Global Data Center Security Market

市场规模(十亿美元)

CAGR :

%

USD

15.96 Billion

USD

62.20 Billion

2024

2032

USD

15.96 Billion

USD

62.20 Billion

2024

2032

| 2025 –2032 | |

| USD 15.96 Billion | |

| USD 62.20 Billion | |

|

|

|

|

全球資料中心安全市場細分,按組件(解決方案(實體安全、邏輯安全)、服務(諮詢、整合和部署、託管服務))、資料中心類型(小型資料中心、中型資料中心、大型資料中心)、部署模式(本地、基於雲端)、應用程式(BFSI、IT 和電信、醫療保健、政府和國防、能源和公用事業、零售業、媒體和娛樂、製造業

全球資料中心安全市場規模

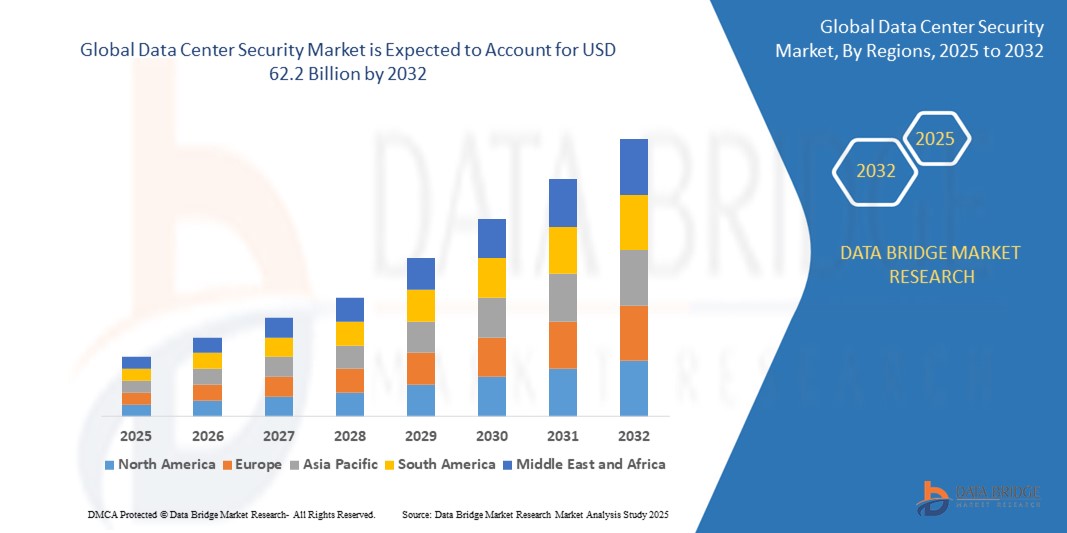

- 2024 年全球資料中心安全市場規模為159.6 億美元 ,預計 到 2032 年將達到 622 億美元,預測期內 複合年增長率為 35.5%。

- 全球資料中心安全市場的成長受到網路威脅的增加、資料中心部署的增加以及對法規遵循和資料保護日益增長的需求的推動。

全球資料中心安全市場分析

隨著各行各業的企業將保護敏感資料、維護業務連續性和確保法規遵循作為優先事項,全球資料中心安全市場正在快速擴張。勒索軟體、DDoS 攻擊和內部入侵等網路威脅的增多,使得資料中心安全成為各種規模組織關注的重點領域。越來越多的公司採用先進的實體和邏輯安全解決方案來保護基礎設施、網路和儲存資料。

市場成長的主要驅動力是金融服務、保險、醫療保健、零售、製造和政府等行業的數位轉型加速。隨著企業轉向雲端運算、物聯網、人工智慧和大數據分析,對安全且具彈性的資料中心環境的需求日益凸顯。人工智慧 (AI)、機器學習 (ML) 和基於行為的分析等技術的整合正在改善即時威脅偵測、事件回應和整體安全態勢。

雲端部署模式的日益普及也重塑了安全格局。雲端原生安全解決方案具備可擴充性、靈活性和成本效益,使企業無需投入巨額基礎設施即可實現強大的安全保障。此外,混合雲和多雲環境促使企業部署全面、集中的安全框架,以保護本地資料中心和虛擬化資料中心。

