Global Cold Brew Coffee Market

市场规模(十亿美元)

CAGR :

%

USD

598.14 Million

USD

1,059.65 Million

2025

2033

USD

598.14 Million

USD

1,059.65 Million

2025

2033

| 2026 –2033 | |

| USD 598.14 Million | |

| USD 1,059.65 Million | |

|

|

|

|

Global Cold Brew Coffee Market Segmentation, By Packaging (Glass Bottle, Plastic Bottle, and Cans), Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Convenience Stores/Grocery Stores, and E-commerce)- Industry Trends and Forecast to 2033

Cold Brew Coffee Market Size

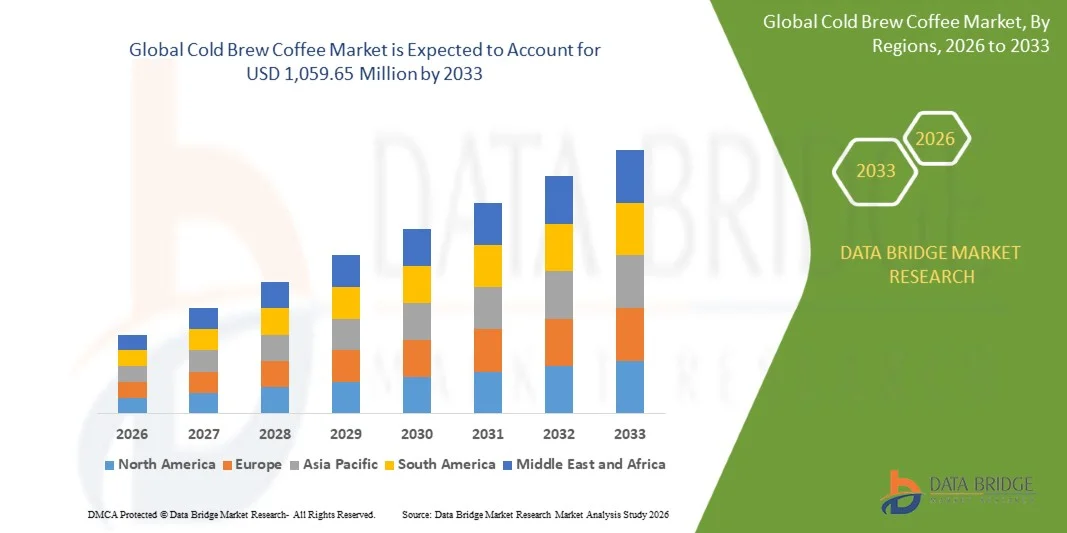

- The global cold brew coffee market size was valued at USD 598.14 million in 2025 and is expected to reach USD 1,059.65 million by 2033, at a CAGR of 7.41% during the forecast period

- The market growth is largely fuelled by the increasing preference for ready-to-drink beverages among urban consumers seeking convenience and premium taste experiences

- Rising health awareness and the perception of cold brew coffee as a smoother, less acidic alternative to traditional coffee are supporting sustained demand

Cold Brew Coffee Market Analysis

- The market is witnessing steady growth driven by changing consumer lifestyles, growing café culture, and increasing experimentation with premium coffee formats

- Strong brand investments, expanding distribution through supermarkets and online platforms, and growing demand from younger demographics are shaping competitive dynamics

- North America dominated the cold brew coffee market with the largest revenue share in 2025, driven by growing consumer preference for ready-to-drink and specialty coffee beverages, as well as increasing café culture and retail availability

- Asia-Pacific region is expected to witness the highest growth rate in the global cold brew coffee market, driven by increasing disposable incomes, rising coffee consumption, and expansion of retail and e-commerce channels

- The Glass Bottle segment held the largest market revenue share in 2025, driven by consumer perception of premium quality, product freshness, and sustainability. Glass bottles are particularly favored in specialty cafés and retail outlets, offering an upscale presentation that appeals to health-conscious and environmentally aware consumers

