Global Enterprise Collaboration Market

市场规模(十亿美元)

CAGR :

%

USD

53.93 Billion

USD

132.64 Billion

2024

2032

USD

53.93 Billion

USD

132.64 Billion

2024

2032

| 2025 –2032 | |

| USD 53.93 Billion | |

| USD 132.64 Billion | |

|

|

|

|

Global Enterprise Collaboration Market Segmentation, By Component (Solutions, Services), Deployment Type (On-Premises, Cloud, Hybrid), Application (Unified Communication, Project Management and Workflow Automation, Document Sharing and Management, Enterprise Social Collaboration, Others), End User (IT and Telecommunication, BFSI, Retail and E-Commerce, Healthcare, Manufacturing, Government, Others) - Industry Trends and Forecast to 2032

Enterprise Collaboration Market Size

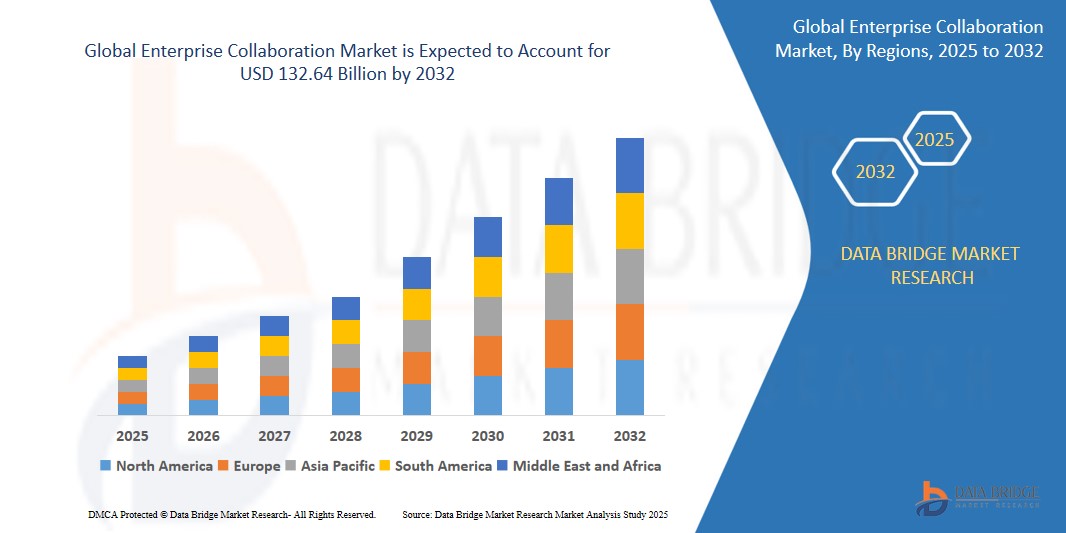

- The global Enterprise Collaboration market size was valued atUSD 53.93 billion in 2024and is expected to reachUSD 132.64 billion by 2032, at aCAGR of 12.1% duringthe forecast period

- This growth is driven by the increasing adoption of cloud-based collaboration tools, the rise of remote and hybrid work models, and the integration of AI to enhance productivity and communication.

Enterprise Collaboration Market Analysis

- The Enterprise Collaboration market encompasses solutions and services that facilitate seamless communication, file sharing, project management, and real-time collaboration among employees within and across organizations, including tools like unified communication platforms, enterprise social networks, and video conferencing systems.

- The demand for enterprise collaboration solutions is significantly driven by the global shift to remote work, with 80% of enterprises adopting collaboration tools by 2024, and the need for real-time communication, with 65% of businesses prioritizing instant feedback mechanisms.

- North America is expected to dominate the Enterprise Collaboration market due to its advanced IT infrastructure, early adoption of 5G, and presence of key vendors like Microsoft and Cisco, holding a 40% market share in 2024.,

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid digital transformation, smartphone penetration, and increasing investments in collaboration tools in countries like China and India.

- The Solutions segment is expected to dominate the market with a market share of60.0%in 2025 due to the critical role of unified communication, project management, and document sharing platforms in enhancing workforce productivity.

Report Scope and Enterprise Collaboration Market Segmentation

|

Attributes |

Enterprise Collaboration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Enterprise Collaboration Market Trends

“Advancements in IoT and AI for Real-Time Data Analytics”

- A prominent trend in the Enterprise Collaboration market is the integration of AI and automation, enabling features like intelligent task prioritization, automated meeting summaries, and predictive analytics, which improve productivity by up to 25% in enterprises.

- These advancements are supported by cloud-based platforms, with 70% of organizations adopting cloud collaboration tools by 2024, offering scalability and real-time data syncing.

- For instance, in September 2024, DingTalk launched DingTalk 365, a subscription service with AI-powered tools like virtual assistants and automated replies to enhance workplace collaboration.

