Global Detox Drinks Market

市场规模(十亿美元)

CAGR :

%

USD

63.69 Billion

USD

91.27 Billion

2025

2033

USD

63.69 Billion

USD

91.27 Billion

2025

2033

| 2026 –2033 | |

| USD 63.69 Billion | |

| USD 91.27 Billion | |

|

|

|

|

全球排毒飲品市場細分,按類型(水、果汁、冰沙、茶、咖啡及其他)、類別(傳統和有機)、包裝類型(瓶裝、袋裝和小袋裝及其他)、分銷渠道(實體店和非實體店)劃分——行業趨勢及至2033年的預測

排毒飲料市場規模

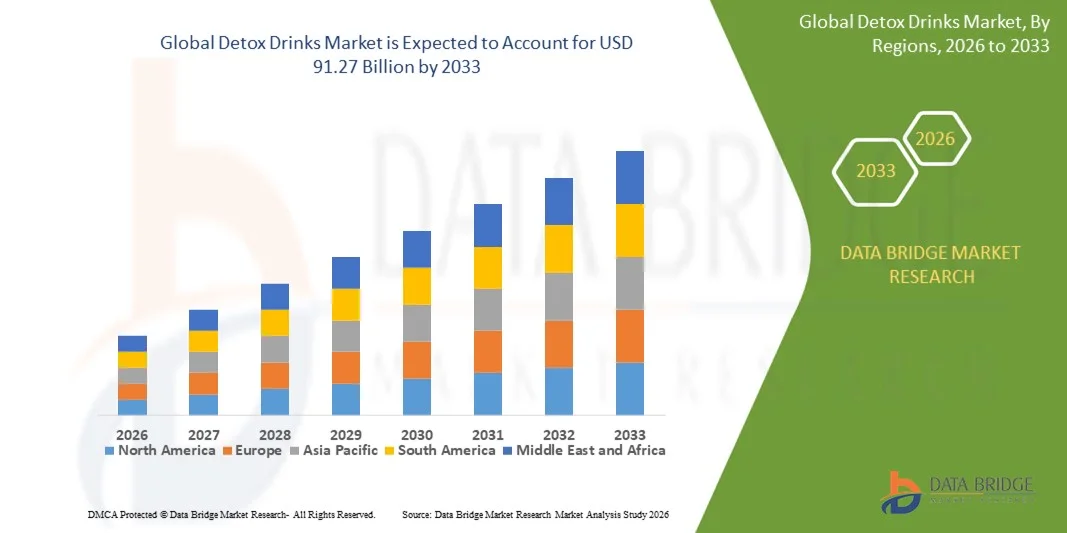

- 2025年全球排毒飲料市場規模為636.9億美元,預計2033年將達到912.7億美元,預測期內 複合年增長率為4.6%。

- 市場成長主要得益於人們健康意識的提高以及消費者對天然、功能性和植物性飲料的偏好日益增強,從而導致城市和注重健康的人群對排毒飲料的接受度更高。

- 此外,人們對體重管理、消化健康和免疫力提升的日益關注,正使排毒飲品成為日常健康生活方式的重要組成部分。這些因素共同推動了排毒飲品的消費,從而顯著促進了該行業的成長。

排毒飲料市場分析

- 排毒飲品具有補水、排毒和補充營養等功能性益處,因其便捷的即飲形式和天然成分,在現代個人和職業環境中,已成為現代飲食和健康實踐中日益重要的組成部分。

- 排毒飲品需求的不斷攀升主要得益於人們健康意識的增強、對植物性和有機飲品的日益青睞,以及隨時隨地飲用的便利性,這使得排毒飲品成為追求健康生活方式的消費者的首選。

- 由於健康意識的提高、健康飲品的普及以及消費者對天然和功能性飲品的偏好日益增長,北美地區預計將在2025年佔據排毒飲品市場的主導地位,市場份額達到32.1% 。

