Global Dental Sleep Apnea Screening Devices And Apps Market

市场规模(十亿美元)

CAGR :

%

USD

254.82 Million

USD

696.86 Million

2025

2033

USD

254.82 Million

USD

696.86 Million

2025

2033

| 2026 –2033 | |

| USD 254.82 Million | |

| USD 696.86 Million | |

|

|

|

|

Global Dental Sleep Apnea Screening Devices & Apps Market Segmentation, By Product Type (Screening & Diagnostic Devices, Wearable Sleep Monitoring Devices, Mobile Screening Apps, and Sleep Monitoring & Analytics Apps), Technology (Device-Based Solutions, App-Enabled Devices, Standalone Mobile Apps, and Cloud- & AI-Based Platforms), Application (Obstructive Sleep Apnea (OSA) Screening, Snoring Detection, Sleep Quality Monitoring, and Risk Assessment & Early Diagnosis), End User (Dental Clinics & Practices, Hospitals & Sleep Laboratories, Home, and Telehealth Providers)- Industry Trends and Forecast to 2033

Dental Sleep Apnea Screening Devices & Apps Market Size

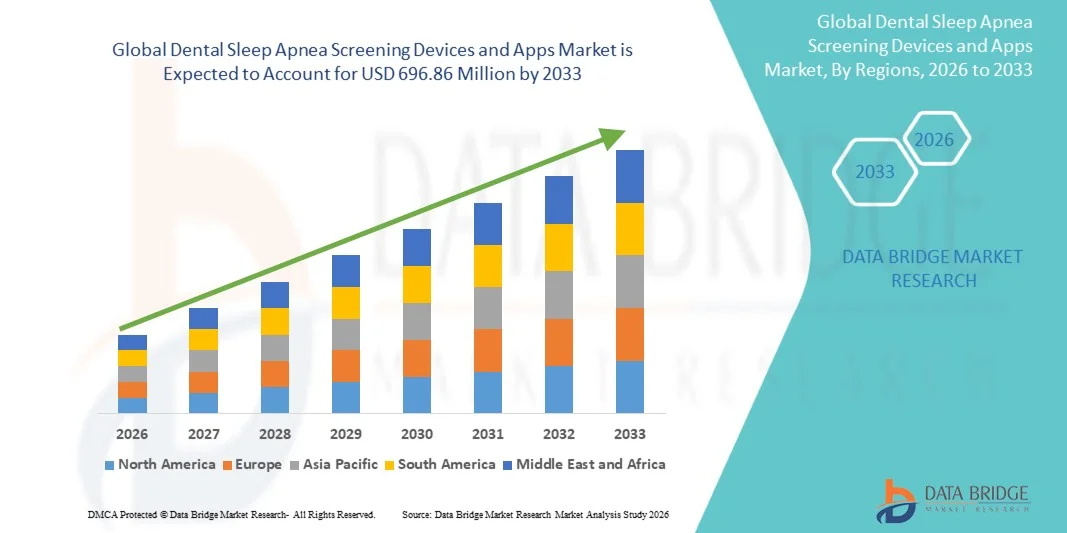

- The global dental sleep apnea screening devices & apps market size was valued at USD 254.82 million in 2025 and is expected to reach USD 696.86 million by 2033, at a CAGR of 13.40% during the forecast period

- The market growth is primarily driven by rising awareness of obstructive sleep apnea (OSA), increasing involvement of dental professionals in early screening, and growing adoption of digital health technologies and mobile health applications across clinical and home-care settings

- Furthermore, the increasing demand for non-invasive, convenient, and cost-effective screening solutions, along with the integration of apps, AI-based analytics, and remote monitoring capabilities, is positioning dental sleep apnea screening devices and apps as essential tools for early diagnosis and patient engagement, thereby significantly supporting overall market expansion

Dental Sleep Apnea Screening Devices & Apps Market Analysis

- Dental sleep apnea screening devices and apps, designed to identify individuals at risk of obstructive sleep apnea (OSA) through dental-based screening tools, wearable monitoring solutions, and mobile applications, are gaining importance in preventive and digital healthcare due to their non-invasive approach, early detection potential, and compatibility with telehealth ecosystems

