Global Fortified Rice Market

市场规模(十亿美元)

CAGR :

%

USD

38.35 Billion

USD

63.47 Billion

2025

2033

USD

38.35 Billion

USD

63.47 Billion

2025

2033

| 2026 –2033 | |

| USD 38.35 Billion | |

| USD 63.47 Billion | |

|

|

|

|

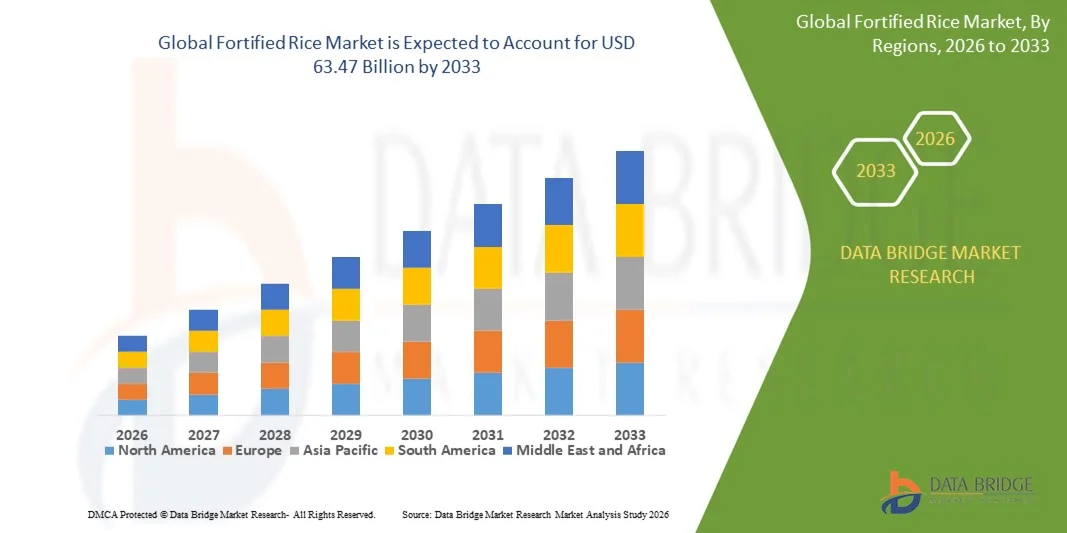

全球強化米市場細分,按微量營養素(礦物質、維生素及其他)、技術(乾燥、擠壓、包衣技術、膠囊封裝及其他)、終端用戶(商業和家庭)、分銷渠道(便利店、現代貿易、藥店、百貨商店、線上商店及其他)劃分——行業趨勢及至2033年的預測

強化米市場規模

- 2025年全球強化米市場規模為383.5億美元,預估至2033年將達634.7億美元,預測期間內 複合年增長率為6.5%。

- 市場成長主要得益於各國政府不斷加強的強制性規定和公共營養計劃,這些計劃旨在解決發展中經濟體和新興經濟體普遍存在的微量營養素缺乏問題,特別是貧血和營養不良問題。

- 此外,人們對預防性營養的認識不斷提高,對糧食安全的日益重視,以及政府、非政府組織和食品加工商之間合作的不斷加強,正在加速強化大米的廣泛應用,從而顯著促進整體市場成長。

強化米市場分析

- 強化米,富含必需維生素和礦物質,因其價格實惠、易於推廣,且能無縫融入居民區和機構中現有的大米消費模式,正日益被認為是一種改善人群營養狀況的關鍵主食幹預措施。

- 強化米需求不斷增長的主要原因是全國範圍內的強化政策、消費者健康意識的提高,以及公共分配系統和福利計劃中對強化主食的依賴性日益增強。

- 由於大規模的政府營養計劃、微量營養素缺乏症的高發生率以及大米作為主食的廣泛消費,亞太地區預計將在2025年佔據強化大米市場58.46%的份額。

- 由於對功能性食品的需求不斷增長以及人們對微量營養素缺乏症的認識不斷提高,預計北美將成為預測期內強化大米市場增長最快的地區。

- 由於政府主導的強化計畫廣泛開展,重點強化維生素A、B群維生素和葉酸,以解決大規模微量營養素缺乏問題,維生素強化米在2025年佔據了56.5%的市場份額,成為市場主導。維生素因其在減少貧血、增強免疫力以及改善兒童和孕產婦健康方面的顯著作用而廣受歡迎。維生素易於與米粒混合,且在烹飪過程中穩定性良好,進一步促進了其在公共分配系統中的普及。強有力的政策支持以及納入國家營養計劃,持續鞏固了維生素強化米的市場主導地位。