- 由於中國、日本和印度等國家快速的城市化進程、可支配收入的增加以及健康意識的提高,預計亞太地區將在預測期內成為排毒飲料市場成長最快的地區。

- 由於其高營養密度和廣泛的消費者認知度,果汁細分市場預計將在2025年佔據41.5%的市場份額。消費者越來越傾向於選擇排毒果汁,因為它們能夠提供濃縮的維生素、礦物質和抗氧化劑,有助於整體健康和排毒。果汁類排毒飲品還具有多樣化、易於添加水果、蔬菜和草藥等配料的優勢,使其深受注重健康的消費者的喜愛。即飲包裝果汁的便利性以及與健身和健康生活方式的契合性進一步提升了其市場需求。

報告範圍及排毒飲料市場細分

|

屬性 |

排毒飲料關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特五力分析和監管框架。 |

排毒飲料市場趨勢

功能性飲料和植物性飲料的需求不斷增長

- 排毒飲品市場的一大趨勢是,消費者越來越傾向於選擇功能性強、植物性的飲品,以促進整體健康和排毒。這一趨勢的驅動因素包括日益增強的健康意識、快節奏的生活方式以及消費者對便利、營養豐富的飲品的需求。

- For instance, companies such as Suja Juice and Evolution Fresh offer cold-pressed, plant-based detox beverages that combine fruits, vegetables, and superfoods. These products appeal to consumers seeking natural cleansing solutions while providing essential vitamins and antioxidants

- The demand for beverages incorporating adaptogens, probiotics, and other functional ingredients is expanding as consumers focus on gut health, immunity, and stress management. This is positioning detox drinks as key lifestyle products that contribute to holistic well-being

- Retailers and e-commerce platforms are actively promoting ready-to-drink detox beverages, making them more accessible and convenient for urban consumers. This distribution expansion is encouraging higher adoption rates across key markets

- There is a rising trend of personalized and customizable detox drinks, allowing consumers to tailor ingredients according to specific health goals. This trend is fostering product innovation and supporting brand differentiation within the market

- The market is experiencing strong growth in premium and organic segments, where beverages emphasize clean-label ingredients and sustainable sourcing. This trend underscores the increasing consumer willingness to invest in health-focused and environmentally conscious products

Detox Drinks Market Dynamics

Driver

Growing Health and Wellness Awareness Among Consumers

- The rising focus on health and wellness is driving the detox drinks market as consumers seek beverages that offer functional benefits beyond basic hydration. Awareness of diet-related health issues and preventative care is prompting greater consumption of detox-focused products

- For instance, PepsiCo’s KeVita brand has gained popularity by offering probiotic-based detox drinks that target digestive health and immunity. Such products align with the increasing consumer preference for beverages that support internal cleansing and well-being

- Rising consumer interest in natural, plant-based ingredients and superfoods is fueling demand for detox beverages that integrate these components. These products are perceived as safer alternatives to sugary drinks and artificial supplements

- Fitness and lifestyle communities are actively promoting detox beverages as part of balanced diets and post-workout recovery routines. This is positioning detox drinks as integral to holistic health regimens

- The growing adoption of preventive healthcare measures globally reinforces the preference for functional beverages, supporting market expansion. Consumers increasingly prioritize products that contribute to long-term health outcomes

Restraint/Challenge

Supply Chain Dependence on Fresh and High-Quality Ingredients

- The detox drinks market faces challenges due to its reliance on fresh fruits, vegetables, and superfood ingredients, which are perishable and subject to seasonal availability. This dependence affects production continuity and increases operational complexity

- For instance, companies such as Suja Juice manage cold-chain logistics to maintain ingredient freshness, yet fluctuations in supply can disrupt production schedules. Such reliance makes cost management and consistent product quality more difficult

- Maintaining high nutritional value while scaling production presents additional hurdles for manufacturers, particularly when sourcing organic or rare ingredients. These constraints can limit market responsiveness and product variety

- Vulnerability to climatic changes, crop yields, and regional supply shortages impacts ingredient procurement, posing risks to production planning and pricing strategies

- The market continues to navigate challenges in securing sustainable, high-quality raw materials while meeting growing consumer demand. These factors collectively emphasize the need for robust supply chain strategies and supplier partnerships to ensure consistent product availability

Detox Drinks Market Scope

The market is segmented on the basis of type, category, packaging type, and distribution channel.