實體安全系統(例如生物辨識門禁、監視攝影機和周界入侵偵測)在設施安全保障中繼續發揮至關重要的作用。同時,邏輯安全解決方案(包括防火牆、加密、身分和存取管理 (IAM) 以及 SIEM 系統)對於保護數位資產並確保遵守 GDPR、HIPAA 和 ISO 27001 等全球法規至關重要。

儘管發展勢頭強勁,但市場仍面臨挑戰。這些挑戰包括高昂的實施成本、安全解決方案與遺留系統整合的複雜性,以及熟練的網路安全專業人員的短缺。此外,資料主權問題和不同的國際法規可能會使跨國企業的部署策略變得複雜。

儘管如此,前景依然十分光明。綠色資料中心、邊緣運算和 5G 基礎設施的投資不斷增長,預計將帶來新的安全需求。此外,網路攻擊的頻率和複雜性不斷提升,將持續推動資料中心安全領域的創新和應用。

報告範圍和全球資料中心安全市場細分

|

屬性 |

全球資料中心安全市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Data Center Security Market Trends

“Innovation and Integration: Enhancing Security Through Smart Technologies”

- A significant and accelerating trend in the Global Data Center Security Market is the integration of smart technologies, such as AI, machine learning, and behavioral analytics, to enable proactive threat detection, automated incident response, and predictive risk management. These capabilities are reshaping how data centers defend against sophisticated cyberattacks.

- Enterprises are increasingly deploying cloud-based and hybrid data center security platforms to gain real-time visibility, centralized control, and scalable protection across diverse environments. This shift supports the dynamic needs of remote workforces, edge computing, and multi-cloud infrastructure.

- The adoption of Zero Trust Architecture (ZTA) is rising, emphasizing identity verification, least-privilege access, and micro-segmentation to strengthen internal network security and reduce attack surfaces.

- Convergence of physical and logical security solutions is gaining traction—combining biometric access controls, smart surveillance, and cybersecurity measures into unified platforms to provide holistic protection for data center infrastructure.

Global Data Center Security Market Dynamics

Driver

“Rising Demand for Compliance, Resilience, and Digital Security Infrastructure”

- The growing emphasis on regulatory compliance (e.g., GDPR, HIPAA, PCI DSS) and data privacy laws across sectors such as BFSI, healthcare, and government is driving demand for robust data center security solutions to safeguard sensitive information and avoid legal penalties.

- The surge in cyberattacks, ransomware threats, and data breaches has led to increased investment in intrusion detection systems, next-gen firewalls, and endpoint protection to ensure business continuity and resilience.

- Cloud adoption, remote workforces, and digital transformation initiatives are accelerating the deployment of scalable, cloud-native security platforms to monitor and protect hybrid and multi-cloud environments.

- Advancements in AI, machine learning, and threat intelligence are enabling proactive threat detection, real-time monitoring, and automated incident response, enhancing the efficiency and effectiveness of data center security operations.

- Growing deployment of edge data centers and the rise of smart cities and 5G infrastructure are creating new security demands, encouraging providers to offer tailored solutions for distributed and high-speed data environments.

Restraint/Challenge

“High Cost, Integration Complexities, and Limited Awareness in Emerging Markets”

- The deployment of comprehensive data center security solutions—including next-generation firewalls, intrusion prevention systems, biometric access control, and AI-driven threat intelligence platforms—requires significant upfront capital. This presents a major challenge for small and medium enterprises (SMEs) and startups, particularly in developing economies, limiting their ability to adopt enterprise-grade security infrastructure.

- Integrating modern security technologies with existing legacy IT systems can be highly complex. Many data centers still operate with outdated infrastructure that lacks compatibility with advanced security tools. As a result, organizations face extended implementation times, increased costs, and operational disruptions during integration, deterring security upgrades.

- A major barrier in both developed and developing regions is the lack of adequately trained cybersecurity professionals. The shortage of skilled personnel who can manage, monitor, and maintain sophisticated security systems hinders the effective use of these technologies, especially in organizations with limited IT resources.

- Global data center operators often struggle to comply with varying data privacy and cybersecurity regulations across jurisdictions (e.g., GDPR in Europe, CCPA in California, and PDPA in Asia). Inconsistent enforcement and differing legal interpretations create confusion, slow down technology rollouts, and add to compliance-related costs.

