Global Financial Detection And Prevention Market

市场规模(十亿美元)

CAGR :

%

USD

29.20 Billion

USD

74.38 Billion

2024

2032

USD

29.20 Billion

USD

74.38 Billion

2024

2032

| 2025 –2032 | |

| USD 29.20 Billion | |

| USD 74.38 Billion | |

|

|

|

|

全球金融檢測與預防市場細分,按組件(解決方案和服務)、詐欺類型(支票詐欺、身分詐欺、內部詐欺、投資詐欺、支付詐欺、保險詐欺、友善詐欺等)、應用(身分盜竊、洗錢、支付詐欺等)、組織規模(中小企業和大型企業)、組織類型(BFSI、政府與國防、醫療保健、IT 和電信、工業製造業、零售業、零售業、20 年和 20 年 20 年和電子商務、工業和電信

金融檢測與預防市場分析

隨著組織和金融機構面臨詐欺活動、網路攻擊和資料外洩等日益嚴峻的挑戰,金融偵測和預防市場正經歷顯著成長。數位化程度的提高、線上金融交易的擴張以及行動支付技術的採用正在推動對先進詐欺檢測技術的需求。機器學習、人工智慧(AI) 和預測分析正在引領詐欺偵測領域的創新,能夠實現即時威脅偵測、提高準確性並減少誤報。此外,生物識別身份驗證和多因素身份驗證 (MFA) 系統正在整合到安全協議中,進一步加強金融系統。例如,人工智慧演算法可以分析交易模式並識別異常行為,使金融機構能夠在詐欺發生之前減輕詐欺影響。此外,GDPR 和 PSD2 等監管框架正在推動公司實施強大的詐欺偵測機制,以確保合規性並保護消費者的個人資料。隨著金融機構和電子商務企業繼續投資這些先進的解決方案,市場將進一步擴張,為銀行、保險、零售和政府等各個領域的數位金融交易提供更大的保護。

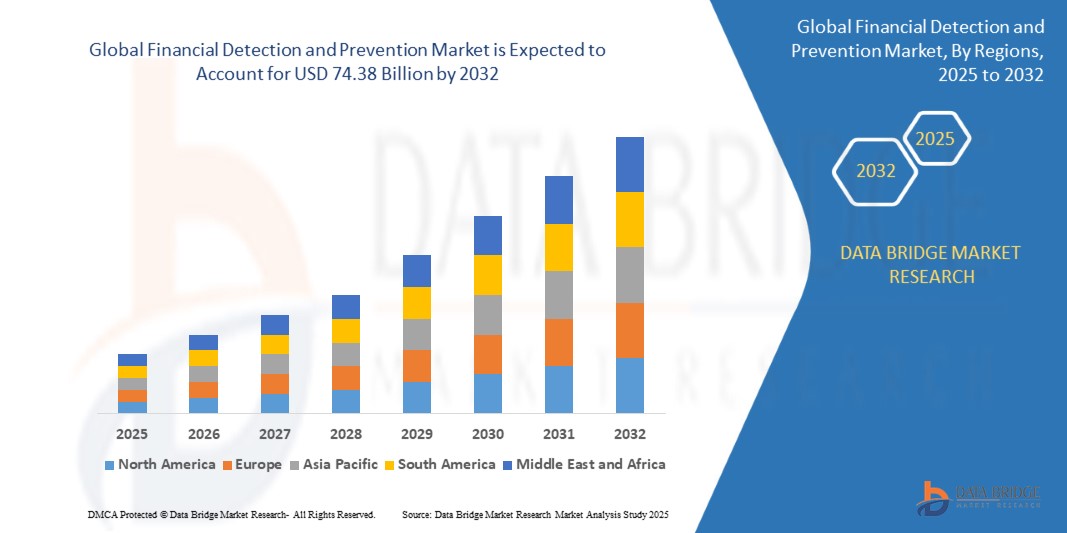

金融檢測與預防市場規模

2024 年全球金融檢測和預防市場規模為 292 億美元,預計到 2032 年將達到 743.8 億美元,在 2025 年至 2032 年的預測期內複合年增長率為 12.40%。除了市場價值、成長率、市場區隔、地理覆蓋範圍、市場參與者和市場情景等市場洞察外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 pestle 分析。

金融檢測與預防市場趨勢

“人工智慧(AI)和機器學習(ML)的融合日益加深”

