Global Dermatology Treatment Devices Market

市场规模(十亿美元)

CAGR :

%

USD

8.60 Billion

USD

27.49 Billion

2024

2032

USD

8.60 Billion

USD

27.49 Billion

2024

2032

| 2025 –2032 | |

| USD 8.60 Billion | |

| USD 27.49 Billion | |

|

|

|

|

Global Dermatology Treatment Devices Market Segmentation, By Product Type (Diagnostic Devices and Treatment Devices), Application (Skin Resurfacing, Skin Rejuvenation, Hair Removal, Psoriasis, Scar, Warts and Skin Tags, Skin Lesions, Pigmented and Vascular, Lesion Removal, Acne, Tattoo Removal, and Hyperhidrosis), End User (Hospitals, SPA Clinics, Dermatology Clinics, and Surgical Centres)- Industry Trends and Forecast to 2032

Dermatology Treatment Devices Market Size

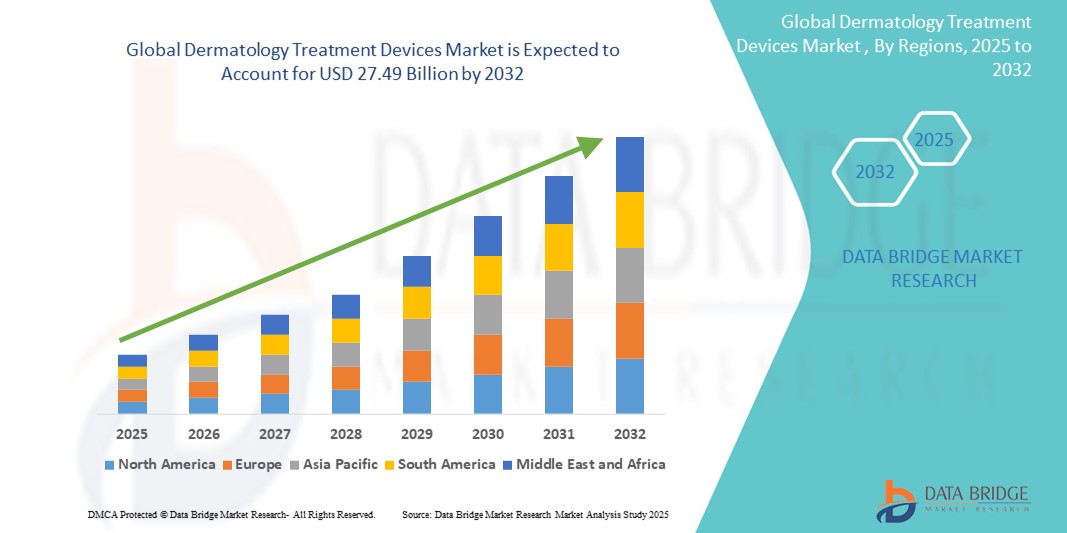

- The global dermatology treatment devices market size was valued atUSD 8.60 billion in 2024and is expected to reachUSD 27.49 billion by 2032, at aCAGR of 15.63%during the forecast period

- This growth is driven by factors such as the aging population, rising prevalence of skin conditions, increasing demand for aesthetic procedures, and advancements in dermatology technology

Dermatology Treatment Devices Market Analysis

- Dermatology treatment devices are essential tools used in the treatment of various skin conditions, including acne, psoriasis, and skin cancers. These devices provide advanced, non-invasive treatments for improving skin health and appearance

- The demand for these devices is primarily driven by the increasing prevalence of skin conditions, rising awareness of aesthetic treatments, and advancements in non-invasive technologies

- North America is expected to dominate the dermatology treatment devices market with a market share of 33.1%, due to its advanced healthcare infrastructure, high adoption of cosmetic treatments, and growing demand for dermatological procedures

- Asia-Pacific is expected to be the fastest growing region in the dermatology treatment devices market during the forecast period due to increasing disposable income, rising awareness of skincare, and a growing aging population

- Treatment devices segment is expected to dominate the market with a market share of 79.78% due to the availability of wide applications of dermatology treatment. In addition, the launch of novel technologies in the laser device category is also attributed to the high segment growth

Report Scope and Dermatology Treatment Devices Market Segmentation

|

Attributes |

Dermatology Treatment Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dermatology Treatment Devices Market Trends

“Advancements in Laser Technology & Non-invasive Dermatology Treatments”

- One prominent trend in the global dermatology treatment devices market is the increasing adoption of advanced laser technologies and non-invasive treatments for skin rejuvenation, acne, and hair removal

