Global Environmental Monitoring Market

市场规模(十亿美元)

CAGR :

%

USD

24.50 Billion

USD

35.70 Billion

2024

2032

USD

24.50 Billion

USD

35.70 Billion

2024

2032

| 2025 –2032 | |

| USD 24.50 Billion | |

| USD 35.70 Billion | |

|

|

|

|

Global Environmental Monitoring Market Segmentation, By Component (Particulate Detection, Chemical Detection, Biological Detection, Temperature Sensing, Moisture Detection, and Noise Measurement), Product Type (Environmental Monitoring Sensors, Environmental Monitors, Environmental Monitoring Software, and Wearable Environmental Monitors), Sampling Method (Continuous Monitoring, Active Monitoring, Passive Monitoring, and Intermittent Monitoring), Application (Air Pollution Monitoring, Water Pollution Monitoring, Soil Pollution Monitoring, and Noise Pollution Monitoring) - Industry Trends and Forecast to 2032

Environmental Monitoring Market Size

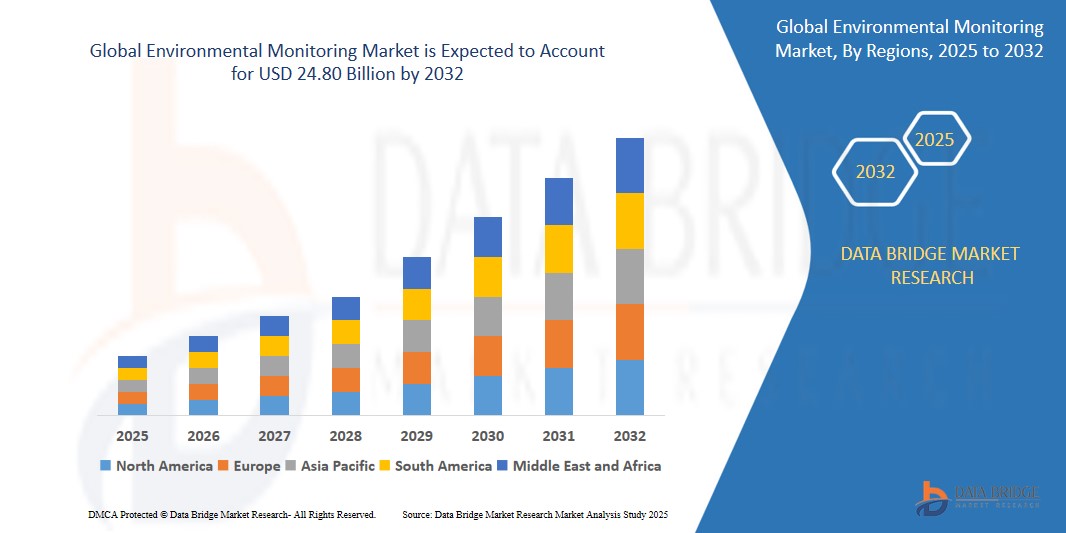

- The global environmental monitoring market size was valued atUSD 16.78 billion in 2024 and is expected to reachUSD 24.80 billion by 2032, at aCAGR of 5.00%during the forecast period

- This growth is driven by mounting requirement of efficient natural resource management

Environmental Monitoring Market Analysis

- Environmental Monitoring technologies are revolutionizing environmental management by enabling real-time tracking of air, water, soil, and noise pollution, thereby helping industries and governments make data-driven decisions to ensure regulatory compliance and ecological sustainability

- The growing demand for environmental monitoring is driven by rising environmental concerns, stringent government regulations for pollution control, and increasing awareness of health hazards associated with environmental degradation across industrial, urban, and rural regions

- North America is expected to dominate the environmental monitoring market with the largest market share of 36.22%, driven by stringent environmental regulations, rapid adoption of advanced monitoring technologies, and significant governmental support for pollution control and climate change mitigation

- Asia-Pacific is expected to witness the fastest growth in the environmental monitoring market, due to rapid industrialization, escalating urban pollution levels, and increasing government mandates on environmental conservation