- By Type

On the basis of type, the detox drinks market is segmented into water, juice, smoothie, tea and coffee, and others. The juice segment dominated the market with the largest revenue share of 41.5% in 2025, driven by its high nutrient density and widespread consumer familiarity. Consumers increasingly prefer detox juices for their ability to provide concentrated vitamins, minerals, and antioxidants, supporting overall wellness and detoxification. Juice-based detox drinks also benefit from diverse flavor profiles and easy customization with ingredients such as fruits, vegetables, and herbs, making them attractive to health-conscious individuals. The convenience of ready-to-drink packaged juices and their compatibility with fitness and wellness routines further enhance their market demand.

The smoothie segment is anticipated to witness the fastest growth rate of 19.8% from 2026 to 2033, fueled by rising adoption among millennials and urban consumers seeking meal-replacement options with detox benefits. For instance, brands such as Suja actively promote smoothie detox programs that combine fruits, vegetables, and superfoods to enhance nutrient intake while supporting digestive health. Smoothies offer a thicker, more satiating option compared to juices, appealing to consumers looking for a functional yet convenient beverage. The trend toward personalization and the addition of protein, probiotics, and adaptogens in smoothies also contributes to their rapid growth.

- By Category

On the basis of category, the detox drinks market is segmented into conventional and organic. The organic segment dominated the market with the largest revenue share in 2025, driven by increasing consumer awareness of natural ingredients and the desire to avoid synthetic additives. Consumers perceive organic detox drinks as safer and more effective for cleansing and promoting overall health, aligning with wellness trends and clean-label preferences. Organic products are also supported by certifications and traceable sourcing, which reinforce consumer trust and willingness to pay a premium. The segment benefits from rising partnerships between organic farms and beverage manufacturers, enhancing product availability and variety.

The conventional segment is expected to witness the fastest CAGR from 2026 to 2033, driven by its affordability and broad distribution across retail channels. For instance, brands such as Tropicana offer conventional detox juice lines that cater to mass-market consumers seeking convenient wellness beverages. These products attract cost-conscious buyers while providing functional benefits such as hydration and antioxidant support. Innovations in flavors and formulations in the conventional segment also help in expanding consumer reach and acceptance.

- By Packaging Type

On the basis of packaging type, the detox drinks market is segmented into bottles, pouches and sachets, and others. The bottles segment dominated the market with the largest revenue share in 2025, driven by their convenience, portability, and ability to preserve freshness and nutritional value. Bottled detox drinks are widely preferred in retail and foodservice channels, offering easy on-the-go consumption and compatibility with cold-chain logistics. The availability of eco-friendly and recyclable bottles further enhances consumer preference, aligning with sustainability trends in the beverage industry. Bottles also allow for premium branding and clear labeling, which is important for detox product transparency.

The pouches and sachets segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for compact, single-serve, and travel-friendly formats. For instance, brands such as Suja and Pressed Juicery provide sachets and pouches that allow consumers to mix fresh detox drinks conveniently at home or work. These formats appeal to busy consumers seeking portion-controlled options without compromising on nutrients. Pouches also reduce storage requirements and enable experimentation with blends and flavors, supporting rapid adoption in urban and health-focused markets.

- By Distribution Channel

On the basis of distribution channel, the detox drinks market is segmented into store-based and non-store-based channels. The store-based segment dominated the market with the largest revenue share in 2025, driven by the extensive presence of supermarkets, hypermarkets, and health food stores that offer easy access to a wide variety of detox beverages. Consumers value the ability to physically examine products, compare labels, and explore flavors in store-based channels, which builds trust and encourages repeat purchases. Retailers also provide in-store promotions and product bundling, enhancing visibility and market penetration. The segment is further supported by partnerships with wellness stores and fitness centers to promote targeted detox programs.