- The increasing demand for these solutions is mainly driven by rising awareness of sleep apnea and its health implications, growing participation of dental professionals in sleep disorder screening, and rapid adoption of mobile health apps and AI-enabled screening technologies

- North America dominated the global dental sleep apnea screening devices & apps market with a revenue share of 40.6% in 2025, supported by strong healthcare infrastructure, high awareness of OSA, widespread use of digital health solutions, and active integration of sleep apnea screening within dental clinics and sleep laboratories, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by increasing prevalence of sleep disorders, expanding dental care access, growing smartphone penetration, and rising acceptance of app-based and wearable sleep monitoring solutions

- The Screening & Diagnostic Devices segment dominated the market with the largest market share of 47.8% in 2025, driven by their widespread adoption in dental clinics and hospitals for preliminary OSA screening and their increasing integration with app-enabled devices and cloud- & AI-based platforms

Report Scope and Dental Sleep Apnea Screening Devices & Apps Market Segmentation

|

Attributes |

Dental Sleep Apnea Screening Devices & Apps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Dental Sleep Apnea Screening Devices & Apps Market Trends

“Growing Integration of AI-Enabled Analytics and Mobile Health Platforms”

- A prominent and accelerating trend in the global dental sleep apnea screening devices & apps market is the increasing integration of artificial intelligence (AI), cloud analytics, and mobile health platforms to enhance early detection, accuracy, and patient engagement across dental and home-care settings

- For instance, AI-enabled screening apps are increasingly being paired with wearable sleep monitoring devices to analyze breathing patterns, snoring intensity, and sleep quality, enabling preliminary risk assessment for obstructive sleep apnea (OSA) before referral to sleep laboratories

- The adoption of AI-driven algorithms allows these solutions to learn from large sleep data sets, improving screening precision and generating personalized risk insights for patients, while reducing reliance on resource-intensive polysomnography at early diagnostic stages

- Mobile apps integrated with dental screening devices enable real-time data visualization, automated reports, and seamless data sharing between dental clinics, sleep laboratories, and telehealth providers, enhancing clinical decision-making and continuity of care

- This convergence of AI, cloud-based platforms, and app-enabled devices supports centralized monitoring and long-term tracking of patient sleep health, aligning with the broader shift toward digital and preventive healthcare models

- As a result, manufacturers and digital health developers are increasingly focusing on intelligent, app-connected screening ecosystems that combine devices, analytics, and remote monitoring, driving stronger adoption across both clinical and home environments

- The increasing interoperability of screening apps with electronic health records (EHRs) is further streamlining clinical workflows and improving collaboration between dental professionals and sleep medicine specialists

Dental Sleep Apnea Screening Devices & Apps Market Dynamics

Driver

“Rising Awareness of Sleep Apnea and Expanding Role of Dental Professionals”

- The increasing global prevalence of obstructive sleep apnea and growing awareness of its association with cardiovascular disease, diabetes, and reduced quality of life are major drivers accelerating demand for early screening solutions

- For instance, dental professionals are increasingly incorporating sleep apnea risk assessments into routine dental checkups, positioning dental clinics as key entry points for early OSA detection

- The shift toward preventive healthcare and early diagnosis is encouraging adoption of non-invasive screening devices and mobile apps that offer convenient, cost-effective alternatives to traditional sleep studies

- Furthermore, the rapid expansion of digital health, telemedicine, and mobile health applications is supporting broader acceptance of app-based and wearable screening solutions among both clinicians and patients

- The growing preference for home-based screening and remote monitoring, supported by app-enabled devices, is further propelling market growth by improving accessibility and patient compliance

- Increasing collaboration between dental associations and sleep medicine organizations is reinforcing clinical acceptance of dental-based screening approaches

- Rising smartphone penetration and digital literacy across emerging markets are also contributing to broader adoption of mobile screening apps and wearable sleep monitoring solutions

Restraint/Challenge

“Diagnostic Limitations and Data Privacy Concerns”

- Limitations in diagnostic accuracy compared to gold-standard polysomnography pose a key challenge for the widespread adoption of dental sleep apnea screening devices and apps, particularly for clinical decision-making without confirmatory testing

- For instance, app-based and wearable screening tools may generate false positives or negatives due to variations in user behavior, sensor quality, or environmental factors, leading to cautious adoption among clinicians