金融檢測和預防市場的一個突出趨勢是人工智慧 (AI) 和機器學習 (ML) 技術日益融合,以實現即時詐欺檢測。隨著線上交易和數位支付的成長,人工智慧和機器學習對於快速且準確地識別和減輕詐欺活動變得至關重要。例如,人工智慧詐欺偵測系統會分析歷史交易資料、客戶行為和其他模式,以便在可疑活動升級之前進行預測和標記。 FIS Global 和 FICO 等公司正在實施這些技術,以幫助金融機構和企業減少因詐欺造成的損失。這些先進的解決方案提高了檢測準確性並減少了誤報,確保合法交易不會被錯誤阻止。此外,這些工具能夠適應和學習新的詐欺模式,不斷發展以應對新出現的威脅。這種向人工智慧驅動的詐欺預防的轉變凸顯了創新智慧系統在保護數位金融生態系統方面日益增長的重要性。

報告範圍和金融檢測與預防市場細分

|

屬性 |

金融檢測與預防關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Fiserv, Inc. (U.S.), FIS Global (U.S.), LexisNexis Risk Solutions (U.S.), TransUnion LLC. (U.S.), Experian Information Solutions, Inc. (Ireland), NICE Actimize (U.S.), ACI Worldwide (U.S.), SAS Institute Inc. (U.S.), RSA Security LLC (U.S.), SAP (Germany), FICO (U.S.), Software GmbH (Germany), Microsoft (U.S.), F5, Inc. (U.S.), Amazon Web Services, Inc. (U.S.), Bottomline Technologies, Inc. (U.S.), ClearSale (Brazil), Genpact (U.S.), Securonix (U.S.), Accertify, Inc. (U.S.), Feedzai (Portugal), Caseware International Inc. (U.S.), LexisNexis Risk Solutions (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Financial detection and Prevention Market Definition

Financial detection and prevention refers to the practices, technologies, and solutions designed to identify and mitigate fraudulent activities within financial systems, transactions, and institutions. This process involves detecting suspicious patterns, behaviors, and anomalies in financial data to prevent fraud, money laundering, identity theft, and other illicit activities.

Financial detection and Prevention Market Dynamics

Drivers

- Rising Cybercrime and Fraudulent Activities

The rise in cybercrime and fraudulent activities has become a significant market driver for the financial detection and prevention sector. According to a report by the Federal Trade Commission (FTC), in 2020, U.S. consumers reported losing nearly USD 3.3 billion due to fraud, with online scams and identity theft being among the top culprits. As the financial sector increasingly adopts digital platforms, cyberattacks are becoming more frequent and sophisticated, with cybercriminals leveraging advanced techniques such as phishing, malware, and ransomware to breach financial systems. In fact, the number of global data breaches increased by 17% in 2020, with many of these breaches targeting financial institutions. This has led to an urgent need for more robust and advanced fraud detection and prevention solutions that can safeguard financial transactions, protect sensitive customer data, and mitigate financial losses. Consequently, the financial detection and prevention market has seen an uptick in demand for innovative solutions such as AI-powered fraud detection systems, real-time monitoring tools, and biometric authentication methods to combat rising cybercrime and enhance security.

- Rapid Growth in Online and Mobile Payments

The rapid growth in online and mobile payments has significantly expanded the opportunities for fraudulent activities, making fraud prevention tools more critical than ever. According to Statista, the number of mobile payment users worldwide is projected to surpass 1.31 billion by 2023, indicating the widespread adoption of digital finance and mobile transactions. However, this growth also comes with a rise in fraud risks, with e-commerce fraud alone expected to reach USD 20 billion by 2024, as reported by Juniper Research. Common fraud techniques in online transactions include credit card fraud, account takeovers, and synthetic identity fraud. As more consumers shift to mobile banking, digital wallets, and online shopping platforms, fraud prevention solutions, such as real-time transaction monitoring, AI-driven fraud detection, and multi-factor authentication, are increasingly essential. This surge in digital financial activity is driving demand for sophisticated fraud prevention tools that ensure secure transactions, protect consumer data, and build trust in e-commerce and mobile payment systems, making it a key market driver.

Opportunities

- Growing Identity Theft and Payment Fraud

The rise in identity theft and payment fraud is driving the demand for advanced fraud detection systems, as both businesses and consumers seek ways to mitigate financial losses. According to a 2020 report by Javelin Strategy & Research, identity fraud affected over 14.7 million U.S. consumers, leading to losses of nearly USD 16.9 billion. Payment fraud, particularly in the form of card-not-present fraud, continues to surge due to the rapid growth of e-commerce and mobile payments. For instance, in 2022, card-not-present fraud was projected to reach USD 7.2 billion in the U.S. alone, according to the Nilson Report. This surge in fraud cases highlights the urgent need for stronger prevention measures. As a result, companies are increasingly investing in advanced fraud detection technologies, including machine learning algorithms, biometric authentication, and real-time fraud monitoring, to safeguard consumer data and secure payment transactions. The escalating risk of identity theft and payment fraud presents a significant market opportunity for the development and implementation of these sophisticated detection and prevention systems, helping businesses protect their revenue and consumers from financial harm.

