Global Diagnostic Electrocardiograph Ecg Market

市场规模(十亿美元)

CAGR :

%

USD

8.84 Billion

USD

13.48 Billion

2024

2032

USD

8.84 Billion

USD

13.48 Billion

2024

2032

| 2025 –2032 | |

| USD 8.84 Billion | |

| USD 13.48 Billion | |

|

|

|

|

Global Diagnostic Electrocardiograph Market Segmentation, By Product and Service (Resting ECG, Stress ECG Devices, Holter Monitors, Implantable Loop Recorders, Event Monitors, MCT Devices, and Smart ECG Monitors), Lead Type (12-lead ECG Devices, 5-lead ECG Devices, 3-lead ECG Devices, 6-lead ECG Devices, Single-lead, and Other Lead Types), End User (Hospitals, Clinics, and Cardiac Centers, Ambulatory Surgical Centers, and Other End Users) - Industry Trends and Forecast to 2032

Diagnostic Electrocardiograph Market Size

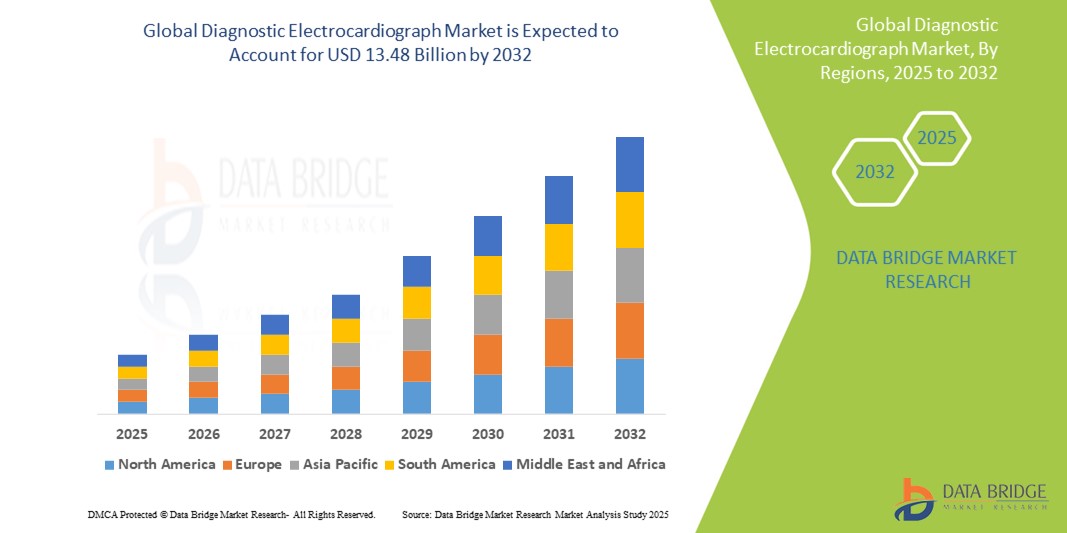

- The global diagnostic electrocardiograph market size was valued atUSD 8.84 billion in 2024and is expected to reachUSD 13.48 billion by 2032, at aCAGR of 5.41%during the forecast period

- This growth is driven by factors such as the increasing prevalence of cardiovascular diseases, advancements in ECG technology, and the rising demand for remote monitoring solutions and early diagnostics in both urban and rural healthcare settings

Diagnostic Electrocardiograph Market Analysis

- Diagnostic electrocardiographs are essential tools in cardiology used to record the electrical activity of the heart, aiding in the diagnosis of arrhythmias, heart attacks, and other cardiovascular conditions

- The growing global burden of cardiovascular diseases, along with an aging population and increased screening programs, is significantly driving the demand for diagnostic electrocardiographs

- North America is expected to dominate the diagnostic electrocardiographs market with a market share of 39.5%, due to advanced healthcare infrastructure, early adoption of innovative diagnostic technologies, and a strong presence of leading ECG manufacturers

- Asia-Pacific is expected to be the fastest growing region in the diagnostic electrocardiograph market with a market share of 19.7%, during the forecast period due to growing healthcare investments, increasing awareness about cardiovascular health, and the rapid adoption of digital health technologies

- Resting ECG segment is expected to dominate the market with a market share of 41.2% due to its widespread use in routine health check-ups and early cardiac diagnostics. It is a non-invasive, quick, and cost-effective tool commonly used in both hospitals and outpatient settings