- Concerns related to data privacy, cybersecurity, and regulatory compliance also present barriers, as these solutions collect sensitive health and sleep data that must comply with strict data protection standards

- Addressing these concerns requires robust validation studies, regulatory approvals, secure data encryption, and clear clinical guidelines to build trust among dental professionals and patients

- In addition, variability in reimbursement policies and lack of standardized screening protocols across regions can hinder consistent adoption, emphasizing the need for clearer regulatory and clinical frameworks to support sustained market growth

- Limited awareness among some dental practitioners regarding the clinical scope and benefits of sleep apnea screening can slow implementation in routine practice

- The absence of universally accepted screening benchmarks and clinical thresholds across devices and apps further complicates large-scale adoption and standardization

Dental Sleep Apnea Screening Devices & Apps Market Scope

The market is segmented on the basis of product type, technology, application, and end user.

- By Product Type

On the basis of product type, the dental sleep apnea screening devices & apps market is segmented into screening & diagnostic devices, wearable sleep monitoring devices, mobile screening apps, and sleep monitoring & analytics apps. The screening & diagnostic devices segment dominated the market with the largest revenue share of 47.8% in 2025, driven by their widespread adoption in dental clinics and hospitals for preliminary obstructive sleep apnea (OSA) risk assessment. These devices are routinely used by dental professionals during chairside evaluations to identify anatomical and functional indicators of sleep-disordered breathing. Their clinical credibility, ease of integration into existing dental workflows, and growing acceptance among dentists as first-line screening tools contribute significantly to their dominance. In addition, the ability of these devices to generate objective data that supports referrals to sleep laboratories strengthens their role in early diagnosis pathways.

The mobile screening apps segment is expected to witness the fastest growth during the forecast period, owing to the rapid expansion of smartphone penetration and increasing consumer preference for convenient, low-cost, and self-administered screening solutions. These apps leverage smartphone sensors, acoustic analysis, and AI algorithms to assess snoring patterns, breathing irregularities, and sleep quality in home settings. Growing awareness of sleep health, coupled with the rising adoption of digital health and telemedicine solutions, is accelerating the use of mobile screening apps among undiagnosed populations. Furthermore, their scalability and ease of updates position mobile apps as a key growth driver in emerging markets.

- By Technology

On the basis of technology, the market is segmented into device-based solutions, app-enabled devices, standalone mobile apps, and cloud- & AI-based platforms. The device-based solutions segment held the largest market revenue share in 2025, supported by their established presence in clinical environments and their reliability in capturing physiological sleep-related parameters. These solutions are commonly used in dental clinics and sleep laboratories where accuracy and consistency are critical. Their dominance is further reinforced by regulatory approvals, clinician familiarity, and their role as adjunct tools supporting referrals for confirmatory diagnostic testing. Device-based solutions also benefit from higher reimbursement acceptance compared to purely app-based tools in certain regions.

The cloud- & AI-based platforms segment is anticipated to register the fastest growth over the forecast period, driven by advancements in data analytics, machine learning, and remote patient monitoring. These platforms enable centralized data storage, trend analysis, and continuous learning from large datasets, improving screening accuracy over time. AI-based technologies support automated risk stratification and personalized insights, reducing clinician workload and enhancing patient engagement. The increasing demand for scalable, interoperable, and telehealth-compatible solutions is accelerating the adoption of cloud-enabled platforms across both clinical and home-care settings.

- By Application

On the basis of application, the market is segmented into obstructive sleep apnea (OSA) screening, snoring detection, sleep quality monitoring, and risk assessment & early diagnosis. The obstructive sleep apnea (OSA) screening segment dominated the market in 2025, as OSA remains the primary clinical focus of dental sleep medicine initiatives. Rising awareness of the severe health consequences associated with untreated OSA, including cardiovascular disease and metabolic disorders, has increased demand for early screening solutions. Dental professionals play a critical role in identifying high-risk individuals during routine examinations, driving widespread adoption of OSA-focused screening tools. The clinical importance and high unmet diagnostic need continue to position OSA screening as the leading application segment.