Report Scope and Cold Brew Coffee Market Segmentation

|

Attributes |

Cold Brew Coffee Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cold Brew Coffee Market Trends

“Rising Demand for Ready-To-Drink and Specialty Coffee Beverages”

• The growing preference for convenient, ready-to-drink beverages is significantly shaping the cold brew coffee market, as consumers increasingly seek premium, smooth, and low-acidity coffee options. Cold brew coffee is gaining traction due to its distinctive taste profile, ease of consumption, and versatility across retail and café formats. This trend is encouraging manufacturers to innovate with flavored, organic, and functional cold brew offerings to cater to evolving consumer tastes

• Increasing awareness around health, wellness, and energy-boosting properties has accelerated the demand for cold brew coffee in retail, foodservice, and e-commerce channels. Health-conscious consumers prefer cold brew for its lower acidity and potential antioxidant benefits, prompting brands to highlight functional and natural aspects in their marketing campaigns

• Premiumization and convenience trends are influencing purchasing decisions, with manufacturers emphasizing high-quality beans, sustainable sourcing, and innovative packaging. These factors help brands differentiate their products in a competitive market, build loyalty, and attract repeat purchases among coffee enthusiasts

• For instance, in 2024, Starbucks in the U.S. and Luckin Coffee in China expanded their cold brew portfolios by introducing flavored and nitro cold brew beverages across cafés and retail channels. These launches were designed to meet rising consumer demand for smooth, ready-to-drink coffee with premium positioning and environmentally responsible packaging

• While demand for cold brew coffee is growing, sustained market expansion depends on continuous innovation, cost-effective production, and distribution across both urban and emerging markets. Companies are also focusing on improving scalability, cold chain logistics, and marketing strategies to balance quality, convenience, and sustainability for broader adoption

Cold Brew Coffee Market Dynamics

Driver

“Growing Preference for Ready-To-Drink and Specialty Coffee”

• Rising consumer demand for convenient, flavorful, and low-acidity beverages is a major driver for the cold brew coffee market. Cafés and retail brands are increasingly offering ready-to-drink and specialty cold brew products to meet evolving consumer preferences and lifestyle trends

• Expanding consumption across foodservice, retail, and online channels is influencing market growth. Cold brew coffee provides versatility in flavor, presentation, and functionality, appealing to millennials and working professionals seeking convenience without compromising quality

• Beverage manufacturers are actively promoting cold brew-based formulations through marketing campaigns, influencer endorsements, and premium packaging. These efforts are supported by growing consumer interest in premium, healthy, and sustainable coffee options, encouraging collaboration with specialty roasters and distributors

• For instance, in 2023, Starbucks in the U.S. and Nestlé in Switzerland reported increased adoption of cold brew coffee in retail-ready formats and café menus. These expansions followed higher consumer demand for smooth, premium, and convenient coffee beverages, driving repeat purchases and brand differentiation

• Although rising demand supports growth, wider adoption depends on cost optimization, distribution efficiency, and cold chain management. Investment in packaging innovation, sustainable sourcing, and e-commerce expansion will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

“Higher Cost And Limited Awareness Compared To Conventional Coffee”

• The relatively higher price of cold brew coffee compared to regular brewed coffee remains a key challenge, limiting adoption among price-sensitive consumers. Longer brewing times, specialized equipment, and premium beans contribute to elevated costs and retail prices

• Consumer and manufacturer awareness remains uneven, particularly in developing markets where cold brew coffee is still emerging. Limited understanding of the flavor profile and functional benefits restricts adoption across certain demographics

• Storage and distribution challenges also impact market growth, as cold brew coffee often requires refrigeration and proper handling to maintain taste and quality. Logistical complexities increase operational costs for manufacturers and retailers

• For instance, in 2024, distributors in Southeast Asia supplying cold brew beverages to cafés and retail outlets reported slower uptake due to higher prices and limited familiarity with the product. Refrigeration requirements and shorter shelf life were additional barriers, affecting product visibility and sales

• Overcoming these challenges will require cost-efficient production, wider retail and online distribution, and focused consumer education. Collaboration with cafés, retailers, and e-commerce platforms, along with marketing campaigns highlighting convenience, taste, and health benefits, will be essential for long-term market growth

Cold Brew Coffee Market Scope

The market is segmented on the basis of packaging and distribution channel.