- In emerging markets, underdeveloped digital infrastructure, unreliable power supply, and harsh environmental conditions (like high humidity or temperature fluctuations) can affect the stability and effectiveness of physical security systems and surveillance technologies. These challenges often require costly custom solutions or specialized equipment to maintain optimal security performance.

Global Data Center Security Market Scope

The market is segmented on the basis of Component, Data Center Type, Deployment Mode and Application

- By Component

The Global Data Center Security Market, based on component, is segmented into solutions and services. The solutions segment includes physical security and logical security. Physical security involves safeguarding the data center infrastructure from physical threats such as unauthorized access, environmental hazards, and theft. This is achieved through systems like surveillance cameras, biometric access controls, alarm systems, and perimeter security measures. Logical security, meanwhile, addresses cybersecurity threats and focuses on protecting digital assets and network infrastructure. It includes technologies such as firewalls, intrusion detection and prevention systems (IDPS), encryption tools, identity and access management (IAM), and antivirus software. The services segment encompasses consulting, integration and deployment, and managed services. Consulting services help organizations assess potential security risks and design effective, compliant security strategies. Integration and deployment services ensure seamless installation and configuration of security solutions into existing IT environments. Managed services offer continuous monitoring, threat intelligence, and rapid incident response, often handled by third-party providers. These services are essential for organizations aiming to maintain high levels of security without the need for extensive internal resources, making them a vital component of the overall data center security ecosystem.

- By Data Center Type

The Global Data Center Security Market, when segmented by data center type, includes Small Data Centers, Medium Data Centers, and Large Data Centers, each with distinct security needs and infrastructure complexities. Small Data Centers are typically used by startups, SMEs, and branch offices. These facilities usually have limited IT resources and staff, making them more reliant on cost-effective, easy-to-deploy security solutions. Despite their size, the growing risk of cyber threats and the increasing regulatory focus on data protection are prompting small data centers to adopt advanced logical security tools like firewalls, endpoint protection, and two-factor authentication systems. Medium Data Centers serve mid-sized enterprises and are often characterized by moderate data volumes and a hybrid IT infrastructure. These data centers require a balanced approach to security, with a mix of physical measures (such as biometric access control and CCTV surveillance) and robust cyber defense systems, including intrusion prevention, encryption, and compliance management tools. Their security strategies tend to be more sophisticated than small data centers due to higher data sensitivity and operational complexity. Large Data Centers—typically operated by global enterprises, cloud service providers, or colocation facilities—are highly complex, with expansive physical footprints and multi-layered network architectures. These centers handle vast amounts of sensitive and mission-critical data, making them prime targets for both physical breaches and cyberattacks. As a result, they deploy advanced and integrated security frameworks that combine AI-driven threat detection, real-time monitoring, access management, and disaster recovery protocols. Large data centers often invest heavily in both physical infrastructure protection and advanced cybersecurity to ensure uninterrupted, compliant, and secure operations across all levels.

- By Deployment Mode

The Global Data Center Security Market, by deployment mode, is segmented into On-Premises and Cloud-Based solutions. On-Premises deployment offers organizations full control over their data and security infrastructure, making it ideal for highly regulated industries like healthcare, BFSI, and government. While it ensures data sovereignty and compliance, it requires higher upfront investment and maintenance. Cloud-Based deployment is rapidly growing due to its scalability, cost-effectiveness, and ease of integration. It enables real-time monitoring, remote access, and advanced threat detection, making it suitable for businesses seeking flexibility and lower capital expenditure. Many organizations now adopt hybrid models to leverage the benefits of both approaches.