- The particulate detection segment is expected to dominate the market with the largest market share of 48.77% due to the emergence of next-generation products, including water-resistant, dustproof, and data-logging sensors integrated with wireless technology

Report Scope and Environmental Monitoring Market Segmentation

|

Attributes |

Environmental Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Environmental Monitoring Market Trends

“Adoption of AI and IoT for Real-Time Environmental Data Collection”

- A significant trend in the environmental monitoring market is the growing integration ofArtificial Intelligence (AI) and the Internet of Things (IoT) to enable real-time monitoring, predictive analysis, and automated alerts for environmental parameters

- Smart sensors connected through IoT networks provide seamless, continuous monitoring of air quality, water purity, and other critical factors across industrial, urban, and rural ecosystems

- AI algorithms help in processing large volumes of environmental data to detect anomalies, predict pollution patterns, and ensure timely regulatory compliance

- For instance, in March 2024, Siemens partnered with a leading smart city initiative in Singapore to deploy AI-enabled environmental monitoring systems that provide real-time pollution insights and alerts to local authorities

- The adoption of AI and IoT is transforming environmental management from reactive to proactive, reducing health risks and environmental damage

Environmental Monitoring Market Dynamics

Driver

“Stringent Government Regulations for Pollution Control”

- Governments worldwide are implementing stricter environmental regulations to curb rising pollution levels, leading to increased demand for accurate and reliable environmental monitoring systems

- Environmental protection agencies now require industries to monitor and report real-time emissions, driving the deployment of air and water quality monitoring equipment

- This regulatory pressure is encouraging companies to adopt advanced technologies to avoid legal penalties and meet sustainability goals

- For instance, in 2023, the U.S. Environmental Protection Agency (EPA) mandated continuous emissions monitoring for large-scale manufacturing plants under its Clean Air Act enforcement

- These evolving regulatory frameworks are a key driver pushing both public and private sectors to adopt environmental monitoring solutions

Opportunity

“Growing Demand for Indoor Air Quality Monitoring in Commercial Buildings”

- An emerging opportunity lies in the growing awareness and demand for Indoor Air Quality (IAQ) monitoring systems, particularly in offices, schools, and hospitals post-COVID-19

- Increased health concerns and employee wellness initiatives are pushing facility managers to install environmental sensors that measure CO₂, particulate matter, humidity, and VOCs

- Smart buildings and green certification programs (such as LEED and WELL) are further fueling demand for real-time IAQ monitoring solutions

- For instance, in 2024, Honeywell launched its latest indoor environmental quality platform targeting corporate campuses, equipped with AI-enabled alerts and real-time analytics

- This trend presents a significant growth opportunity for environmental monitoring vendors targeting commercial infrastructure upgrades

Restraint/Challenge

“High Initial Costs and Infrastructure Requirements”

- A major restraint in the environmental monitoring market is the high cost of advanced sensors, data transmission systems, and integration with existing infrastructure

- Smaller municipalities and industries in developing regions often lack the capital and technical capacity to deploy real-time monitoring systems at scale

- Maintenance, calibration, and training for personnel further add to the total cost of ownership, limiting adoption in budget-constrained environments

- For instance, in 2023, several Southeast Asian cities delayed their urban monitoring projects due to insufficient funding and lack of compatible infrastructure for networked sensors

- Cost-effective, scalable solutions will be critical to expanding environmental monitoring adoption in underserved markets

Environmental Monitoring Market Scope

The market is segmented on the basis of component, product type, sampling method, and application.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Product Type |

|

|

By Sampling Method |

|

|

By Application |

|

In 2025, the environmental monitors is projected to dominate the market with a largest share in product type segment

The environmental monitors segment is expected to dominate the environmental monitoring market with the largest market share of 32.58% in 2025 due to the emergence of next-generation products, including water-resistant, dustproof, and data-logging sensors integrated with wireless technology.

The particulate detection is expected to account for the largest share during the forecast period in component segment

In 2025, the particulate detection segment is expected to dominate the market with the largest market share of 48.77% due to increasing concentration of particulate matter (PM2.5 and PM10) in the air due to industrialization and urbanization has heightened the need for effective monitoring solutions.