報告範圍及強化米市場細分

|

屬性 |

強化米關鍵市場洞察 |

|

涵蓋部分 |

|

|

覆蓋國家/地區 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機遇 |

|

|

加值資料資訊集 |

除了對市場狀況(如市場價值、成長率、細分、地理覆蓋範圍和主要參與者)的洞察之外,Data Bridge Market Research 精心編制的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特五力分析和監管框架。 |

強化米市場趨勢

擴大政府主導的強制性米強化計劃

- A significant trend in the fortified rice market is the expansion of government-led mandatory fortification programs aimed at addressing large-scale micronutrient deficiencies and improving public health outcomes. These programs are strengthening the role of fortified rice as a core nutritional intervention, particularly in regions where rice is a primary staple food and malnutrition levels remain high

- For instance, the Government of India has mandated fortified rice distribution through the Public Distribution System, Mid-Day Meal Scheme, and Integrated Child Development Services, creating sustained demand for fortified rice kernels supplied by companies such as LT Foods and VSR Foods. This initiative has accelerated large-scale adoption and standardized fortified rice consumption across multiple population segments

- Several developing economies are aligning national food security strategies with global nutrition goals set by organizations such as the World Food Programme and UNICEF. This alignment is reinforcing fortified rice as a long-term solution for addressing anemia and vitamin deficiencies at a population level

- The trend is also encouraging modernization within rice milling and processing facilities to meet fortification standards and quality benchmarks. Manufacturers are increasingly investing in technology upgrades to comply with regulatory requirements and ensure consistent nutrient delivery

- Public-private partnerships are expanding as governments collaborate with rice millers, technology providers, and NGOs to scale fortified rice production efficiently. These collaborations are improving supply chain reliability and enhancing market penetration

- The continued expansion of mandatory fortification initiatives is positioning fortified rice as an essential component of national nutrition frameworks. This trend is reinforcing steady market growth and long-term demand visibility across both public and institutional channels

Fortified Rice Market Dynamics

Driver

Rising Prevalence of Micronutrient Deficiencies and Malnutrition

- The rising prevalence of micronutrient deficiencies and malnutrition is a key driver fueling growth in the fortified rice market, as governments and health organizations seek scalable and cost-effective nutritional interventions. Fortified rice offers an efficient method to deliver essential vitamins and minerals through daily diets without requiring major changes in consumption behavior

- For instance, the World Food Programme actively supports fortified rice distribution across Asia and Africa to combat iron-deficiency anemia and vitamin deficiencies, collaborating with local rice millers and suppliers. These programs are increasing institutional demand and driving consistent procurement volumes

- High rates of anemia among women and children in countries such as India and Bangladesh are accelerating policy focus on fortified staples rather than supplements alone. This shift is strengthening reliance on fortified rice as a preventive nutrition tool

- Healthcare authorities are increasingly recognizing fortified rice as a sustainable solution for improving long-term health indicators, particularly in low-income and food-insecure populations. This recognition is translating into sustained funding and regulatory support

- The persistent burden of micronutrient deficiencies is therefore acting as a strong structural driver, ensuring steady expansion of the fortified rice market over the forecast period

Restraint/Challenge

High Implementation and Compliance Costs for Small Rice Millers

- The fortified rice market faces challenges due to the high implementation and compliance costs associated with fortification requirements, particularly for small and medium-sized rice millers. Fortification demands investments in extrusion equipment, blending systems, quality testing, and regulatory compliance, which can strain limited financial resources

- For instance, small-scale rice millers in India have faced difficulties upgrading facilities to meet fortified rice standards set by the Food Safety and Standards Authority of India, leading to slower adoption among unorganized players. These cost barriers can limit participation and create supply-side disparities

- Maintaining consistent micronutrient levels requires regular monitoring, skilled technical personnel, and adherence to strict quality protocols. These operational demands increase overhead costs and complexity for smaller producers

- The challenge is further compounded by fluctuating input costs and limited access to financing for equipment upgrades. Small millers often struggle to balance compliance with profitability under competitive pricing pressures

- As a result, market consolidation is gradually increasing, with larger organized players better positioned to absorb compliance costs. This challenge continues to restrict uniform adoption across the supply chain and places pressure on policymakers to provide financial and technical support mechanisms

Fortified Rice Market Scope

The market is segmented on the basis of micronutrient, technology, end users, and distribution channel.