- By Application

按應用劃分,全球資料中心安全市場受到各行各業資料保護與合規性需求不斷增長的驅動,這些行業包括銀行、金融服務和保險 (BFSI)、IT 和電信、醫療保健、政府和國防、能源和公用事業、零售、媒體和娛樂以及製造業。在銀行、金融服務和保險 (BFSI) 領域,資料中心安全對於保護客戶資訊、確保交易完整性以及遵守 PCI DSS 和 SOX 等嚴格法規至關重要。金融機構在入侵防禦、加密和存取控制系統方面投入大量資金。 IT 和電信業依賴安全且高度可用的資料中心來支援雲端服務、行動連線和數位通訊。隨著資料流量的成長,企業越來越關注進階威脅偵測、防火牆系統和 DDoS 防護。在醫療保健領域,對電子健康記錄 (EHR) 的保護以及對 HIPAA 和 GDPR 等資料隱私法的遵守,推動了對高度安全可靠的資料中心環境的需求。政府和國防機構需要強大且通常採用隔離措施的基礎設施來儲存敏感的公民資料、軍事情報和關鍵的國家系統,因此安全是重中之重。能源和公用事業使用智慧電網和監控與資料收集 (SCADA) 系統,這些系統日益數位化和互聯互通,這增加了網路攻擊的風險,並要求其資料中心具備強大的邊界和網路安全保障。在電子商務和全通路平台的推動下,零售業處理大量的客戶資料和支付資訊。資料中心安全有助於保護這些資訊並維護客戶信任。在媒體和娛樂領域,串流媒體服務、數位內容創作和智慧財產權保護的快速成長,導致企業越來越依賴安全、可擴展的資料中心來處理大型媒體檔案並保護創意資產。製造企業採用資料中心安全來支援智慧工廠營運和物聯網驅動的生產系統,並保護商業機密和產品設計免受網路威脅。

全球資料中心安全市場區域分析

- 北美仍然是主導的區域市場,其中美國佔據主導地位。截至2023年,美國擁有超過38,000個安全資料中心,其中超過70%的超大規模資料中心配備了升級的實體和人工智慧驅動的網路監控系統。 HIPAA和CMMC等監管框架,以及對勒索軟體和雲端漏洞日益增長的擔憂,持續推動安全投資。加拿大的醫療保健和金融業也為北美的成長做出了重大貢獻。

- 歐洲佔第二大份額,擁有超過 35,000 個安全中心,這得益於 GDPR 的實施、主權雲端計畫以及對隱私技術的投資。德國、英國、法國和荷蘭等國家在零信任和安全雲端合規方面的應用方面處於區域領先地位。

- 亞太地區呈現最快的區域成長軌跡,2023年將新增超過51,000個資料中心。中國(22,000個)、印度、日本和韓國是主要貢獻者,其雲端服務擴張、電信基礎設施建設和超大規模部署都在快速推進。中國政府的監管規定和印度的「數位印度」倡議進一步推動了資料中心的加速普及。

- 中東和非洲 (MEA) 擁有約 13,000 個安全資料中心,其中阿聯酋和沙烏地阿拉伯透過政府推動的智慧城市和基礎設施計畫處於領先地位,而南非則透過電信和主機託管中心做出了重大貢獻。

- 拉丁美洲呈現穩定成長,這得益於巴西、墨西哥和阿根廷數位服務的不斷擴張。儘管基數相對較小,但改善資料治理和網路安全框架的投資正在提升該地區的影響力。

北美資料中心安全市場洞察

北美資料中心安全市場呈現強勁成長,這得益於該地區不斷擴張的數位基礎設施、雲端運算的廣泛普及以及嚴格的合規監管要求。美國擁有大量超大規模資料中心和企業資料中心,引領該地區發展,這些資料中心需要強大的實體和邏輯安全解決方案。人們對網路威脅、資料外洩和勒索軟體攻擊日益增長的擔憂,加速了對先進安全技術(例如基於人工智慧的威脅偵測、加密和生物辨識存取控制)的投資。此外,領先的科技公司和託管服務供應商的存在也促進了創新資料中心安全解決方案的快速部署,進一步鞏固了該地區的市場地位。

歐洲資料中心安全市場洞察

歐洲資料中心安全市場呈現強勁成長,這得益於《一般資料保護規範》(GDPR)和《數位營運彈性法案》(DORA)等嚴格的監管框架,這些框架強制企業採用全面的安全策略。這些法規促使企業和資料中心營運商大力投資實體和邏輯安全措施,以確保合規性和抵禦網路威脅的能力。西歐國家,尤其是德國、英國、法國和荷蘭,憑藉其先進的數位基礎設施和雲端運算的早期應用,在該地區處於領先地位。超大規模資料中心的興起和邊緣運算的擴展進一步加劇了對可擴展和整合安全解決方案的需求。