The non-store-based segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the growing adoption of e-commerce, online grocery platforms, and direct-to-consumer subscription models. For instance, companies such as Daily Harvest offer online subscription-based detox drinks that provide convenience, doorstep delivery, and personalized beverage plans. Non-store-based channels attract tech-savvy consumers and those seeking regular, hassle-free access to detox beverages. Digital marketing, social media influence, and flexible delivery options contribute significantly to the rapid growth of this segment.

Detox Drinks Market Regional Analysis

- North America dominated the detox drinks market with the largest revenue share of 32.1% in 2025, driven by rising health awareness, increasing adoption of wellness beverages, and growing consumer preference for natural and functional drinks

- Consumers in the region highly value the convenience, nutrient-rich profiles, and variety of flavors offered by detox drinks, which are often incorporated into fitness and dietary routines

- This widespread adoption is further supported by high disposable incomes, a health-conscious population, and the growing trend of preventive healthcare, establishing detox drinks as a favored choice among both urban and suburban consumers

U.S. Detox Drinks Market Insight

The U.S. detox drinks market captured the largest revenue share in 2025 within North America, fueled by strong demand for functional beverages and increasing consumer inclination toward plant-based and organic options. Consumers are increasingly prioritizing beverages that support weight management, digestion, and overall wellness. The rising popularity of ready-to-drink detox juices, smoothies, and teas, combined with robust retail and e-commerce distribution channels, further propels market growth. In addition, the adoption of clean-label and organic certifications by brands enhances consumer trust and encourages repeat purchases.

Europe Detox Drinks Market Insight

歐洲排毒飲品市場預計在預測期內將以顯著的複合年增長率增長,主要驅動力來自日益增強的健康意識、生活方式的改變以及對有機和天然飲品需求的增長。都市化進程的加快,以及健身和健康理念的普及,都促進了排毒飲品的消費。歐洲消費者也青睞便利的包裝形式和營養豐富的產品。該地區在超市、專賣店和線上平台均呈現顯著成長,各大品牌致力於產品創新和環保包裝以吸引消費者。

英國排毒飲料市場洞察

受健康意識增強、注重健康的生活方式以及對功能性飲料需求不斷增長的推動,英國排毒飲料市場預計在預測期內將以顯著的複合年增長率增長。消費者選擇排毒飲料是為了增強免疫力、控制體重和提升精力水平。英國強大的零售和電子商務基礎設施,以及社交媒體對健康趨勢的積極推廣,預計將繼續刺激市場成長。此外,有機和冷壓飲料的日益普及也提升了市場接受度。

德國排毒飲料市場洞察

預計在預測期內,德國排毒飲品市場將以可觀的複合年增長率增長,這主要得益於消費者對預防性醫療保健的重視、對有機產品的接受度提高以及生活方式驅動的消費模式的轉變。德國完善的零售網絡以及對可持續和環保包裝日益增長的需求,都促進了排毒飲品的消費。消費者正在尋找能夠提供抗氧化劑、補充水分和促進消化等功效的功能性飲料。將健康飲品融入日常生活正在推動城市和郊區市場的成長。

亞太地區排毒飲料市場洞察

受中國、日本和印度等國快速城市化、可支配收入增加以及健康意識提升的推動,亞太地區排毒飲品市場預計將在2026年至2033年預測期內以最快的複合年增長率增長。該地區對健康日益增長的興趣,以及數位化健身趨勢和社交媒體的影響,正在推動排毒飲品的普及。此外,亞太地區正在崛起為飲料創新和生產中心,為更廣泛的消費者群體提供價格實惠且易於獲取的選擇。

日本排毒飲料市場洞察

由於日本日益增長的健康意識、人口老化以及對預防性健康管理的重視,日本排毒飲品市場正蓬勃發展。消費者越來越多地將排毒飲品融入日常生活,以促進消化、提升精力和增強免疫力。消費者對功能性、便利性和天然飲品的需求,以及訂閱式配送服務的普及,共同推動了市場成長。此外,排毒飲品與生活方式潮流和健身計劃的融合,也促進了其在家庭和工作場所的廣泛應用。