- These innovations enhance treatment effectiveness and patient comfort, offering high precision and minimal downtime, which is particularly beneficial for aesthetic dermatology procedures

- For instance, modern laser systems provide targeted treatment for a variety of skin conditions such as pigmentation, wrinkles, and vascular lesions, with improved outcomes and reduced side effects

- These advancements are revolutionizing the dermatology landscape, increasing patient satisfaction, and driving the demand for next-generation dermatology devices equipped with state-of-the-art technology

Dermatology Treatment Devices Market Dynamics

Driver

“Growing Demand Due to Rising Prevalence of Skin Conditions”

- The increasing prevalence of skin conditions such as acne, eczema, psoriasis, and skin cancer is significantly driving the demand for dermatology treatment devices

- As the global population grows and ages, the incidence of skin-related issues continues to rise, with many individuals seeking effective treatment options to manage both medical and aesthetic concerns

- As more individuals seek treatments for these conditions, the demand for advanced dermatology devices rises, improving treatment outcomes and enhancing the quality of care in dermatology

For instance,

- In 2020, according to the World Health Organization, skin diseases, including acne and eczema, affect millions of people worldwide, with a notable increase in cases attributed to urbanization and changing lifestyle factors. These trends are fueling demand for more advanced and efficient dermatology treatment devices

- As a result, the rising prevalence of skin conditions is driving a significant increase in the demand for dermatology treatment devices, which are becoming essential in both medical and aesthetic dermatology practices

Opportunity

“Leveraging Artificial Intelligence for Enhanced Dermatology Treatments”

- AI-powered dermatology treatment devices are transforming the way skin conditions are diagnosed and treated, enhancing treatment precision, automating routine tasks, and improving patient outcomes

- AI algorithms can analyze real-time patient data and images, providing instant feedback to dermatologists, helping them identify and track skin conditions more accurately

- Additionally, AI-powered devices can assist in image analysis, enabling dermatologists to review and compare images, assess treatment progress, and make more informed decisions during procedures

For instance,

- In December 2024, according to a study published in the Journal of Dermatology, AI systems, especially those based on deep learning, are increasingly being used to detect early signs of melanoma and other skin cancers with high accuracy. These AI systems can process large volumes of images quickly, improving early detection and increasing the chances of successful treatment

- The integration of AI in dermatology treatment devices offers a significant opportunity for improving diagnostic accuracy, reducing treatment times, and enhancing patient satisfaction, making it a key driver in the market’s growth

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- The high cost of dermatology treatment devices poses a significant challenge for the market, especially for smaller clinics and practices, as well as healthcare facilities in developing regions

- These advanced devices, which are crucial for procedures such as laser treatments, acne therapy, and hair removal, can often range from thousands to tens of thousands of dollars, making them a substantial financial investment

- The high upfront cost can deter many smaller healthcare providers or clinics with limited budgets from upgrading their equipment or investing in new technologies, resulting in continued reliance on outdated devices

For instance,

- In January 2024, according to an article published by Global Healthcare Insights, the significant cost associated with dermatology treatment devices limits their accessibility, particularly in developing countries where budget constraints are common. This can prevent healthcare facilities from adopting the latest advancements in dermatological care, thereby impacting the quality of treatment provided to patients

- Consequently, such financial barriers can contribute to disparities in access to advanced dermatology treatments, restricting market growth and innovation

Dermatology Treatment Devices Market Scope

The market is segmented on the basis of product type, application, and end user

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

In 2025, the treatment devices is projected to dominate the market with a largest share in product type segment

The treatment devices segment is expected to dominate the dermatology treatment devices market with the largest share of 79.78% due to the availability of wide applications of dermatology treatment. In addition, the launch of novel technologies in the laser device category is also attributed to the high segment growth

The lasers is expected to account for the largest share during the forecast period in product type market

In 2025, the lasers segment is expected to dominate the market with the largest market share of 46.1% due to the widespread adoption of laser-based treatments for various skin conditions. Lasers offer high precision, minimal invasiveness, and faster recovery times, making them the preferred choice for treating a range of dermatological issues, including acne, pigmentation, hair removal, and skin rejuvenation.