The risk assessment & early diagnosis segment is expected to grow at the fastest rate during the forecast period, supported by the shift toward preventive healthcare and early intervention strategies. Solutions in this segment emphasize identifying at-risk individuals before symptoms worsen, enabling timely referrals and treatment planning. The integration of AI-driven analytics and longitudinal sleep data tracking enhances the predictive capabilities of these tools. Growing emphasis on population-level screening and cost containment is further accelerating demand for early risk assessment applications.

- By End User

On the basis of end user, the market is segmented into dental clinics & practices, hospitals & sleep laboratories, home, and telehealth providers. The dental clinics & practices segment accounted for the largest market share in 2025, driven by the expanding role of dentists in sleep apnea screening and preventive care. Dental settings serve as accessible and frequent points of patient interaction, making them ideal for early identification of sleep-related breathing disorders. The integration of screening tools into routine dental visits supports early detection and increases referral rates to sleep specialists. Growing training initiatives and professional guidelines are further reinforcing the dominance of dental clinics in this market.

The home segment is projected to be the fastest-growing end-user segment during the forecast period, fueled by rising demand for convenient, non-invasive, and self-administered screening solutions. Home-based devices and apps enable users to monitor sleep patterns in familiar environments, improving compliance and data reliability. Increasing acceptance of remote healthcare, coupled with advancements in wearable and app-based technologies, is accelerating adoption in this segment. The growing focus on patient empowerment and remote monitoring is expected to sustain strong growth in home-based screening solutions.

Dental Sleep Apnea Screening Devices & Apps Market Regional Analysis

- North America dominated the global dental sleep apnea screening devices & apps market with a revenue share of 40.6% in 2025, supported by strong healthcare infrastructure, high awareness of OSA, widespread use of digital health solutions, and active integration of sleep apnea screening within dental clinics and sleep laboratories, particularly in the U.S.

- Healthcare professionals and consumers in the region place strong emphasis on early diagnosis, preventive care, and the use of non-invasive screening solutions, supporting widespread adoption of dental-based devices and app-enabled screening tools

- This strong market position is further supported by well-established dental practices, high smartphone penetration, favorable reimbursement environments, and the growing integration of sleep apnea screening within routine dental and telehealth services

U.S. Dental Sleep Apnea Screening Devices & Apps Market Insight

The U.S. dental sleep apnea screening devices & apps market captured the largest revenue share within North America in 2025, driven by high awareness of obstructive sleep apnea (OSA) and the expanding role of dental professionals in early screening. Patients and clinicians are increasingly prioritizing early detection and preventive care to mitigate long-term health risks associated with untreated sleep apnea. The widespread adoption of digital health technologies, mobile screening apps, and wearable sleep monitoring devices further supports market growth. Moreover, strong collaboration between dental clinics, sleep laboratories, and telehealth providers is significantly contributing to the expansion of this market in the U.S.

Europe Dental Sleep Apnea Screening Devices & Apps Market Insight

The Europe dental sleep apnea screening devices & apps market is projected to expand at a steady CAGR throughout the forecast period, primarily driven by increasing awareness of sleep disorders and supportive healthcare policies emphasizing preventive care. Rising urbanization, aging populations, and growing focus on chronic disease management are encouraging early screening for sleep apnea. European healthcare systems are increasingly adopting non-invasive, cost-effective screening tools to reduce the burden on sleep laboratories. The region is witnessing notable adoption across dental clinics, hospitals, and home settings, supported by growing acceptance of digital and app-based health solutions.

U.K. Dental Sleep Apnea Screening Devices & Apps Market Insight

The U.K. dental sleep apnea screening devices & apps market is anticipated to grow at a notable CAGR during the forecast period, driven by increasing awareness of sleep health and the integration of screening practices into routine dental care. Rising concerns about undiagnosed OSA and its impact on public health are encouraging early screening initiatives. The U.K.’s strong digital health ecosystem, along with widespread smartphone usage, supports the adoption of mobile screening apps and wearable devices. In addition, the expansion of telehealth services is further accelerating market growth across both clinical and home-based settings.