Environmental Monitoring Market Regional Analysis

“North America Holds the Largest Share in the Environmental Monitoring Market”

- North America is expected to dominate the environmental monitoring market with the largest market share of 36.22%, driven by stringent environmental regulations, rapid adoption of advanced monitoring technologies, and significant governmental support for pollution control and climate change mitigation

- The U.S. dominates regional growth, due to its robust environmental compliance framework, heavy investments in industrial monitoring, and presence of key environmental monitoring equipment manufacturers such as Thermo Fisher Scientific and Honeywell

- The region is also benefiting from the rising demand for real-time air and water quality monitoring in sectors such as oil & gas, chemicals, and utilities, boosting the need for high-precision sensors and IoT-based monitoring systems

“Asia-Pacific is projected to register the Highest CAGR in the Environmental Monitoring Market”

- Asia-Pacific is expected to witness the highest growth rate in the environmental monitoring market, due to rapid industrialization, escalating urban pollution levels, and increasing government mandates on environmental conservation

- Countries such as China, India, and Japan are spearheading regional growth through large-scale infrastructure developments, smart city initiatives, and widespread adoption of environmental sensing devices for air and water monitoring

- Increasing awareness of environmental hazards, combined with technological advancements in wireless sensor networks and data analytics, is accelerating the deployment of environmental monitoring solutions in both urban and rural areas

- With environmental degradation becoming a critical concern, Asia-Pacific is emerging as a major growth engine, offering substantial opportunities for equipment manufacturers and service providers in the environmental technology space

Environmental Monitoring Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BioMérieux (France)

- Honeywell International Inc. (U.S.)

- Merck KGaA (Germany)

- Siemens (Germany)

- Forbes Marshall (India)

- HORIBA (Japan)

- Agilent Technologies Inc. (U.S.)

- Thermo Fisher Scientific (U.S.)

- Shimadzu Corporation (Japan)

- PerkinElmer Inc. (U.S.)

- 3M (U.S.)

- Emerson Electric Co. (U.S.)

- Sensors, Inc. (Canada)

- Danaher (U.S.)

- Spectris (U.K.)

- TE Connectivity (Switzerland)

- Teledyne Technologies Incorporated (U.S.)

- RTX (U.S.)

- ams-OSRAM AG (Austria)

Latest Developments in Global Environmental Monitoring Market

- In May 2024, Thermo Fisher Scientific, a global leader in science and technology innovation, announced the commencement of air quality monitoring system manufacturing at its facility in India. This strategic move is expected to enhance India's manufacturing capabilities in environmental monitoring and support the country's industrial development

- In October 2021, ABB launched the world’s first touch-free environmental smart sensor—ABB Fusion Air Intelligent Sensor—to help combat indoor air pollution. The sensor offers four detection modes to optimize air quality, safety, and comfort, addressing growing concerns over indoor air pollution, which is reported to be 3.5 times worse than outdoor air on average. This innovation supports healthier indoor environments and positions ABB as a leader in smart IAQ solutions

- In January 2021, Pittsburgh International Airport partnered with Honeywell to implement and test air quality improvement technologies at its innovation center, Uxbridge. Honeywell’s Healthy Buildings platform was deployed to measure and manage indoor environmental factors such as temperature, humidity, CO₂, particulate matter, and VOCs. This initiative reinforces Honeywell’s commitment to enhancing public safety and indoor air quality in high-traffic environments

- In September 2020, Hach, a subsidiary of Danaher, entered a partnership with 120Water to offer an end-to-end lead and copper compliance testing solution. Through this collaboration, Hach integrated 120Water’s digital water platform into its services, strengthening its water quality monitoring and compliance offerings for both new and existing customers

- In April 2020, Emerson completed the acquisition of American Governor Company to expand its reach and expertise in hydropower control systems. This acquisition enhanced Emerson’s position in the environmental monitoring segment, particularly within the energy and water infrastructure sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。