• By Packaging

On the basis of packaging, the cold brew coffee market is segmented into Glass Bottle, Plastic Bottle, and Cans. The Glass Bottle segment held the largest market revenue share in 2025, driven by consumer perception of premium quality, product freshness, and sustainability. Glass bottles are particularly favored in specialty cafés and retail outlets, offering an upscale presentation that appeals to health-conscious and environmentally aware consumers.

The Plastic Bottle segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its lightweight, portable nature, and convenience for on-the-go consumption. Plastic bottles are increasingly used for ready-to-drink cold brew coffee in retail and e-commerce channels, making them a practical choice for urban consumers seeking ease of use and accessibility.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Supermarket/Hypermarket, Specialty Stores, Convenience Stores/Grocery Stores, and E-commerce. The Supermarket/Hypermarket segment accounted for the largest revenue share in 2025, fueled by wide product availability, competitive pricing, and strong promotional activities. Retail chains provide high visibility and easy access to cold brew coffee, encouraging repeat purchases among consumers.

The E-commerce segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing online grocery shopping, subscription-based beverage services, and the convenience of home delivery. Online channels also allow brands to offer a variety of flavors and pack sizes, catering to a broader audience and expanding market reach.

Cold Brew Coffee Market Regional Analysis

• North America dominated the cold brew coffee market with the largest revenue share in 2025, driven by growing consumer preference for ready-to-drink and specialty coffee beverages, as well as increasing café culture and retail availability

• Consumers in the region highly value the convenience, premium taste, and variety of flavors offered by cold brew coffee, making it a preferred choice for both at-home consumption and on-the-go lifestyles

• This widespread adoption is further supported by high disposable incomes, urban lifestyles, and a strong preference for innovative beverage formats, establishing cold brew coffee as a favored option across retail and foodservice channels

U.S. Cold Brew Coffee Market Insight

The U.S. cold brew coffee market captured the largest revenue share in 2025 within North America, fueled by rising demand for premium, smooth, and low-acidity coffee options. Consumers increasingly prioritize convenience and ready-to-drink formats, while the growing café culture and online subscription services support widespread adoption. In addition, the integration of innovative flavors, functional ingredients, and eco-friendly packaging is significantly contributing to market growth.

Europe Cold Brew Coffee Market Insight

The Europe cold brew coffee market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising urbanization, expanding specialty coffee shops, and the growing preference for premium and functional beverages. Consumers are also drawn to the convenience and versatility offered by cold brew coffee in retail and foodservice settings. The region is experiencing strong adoption across cafés, supermarkets, and online channels, with product innovations catering to evolving tastes.

U.K. Cold Brew Coffee Market Insight

The U.K. cold brew coffee market is expected to witness significant growth from 2026 to 2033, driven by increasing café culture, demand for premium beverages, and the convenience of ready-to-drink formats. Concerns regarding health, wellness, and natural ingredients are encouraging consumers to adopt cold brew coffee over traditional options. The country’s robust retail infrastructure and strong e-commerce penetration are expected to continue supporting market expansion.

Germany Cold Brew Coffee Market Insight

The Germany cold brew coffee market is expected to witness strong growth from 2026 to 2033, fueled by rising demand for high-quality, sustainable, and specialty coffee products. Consumers are increasingly exploring premium ready-to-drink options and innovative flavors, while cafés and retail chains promote cold brew beverages for convenience and taste. Growing awareness of functional and organic beverages further supports market adoption.

Asia-Pacific Cold Brew Coffee Market Insight

The Asia-Pacific cold brew coffee market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and the expansion of coffee culture in countries such as China, Japan, and India. The region’s growing preference for ready-to-drink beverages, combined with retail and e-commerce expansion, is boosting adoption. In addition, the availability of affordable cold brew options and local production is making these beverages accessible to a broader consumer base.