- By Micronutrient

On the basis of micronutrient, the fortified rice market is segmented into minerals, vitamins, and others. The vitamins segment dominated the market with the largest revenue share of 56.5% in 2025, driven by widespread government-led fortification programs focusing on vitamin A, B-complex, and folic acid to address large-scale micronutrient deficiencies. Vitamins are widely preferred due to their proven role in reducing anemia, improving immunity, and supporting child and maternal health outcomes. Their ease of blending with rice kernels and stability during cooking further strengthens adoption across public distribution systems. Strong policy backing and inclusion in national nutrition schemes continue to reinforce the dominance of vitamin-fortified rice.

The minerals segment is expected to witness the fastest growth from 2026 to 2033, supported by rising emphasis on iron and zinc fortification to combat iron-deficiency anemia. Increasing clinical evidence linking mineral fortification with improved cognitive and physical development is accelerating uptake. Food processors are investing in advanced formulations to improve bioavailability without altering taste or appearance. Growing awareness among urban consumers and nutrition-focused organizations is also driving rapid expansion of mineral-fortified rice.

- By Technology

On the basis of technology, the fortified rice market is segmented into drying, extrusion, coating technology and encapsulation, and others. The extrusion segment dominated the market in 2025, owing to its ability to uniformly incorporate multiple micronutrients while maintaining rice-like texture and appearance. Extrusion technology offers high nutrient retention and consistency, making it the preferred choice for large-scale fortification initiatives. Its compatibility with mass production and cost efficiency supports extensive adoption by government suppliers and large food manufacturers. The technology’s proven performance across diverse cooking conditions further strengthens its leading position.

The coating technology and encapsulation segment is projected to grow at the fastest rate during the forecast period, driven by advancements in microencapsulation that enhance nutrient stability and shelf life. This technology minimizes nutrient loss during washing and cooking, addressing a key consumer concern. Increasing demand for premium fortified rice with higher efficacy is encouraging manufacturers to adopt coating-based solutions. Continuous innovation in encapsulation materials is expected to accelerate this segment’s growth.

- By End Users

On the basis of end users, the fortified rice market is segmented into commercial and residential. The commercial segment accounted for the largest market share in 2025, supported by bulk procurement from governments, schools, hospitals, and welfare institutions. Public food distribution systems and mid-day meal programs rely heavily on fortified rice to improve nutritional intake at scale. Commercial buyers prioritize standardized quality, regulatory compliance, and cost efficiency, which favors large-volume fortified rice supply. Long-term supply contracts and institutional demand continue to sustain this segment’s dominance.

The residential segment is anticipated to register the fastest growth from 2026 to 2033, driven by rising consumer awareness of hidden hunger and preventive nutrition. Urban households are increasingly opting for fortified staples as part of daily diets to improve overall health outcomes. Improved packaging, branding, and availability through modern retail channels are enhancing household adoption. Growing health consciousness and willingness to pay for nutritional benefits are accelerating residential demand.

- By Distribution Channel

On the basis of distribution channel, the fortified rice market is segmented into convenience stores, modern trade, drug store, departmental stores, online stores, and others. The modern trade segment dominated the market in 2025, driven by strong presence of supermarkets and hypermarkets offering a wide range of fortified rice brands. These outlets provide better product visibility, quality assurance, and consumer education through labeling and in-store promotions. Established supply chains and partnerships with leading food manufacturers further support high sales volumes. Consumers’ trust in organized retail continues to reinforce this channel’s leadership.

The online stores segment is expected to witness the fastest growth over the forecast period, supported by rapid digitalization and changing purchasing behavior. E-commerce platforms offer convenience, subscription models, and access to niche fortified rice variants. Detailed product information and nutritional transparency are influencing informed buying decisions. Expanding internet penetration and growth of direct-to-consumer strategies are accelerating online channel adoption.

Fortified Rice Market Regional Analysis

- Asia-Pacific dominated the fortified rice market with the largest revenue share of 58.46% in 2025, driven by large-scale government nutrition programs, high prevalence of micronutrient deficiencies, and widespread rice consumption as a staple food

- The region’s strong public distribution systems, increasing investments in food fortification infrastructure, and collaboration with international nutrition agencies are accelerating market penetration

- Rising population, supportive regulatory frameworks, and growing focus on food security across developing economies are contributing to sustained demand for fortified rice

中國強化米市場洞察

預計到2025年,中國將佔據亞太地區強化米市場最大份額,這得益於其龐大的食品加工業和政府對提升國民營養水準的大力重視。國家推行的強化主食政策,加上大規模的生產能力,正在推動強化米的普及。持續加大對食品品質標準和技術升級的投入,也進一步促進了市場成長。