亞太資料中心安全市場洞察

Asia Pacific is witnessing robust growth in the data center security market, driven by rapid digital transformation, growing cloud adoption, and rising cyber threats across major economies. Countries like China, India, Japan, and Australia are investing heavily in secure digital infrastructure, propelled by government-led initiatives and increasing enterprise demand for secure data environments. The expansion of 5G, IoT, and edge computing is further accelerating the need for integrated security solutions. Additionally, stricter regulatory frameworks around data privacy and sovereignty are compelling organizations to upgrade their physical and logical data center security systems. The region’s dynamic digital ecosystem, along with a surge in hyperscale data centers and colocation facilities, positions Asia Pacific as one of the fastest-growing markets in the global data center security landscape.

Middle East and Africa Data Center Security Market Insight

he Middle East and Africa region is witnessing steady growth in the data center security market, driven by increased investments in digital infrastructure, rising cyber threats, and government-led smart city initiatives. Countries like the UAE, Saudi Arabia, and South Africa are leading the charge with large-scale data center developments and heightened focus on data protection regulations. The growing presence of cloud service providers and expanding telecom and BFSI sectors are also driving the demand for advanced physical and logical security solutions. However, challenges such as limited cybersecurity awareness, skills shortages, and fragmented regulatory frameworks continue to restrain widespread adoption.

Latin America Data Center Security Market Insight

Latin America is experiencing steady growth in the data center security market, driven by the increasing digitalization of services across sectors such as banking, retail, and telecommunications. Countries like Brazil and Mexico are leading the region in terms of data center investments and cybersecurity initiatives. The expansion of cloud computing, growing concerns over data breaches, and the implementation of stricter regulatory frameworks are prompting enterprises to adopt advanced physical and logical security solutions. Moreover, the rise in hybrid work models and the increasing use of online services are pushing both public and private sectors to strengthen data center infrastructure and protection mechanisms. Despite challenges such as budget constraints and varying technological maturity across countries, the market is poised for expansion due to increasing awareness and government-backed digital transformation programs.

Global Data Center Security Market Share

The Global Automotive Wheels industry is primarily led by well-established companies, including:

- Cisco Systems, Inc.

- IBM Corporation

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Honeywell International Inc.

- Hewlett Packard Enterprise (HPE)

- Schneider Electric SE

- McAfee Corp.

- Dell Technologies Inc.

- Symantec Corporation (Broadcom Inc.)

- Juniper Networks, Inc.

- Palo Alto Networks, Inc.

- Trend Micro Incorporated

- Siemens AG

- Avigilon (a Motorola Solutions company)

Latest Developments in Global Data Center Security Market

- In May 2025, Google Cloud completed its $32 billion acquisition of Wiz, a leading cloud security startup, to enhance its data center and multicloud security offerings, marking one of the largest cybersecurity acquisitions in history.

- In March 2025, F5, Inc. acquired LeakSignal, a data leakage prevention startup, to strengthen its portfolio of zero-trust and real-time data protection solutions within hyperscale data centers.

- In January 2025, Cisco Systems launched its new Hypershield architecture, designed to secure AI-scale data centers with distributed firewall capabilities and microsegmentation tools for hybrid cloud environments.

- In November 2024, Fortinet introduced FortiGate 6000F, a high-performance firewall with advanced threat protection and integrated AI for hyperscale and colocation data centers, expanding its presence in the large enterprise segment.

- In August 2024, Trend Micro released an AI-powered threat detection suite tailored for hybrid cloud and on-premises data centers, with integrated support for major platforms like AWS, Azure, and GCP.

- In June 2024, Honeywell acquired Carrier Global's Access Solutions unit, strengthening its physical security and access control offerings across critical infrastructure and data centers globally.

- In March 2024, Check Point Software Technologies expanded its cloud-native security solutions with deeper integration into hybrid cloud environments, ensuring full-stack protection across enterprise data centers.

- In December 2023, IBM and Equinix announced a strategic collaboration to launch compliance automation and risk management solutions for colocation data centers, addressing rising regulatory demands.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。