease management, preventive care, and population health initiatives. Cloud-based, scalable solutions are enabling wider adoption across providers of all sizes

- The demand for real-time analytics and predictive insights continues to fuel market growth. Overall, Clinical Risk Grouping Solutions are becoming essential for modern healthcare ecosystems, improving efficiency and quality of care

Clinical Risk Grouping Solutions Market Dynamics

Driver

Rising Demand for Efficient Resource Allocation in Healthcare Systems

- The growing pressure on healthcare systems to optimize resource utilization is a key driver for Clinical Risk Grouping Solutions adoption

- For instance, in April 2022, Cerner launched a new risk adjustment module in its population health suite to help providers identify high-risk patients and allocate resources effectively

- Hospitals face increasing patient volumes, rising chronic disease prevalence, and escalating healthcare costs, making risk stratification solutions essential. By identifying high-risk patients, providers can implement targeted interventions, reduce readmissions, and improve care quality

- Insurance payers and accountable care organizations (ACOs) are increasingly using these platforms to support risk-adjusted payment models. Cloud-based, scalable solutions allow mid-sized providers to adopt Clinical Risk Grouping Solutions without extensive IT infrastructure investment

- Regulatory requirements for patient outcomes reporting further encourage adoption. Streamlining workflows and reducing administrative burden enhances operational efficiency

- Targeted interventions allow better utilization of healthcare resources and reduce overall costs. Integration with EHRs and other hospital systems increases clinical decision-making accuracy

- North America leads adoption due to advanced healthcare infrastructure and high technology acceptance, while emerging economies are starting to invest. The growing emphasis on value-based care and population health management continues to propel market growth

Restraint/Challenge

Concerns Around Data Privacy, Integration, and Cost

- Data privacy, system interoperability, and high implementation costs are significant challenges for Clinical Risk Grouping Solutions

- For instance, in November 2023, a U.S. hospital reported delays deploying a risk stratification system due to integration issues with existing EHR platforms. Compliance with regulations such as HIPAA and GDPR is mandatory and complex

- Integrating these solutions into legacy systems can require substantial IT support and staff training. Smaller hospitals and clinics may face financial barriers due to high upfront costs for licensing, implementation, and maintenance

- Lack of standardized data collection and analysis protocols can hinder adoption. Concerns around security, vendor reliability, and data sharing persist despite cloud-based deployment

- Addressing these challenges through robust cybersecurity measures and standardized integration frameworks is critical. Cost-effective deployment models are essential for adoption in developing regions

- Healthcare providers need education on best practices for data security and system use. Market growth depends on overcoming privacy, integration, and cost hurdles

- Continued innovation and support from vendors will help sustain the adoption of Clinical Risk Grouping Solutions globally

Clinical Risk Grouping Solutions Market Scope

The market is segmented on the basis of product, deployment model, and end-user.

- By Product

On the basis of product, the Clinical Risk Grouping Solutions market is segmented into Scorecards & Visualization Tools, Dashboard Analytics Solutions, and Risk Reporting Solutions. The Scorecards & Visualization Tools segment dominated the largest market revenue share of 38.5% in 2025, driven by its ability to provide actionable insights at a glance, simplify complex datasets, and support effective clinical decision-making. Healthcare providers and payers increasingly rely on scorecards to monitor patient outcomes, assess risk-adjusted performance, and benchmark against national standards. Scorecards facilitate easy comparison across departments, hospitals, and patient populations, improving operational efficiency. The visual representation of data enhances comprehension for both clinical staff and administrative teams. Integration with electronic health records (EHRs) and population health platforms further boosts adoption. Cloud-based and on-premise scorecard solutions are widely deployed in hospitals, payer organizations, and long-term care facilities. Stakeholders value real-time monitoring of key performance indicators (KPIs) to guide interventions. The demand for actionable, interpretable, and customizable tools drives continued growth. Providers also leverage these tools to meet compliance and regulatory reporting requirements. Training and support services offered by vendors enhance usability, driving implementation across healthcare settings. The segment's widespread acceptance, scalability, and proven ROI contribute to its market leadership.

The Dashboard Analytics Solutions segment is expected to witness the fastest CAGR of 12.8% from 2026 to 2033, fueled by increasing demand for interactive and real-time dashboards that integrate multiple data sources. Hospitals and payer organizations are adopting dashboards to track clinical, operational, and financial metrics simultaneously. For instance, in June 2023, Optum launched an advanced dashboard analytics suite that consolidates patient risk scores, utilization data, and care gaps in one interface. Dashboards enable trend analysis, predictive modeling, and proactive interventions, supporting evidence-based decision-making. Their ability to provide immediate insights helps reduce preventable hospital readmissions and optimize resource allocation. Cloud-based deployment and mobile access enhance accessibility for clinicians and administrators. Dashboards also improve collaboration among care teams by sharing insights in real time. Healthcare systems increasingly prioritize dashboards to enhance population health management. The flexibility to customize views and metrics drives adoption across hospitals, payers, and ambulatory care centers. Integration with AI and predictive analytics is further enhancing the utility of dashboard solutions. The segment’s user-friendly design and actionable insights are key factors for its rapid growth.