印度強化米市場洞察

在亞太地區,印度的成長速度最快,這主要得益於全國範圍內的糧食強化政策,包括公共配給和學校午餐計畫。政府針對貧血和營養不良問題的舉措,以及與私營碾米廠的合作,都顯著提升了市場需求。此外,人們對營養安全的日益重視和農村推廣計畫的不斷擴大,也進一步促進了市場的擴張。

歐洲強化米市場洞察

在歐洲,強化米市場正穩步擴張,這得益於消費者預防性營養意識的提高以及對功能性食品需求的成長。該地區對食品安全、標籤和品質標準的嚴格監管,也促進了強化主食的普及。此外,健康意識的增強和人口老化進一步推動了市場成長。

德國強化米市場洞察

德國的強化米市場得益於其發達的食品飲料產業和對營養創新的高度重視。德國注重以研究為基礎的營養強化、清潔標籤產品以及嚴格的食品法規,這些都支撐著市場持續的需求。強化米在註重健康的零售和機構食品領域正日益受到青睞。

英國強化米市場洞察

英國市場受惠於強化食品和功能性食品的日益普及,以及政府和非政府組織為解決營養缺口所採取的各項措施。消費者對有益健康的日常主食日益增長的需求,以及大型零售企業的蓬勃發展,都促進了市場的發展。此外,對透明度和營養標籤的重視也進一步推動了強化米的銷售。

北美強化米市場洞察

預計2026年至2033年間,北美將以最快的複合年增長率成長,主要受功能性食品需求成長和人們對微量營養素缺乏症認識提高的推動。強大的購買力、不斷變化的飲食習慣以及強化食品供應的增加是關鍵的成長驅動因素。該地區對預防性醫療保健和健康飲食的重視正在加速相關產品的普及。

美國強化米市場洞察

2025年,美國在北美市場佔最大份額,這主要得益於消費者高度的營養意識、先進的食品加工能力和強大的分銷網絡。強化食品和營養強化食品在零售和機構通路日益普及,也推動了市場需求的成長。持續的創新和對營養強化的重視,將繼續鞏固美國的領先地位。

強化米市佔率

強化米產業主要由一些老牌企業主導,其中包括:

- 達爾伯格集團(瑞士)

- 邦吉有限公司(美國)

- 嘉吉公司(美國)

- VSR食品(印度)

- DSM(荷蘭)

- LT食品(印度)

- EstracoKft(匈牙利)

- Rice 'n Spice International Ltd(英國)

- 東區食品有限公司(英國)

- 食品集團有限公司(印度)

- 瑪氏公司(美國)

- Goalzy(英國)

- JVS Foods Pvt Ltd(印度)

- Loften India Private Limited(印度)

- 巴斯夫股份公司(德國)

- Christy Friedgram 產業(印度)

全球強化米市場最新動態

- 2025年6月,金達爾米廠(Jindal Rice Mills)推出全新消費品牌Nourifyme,提供包括巴斯馬蒂大米在內的多種強化大米產品以及強化小麥粉,從而加劇了強化大米市場的競爭。同時,阿南德農業工業公司(Anand Agro Industries)也推出了White Spoon品牌的強化巴斯馬蒂米。這些新品的上市標誌著市場正向品牌化、高附加價值的強化主食轉型,消費者購買管道不再侷限於政府通路,品牌差異化也進一步強化了市場競爭。

- 2025年4月,Shyamatara Rice Mills推出Bengal Crown強化米,進一步拓展了其產品線,旨在提升西孟加拉邦的營養水平。此舉鞏固了區域性碾米企業在支持公共衛生目標方面的作用,同時也提高了強化米在消費量高的市場的本地化普及率。

- 2024年11月,ACI Foods Limited旗下ACI Pure品牌推出了孟加拉首款強化米,這標誌著該國食品強化領域的一個重要里程碑。此次上市加速了市場正規化進程,促進了監管支持,並為新興南亞市場的其他食品加工商樹立了標竿。

- 2024年1月,印度政府加快了全國推廣強化米的步伐,在公共分配系統、學校午餐計劃和綜合兒童發展服務中強制推行強化大米分發。這項政策驅動的推廣活動顯著擴大了市場需求,確保了市場的長期穩定,並將印度定位為全球強化米市場的重要成長引擎。

- 2023年9月,布勒集團與多家亞洲碾米企業合作,部署先進的擠壓技術以強化米粒的生產。這項技術提高了生產效率、營養成分保留率和可擴展性,使生產商能夠滿足日益增長的監管和機構要求,同時提升整體市場產能。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。