中國排毒飲料市場洞察

預計到2025年,中國排毒飲品市場將佔據亞太地區最大的市場份額,這主要得益於快速的城市化進程、不斷增長的可支配收入以及日益增強的健康意識。在中國,即飲果汁、冰沙和茶基排毒飲品在城市地區廣受歡迎。強大的本土生產商以及不斷完善的零售和電商分銷網絡是推動市場成長的關鍵因素。政府倡導健康生活方式和飲食意識的措施也進一步促進了排毒飲品市場的擴張。

排毒飲料市佔率

排毒飲料產業主要由一些知名企業主導,其中包括:

- 瑜伽士(美國)

- Pukka Herbs(英國)

- Celestial Seasonings, Inc.(美國)

- Jus By Julie(美國)

- Suja Life, LLC(美國)

- Project Juice(美國)

- Raw Generation Inc.(美國)

- 海恩天體(美國)

- 史都華博士茶(英國)

- 仙台丁宜(馬來西亞)

- LiveLife International(英國)

- Nano Japan(日本)

- 阿基瓦·洛夫(美國)

- Nature's Way Products, LLC.(美國)

- Supergreen Asia LLP(印度)

- 瓦爾內塞(法國)

全球排毒飲料市場最新發展動態

- 2023年8月,FSD Pharma Inc.與Celly Nutrition Inc.達成策略合作,共同生產一款名為UNBUZZD的快速解酒飲品。此次合作旨在透過推出針對酒精依賴康復的創新解酒方案,進一步鞏固功能性飲料市場的地位。 UNBUZZD的上市提升了消費者對專業解酒飲品的認知度,為健康飲品和小眾成人飲品市場開闢了新的機遇,同時也將FSD Pharma和Celly Nutrition定位為解酒領域的關鍵創新者。

- 2023年7月,Jupiter Wellness, Inc.透過與GBB Drink Lab Inc.達成的資產收購協議,收購了Safety Shot飲料。此次收購使Jupiter Wellness得以拓展其功能性飲料和排毒飲料的產品組合,進而提升市場佔有率和競爭地位。 Safety Shot整合到Jupiter Wellness的分銷管道後,將加快產品上市速度,方便消費者購買,從而推動即飲排毒飲料市場的成長,並滿足消費者對便利健康飲料日益增長的需求。

- 2022年8月,Califia Farms致力於拓展產品線,推出了一系列新品,例如限量版「南瓜香料燕麥咖啡師」(Pumpkin Spice Oat Barista),這款飲品採用肉桂、肉荳蔻和生薑等植物性原料製成。這次產品線擴張凸顯了消費者對時令性、植物性及健康飲品日益增長的需求,並增強了品牌差異化優勢。透過運用功能性天然成分,Califia Farms鞏固了其在高端排毒和植物性飲品市場的地位,同時吸引了注重健康和生活方式的消費者。

- 2022年3月,總部位於海德拉巴的新創公司Drunken Monkey宣布推出獨特的排毒冰沙飲品,其原料包括蘋果、薄荷和酪梨等。這些冰沙的推出鞏固了新鮮、營養豐富的飲品在印度的受歡迎程度,並推動了城市功能飲料市場的成長。 Drunken Monkey透過提供創新且口味豐富的排毒選擇,迎合了追求便捷健康解決方案的年輕、注重健康的消費者的需求,從而推動了冰沙和排毒飲品市場的發展。

- 2020年6月,嘉寶推出了專為幼兒設計的“有機水果浸泡水”,該產品不含糖分和人工防腐劑。這款產品滿足了兒童對安全健康飲品日益增長的需求,並強調其便利性和補水功效。透過推出以幼兒為中心的有機排毒飲品,嘉寶鞏固了其在兒童健康市場的地位,同時也有助於提高低齡族群對功能性天然飲品的認知度和消費量。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。