Japan Cold Brew Coffee Market Insight

The Japan cold brew coffee market is expected to witness steady growth from 2026 to 2033 due to the country’s high-tech culture, busy urban lifestyles, and demand for convenient beverage options. Consumers are increasingly adopting ready-to-drink cold brew for its smooth flavor and low acidity, with integration of functional ingredients gaining popularity. The expansion of cafés and online delivery platforms further supports market growth.

China Cold Brew Coffee Market Insight

The China cold brew coffee market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid urbanization, rising middle-class population, and increasing adoption of specialty beverages. Cold brew coffee is gaining popularity across retail, foodservice, and e-commerce channels. The expansion of coffee chains, local production, and affordable product options, along with growing awareness of premium and ready-to-drink beverages, are key factors driving market growth in China.

Cold Brew Coffee Market Share

The Cold Brew Coffee industry is primarily led by well-established companies, including:

- Javy Coffee Company (U.S.)

- The J. M. Smucker Company (U.S.)

- Starbucks Corporation (U.S.)

- Blue Bottle Coffee, Inc. (U.S.)

- Sleepy Owl (India)

- Finlay’s (U.K.)

- Nestle S.A. (U.S.)

- CoolBrew (U.S.)

- JAB Holding Company (Luxembourg)

- Wandering Bear Coffee (U.S.)

Latest Developments in Global Cold Brew Coffee Market

- In October 2025, Dunkin’ (U.S.) launched a marketing campaign emphasizing affordability and convenience for its cold brew offerings. This campaign aimed to attract budget-conscious consumers and strengthen Dunkin’s market share amid growing competition from premium cold brew brands

- In September 2025, Nestle (CH) expanded its cold brew portfolio by acquiring a local cold brew startup in Brazil, allowing the company to tap into the rapidly growing South American market. The acquisition enhanced Nestle’s distribution capabilities and competitive position in the region

- In August 2025, Starbucks (U.S.) launched a new line of organic cold brew beverages targeting health-conscious and environmentally aware consumers. This strategic move reinforced the brand’s sustainability initiatives and solidified its leadership in the premium organic cold brew segment

- In May 2024, Nescafé introduced Nescafé Espresso Concentrate in sweet vanilla and Espresso Black flavors, customizable with milk, water, or juice. This innovation expanded Nescafé’s ready-to-drink offerings and catered to consumers seeking convenience and versatility

- In May 2024, Starbucks Coffee Company launched new Starbucks Iced Coffee blends and Starbucks Cold Brew Concentrates in Dark Chocolate Hazelnut and Sweetened Black flavors. These products enabled consumers to enjoy café-quality cold brew at home, driving at-home consumption and strengthening Starbucks’ position in the premium segment

- In May 2024, Nescafé introduced Nescafé Espresso Concentrate in sweet vanilla and Espresso Black flavors, customizable with milk, water, or juice. This innovation expanded Nescafé’s ready-to-drink offerings and catered to consumers seeking convenience and versatility

- In June 2023, Tata Coffee launched its new cold brew product, Tata Coffee Gold, brewed in cold water to ensure smoothness and offered in classic, mocha, and hazelnut variants. The product aims to provide a balanced, less bitter coffee experience, enhancing the brand’s portfolio in the premium cold brew segment and appealing to consumers seeking high-quality, flavorful options

- In December 2022, Dunkin introduced cold brew coffee under The J.M. Smucker Company, expanding its portfolio toward faster-growing premium and K-Cup segments. This move strengthened Dunkin’s presence in the ready-to-drink and at-home coffee markets, supporting broader adoption of cold brew products

- In December 2021, Blue Tokai Coffee Roasters released special cold brew cans in six flavors, including coffee cherry, passion fruit, tender coconut, classic light, classic bold, and single-origin Ratnagiri estate. The launch diversified the brand’s product range and targeted consumers looking for unique, ready-to-drink coffee experience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。