- Increasing Stringency of Regulatory Compliance Requirements

The increasing stringency of regulatory compliance requirements is becoming a significant market opportunity for fraud detection and prevention solutions. For instance, the implementation of the General Data Protection Regulation (GDPR) in the European Union has set high standards for data protection, demanding that organizations handle customer data securely and ensure that breaches are detected and reported swiftly. Similarly, the U.S. has introduced the Financial Industry Regulatory Authority (FINRA) regulations and the Bank Secrecy Act (BSA), which mandate financial institutions to adopt effective fraud detection measures. In response to such regulations, financial institutions are investing in advanced fraud detection solutions to avoid hefty fines and maintain customer trust. The growing focus on regulatory compliance means that companies must equip themselves with the necessary tools to detect suspicious activities, comply with reporting requirements, and protect customer data. As regulatory frameworks continue to tighten globally, the demand for fraud detection systems is expected to rise, presenting a lucrative opportunity for businesses providing compliance-driven fraud prevention solutions.

Restraints/Challenges

- False Positives in Financial Fraud Detection

金融詐欺檢測中的誤報代表著重大的市場挑戰,因為它們可能導致不必要的營運成本、客戶不滿意甚至聲譽損害。當合法交易被標記為詐欺時,就會出現誤報,需要時間和資源來調查和解決問題。例如,如果客戶出國旅行並嘗試進行國際購買,則該交易可能會因意外的地點或交易類型而被標記為可疑,即使它是合法的。這可能會導致客戶的帳戶被暫時凍結或交易被阻止,從而導致客戶不滿並可能造成業務損失。除了客戶不滿之外,處理這些錯誤警報通常還會為金融機構帶來大量的管理開銷,包括對標記交易的手動審查,這可能會延遲真正的詐欺偵測。此外,反覆的誤報可能會削弱客戶對系統的信任,導致他們尋求其他地方的服務。因此,管理和減少誤報對於平衡安全性和客戶體驗至關重要,這使其成為詐欺偵測和預防市場面臨的重大挑戰。

- 數據量和複雜性

金融檢測和預防市場的數據量和複雜性對試圖檢測和預防詐欺的組織提出了重大挑戰。金融機構每天處理大量的交易數據,包括數百萬筆付款和轉帳記錄、用戶行為日誌和客戶資料,所有這些都需要進行分析以查找可疑活動。這些數據的龐大數量可能會讓傳統系統不堪重負,難以即時提取有意義的見解。例如,一家大型銀行每秒可能處理數千筆交易,每筆交易的風險程度各不相同,具體取決於地理位置、交易歷史和付款方式等因素。隨著數據變得越來越複雜,隨著多通路交易、即時支付以及與數位貨幣或去中心化金融平台的整合,偵測詐欺模式變得更加複雜。金融機構經常面臨的挑戰是創建能夠有效分析如此大規模數據的強大演算法,這會導致詐欺行為被遺漏或誤報導致系統不堪重負的風險。這種數量和複雜性,加上對先進工具和技術的需求,為試圖確保準確和迅速的詐欺檢測的金融機構帶來了巨大的市場挑戰。

本市場報告提供了最新發展、貿易法規、進出口分析、生產分析、價值鏈優化、市場份額、國內和本地化市場參與者的影響的詳細信息,分析了新興收入領域的機會、市場法規的變化、戰略市場增長分析、市場規模、類別市場增長、應用領域和主導地位、產品批准、產品發布、地理擴展、市場技術創新。要獲取更多市場信息,請聯繫 Data Bridge Market Research 獲取分析師簡報,我們的團隊將幫助您做出明智的市場決策,實現市場成長。

金融檢測與預防市場範圍

市場根據組件、詐欺類型、應用、組織類型和組織規模進行細分。這些細分市場之間的成長將幫助您分析行業中微弱的成長細分市場,並提供給用戶。這些細分市場之間的成長將幫助您分析行業中成長微弱的細分市場,並為用戶提供有價值的市場概覽和市場洞察,幫助他們做出策略決策,確定核心市場應用。

成分

- 解決方案

- 詐欺分析

- 預測分析

- 描述性分析

- 規範分析

- 國民帳體系

- 文字分析

- 行為分析

- 驗證

- 單因子身份驗證(SFA)

- 多重身份驗證 (MFA)