Germany Dental Sleep Apnea Screening Devices & Apps Market Insight

The Germany dental sleep apnea screening devices & apps market is expected to expand at a considerable CAGR during the forecast period, supported by strong healthcare infrastructure and high emphasis on medical technology innovation. German consumers and healthcare providers place significant value on clinically validated, data-secure, and privacy-focused healthcare solutions. The growing prevalence of sleep disorders, combined with an aging population, is driving demand for early screening tools. Adoption is particularly strong in dental clinics and hospitals, where app-enabled and AI-supported screening solutions are increasingly integrated into care pathways.

Asia-Pacific Dental Sleep Apnea Screening Devices & Apps Market Insight

The Asia-Pacific dental sleep apnea screening devices & apps market is expected to grow at the fastest CAGR during the forecast period, driven by rising prevalence of sleep disorders, expanding access to dental care, and rapid growth in smartphone penetration. Increasing urbanization and lifestyle changes in countries such as China, Japan, and India are contributing to higher rates of sleep apnea. Government initiatives promoting digital healthcare and telemedicine are further accelerating adoption of app-based and wearable screening solutions. The region’s growing focus on cost-effective, scalable healthcare technologies supports strong market expansion.

Japan Dental Sleep Apnea Screening Devices & Apps Market Insight

The Japan dental sleep apnea screening devices & apps market is gaining momentum due to the country’s advanced healthcare system, strong digital adoption, and aging population. Japan places a high emphasis on preventive healthcare and early diagnosis, which aligns well with dental-based sleep apnea screening solutions. The integration of wearable devices and mobile apps with broader digital health platforms is supporting market growth. In addition, the demand for easy-to-use, non-invasive screening tools is increasing in both residential and clinical settings, particularly among elderly populations.

India Dental Sleep Apnea Screening Devices & Apps Market Insight

The India dental sleep apnea screening devices & apps market accounted for a significant share within Asia-Pacific in 2025, driven by rising awareness of sleep disorders, rapid urbanization, and increasing adoption of digital health technologies. India’s large population base and high smartphone penetration create strong demand for mobile screening apps and affordable wearable solutions. The expansion of private dental clinics and telehealth platforms is further supporting early screening initiatives. In addition, government-led digital health programs and the growing focus on preventive care are key factors propelling market growth in India.

Dental Sleep Apnea Screening Devices & Apps Market Share

The Dental Sleep Apnea Screening Devices & Apps industry is primarily led by well-established companies, including:

- Merck & Co., Inc., (U.S.)

- ResMed Inc. (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Apple Inc. (U.S.)

- Garmin Ltd. (Switzerland)

- Withings (France)

- ResApp Health Limited (Australia)

- SnailSleep (U.S.)

- Apneal (France)

- CONSUSIS (Germany)

- BetterNight (U.S.)

- ResDent (U.S.)

- SomniScan (India)

- Daphne Software, Inc. (U.S.)

- Sleep Data Services LLC (U.S.)

- ApneaMed (U.S.)

- MedBridge Healthcare (U.S.)

- SoundHealth Inc. (U.S.)

- Sleep Cycle AB (Sweden)

What are the Recent Developments in Global Dental Sleep Apnea Screening Devices & Apps Market?

- In September 2025, SoundHealth presented its revolutionary AI-powered Airway app at the World Sleep 2025 conference, offering a non-invasive smartphone-based airway and sleep apnea screening tool optimized for pediatric and adult populations

- In August 2025, SnailSleep announced the global launch of its AI-powered obstructive sleep apnea (OSA) screening and monitoring app that uses smartphone sensors for comprehensive sleep analysis with medical-grade clinical validation, providing high predictive accuracy without extra hardware

- In June 2025, Sleep Cycle launched a clinical study to validate its new AI-powered smartphone-based sleep apnea screening feature, enabling obstructive sleep apnea (OSA) assessment using just an iPhone without additional wearable hardware, marking a major step toward accessible digital screening for millions worldwide

- In October 2024, teledentistry platform Dentulu launched a nationwide sleep apnea program in the U.S., combining virtual consultations, at-home sleep test kits, and dental-based treatment pathways to expand access to screening and care beyond traditional clinical settings

- In February 2024, Samsung’s Sleep Apnea feature on Galaxy Watch devices became the first of its kind to receive De Novo authorization from the U.S. FDA, enabling compatible smartwatches and mobile apps to detect signs of moderate to severe OSA, significantly expanding digital screening tools in consumer wearables

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。