- By Deployment Model

On the basis of deployment model, the market is segmented into Private Cloud, Public Cloud, and Hybrid Cloud. The Private Cloud segment dominated the market with a revenue share of 42.3% in 2025, owing to healthcare organizations’ emphasis on data security, compliance, and control over sensitive patient information. Hospitals, long-term care centers, and payer organizations prefer private cloud solutions to ensure HIPAA compliance and maintain internal governance of patient data. Private clouds allow customization to align with existing IT infrastructure and internal workflows. Data encryption, secure access protocols, and dedicated resources provide robust security for critical healthcare data. Providers value high availability and reliability, minimizing downtime and ensuring uninterrupted access to clinical risk insights. Private cloud adoption is particularly strong in North America and Europe due to stringent regulatory requirements. Integration with existing health IT systems and enterprise applications further drives usage. Vendors provide dedicated support and training for private cloud implementations. The solution ensures scalability while maintaining security, appealing to large hospitals and integrated delivery networks. The perceived ROI and improved operational efficiency reinforce market dominance.

The Hybrid Cloud segment is expected to register the fastest CAGR of 13.2% from 2026 to 2033, driven by the growing need for flexibility and scalability while ensuring compliance with healthcare regulations. Hybrid deployment allows organizations to keep sensitive patient data on private infrastructure while leveraging public cloud resources for analytics and reporting. For instance, in September 2024, IBM Watson Health expanded its hybrid cloud Clinical Risk Grouping Solutions, enabling payers to combine secure data storage with AI-powered analytics. The hybrid model supports multi-site hospitals and large networks requiring centralized data processing with local control. Organizations benefit from reduced infrastructure costs, rapid deployment, and enhanced interoperability with other digital health systems. Hybrid solutions provide a balance between security, performance, and cost-effectiveness. Increasing cloud adoption and rising data volumes further fuel market growth. The ability to scale operations quickly to meet demand surges is attractive to both large and mid-sized providers. The combination of private and public cloud capabilities enhances disaster recovery and business continuity. Hybrid cloud deployment aligns with the trend toward integrated population health management, improving patient outcomes.

- By End-User

On the basis of end-user, the Clinical Risk Grouping Solutions market is segmented into Hospitals, Payers, Ambulatory Care Centers, Long-Term Care Centers, and Others. The Hospitals segment dominated the market with a revenue share of 46.7% in 2025, attributed to their large patient base, complex operations, and need for comprehensive risk stratification. Hospitals utilize Clinical Risk Grouping Solutions to monitor high-risk patients, optimize care pathways, and comply with regulatory reporting requirements. Integration with EHRs and other hospital IT systems enables real-time monitoring of patient outcomes. Hospitals leverage analytics for population health management, predictive modeling, and resource allocation. The segment benefits from advanced infrastructure, trained personnel, and access to high-quality data. Increasing hospital mergers and health system expansions further drive adoption. Providers prioritize solutions that improve care quality while reducing costs. Customizable dashboards and reports help clinicians and administrators make informed decisions. Hospitals also utilize these tools to track key performance indicators and improve operational efficiency.

The Ambulatory Care Centers segment is expected to witness the fastest CAGR of 11.9% from 2026 to 2033, fueled by the growing adoption of risk stratification solutions in outpatient settings. Ambulatory centers are increasingly focused on proactive care management and early intervention for chronic disease patients. For instance, in August 2023, Cerner introduced its Clinical Risk Grouping platform for outpatient clinics, enabling early identification of high-risk individuals. Cloud-based deployment allows small and mid-sized centers to access advanced analytics without heavy IT investment. The ability to track patient outcomes, monitor adherence, and coordinate care remotely enhances clinical effectiveness. Ambulatory centers benefit from integration with telehealth platforms, improving patient engagement. The segment’s rapid growth is also driven by increasing outpatient procedures and the shift toward value-based care models.

Clinical Risk Grouping Solutions Market Regional Analysis

- North America dominated the clinical risk grouping solutions market with the largest revenue share of approximately 41% in 2025, supported by advanced healthcare infrastructure, widespread adoption of digital health platforms, favorable reimbursement policies, and the presence of leading healthcare analytics companies

- The market accounts for the majority of regional revenue, driven by high adoption rates of risk stratification solutions, robust healthcare IT infrastructure, and significant investment in predictive and value-based care models. Hospitals, payers, and ambulatory care centers in the U.S. are increasingly leveraging Clinical Risk Grouping Solutions to enhance patient management, optimize resource allocation, and improve clinical outcomes

- In addition, the rising focus on population health management and integration of analytics tools into electronic health records is propelling market growth

U.S. Clinical Risk Grouping Solutions Market Insight

The U.S. clinical risk grouping solutions market captured the largest share within North America in 2025, with increasing deployment across hospitals, long-term care centers, and payer organizations. The country’s mature healthcare ecosystem, high incidence of chronic diseases, and growing emphasis on preventive care and value-based healthcare models are driving demand. Furthermore, strong investments in predictive analytics, data interoperability, and cloud-based healthcare IT solutions are accelerating adoption. Leading analytics providers and healthcare IT companies are focusing on developing advanced dashboard analytics and reporting solutions to support better decision-making and improve patient outcomes.