- 喬治亞

- 詐欺分析

- 服務

- 專業的

- 風險評估

- 諮詢和培訓

- 實施與支持

- 託管

- 專業的

詐欺類型

- 支票詐欺

- 身分詐欺

- 內部詐欺

- 投資詐欺

- 支付詐欺

- 保險詐欺

- 友善詐欺

- 其他的

應用

- 身分盜竊

- 洗錢

- 支付詐欺

- 其他的

組織規模

- 中小企業

- 大型企業

組織類型

- 金融服務業

- 政府和國防

- 衛生保健

- 資訊科技和電信

- 工業和製造業

- 零售與電子商務

- 其他的

金融檢測與預防市場區域分析

對市場進行分析,並按國家、組成部分、詐欺類型、應用、組織類型和組織規模提供市場規模洞察和趨勢。這些細分市場之間的成長將幫助您分析行業中的微弱成長細分市場,並為用戶提供如上所述的資訊。

市場報告涉及的國家有:北美的美國、加拿大、墨西哥、德國、瑞典、波蘭、丹麥、義大利、英國、法國、西班牙、荷蘭、比利時、瑞士、土耳其、俄羅斯、歐洲的其他地區、日本、中國、印度、韓國、紐西蘭、越南、澳洲、新加坡、馬來西亞、泰國、印尼、菲律賓、亞太地區(APAC)的其他地區、巴西、阿根廷、南美洲的其他地區、歐洲地區(AME、AME)。

North America dominates the financial detection and Prevention market, driven by advanced technological infrastructure and the region’s focus on cybersecurity. The U.S. and Canada have been quick to adopt AI-driven fraud prevention solutions across various sectors, including banking, retail, and e-commerce. Increased investment in fraud management technologies has led to a strong market presence, with organizations prioritizing consumer data protection and secure transactions. In addition, stringent regulations and heightened awareness around data breaches have further fueled the growth of this market in North America.

Asia Pacific is the fastest growing region in the forecast period, driven by digitalization and the growing penetration of the internet. The rapid expansion of the e-commerce sector has led to an increase in online transactions, opening up opportunities for fraud, including payment fraud and identity theft. China is leading this growth, with businesses investing significantly in advanced fraud detection technologies to safeguard consumer data and improve transaction security. The widespread adoption of mobile payment systems is further accelerating this trend, as companies work to implement strong defenses against potential cyber threats.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Financial Detection and Prevention Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Financial detection and Prevention Market Leaders Operating in the Market Are:

- Fiserv, Inc. (U.S.)

- FIS Global (U.S.)

- LexisNexis Risk Solutions (U.S.)

- TransUnion LLC. (U.S.)

- Experian Information Solutions, Inc. (Ireland)

- NICE Actimize (U.S.)

- ACI Worldwide (U.S.)

- SAS Institute Inc. (U.S.)

- RSA Security LLC (U.S.)

- SAP (Germany)

- FICO (U.S.)

- Software GmbH (Germany)

- Microsoft (U.S.)

- F5, Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Bottomline Technologies, Inc. (U.S.)

- ClearSale (Brazil)

- Genpact (U.S.)

- Securonix (U.S.)

- Accertify, Inc.(美國)

- Feedzai(葡萄牙)

- Caseware International Inc.(美國)

- LexisNexis Risk Solutions(美國)

金融檢測與預防市場的最新發展

- 2024 年 8 月,CPI 卡集團與專門從事詐欺預防的平台 Rippleshot 聯手,將 Rippleshot 的先進服務整合到其產品中。此次合作旨在增強 CPI 的詐欺管理能力,使客戶能夠主動應對詐欺活動,降低相關成本,並提高客戶保留率和滿意度

- 2024 年 3 月,Visa 在其 Visa Protect 套件中引入了三種新的 AI 驅動解決方案,以加強詐欺預防。其中一個關鍵解決方案專注於解決即時支付欺詐,並擴展了旨在打擊跨支付網路詐欺的功能

- 2023 年 10 月,中東和北非地區主要發卡機構 Nymcard 與領先的即時 POS 支付解決方案供應商 ACI Worldwide 建立了合作夥伴關係。此次合作旨在增強 Nymcard 的反詐騙平台,幫助保護其客戶免受日益嚴重的金融詐騙威脅

- 2023 年 9 月,萬事達卡和甲骨文合作實現 B2B 支付自動化,旨在解決資料、系統和流程碎片化等挑戰。透過萬事達卡的虛擬卡技術,甲骨文將幫助企業安全地分享資訊並簡化企業客戶的金融交易

- 2023 年 10 月,Oscilar 推出了業界首個由人工智慧驅動的防詐騙平台。該平台使用生成式人工智慧自動偵測潛在的詐欺模式,進行根本原因分析,並提供即時風險建議

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。