Dermatology Treatment Devices Market Regional Analysis

“North America Holds the Largest Share in the Dermatology Treatment Devices Market”

- North America dominates the dermatology treatment devices market with a market share of 33.1%, driven by advanced healthcare infrastructure, high demand for aesthetic treatments, and the strong presence of key market players in the region

- The U.S. holds a significant market share of approximately 37.8% due to the growing prevalence of skin conditions, rising demand for non-invasive cosmetic procedures such as laser treatments and hair removal, and continuous innovations in dermatology technologies

- The availability of well-established reimbursement policies for dermatological procedures and increasing investments in research & development by leading companies further strengthen the market

- Additionally, the expanding number of dermatology clinics, the increasing focus on skin health, and the rising popularity of aesthetic treatments contribute to the region's dominance in the market

“Asia-Pacific is Projected to Register the Highest CAGR in the Dermatology Treatment Devices Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the dermatology treatment devices market, fueled by rapid advancements in healthcare infrastructure, increasing awareness about skin health, and rising disposable incomes

- Countries such as China, India, and Japan are emerging as key markets due to their large populations, growing prevalence of skin conditions, and the increasing demand for cosmetic and medical dermatology procedures

- Japan, with its well-established healthcare system and high adoption of advanced medical technologies, remains a critical market for dermatology devices, particularly in the aesthetic dermatology sector

- China and India, with their expanding middle class and rising demand for both medical and cosmetic dermatology services, are experiencing increased investments in advanced dermatology treatment devices. The presence of global medical device manufacturers and improving access to dermatological care further fuel market growth in this region.

Dermatology Treatment Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AbbVie Inc. (U.S.)

- Lumenis (Israel)

- Syneron Candela (Israel)

- Johnson & Johnson (U.S.)

- Hologic, Inc. (U.S.)

- Cynosure, Inc. (U.S.)

- Sciton, Inc. (U.S.)

- Fotona (Slovenia)

- Bausch Health Companies, Inc. (Canada)

- Cutera, Inc. (U.S.)

- Revance Therapeutics, Inc. (U.S.)

- Merz Pharmaceuticals (Germany)

- Zimmer Biomet (U.S.)

- Medtronic (Ireland)

- Air Liquide Medical Systems (France)

- Alma Lasers (Israel)

- Quanta System S.p.A. (Italy)

- Beurer GmbH (Germany)

- Medytox, Inc. (South Korea)

- Evolus, Inc. (U.S.)

Latest Developments in Global Dermatology Treatment Devices Market

- In August 2023, Lumenis received FDA clearance for its PiQo4 picosecond laser, a state-of-the-art device designed for tattoo removal, pigmentation treatment, and wrinkle reduction. This regulatory approval underscores the growing advancements in non-invasive aesthetic treatments, providing precise and highly effective solutions for various dermatological concerns. The approval of the PiQo4 laser is particularly relevant to the global dermatology treatment devices market, as it reflects the increasing demand for advanced technologies that offer enhanced treatment outcomes with minimal patient downtime

- In July 2023, Canfield Scientific unveiled its latest dermatology innovations at the 25th World Congress of Dermatology held in Singapore from July 4th to 7th. The showcased products included IntelliStudio, VEOS, DermaGraphix, and VECTRA WB360, which highlight the company’s commitment to advancing imaging and diagnostic technologies designed to improve clinical outcomes in dermatological practices. These innovations are highly relevant to the global dermatology treatment devices market, as they reflect the increasing emphasis on precision diagnostics and personalized treatment solutions

- In April 2023, Canfield Scientific attained ISO 9001:2015 and ISO 13485:2016 certifications for its quality management systems. This dual certification emphasizes Canfield's ongoing dedication to upholding rigorous standards in product quality and regulatory compliance for its medical imaging and software solutions within the dermatology sector. The achievement of these certifications is highly significant for the global dermatology treatment devices market, as it reflects the increasing importance of quality assurance and regulatory adherence in the development of advanced dermatology technologies

- In February 2023, Candela Corporation received Health Canada’s licensing for its dual-wavelength Frax Pro non-ablative fractional laser platform and the Nordlys multi-application platform. These advanced technologies, which integrate Selective Waveband Technology (SWT), are designed to broaden treatment options in medical aesthetics, providing versatile solutions for a variety of skin conditions while enhancing safety and efficacy. This regulatory approval is highly relevant to the global dermatology treatment devices market, as it reflects the increasing demand for innovative, non-invasive treatments that offer customizable, effective solutions for a range of dermatological concerns

- In February 2023, Candela Corporation, a global leader in medical aesthetic devices, announced that its dual-wavelength Frax Pro non-ablative fractional laser platform and the Nordlys multi-application platform, featuring Selective Waveband Technology (SWT), were granted licensing by Health Canada and are now available for use. The availability of these innovative platforms in the global dermatology treatment devices market highlights the ongoing shift towards non-invasive aesthetic solutions that provide customizable and effective treatments for diverse dermatological concerns

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。