Europe Clinical Risk Grouping Solutions Market Insight

The Europe clinical risk grouping solutions market is expected to expand at a significant CAGR during the forecast period, driven by the growing focus on efficient resource utilization, healthcare cost containment, and patient-centric care. Countries such as the U.K., Germany, and France are witnessing increased adoption in hospitals, payer organizations, and long-term care centers. Government initiatives to implement standardized healthcare IT systems and promote population health management further boost the market. Additionally, healthcare providers are increasingly integrating predictive and risk scoring tools to optimize patient management and enhance clinical efficiency.

U.K. Clinical Risk Grouping Solutions Market Insight

The U.K. clinical risk grouping solutions market is projected to grow steadily, fueled by rising demand for data-driven decision-making in healthcare. Adoption is supported by national programs promoting digital health, emphasis on value-based care, and increasing investments in predictive analytics. Hospitals and payer organizations are leveraging these solutions to improve population health management and optimize treatment pathways, while long-term care and ambulatory centers are using analytics tools to enhance patient outcomes and operational efficiency.

Germany Clinical Risk Grouping Solutions Market Insight

The Germany clinical risk grouping solutions market is expected to expand at a considerable CAGR, driven by initiatives to digitize healthcare, promote data interoperability, and improve patient care quality. Healthcare providers and insurers are adopting risk stratification solutions to manage chronic conditions, reduce hospital readmissions, and implement population health programs. Integration with electronic health records and advanced analytics platforms is enhancing workflow efficiency and enabling informed decision-making across hospitals and payer organizations.

Asia-Pacific Clinical Risk Grouping Solutions Market Insight

The Asia-Pacific clinical risk grouping solutions market is anticipated to register the fastest CAGR of around 13% from 2026 to 2033, driven by rising healthcare expenditure, expansion of telemedicine services, growing awareness of population health management, and improving access to advanced healthcare technologies in countries such as China, India, and Japan. The increasing adoption of cloud-based healthcare IT systems, predictive analytics, and digital health platforms in hospitals and payer organizations is supporting market growth. Furthermore, government initiatives promoting healthcare digitization and investment in value-based care programs are creating significant opportunities for solution providers.

Japan Clinical Risk Grouping Solutions Market Insight

The Japan clinical risk grouping solutions market is gaining momentum due to high investments in digital health, an aging population, and increasing focus on chronic disease management. Hospitals and long-term care centers are deploying predictive analytics and risk scoring solutions to improve patient care efficiency. Integration with electronic medical records and telemedicine platforms is enhancing clinical workflows and enabling better population health management.

China Clinical Risk Grouping Solutions Market Insight

The China clinical risk grouping solutions market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, expansion of telehealth services, increasing healthcare spending, and growing awareness of risk-based patient management. Hospitals, payer organizations, and ambulatory care centers are adopting cloud-based analytics and risk reporting solutions to improve clinical outcomes, optimize resources, and support value-based care initiatives. Government policies promoting healthcare IT and population health programs are further propelling market growth.

Clinical Risk Grouping Solutions Market Share

The Clinical Risk Grouping Solutions industry is primarily led by well-established companies, including:

• Optum (U.S.)

• Oracle (U.S.)

• 3M Health Information Systems (U.S.)

• IBM (U.S.)

• Health Catalyst (U.S.)

• Allscripts Healthcare Solutions (U.S.)

• Epic Systems Corporation (U.S.)

• Truven Health Analytics (U.S.)

• Medecision (U.S.)

• Inovalon (U.S.)

• McKesson Corporation (U.S.)

• eClinicalWorks (U.S.)

• Verscend Technologies (U.S.)

• Cotiviti (U.S.)

• Change Healthcare (U.S.)

• OptumInsight (U.S.)

• GE Healthcare (U.S.)

• Philips Healthcare (Netherlands)

• Cognizant (U.S.)

• SAS Institute (U.S.)

Latest Developments in Global Clinical Risk Grouping Solutions Market

- In May 2025, Johns Hopkins ACG System released version 14.0, which included a comprehensive “model recalibration” to align its predictive risk‑scoring outputs with current population health data, updated demographic and clinical inputs, and revised risk‑adjustment parameters — enhancing predictive accuracy and reliability of clinical risk grouping for payers and providers

- In August 2022, Reveleer, Inc. launched Risk Adjustment 2.0, an AI‑driven coding and risk‑adjustment platform to support healthcare payers and providers, aiming to improve coding accuracy for hierarchical condition categories (HCCs) and streamline risk stratification workflows — marking a significant step forward in automated clinical risk grouping

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。