Report Scope and Diagnostic Electrocardiograph Market Segmentation

|

Attributes |

Diagnostic Electrocardiograph Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diagnostic Electrocardiograph Market Trends

“Technological Advancements in ECG Devices & Integration with Remote Monitoring”

- One prominent trend in the diagnostic electrocardiograph market is the rapid integration of wireless connectivity, AI-powered analysis, and portable form factors in ECG devices

- These innovations are enhancing diagnostic accuracy and expanding the use of ECGs in ambulatory, home-based, and remote healthcare settings

- For instance, modern ECG devices with Bluetooth or cloud-based capabilities allow real-time transmission of cardiac data to healthcare providers, enabling early detection and continuous monitoring of arrhythmias and other heart conditions

- These advancements are reshaping cardiac care, increasing access to diagnostics, and fueling demand for smart, user-friendly ECG systems tailored for both clinical and non-clinical environments

Diagnostic Electrocardiograph Market Dynamics

Driver

“Rising Burden of Cardiovascular Diseases and Need for Early Diagnosis”

- The increasing global prevalence of cardiovascular diseases (CVDs), including arrhythmias, myocardial infarctions, andheart failure,is a primary driver of the diagnostic electrocardiograph market

- CVDs remain the leading cause of mortality worldwide, creating an urgent need for early detection, continuous monitoring, and timely intervention, which diagnostic ECG devices facilitate effectively

- Growing awareness about preventive healthcare and routine cardiac screening is boosting the adoption of ECG systems in both clinical and remote healthcare settings

For instance,

- According to the World Health Organization (WHO), CVDs account for approximately 17.9 million deaths per year, representing 32% of all global deaths, with early diagnosis being a critical factor in reducing complications

- As the burden of heart-related illnesses continues to grow, the demand for reliable and accessible diagnostic tools such as electrocardiographs is expected to surge significantly

Opportunity

“Enhancing Cardiac Care with AI Integration and Remote Monitoring”

- The integration ofartificial intelligence(AI) in diagnostic electrocardiograph systems is revolutionizing cardiac diagnostics by improving interpretation accuracy, streamlining workflows, and enabling predictive analytics

- AI-powered ECG platforms can analyze complex cardiac data in real-time, detect subtle abnormalities, and alert clinicians to potential arrhythmias or ischemic changes, facilitating faster and more accurate decision-making

- In addition, AI combined with wearable and remote ECG devices allows continuous patient monitoring outside traditional clinical settings, expanding access to care for rural and aging populations

For instance,

- In In a study published in Nature Medicine (2023), an AI-enabled ECG system demonstrated over 94% accuracy in detecting asymptomatic left ventricular dysfunction — a condition often missed in routine screenings — enabling earlier interventions and reducing adverse outcomes

- The These technological advancements offer vast potential to improve early detection, support telecardiology programs, and reduce hospital readmissions, thereby strengthening overall cardiac care infrastructure globally.

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- The high cost of advanced diagnostic electrocardiograph systems presents a major barrier to widespread adoption, particularly in low- and middle-income countries and smaller healthcare facilities

- Modern ECG devices, especially those with wireless connectivity, AI integration, and multi-lead capabilities, can be significantly more expensive than basic models, making them less accessible to resource-limited settings

- Healthcare providers with constrained budgets may delay the adoption of newer ECG technologies, relying instead on outdated or less accurate equipment, which can impact diagnostic precision and patient outcomes

For instance,

- In a report of 2024, the cost of advanced 12-lead ECG systems with AI and telemetry features can exceed USD 20,000, not including recurring software or maintenance fees—posing a substantial burden for small clinics and public hospitals in emerging economies

- Consequently, this financial limitation contributes to healthcare inequities, delays in diagnosis, and underutilization of next-generation diagnostic tools, ultimately restricting market growth and penetration

Diagnostic Electrocardiograph Market Scope

The market is segmented on the basis of product and service, lead type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product and Service |

|

|

By Lead Type |

|

|

By End User |

|

In 2025, the resting ECG is projected to dominate the market with a largest share in product and service segment

The resting ECG segment is expected to dominate the diagnostic electrocardiograph market with the largest share of 41.2% in 2025 due to its widespread use in routine health check-ups and early cardiac diagnostics. It is a non-invasive, quick, and cost-effective tool commonly used in both hospitals and outpatient settings. The increasing prevalence of cardiovascular diseases and emphasis on preventive healthcare further support its growing demand.