- This trend is driving demand for innovative, AI-driven collaboration solutions that streamline workflows and enhance communication.

Enterprise Collaboration Market Dynamics

Driver

“Rise of Remote and Hybrid Work Models”

- The global shift to remote and hybrid work models, with 60% of organizations adopting flexible work policies by 2024, and the increasing demand for real-time collaboration tools are significantly contributing to the Enterprise Collaboration market growth.

- These solutions enable seamless communication, file sharing, and project management across distributed teams, improving operational efficiency by 20%.

For instance,

- In February 2024, Tata Communications collaborated with Microsoft to integrate voice calling on Microsoft Teams, enhancing workforce efficiency for Indian enterprises.

- As enterprises prioritize workforce connectivity, the demand for collaboration tools continues to rise, ensuring business continuity and productivity.

Opportunity

“Adoption of Collaboration Tools by SMEs”

- Small and medium-sized enterprises (SMEs) are increasingly adopting cost-effective, cloud-based collaboration tools, enabling them to compete with larger organizations, with SMEs projected to grow at the fastest CAGR from 2025 to 2032.

- These tools offer scalable solutions for communication, task management, and document sharing, boosting productivity without significant infrastructure costs.

For instance,

- in 2024, SMEs in retail adopted platforms like Slack and Zoom, increasing team efficiency by 15%.

- This opportunity drives market growth by expanding the accessibility of collaboration technologies to smaller businesses.

Restraint/Challenge

“Security Concerns and Integration Complexity”

- Security concerns, with 45% of enterprises reporting data breaches in cloud-based collaboration platforms in 2024, and integration complexity with existing systems, with 50% of firms facing compatibility issues, pose significant barriers to the Enterprise Collaboration market.

- These issues require robust cybersecurity measures and simplified integration frameworks, increasing deployment costs for organizations.

For instance,

- in 2024, 30% of mid-sized firms cited security concerns as a barrier to adopting cloud collaboration tools

- These challenges can hinder market growth, necessitating secure and interoperable solutions.

Enterprise Collaboration Market Scope

The market is segmented on the basis of component, deployment type, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Type |

|

|

By Application |

|

|

By End User |

|

In 2025, the Solutions segment is projected to dominate the market with the largest share in the component segment.

The Solutions segment is expected to dominate the Enterprise Collaboration market with the largest share of 60.0% in 2025 due to the essential role of unified communication, project management, and document sharing platforms in enabling seamless collaboration across enterprises.

“North America Holds the Largest Share in the Enterprise Collaboration Market”

- North America dominates the Enterprise Collaboration market, driven by its advanced IT infrastructure, early adoption of 5G, and presence of key vendors like Microsoft, Cisco, and IBM, with a 40% market share in 2024.,

- The U.S. holds a significant share, valued at USD 21.6 billion in 2024, due to high demand for cloud-based solutions and collaborations like Tata Communications-Microsoft in 2024.

- The region’s focus on digital transformation and robust adoption of collaboration tools in BFSI and IT sectors further strengthens the market.

- In addition, high demand for real-time communication tools, with 70% of U.S. enterprises using platforms like Microsoft Teams, fuels market expansion.

“Asia-Pacific is Projected to Register the Highest CAGR in the Enterprise Collaboration Market”

- The Asia-Pacific region is expected to witness the highest growth rate, driven by rapid digital transformation, increasing smartphone penetration, and growing adoption of collaboration tools in countries like China, India, and Japan.

- China, with a projected market value of USD 15 billion by 2032, remains a key market due to its focus on enterprise digitalization and remote work adoption.

- India is projected to grow at a CAGR of 14.0% due to affordable cloud solutions and expanding IT infrastructure.

- The expanding presence of global vendors and government support for digital initiatives further contribute to market growth.

Enterprise Collaboration Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Microsoft Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Slack Technologies, LLC (U.S.)

- IBM Corporation (U.S.)

- Adobe Inc. (U.S.)

- SAP SE (Germany)

- Huawei Technologies Co., Ltd. (China)

- Atlassian Corporation Plc (Australia)

- Zoom Video Communications, Inc. (U.S.)

- Wrike, Inc. (U.S.)

Latest Developments in Global Enterprise Collaboration Market

- October 2024: Miro launched Innovation Workspace, an AI-powered platform designed to foster team collaboration throughout the entire process, from brainstorming to execution. This tool leverages AI to streamline workflows, making collaboration more efficient and impactful for teams.

- September 2024: DingTalk introduced DingTalk 365, a subscription-based service featuring AI tools such as virtual assistants and automated replies. This service is aimed at improving workplace collaboration by automating routine tasks and enhancing team communication and efficiency.

- February 2024: Tata Communications partnered with Microsoft to integrate voice calling into Microsoft Teams, enhancing workforce productivity and collaboration for Indian enterprises. This integration allows for seamless communication within the Teams platform, improving efficiency across organizations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。