The 6-lead ECG devices is expected to account for the largest share during the forecast period in lead type market

In 2025, 6-lead ECG devices segment is expected to dominate the market with the largest market share of 33% due to its optimal balance between diagnostic accuracy and portability. These devices offer enhanced cardiac monitoring capabilities compared to single-lead ECGs while remaining compact and user-friendly. Their growing adoption in home healthcare and remote patient monitoring further drives market growth

Diagnostic Electrocardiograph Market Regional Analysis

“North America Holds the Largest Share in the Diagnostic Electrocardiograph Market”

- North America dominates the diagnostic electrocardiograph market with a market share of estimated 39.5%, driven, by advanced healthcare infrastructure, early adoption of innovative diagnostic technologies, and a strong presence of leading ECG manufacturers

- U.S. holds a market share of 82.6%, due to the high prevalence of cardiovascular diseases, a growing geriatric population, and an increased focus on preventive cardiac care

- Favorable reimbursement policies, government initiatives promoting heart health, and ongoing investment in AI-integrated diagnostic systems further support regional growth

- In addition, the widespread availability of portable and wireless ECG devices and their integration into telehealth platforms are accelerating the adoption of ECG systems across outpatient and home care settings

“Asia-Pacific is Projected to Register the Highest CAGR in the Diagnostic Electrocardiograph Market”

- Asia-Pacific is expected to witness the highest growth rate in the Diagnostic Electrocardiograph market with a market share of 19.7%, driven by growing healthcare investments, increasing awareness about cardiovascular health, and the rapid adoption of digital health technologies

- Countries such as China, India, and Japan are key contributors due to their large patient populations and increasing burden of heart diseases, such as arrhythmias, ischemic heart disease, and hypertension

- Japan, with its highly advanced medical infrastructure and commitment to adopting precision diagnostic tools, is a significant market for next-generation ECG systems

- India is projected to register the highest CAGR in the region, fueled by the rising prevalence of CVDs, government-led cardiac screening programs, and expanding access to affordable diagnostic equipment across urban and rural areas

Diagnostic Electrocardiograph Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- General Electric Company(U.S.)

- Koninklijke Philips N.V.(Netherlands)

- NIHON KOHDEN CORPORATION(Japan)

- Hill-Rom Holdings, Inc.(U.S.)

- Ambu A/S(Denmark)

- SCHILLER (Switzerland)

- ACS Diagnostics (U.S.)

- BPL Medical Technologies (India)

- BioTelemetry, a Philips Company (U.S.)

- OSI Systems, Inc. (U.S.)

- BTL (U.S.)

- Allengers (India)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- EDAN Instruments, Inc. (China)

- Cardioline S.P.A. (Italy)

- SUZUKEN CO., LTD. (Japan)

- Norav Medical (U.S.)

- Bionet America, Inc. (U.S.)

- VectraCor, Inc. (U.S.)

- Nexus Lifecare (India)

- Midmark Corporation (U.S.)

- Spacelabs Healthcare (U.S.)

- Innomed Medical Inc. (Hungary)

Latest Developments in the Market

- In March 2025, GE HealthCare announced the U.S. launch of its MAC IQ ECG system at the American College of Cardiology (ACC) 2025 conference. The system features advanced AI-driven analysis tools for early detection of subtle cardiac abnormalities and integrates cloud connectivity for seamless data sharing

- In February 2025, Philips advanced its remote cardiac monitoring solutions through its BioTel Heart division, enhancing Mobile Cardiac Telemetry (MCOT) devices with improved algorithms for arrhythmia detection and treatment

- In November 2024, Hill-Rom's Welch Allyn CP 300 ECG system was updated with a new user interface and better data management capabilities. It also offers EMR connectivity and an intuitive touchscreen for primary care clinics and emergency departments.

- October 2024, BPL Medical Technologies launched the Cardiart GenX3, a 3-channel ECG machine featuring the Glasgow ECG Interpretation algorithm. It's designed for use in clinics and hospitals, offering real-time data transfer capabilities

- In January, 2021, BioTelemetry, Inc., a prominent provider of remote cardiac diagnosis and monitoring systems in the United States, has been acquired by Koninklijke Philips N.V. Philips will be able to expand its portfolio of patient care management solutions as a result of this acquisition

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。